Market Overview:

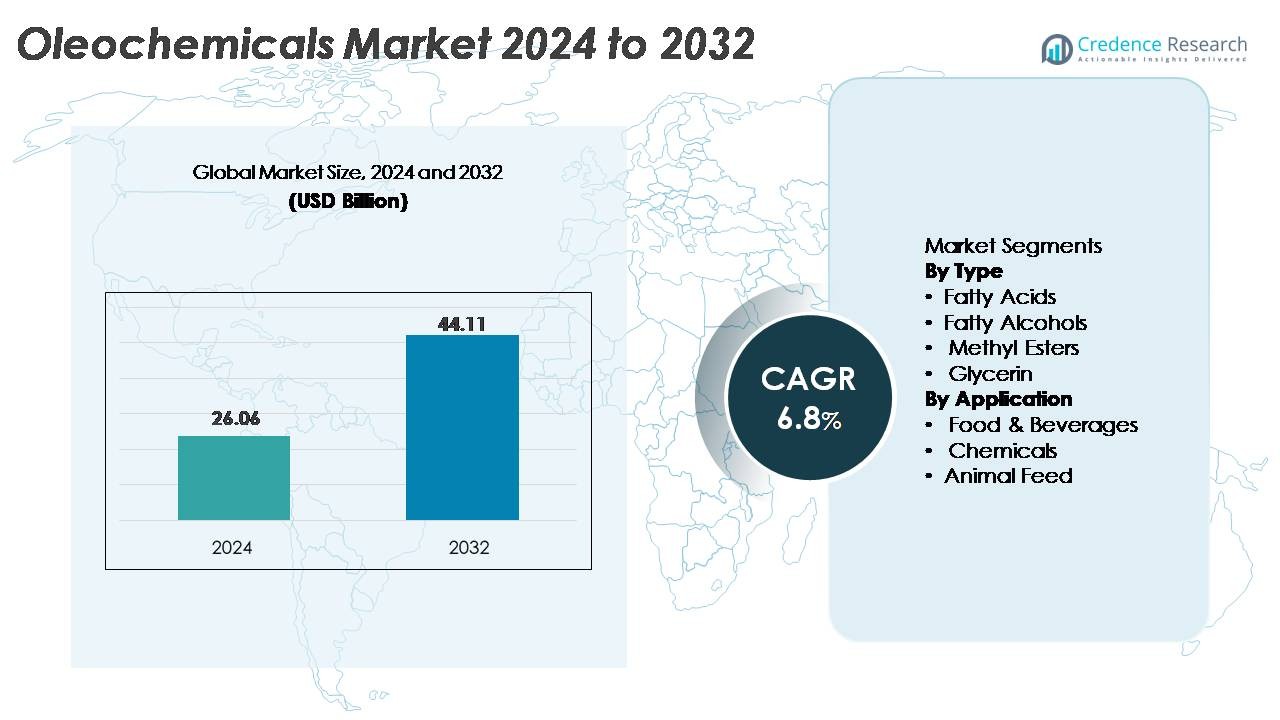

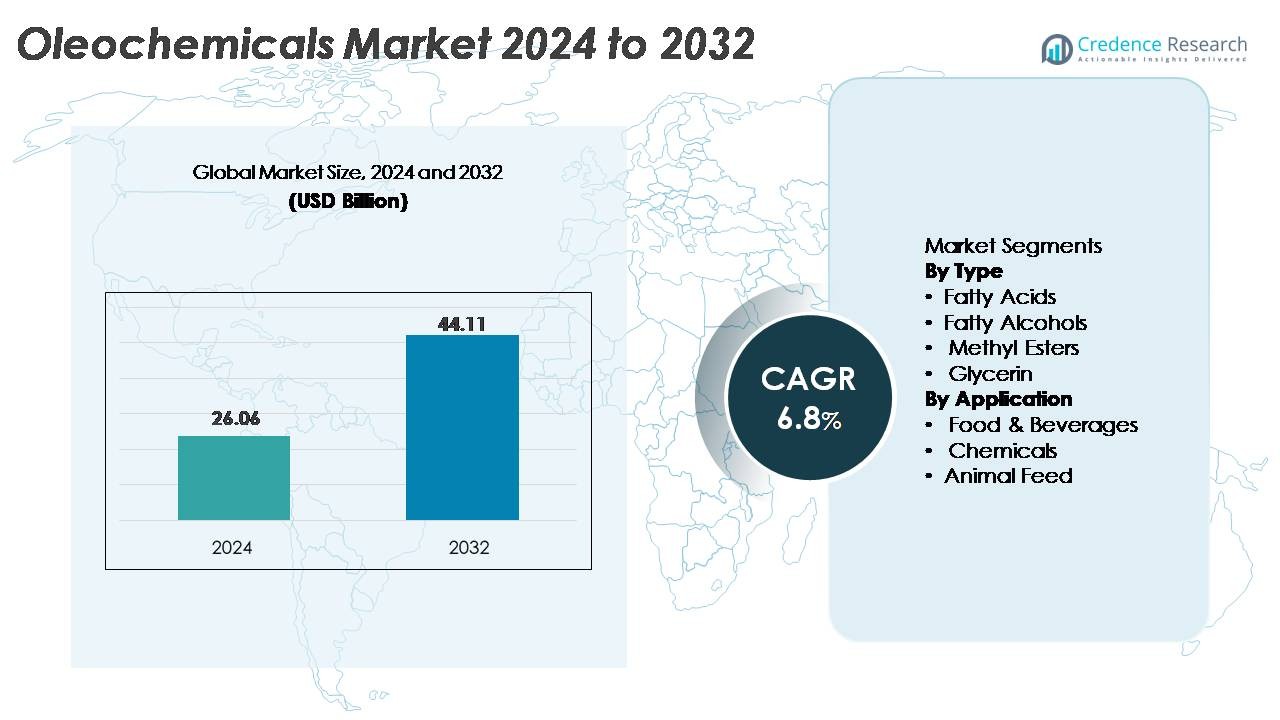

The global oleochemicals market was valued at USD 26.06 billion in 2024 and is projected to reach USD 44.11 billion by 2032, registering a robust CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America On-Site Preventive Care Market Size 2024 |

USD 26.06 Billion |

| North America On-Site Preventive Care Market, CAGR |

6.8% |

| North America On-Site Preventive Care Market Size 2032 |

USD 44.11 Billion |

The oleochemicals market is shaped by the strong presence of global leaders such as Wilmar International, Cargill Inc., BASF SE, Kuala Lumpur Kepong Berhad, IOI Group Berhad, Oleon N.V., Croda Industrial Chemicals, Evonik Industries, Twin Rivers Technologies, and Kao Chemicals. These companies leverage advanced processing capabilities, vertically integrated supply chains, and sustainable certification frameworks to strengthen competitiveness across fatty acids, fatty alcohols, glycerin, and esters. Asia-Pacific dominates the global market with approximately 45% share, supported by extensive feedstock availability and large-scale manufacturing in Malaysia, Indonesia, China, and India. Europe follows with roughly 22% share, driven by stringent sustainability regulations and strong demand for bio-based surfactants and green chemicals. North America accounts for nearly 18%, benefiting from expanding applications in pharmaceuticals, home care, and industrial formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global oleochemicals market was valued at USD 26.06 billion in 2024 and is projected to reach USD 44.11 billion by 2032, registering a CAGR of 6.8%, driven by expanding demand for bio-derived chemical intermediates.

- Strong market growth is supported by rising consumption of fatty acids, the largest segment, due to their extensive use in surfactants, personal care, detergents, and industrial chemicals, alongside increasing adoption of fatty alcohols and glycerin in home-care and pharmaceutical applications.

- Key trends include accelerated transition toward renewable, biodegradable raw materials, expansion of bio-surfactants, and increased integration of certified sustainable palm-based supply chains across major producing countries, strengthening long-term sector resilience.

- Competitive intensity rises as global leaders like Wilmar, BASF, KLK, IOI, Oleon, Evonik, and Croda scale high-purity processing technologies while navigating challenges such as feedstock price volatility and strict sustainability compliance frameworks.

- Asia-Pacific leads with ~45% market share, followed by Europe at ~22% and North America at ~18%, while the chemicals segment remains dominant across applications, supported by strong demand for oleochemical intermediates in surfactants, lubricants, food additives, and industrial processing.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Fatty acids dominate the oleochemicals market, holding the largest share due to their extensive use in detergents, soaps, surfactants, personal care formulations, and rubber processing chemicals. Their strong demand is reinforced by the growth of sustainable cleaning ingredients and the shift toward biodegradable feedstock in FMCG sectors. Fatty alcohols show steady expansion supported by their use in emulsifiers and surfactants, while methyl esters benefit from rising biodiesel blending mandates. Glycerin continues gaining traction in pharmaceuticals, food additives, and cosmetics, driven by its purity, humectant properties, and expanding applications in nutraceuticals.

- For instance, KLK OLEO operates multiple integrated oleochemical complexes globally, including facilities in Malaysia. These facilities collectively produce a wide range of basic and specialty oleochemical products, such as fatty acids, fatty alcohols, and glycerin, which supply C8–C18 fractions used worldwide in home-care, personal-care, and various industrial applications.

By Application

The chemicals segment leads the market, capturing the dominant share as fatty acids, alcohols, and methyl esters act as critical intermediates in surfactants, lubricants, polymers, coatings, agrochemicals, and specialty chemical manufacturing. Food and beverages remain a fast-growing application as glycerin and specialty fatty acids see increasing use in emulsifiers, stabilizers, and texturizing agents. Animal feed applications expand steadily as oleochemicals support energy density, digestibility, and livestock nutrition enhancement. The shift toward bio-derived inputs across downstream industries ensures sustained demand for oleochemicals across all application segments.

- For instance, BASF’s Care Chemicals division is a major global producer of oleochemical-based surfactants, with an annual production capacity of over 1.2 million metric tonnes of anionic and nonionic surfactants combined across its global production sites.

Key Growth Drivers

Rising Global Shift Toward Bio-Based and Sustainable Chemicals

The accelerating transition from petrochemical feedstocks to renewable, plant-derived alternatives remains the strongest growth catalyst for the oleochemicals market. Regulatory pressure to reduce carbon intensity in industrial manufacturing encourages companies across personal care, home care, lubricants, plastics, coatings, and pharmaceuticals to substitute fossil-based intermediates with biodegradable oleochemical derivatives. This trend is reinforced by the expanding availability of sustainable palm, coconut, rapeseed, and tallow feedstocks supported by certification schemes such as RSPO and ISCC. Manufacturers increasingly adopt green chemistry principles, reducing VOC emissions and integrating circular bioeconomy models that utilize waste cooking oil and biomass residues. As downstream industries intensify ESG commitments, oleochemicals gain preference due to their favorable environmental profile, non-toxic nature, and compatibility with high-performance formulations. The shift toward low-carbon supply chains substantially strengthens long-term market demand.

- For instance, Wilmar International processes tens of millions of metric tonnes of renewable feedstocks annually across its integrated refining and oleochemical complexes, ensuring large-scale availability of plant-based inputs; its total sales volume for the Feed and Industrial Products segment reached 68.7 million metric tonnes in FY2024″.

Expanding Applications Across High-Growth End-Use Industries

The diversification of oleochemical applications into pharmaceuticals, nutraceuticals, food processing, agrochemicals, biopolymers, and performance materials significantly drives market expansion. In pharmaceuticals, glycerin and specialty fatty acids support excipient formulations, capsule manufacturing, and topical therapeutics. The food and beverage sector uses oleochemicals in emulsifiers, humectants, stabilizers, and coating agents. Rising biodiesel production enhances demand for methyl esters, while the increasing use of fatty alcohols in detergents, industrial cleaners, and textile processing fuels continuous growth. Oleochemicals also enable innovations in bioplastics, especially polyhydroxyalkanoates (PHAs) and other biodegradable polymers derived from fatty acid feedstocks. As multiple industries substitute petrochemical-based surfactants and additives with plant-derived alternatives, oleochemicals experience strong structural demand across both established and emerging sectors.

- For instance, Croda’s Avanti Polar Lipids business (now operating under the brand name Avanti Research for research products and integrated into Croda Pharma for commercial manufacturing) operates state-of-the-art cGMP facilities in Alabaster, Alabama, and an expanded, advanced facility in Lamar, Pennsylvania.

Advancements in Processing Technology and Feedstock Optimization

Continuous improvements in hydrogenation, transesterification, fractionation, and enzymatic processing enhance oleochemical output quality, yield, and operational efficiency. Next-generation reactors, improved catalyst systems, and energy-optimized production lines enable manufacturers to reduce impurities and tailor product specifications for high-performance end uses. Feedstock optimization through integrated supply chains—such as traceable palm oil, waste oil valorization, and precision-controlled oilseed cultivation—strengthens security and reduces volatility. Enzymatic technologies further support mild reaction conditions, lower carbon footprints, and selective conversion pathways that improve product consistency for pharmaceutical and cosmetic applications. Increasing investments in digitalized manufacturing, including process automation, real-time analytics, and predictive maintenance, enhance production stability and cost competitiveness. These technological gains empower industry players to expand product portfolios, meet stringent regulatory standards, and serve evolving customer needs.

Key Trends & Opportunities

Growth of Bio-Based Surfactants and Green Cleaning Formulations

The rapid shift toward natural, plant-derived skincare, personal hygiene, and household cleaning products is creating significant opportunities for fatty acids, fatty alcohols, and glycerin derivatives. Consumer preferences for sulfate-free, paraben-free, and biodegradable formulations are increasing the use of oleochemical surfactants such as alkyl polyglucosides, fatty acid esters, and amphoteric surfactants. FMCG companies continue launching eco-friendly product lines, driving demand for high-purity oleochemicals with enhanced foaming, emulsifying, and mildness characteristics. Regulatory restrictions on petroleum-derived surfactants in Europe and North America accelerate the adoption of renewable alternatives. This trend is expected to strengthen as global brands pursue sustainability commitments, enabling oleochemical suppliers to integrate deeper into premium personal care and home care value chains.

- For instance, BASF’s APG® (alkyl polyglucoside) surfactant platform is supported by production assets capable of manufacturing more than 120,000 tonnes per year across its facilities in Germany, the U.S., and China, ensuring large-scale supply of biodegradable sugar-based surfactants used in eco-friendly cleaning formulations.

Rising Opportunity in Biodegradable Lubricants, Plastics, and Agrochemicals

Oleochemical-based esters and fatty acids are increasingly used in biodegradable lubricants, bio-based polymer additives, and sustainable agrochemical formulations. Industrial and automotive sectors adopt bio-lubricants to comply with strict environmental regulations governing leakage, disposal, and biodegradability. In bioplastics, oleochemicals act as plasticizers, slip agents, and stabilizers essential for improving flexibility, thermal resistance, and processability. Agricultural applications use oleochemical derivatives in controlled-release fertilizers, crop protection adjuvants, and botanical pesticide carriers. As industries seek to reduce ecological impact, oleochemicals present substantial growth potential across materials, mobility, and environmental solutions. The accelerating global focus on decarbonization reinforces revenue opportunities in these high-value emerging applications.

- For instance, Emery Oleochemicals operates a dedicated ester-based synthetic lubricant production line in Cincinnati with a capacity exceeding 50,000 tonnes per year, supplying polyol esters and adipates used in industrial and automotive bio-lubricants that meet OECD biodegradability standards.

Supply Chain Localization and Integration of Traceable, Ethical Feedstocks

Companies increasingly invest in vertically integrated, traceable supply chains to ensure sustainability and secure long-term feedstock availability. Traceability technologies—such as satellite monitoring, blockchain tracking, and segregated certified palm supply systems—enable producers to meet growing ESG and compliance requirements. Localized production facilities in Asia-Pacific, Europe, and Latin America reduce transportation emissions and improve feedstock resilience. This trend opens opportunities for oleochemical producers to partner with growers, food processors, and waste oil collectors to secure consistent inputs. As global demand for ethically sourced, deforestation-free raw materials intensifies, suppliers with transparent and certified supply chains will gain significant competitive advantage.

Key Challenges

Feedstock Price Volatility and Supply Uncertainty

Oleochemical production remains heavily dependent on palm oil, coconut oil, soy oil, and tallow, all of which experience significant cost fluctuations due to climate variations, agricultural yield cycles, geopolitical conditions, and trade policy changes. Extreme weather events and sustainability-related restrictions further affect availability and pricing, exerting pressure on manufacturer margins. Competition from food and biofuel industries intensifies demand for the same raw materials, amplifying price sensitivity. While diversification into recycled oils and alternative oilseed pathways is emerging, producers still face operational risks when feedstock markets experience rapid disruptions. This challenge necessitates robust procurement strategies, long-term supplier partnerships, and hedging mechanisms.

Complex Regulatory and Sustainability Compliance Requirements

The oleochemicals sector must navigate stringent environmental, labor, and sustainability standards related to land use, supply chain traceability, chemical safety, and carbon emissions. Compliance with global frameworks such as REACH, RSPO, ISCC, and biodiversity protection laws requires continuous investment in auditing, certification, and monitoring systems. Manufacturers also face increasing scrutiny from downstream customers demanding deforestation-free, low-carbon ingredients. Meeting these requirements adds operational complexity and cost, particularly for small and mid-sized producers. Failure to comply risks market access limitations, reputational damage, and potential supply chain disruptions, making regulatory alignment a critical market challenge.

Regional Analysis

North America

North America holds around 18% of the global oleochemicals market, driven by strong demand for bio-based surfactants, personal care ingredients, and specialty chemicals. The U.S. leads regional growth due to expanding applications in pharmaceuticals, food additives, industrial lubricants, and sustainable home-care formulations. Increasing regulatory pressure to reduce reliance on petrochemicals accelerates adoption of glycerin, fatty acids, and fatty alcohols across manufacturing sectors. Strategic investments in biodegradable lubricants and green polymer additives further strengthen market penetration. Rising consumer preference for natural skincare and eco-friendly cleaning solutions continues to reinforce long-term demand across the region.

Europe

Europe accounts for approximately 22% of the market, supported by stringent sustainability regulations and rapid substitution of petrochemical-based surfactants with renewable oleochemical alternatives. Demand is strongest in Germany, the Netherlands, France, and the U.K., where green chemistry adoption drives high consumption of fatty acids, esters, and bio-lubricants. The region’s focus on carbon neutrality, circular supply chains, and biodegradable product certification supports increased use in personal care, home care, coatings, and agrochemicals. Expanding biodiesel production in the EU also boosts methyl ester demand. Strong regulatory alignment with REACH and deforestation-free supply policies encourages consistent market expansion.

Asia-Pacific

Asia-Pacific dominates the global market with roughly 45% share, driven by abundant feedstock availability, large-scale manufacturing capacity, and strong regional consumption across FMCG, food, and industrial sectors. Indonesia, Malaysia, China, and India serve as major hubs for fatty acids, fatty alcohols, and glycerin production. Rapid industrialization and expanding home-care and personal-care product usage significantly accelerate demand. The region also benefits from integrated palm oil supply chains, cost-competitive processing facilities, and rising investment in sustainable certification systems. Growth in biodiesel programs—particularly in Indonesia and Malaysia—further supports methyl ester consumption, reinforcing APAC’s leading market position.

Latin America

Latin America holds around 8% of the market, driven by expanding oleochemical production in Brazil, Colombia, and Argentina, supported by strong agricultural feedstock availability such as soybean and palm derivatives. Growing adoption of natural-based surfactants in home care and personal care, along with a rising focus on biodegradable packaging additives, fuels market momentum. Brazil’s biodiesel blending mandates continue to strengthen demand for methyl esters. Increasing regional manufacturing of lubricants, adhesives, and food additives further enhances consumption. Investments in sustainable palm cultivation and certification frameworks gradually improve competitiveness and support long-term growth.

Middle East & Africa

The Middle East & Africa region accounts for roughly 7% market share, with growth supported by rising adoption of oleochemicals in food processing, detergents, industrial lubricants, and agrochemicals. South Africa, GCC countries, and emerging North African markets serve as primary demand centers. Increasing investments in industrial manufacturing and expanding consumer goods sectors drive stronger usage of fatty acids, glycerin, and esters. Limited local production leads to high import dependence, but new projects in sustainable feedstock cultivation and regional specialty chemical facilities are improving supply stability. Growing demand for biodegradable formulations creates steady long-term opportunities.

Market Segmentations:

By Type

- Fatty Acids

- Fatty Alcohols

- Methyl Esters

- Glycerin

By Application

- Food & Beverages

- Chemicals

- Animal Feed

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The oleochemicals market features a competitive mix of integrated agribusiness companies, specialty chemical manufacturers, and bio-based ingredient suppliers that compete through feedstock security, technological specialization, and sustainability leadership. Major players such as Wilmar International, KLK Oleo, IOI Oleochemicals, Evonik Industries, Emery Oleochemicals, BASF, and Croda International strengthen their positions through vertically integrated palm and coconut supply chains, enabling greater cost stability and traceability. Companies increasingly invest in advanced hydrogenation, esterification, and fractionation technologies to deliver high-purity fatty acids, fatty alcohols, glycerin, and esters tailored for premium personal care and pharmaceutical applications. Strategic priorities include capacity expansions in Asia-Pacific, development of certified sustainable feedstocks, and partnerships supporting circular production using waste oils and biomass. Leading firms pursue low-carbon manufacturing, RSPO/ISCC certification, and new product lines for bio-surfactants, biodegradable lubricants, and green polymer additives. Intense emphasis on ESG compliance and downstream innovation continues to shape competitive dynamics across the industry.

Key Player Analysis:

- Wilmar International (Singapore)

- Cargill Inc. (U.S.)

- Croda Industrial Chemicals (U.K.)

- IOI Group Berhad (Malaysia)

- Evonik Industries (Germany)

- Kao Chemicals (Japan)

- BASF SE (Germany)

- Twin Rivers Technologies (U.S.)

- Kuala Lumpur Kepong Berhad (Malaysia)

- Oleon N.V. (Belgium)

Recent Developments:

- In April 2025, Evonik showcased a set of new high-performance and eco-friendly personal-care ingredients at the global tradeshow in‑cosmetics® global, emphasising its commitment to sustainable oleochemical derivatives for skin and hair formulations.

- In August 2022 – The Kuala Lumpur Kepong Berhad Group offered a product named DavosLife E3, which can be used in food and nutrition applications. According to Kuala Lumpur Kepong Berhad, the product has wide-reaching, clinically proven health benefits for heart health, liver health, and brain health.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for bio-based surfactants, lubricants, and specialty chemicals will continue rising as industries accelerate the shift from petrochemical ingredients to renewable alternatives.

- Adoption of high-purity fatty acids, alcohols, glycerin, and esters will increase as personal care and home-care brands expand natural and eco-friendly product portfolios.

- Sustainability certifications and traceable feedstock systems will gain greater importance, driving investment in deforestation-free and ethically sourced palm supply chains.

- Advanced processing technologies such as enzymatic conversion and energy-efficient fractionation will enhance product performance and reduce manufacturing emissions.

- Biodegradable lubricants and polymer additives will become major growth avenues as automotive and industrial sectors prioritize low-carbon materials.

- Circular production models using waste oils, biomass residues, and recycled feedstocks will expand, supporting resilient and cost-efficient supply chains.

- Biodiesel blending programs and renewable fuel regulations will further strengthen demand for methyl esters across emerging economies.

- Food, pharmaceutical, and nutraceutical applications will broaden as high-grade oleochemicals gain regulatory acceptance for sensitive formulations.

- Regional manufacturing expansion in Asia-Pacific, Latin America, and the Middle East will diversify global supply and reduce import dependencies.

- Competitive differentiation will increasingly rely on ESG performance, innovation in green chemistry, and value-added oleochemical derivatives tailored to specialty markets.

Market Segmentation Analysis:

Market Segmentation Analysis: