Market Overview

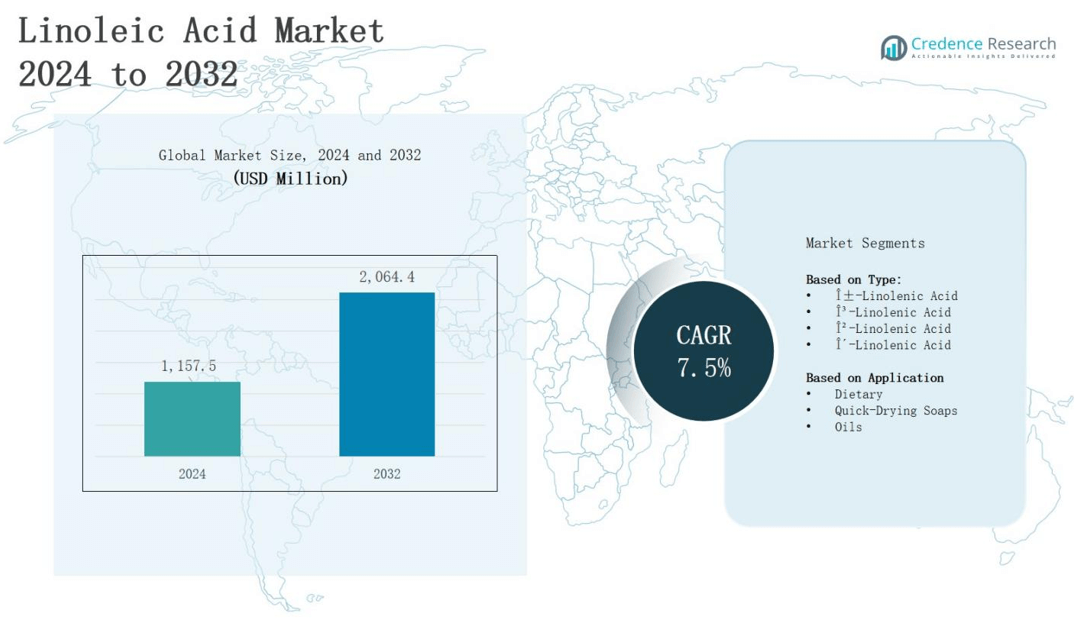

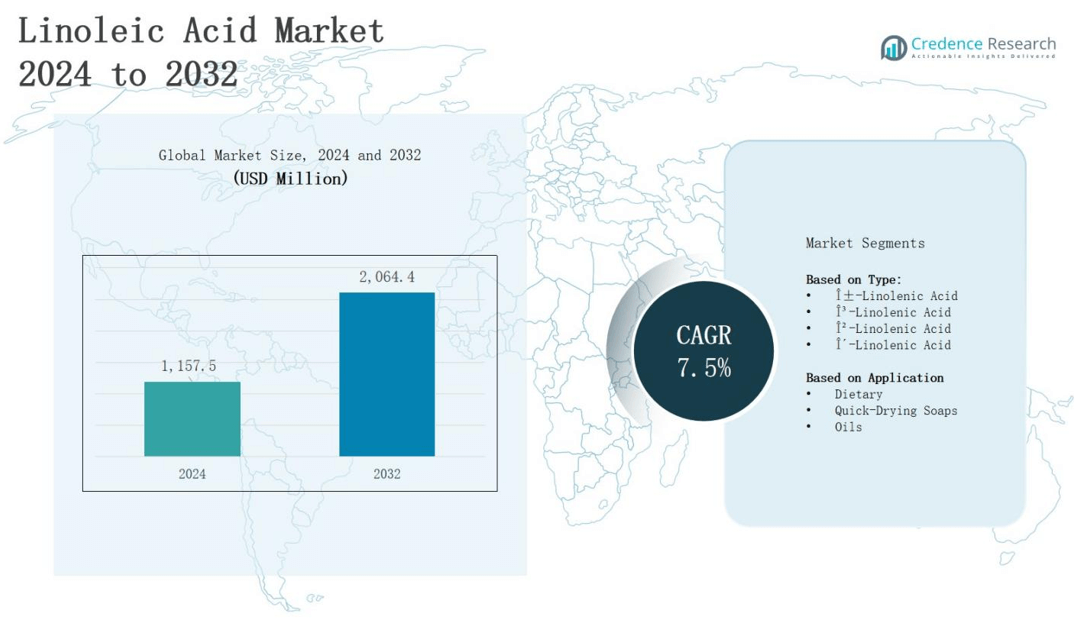

The linoleic acid market is projected to grow from USD 1,157.5 million in 2024 to USD 2,064.4 million by 2032, registering a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Linoleic Acid Market Size 2024 |

USD 1,157.5 million |

| Linoleic Acid Market, CAGR |

7.5% |

| Linoleic Acid Market Size 2032 |

USD 2,064.4 million |

The linoleic acid market is experiencing growth driven by its expanding use in food, cosmetics, and pharmaceuticals, owing to its nutritional value and skin-enhancing properties. Rising consumer preference for plant-based and functional ingredients is fueling demand in dietary supplements and fortified foods. Its anti-inflammatory and moisturizing benefits are increasing its adoption in skincare and haircare formulations. Growing awareness of omega-6 fatty acids’ role in heart health and immunity is further boosting market uptake. Key trends include the shift toward high-purity, sustainably sourced products, advancements in extraction methods, and a strong focus on clean-label, non-GMO, and eco-friendly formulations.

The linoleic acid market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing distinct growth drivers. North America leads with strong demand in food, nutraceutical, and personal care sectors, while Europe benefits from premium cosmetics and functional food markets. Asia-Pacific shows rapid growth driven by urbanization, health awareness, and raw material availability. The Rest of the World gains traction from emerging food and cosmetic industries. Key players include Perdue AgriBusiness, Sumitomo Chemical, Croda International, Emery Oleochemicals, AAK, Borregaard AS, IOI Group, Kolon Industries, Cargill, BASF, Wilmar International, and Elevance Renewable Sciences.

Market Insights

- The linoleic acid market is projected to grow from USD 1,157.5 million in 2024 to USD 2,064.4 million by 2032, registering a CAGR of 7.5% during the forecast period.

- Expanding applications in food, nutraceutical, and cosmetic industries drive demand due to its nutritional value, moisturizing benefits, and skin health properties.

- Rising preference for plant-based, non-GMO, and clean-label products boosts adoption in dietary supplements, fortified foods, and premium personal care formulations.

- North America leads with 34% share, followed by Europe at 28%, Asia-Pacific at 25%, and the Rest of the World at 13%, each offering distinct growth drivers.

- Key players include Perdue AgriBusiness, Sumitomo Chemical, Croda International, Emery Oleochemicals, AAK, Borregaard AS, IOI Group, Kolon Industries, Cargill, BASF, Wilmar International, and Elevance Renewable Sciences.

- Market growth is supported by advancements in sustainable sourcing, extraction technologies, and high-purity processing standards across industries.

- Challenges include raw material price volatility, supply chain constraints, and complex regulatory compliance requirements in multiple regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand in Food and Nutraceutical Applications

The linoleic acid market benefits from growing demand in the food and nutraceutical sectors due to its role in promoting heart health, immunity, and overall wellness. It is widely incorporated into fortified foods, dietary supplements, and functional beverages targeting health-conscious consumers. The rising preference for plant-based sources aligns with vegan and vegetarian diets. Increasing awareness of omega-6 fatty acids’ nutritional benefits supports adoption. Manufacturers invest in product innovations to meet evolving dietary trends.

- For instance, safflower oil, with approximately 12,700 mg of linoleic acid per 100 grams, is a popular cooking oil used in salad dressings and baked goods for its heart-healthy properties.

Expanding Use in Cosmetics and Personal Care

The linoleic acid market gains momentum from its extensive use in skincare, haircare, and cosmetic formulations. It offers moisturizing, anti-inflammatory, and barrier-repair properties, making it valuable for treating dry skin and scalp conditions. Beauty brands increasingly incorporate it into natural and clean-label products to meet consumer expectations for safe, sustainable ingredients. Growing demand for premium personal care products supports higher-value applications. It aligns with rising interest in multifunctional, plant-derived cosmetic solutions.

- For instance, Kraft Chemical notes that linoleic acid, as the most abundant polyunsaturated fatty acid in the skin’s outer layer, serves as an emollient and anti-inflammatory agent in many cosmetic and personal care products, enhancing skin hydration and barrier function.

Increased Awareness of Health Benefits

The linoleic acid market experiences growth due to heightened awareness of its role in maintaining cardiovascular health, regulating cholesterol, and supporting immune function. It appeals to both preventive healthcare consumers and those managing chronic conditions. Health organizations and industry campaigns emphasize omega-6 fatty acids’ significance in balanced diets. Demand rises across diverse age groups seeking long-term wellness. This trend drives uptake in both mainstream retail and specialized health-focused distribution channels.

Advancements in Sourcing and Processing Technologies

The linoleic acid market benefits from advancements in extraction, refining, and formulation technologies that improve purity and stability. It now meets stricter quality standards for food, cosmetic, and pharmaceutical applications. Sustainable sourcing initiatives, including non-GMO and organic production, align with global environmental goals. Manufacturers invest in efficient production methods to reduce costs while maintaining quality. These developments expand its application potential across high-growth industries, supporting long-term market expansion.

Market Trends

Growing Shift Toward Clean-Label and Natural Formulations

The linoleic acid market reflects a clear shift toward clean-label, natural, and plant-based formulations across food, nutraceutical, and cosmetic industries. It meets consumer expectations for transparency, safety, and sustainability. Brands actively reformulate products to remove synthetic additives while maintaining performance and quality. Demand for non-GMO and organic-certified linoleic acid is rising in premium segments. The focus on minimally processed, eco-friendly ingredients drives innovation and strengthens market positioning in competitive sectors.

- For instance, MEGGLE Food Ingredients offers a broad range of clean-label solutions in bakery, nutrition, dairy, and savory segments, developing non-hydrogenated and plant-based fats with transparent, recognizable ingredients suited for health-conscious consumers.

Increasing Penetration in High-Performance Personal Care Products

The linoleic acid market is witnessing stronger integration into high-performance skincare, haircare, and dermatological products. It delivers proven benefits such as barrier repair, hydration enhancement, and inflammation reduction, appealing to both mass and luxury segments. Formulators are leveraging its versatility to create multifunctional products targeting multiple skin and hair concerns. Demand for plant-derived actives is growing in both developed and emerging markets. This trend reinforces its value proposition in the personal care industry.

Advancements in Sustainable Sourcing and Processing

The linoleic acid market is influenced by advancements in sustainable sourcing, extraction, and refining techniques. It increasingly comes from renewable feedstocks like sunflower, safflower, and soybean oils that meet environmental and ethical standards. Producers invest in cleaner, energy-efficient processes that improve purity without compromising yield. Growing corporate commitments to sustainability enhance its market appeal. These developments create competitive advantages for suppliers and strengthen the long-term adoption of eco-conscious solutions.

- For instance, BASF SE focuses on cold-pressed, non-GMO, and organic oils for premium food and cosmetic applications, reinforcing cleaner production techniques.

Integration into Functional and Fortified Food Portfolios

The linoleic acid market benefits from its growing inclusion in functional foods and fortified product lines. It supports claims related to heart health, immunity, and metabolic balance, appealing to health-focused consumers. Food manufacturers expand applications in spreads, dairy alternatives, and nutritional beverages. Marketing strategies emphasize science-backed benefits to build consumer trust. This integration into everyday diets increases market visibility and sustains demand across mainstream and specialized retail channels.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Constraints

The linoleic acid market faces challenges from volatility in raw material prices and disruptions in the supply chain. It relies heavily on vegetable oil sources such as sunflower, safflower, and soybean, which are affected by climatic conditions, agricultural yield variations, and global trade policies. Price instability impacts production costs and profit margins for manufacturers. Supply shortages can delay order fulfillment and hinder consistent quality delivery. These factors require suppliers to adopt risk mitigation strategies, diversify sourcing, and secure long-term contracts with growers.

Regulatory Compliance and Quality Standard Requirements

The linoleic acid market must address complex regulatory frameworks and stringent quality requirements across different regions. It is subject to food safety, cosmetic ingredient, and pharmaceutical standards that vary by jurisdiction, increasing compliance costs and operational complexity. Failure to meet these standards can lead to market restrictions or product recalls. Maintaining purity, stability, and traceability throughout production is essential. Manufacturers invest in advanced testing, certification, and process optimization to meet evolving regulatory expectations while ensuring global market access.

Market Opportunities

Rising Demand for Functional and Preventive Healthcare Products

The linoleic acid market presents significant opportunities through the expanding demand for functional foods, nutraceuticals, and dietary supplements targeting preventive healthcare. It offers clinically recognized benefits for cardiovascular health, immune support, and metabolic balance, making it appealing to health-conscious consumers. Manufacturers can leverage this demand to develop fortified products and position them with science-backed claims. Growing interest in plant-based omega-6 sources opens avenues for innovation in vegan and vegetarian product lines. Strategic marketing focused on health outcomes can strengthen brand differentiation and customer loyalty.

Expansion Potential in Premium Personal Care and Cosmetic Segments

The linoleic acid market can capture growth by targeting the premium personal care segment, where demand for natural, multifunctional, and high-performance ingredients continues to rise. It provides proven efficacy in skin barrier repair, anti-inflammatory treatment, and hydration enhancement, meeting consumer expectations for clean-label and eco-friendly solutions. Brands can integrate it into advanced formulations for anti-aging, sensitive skin, and hair repair products. Emerging markets with growing disposable incomes offer untapped potential for premium beauty applications. Partnerships with cosmetic innovators can accelerate product adoption and market penetration.

Market Segmentation Analysis:

By Type

The linoleic acid market is segmented into α-linolenic acid, γ-linolenic acid, β-linolenic acid, and δ-linolenic acid, each offering distinct functional properties. α-Linolenic acid dominates due to its widespread use in dietary supplements and functional foods for cardiovascular and metabolic health benefits. γ-Linolenic acid finds strong demand in skincare and pharmaceutical applications due to its anti-inflammatory properties. β- and δ-linolenic acids cater to specialized industrial and nutraceutical uses, contributing to niche but growing demand across targeted segments.

- For instance, Colgate-Palmolive re-launched products with science-backed formulas that include γ-linolenic acid for skin health benefits. β- and δ-linolenic acids cater to specialized industrial and nutraceutical uses, contributing to niche but growing demand across targeted segments.

By Application

The linoleic acid market by application covers dietary, quick-drying soaps, and oils, with dietary usage accounting for the largest share. It supports health-focused products such as fortified foods, nutritional beverages, and omega-rich supplements. Quick-drying soaps leverage its emollient and conditioning qualities, appealing to both personal care and specialty cleaning markets. Oils segment benefits from its role as a base in cosmetics, industrial coatings, and therapeutic formulations. Rising consumer preference for plant-derived, multifunctional ingredients strengthens adoption across these categories.

- For dietary applications, General Nutrition Corporation offers flaxseed oil capsules containing 144 mg of linoleic acid per capsule, which are used in nutritional supplements to support heart and skin health.

Segments:

Based on Type:

- α-Linolenic Acid

- γ-Linolenic Acid

- β-Linolenic Acid

- δ-Linolenic Acid

Based on Application

- Dietary

- Quick-Drying Soaps

- Oils

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 34% of the global linoleic acid market, driven by strong demand from the food, nutraceutical, and personal care industries. It benefits from high consumer awareness regarding the health benefits of omega-6 fatty acids and a well-established dietary supplement sector. The region also leads in product innovation and adoption of clean-label ingredients. It supports growth through advanced manufacturing facilities and strict quality standards. Rising demand for natural cosmetics further strengthens its market position. Strategic partnerships between suppliers and consumer brands enhance distribution and brand reach.

Europe

Europe accounts for 28% of the linoleic acid market, supported by robust demand in functional foods, pharmaceuticals, and premium cosmetics. It benefits from a mature regulatory framework that promotes high-quality, sustainable sourcing and non-GMO products. The region’s strong beauty and skincare industry drives adoption in high-performance formulations. It also gains from consumer preference for eco-friendly and plant-derived products. Growing awareness of cardiovascular and metabolic health further supports dietary supplement sales. Expansion in organic-certified product lines strengthens long-term demand.

Asia-Pacific

Asia-Pacific holds 25% of the linoleic acid market, fueled by rapid urbanization, rising disposable incomes, and expanding health-conscious consumer segments. It experiences strong growth in dietary supplements, fortified foods, and personal care products, particularly in China, Japan, and India. The region benefits from abundant raw material availability, supporting competitive pricing and supply stability. It also gains from the rise of domestic beauty brands integrating natural oils into formulations. Government initiatives promoting functional food consumption further boost demand.

Rest of the World

The Rest of the World represents 13% of the linoleic acid market, with growth driven by emerging demand in Latin America, the Middle East, and Africa. It benefits from increasing investments in food processing, cosmetics manufacturing, and nutraceutical production. Rising consumer interest in plant-based health solutions supports uptake in dietary products. It faces challenges from limited processing infrastructure but gains opportunities from export-oriented production. Growing adoption of sustainable agricultural practices enhances supply reliability. Strategic market entry initiatives expand product availability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Perdue AgriBusiness

- Sumitomo Chemical

- Croda International

- Emery Oleochemicals

- AAK

- Borregaard AS

- IOI Group

- Kolon Industries

- Cargill

- BASF

- Wilmar International

- Elevance Renewable Sciences

Competitive Analysis

The linoleic acid market is characterized by a competitive landscape with global and regional players focusing on product quality, sustainable sourcing, and innovation to strengthen market presence. It is driven by companies such as Perdue AgriBusiness, Sumitomo Chemical, Croda International, Emery Oleochemicals, AAK, Borregaard AS, IOI Group, Kolon Industries, Cargill, BASF, Wilmar International, and Elevance Renewable Sciences, which invest in advanced extraction and refining technologies to improve purity and application versatility. Strategic initiatives include capacity expansions, partnerships with food, cosmetic, and pharmaceutical manufacturers, and the development of non-GMO and organic-certified products to meet evolving consumer preferences. Players emphasize supply chain resilience through diversified sourcing and long-term agreements with agricultural producers. Strong brand positioning, regulatory compliance, and competitive pricing strategies remain critical to sustaining market leadership. The competitive environment is further shaped by growing demand for plant-based, clean-label formulations, prompting companies to differentiate through innovation, targeted marketing, and expansion into high-growth regions.

Recent Developments

- In May 2025, Bioriginal Food and Science Corp. launched a cold-pressed, non-GMO borage oil standardized to 25 percent gamma-linoleic acid, targeting both human and pet nutrition markets.

- In December 2024, BASF agreed to sell its Food and Health Performance Ingredients business to Louis Dreyfus Company, including conjugated linoleic acid and other human-nutrition ingredients, marking a strategic portfolio shift.

- In December 2024, Louis Dreyfus Company announced the acquisition of BASF’s Food & Health Performance Ingredients business, which includes its conjugated linoleic acid (CLA) portfolio, a production facility, and a state-of-the-art R&D center in Germany.

Market Concentration & Characteristics

The linoleic acid market demonstrates a moderately concentrated structure, with a mix of global leaders and regional suppliers competing through product quality, innovation, and sustainable sourcing practices. It features established companies such as Perdue AgriBusiness, Sumitomo Chemical, Croda International, Emery Oleochemicals, AAK, Borregaard AS, IOI Group, Kolon Industries, Cargill, BASF, Wilmar International, and Elevance Renewable Sciences, which hold significant influence over pricing and supply. It is characterized by a strong focus on clean-label, non-GMO, and high-purity products that meet stringent regulatory standards in food, cosmetic, and pharmaceutical sectors. The market benefits from stable demand across multiple industries, supported by the growing popularity of plant-based and functional ingredients. Barriers to entry include high capital requirements, strict quality compliance, and the need for secure raw material sourcing. Competitive strategies emphasize technological advancements, brand differentiation, and global distribution capabilities to capture emerging opportunities in high-growth regions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in functional foods and nutraceuticals driven by growing health awareness.

- Use in premium skincare and haircare products will expand due to proven efficacy.

- Sustainable and non-GMO sourcing will become a standard industry requirement.

- Advancements in extraction and refining will improve product purity and stability.

- Plant-based formulations will gain a larger share in dietary supplement markets.

- Regional brands will increase competition in emerging markets.

- Strategic partnerships between suppliers and consumer brands will strengthen distribution networks.

- Regulatory compliance will remain a key factor influencing market entry and expansion.

- Innovation in multifunctional products will attract diverse consumer segments.

- Adoption in high-growth regions will accelerate through targeted marketing and localized production.