Market Overview

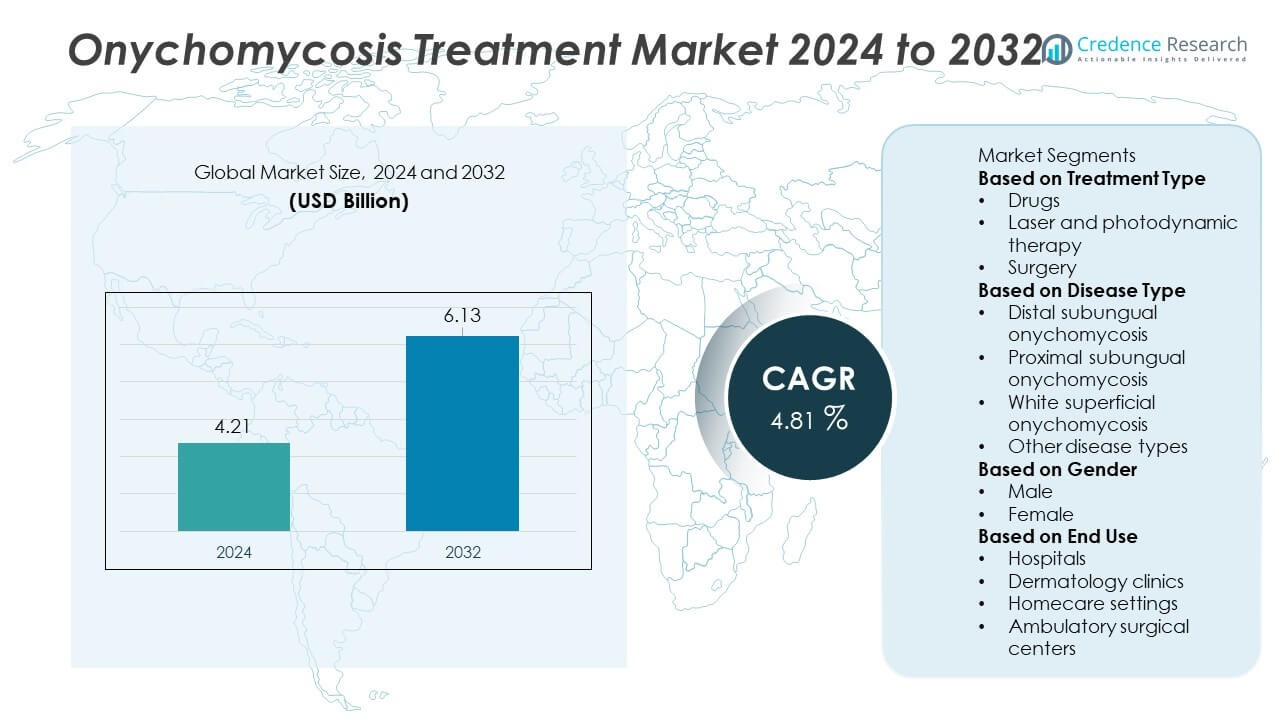

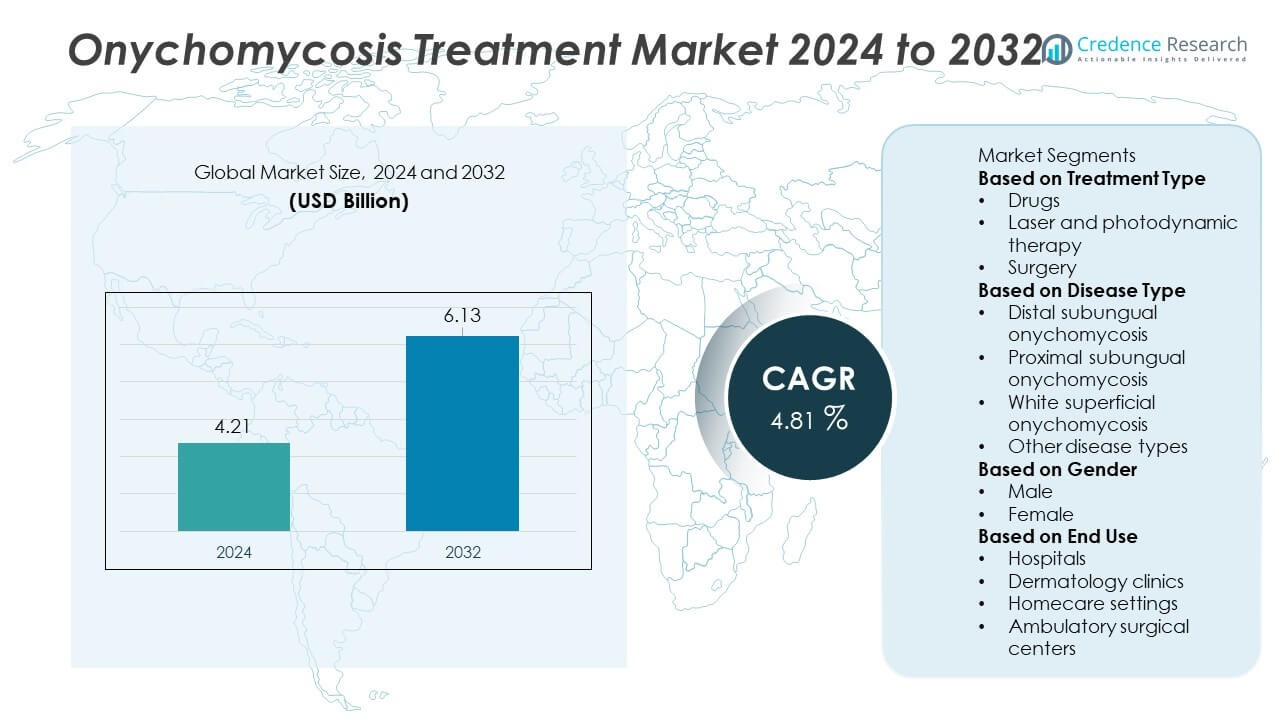

The Onychomycosis Treatment market was valued at USD 4.21 billion in 2024 and is projected to reach USD 6.13 billion by 2032, growing at a CAGR of 4.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Onychomycosis Treatment Market Size 2024 |

USD 4.21 Billion |

| Onychomycosis Treatment Market, CAGR |

4.81% |

| Onychomycosis Treatment Market Size 2032 |

USD 6.13 Billion |

Top players in the Onychomycosis Treatment market include Moberg Pharma, GlaxoSmithKline, Dr. Reddy’s Laboratories, Johnson & Johnson Services, Merz Pharma, Novartis, Galderma Laboratories, Bausch Health Sciences, Azilda Family Foot Care, and Kaken Pharmaceuticals. These companies strengthen their position through advanced antifungal formulations, strong clinical research, and wide distribution across dermatology clinics and retail pharmacies. North America leads the market with a 39% share, supported by high treatment awareness and strong adoption of prescription and OTC products. Europe holds a 28% share, driven by established dermatology care and strong hygiene awareness. Asia Pacific follows with a 26% share, supported by large patient populations, rising foot care awareness, and increasing access to affordable antifungal therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Onychomycosis Treatment market reached USD 4.21 billion in 2024 and is expected to hit USD 6.13 billion by 2032 at a 4.81% CAGR, reflecting steady demand for effective antifungal therapies.

- Growth is driven by rising fungal nail infections, with drug-based treatments holding a 72% segment share due to strong clinical efficacy and widespread dermatology prescriptions.

- Market trends highlight increasing adoption of advanced topical formulations, improved nail-penetration technologies, and growing interest in laser and photodynamic therapies across urban clinics.

- Competition intensifies as key players focus on improved formulations, patient-friendly delivery systems, and wider OTC availability, while new entrants explore faster-acting and non-invasive treatment options.

- Regionally, North America leads with 39%, followed by Europe with 28% and Asia Pacific with 26%, supported by rising awareness, expanding dermatology services, and strong demand for both prescription and OTC antifungal products.

Market Segmentation Analysis:

By Treatment Type

Drugs dominate this segment with a 72% share, driven by high prescription rates and strong clinical efficacy of oral antifungals such as terbinafine and itraconazole. Topical formulations also support steady adoption among patients seeking non-invasive therapy and long-term maintenance. Laser and photodynamic therapy show rising interest due to faster results, but remain secondary because of higher costs and limited access. Surgical procedures represent a small share, mainly used in severe or resistant cases. Growing awareness of early-stage treatment and increasing dermatology consultations further strengthen the demand for drug-based therapies.

- For instance, Moberg Pharma conducted phase 3 clinical trials on its topical solution, MOB-015, involving more than 800 patients across North America and Europe, which demonstrated a high mycological cure rate of up to 76% at 52 weeks in the European study, a superior result compared to other topical treatments.

By Disease Type

Distal subungual onychomycosis leads the segment with a 64% share, supported by its high global prevalence and strong diagnosis rates. This form of infection is the most commonly reported in both clinical and home-care settings, driving consistent demand for oral and topical antifungals. Proximal subungual and white superficial cases contribute moderate volumes, often linked to specific risk groups and early symptoms. Other disease types hold a minor portion but show growing detection due to improved screening. Rising awareness of nail hygiene and increasing cases linked to diabetes and aging populations support overall market expansion.

- For instance, Kaken Pharmaceutical’s clinical analysis of 320 distal subungual cases treated with efinaconazole showed quantifiable reductions in pathogen presence confirmed through culture testing, along with documented improvements in nail plate thickness measured via digital imaging devices.

By Gender

The male segment dominates with a 58% share, driven by higher incidence of fungal nail infections among men due to lifestyle patterns, frequent sports activity, and greater exposure to humid environments. Men also show higher recurrence rates, contributing to stronger demand for long-duration antifungal therapy. The female segment accounts for the remaining share, supported by rising cosmetic concerns and early adoption of topical treatments. Increasing healthcare awareness and growing willingness to seek dermatological care support treatment uptake across both groups. Expanding OTC availability and improved treatment options further strengthen market engagement.

Key Growth Drivers

Rising Prevalence of Fungal Nail Infections

Increasing global cases of fungal nail infections strengthen demand for effective onychomycosis treatments. Higher exposure to humid environments, aging populations, and growing rates of chronic conditions such as diabetes elevate infection risk. Dermatology clinics report rising consultations for nail discoloration, thickening, and painful infections, supporting higher use of oral and topical antifungals. Public awareness campaigns on nail hygiene also encourage early diagnosis. Strong demand from both clinical and OTC channels continues to push market growth across developed and emerging regions.

- For instance, Bausch Health conducted two pivotal Phase 3 clinical trials, studies 301 and 302, involving over 1,650 patients in total across North America with mild to moderate onychomycosis using its topical solution, efinaconazole 10%.

Growing Adoption of Advanced Antifungal Therapies

Newer antifungal formulations with improved nail penetration and reduced side effects drive treatment preference. Pharmaceutical companies focus on enhanced topical solutions and combination therapies that deliver faster and more consistent clinical outcomes. Patients increasingly choose effective, non-invasive options for mild and moderate infections. Dermatologists also recommend advanced oral agents for high-severity cases due to strong cure rates. As updated treatment guidelines promote improved therapeutic regimens, adoption of modern antifungals continues to rise.

- For instance, in two phase 3 randomized studies including a total of 1,655 patients, once-daily treatment with Jublia (efinaconazole) 10% solution for 48 weeks resulted in complete cure rates of 15.2% to 17.8%, with quantifiable drug concentration levels in the nail bed measured through methods like high-performance liquid chromatography.

Increasing Foot Care Awareness and Dermatology Visits

Growing interest in personal grooming, foot care, and nail aesthetics boosts treatment uptake. People are more likely to seek early care when noticing nail damage, discoloration, or discomfort. Expanding podiatry and dermatology services also improve access to professional diagnosis and structured treatment plans. Retail pharmacies and online platforms offer easy access to OTC antifungals, supporting self-care adoption. Rising awareness among athletes and workers in high-moisture environments further accelerates demand.

Key Trends & Opportunities

Rising Use of Laser and Photodynamic Therapy

Laser-based treatment gains traction as patients seek faster results and drug-free alternatives. Clinics expand these services due to growing consumer interest in painless and non-invasive solutions. While still costlier than drugs, laser therapy offers strong opportunities for premium service providers. Manufacturers invest in portable and clinic-grade devices with improved precision and lower recurrence rates. Increasing acceptance in dermatology centers enhances visibility and long-term market adoption.

- For instance, controlled clinical studies on Cutera’s 1064-nm Nd:YAG laser technology for onychomycosis have involved various patient numbers, with one study using a 1064-nm diode laser involving 56 patients (resulting in 11% complete cure with laser only after an average of 4.7 treatments) and another study using a short-pulse 1064-nm Nd:YAG laser (Cutera GenesisPlus) on 51 patients reporting 0% complete cure after three treatments.

Growth of Home-Based and OTC Treatment Solutions

Busy lifestyles and high recurrence rates push patients toward convenient home-based therapies. OTC antifungals become more popular due to easy availability, lower costs, and frequent self-medication behavior. Digital health platforms promote guided treatment and symptom monitoring, improving compliance. Companies expand product lines with user-friendly applicators and long-lasting formulations. This trend supports strong growth opportunities, especially in regions with limited access to dermatology care.

- For instance, Dr. Reddy’s Laboratories manufactures over-the-counter (OTC) antifungal treatments, such as those containing active ingredients like terbinafine or clotrimazole, which are available to consumers.

Key Challenges

High Recurrence and Long Treatment Duration

Onychomycosis often requires several months of continuous therapy, leading to low patient adherence. Thick nail plates slow drug absorption, reducing treatment response for many patients. Even after successful therapy, recurrence rates remain high, pushing clinicians to consider long-term management strategies. These factors create frustration for patients and limit overall treatment success. Companies must focus on improved formulations and shorter-duration therapies to address this challenge.

Safety Concerns Associated with Oral Antifungals

Oral antifungal drugs, though effective, face scrutiny due to potential liver toxicity and drug interactions. Physicians often avoid prescribing them to patients with chronic illnesses or those taking multiple medications. Regulatory agencies maintain strict monitoring for adverse effects, increasing compliance requirements for manufacturers. These concerns limit adoption in certain patient groups, slowing market penetration. Development of safer oral options and strong monitoring frameworks remains essential for sustained growth.

Regional Analysis

North America

North America holds a 39% share, driven by high awareness of nail health, strong access to dermatology services, and widespread use of advanced antifungal drugs. The region benefits from early diagnosis, high healthcare spending, and strong adoption of both prescription and OTC treatments. Laser-based therapies also gain traction due to growing demand for fast, non-invasive options. The presence of major pharmaceutical companies and continuous product improvements further support market expansion. Rising cases linked to aging populations, diabetes, and active lifestyles continue to strengthen treatment demand across the United States and Canada.

Europe

Europe accounts for a 28% share, supported by strong healthcare infrastructure, high foot care awareness, and consistent demand for prescription antifungal therapies. Countries such as Germany, the U.K., France, and Italy show strong adoption due to well-established dermatology services and growing use of topical and device-based treatments. Public health campaigns on hygiene and early diagnosis improve treatment rates. Aging demographics and rising fungal infection incidence further drive growth. Regulatory focus on safe and effective formulations also encourages manufacturers to invest in compliant and high-quality therapeutic options across the region.

Asia Pacific

Asia Pacific holds a 26% share, driven by large patient populations, rising dermatology visits, and increasing awareness of fungal nail infections. Countries such as China, India, Japan, and South Korea show strong demand due to humid climates, higher infection risk, and expanding access to affordable antifungal drugs. Growing middle-class spending and wider OTC availability support market penetration. Clinics adopt laser treatments at a faster pace in urban centers, increasing premium service adoption. Improved hygiene awareness and rising healthcare access further enhance regional treatment uptake.

Latin America

America captures a 5% share, supported by rising incidence of fungal infections linked to warm climates, sports activity, and growing urban populations. Brazil and Mexico dominate demand due to wider access to dermatology care and expanding pharmacy networks offering topical antifungals. Cost-effective generic drugs strengthen treatment accessibility across the region. Public health initiatives promoting hygiene and foot care also improve early diagnosis rates. Despite limited adoption of advanced therapies, steady awareness growth supports long-term market expansion.

Middle East & Africa

The Middle East & Africa region accounts for a 2% share, driven by increasing awareness of foot and nail health and expanding access to essential antifungal treatments. Gulf countries show stronger market presence due to better healthcare infrastructure and rising use of dermatology services. African nations rely more on generics because of affordability needs and limited specialist availability. Warm climates and rising diabetes cases contribute to higher infection prevalence. Gradual improvements in healthcare access and pharmacy distribution networks support slow but steady market growth across the region.

Market Segmentations:

By Treatment Type

- Drugs

- Laser and photodynamic therapy

- Surgery

By Disease Type

- Distal subungual onychomycosis

- Proximal subungual onychomycosis

- White superficial onychomycosis

- Other disease types

By Gender

By End Use

- Hospitals

- Dermatology clinics

- Homecare settings

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes key players such as Moberg Pharma, GlaxoSmithKline, Dr. Reddy’s Laboratories, Johnson & Johnson Services, Merz Pharma, Novartis, Galderma Laboratories, Bausch Health Sciences, Azilda Family Foot Care, and Kaken Pharmaceuticals. These companies compete by expanding product portfolios, improving topical and oral antifungal formulations, and strengthening global distribution networks. Many manufacturers invest in advanced delivery technologies that enhance nail penetration and shorten treatment duration. Rising demand for non-invasive solutions encourages companies to develop improved topical therapies and support the adoption of laser-based treatment options in clinics. Strategic partnerships with dermatologists, podiatrists, and pharmacy chains help increase brand visibility and strengthen market access. Leading players also focus on clinical trials, patient safety, and regulatory compliance to maintain competitive advantage. Continuous innovation, strong marketing efforts, and geographic expansion strategies allow these companies to capture growing demand across both prescription and OTC channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Moberg Pharma

- GlaxoSmithKline

- Reddy’s Laboratories

- Johnson & Johnson Services

- Merz Pharma

- Novartis

- Galderma Laboratories

- Bausch Health Sciences

- Azilda Family Foot Care

- Kaken Pharmaceuticals

Recent Developments

- In November 2025, Moberg Pharma entered an exclusive licence agreement with Karo Healthcare to launch its topical treatment MOB-015 (Terclara®) under the Lamisil® brand across 19 European markets for nail-fungus (onychomycosis).

- In April 2024, Bausch Health was granted a patent covering a topical pharmaceutical composition (ethanol + antifungal agents) for treatment of onychomycosis.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Disease Type, Gender, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for onychomycosis treatments will rise as fungal infections become more common worldwide.

- Advanced topical formulations with improved nail penetration will gain stronger adoption.

- Laser and photodynamic therapies will expand as patients seek faster, non-invasive solutions.

- OTC antifungal products will grow due to increased self-care and home-based treatment preference.

- Pharmaceutical companies will invest more in combination therapies to improve cure rates.

- Digital health tools will support better treatment adherence and symptom monitoring.

- Dermatology clinics will expand service offerings with device-based treatment options.

- Generic manufacturers will strengthen market presence through wider distribution and pricing advantages.

- Asia Pacific will play a larger role in global consumption due to rising treatment awareness.

- Companies will focus more on reducing recurrence rates through advanced formulation and long-term care solutions.