Market Overview

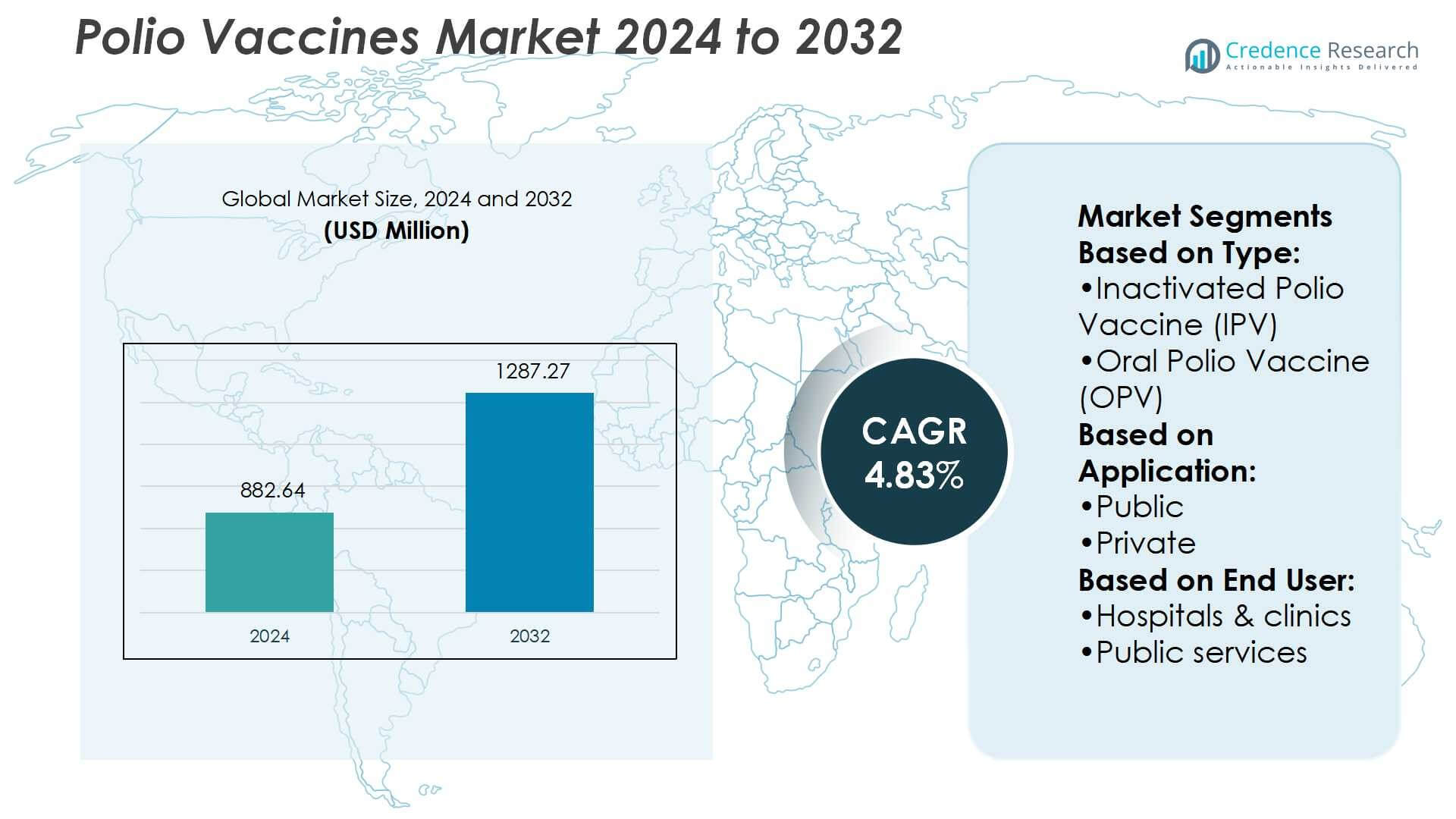

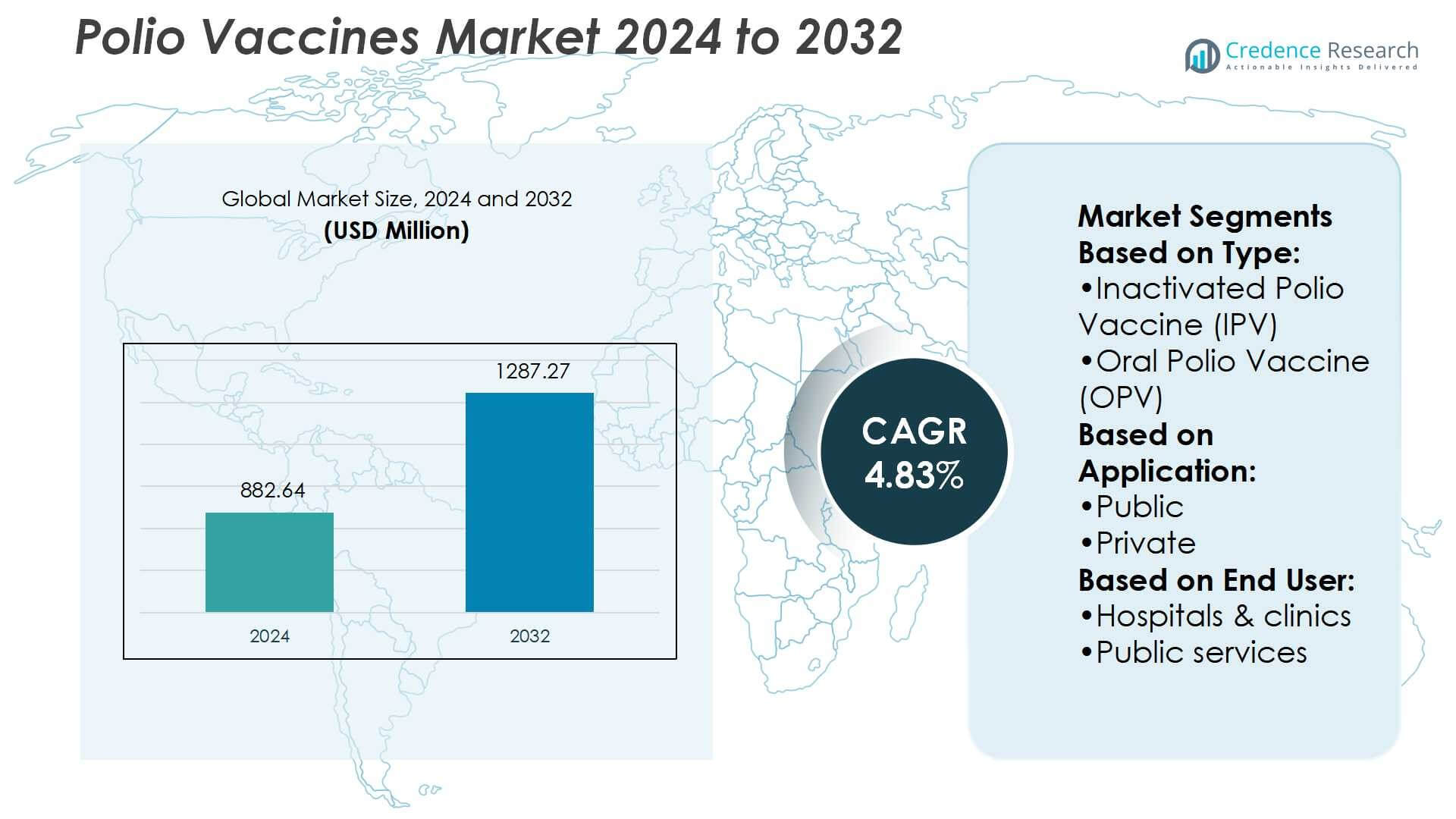

Polio Vaccines Market size was valued USD 882.64 million in 2024 and is anticipated to reach USD 1287.27 million by 2032, at a CAGR of 4.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polio Vaccines Market Size 2024 |

USD 882.64 Million |

| Polio Vaccines Market, CAGR |

4.83% |

| Polio Vaccines Market Size 2032 |

USD 1287.27 Million |

The polio vaccines market is shaped by leading players such as Sanofi, GSK, Serum Institute, Panacea Biotec Ltd, Tiantan Biological, Bibcol, Bio-Med, IMBCA, and Halfkin Bio-Pharmaceuticals. These companies compete through large-scale manufacturing, government partnerships, and supply agreements with global health agencies to meet rising demand for IPV and OPV. Their strategies focus on expanding production capacity, ensuring regulatory compliance, and maintaining reliable distribution networks. Asia-Pacific emerges as the leading region, holding 42% market share, driven by its large population base, extensive government-led immunization programs, and strong support from international organizations to sustain eradication efforts.

Market Insights

Market Insights

- The polio vaccines market was valued at USD 882.64 million in 2024 and is projected to reach USD 1287.27 million by 2032, registering a CAGR of 4.83% during the forecast period.

- Market growth is driven by government-led immunization campaigns, international funding, and the increasing global shift from OPV to IPV to ensure safer and more effective protection.

- A key trend is the integration of IPV into combination vaccines, reducing administration costs and improving compliance, while technological advancements in manufacturing strengthen production efficiency.

- The competitive landscape includes major players such as Sanofi, GSK, Serum Institute, Panacea Biotec Ltd, Tiantan Biological, Bibcol, Bio-Med, IMBCA, and Halfkin Bio-Pharmaceuticals, with strategies centered on capacity expansion, regulatory compliance, and global supply partnerships.

- Asia-Pacific leads with a 42% regional share, followed by North America at 22% and Europe at 20%, while the public application segment dominates with bulk procurement and wide-scale distribution through government and health agencies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The inactivated polio vaccine (IPV) dominates the segment, holding the largest market share due to its safety profile and effectiveness in eliminating risks of vaccine-derived poliovirus. Governments and health agencies increasingly recommend IPV over oral polio vaccines (OPV), driving higher adoption rates. Expanded immunization programs, especially in high-income and polio-free regions, further reinforce IPV’s market leadership. OPV still finds use in low- and middle-income countries due to its cost advantage and ease of administration, but global transition policies toward IPV ensure its long-term dominance.

- For instance, GSK has a global network of 37 medicines and vaccines manufacturing sites. Global vaccine supply chain: GSK’s global supply chain is critical to manufacturing and supplying high-quality vaccines and medicines worldwide.

By Application

The public segment accounts for the dominant market share, supported by large-scale immunization campaigns led by governments and organizations such as WHO and UNICEF. Public procurement programs secure vaccines in bulk, ensuring affordability and wider access. These initiatives remain critical in both endemic and polio-free countries to sustain eradication efforts. The private segment grows steadily, driven by demand from urban populations seeking convenience and premium healthcare services. However, its share remains smaller compared to public distribution channels, which continue to anchor the market.

- For instance, Pfizer and BioNTech have distributed 5 billion doses globally of their mRNA COVID-19 vaccine, Comirnaty, leveraging lipid nanoparticle technology to scale production while retaining safety and efficacy.

By End-User

Hospitals and clinics represent the largest end-user segment, holding the majority market share due to their central role in vaccination programs and patient care. These facilities serve as primary vaccination points for both routine immunization and emergency response drives. Public services, including government-run vaccination centers and outreach programs, contribute significantly in rural and underserved regions, ensuring broad coverage. The “others” category, comprising NGOs and mobile health units, plays a supportive role, especially in remote areas. Strong hospital networks and government partnerships drive hospitals and clinics’ leadership position in this segment.

Key Growth Drivers

Government-Led Immunization Programs

Government-backed vaccination programs remain the strongest driver of the polio vaccines market. National health authorities, supported by WHO, UNICEF, and Gavi, purchase vaccines in bulk to sustain eradication initiatives. These programs ensure large-scale distribution through public healthcare systems and outreach campaigns. Mass immunization days and door-to-door programs enhance access, particularly in low-income and rural areas. Continued global financial commitments from donor countries and organizations guarantee stable demand, making government initiatives a cornerstone of market expansion and long-term sustainability.

- For instance, The combined BioNTech-Pfizer network had a goal of achieving an annual production capacity of up to 4 billion finished doses by the end of 2022, after reaching 3 billion finished doses.

Shift Toward Inactivated Polio Vaccine (IPV)

The increasing preference for IPV over OPV drives significant market growth. IPV eliminates the risk of vaccine-derived poliovirus, a major concern in global eradication efforts. Many countries are transitioning national schedules to IPV, supported by WHO recommendations and regulatory frameworks. Demand rises in high-income regions prioritizing safety and long-term immunity. Multinational manufacturers continue scaling production capacity to meet this shift, creating growth opportunities. The adoption of IPV as a global standard strengthens its market position while reducing reliance on OPV-based immunization campaigns.

- For instance, CureVac’s oncology therapeutic CVHNLC is being evaluated at dose levels between 100 µg and 400 µg in a dose-escalation study in metastatic squamous non-small cell lung cancer.

Rising Investments in Healthcare Infrastructure

Improved healthcare infrastructure in emerging economies supports higher vaccine penetration and market expansion. Governments across Asia-Pacific, Africa, and Latin America are strengthening immunization supply chains through cold storage facilities, logistics systems, and hospital capacity upgrades. Expanding access to routine immunization services ensures wider vaccine coverage in rural and underserved populations. Public-private partnerships also enable funding for vaccination drives, contributing to demand stability. With global efforts aimed at sustaining polio-free status, investments in infrastructure directly drive stronger vaccine distribution, reliability, and uptake worldwide.

Key Trends & Opportunities

Integration of Polio Vaccines with Routine Immunization

A key trend is the integration of polio vaccines into broader immunization schedules for infants and children. Combining IPV with other vaccines such as DTP (diphtheria, tetanus, and pertussis) reduces program costs and improves compliance. This approach boosts efficiency for healthcare systems while increasing uptake among parents. Pharmaceutical companies are developing combination vaccines that simplify administration, creating commercial opportunities. Such integration aligns with WHO recommendations and enhances long-term demand, positioning polio vaccines as part of universal health coverage frameworks globally.

- For instance, Merck’s V116-PCV, a 21-valent pneumococcal conjugate vaccine, has demonstrated the ability to elicit immune responses for its 21 serotypes in adult subjects during clinical trials.

Expansion in Emerging Economies

Emerging markets provide strong growth opportunities due to expanding healthcare access and rising birth rates. Governments in Asia-Pacific, Africa, and Latin America actively implement polio vaccination campaigns with international support. Growing middle-class populations demand better preventive healthcare services, increasing private segment uptake. International partnerships help fund large-scale procurement and distribution. As infrastructure strengthens, these regions are expected to become focal points for market growth, offering new opportunities for vaccine manufacturers and suppliers to capture untapped potential in large population bases.

- For instance, the World Health Organization (WHO) announced the allocation of 899,000 Mpox vaccine doses to the 9 African countries affected by the Mpox surge in Africa.

Key Challenges

Logistical and Distribution Barriers

One major challenge is maintaining effective cold chain systems in low-income and rural regions. Polio vaccines, especially IPV, require strict temperature control to preserve efficacy. Weak infrastructure in developing countries often leads to supply disruptions and wastage. Limited availability of trained personnel for handling and administering vaccines further complicates operations. These challenges delay immunization drives, creating risks for disease reemergence. Addressing cold chain inefficiencies requires sustained investments in storage, transport systems, and training programs to ensure consistent global vaccination coverage.

Vaccine Hesitancy and Misinformation

Vaccine hesitancy remains a growing obstacle to polio eradication efforts. Misinformation and mistrust in certain communities lead to refusal or delayed acceptance of vaccines. Cultural beliefs, religious influences, and fears of side effects often undermine public health campaigns. Social media amplifies misinformation, affecting parental decisions in both developed and developing countries. This resistance hampers herd immunity and forces governments to increase awareness and education campaigns. Overcoming hesitancy requires targeted communication strategies, community engagement, and transparent public health messaging to rebuild trust.

Regional Analysis

North America

North America holds 22% share of the polio vaccines market, driven by robust healthcare infrastructure and strong government funding. The U.S. dominates regional demand through mandatory immunization schedules, well-established cold chain systems, and continuous public health investments. Widespread adoption of IPV ensures safer immunization coverage, aligning with WHO recommendations. Canada contributes with comprehensive immunization programs and high vaccine compliance rates. Ongoing public awareness campaigns, efficient vaccine distribution, and stable private sector participation sustain demand. With consistent funding support and reliable healthcare frameworks, North America remains a stable and mature market for polio vaccines.

Europe

Europe accounts for 20% market share, supported by strict immunization policies and high healthcare standards. Countries such as Germany, France, and the UK mandate IPV in routine vaccination schedules, ensuring broad coverage. Strong government funding and EU-backed healthcare initiatives enhance access and sustain demand. Technological advances in vaccine production and distribution further strengthen supply reliability. Public awareness campaigns and healthcare professional engagement drive high compliance rates. With continued focus on safety and integration of IPV into combination vaccines, Europe maintains a leading role in sustaining eradication progress across developed nations.

Asia-Pacific

Asia-Pacific leads the global polio vaccines market with 42% share, driven by its large population base and extensive immunization campaigns. China and India account for a major portion of demand through government-led initiatives supported by WHO, UNICEF, and Gavi. Public programs ensure widespread access across rural and urban regions, though infrastructure disparities remain. Rising healthcare investments and growing adoption of IPV highlight progress in improving safety standards. Expanding birth rates and rapid urbanization further strengthen vaccine demand. Asia-Pacific’s dominant position reflects its role as both a high-demand region and a critical focus for eradication strategies.

Latin America

Latin America represents 8% of the global market, supported by government-led immunization programs and rising healthcare access. Countries such as Brazil and Mexico lead demand, with vaccination integrated into national schedules. Public procurement remains the largest contributor, ensuring widespread availability. International funding agencies support supply chains in low-income areas, reducing risks of outbreak resurgence. Expanding private healthcare networks and growing urban middle-class populations enhance uptake beyond public programs. Despite economic disparities, Latin America shows steady progress in sustaining polio-free status, making the region a consistent contributor to global vaccine demand.

Middle East & Africa

The Middle East & Africa region holds 8% share of the polio vaccines market, characterized by ongoing eradication efforts and reliance on international support. Nigeria and Pakistan remain key focus areas, requiring sustained immunization drives to prevent resurgence. WHO, Gavi, and UNICEF provide funding and logistical aid, strengthening distribution in conflict-prone and rural areas. Public services dominate vaccine administration, while infrastructure challenges and cold chain issues restrict full coverage. Despite barriers, rising government commitments and international partnerships are improving access, making the region a critical target for sustaining global eradication progress.

Market Segmentations:

By Type:

- Inactivated Polio Vaccine (IPV)

- Oral Polio Vaccine (OPV)

By Application:

By End User:

- Hospitals & clinics

- Public services

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Polio Vaccines Market players such as Panacea Biotec Ltd, GlaxoSmithKline, Serum Institute, IMBCA, Halfkin Bio-Pharmaceuticals, Bio-Med, Sanofi, Tiantan Biological, Bibcol, and GSK. The polio vaccines market features strong competition shaped by global supply networks, large-scale production, and long-term procurement agreements with governments and international health agencies. Manufacturers focus on scaling inactivated polio vaccine (IPV) output to meet rising safety standards while gradually phasing out oral polio vaccines (OPV). Strategic partnerships with organizations such as WHO, UNICEF, and Gavi ensure stable demand and widespread access, particularly in developing regions. Continuous investments in research, technology upgrades, and cold chain infrastructure enhance reliability and efficiency. Market players emphasize cost optimization, compliance with global immunization guidelines, and integration into routine vaccination schedules to strengthen their presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panacea Biotec Ltd

- GlaxoSmithKline

- Serum Institute

- IMBCA

- Halfkin Bio-Pharmaceuticals

- Bio-Med

- Sanofi

- Tiantan Biological

- Bibcol

- GSK

Recent Developments

- In April 2025, Pfizer Inc. announced the amendment in the marketing authorization for ABRYSVO (RSV vaccine) that reported the extension of indication, including prevention of Lower Respiratory Tract Disease (LRTD) caused by RSV.

- In April 2025, GSK plc announced that the CDC’s Advisory Committee on Immunization Practices (ACIP) has voted to endorse the inclusion of Penmenvy (Meningococcal Groups A, B, C, W, and Y Vaccine) in the adolescent meningococcal vaccination schedule.

- In February 2025, Mass polio immunization campaign in Gaza immunized around 603,000 children with the new type 2 of the oral polio vaccine (nOPV2) to prevent poliovirus outbreak.

- In January 2025, Esphera Synbio, a well-known pre-clinical stage synthetic biology company, introduced a new project to develop and increase the efficacy of mRNA vaccines by using its proprietary technology to engineer mRNA vaccines.

- In May 2024, Novavax and Sanofi disclosed a co-exclusive licensing agreement to co-commercialize a COVID-19 vaccine and collaborate on developing novel combination vaccines for COVID-19 and influenza. This strategic partnership allows both companies to leverage their respective expertise and resources to bring innovative vaccine solutions to the market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing adoption of inactivated polio vaccines globally.

- Government funding will remain a primary driver of vaccine demand.

- Emerging economies will strengthen their role with rising immunization coverage.

- Combination vaccines will gain traction to improve compliance and reduce costs.

- International partnerships will ensure reliable supply across low-income countries.

- Cold chain infrastructure improvements will enhance vaccine distribution efficiency.

- Private healthcare networks will see gradual growth in vaccine administration.

- Public awareness programs will reduce vaccine hesitancy in key regions.

- Technological advancements will optimize large-scale vaccine production processes.

- Sustained eradication campaigns will continue to shape long-term market stability.

Market Insights

Market Insights