Market Overview

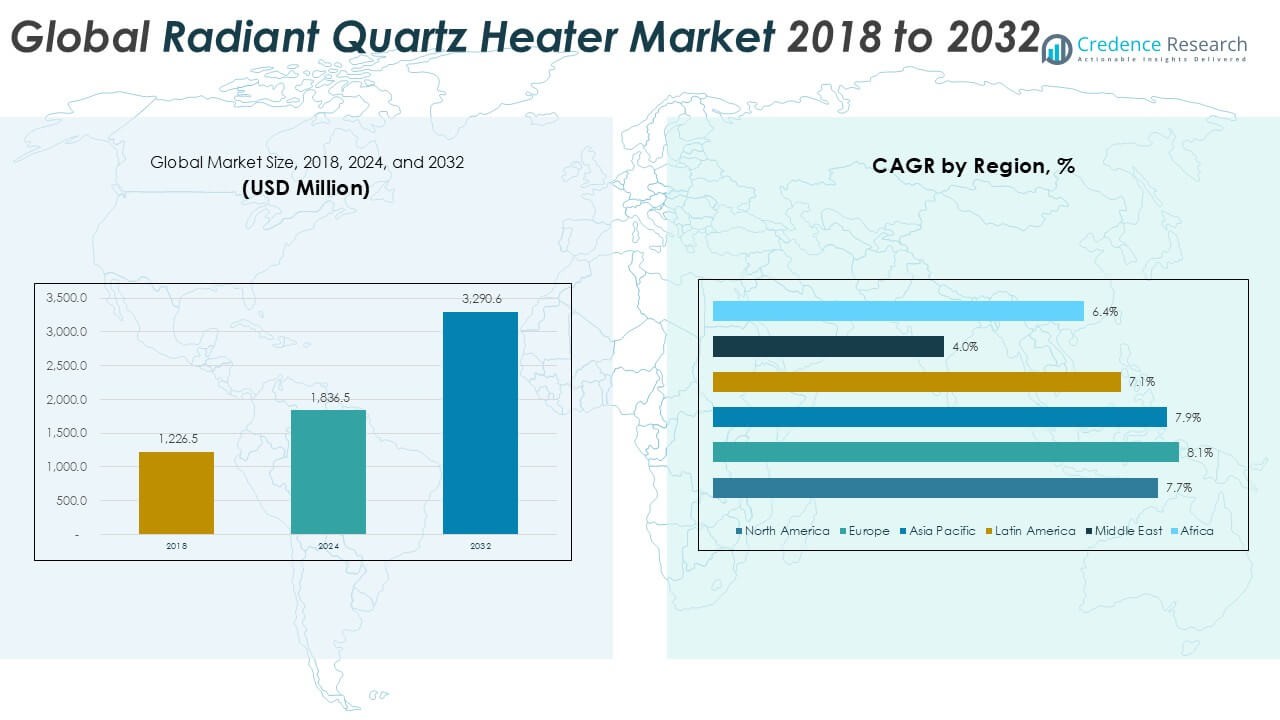

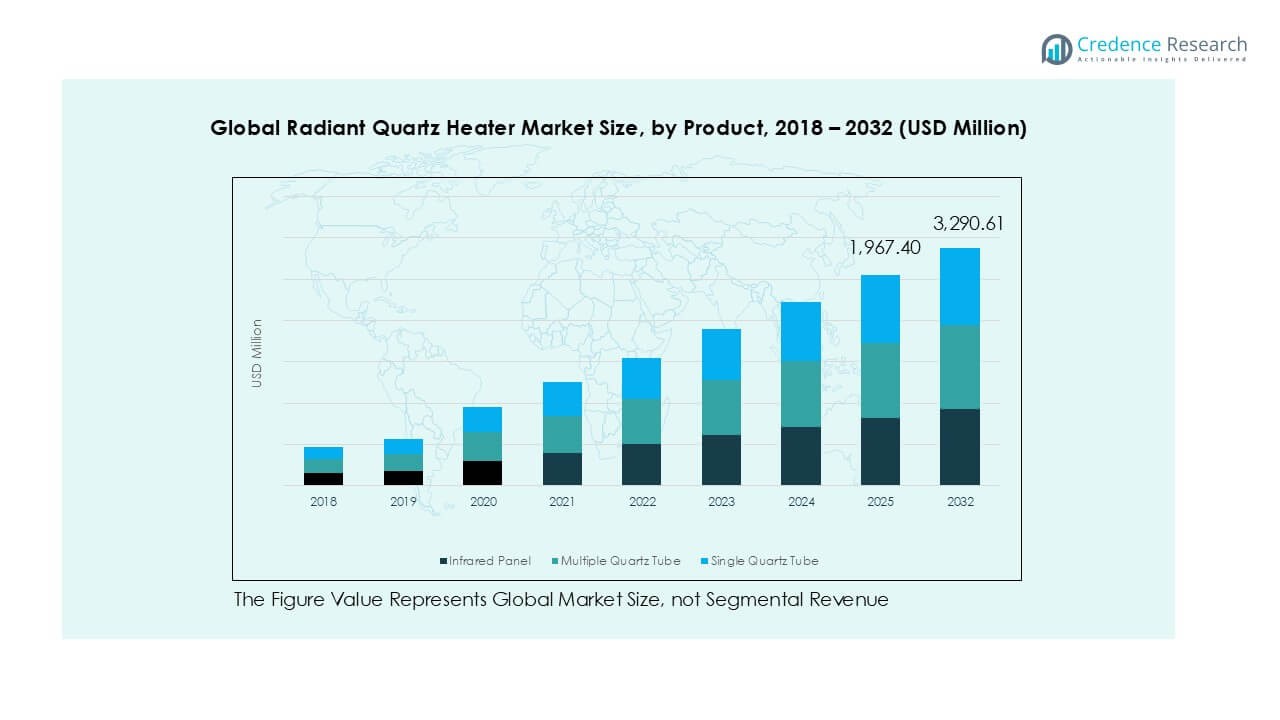

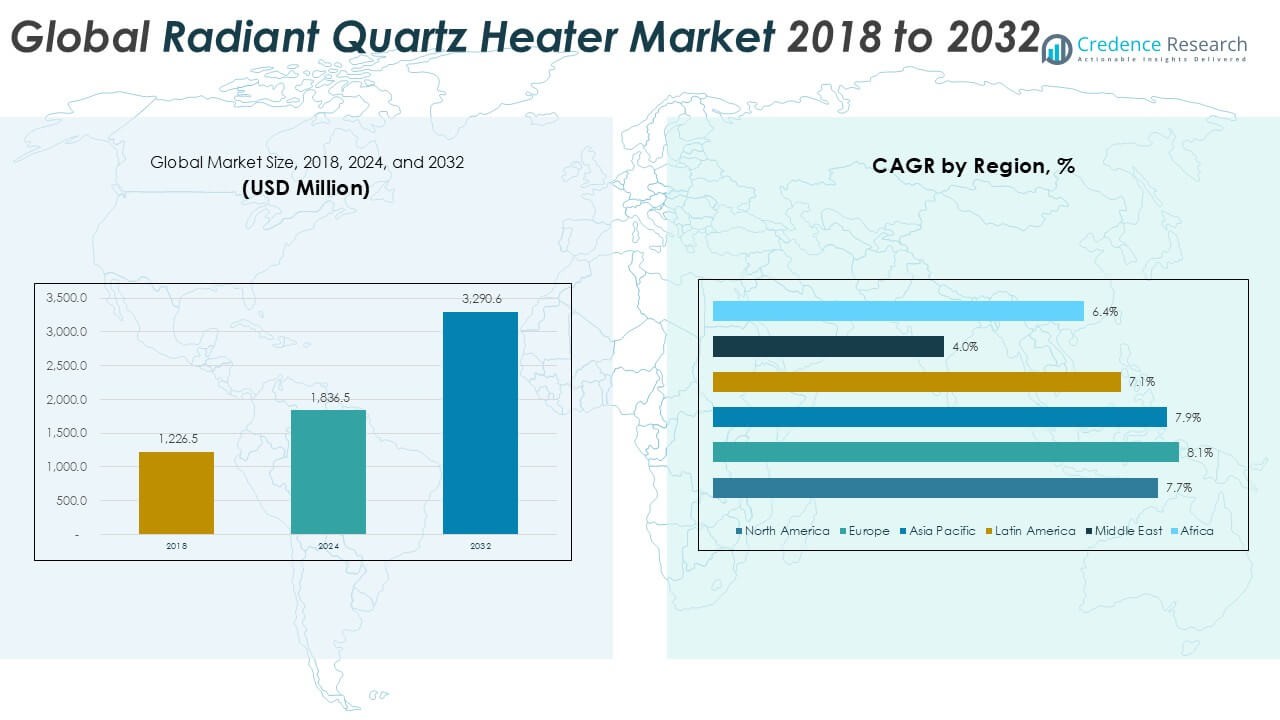

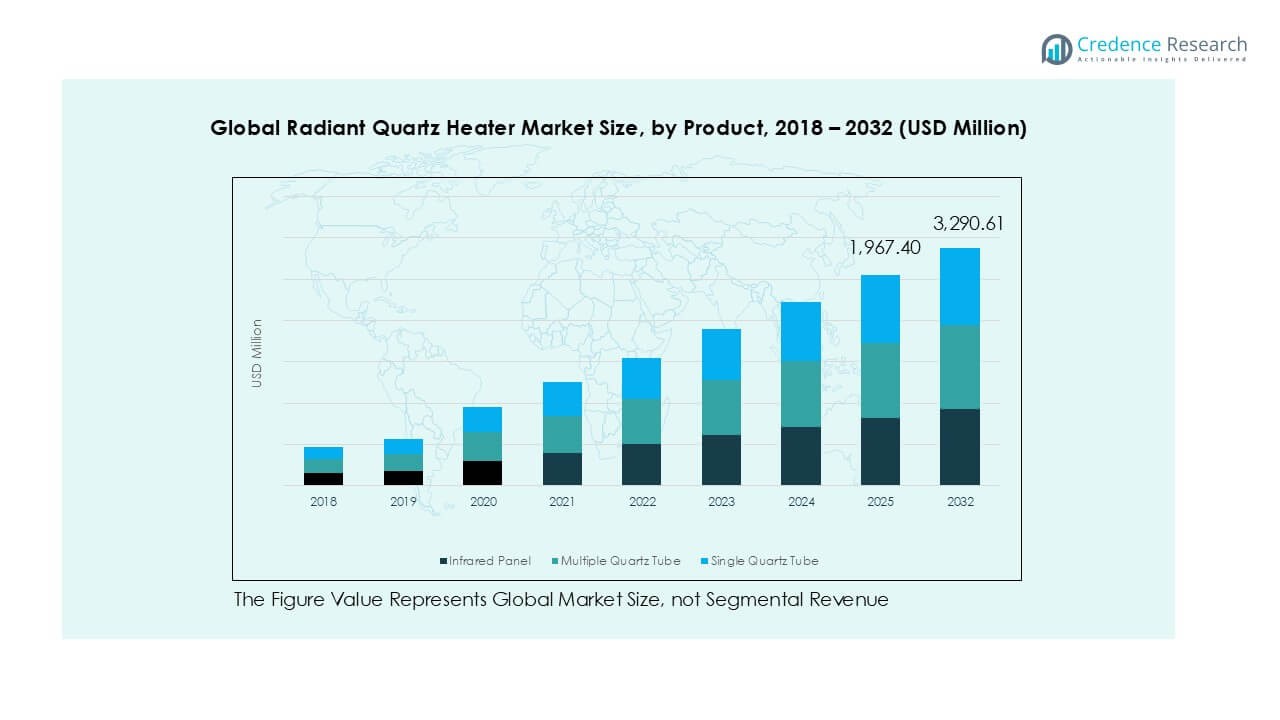

Global Radiant Quartz Heater market size was valued at USD 1,226.5 million in 2018 to USD 1,836.5 million in 2024 and is anticipated to reach USD 3,290.6 million by 2032, at a CAGR of 7.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Radiant Quartz Heater Market Size 2024 |

USD 1,836.5 Million |

| Radiant Quartz Heater Market, CAGR |

7.62% |

| Radiant Quartz Heater Market Size 2032 |

USD 3,290.6 Million |

The global radiant quartz heater market features strong competition among established appliance manufacturers and regional specialists. Key players include Glen Dimplex Group, De’Longhi Appliance S.r.l., Honeywell International Inc., Lasko Products, Vornado Air, Duraflame, Pelonis Technologies, TPI Corporation, Sunpentown International, and Wipe Hotwire India Thermal Equipments. These companies compete through product efficiency, safety compliance, and wide distribution reach. Regionally, Asia Pacific leads with about 32.1% market share, driven by high volume demand and urban growth. Europe follows with nearly 26.5%, supported by strict energy regulations and replacement demand. North America holds around 23.7%, backed by strong residential adoption and seasonal heating needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global radiant quartz heater market reached USD 1,836.5 million in 2024 and is projected to reach USD 3,290.6 million by 2032, growing at a CAGR of 7.62%, driven by rising demand for efficient electric heating across residential and light commercial spaces.

- Growing preference for energy-efficient, fast-heating, and portable solutions drives market expansion, supported by urban housing growth and increased use of supplemental heating during colder seasons.

- Key trends include rising adoption of 1000–1500 watt heaters as the dominant segment, growth of multiple quartz tube products for higher heat output, and rapid expansion of online sales channels due to price transparency and convenience.

- Competition remains moderately fragmented, with global brands and regional players focusing on product design, safety features, pricing, and distribution strength to capture market share.

- Asia Pacific leads with about 32.1% market share, followed by Europe at 26.5% and North America at 23.7%, while electricity cost sensitivity and safety regulations act as key restraints.

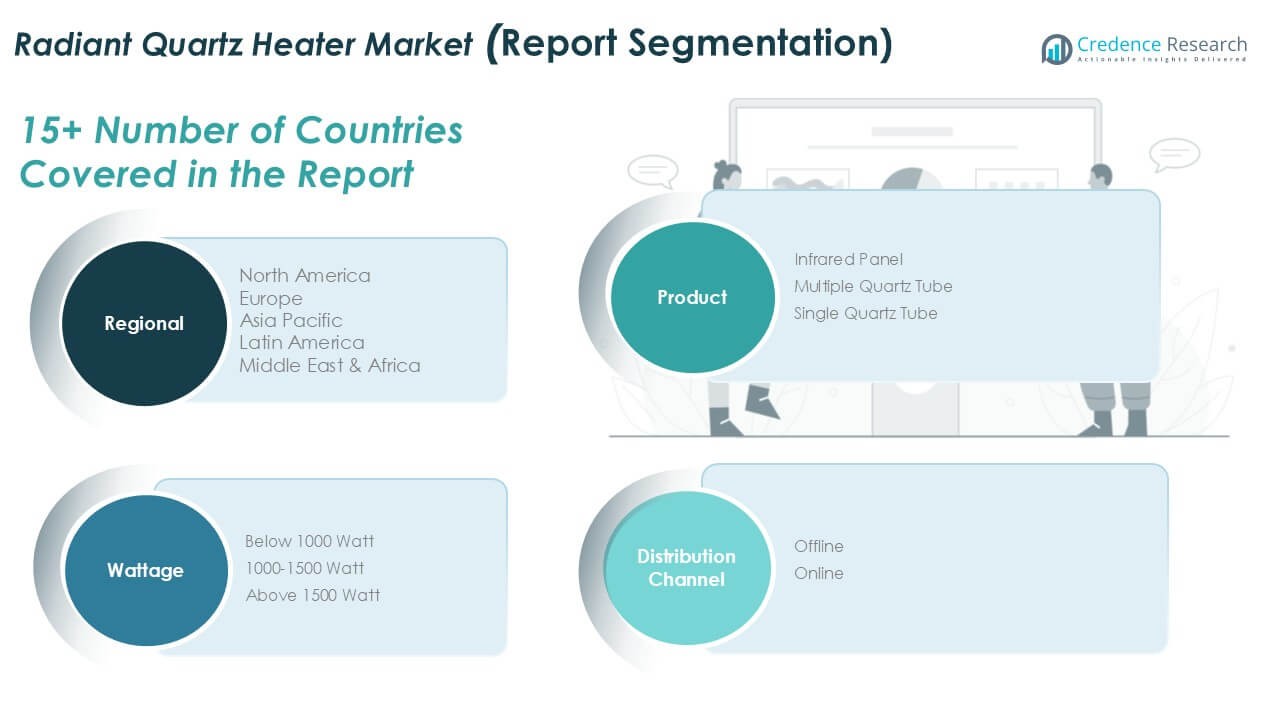

Market Segmentation Analysis:

By Product

- The product segment shows clear variation in adoption based on heating efficiency and application needs. Multiple quartz tube heaters dominate this segment, holding the largest market share. The dominance comes from higher heat output, uniform heat distribution, and suitability for large residential and commercial spaces. These models perform well in colder regions and semi-outdoor settings. Infrared panel heaters see steady demand in modern interiors due to slim design and silent operation. Single quartz tube heaters mainly serve small rooms and budget buyers, limiting their overall share.

- For instance, Havells’ Cista room heater is a fan (convector) heater with a maximum power of 2000 watts, offering two heat settings (1000 W and 2000 W) for effective heating in small to medium-sized indoor spaces.

By Wattage Segment

The 1000–1500-watt category represents the dominant wattage segment in the global radiant quartz heater market. This range balances energy efficiency with sufficient heating performance for bedrooms, offices, and small commercial spaces. Consumers prefer this segment due to lower electricity consumption and compatibility with standard power outlets. Below 1000-watt heaters cater to localized and personal heating needs, such as desks or compact rooms. Above 1500-watt units serve large halls and industrial uses but face slower adoption due to higher operating costs.

- For instance, De’Longhi offers a 1500-watt radiant panel heater, which quickly distributes quiet, uniform warmth in small to medium-sized rooms on standard outlets.

By Distribution Channel

Offline channels account for the dominant market share in the distribution segment. Specialty appliance stores, electronics retailers, and home improvement outlets drive sales through product demonstrations and in-person guidance. Many buyers prefer offline purchases due to safety concerns and the need to assess build quality. However, online channels are growing rapidly, supported by rising e-commerce adoption and wider product availability. Competitive pricing, customer reviews, and home delivery drive online growth, especially among urban consumers and younger buyers seeking convenience.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

Energy efficiency remains a primary growth driver in the global radiant quartz heater market. Consumers increasingly seek heating products that deliver rapid warmth with lower power consumption. Radiant quartz heaters convert electricity directly into heat, reducing energy loss compared to convection systems. This efficiency appeals to residential users facing rising electricity tariffs. Governments also promote efficient appliances through energy standards and awareness programs. Compact design and instant heat further strengthen adoption in urban homes. Commercial users favor these heaters for zone heating and controlled energy use. The ability to heat specific areas lowers overall operating costs. These factors collectively support strong and sustained market expansion.

- For instance, Glen Dimplex’s Creda quartz radiant heater operates at 1,200 W and reaches operating temperature in under 3 seconds, enabling instant zone heating.

Growth in Residential and Small Commercial Construction

Expanding residential construction significantly drives demand for radiant quartz heaters. Urbanization continues to increase apartment and compact housing development worldwide. Smaller living spaces require fast and space-saving heating solutions. Radiant quartz heaters meet this need with wall-mounted and portable formats. Small offices, retail outlets, and clinics also adopt these systems for targeted heating. Seasonal demand spikes further boost unit sales in colder regions. Renovation activity in mature markets adds replacement demand. Affordable pricing across multiple wattage options supports wider penetration. Construction-linked demand remains a stable long-term growth driver.

- For instance, Stiebel Eltron’s heater series includes wall-mounted models rated at 800 W and 1,600 W (or other wattages), which are typically recommended for much smaller rooms or as a supplementary heat source

Increasing Adoption of Portable and Supplemental Heating

Consumers increasingly prefer portable and supplemental heating systems. Radiant quartz heaters offer flexibility for temporary and localized heating needs. Users deploy these heaters in bedrooms, balconies, garages, and workshops. Lightweight construction and plug-and-play operation enhance convenience. Rental households prefer portable heaters due to easy relocation. Supplemental heating reduces dependence on central heating systems. This approach lowers energy bills and improves comfort control. The trend aligns with changing lifestyle patterns and hybrid work models. As usage scenarios expand, demand for radiant quartz heaters continues to grow steadily.

Key Trends & Opportunities

Expansion of Smart and Design-Oriented Heater Models

Manufacturers increasingly focus on smart and aesthetically refined radiant quartz heaters. Slim infrared panels and modern finishes align with contemporary interior design. Integration of timers, thermostats, and remote controls enhances user convenience. Smart features help optimize energy use and improve safety. Consumers value products that combine performance with visual appeal. Premium residential segments show strong interest in these innovations. This trend creates opportunities for product differentiation and higher margins. Brands investing in design and smart functionality gain competitive advantage. The shift supports value-driven market growth.

- For instance, Xiaomi’s Mijia Smart Quartz Heater integrates Wi-Fi connectivity with a digital thermostat adjustable in 1 °C steps across a 16–28 °C range.

Rapid Growth of Online Sales Channels

Online distribution presents a major growth opportunity for the market. E-commerce platforms expand product visibility across regions. Consumers compare prices, features, and reviews before purchasing. Online channels reduce dependence on physical retail infrastructure. Manufacturers reach end users directly through branded stores. Promotional discounts and seasonal sales accelerate online adoption. Urban and tech-savvy buyers increasingly prefer digital purchasing. Improved logistics and return policies build consumer trust. Online expansion supports faster market penetration and global reach.

- For instance, Dyson sells its PTC ceramic-based fan heater models through its direct-to-consumer online store, offering heaters with airflow output of up to 290 liters per second and remote-control operation.

Key Challenges

High Sensitivity to Electricity Prices

Electricity cost volatility presents a key challenge for market growth. Radiant quartz heaters rely entirely on electric power. Rising tariffs discourage prolonged usage in some regions. Cost-conscious consumers may limit adoption during peak seasons. This challenge affects price-sensitive emerging markets more strongly. Users compare heaters with alternative fuel-based systems. Energy price uncertainty reduces replacement cycles. Manufacturers face pressure to improve efficiency further. Managing operating cost concerns remains critical for sustained adoption.

Safety Concerns and Regulatory Compliance

Safety concerns pose another significant challenge in the market. Radiant quartz heaters generate high surface temperatures. Improper use increases fire and burn risks. Regulatory bodies enforce strict safety and quality standards. Compliance raises manufacturing and certification costs. Low-quality imports damage consumer confidence in some markets. Manufacturers must invest in safety features and testing. Clear user guidelines and certifications are essential. Addressing safety perceptions remains vital for long-term market stability.

Regional Analysis

North America

North America accounted for about 23.7% market share in 2018, with a market size of USD 290.32 million. The region reached USD 436.44 million in 2024 and is projected to grow to USD 786.13 million by 2032, registering a CAGR of 7.7%. Demand is driven by cold climatic conditions, high adoption of electric heating appliances, and strong replacement cycles. Residential applications dominate due to widespread use of supplemental heating. Growth also benefits from energy-efficiency awareness and strong retail networks across the United States and Canada.

Europe

Europe held nearly 26.5% market share in 2018, supported by a market value of USD 324.41 million. The market expanded to USD 497.97 million in 2024 and is forecast to reach USD 921.37 million by 2032, at a CAGR of 8.1%, the highest among regions. Strict energy regulations and cold winters drive adoption. Consumers favor efficient, design-oriented heaters for apartments and offices. Replacement of legacy heating systems and strong demand from Western Europe further support sustained regional growth.

Asia Pacific

Asia Pacific represented the largest share at around 32.1% in 2018, with a market size of USD 393.96 million. The market grew to USD 597.53 million in 2024 and is expected to reach USD 1,088.86 million by 2032, at a CAGR of 7.9%. Rapid urbanization, rising disposable incomes, and expanding residential construction fuel demand. Countries such as China, Japan, and South Korea drive volume sales. Increasing winter appliance penetration in emerging Asian markets further strengthens long-term growth potential.

Latin America

Latin America accounted for approximately 10.8% market share in 2018, with a value of USD 132.22 million. The market increased to USD 192.08 million in 2024 and is projected to reach USD 330.05 million by 2032, growing at a CAGR of 7.1%. Demand is concentrated in urban residential settings and colder southern regions. Rising middle-class income and improved retail access support adoption. Seasonal heating needs and growing awareness of electric heaters contribute to steady, moderate regional expansion.

Middle East

The Middle East held a smaller 4.8% share in 2018, with a market size of USD 58.63 million. The market reached USD 74.56 million in 2024 and is expected to grow to USD 102.01 million by 2032, at a CAGR of 4.0%. Limited cold weather restricts widespread adoption. Demand mainly comes from cooler sub-regions and seasonal use in residential spaces. Commercial and hospitality sectors contribute niche demand. Growth remains modest compared to other regions due to climate constraints.

Africa

Africa represented about 2.2% market share in 2018, with a value of USD 26.98 million. The market expanded to USD 37.96 million in 2024 and is forecast to reach USD 62.19 million by 2032, growing at a CAGR of 6.4%. Demand is driven by urbanization and increasing electrification. Adoption remains concentrated in higher-income urban areas and cooler regions. Expanding retail availability and rising consumer awareness support gradual market development across the continent.

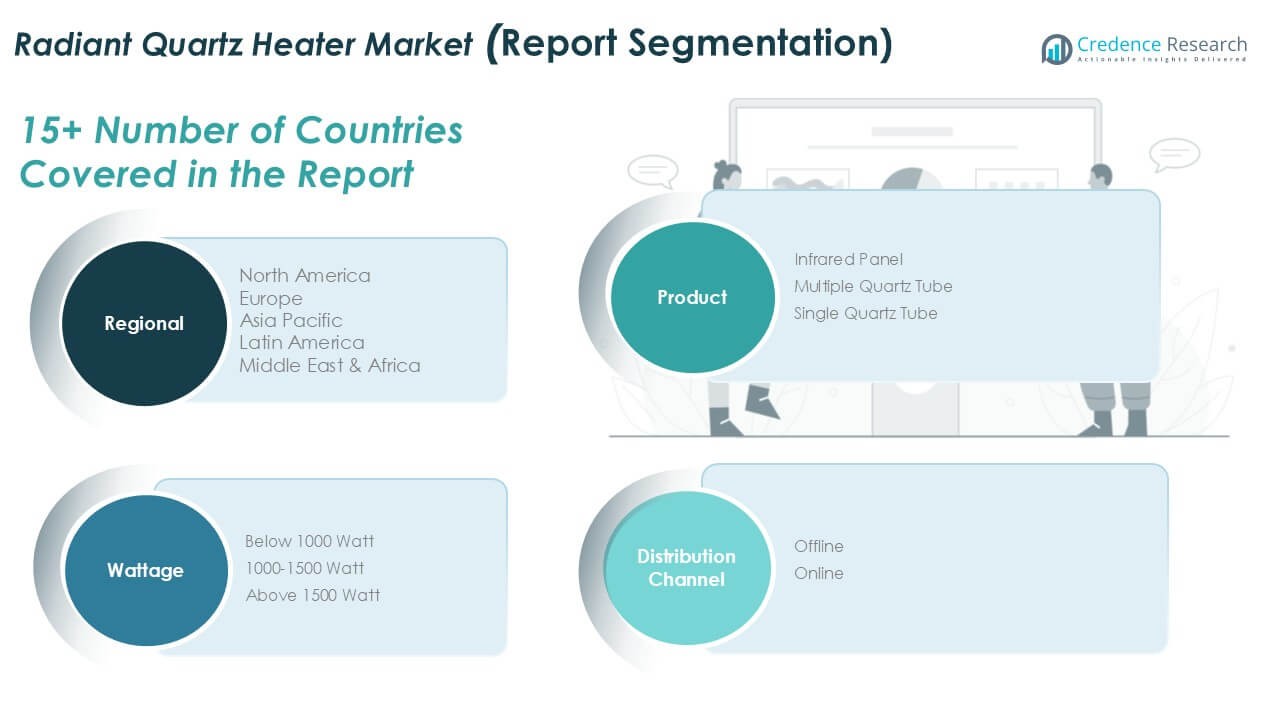

Market Segmentations:

By Product

- Infrared Panel

- Multiple Quartz Tube

- Single Quartz Tube

By Wattage Segment

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global radiant quartz heater market remains moderately fragmented, with the presence of multinational appliance brands and regional manufacturers. Leading players compete on product efficiency, safety features, design, and price positioning. Companies such as Glen Dimplex Group, De’Longhi, Honeywell, and Vornado leverage strong brand recognition and broad distribution networks. Regional players focus on cost-effective models and localized demand. Product innovation centers on energy efficiency, multiple wattage options, and modern aesthetics. Online sales expansion intensifies price competition and accelerates market reach. Strategic priorities include portfolio diversification, compliance with safety standards, and selective geographic expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2023, The European Union revised its overarching Energy Efficiency Directive, and new, stricter Ecodesign standards for local space heaters, including radiant heaters, were adopted in April 2024 and will apply from July 1, 2025.

- In January 2023, Honeywell announced a new line of smart radiant quartz heaters with integrated Wi-Fi capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage Segment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise steadily due to increasing need for efficient supplemental heating.

- Urban housing growth will support higher adoption in compact living spaces.

- Energy efficiency improvements will remain a key product development focus.

- Multiple quartz tube models will continue to lead product demand.

- Mid-range wattage heaters will see strong preference across residential users.

- Online sales channels will expand faster than offline retail formats.

- Smart controls and safety features will gain wider consumer acceptance.

- Asia Pacific will remain the leading regional growth contributor.

- Regulatory compliance will influence product design and manufacturing strategies.

- Competition will intensify through pricing, design, and distribution expansion.