Market Overviews

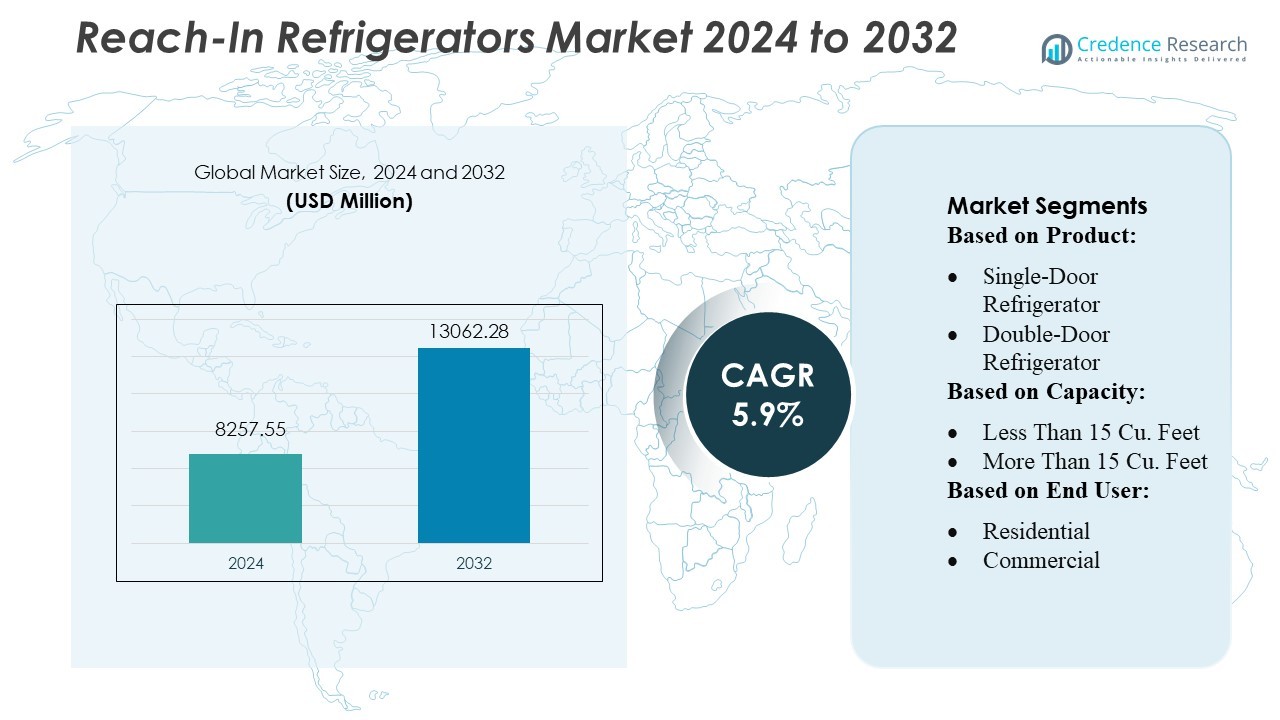

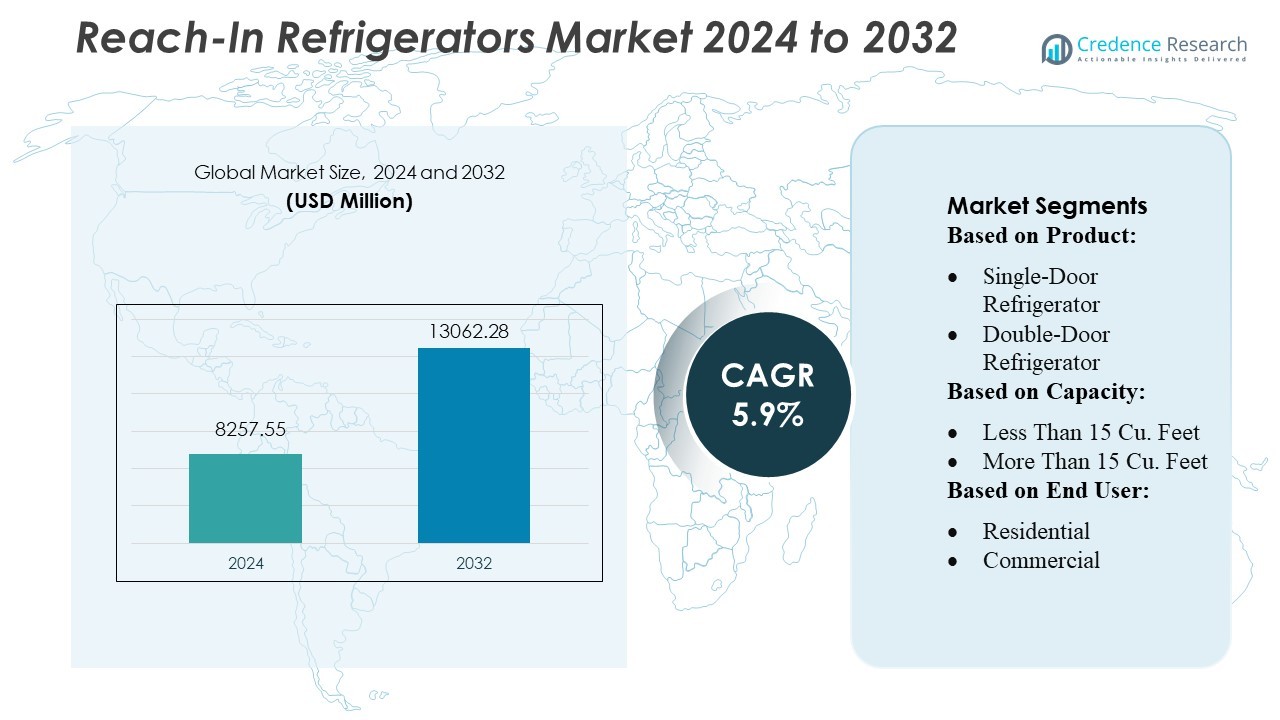

Reach‑In Refrigerators Market size was valued USD 8257.55 million in 2024 and is anticipated to reach USD 13062.28 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reach‑In Refrigerators Market Size 2024 |

USD 8257.55 Million |

| Reach‑In Refrigerators Market, CAGR |

5.9% |

| Reach‑In Refrigerators Market Size 2032 |

USD 13062.28 Million |

The reach-in refrigerators market is dominated by a group of leading global manufacturers, including Illinois Tool Works Inc., Ali Group, Daikin Industries Ltd., Lennox International Inc., Carrier, Hussmann Corporation, Johnson Control, Dover Corporation, Electrolux AB, and AHT Cooling Systems GmbH. These companies compete aggressively across innovation, sustainability, and service excellence, offering energy-efficient compressors, smart connectivity, and modular designs. Geographically, North America emerges as the leading region, capturing approximately 35 % of the global market, driven by its developed foodservice infrastructure, stringent energy and safety standards, and high penetration of advanced refrigeration solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Reach-In Refrigerators Market reached USD 8257.55 million in 2024 and is projected to reach USD 13062.28 million by 2032, expanding at a 5.9% CAGR, supported by increasing demand across foodservice, retail, and institutional applications.

- Rising focus on energy-efficient and smart refrigeration systems drives market growth as operators prioritize reduced operational costs, sustainability compliance, and real-time performance monitoring.

- Competitive intensity remains high, with global players advancing eco-friendly refrigerants, modular designs, and connected cooling technologies to strengthen product differentiation and service capabilities.

- High initial investment, maintenance costs, and regulatory compliance challenges act as restraints, particularly for small businesses and price-sensitive markets.

- Regionally, North America leads with around 35% share, supported by advanced foodservice infrastructure, while the commercial segment holds the largest application share, driven by strong demand from restaurants, hotels, and supermarkets.

Market Segmentation Analysis:

By Product

Single-door refrigerators dominate the reach-in refrigerator market, capturing the largest share due to their compact design, lower energy consumption, and suitability for small commercial kitchens and space-constrained retail environments. Demand remains strong as foodservice operators prioritize cost-efficient storage solutions that support frequent access and consistent cooling. Their widespread adoption is driven by ease of installation, reduced maintenance requirements, and compatibility with standardized kitchen layouts. Meanwhile, double-door and multi-door models gain traction in high-volume operations, yet single-door units remain the preferred choice for balancing capacity, efficiency, and operational flexibility.

- For instance, Ali Group, Beverage-Air and Victory Refrigeration transitioned their entire self-contained reach-in line to R290 refrigerant, eliminating HFCs in foam and refrigerant, while achieving up to 25% energy savings in their adaptive units.

By Capacity

The segment with more than 15 cu. feet holds the dominant market share, supported by the rising need for high-capacity cold storage in commercial foodservice, hospitality, and large retail establishments. Operators increasingly invest in larger units to minimize restocking frequency, maintain temperature stability, and support diversified product storage. These models also benefit from improved energy-efficient compressors and advanced insulation technologies that enhance performance without significantly raising operational costs. Although units below 15 cu. feet serve small businesses and residential needs, the higher-capacity category leads due to its ability to meet intensive, multi-product storage demands.

- For instance, Daikin’s multi-compressor racks (CM series) Capacities range from 9.5 kW to approximately 66 kW. Low-temperature applications: Capacities range from 3.5 kW to approximately 49 kW.

By End User

The commercial end-user segment accounts for the highest market share, fueled by expanding foodservice businesses, quick-service restaurants, and convenience stores that rely on reach-in refrigerators for reliable, high-volume cooling solutions. Commercial operators prioritize durability, larger storage capacity, and advanced temperature-control features that support continuous operation. Growth is further driven by stricter food safety regulations requiring stable refrigeration environments. While residential usage is increasing with premium kitchen upgrades and larger household storage preferences, the commercial sector remains dominant as businesses scale operations and require robust, long-lasting refrigeration systems.

Key Growth Drivers

- Rising Demand from Foodservice and Hospitality Sector

The rapid expansion of restaurants, quick-service chains, and cloud kitchens drives strong adoption of reach-in refrigerators. Operators prioritize equipment that ensures food safety, enables faster food preparation, and supports continuous cooling in high-volume environments. Energy-efficient models with digital temperature control and enhanced storage flexibility strengthen purchasing decisions. The growing presence of international hospitality brands and increased catering activities further accelerate installations. As commercial kitchens scale their operations, they increasingly rely on durable and high-capacity reach-in units to maintain consistent cooling performance and reduce inventory spoilage.

- For instance, Lennox’s refrigeration division — Heatcraft, a part of Lennox International — is developing commercial refrigeration equipment using Honeywell Solstice L40X (R-455A), a low-GWP refrigerant with a GWP below 150, as confirmed in a Lennox-Heatcraft / Honeywell press release.

- Advancements in Energy-Efficient Refrigeration Technologies

Manufacturers are integrating improved insulation, variable-speed compressors, and advanced refrigerants to reduce operational costs and meet regulatory energy standards. These innovations enhance cooling uniformity while lowering overall energy consumption, making modern units more attractive for both commercial and residential buyers. Smart sensors, adaptive defrost systems, and intelligent diagnostics further optimize performance. With stricter sustainability mandates and rising electricity prices, businesses increasingly upgrade to energy-efficient reach-in refrigerators to achieve long-term savings, reduce carbon footprints, and enhance equipment reliability across diverse operating conditions.

- For instance, Carrier Commercial Refrigeration’s CO₂OLtec® CO₂ efficiency booster skid can reduce energy consumption by up to 10 % compared to conventional CO₂ booster systems, according to Carrier’s own press release.

- Growth of Packaged Food, Cold-Chain Expansion, and Urban Retail

The increasing consumption of packaged foods, ready-to-serve meals, and perishable items fuels demand for efficient refrigeration across supermarkets, convenience stores, and specialty food outlets. Urbanization and modernization of retail infrastructure strengthen requirements for advanced cooling storage solutions. Concurrently, expanding cold-chain networks create more touchpoints for equipment deployment across distribution hubs and retail formats. As retailers focus on maintaining product quality and minimizing waste, reach-in refrigerators become essential for standardized temperature control, product visibility, and efficient inventory management.

Key Trends & Opportunities

1. Growing Adoption of Smart and Connected Refrigeration

IoT-enabled reach-in refrigerators with remote monitoring, predictive maintenance alerts, and real-time temperature tracking are gaining momentum. Operators benefit from improved asset management, reduced downtime, and enhanced food safety compliance. Cloud-based platforms allow multi-site businesses to centralize performance oversight, enabling data-driven decisions for energy optimization and maintenance scheduling. As digital transformation accelerates across foodservice and retail industries, connected refrigeration presents significant opportunities for manufacturers to differentiate offerings and develop value-added service models.

- For instance, Hussmann’s StoreConnect® IoT platform collects continuous data via embedded analytics running 24/7/365 across connected racks and cases. According to Hussmann, this system uses predictive insights on defrost cycles, superheat, refrigerant leaks.

2. Rising Use of Eco-Friendly Refrigerants and Sustainable Materials

Increasing environmental regulations encourage broader replacement of traditional refrigerants with low-GWP alternatives such as R290. This transition drives manufacturers to redesign systems with improved heat-exchange efficiency and eco-friendly insulation materials. Opportunities emerge for brands offering sustainable, recyclable components and reduced-emission production processes. As buyers prioritize green procurement standards, suppliers capable of demonstrating environmental compliance and sustainability certifications gain a competitive advantage. This trend also supports the introduction of long-lifespan equipment designed to minimize environmental impact throughout its lifecycle.

- For instance, Johnson Controls has selected R-454B, a lower-global-warming-potential (GWP) refrigerant, to replace R-410A in its ducted residential and commercial unitary products; R-454B has a GWP of 466, which is only one-fifth that of R-410A.

3. Growing Penetration of Reach-In Refrigerators in Residential Use

Premium households increasingly adopt reach-in refrigerators for their large storage capacity, advanced temperature management, and superior durability compared to traditional household units. The rise of home-based catering, bulk food storage, and organized home kitchens further stimulates residential demand. Stylish designs, quiet operation, and features such as dual-zone temperature control make these units appealing to high-income consumers. Manufacturers can tap into this emerging segment by offering compact, aesthetically refined models that blend commercial durability with residential convenience.

Key Challenges

1. High Initial Investment and Maintenance Costs

Despite strong functionality, high acquisition costs and ongoing maintenance expenses remain a major barrier for small restaurants, local retailers, and household buyers. Advanced components, specialized refrigerants, and strict installation requirements increase total ownership costs. Frequent servicing, especially for heavy-duty commercial use, adds further financial pressure. Budget-constrained operators often delay equipment upgrades or opt for lower-cost alternatives, limiting market penetration. Manufacturers need to focus on cost-optimized models and flexible financing solutions to broaden adoption.

2. Compliance with Stringent Energy and Environmental Regulations

Regulations governing energy efficiency, refrigerant usage, and emission control require manufacturers to continuously upgrade product designs, which increases development costs and slows time-to-market. Adapting to shifting global, regional, and national policies adds operational complexity, especially for companies with extensive distribution networks. Ensuring compliance while maintaining performance and durability can be technically challenging. These regulatory pressures may also increase product prices, affecting customer purchase decisions. Companies must invest in R&D and modular designs to navigate ongoing regulatory transitions.

Regional Analysis

North America

North America holds about 35% of the reach-in refrigerators market, supported by a well-developed foodservice industry and strict food-safety standards. Restaurants, supermarkets, and institutional kitchens drive consistent demand for energy-efficient and high-capacity units. The region also leads in adopting smart, connected refrigeration systems used for remote monitoring and maintenance. Frequent equipment upgrades and strong preference for sustainable refrigerants further strengthen market penetration. The U.S. remains the largest contributor, followed by Canada, with both markets benefiting from strong distribution networks and high commercial kitchen investments.

Asia Pacific

Asia Pacific accounts for roughly 32% of the market and continues to grow rapidly due to urbanization, rising incomes, and expansion of foodservice chains. Countries like China, India, and Japan see increasing demand driven by modern retail, cloud kitchens, and cold-chain improvements. The region also benefits from local manufacturing, which makes products more accessible and cost-efficient. Adoption of energy-saving models is rising as governments promote environmentally responsible refrigeration. Asia Pacific remains the most dynamic region, offering strong opportunities for both international and domestic suppliers.

Europe

Europe captures about 24% of the global reach-in refrigerators market, driven by strong regulations that encourage use of energy-efficient and low-emission refrigeration. Foodservice chains, hotels, and retail outlets across Germany, France, the UK, and Italy are major adopters. The region prioritizes sustainable cooling technologies and equipment that supports connected monitoring. Demand is also supported by the hospitality sector’s focus on reducing electricity consumption and meeting environmental compliance requirements. Europe’s preference for durable and high-quality equipment continues to drive stable market growth.

Latin America

Latin America holds about 5% of the market, with growth supported by the expansion of supermarkets, convenience stores, and quick-service restaurants. Countries such as Brazil and Mexico drive most of the demand, though economic fluctuations and cost sensitivity limit rapid adoption. Modernization of food retail and improvements in cold-chain infrastructure are gradually increasing demand for reach-in refrigerators. Manufacturers focusing on affordable, durable, and energy-efficient models find strong opportunities in this region.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% of the market, supported by growing hospitality networks, rising retail development, and increasing investments in healthcare facilities. GCC countries, especially the UAE and Saudi Arabia, lead demand due to expanding hotels and foodservice establishments. Harsh climatic conditions make reliable refrigeration essential, while energy-efficient models gain popularity to reduce operating costs. Despite logistical challenges and import dependency, the region shows steady adoption of commercial reach-in units.

Market Segmentations:

By Product:

- Single-Door Refrigerator

- Double-Door Refrigerator

By Capacity:

- Less Than 15 Cu. Feet

- More Than 15 Cu. Feet

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The reach-in refrigerators market features a competitive landscape led by major global companies such as Illinois Tool Works Inc., Ali Group, Daikin Industries Ltd., Lennox International Inc., Carrier, Hussmann Corporation, Johnson Control, Dover Corporation, Electrolux AB, and AHT Cooling Systems GmbH. The reach-in refrigerators market is shaped by global manufacturers that focus on technological innovation, energy efficiency, and sustainability-driven product development. Companies compete by expanding their portfolios with smart, connected cooling systems that offer precise temperature control, predictive maintenance, and improved operational reliability. The market also sees strong emphasis on eco-friendly refrigerants, advanced compressor technologies, and durable materials that reduce lifecycle costs. Strategic initiatives such as product line diversification, regional expansion, and enhanced after-sales service capabilities strengthen market positioning. As foodservice, retail, and institutional sectors modernize, competition intensifies around performance optimization, design flexibility, and regulatory compliance.

Key Player Analysis

- Illinois Tool Works Inc.

- Ali Group

- Daikin Industries Ltd.

- Lennox International Inc.

- Carrier

- Hussmann Corporation

- Johnson Control

- Dover Corporation

- Electrolux AB

- AHT Cooling Systems GmbH

Recent Developments

- In May 2025, AHT Cooling Systems GmbH introduced SPI CIRCUMPOLAR, a patented modular pump station for semi-plug-in water-loop refrigeration systems. This innovation enhances flexibility, scalability, and integration in the commercial refrigeration equipment industry, driving sustainability and efficiency improvements.

- In May 2025, Hussmann Corporation signed an exclusive distribution partnership with Lithuanian manufacturer Refra to offer transcritical CO₂ racks and R290 heat pump solutions across Australia and New Zealand, expanding its natural‑refrigerant portfolio.

- In March 2025, Phoenix Energy Technologies and Hussmann Corporation announced a strategic partnership to launch Refrigeration IQ, an AI-driven solution to improve the efficiency of refrigeration systems. The partnership combines Phoenix’s AI platform with Hussmann’s automated leak detection to monitor asset health and reduce refrigerant leaks in facilities like grocery stores.

- In February 2025, Daikin launched the Pro‑C CRAH range, new computer room air handlers delivering 30-210 kW cooling, optimized controls, and modular architecture to boost efficiency in data center refrigeration applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue advancing energy-efficient technologies as regulations tighten and customers prioritize reduced operating costs.

- Adoption of smart, connected refrigeration systems will rise as operators seek real-time monitoring and predictive maintenance.

- Demand for eco-friendly refrigerants will grow as manufacturers transition toward low-GWP alternatives to meet sustainability goals.

- Foodservice expansion, including cloud kitchens and quick-service chains, will drive steady installations of high-capacity reach-in units.

- Retail modernization and growth in packaged food consumption will strengthen demand for reliable commercial refrigeration.

- Manufacturers will increasingly design modular and service-friendly units to reduce downtime and extend equipment life cycles.

- Residential adoption of premium reach-in units will rise as consumers seek larger storage and professional-grade performance.

- Cold-chain development in emerging markets will expand opportunities for commercial refrigeration suppliers.

- The market will see greater integration of IoT analytics to optimize energy usage and improve operational visibility.

- Competitive differentiation will focus on sustainability, product durability, and advanced temperature-control features.