Market Overview

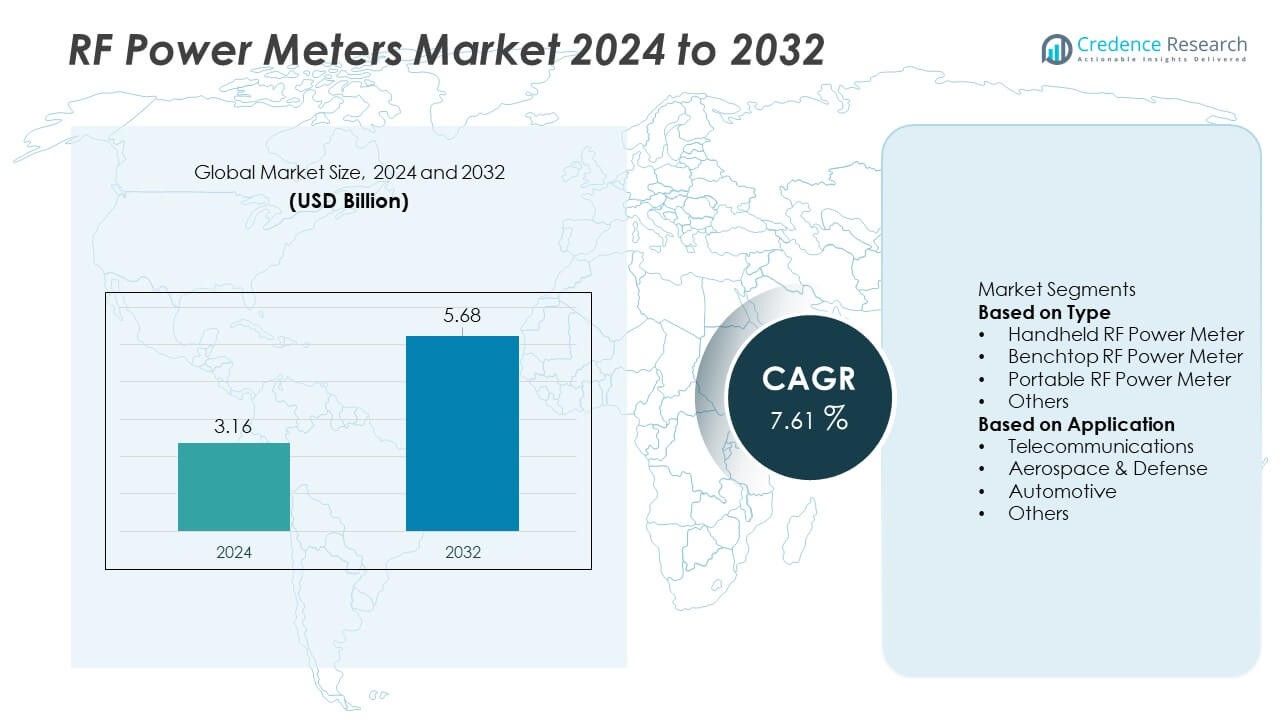

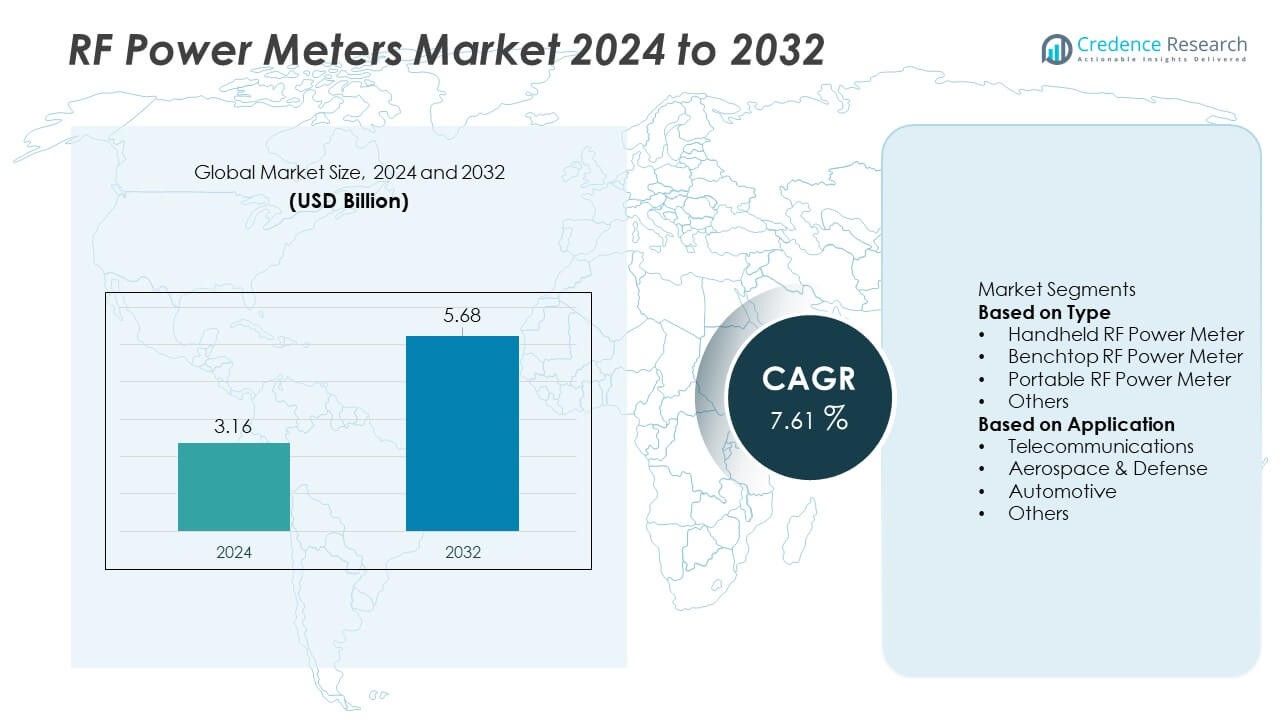

The RF Power Meters Market reached USD 3.16 billion in 2024 and is projected to rise to USD 5.68 billion by 2032, reflecting a CAGR of 7.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Power Meters Market Size 2024 |

USD 3.16 Billion |

| RF Power Meters Market, CAGR |

7.61% |

| RF Power Meters Market Size 2032 |

USD 5.68 Billion |

The RF Power Meters market includes major players such as Rohde & Schwarz, Keysight Technologies, Anritsu, Bird, Emerson Electric Co., TEKTRONIX, INC., Wireless Telecom Group, Aim-TTi, Cobham Limited, and Fluke. These companies lead through advancements in high-frequency measurement, portable testing tools, and software-enabled analysis. North America remained the leading region with 36% share, supported by strong 5G expansion, robust aerospace and defense programs, and well-established R&D facilities. Asia Pacific followed due to rapid electronics manufacturing and telecom growth, while Europe maintained steady demand driven by automotive radar testing and strict regulatory standards.

Market Insights

Market Insights

- The RF Power Meters market reached USD 3.16 billion in 2024 and is projected to hit USD 5.68 billion by 2032, registering a CAGR of 7.61% during the forecast period.

- Strong market growth is driven by increasing 5G deployment, rising IoT device production, and growing demand for accurate RF testing across telecom, aerospace, and automotive sectors. Handheld RF power meters led the type segment with 38% share, supported by high field-testing adoption.

- Key trends include rising demand for portable testing tools, automation-driven measurement platforms, and integration of advanced software analytics across R&D and production environments.

- Competitive activity remains intense, with leading players investing in high-frequency capability, broader product portfolios, and cloud-enabled measurement systems, while high instrument costs and need for skilled technicians continue to act as restraints.

- Regionally, North America dominated with 36% share, followed by Asia Pacific at 29% and Europe at 26%, supported by strong telecom, defense, and electronics manufacturing growth across each region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Handheld RF power meters held the dominant position with 38% share in 2024, driven by rising field-level testing needs and strong demand from telecom tower maintenance teams. Their compact design, battery efficiency, and simple interface support rapid adoption among technicians who require reliable on-site measurements. Benchtop RF power meters followed due to high accuracy requirements in laboratories and R&D facilities, while portable variants gained traction in multi-site industrial inspections. The type segment continues to benefit from increased focus on real-time signal verification, expanding 5G rollouts, and greater investment in wireless device testing across production environments.

- For instance, Rohde & Schwarz enhanced its NRP90S sensors with a 90 GHz upper frequency limit and a 100 µs measurement time, enabling faster field diagnostics.

By Application

Telecommunications emerged as the leading application segment with 42% share in 2024, supported by extensive 5G deployment, higher network density, and increased testing of RF components across base stations and small cells. Telecom operators continue to invest in accurate power measurement tools to maintain signal quality and reduce network downtime. Aerospace and defense followed due to stringent validation needs in radar and satellite systems, while the automotive industry showed steady growth with expanding ADAS, V2X, and radar-based sensing technologies. Broader integration of wireless modules across connected products further accelerates RF measurement demand across diversified industrial settings.

- For instance, Anritsu expanded its 5G NR test support to 7.125 GHz, enabling operators to validate sub-THz signals in dense networks.

Key Growth Driver

Expansion of 5G Networks and High-Frequency Testing

The rapid deployment of 5G networks fuels strong demand for RF power meters that support higher frequencies, wider bandwidth, and precise signal measurement. Telecom operators prioritize advanced testing tools to validate base stations, small cells, and massive MIMO equipment. Rising spectrum utilization across sub-6 GHz and mmWave bands also increases the need for reliable power monitoring. Equipment manufacturers adopt RF meters to optimize transmitter performance and reduce network failures. As nations accelerate 5G rollouts, service providers invest in enhanced field-testing tools, making high-frequency measurement capability a core driver of market expansion.

- For instance, Keysight expanded its high-frequency testing portfolio with sensors capable of measuring up to 110 GHz, supporting mmWave verification in dense 5G zones.

Rising Adoption of Wireless Devices and IoT Ecosystems

Increasing use of connected devices across consumer electronics, industrial automation, healthcare, and automotive sectors strengthens RF power meter adoption. Manufacturers require precise RF validation during production to ensure device reliability and regulatory compliance. High device density in IoT ecosystems drives continuous monitoring of RF output to minimize interference and enhance connectivity performance. Growth in smart homes, wearables, telematics, and sensor networks further expands testing requirements. As organizations scale IoT deployments, they invest in accurate RF measurement tools to support stable performance in diverse, multi-frequency operating environments.

- For instance, Tektronix upgraded its RF validation tools with modules that capture signals at 6.2 GHz for diverse IoT device testing.

Advancements in Aerospace, Defense, and Radar Technologies

Aerospace and defense applications rely on precise RF power analysis for radar systems, electronic warfare systems, satellite communication modules, and secure communication networks. Modern radar technologies demand ultra-stable signal calibration and high-power measurement capability, driving procurement of advanced RF meters. Growth in space missions and defense modernization programs increases the use of RF payloads that require continuous monitoring. Defense agencies emphasize accuracy and durability, favoring robust benchtop and handheld RF meters. These developments create sustained demand, making defense modernization a key driver of market growth.

Key Trend & Opportunity

Increasing Shift Toward Portable and Field-Ready RF Testing Solutions

End users prefer handheld and portable RF power meters due to rising field maintenance needs across telecom and industrial environments. Miniaturized designs, higher battery life, and multi-band measurement capability create strong adoption opportunities. Technicians value lightweight instruments for quick diagnostics, especially during tower inspections and network optimization tasks. Portable meters also support remote testing in defense and aviation sectors. As industries prioritize mobility and operational efficiency, manufacturers focus on smart, connected, and rugged designs, opening new opportunities for product differentiation and premium offerings.

- For instance, Bird Technologies produces a range of high-power RF sensors, including models capable of measuring up to 1300 W peak power (like the 5017D and 5017D-AV models) and some up to 1500 W peak power (like the 7022 series), enabling safe and accurate measurements in high-output tower sites.

Integration of Automation and Software-Driven Measurement Platforms

Automation-driven RF testing gains momentum as organizations adopt faster and more reliable workflows. Software-enabled RF meters support real-time visualization, automated logging, cloud analytics, and integration with network monitoring systems. R&D labs and production facilities benefit from programmable meters that streamline repetitive measurement tasks and reduce human errors. Growing interest in AI-based signal analysis and automated troubleshooting boosts demand for software-centric platforms. This trend creates opportunities for vendors to enhance product value through advanced data analytics, remote control features, and cloud-enabled diagnostics.

- For instance, National Instruments expanded its PXI-based RF systems with 26.5 GHz programmable modules, improving automation in high-frequency research and validation tasks.

Key Challenge

High Cost of Advanced RF Measurement Instruments

High-performance RF power meters with wide frequency coverage, superior accuracy, and advanced digital features often come with significant investment costs. Small service providers, testing contractors, and emerging research labs face budget constraints that limit adoption. The need for additional calibration tools and frequent maintenance further increases operational expenses. These cost barriers slow technology upgrades, especially in developing regions. As testing requirements become more complex with 5G and aerospace applications, price sensitivity remains a key challenge for market expansion among smaller user groups.

Complexity of RF Measurement and Need for Skilled Technicians

RF power measurement demands technical expertise due to the sensitivity of signal parameters and the risk of inaccurate readings. Many industries face shortages of skilled RF technicians who can perform precise calibration and troubleshoot high-frequency systems. Errors in measurement can lead to equipment failures, network downtime, or regulatory non-compliance. The learning curve for advanced RF meters, combined with evolving spectrum technologies, adds pressure on workforce training. Limited expertise, especially in emerging markets, poses a major challenge for consistent and reliable RF testing operations.

Regional Analysis

North America

North America led the RF Power Meters market with 36% share in 2024, supported by strong investments in 5G deployment, defense modernization, and advanced R&D infrastructure. The region benefits from high adoption of RF testing tools in telecom operators, aerospace agencies, and semiconductor manufacturers. Growth in satellite programs and radar upgrades further strengthens demand. Leading technology firms and calibration labs accelerate product innovation and early adoption of high-frequency testing solutions. Expanding IoT networks, dense telecom infrastructure, and rising demand for automated RF validation continue to position North America as a key market contributor.

Europe

Europe held 26% share in 2024, driven by ongoing 5G rollouts, strict regulatory standards, and strong aerospace and defense activity. Countries such as Germany, France, and the UK invest heavily in RF testing for telecom equipment, radar systems, and electronic component validation. Automotive manufacturers adopt RF meters to support radar-based ADAS and V2X communication testing. Research institutions and test labs across the region emphasize precision measurement, boosting demand for advanced benchtop RF meters. Sustainable digital infrastructure initiatives and expanding industrial IoT deployments continue to strengthen market growth across Europe.

Asia Pacific

Asia Pacific accounted for 29% share in 2024, driven by rapid telecom expansion, high-volume electronics manufacturing, and rising semiconductor production. China, Japan, South Korea, and India lead adoption due to strong investment in 5G networks, consumer electronics, and defense communication systems. The region’s large manufacturing base relies on RF meters for device certification, production testing, and compliance checks. Growth in smart devices, electric vehicles, and industrial automation amplifies RF testing needs. Increasing adoption of portable RF meters and strong R&D spending across emerging tech sectors further boost Asia Pacific’s market momentum.

Latin America

Latin America captured 5% share in 2024, with growth supported by expanding telecom infrastructure, rising adoption of connected devices, and modernization of broadcasting networks. Countries such as Brazil, Mexico, and Argentina invest in RF testing for network upgrades and equipment validation. The region shows increasing demand for handheld and portable RF meters due to field service needs and cost-sensitive operations. Slow 5G deployment remains a hurdle, but rising digitalization efforts and industrial connectivity projects create new opportunities. Growing interest in IoT-based solutions continues to drive steady market development.

Middle East & Africa

The Middle East & Africa region accounted for 4% share in 2024, driven by growing investments in telecom modernization, defense communication systems, and satellite infrastructure. Gulf countries expand RF testing capabilities to support national telecom upgrades and advanced radar deployments. Africa sees gradual adoption as mobile operators enhance network reliability and expand 4G and early-stage 5G services. Increased focus on secure communication, airport radar systems, and industrial connectivity drives demand for precise RF measurement tools. Strengthening digital transformation initiatives across key economies supports the region’s long-term growth outlook.

Market Segmentations:

By Type

- Handheld RF Power Meter

- Benchtop RF Power Meter

- Portable RF Power Meter

- Others

By Application

- Telecommunications

- Aerospace & Defense

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The RF Power Meters market features strong competition among key players such as Rohde & Schwarz, Keysight Technologies, Anritsu, Bird, Emerson Electric Co., TEKTRONIX, INC., Wireless Telecom Group, Aim-TTi, Cobham Limited, and Fluke. These companies focus on enhancing frequency coverage, accuracy, and measurement stability to meet rising testing demands across telecom, aerospace, and electronics manufacturing. Leading vendors invest in software-driven platforms, portable designs, and high-precision benchtop systems to address diverse customer needs. Strategic priorities include expanding product portfolios, improving calibration services, and integrating cloud connectivity for real-time data insights. Partnerships with telecom operators, R&D labs, and defense agencies help strengthen market presence. Mergers, acquisitions, and continuous R&D spending support innovation, while competitive pricing and service differentiation remain central to gaining market share in both developed and emerging regions.

Key Player Analysis

- Aim-TTi

- Fluke

- Bird

- Rohde & Schwarz

- Cobham Limited

- Anritsu

- Emerson Electric Co.

- Keysight Technologies

- TEKTRONIX, INC.

- Wireless Telecom Group, Inc.

Recent Developments

- In November 2025, Rohde & Schwarz introduced the R&S NRP-Z47 power-sensor module (up to 50 GHz) to convert an R&S FSMR3000 receiver into a precision power-meter calibration setup.

- In July 2025, Anritsu Corporation released new software options for its MT8000A 5G device test solution supporting 1024QAM and Tx Switching (2Tx→2Tx).

- In December 2024, Rohde & Schwarz launched its new R&S NRPxE RF power sensors covering 10 MHz–8/18 GHz with dynamic range of 80 dB, video bandwidth 100 kHz, and USB-TMC interface.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for RF power meters will rise as 5G networks expand into higher-frequency bands.

- Field technicians will adopt more portable and connected RF testing tools for faster diagnostics.

- R&D labs will invest in high-precision meters to support advanced wireless and radar technologies.

- Software-driven measurement platforms will gain traction with real-time analytics and automation.

- IoT expansion will increase RF testing needs across manufacturing and device certification.

- Defense programs will drive adoption of robust meters for radar and secure communication systems.

- Semiconductor growth will boost demand for RF validation in chip design and production lines.

- Integration with cloud platforms will support remote monitoring and digital calibration workflows.

- Multi-band and wide-dynamic-range meters will become essential for next-generation communication systems.

- Emerging markets will see stronger adoption as telecom operators upgrade network infrastructure.

Market Insights

Market Insights