Market Overview

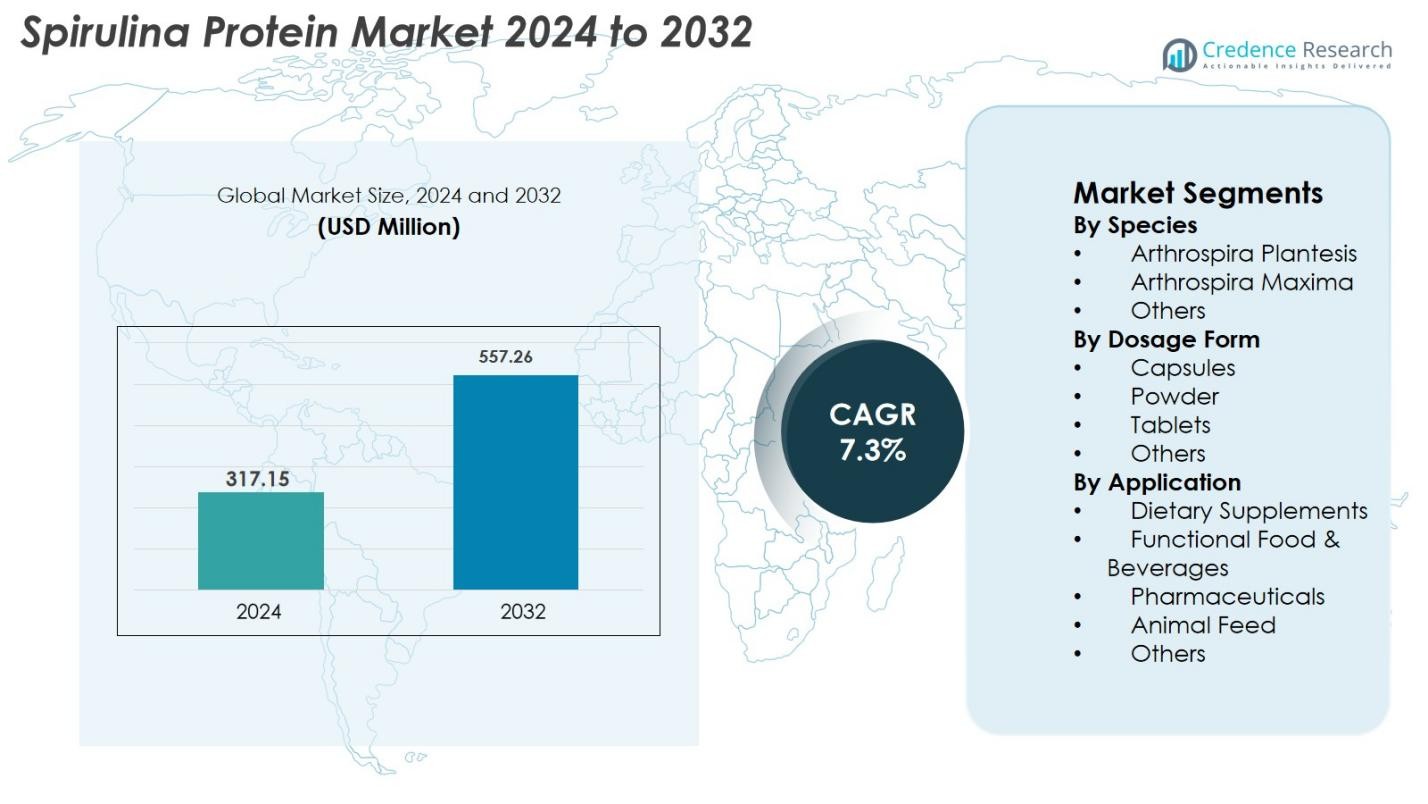

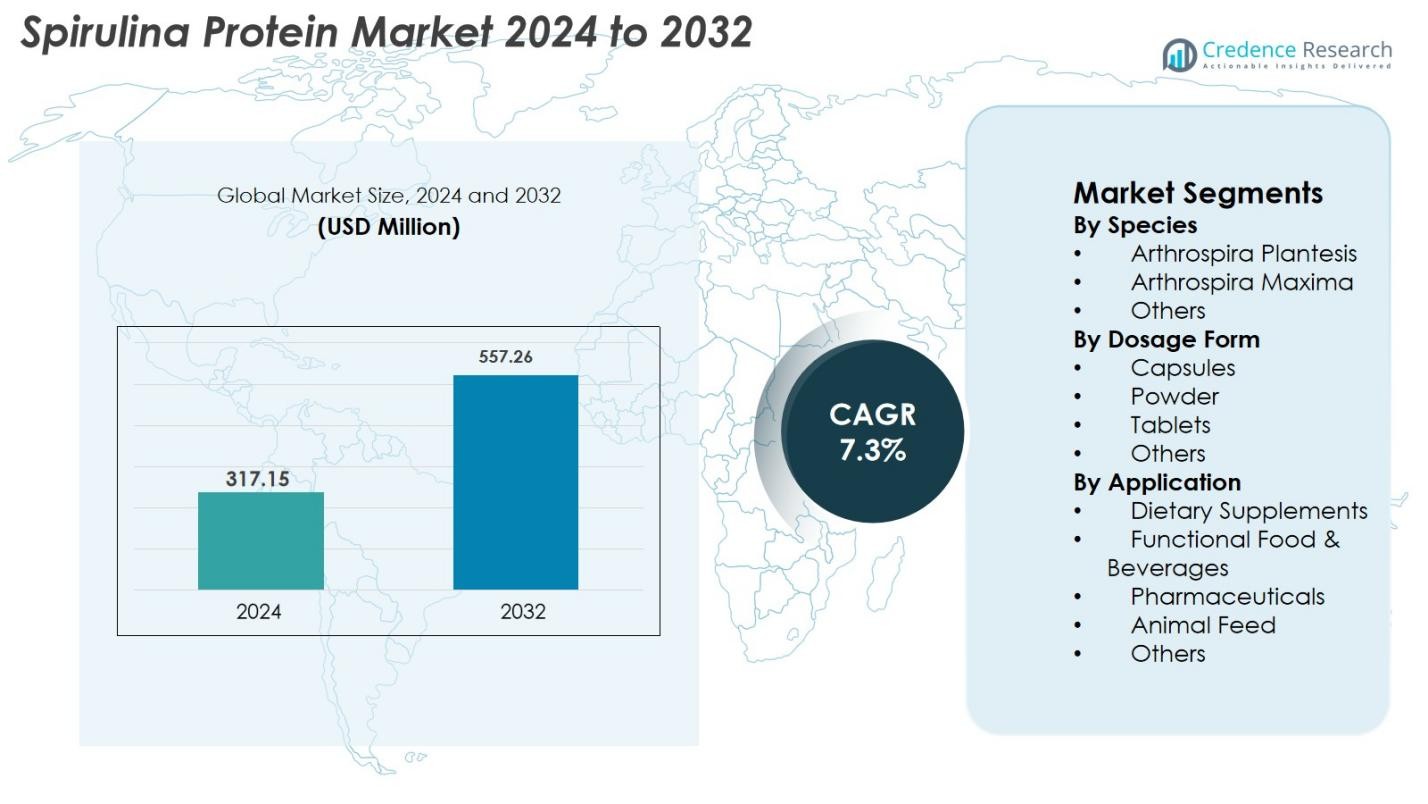

Spirulina Protein Market size was valued at USD 317.15 million in 2024 and is anticipated to reach USD 557.26 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spirulina Protein Market Size 2024 |

USD 317.15 Million |

| Spirulina Protein Market, CAGR |

7.3% |

| Spirulina Protein Market Size 2032 |

USD 557.26 Million |

Spirulina Protein Market is shaped by the presence of leading players such as Cyanotech Corporation, Earthrise Nutritionals LLC, Allmicroalgae, Nutrex Hawaii Inc., E.I.D. Parry (India) Ltd., Prolgae Spirulina Supplies Pvt. Ltd., ENERGYbits Inc., Phycom Microalgae, Far East Bio-Tec Co. Ltd., and Yunna Green A Biological Project Co. Ltd., all of which focus on high-purity cultivation and advanced microalgae processing technologies. These companies drive product innovation across dietary supplements, functional foods, and pharmaceutical formulations. Regionally, North America leads the market with a 32.6% share in 2024, supported by strong nutraceutical demand, large-scale algae farming initiatives, and high consumer adoption of plant-based protein ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Spirulina Protein Market was valued at USD 317.15 million in 2024 and is projected to reach USD 557.26 million by 2032, growing at a CAGR of 7.3% during the forecast period.

- Demand continues to rise due to increasing adoption of plant-based, nutrient-dense proteins, with Arthrospira Platensis holding the largest species share at 62.4% and powder remaining the dominant dosage form at 58.7%.

- A key trend shaping the market is the expanding use of spirulina in functional foods and beverages, supported by clean-label preferences and sustainability-driven consumer behavior.

- Market presence is defined by players such as Cyanotech Corporation, Earthrise Nutritionals LLC, Allmicroalgae, and E.I.D. Parry (India) Ltd., all prioritizing advanced cultivation technologies and high-purity product lines.

- Regionally, North America leads with a 32.6% share, followed by Europe at 28.4% and Asia-Pacific at 29.8%, driven by strong supplement consumption, advanced production capabilities, and increasing use across dietary and functional applications.

Market Segmentation Analysis:

By Species

The Spirulina Protein Market by species is dominated by Arthrospira Platensis, accounting for 62.4% of the total share in 2024. Its leadership stems from higher protein density, wider commercial cultivation, and strong adoption in dietary supplements and functional foods. Arthrospira Maxima follows due to its niche use in premium nutraceutical formulations, while the Others category remains limited to specialized applications. Growing demand for natural, plant-based protein sources and expanding microalgae cultivation technologies continue to reinforce Platensis as the preferred species across global manufacturers.

- For instance, analyses of A. platensis biomass show protein contents of roughly 60–70 % by dry weight, making it one of the richest microalgal protein sources used in nutraceutical powders and capsules.

By Dosage Form

Within dosage forms, the powder segment leads the Spirulina Protein Market with 58.7% share in 2024, driven by its versatility, ease of incorporation in beverages, snacks, and supplement formulations, and cost-efficient large-scale production. Capsules hold notable traction among consumers seeking convenient and precisely dosed nutrient intake. Tablets remain relevant in pharmaceutical and nutraceutical channels, whereas the Others category includes liquid blends and ready-to-mix formats. Rising demand for clean-label, customizable protein ingredients continues to strengthen the dominance of spirulina powder across industries.

- For instance, multiple clinical nutrition trials have formulated powder-based spirulina blends delivering 2–8 g per serving to enhance antioxidant and protein intake, demonstrating strong compatibility with powdered supplement systems.

By Application

The dietary supplements segment dominates the Spirulina Protein Market with 41.3% share in 2024, supported by increasing consumer preference for plant-based superfoods, immune-boosting ingredients, and high-purity protein sources. Functional food and beverage applications also show strong growth as brands integrate spirulina into smoothies, bars, and fortified products for enhanced nutritional value. Pharmaceuticals utilize spirulina for antioxidant and anti-inflammatory properties, while animal feed adoption rises due to its role in improving livestock nutrition. Broader awareness of microalgae-derived protein sustainability continues to drive expansion across applications.

Key Growth Drivers

Rising Demand for Plant-Based and High-Purity Protein Sources

The Spirulina Protein Market benefits greatly from the global shift toward plant-based nutrition, as consumers increasingly prefer natural, allergen-free, and sustainable protein alternatives. Spirulina offers a complete amino acid profile, high bioavailability, and antioxidant richness, making it a preferred ingredient in supplements, functional foods, and clinical nutrition. Its reputation as a superfood supports rapid adoption across health-conscious populations, while vegan diets, clean-label preferences, and preventive healthcare trends further accelerate demand. These factors collectively position spirulina as one of the most sought-after microalgae-derived protein ingredients.

- For instance, DIC Corporation expanded its spirulina production facilities in February 2024 to secure larger volumes of algae-based ingredients for food and dietary supplement applications, citing rising global demand for plant-based and sustainable nutrition inputs.

Expansion of Functional Food and Beverage Applications

A major driver for the Spirulina Protein Market is the growing incorporation of spirulina into functional food and beverage products, including smoothies, bars, snacks, dairy alternatives, and fortified beverages. Manufacturers increasingly leverage spirulina’s nutrient density, natural coloring properties, and clean-label appeal to differentiate product offerings. The rise of personalized nutrition and fortified foods boosts product innovation across global markets. As consumers seek immunity-boosting, antioxidant-rich, and energy-enhancing food options, spirulina becomes a highly attractive formulation ingredient, strengthening its presence in mainstream and premium product categories.

- For instance, FDA-approved spirulina extract is widely used as a natural blue colorant in beverages and confectionery, replacing synthetic dyes while adding phytonutrient value.

Technological Advancements in Microalgae Cultivation

Improved cultivation systems—such as photobioreactors, controlled raceway ponds, and precision nutrient management—significantly enhance spirulina yield, purity, and cost efficiency. These technological advancements help producers reduce contamination risks, optimize biomass output, and ensure consistent protein composition. Automation and AI-driven monitoring streamline large-scale production, making spirulina more accessible for pharmaceutical, nutraceutical, and food manufacturers. Enhanced extraction processes also improve protein concentration and quality. Collectively, these innovations expand production scalability, reduce operational costs, and support the growing commercial feasibility of spirulina-based protein products.

Key Trends & Opportunities

Growing Adoption of Spirulina in Clean-Label and Sustainable Nutrition Products

A major trend reshaping the Spirulina Protein Market is the strong industry shift toward clean-label, minimally processed, and eco-friendly nutrition solutions. Spirulina aligns with global sustainability goals due to its low land footprint, minimal water usage, and rapid biomass generation compared to traditional protein sources like soy or animal-derived proteins. Brands increasingly highlight spirulina’s natural origin, dense nutrient composition, and absence of synthetic additives to appeal to health-conscious consumers. Opportunities are rising in plant-based snacks, beverages, meal replacements, and organic supplements, where spirulina serves as a premium protein and antioxidant ingredient. This trend is further strengthened by regulatory support for sustainable food systems and the growing consumer willingness to pay for natural, responsibly sourced functional ingredients.

- For instance, FAO assessments highlight that spirulina requires significantly less water than livestock protein and can yield more protein per hectare than many crops, strengthening its reputation as a sustainable alternative.

Expansion in Pharmaceutical and Therapeutic Nutrition Applications

An emerging opportunity for spirulina protein lies in its expanding use in pharmaceutical formulations and medical nutrition products. Research continues to validate its antioxidant, anti-inflammatory, antiviral, and immune-supporting properties, positioning spirulina as a valuable input in therapeutic supplements and disease-specific nutritional regimens. Its role in muscle recovery, metabolic health, and chronic disease management enhances pharmaceutical interest. Additionally, aging populations and rising chronic illness incidences drive demand for high-quality protein with superior bioavailability. As clinical studies strengthen spirulina’s health benefits, pharmaceutical manufacturers increasingly integrate it into prescription supplements and specialized nutritional therapies.

- For instance, a controlled study in European Review for Medical and Pharmacological Sciences showed spirulina enhanced muscle strength and reduced fatigue in elderly participants, supporting its use in sarcopenia-related nutrition.

Key Challenges

High Production Costs and Yield Variability

Despite rising demand, spirulina protein production remains cost-intensive due to stringent cultivation requirements, controlled environmental conditions, and advanced harvesting technologies. Yield variability caused by climate fluctuations, contamination risks, and operational inefficiencies further affects supply stability. These factors lead to higher end-product pricing, limiting broader adoption in cost-sensitive markets such as mass food production and large-scale animal feed. Manufacturers face continuous pressure to optimize production economics while maintaining high purity and safety standards.

Limited Awareness in Emerging and Price-Sensitive Markets

While spirulina is well-recognized in developed regions, consumer awareness remains low in emerging economies, where conventional protein sources dominate due to affordability and familiarity. High price points, limited product availability, and inadequate knowledge of spirulina’s nutritional value hinder widespread adoption. Additionally, taste, color, and formulation challenges restrict its use in mainstream foods for some demographics. Overcoming these barriers requires strong consumer education, strategic pricing, and broader distribution networks to expand spirulina protein adoption globally.

Regional Analysis

North America

North America holds a leading position in the Spirulina Protein Market with a 32.6% share in 2024, driven by strong consumer adoption of plant-based supplements, functional foods, and natural protein ingredients. The region benefits from well-established nutraceutical brands, advanced microalgae cultivation facilities, and high spending on wellness and preventative healthcare. The U.S. dominates due to extensive product innovation and increasing investment in large-scale algae farming technologies. Rising demand for vegan nutrition, clean-label ingredients, and sustainable protein alternatives continues to reinforce market expansion across the region.

Europe

Europe accounts for 28.4% of the Spirulina Protein Market in 2024, supported by strict sustainability regulations, strong preference for organic and clean-label products, and rising incorporation of spirulina in functional foods and beverages. Countries such as Germany, France, and the U.K. lead adoption, driven by heightened awareness of microalgae-based nutrition and expanding vegan and flexitarian populations. The presence of advanced biotechnology firms and government-backed initiatives promoting algae cultivation enhances spirulina’s market penetration. Growing pharmaceutical applications and fortified food development further strengthen Europe’s position.

Asia-Pacific

Asia-Pacific dominates high-volume production and holds 29.8% share in 2024, making it one of the fastest-growing regions in the Spirulina Protein Market. China, India, and Japan contribute significantly through large-scale spirulina farming, cost-efficient production systems, and strong consumption of dietary supplements. Expanding awareness of microalgae-based proteins, rising disposable incomes, and growing demand for functional foods accelerate market growth. Government support for algae cultivation, especially in China and India, enhances supply capabilities. The region’s expanding health and wellness sector continues to drive spirulina protein adoption across diverse applications.

Latin America

Latin America captures 5.6% of the Spirulina Protein Market in 2024, with growth primarily driven by increasing acceptance of natural supplements and expanding nutraceutical distribution networks in Brazil, Mexico, and Chile. The region benefits from favorable climatic conditions for microalgae cultivation, encouraging local production initiatives. Rising interest in plant-based diets and fortified foods supports spirulina adoption, although limited awareness in rural markets remains a challenge. Continued investment in local manufacturing and regulatory improvements is expected to enhance spirulina’s commercial availability across the region.

Middle East & Africa

The Middle East & Africa region holds a 3.6% share of the Spirulina Protein Market in 2024, supported by growing demand for nutritional supplements and healthier food alternatives. Adoption is rising in Gulf countries due to increasing lifestyle-related health concerns and higher spending on premium wellness products. Africa shows production potential, particularly in countries promoting algae cultivation for nutrition and food security. However, limited consumer awareness and higher product costs restrict widespread market penetration. Increasing government focus on sustainable food resources is expected to unlock long-term opportunities in the region.

Market Segmentations

By Species

- Arthrospira Plantesis

- Arthrospira Maxima

- Others

By Dosage Form

- Capsules

- Powder

- Tablets

- Others

By Application

- Dietary Supplements

- Functional Food & Beverages

- Pharmaceuticals

- Animal Feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Spirulina Protein Market features a well-established and expanding competitive landscape, driven by leading producers focused on scaling microalgae cultivation, improving extraction efficiency, and diversifying product applications. Key players such as Cyanotech Corporation, Earthrise Nutritionals LLC, Allmicroalgae, E.I.D. Parry (India) Ltd., Nutrex Hawaii Inc., Prolgae Spirulina Supplies Pvt. Ltd., ENERGYbits Inc., Phycom Microalgae, Far East Bio-Tec Co. Ltd., and Yunna Green A Biological Project Co. Ltd. actively invest in advanced photobioreactor technologies, sustainability-driven production models, and high-purity spirulina protein formulations. Companies emphasize innovation in powder, capsule, and functional food-grade variants to meet rising demand across supplements, F&B, pharmaceuticals, and animal nutrition. Strategic collaborations, capacity expansions, and product differentiation initiatives strengthen their global footprint. Additionally, increasing focus on organic certification, traceability, and compliance with global food safety standards continues to shape competition, enabling leading players to address premium consumer segments and accelerate market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ENERGYbits Inc.

- Yunna Green A Biological Project Co. Ltd.

- Far East Bio-Tec Co. Ltd.

- Allmicroalgae

- Nutrex Hawaii Inc.

- Prolgae Spirulina Supplies Pvt. Ltd.

- Earthrise Nutritionals LLC

- Phycom Microalgae

- E.I.D. Parry (India) Ltd.

- Cyanotech Corporation

Recent Developments

- In November 2025, Edonia (France) partnered with global catering services company Newrest to integrate its spirulina-based protein ingredient EDO into institutional meals, marking a commercial adoption of the ingredient in prepared food service.

- In September 2023, Lumen Bioscience won the inaugural $1.5 million Wilkes Center Climate Prize at the University of Utah for its breakthrough innovation. Their solution addressed the significant contribution of global warming by using Spirulina to target and neutralize methane-producing microorganisms in the cow gut.

Report Coverage

The research report offers an in-depth analysis based on Species, Dosage Form, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand for sustainable, plant-based protein sources accelerates globally.

- Advancements in microalgae cultivation technologies will improve yield, purity, and cost efficiency.

- Spirulina will gain wider acceptance in functional foods and beverages as brands expand clean-label product portfolios.

- Pharmaceutical and clinical nutrition applications will increase as research validates spirulina’s therapeutic benefits.

- Rising vegan and flexitarian populations will drive higher consumption of spirulina-based supplements.

- Innovation in flavored and reformulated spirulina products will address taste, color, and sensory challenges.

- Large-scale production expansion in Asia-Pacific will strengthen global supply capabilities.

- Strategic collaborations among nutraceutical, biotechnology, and food companies will accelerate product development.

- Regulatory support for sustainable food systems will enhance market penetration across new regions.

- Increased investment in algae-based protein alternatives will position spirulina as a key contributor to future protein security.