Market Overview

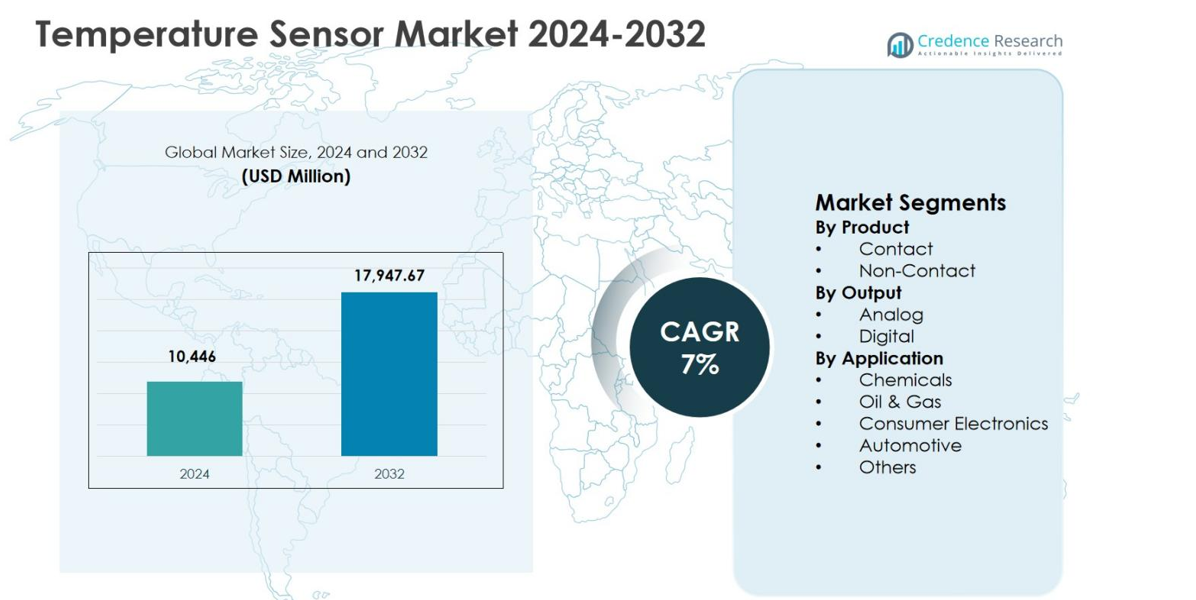

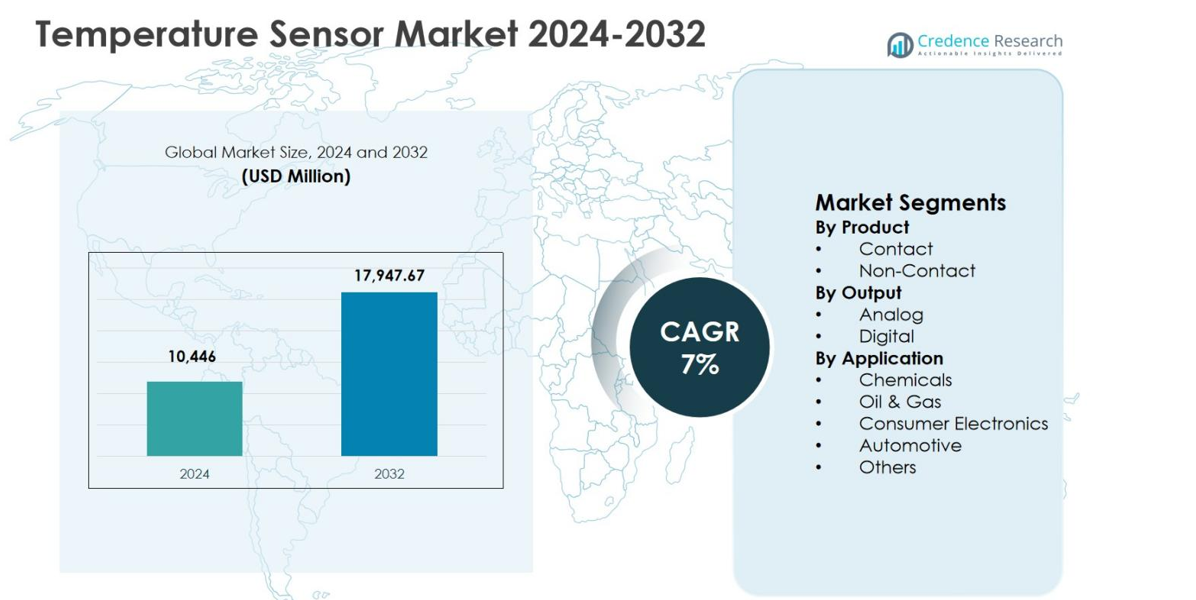

The Temperature Sensor Market size was valued at USD 10,446 million in 2024 and is anticipated to reach USD 17,947.67 million by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Temperature Sensor Market Size 2024 |

USD 10,446 million |

| Temperature Sensor Market, CAGR |

7% |

| Temperature Sensor Market Size 2032 |

USD 17,947.67 million |

The Temperature Sensor Market is led by established global manufacturers such as NXP Semiconductors N.V., Analog Devices, Inc., Infineon Technologies AG, TE Connectivity Ltd., Amphenol Corporation, Microchip Technology Inc., ON Semiconductor Corporation, Sensirion AG, Emerson Electric Co., and Maxim Integrated Products, Inc., which drive innovation through advanced sensing technologies and diversified product portfolios. These companies focus on high-accuracy digital and non-contact sensors for automotive, industrial automation, and consumer electronics applications. Regionally, Asia Pacific dominated the Temperature Sensor Market with a 34.9% share in 2024, supported by large-scale electronics manufacturing, expanding automotive production, and strong semiconductor ecosystems. North America followed with a 31.8% share, driven by automation and electric vehicle adoption, while Europe accounted for 27.6%, supported by automotive and industrial demand.

Market Insights

- The Temperature Sensor Market was valued at USD 10,446 million in 2024 and is projected to reach USD 17,947.67 million by 2032, growing at a CAGR of 7% during the forecast period, supported by rising adoption across automotive, industrial, and electronics sectors.

- Market growth is primarily driven by automotive electrification and industrial automation, with the automotive application segment holding a 34.6% share in 2024, reflecting high sensor integration in battery management, power electronics, and thermal control systems.

- Key market trends include rapid adoption of digital sensing solutions, where digital temperature sensors accounted for 58.1% share in 2024, driven by IoT integration, real-time monitoring needs, and smart manufacturing expansion.

- Market restraint includes pricing pressure and product commoditization, especially in contact sensors, despite contact temperature sensors leading with a 62.4% share in 2024, limiting margin expansion for manufacturers.

- Regionally, Asia Pacific led with a 34.9% share in 2024, followed by North America at 31.8% and Europe at 27.6%, driven by electronics manufacturing, automotive production, and industrial modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The Temperature Sensor Market, by product, is dominated by Contact temperature sensors, which accounted for 62.4% market share in 2024, owing to their high accuracy, reliability, and wide adoption across industrial and automotive applications. Contact sensors such as thermocouples and RTDs are extensively used in harsh and high-temperature environments, particularly in manufacturing, chemicals, and oil & gas operations. Their cost-effectiveness, long operational life, and compatibility with legacy systems further drive adoption. In contrast, non-contact sensors are gaining traction in specialized applications but currently hold a smaller share.

- For instance, Thermetrics Corporation deploys tube skin thermocouples in refining facilities worldwide to monitor temperatures in Coker units and Primary Reformers, using superior metallurgy for harsh petrochemical processes.

By Output:

Based on output, Digital temperature sensors held the dominant share of 58.1% in 2024 in the Temperature Sensor Market, supported by increasing demand for precise, real-time temperature monitoring and seamless integration with digital control systems. Digital sensors offer higher noise immunity, improved signal accuracy, and ease of integration with IoT-enabled devices and smart systems. These advantages make them highly preferred in automotive electronics, consumer devices, and industrial automation. Analog sensors maintain steady demand in cost-sensitive and legacy applications but face slower growth due to limited data processing capabilities.

- For instance, Sensirion’s STS31-DIS offers ±0.2°C accuracy over 0°C to 90°C in a compact 2.5 x 2.5 mm DFN package, supporting battery-driven consumer applications like smart thermostats and wearables with 1.7 µA average current.

By Application:

Among applications, the Automotive segment led the Temperature Sensor Market with a 34.6% share in 2024, driven by rising vehicle electrification, stringent emission regulations, and growing adoption of advanced driver-assistance systems. Temperature sensors are critical for battery management systems, engine control units, exhaust monitoring, and cabin climate control. Increasing production of electric and hybrid vehicles significantly boosts sensor deployment per vehicle. Consumer electronics and oil & gas applications also contribute steadily; however, automotive remains dominant due to high-volume production and continuous technological integration.

Key Growth Drivers

Expanding Automotive Electrification

The rapid growth of electric and hybrid vehicles is a major driver for the Temperature Sensor Market. Modern vehicles rely on multiple temperature sensors to monitor batteries, power electronics, motors, and thermal management systems. Stringent emission regulations and vehicle safety standards further increase sensor deployment in both internal combustion and electric vehicles. In addition, the rising adoption of advanced driver-assistance systems and onboard diagnostics increases the need for accurate temperature monitoring, supporting sustained demand across passenger and commercial automotive segments.

- For instance, SEMITEC delivered about 2 million water temperature sensors for EV battery coolant systems, enabling high-sensitivity detection of coolant temperature changes to enhance vehicle safety and thermal management.

Growth in Industrial Automation and Process Control

Rising automation across manufacturing, chemicals, oil & gas, and energy sectors is significantly driving the Temperature Sensor Market. Temperature sensors are essential for maintaining process stability, operational safety, and energy efficiency in automated environments. Increasing investments in Industry 4.0 and smart factory initiatives accelerate demand for sensors that enable continuous monitoring and real-time data feedback. The focus on reducing equipment downtime, improving product quality, and meeting regulatory compliance requirements further strengthens market growth.

- For instance, Johnson Controls developed temperature sensors for HVAC systems that optimize heating and cooling. These sensors help buildings cut energy consumption by up to 30% through precise control in energy-intensive facilities.

Increasing Demand from Consumer Electronics

The expanding consumer electronics sector is a key growth driver for the Temperature Sensor Market. Devices such as smartphones, laptops, wearables, and smart home products increasingly incorporate temperature sensors for thermal protection and performance optimization. Ongoing miniaturization and higher functionality of electronic devices have increased sensor integration per unit. Rising consumer demand for connected and high-performance electronics, particularly in emerging economies, continues to support steady growth in this segment.

Key Trends & Opportunities

Integration with IoT and Smart Monitoring Systems

The integration of temperature sensors with IoT and smart monitoring platforms represents a major trend and opportunity in the Temperature Sensor Market. Connected sensors enable real-time data collection, predictive maintenance, and remote system management across industrial, automotive, and building automation applications. This capability improves operational efficiency and reduces maintenance costs. Growing adoption of smart infrastructure and digitalized industrial processes creates strong demand for advanced digital sensors with wireless connectivity and data analytics capabilities.

- For instance, Odoo integrates IoT temperature and vibration sensors in car manufacturing plants to monitor machine performance, alerting teams to overheating or anomalies for proactive maintenance that reduces breakdowns and downtime.

Advancements in Non-Contact Temperature Sensing

Technological advancements in non-contact temperature sensing are creating new opportunities in the Temperature Sensor Market. Improvements in infrared sensing accuracy, response speed, and reliability are expanding usage across healthcare, consumer electronics, and industrial safety applications. Non-contact sensors enable temperature measurement in hazardous, moving, or sterile environments where traditional contact sensors are unsuitable. Increasing demand for touch-free and safety-oriented solutions further accelerates adoption of advanced non-contact sensing technologies.

- For instance, OMRON’s ES1-N infrared thermosensor offers ±0.5°C reproducibility and 0.14-second (95%) response time for precise non-contact measurements from -50 to 500°C. The laser pointer variant enhances reliability in dynamic consumer applications like safety monitoring.

Key Challenges

Accuracy, Drift, and Calibration Issues

Ensuring long-term accuracy and calibration stability remains a key challenge in the Temperature Sensor Market. Sensors operating in extreme temperatures, high vibration, or corrosive conditions are susceptible to performance drift over time. Frequent calibration requirements increase operational costs and complexity, particularly in industrial and automotive applications. Inaccurate temperature readings can impact safety, efficiency, and regulatory compliance, compelling manufacturers to invest in advanced materials and robust sensor designs.

Pricing Pressure and Competitive Intensity

Pricing pressure driven by intense competition presents a significant challenge for the Temperature Sensor Market. The presence of numerous global and regional suppliers has increased product commoditization, especially for standard sensor types. Price sensitivity among end users limits margin expansion, while rapid technological evolution requires continuous investment in research and development. Balancing cost efficiency with innovation and product differentiation remains a persistent challenge for market participants.

Regional Analysis

North America

North America accounted for 31.8% market share in 2024 in the Temperature Sensor Market, driven by strong demand from automotive, aerospace, industrial automation, and healthcare sectors. The region benefits from early adoption of advanced sensing technologies and widespread integration of IoT-enabled monitoring systems. High investments in electric vehicle production and smart manufacturing further support market growth. The presence of leading sensor manufacturers and semiconductor companies enhances innovation and supply chain efficiency. Strict regulatory standards related to safety and energy efficiency also encourage continuous deployment of temperature sensors across critical applications.

Europe

Europe held a 27.6% market share in 2024 in the Temperature Sensor Market, supported by stringent environmental regulations and strong automotive and industrial bases. Countries such as Germany, France, and the United Kingdom drive demand through extensive use of sensors in automotive manufacturing, renewable energy systems, and industrial process control. The region’s focus on vehicle electrification, emission reduction, and factory automation accelerates sensor adoption. Additionally, robust research and development activities and the presence of established automotive OEMs and industrial equipment manufacturers strengthen regional market performance.

Asia Pacific

Asia Pacific dominated the Temperature Sensor Market with a 34.9% market share in 2024, led by rapid industrialization, expanding consumer electronics manufacturing, and growing automotive production. China, Japan, South Korea, and India are key contributors due to large-scale electronics manufacturing hubs and increasing adoption of electric vehicles. Rising investments in smart factories and infrastructure development further boost sensor demand. Cost-efficient manufacturing capabilities and a strong semiconductor ecosystem support high-volume production, making Asia Pacific the leading regional market for temperature sensors.

Latin America

Latin America captured a 3.8% market share in 2024 in the Temperature Sensor Market, driven by growing industrial activity and gradual expansion of the automotive and oil & gas sectors. Countries such as Brazil and Mexico are witnessing increased deployment of temperature sensors in manufacturing, energy, and process industries. Investments in industrial modernization and infrastructure development support steady market growth. Although adoption remains lower compared to developed regions, increasing regulatory focus on safety and efficiency is expected to strengthen demand for temperature sensors across key applications.

Middle East & Africa

The Middle East & Africa accounted for 1.9% market share in 2024 in the Temperature Sensor Market, supported by demand from oil & gas, energy, and industrial processing industries. Temperature sensors play a critical role in monitoring extreme operating conditions across refineries and power generation facilities. Growing investments in industrial diversification and infrastructure projects in Gulf countries further support adoption. While market size remains comparatively smaller, increasing focus on automation, energy efficiency, and operational safety continues to create growth opportunities across the region.

Market Segmentations:

By Product

By Output

By Application

- Chemicals

- Oil & Gas

- Consumer Electronics

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

NXP Semiconductors N.V., Analog Devices, Inc., Infineon Technologies AG, TE Connectivity Ltd., Amphenol Corporation, Microchip Technology Inc., ON Semiconductor Corporation, Sensirion AG, Emerson Electric Co., and Maxim Integrated Products, Inc. form the core competitive structure of the Temperature Sensor Market. The market is characterized by strong competition driven by continuous product innovation, portfolio expansion, and strategic partnerships. Leading players focus on developing high-accuracy digital and non-contact temperature sensors tailored for automotive electrification, industrial automation, and consumer electronics applications. Investments in research and development remain central, particularly for enhancing sensor precision, miniaturization, and IoT compatibility. Companies are also strengthening their global presence through capacity expansions and collaborations with OEMs to secure long-term supply agreements. Additionally, competitive differentiation increasingly depends on reliability, compliance with stringent safety standards, and the ability to offer integrated sensing solutions, intensifying rivalry among established players and regional manufacturers alike.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Emerson Electric Co.

- Sensirion AG

- Infineon Technologies AG

- Amphenol Corporation

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- TE Connectivity Ltd.

- Analog Devices, Inc.

- ON Semiconductor Corporation

- Maxim Integrated Products, Inc.

Recent Developments

- In October 2025, Industrial Control Solutions (ICS) completed the acquisition of Duro-Sense Corporation, expanding its capabilities in temperature measurement and industrial sensing solutions to enhance precision monitoring in aerospace and industrial applications.

- In November 2025, DwyerOmega acquired Consistec, a Brazilian manufacturer of temperature monitoring solutions, strengthening its portfolio and global presence in innovative sensing and control solutions.

- In June 2025, Sensirion also introduced new digital humidity and temperature sensors (SHT40-AD1P-R2 and SHT41-AD1P-R2) to broaden its portfolio for precise environmental sensing.

- In July 2025, COTEMP Sensing acquired LPG Industries Inc. to expand its high-performance temperature measurement solutions for power generation

Report Coverage

The research report offers an in-depth analysis based on Product, Output, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Temperature Sensor Market will continue to expand due to increasing adoption in automotive electrification and advanced thermal management systems.

- Growing implementation of Industry 4.0 and smart manufacturing will sustain long-term demand for accurate temperature monitoring solutions.

- Integration of temperature sensors with IoT platforms will enhance real-time monitoring, predictive maintenance, and operational efficiency.

- Demand for digital temperature sensors will rise as industries shift toward connected and data-driven control systems.

- Non-contact temperature sensing technologies will gain wider adoption in safety-critical and high-speed industrial applications.

- Consumer electronics innovation will drive higher sensor integration per device to support performance optimization and thermal protection.

- Advancements in sensor miniaturization will enable broader use in compact and portable electronic devices.

- Regulatory emphasis on safety, emissions, and energy efficiency will reinforce sensor deployment across multiple industries.

- Emerging economies will offer growth opportunities due to industrial expansion and infrastructure development.

- Competitive intensity will encourage continuous innovation, cost optimization, and strategic collaborations among market participants.