Market Overview

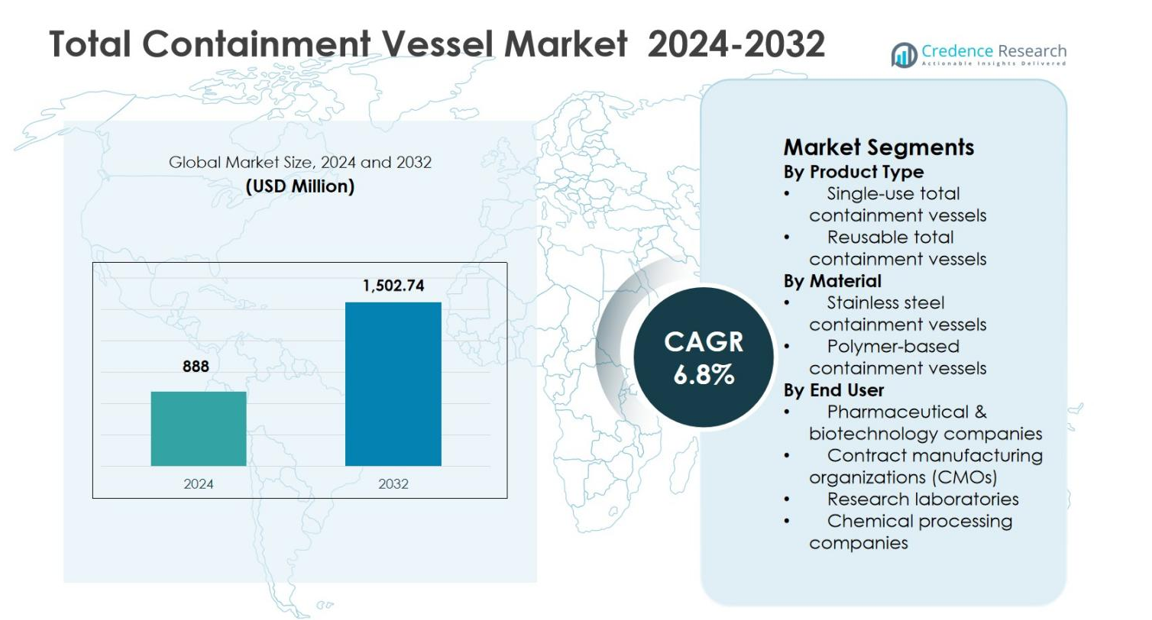

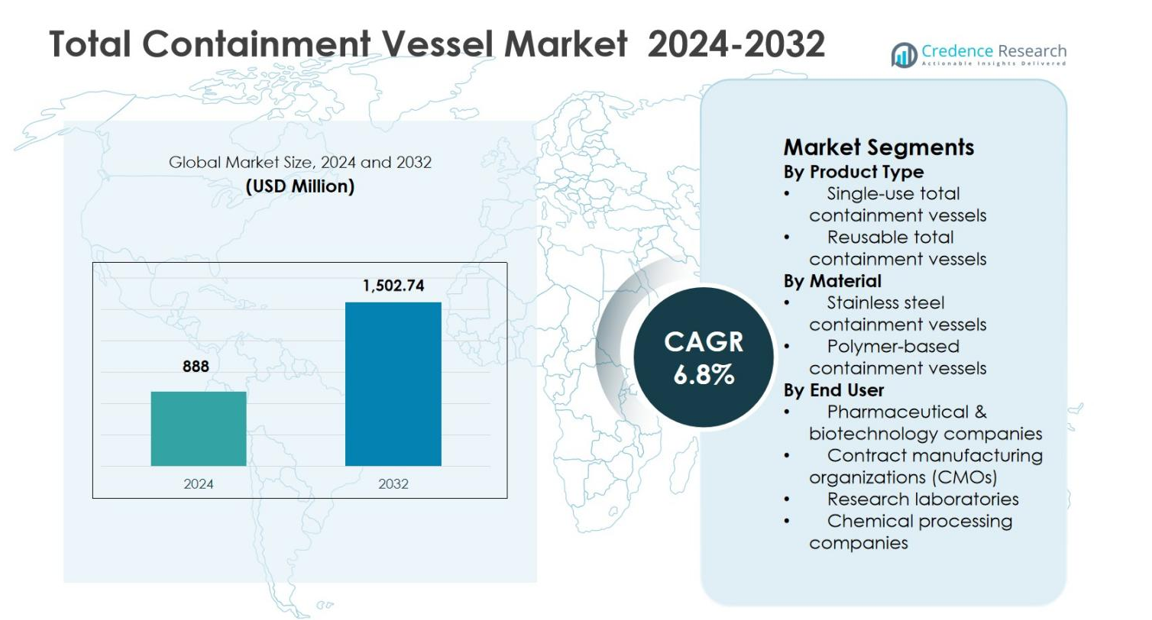

The Total Containment Vessel Market size was valued at USD 888 million in 2024 and is anticipated to reach USD 1,502.74 million by 2032, growing at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Total Containment Vessel Market Size 2024 |

USD 888 million |

| Total Containment Vessel Market, CAGR |

6.8% |

| Total Containment Vessel Market Size 2032 |

USD 1,502.74 million |

Total Containment Vessel Market is driven by the strong presence of established manufacturers focusing on high-performance containment solutions for pharmaceutical, biotechnology, and chemical applications. Key players such as Allen-Vanguard Corporation, NABCO Systems LLC, Dynasafe, Thales Group, Mistral Group, Scanna MSC Ltd., and T.M. International (TMII) emphasize advanced engineering, regulatory compliance, and customized system designs to meet stringent safety standards. These companies invest in product innovation, automation, and durable materials to support handling of high-potency and hazardous compounds. Regionally, North America leads the Total Containment Vessel Market with a 38.6% market share in 2024, supported by strong pharmaceutical manufacturing capacity and strict safety regulations, followed by Europe with 31.2%, driven by robust regulatory frameworks and growing demand for advanced containment infrastructure.

Market Insights

- The Total Containment Vessel Market was valued at USD 888 million in 2024 and is projected to reach USD 1,502.74 million by 2032, registering a CAGR of 6.8% during the forecast period.

- Growth in the Total Containment Vessel Market is driven by rising production of high-potency APIs, oncology drugs, and hazardous compounds, along with stringent occupational safety and regulatory compliance requirements across pharmaceutical and chemical manufacturing facilities.

- Market trends highlight increasing adoption of reusable total containment vessels, which held 62.4% segment share in 2024, supported by durability, long service life, and cost efficiency, alongside growing integration of automation and digital monitoring systems.

- The market faces restraints from high capital investment, complex installation, and validation requirements, which can limit adoption among small and mid-sized manufacturers despite strong regulatory pressure.

- Regionally, North America led the market with 38.6% share in 2024, followed by Europe at 31.2% and Asia Pacific at 22.4%, while Latin America and Middle East & Africa accounted for 4.6% and 3.2% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The Total Containment Vessel Market by product type is led by reusable total containment vessels, which accounted for 62.4% of the market share in 2024, driven by their durability, long service life, and cost efficiency in high-containment pharmaceutical and chemical operations. End users increasingly prefer reusable systems due to their ability to withstand repeated sterilization cycles, high-pressure conditions, and stringent regulatory requirements. These vessels support continuous manufacturing workflows and reduce long-term operational costs, making them the preferred choice in large-scale production facilities. Single-use total containment vessels continue to gain adoption in niche and pilot-scale applications.

- For instance, ILC Dover’s DoverPac® SF provides single-use powder containment with over 99.5% product recovery using ArmorFlex® films for static-free charging in pilot-scale transfers, available in 50L V-fold models with 4-6” sanitary connections.

By Material:

Based on material, stainless steel containment vessels dominated the Total Containment Vessel Market with a 68.1% share in 2024, supported by superior mechanical strength, corrosion resistance, and compliance with GMP standards. Stainless steel vessels are widely used in pharmaceutical, biotechnology, and chemical processing environments that require high-pressure resistance and rigorous cleaning protocols. Their compatibility with aggressive chemicals and high-temperature sterilization processes enhances safety and containment efficiency. Polymer-based containment vessels are expanding gradually, primarily in lightweight, portable, and single-use applications where flexibility and lower upfront costs are prioritized.

- For instance, Beltecno supplied Serum Institute of India with a 45,000-liter stainless steel panel tank (3m width x 5m length x 3m height) for RO water storage in vaccine production, offering corrosion resistance and easy installation.

By End User:

Among end users, pharmaceutical & biotechnology companies held the largest share of the Total Containment Vessel Market at 54.6% in 2024, driven by rising demand for potent drug manufacturing, oncology therapeutics, and controlled handling of hazardous compounds. Stringent regulatory frameworks and increased focus on operator safety and cross-contamination prevention are accelerating adoption across pharma production lines. These companies rely heavily on advanced containment solutions to meet occupational exposure limits and ensure product integrity. Contract manufacturing organizations and research laboratories are also witnessing steady growth due to outsourcing trends and increased R&D activity.

Key Growth Drivers

Increasing Demand for High-Potency Drug Manufacturing

The Total Containment Vessel Market is driven by the rising production of high-potency active pharmaceutical ingredients, oncology drugs, and cytotoxic compounds. Pharmaceutical and biotechnology manufacturers require advanced containment solutions to ensure safe handling of hazardous substances while meeting strict occupational exposure limits. Stringent regulatory mandates related to operator safety and contamination control further accelerate adoption. The growing shift toward complex biologics and personalized medicines also supports demand, as these manufacturing processes require sealed, controlled environments to maintain product quality and ensure workforce protection.

- For instance, GEA supplied Ranbaxy Laboratories with UltimaPro single-pot processors (10 L and 75 L) integrated with Hicoflex containment interfaces for manufacturing highly potent anticancer drugs at an OEL of 1–10 μg/m³, enabling full containment from granulation to drying without operator exposure.

Expansion of Pharmaceutical Outsourcing and CMOs

The rapid growth of contract manufacturing organizations significantly supports the Total Containment Vessel Market. Pharmaceutical companies increasingly outsource manufacturing to CMOs to optimize costs, scale production, and accelerate commercialization timelines. This trend compels CMOs to invest in flexible and compliant containment systems capable of handling multiple potent compounds. Total containment vessels enable CMOs to meet global regulatory standards, reduce cross-contamination risks, and support multi-product manufacturing environments, driving sustained demand across outsourced pharmaceutical production facilities.

- For instance, Catalent invested $10 million to expand high-potency containment capabilities at its sites in Malvern, PA, and Dartford, UK, enabling flexible jet milling under containment to occupational exposure limits of less than 1 microgram per cubic meter for highly potent compounds.

Heightened Focus on Workplace Safety and Regulatory Compliance

Increasing emphasis on workplace safety and regulatory compliance acts as a strong growth driver for the Total Containment Vessel Market. Regulatory authorities enforce strict containment and exposure-control standards to protect personnel from hazardous substances. Companies prioritize advanced containment infrastructure to minimize health risks, prevent leaks, and improve audit readiness. Investments in total containment vessels are increasingly viewed as long-term risk-mitigation strategies that enhance operational reliability, regulatory confidence, and overall manufacturing sustainability.

Key Trends & Opportunities

Integration of Smart and Automated Containment Technologies

A prominent trend in the Total Containment Vessel Market is the integration of smart and automated technologies. Manufacturers are adopting systems equipped with digital sensors, pressure monitoring, and automated handling to reduce human intervention and improve safety. These technologies enhance process control, enable real-time performance tracking, and support predictive maintenance. As pharmaceutical manufacturing becomes more data-driven, demand increases for technologically advanced containment vessels that improve efficiency while maintaining consistent compliance standards.

- For instance, Tema Sinergie provides aseptic containment isolators for oncology HPAPIs featuring integrated glove leak testing (AGLTS) and SCADA systems, which deliver automated pressure monitoring and real-time alerts to maintain high containment integrity.

Emerging Market Expansion in Pharmaceutical Manufacturing

Expanding pharmaceutical manufacturing capacity in emerging economies presents strong growth opportunities for the Total Containment Vessel Market. Countries in Asia Pacific, Latin America, and the Middle East are investing in compliant drug production facilities to support domestic demand and exports. Government incentives and regulatory alignment with international standards encourage adoption of advanced containment systems. As local manufacturers upgrade facilities, demand for reliable and compliant total containment vessels continues to rise.

- For instance, Mubadala Bio opened a high-potency drug manufacturing facility in Abu Dhabi, designed for oncology and hormone therapies meeting international safety standards. The site supports local production of complex medicines like Sunitinib for advanced cancers, reducing import reliance.

Key Challenges

High Capital and Implementation Costs

High capital investment requirements pose a major challenge for the Total Containment Vessel Market. Advanced containment vessels involve significant upfront costs related to equipment procurement, customization, and facility integration. Small and mid-sized manufacturers often face financial constraints, slowing adoption. Additionally, complex installation and commissioning processes increase project timelines and costs, limiting penetration in cost-sensitive markets and emerging pharmaceutical enterprises.

Complexity of Validation, Maintenance, and Skill Requirements

The complexity of validation and maintenance processes presents another challenge in the Total Containment Vessel Market. Regulatory compliance demands extensive testing, documentation, and periodic revalidation, increasing operational workload. Specialized maintenance and trained personnel are required to ensure long-term system performance and safety. Organizations with limited technical expertise may face higher lifecycle costs and operational downtime, which can negatively impact efficiency and return on investment.

Regional Analysis

North America

North America accounted for 38.6% of the Total Containment Vessel Market share in 2024, driven by strong pharmaceutical manufacturing capacity, strict occupational safety regulations, and early adoption of advanced containment technologies. The region benefits from a high concentration of pharmaceutical and biotechnology companies focused on high-potency drug and biologics production. Regulatory bodies enforce stringent exposure control and contamination prevention standards, encouraging sustained investment in total containment vessels. The presence of major contract manufacturing organizations and continuous R&D activities further supports demand, while modernization of existing manufacturing facilities strengthens long-term market growth across the region.

Europe

Europe held a 31.2% share of the Total Containment Vessel Market in 2024, supported by robust pharmaceutical production, well-established regulatory frameworks, and strong emphasis on worker safety. Countries such as Germany, France, Italy, and the United Kingdom drive adoption through increased production of oncology drugs and active pharmaceutical ingredients. European manufacturers prioritize compliance with GMP and occupational exposure limits, accelerating demand for advanced containment solutions. The region also benefits from a growing network of contract manufacturing organizations and rising investments in biologics and specialty drugs, reinforcing consistent demand for total containment vessels.

Asia Pacific

Asia Pacific captured 22.4% of the Total Containment Vessel Market share in 2024, driven by rapid expansion of pharmaceutical manufacturing in China, India, South Korea, and Japan. The region experiences increasing investments in drug production infrastructure to support domestic demand and exports. Governments actively promote pharmaceutical self-sufficiency and regulatory alignment with global standards, accelerating adoption of containment technologies. Rising outsourcing activities from global pharmaceutical companies to regional CMOs further support market growth. Cost-effective manufacturing capabilities combined with increasing focus on safety and compliance strengthen long-term opportunities in Asia Pacific.

Latin America

Latin America represented 4.6% of the Total Containment Vessel Market share in 2024, supported by gradual growth in pharmaceutical manufacturing across Brazil, Mexico, and Argentina. The region is witnessing increasing investments in modern drug production facilities to meet local healthcare needs and reduce dependency on imports. Regulatory improvements and growing awareness of occupational safety standards drive adoption of containment solutions. Expansion of generic drug manufacturing and rising presence of international pharmaceutical companies contribute to steady demand, while ongoing infrastructure upgrades support moderate but consistent market growth.

Middle East & Africa

The Middle East & Africa accounted for 3.2% of the Total Containment Vessel Market share in 2024, driven by expanding pharmaceutical manufacturing capabilities in countries such as Saudi Arabia, the United Arab Emirates, and South Africa. Governments actively support local drug production through healthcare investments and industrial diversification initiatives. Increasing focus on regulatory compliance and workforce safety encourages adoption of containment vessels. Although market penetration remains limited compared to developed regions, rising healthcare expenditure, improving regulatory frameworks, and growing interest in domestic pharmaceutical manufacturing create long-term growth potential.

Market Segmentations:

By Product Type

- Single-use total containment vessels

- Reusable total containment vessels

By Material

- Stainless steel containment vessels

- Polymer-based containment vessels

By End User

- Pharmaceutical & biotechnology companies

- Contract manufacturing organizations (CMOs)

- Research laboratories

- Chemical processing companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Total Containment Vessel Market is shaped by the presence of key players including Allen-Vanguard Corporation, NABCO Systems LLC, Mistral Group, Scanna MSC Ltd., T.M. International (TMII), Dynasafe, Thales Group, Karil International, HBA System, and TJ Systems S Pte Ltd. These companies focus on advanced engineering capabilities, compliance-driven designs, and high-performance containment solutions to address stringent safety and regulatory requirements. Market participants compete through product innovation, customization, and expansion of application-specific containment systems for pharmaceutical, biotechnology, and chemical sectors. Strategic collaborations with end users, long-term supply agreements, and investments in R&D strengthen their market positioning. Players also emphasize global distribution networks and after-sales services to enhance customer retention. Continuous upgrades in material strength, automation, and monitoring technologies remain central to sustaining competitiveness and addressing evolving industry safety standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NABCO Systems LLC

- Mistral Group

- Scanna MSC Ltd.

- T.M. International (TMII)

- Dynasafe

- Thales Group

- Karil International

- HBA System

- TJ Systems S Pte Ltd.

- Allen-Vanguard Corporation

Recent Developments

- In June 2024, Syntegon’s Pharmatec business launched its new Modular Bioprocessing Platform (MBP) at Achema 2024 to support flexible, closed, and compliant biopharmaceutical processing with integrated containment features.

- In March 2024, Telstar introduced a new dual-mode isolator system capable of operating in either high-containment or aseptic mode, enabling safe handling of potent compounds and sterile processing within a single vessel-based enclosure.

- In June 2023, Getinge introduced its ISOPRIME pharmaceutical isolator, a versatile and cost-efficient system with integrated hydrogen peroxide bio-decontamination and connectivity features for aseptic and sterile processes.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Total Containment Vessel Market will experience steady growth driven by increasing production of high-potency and hazardous compounds.

- Pharmaceutical and biotechnology companies will continue to expand investments in advanced containment infrastructure to meet regulatory requirements.

- Adoption of reusable containment vessels will increase due to their long-term cost efficiency and durability in continuous manufacturing environments.

- Integration of automation and digital monitoring technologies will enhance safety, operational efficiency, and compliance management.

- Contract manufacturing organizations will remain key demand generators as outsourcing of drug manufacturing accelerates globally.

- Emerging markets will witness rising adoption supported by expanding pharmaceutical manufacturing capacity and regulatory alignment.

- Manufacturers will focus on customized containment solutions tailored to specific process and compound requirements.

- Increasing emphasis on workplace safety will drive replacement of conventional systems with advanced containment vessels.

- Ongoing advancements in materials and vessel design will improve performance, reliability, and lifecycle efficiency.

- Strategic partnerships and technological innovation will strengthen competitive positioning across the global market.