Market overview

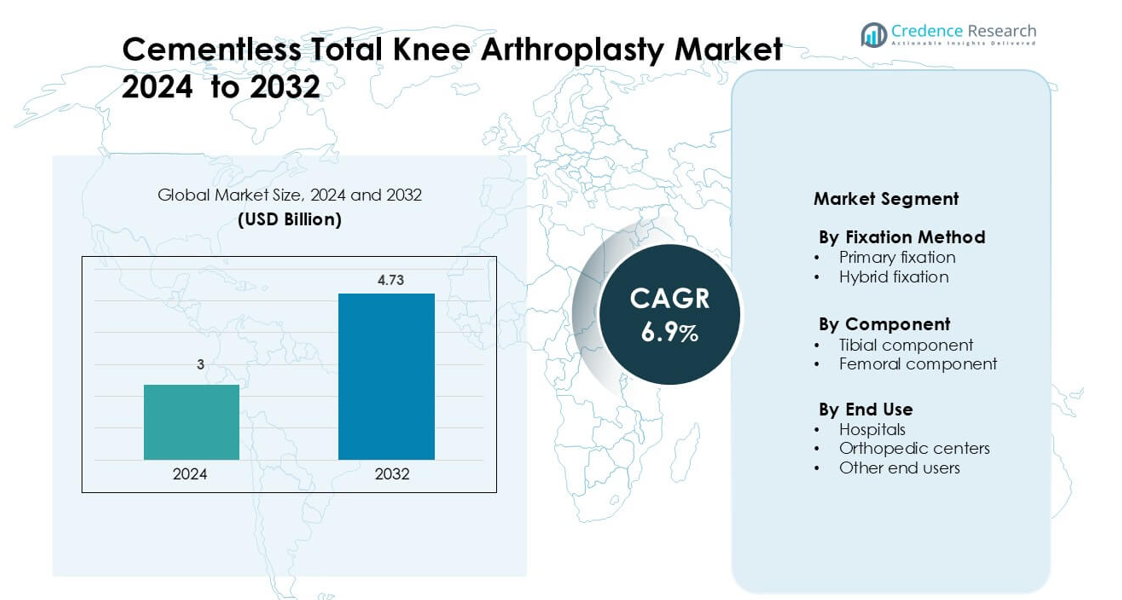

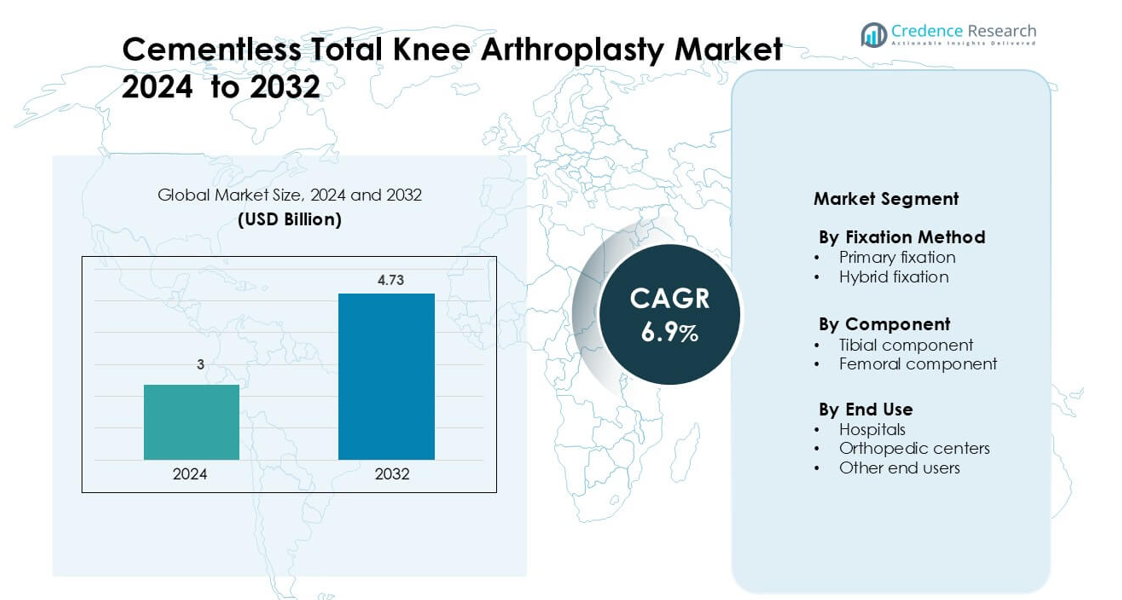

Cementless Total Knee Arthroplasty Market was valued at USD 3 billion in 2024 and is anticipated to reach USD 4.73 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cementless Total Knee Arthroplasty Market Size 2024 |

USD 3 billion |

| Cementless Total Knee Arthroplasty Market, CAGR |

6.9% |

| Cementless Total Knee Arthroplasty Market Size 2032 |

USD 4.73 billion |

The Cementless Total Knee Arthroplasty Market is shaped by leading companies such as MicroPort Orthopedics, Enovis, Aesculap, Corin Group, Medacta International, Dentsply Sirona, Exactech, Episurf Medical, Conformis, and DePuy Synthes. These manufacturers compete through advanced porous-coated implants, 3D-printed components, and navigation-ready designs that enhance biological fixation and long-term stability. Product development focuses on improved femoral and tibial interfaces that support strong early fixation and faster recovery. North America remains the dominant region, holding about 41% share in 2024 due to high procedure volumes, rapid adoption of robotic systems, and strong clinical preference for cementless platforms.

Market Insights

- The Cementless Total Knee Arthroplasty Market reached a significant valuation of USD 3 billion in 2024 and is projected to grow steadily toward 2032 at a strong CAGR of 6.9%, supported by rising adoption among younger and active patients.

- Growth is driven by demand for long-lasting implants, improved porous coatings, and wider use of robotic navigation that enhances fixation accuracy in primary fixation, which held the largest segment share at about 63% in 2024.

- Key trends include expanding use of 3D-printed components, faster adoption in outpatient centers, and rising preference for biologic fixation as clinical studies show improved long-term outcomes.

- Competition intensifies as players such as MicroPort Orthopedics, Enovis, Aesculap, Corin Group, Medacta International, Dentsply Sirona, Exactech, Episurf Medical, Conformis, and DePuy Synthes invest in next-generation porous designs and personalized knee systems.

- North America leads with around 41% share in 2024, followed by Europe and Asia-Pacific, while hospitals remain the dominant end-use environment with about 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fixation Method

Primary fixation leads this segment with about 63% share in 2024. Surgeons prefer primary fixation because porous-coated implants support faster bone ingrowth and stronger long-term stability. Adoption grows as younger and active patients choose cementless procedures to avoid cement-related loosening. Better implant surface engineering, high-precision 3D porous structures, and improved instrumentation also strengthen primary fixation demand. Hybrid fixation expands at a steady pace, but its use remains lower due to rising confidence in fully cementless platforms.

- For instance, A pre-clinical ovine (sheep) lumbar spine fusion model study was indeed conducted to compare Stryker’s 3D-printed porous titanium alloy (PTA, or Tritanium) cages with PEEK cages. The results were published in The Spine Journal in 2018.

By Component

The femoral component dominates this segment with nearly 52% share in 2024. Demand increases as modern femoral designs provide better load distribution, reduced micromotion, and enhanced biocompatibility. Manufacturers focus on titanium alloy interfaces and advanced porous coatings, which encourage strong bone integration. Growth also rises due to higher revision rates linked to femoral wear in older cemented systems. The tibial component segment grows with adoption of monoblock titanium trays, but its share stays lower as femoral implants remain the primary focus of cementless optimization.

- For instance, Stress shielding occurs when a rigid implant (like CoCr with its high modulus) diverts the load away from the adjacent bone, which can lead to bone resorption and potential implant loosening over time.

By End Use

Hospitals hold the largest share at around 58% in 2024. High adoption comes from broad surgical capacity, access to advanced navigation systems, and strong reimbursement support. Hospitals perform most primary and revision cementless knee procedures due to experienced orthopedic teams and high patient volume. Orthopedic centers expand quickly with specialized surgeons, yet their share remains smaller than large multispecialty hospitals. Other end users, including ambulatory surgical units, show early traction as minimally invasive cementless systems improve recovery times.

Key Growth Drivers

Rising Preference for Long-Term Implant Durability

Demand grows as surgeons choose cementless total knee arthroplasty for younger and more active patients who need implants that last longer. Porous-coated designs help bone grow into the implant and create a stronger biological bond. This natural fixation reduces risks linked to cement failure, such as loosening after high daily stress. Surgeons report better alignment and stability due to improved implant geometry. Hospitals also support cementless procedures as recovery improves with lighter surgical steps and reduced cement-handling time. These advantages make cementless systems a strong option for patients seeking long-term knee function and reduced revision needs.

- For instance, in a large series of 454 younger patients receiving trabecular-metal (tantalum) cementless TKA, only 8 revision surgeries were needed over a mean follow-up of 10 years, and none were for aseptic loosening of the tibial baseplate.

Advancements in Implant Surface Engineering

Modern coating technologies drive adoption across global orthopedic centers. Manufacturers use 3D-printed porous metals, titanium lattices, and advanced hydroxyapatite layers to boost bone integration. These surface systems increase friction and stability, leading to fewer early failures. Better tibial and femoral surface finishes also improve mechanical grip on cancellous bone. Surgeons value these enhancements because they reduce micromotion and support fast postoperative weight-bearing. Industry investment in product testing and simulation methods strengthens trust in these designs. Growth rises as evidence shows better long-term fixation with new porous coatings compared to older cemented models.

- For instance, Stryker Tritanium material (used in its spinal and orthopedic implants) has a mean pore size in its porous lattice of 400–500 µm, with pores ranging from 100 to 700 µm, closely mimicking cancellous bone structure this helps support bony ingrowth.

Expansion of High-Volume Joint Replacement Programs

Large hospitals and high-volume orthopedic centers push cementless adoption as procedure numbers rise worldwide. These centers invest in robotic navigation, digital templating, and improved surgical tools that help surgeons achieve precise bone cuts for cementless placement. Higher accuracy means better contact between bone and porous implant surfaces. Growth also comes from strong reimbursement frameworks that support knee replacement surgeries. Patient awareness programs highlight faster recovery and lower revision needs, which boosts acceptance. The rise of day-care joint replacement pathways further supports cementless systems because they reduce operative steps and speed discharge.

Key Trend & Opportunity

Growth in Robotic-Assisted Cementless Procedures

Robotic knee systems improve accuracy in bone preparation and alignment, helping surgeons place cementless implants more reliably. This precision reduces errors that once slowed cementless adoption. As robotic platforms spread into mid-size hospitals, manufacturers see a chance to combine advanced implants with guided workflow tools. This shift encourages consistent outcomes and reduces variability across surgeons. The opportunity expands as robotic systems enable personalized joint balancing, promoting proper bone-implant contact. Wider use of robotic surgery strengthens global confidence in cementless knee technology and encourages investment in fully integrated surgical ecosystems.

- For instance, a multi-center evaluation of Zimmer Biomet’s ROSA Knee System documented a reduction in alignment outliers, achieving mechanical axis alignment within 3° in the majority of cases, which is a key parameter influencing cementless fixation success.

Increased Adoption Among Younger Patient Groups

More adults under 60 choose knee replacement due to rising sports injuries and early-onset osteoarthritis. Younger patients prefer cementless implants because biological fixation lasts longer and better supports active lifestyles. This creates a major opportunity for manufacturers designing high-strength femoral and tibial systems. Faster recovery times also appeal to working-age patients who want minimal downtime. Clinical research shows improved durability with porous coatings in younger demographics, boosting surgeon confidence. As aging patterns shift and chronic joint disorders appear earlier, the addressable market for cementless systems expands rapidly.

- For instance, in a study of 500 cementless TKAs in patients under 55 years, researchers found an all-cause implant survival rate of 98.4% at a median follow-up of 10.7 years, with an aseptic survival of 99.2%.

Rapid Expansion in Emerging Healthcare Markets

Countries in Asia-Pacific, the Middle East, and Latin America expand orthopedic infrastructure and increase surgical capacity. These regions invest in advanced joint replacement units, which boosts interest in cementless systems. Surgeons in emerging markets adopt these implants as training programs improve and global guidelines spread. Rising income levels and insurance coverage help more patients access knee replacement surgery. Manufacturers see strong growth potential through partnerships with regional distributors, localized manufacturing, and surgeon education programs. This expansion opens new high-volume opportunities for cementless knee systems.

Key Challenge

Higher Upfront Cost and Limited Access in Smaller Centers

Cementless implants often cost more due to advanced coatings and 3D-printed structures. Smaller hospitals struggle with capital limitations, which slows adoption compared to cemented options. Limited access to robotic systems or advanced instrumentation further increases barriers because cementless placement needs higher precision. In cost-sensitive regions, reimbursement plans still favor cemented implants, making providers cautious. These financial gaps restrict broad adoption, especially in rural hospitals. Manufacturers must address pricing and support to unlock full market potential.

Steeper Learning Curve and Technique Sensitivity

Cementless total knee arthroplasty requires precise bone preparation and implant alignment to achieve firm initial fixation. Surgeons with limited experience may face higher risks of early instability or micromotion. This technical sensitivity makes some clinicians prefer cemented implants for predictable outcomes. Training programs and digital navigation tools help reduce skill gaps, but adoption remains uneven. Inconsistent surgical proficiency slows widespread cementless use, especially in low-volume centers. Improving education, standardized workflow tools, and supporting clinical data can help overcome this challenge.

Regional Analysis

North America

North America leads the Cementless Total Knee Arthroplasty Market with about 41% share in 2024. Growth comes from high procedure volumes, strong adoption of robotic systems, and broad use of advanced porous-coated implants. Hospitals in the U.S. invest heavily in digital navigation tools that support precise placement of cementless components. Surgeon preference shifts toward biological fixation as younger patients seek long-lasting knee solutions. Supportive reimbursement programs and strong orthopedic training networks further boost uptake. Canada follows similar trends with rising demand for cementless options in high-volume joint replacement centers.

Europe

Europe holds nearly 29% share in 2024, driven by steady use of cementless implants across Germany, the U.K., France, and Italy. Surgeons in the region adopt porous-coated systems due to strong clinical evidence supporting bone ingrowth and reduced long-term loosening. Government-backed healthcare systems promote standardized joint replacement pathways, which enhance access to advanced implants. Growth increases as aging populations drive higher knee arthroplasty demand. Northern and Western Europe lead adoption, while Eastern Europe expands gradually with improved orthopedic infrastructure and surgeon training programs.

Asia-Pacific

Asia-Pacific captures around 22% share in 2024 and remains the fastest-growing region. Rising healthcare spending, rapid expansion of orthopedic hospitals, and increasing awareness of long-term implant durability drive adoption. China and India boost demand with rising osteoarthritis cases and growing use of cementless systems in tier-1 hospitals. Japan and South Korea contribute through advanced surgical robotics and strong implant innovation. The region benefits from large patient pools and expanding insurance coverage, which make cementless knee procedures more accessible across urban centers.

Latin America

Latin America accounts for nearly 5% share in 2024, supported by growing orthopedic capabilities in Brazil, Mexico, and Argentina. Adoption rises as private hospitals introduce robotic and navigation systems that improve surgical precision for cementless implants. Economic challenges limit broad access, but premium centers focus on young and active patients seeking long-term fixation. Training programs and partnerships with global implant manufacturers help expand surgeon expertise. Growth remains moderate but strengthens as healthcare investments rise in major metropolitan regions.

Middle East & Africa

The Middle East & Africa region holds about 3% share in 2024. Demand increases in the UAE, Saudi Arabia, and South Africa where hospitals upgrade joint replacement facilities and adopt advanced cementless designs. Medical tourism in Gulf countries boosts procedure volumes, especially for high-end orthopedic care. Limited access in low-income nations slows wider adoption, but targeted investments improve availability in urban hospitals. Regional growth also benefits from rising awareness of long-term implant durability and the spread of modern surgical technologies.

Market Segmentations

By Fixation Method

- Primary fixation

- Hybrid fixation

By Component

- Tibial component

- Femoral component

By End Use

- Hospitals

- Orthopedic centers

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cementless Total Knee Arthroplasty Market features strong competition among major orthopedic implant manufacturers, including MicroPort Orthopedics, Enovis, Aesculap, Corin Group, Medacta International, Dentsply Sirona, Exactech, Episurf Medical, Conformis, and DePuy Synthes. Companies focus on advanced porous coatings, 3D-printed structures, and improved femoral and tibial designs to enhance bone ingrowth and long-term fixation. Many players invest in robotic and navigation-compatible systems that support precise bone preparation, which strengthens clinical outcomes for cementless procedures. Strategic moves include product launches, surgeon training programs, and expansion in high-volume orthopedic centers across North America, Europe, and Asia-Pacific. Manufacturers also compete through personalized implant designs, lightweight materials, and biologically active surfaces that reduce micromotion. Rising global demand for long-lasting implants drives continuous innovation, while partnerships with hospitals and digital surgery platforms help companies widen their market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MicroPort Orthopedics

- Enovis

- Aesculap

- Corin Group

- Medacta International

- Dentsply Sirona

- Exactech

- Episurf Medical

- Conformis

- DePuy Synthes

Recent Developments

- In November 2024, Corin Group Corin highlighted 2024 as a landmark year at the AAHKS Annual Meeting, announcing clinical use of its Apollo robotic platform and ApolloKnee application plus 510(k)-cleared Unity Knee line extensions. These updates expand Corin’s digitally enabled total knee ecosystem and support more precise, personalized implantation pathways relevant to cementless TKA adoption.

- In 2024, Enovis announced it would showcase its latest orthopedic technologies, including advanced hip and knee reconstruction systems and the EMPOWR Porous Knee System, at the 2024 AAOS meeting

Report Coverage

The research report offers an in-depth analysis based on Fixation Method, Component, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cementless knee systems will gain wider use as long-term durability improves.

- Younger and active patients will drive strong demand for biological fixation.

- Robotic and navigation-assisted surgery will boost accuracy and adoption rates.

- 3D-printed porous implants will become standard across major product lines.

- Hospitals will expand same-day knee replacement programs using cementless designs.

- Clinical evidence will strengthen confidence in cementless tibial and femoral components.

- Emerging markets will adopt advanced cementless systems as orthopedic capacity grows.

- Personalized implant sizing and patient-matched designs will see rapid scaling.

- Training programs will reduce technique barriers and support broader surgeon adoption.

- Competition will intensify as manufacturers launch new surface technologies and lighter implants.