Market Overview:

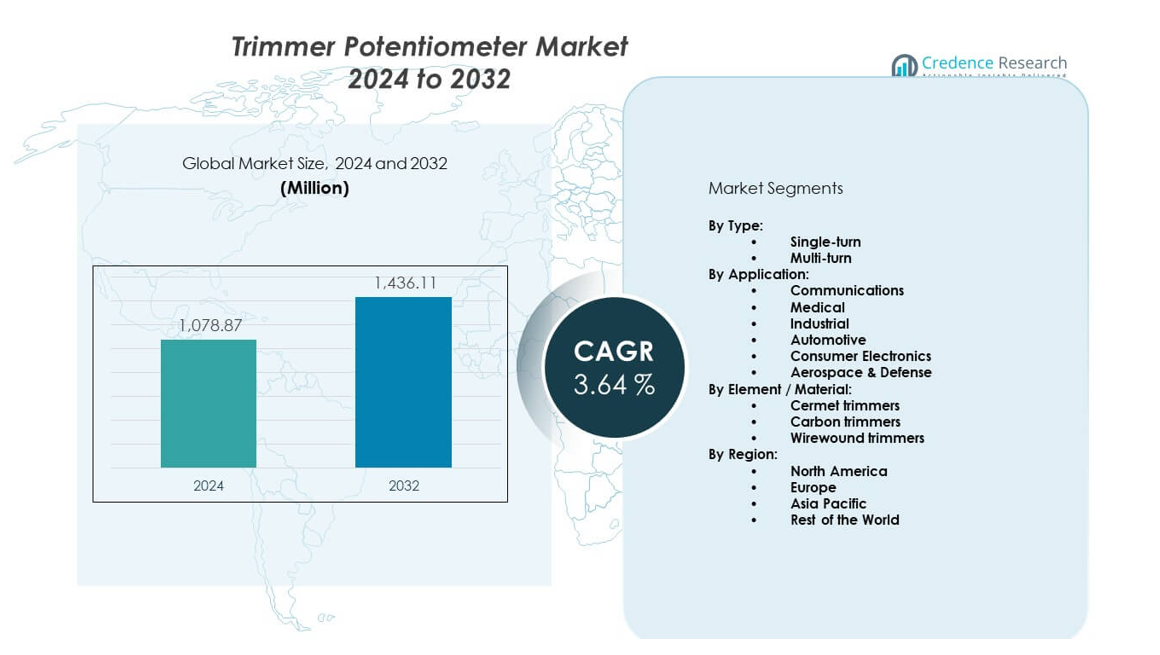

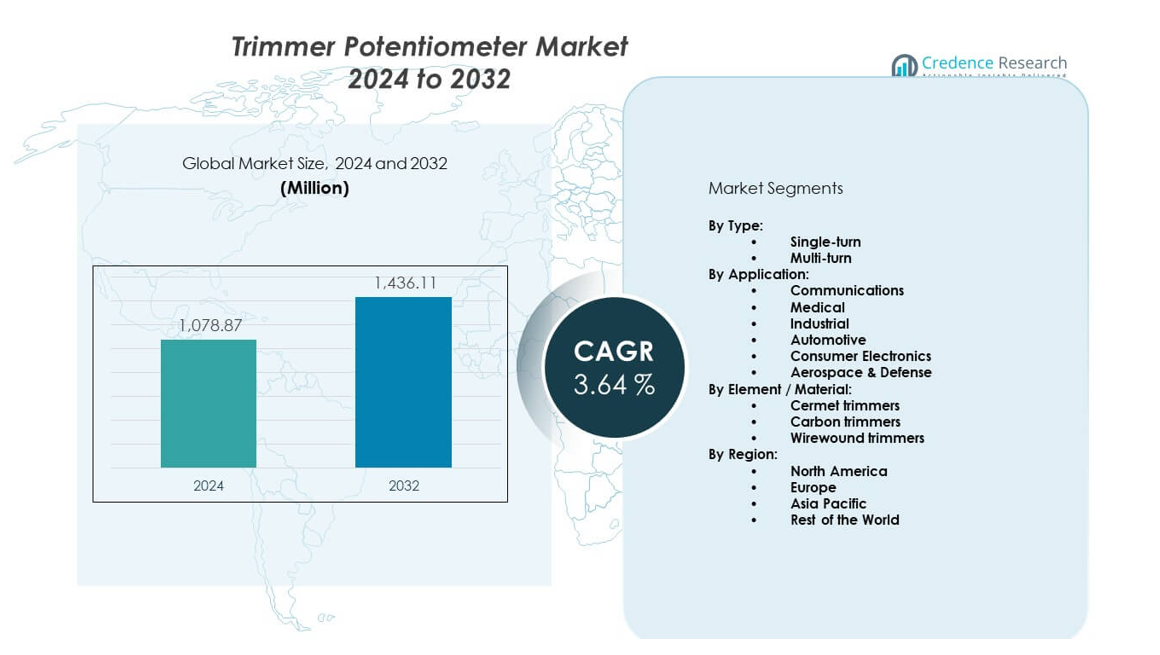

The Trimmer potentiometer market is projected to grow from USD 1,078.87 million in 2024 to USD 1,436.11 million by 2032, with a CAGR of 3.64% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trimmer Potentiometer Market Size 2024 |

USD 1,078.87 million |

| Trimmer Potentiometer Market, CAGR |

3.64% |

| Trimmer Potentiometer Market Size 2032 |

USD 1,436.11 million |

The market grows due to wider use of precision tuning components across consumer electronics, industrial equipment, and communication systems. Manufacturers integrate compact and stable trimmer designs to support tighter performance control in power supplies, sensors, and calibration modules. Rising demand for automation boosts adoption in control circuits and adjustment units. Device makers focus on improved reliability, long cycle life, and resistance against environmental stress. Miniaturization trends in wearables and IoT ecosystems further support steady uptake across new product platforms.

Asia Pacific leads due to strong electronics manufacturing bases and rapid component consumption across China, South Korea, and Japan. North America follows with high design activity in industrial automation and communication hardware. Europe remains important due to strong automotive electronics production. Emerging growth appears in Southeast Asian countries as new assembly facilities expand. Steady development in these regions supports broader adoption across consumer devices, industrial tools, and precision control systems.

Market Insights:

- The Trimmer potentiometer market is valued at USD 1,078.87 million in 2024 and is projected to reach USD 1,436.11 million by 2032, growing at a CAGR of 3.64% from 2024 to 2032.

- Asia Pacific leads with 45% share, North America follows with 25%, and Europe holds 20%, driven by strong electronics manufacturing, automation investment, and high adoption in industrial and automotive systems across these regions.

- Asia Pacific is also the fastest-growing region with 45% share, supported by large-scale component production, semiconductor expansion, and rising demand for compact consumer electronics.

- The industrial application segment holds the largest share at 30%, supported by calibration needs across control units, automation systems, and machinery.

- Cermet trimmers dominate the material segment with 40% share, due to better stability, longer life, and strong adoption across communication, industrial, and precision devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Precision Control in Electronic and Industrial Systems

The Trimmer potentiometer market grows due to strong interest in precise tuning across electronic modules. Industrial firms require stable adjusters to support calibration routines in sensors and control circuits. Manufacturers design compact formats that offer high reliability under shifting loads. Consumer device builders use trimmers to improve performance in audio, power, and display units. Engineers adopt these components to correct drift in sensitive circuits. It supports miniaturized platforms that need accurate alignment. Automation trends raise demand for stable trimming in industrial boards. Broader electronics growth strengthens long-term usage across key sectors.

- For instance, Bourns Inc. offers a 3362-series trimmer that achieves contact-resistance variation of just 1 % or 3 Ω max and handles a temperature coefficient of ±100 ppm/°C.

Expanding Integration in IoT, Wearables, and Compact Consumer Devices

The Trimmer potentiometer market gains support from rapid growth in IoT and portable electronics. Designers integrate small trimmers to stabilize outputs in micro-controllers and compact power systems. Wearable makers use these devices to refine signal accuracy in tight form factors. Telecom hardware benefits from stable calibration in RF circuits. It enables greater control in low-power communication devices. Smart home appliances adopt these components to enhance tuning precision. Product engineers switch to high-quality trimmers to maintain long device life. Miniaturization trends raise adoption across several emerging product categories.

- For instance, Vishay Intertechnology Inc. released its T63 series cermet trimmers with low contact-resistance variation of less than 2 % and seal rating of IP67, suited for tight IoT modules. Telecom hardware benefits from stable calibration in RF circuits.

Growing Need for Reliable Components in Automotive and EV Electronics

The Trimmer potentiometer market expands due to rising use in vehicle electronics. Automakers integrate trimmers into dashboard systems, lighting controls, and sensor modules. Advanced driver assistance systems require fine tuning to maintain steady performance. EV platforms use these devices in battery management and inverter units. It supports stable calibration under heat and vibration exposure. Tier-1 suppliers demand high-life cycle parts for safety-critical hardware. Engineers depend on accurate trimming to support dynamic driving conditions. Strong vehicle electrification pushes demand for robust tuning components.

High Adoption in Testing, Measurement, and Calibration Equipment

The Trimmer potentiometer market benefits from continual expansion in test and measurement systems. Laboratories rely on trimmers to maintain precise alignment in analyzers and diagnostic units. Calibration equipment needs stable adjusters to correct circuit deviations. Engineers use these devices to fine-tune prototypes during development cycles. It supports consistent accuracy in industrial quality checks. Research institutions prefer trimmers that hold values under temperature shifts. Instrument makers focus on designs that offer tight tolerance levels. The rise of advanced R&D tools increases adoption across several technical environments.

Market Trends:

Shift Toward SMD Trimmers for Higher Density and Automated Assembly

The Trimmer potentiometer market sees rising preference for SMD trimmers that support dense board layouts. Electronics manufacturers use these formats to reduce space in compact modules. Automated assembly plants adopt SMD versions to improve throughput. IoT devices depend on these components to achieve reliable tuning in small enclosures. It helps engineers enhance stability in low-profile designs. Telecom equipment integrates SMD trimmers to support lightweight circuit builds. Consumer gadgets benefit from improved precision in miniature power units. Demand rises across sectors focusing on compact electronics.

- For instance, Bourns’ 3224 SMD trimmers offer dimensions down to 4 mm, temperature range from –65 °C to +150 °C, and power rating of 0.25 W at 85 °C, enhancing placement flexibility in automated lines. IoT devices depend on these components to achieve reliable tuning in small enclosures.

Growing Interest in High-Reliability Sealed Trimmers for Harsh Environments

The Trimmer potentiometer market records higher adoption of sealed trimmers suited for dust, moisture, and vibration exposure. Industrial plants prefer sealed designs to protect calibration integrity. Automotive suppliers rely on these variants to ensure stable tuning in demanding zones. Medical equipment manufacturers adopt sealed trimmers to improve reliability in sensitive devices. It supports long-term endurance in rugged environments. Defense electronics integrate sealed versions for mission-critical operations. Engineers choose these components to avoid drift under harsh conditions. Rising need for durable electronics fuels ongoing demand.

- For instance, Bourns’ military-qualified Trimpot® models offer sealed formats with rated power up to 1 W through-hole and resistive stability of 1 % or 1 Ω in rugged conditions. Medical equipment manufacturers adopt sealed trimmers to improve reliability in sensitive devices.

Adoption of Multi-Turn Trimmers for Advanced Calibration Needs

The Trimmer potentiometer market sees strong interest in multi-turn variants that deliver higher precision. Engineers use these designs when fine adjustments are required in instrumentation circuits. Telecom units adopt multi-turn trimmers for accurate RF alignment. Power supply builders depend on these parts to control voltage with better accuracy. It helps product developers maintain stable tuning during long duty cycles. Automotive systems use multi-turn options to support tight calibration. Industrial equipment integrates these units for consistent performance. Growth in complex electronics drives their ongoing uptake.

Increased Use of Automated Optical Inspection (AOI) Compatible Trimmers

The Trimmer potentiometer market shifts toward AOI-friendly designs that streamline quality checks. Manufacturers adopt trimmers with clear markings to support faster inspection. PCB assemblers rely on AOI features to verify placement accuracy. Consumer electronics units use these components to enhance assembly efficiency. It helps reduce production errors across high-speed lines. Telecom firms benefit from reliable inspection outcomes. IoT builders adopt AOI-compatible trimmers to support mass manufacturing. Demand rises with growing focus on automated quality assurance systems.

Market Challenges Analysis:

Rising Pressure from Low-Cost Substitutes and Alternative Technologies

The Trimmer potentiometer market faces pressure from substitutes that offer tuning functions through digital circuits. Manufacturers adopt IC-based adjustment methods that reduce need for manual trimming. Consumer electronics brands shift to fixed calibration during production to cut labor steps. It raises barriers for traditional trimmers in high-volume applications. Low-cost imports create pricing pressure across several regions. Engineers choose alternate components when space shrinkage limits mechanical formats. Industrial buyers evaluate digital calibrators for advanced control. Growing innovation in solid-state electronics limits growth prospects in some sectors.

Quality Variability, Supply Chain Shifts, and Environmental Limitations

The Trimmer potentiometer market encounters challenges due to component variability across low-cost suppliers. Performance drift concerns reduce confidence in poorly tested products. It affects long-term stability in sensitive electronics. Supply chain disruptions influence manufacturing timelines in key regions. Harsh climate exposure impacts lifespan in outdoor or industrial zones. Engineers face constraints in meeting tight tolerances during mass assembly. Compliance norms demand high reliability across several sectors. Shifting environmental rules shape material choices for upcoming designs.

Market Opportunities:

Rising Adoption in Smart Devices, Miniaturized Platforms, and New Sensor Modules

The Trimmer potentiometer market gains opportunities through growth in smart devices and compact electronics. IoT builders adopt precision trimmers to maintain stable calibration in small modules. Wearables need fine tuning to support power and signal accuracy. It creates demand for compact high-reliability versions. Smart home appliances integrate trimmers to support performance alignment. Sensor developers rely on these parts to refine detection accuracy. Expanding applications across portable platforms open new revenue prospects.

Expanding Use Across Automotive, Industrial Automation, and Advanced Testing Systems

The Trimmer potentiometer market benefits from rising adoption in EV electronics, automated machinery, and calibration tools. Automotive engineers use these components to support stable tuning across dynamic systems. Industrial plants depend on trimmers to correct circuit drift under heavy workloads. It helps maintain reliability during long duty cycles. Test instrument makers integrate trimmers for precision adjustments. Growth in advanced R&D strengthens opportunities across technical environments.

Market Segmentation Analysis:

By Type

The Trimmer potentiometer market divides into single-turn and multi-turn variants, each serving different calibration needs. Single-turn trimmers support quick adjustments in compact devices that rely on simple tuning. Multi-turn trimmers offer finer precision that benefits instruments, power supplies, and communication hardware. It gains demand in environments that require stable and repeatable tuning. Single-turn formats remain common in consumer electronics and automotive modules. Multi-turn versions hold strong relevance in high-accuracy circuits. Both types maintain steady usage across legacy and advanced designs. Segment demand aligns with performance needs across several industries.

- For instance, Vishay’s T63 multi‐turn models enable up to 14 turns, with resistance range 10 Ω–2.2 MΩ and contact-resistance variation under 2 %. It gains demand in environments that require stable and repeatable tuning. Single-turn formats remain common in consumer electronics and automotive modules.

By Application

Communications, medical, industrial, automotive, consumer electronics, and aerospace and defense represent major application groups. Communications hardware uses trimmers for RF alignment and signal control. Medical devices rely on stable tuning to support sensitive diagnostic functions. Industrial systems need these components for calibration across control units. Automotive platforms integrate trimmers into dashboards, sensors, and EV modules. Consumer electronics use them for audio, display, and power adjustments. Aerospace and defense units depend on high-reliability formats for mission-critical circuits. Each segment drives steady demand within its performance boundaries.

- For instance, Bourns lists AEC-Q200 qualified sealed trimmers used in automotive applications with rotational life up to 200 cycles and insulating resistance of 10 MΩ min in humidity conditions. Consumer electronics use them for audio, display, and power adjustments.

By Element / Material

Cermet, carbon, and wirewound trimmers form the core material segments. Cermet trimmers offer strong stability and support industrial and communication equipment. Carbon trimmers provide cost-effective tuning for consumer devices and basic modules. Wirewound types deliver higher precision suited for power systems and laboratory instruments. It supports durable performance where accuracy remains essential. Material choice depends on tolerance, resistance stability, and environmental endurance. Each option serves distinct circuit conditions and design goals. Material-based differentiation strengthens product selection across global applications.

Segmentation:

By Type:

By Application:

- Communications

- Medical

- Industrial

- Automotive

- Consumer Electronics

- Aerospace & Defense

By Element / Material:

- Cermet trimmers

- Carbon trimmers

- Wirewound trimmers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Trimmer potentiometer market holds about 25% share in North America, driven by strong demand from industrial automation, medical equipment, and communication hardware manufacturers. The region benefits from high adoption of precision-grade components across advanced electronic systems. It gains support from strong R&D activity in the U.S. and Canada that promotes use of multi-turn and sealed trimmers. Automotive electronics integration strengthens demand in EV platforms and sensor modules. Consumer electronics brands adopt compact trimmers to improve power and audio tuning. Defense programs use high-reliability variants for secure communication and control systems. Steady modernization of electronic infrastructure sustains long-term growth.

Europe

Europe accounts for roughly 20% share, supported by strong automotive production, industrial equipment demand, and growing reliance on precision tuning components. The Trimmer potentiometer market gains traction across Germany, the U.K., and France due to high engineering standards and strict reliability requirements. It benefits from wide integration in EV power systems, factory automation platforms, and advanced instrumentation. Medical device manufacturers in the region rely on robust trimmers for stable calibration. Aerospace and defense applications strengthen uptake of sealed and high-tolerance versions. Rising miniaturization in consumer and industrial electronics supports consistent adoption across European facilities.

Asia Pacific and Rest of the World

Asia Pacific leads globally with an estimated 45% share, supported by large-scale electronics manufacturing in China, Japan, South Korea, and Taiwan. The Trimmer potentiometer market benefits from high-volume production of consumer devices, communication hardware, and industrial systems. It grows through rapid expansion of semiconductor and component assembly plants. Strong use in IoT devices, wearables, and compact modules supports sustained demand. Rest of the World holds close to 10% share, driven by emerging adoption in Latin America and the Middle East and Africa. Growth in these regions connects to industrial upgrades, rising automotive electronics needs, and broader access to affordable components.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bourns Inc.

- Vishay Intertechnology Inc.

- Nidec Copal Electronics

- TT Electronics plc

- TE Connectivity Ltd

- Honeywell International Inc.

- CTS Corporation

- Murata Manufacturing Co., Ltd.

- Piher Sensors & Controls

- Ohmite Manufacturing Co.

Competitive Analysis:

The Trimmer potentiometer market features strong competition among global component manufacturers that focus on precision, reliability, and miniaturized formats. Leading players strengthen portfolios with multi-turn, sealed, and SMD variants that support advanced electronics. It gains attention from firms that invest in durable materials and tighter tolerance control. Companies differentiate through improved lifecycle performance and stable resistance characteristics. Key brands target automotive, industrial, and communication applications to secure long-term contracts. Strategic expansion across Asia Pacific further boosts competitive positioning. Continuous product refinement shapes rivalry among established suppliers.

Recent Developments:

- In March 2025, Vishay Intertechnology Inc. showcased new power electronics solutions targeting high-reliability industrial applications, and highlighted its recent acquisition of Ametherm for current limiting solutions. The company also integrated SiC MOSFET technology from its earlier acquisition of MaxPower Semiconductor, targeting advanced battery and automotive applications.

- On March 31, 2023, Nidec Copal Electronics, a subsidiary of Nidec Corporation , completed the acquisition of all shares of Midori Precisions Co., Ltd., enhancing its position sensing (potentiometer and encoder) technology and expanding its global sales channels and product offerings for sensor applications.

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand grows due to expansion of industrial automation and high-accuracy control systems.

- Miniaturized formats gain adoption in IoT, wearables, and compact electronics.

- Automotive and EV electronics drive interest in durable, vibration-resistant trimmers.

- Growth in medical and diagnostic equipment increases use of precision tuning components.

- SMD trimmer designs strengthen adoption in automated assembly environments.

- Multi-turn variants gain preference for advanced calibration requirements.

- Asia Pacific remains the dominant manufacturing hub for high-volume production.

- Material advancements enhance stability and reduce drift across temperature ranges.

- Sealed trimmers gain demand in rugged and mission-critical applications.

- Long-term growth benefits from sustained expansion across communication hardware.