Market Overview

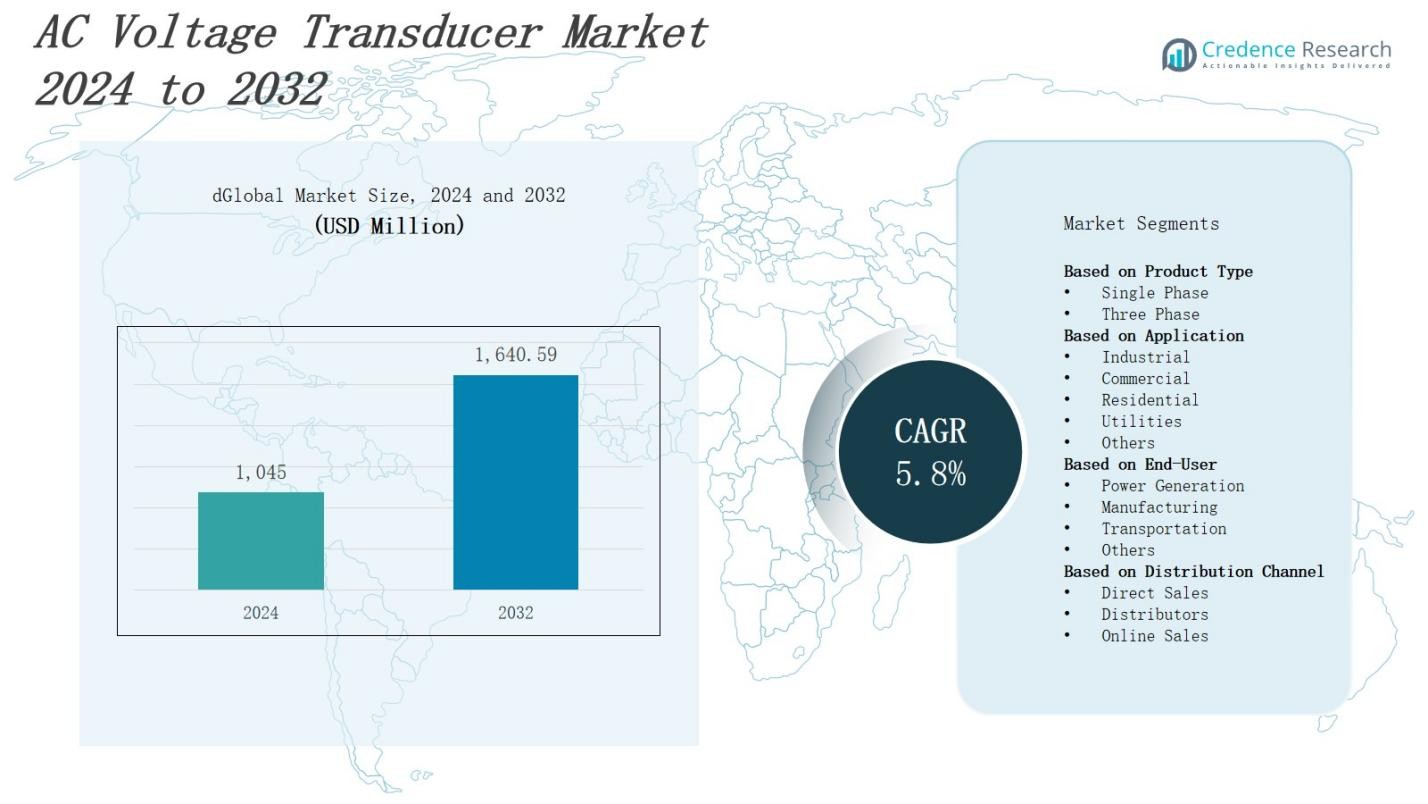

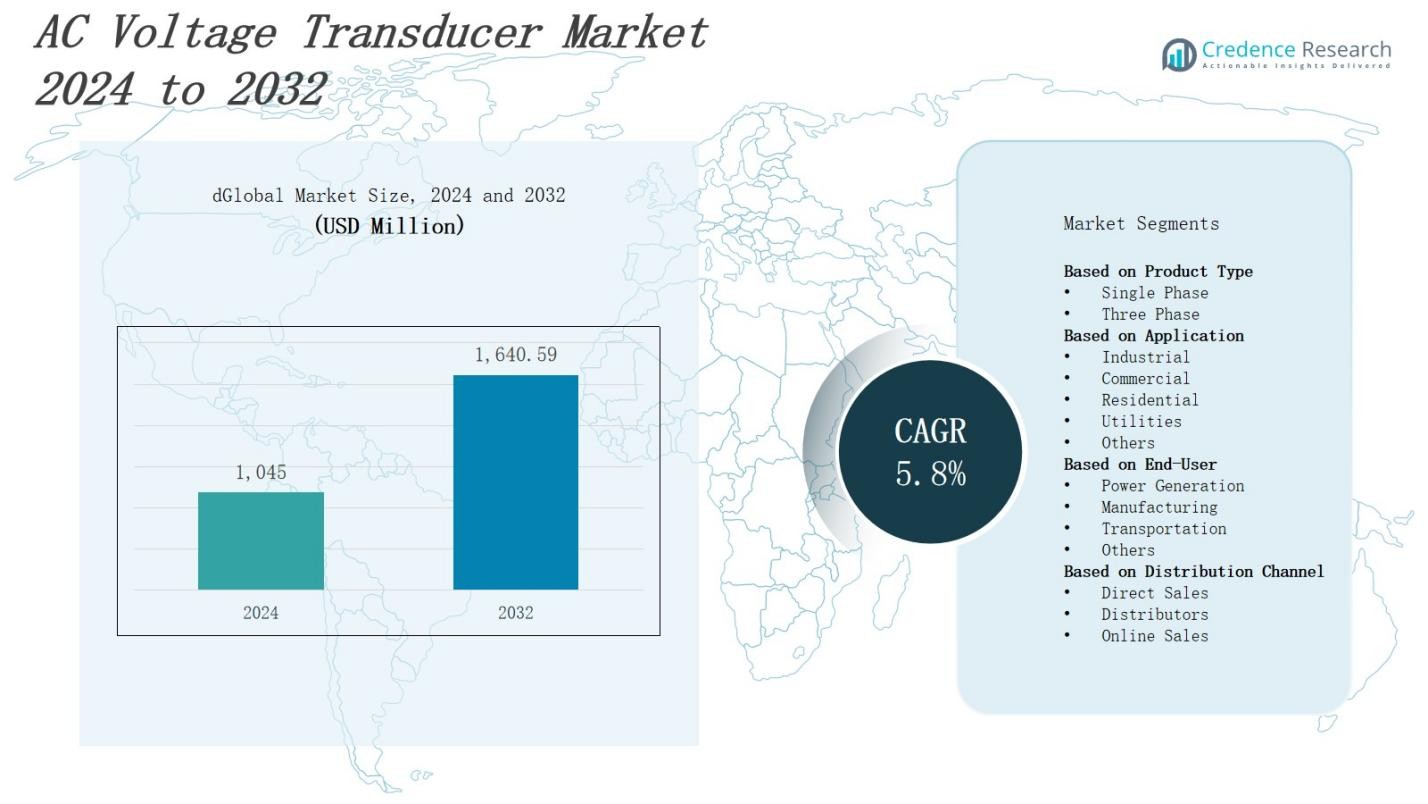

The AC voltage transducer market is projected to grow from USD 1,045 million in 2024 to USD 1,640.59 million by 2032, registering a compound annual growth rate (CAGR) of 5.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AC Voltage Transducer Market Size 2024 |

USD 1,045 Million |

| AC Voltage Transducer Market, CAGR |

5.8% |

| AC Voltage Transducer Market Size 2032 |

USD 1,640.59 Million |

The AC voltage transducer market grows driven by increasing demand for accurate voltage measurement and monitoring across industrial automation, power generation, and electrical distribution sectors. Rising adoption of smart grid technologies and the need for enhanced energy management boost market expansion. Advancements in sensor accuracy, miniaturization, and integration with IoT systems enhance functionality and appeal. Additionally, stringent regulatory standards for electrical safety and energy efficiency promote the use of reliable transducers. The trend toward digitalization and real-time data analytics further supports market growth, enabling predictive maintenance and improved operational efficiency in electrical systems globally.

The AC voltage transducer market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, with North America holding the largest share, followed by Europe and Asia-Pacific showing rapid growth. Emerging markets in Latin America, the Middle East, and Africa also contribute to expanding demand. Leading key players such as ABB Ltd., Siemens AG, Schneider Electric SE, Honeywell International Inc., and Eaton Corporation plc drive innovation and market expansion globally. Their strong presence across these regions supports widespread adoption of advanced voltage transducer technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The AC voltage transducer market is projected to grow from USD 1,045 million in 2024 to USD 1,640.59 million by 2032, registering a CAGR of 5.8%.

- Increasing demand for precise voltage measurement in industrial automation, power generation, and electrical distribution drives market growth.

- Rising adoption of smart grid technologies and enhanced energy management boosts market expansion.

- Advances in sensor accuracy, miniaturization, and IoT integration improve device functionality and market appeal.

- Stringent electrical safety and energy efficiency regulations promote the use of reliable voltage transducers.

- North America leads with 35% market share, followed by Europe at 28% and Asia-Pacific growing rapidly with 25%. The Rest of the World accounts for 12%.

- Leading players like ABB Ltd., Siemens AG, Schneider Electric SE, Honeywell International Inc., and Eaton Corporation plc drive innovation and global market expansion.

Market Drivers

Rising Demand for Accurate Voltage Measurement in Industrial Applications

The growing complexity of industrial processes requires precise voltage measurement to ensure system reliability and safety. Industries such as manufacturing, oil and gas, and utilities increasingly depend on accurate monitoring to prevent equipment failure and downtime. The AC voltage transducer market benefits from this demand, as these devices offer reliable voltage conversion and isolation. Companies invest in advanced transducers to comply with stringent operational standards and enhance automation efficiency. Continuous improvements in measurement accuracy boost confidence among end users. Industrial growth and modernization further drive the uptake of these critical components.

- For instance, ABB developed high-precision voltage sensors for manufacturing automation that comply with rigorous international safety standards, resulting in increased operational uptime.

Expansion of Smart Grid and Energy Management Systems

Smart grid initiatives worldwide drive significant demand for advanced voltage sensing solutions. Utilities require real-time voltage monitoring to manage energy flow efficiently and reduce losses. It enables better load balancing, fault detection, and integration of renewable energy sources. The AC voltage transducer market gains momentum through these technological advancements. Increasing government support and regulatory mandates for energy-efficient infrastructure further stimulate adoption. The ability to interface with IoT platforms and remote monitoring systems strengthens market potential. Utilities prioritize transducers that facilitate smart grid deployment and improved energy management.

- For instance, smart sensors like Phasor Measurement Units (PMUs) provide synchronized voltage and current data at high speed, helping grid operators prevent outages by detecting faults and enabling advanced control of the grid dynamics.

Technological Advancements in Sensor Design and Integration

Innovations in sensor technology enhance the performance and functionality of voltage transducers. Miniaturization and improved materials reduce size and power consumption while increasing durability. The market benefits from products with digital output and compatibility with wireless communication protocols. It supports seamless integration into automated control systems and industrial networks. Enhanced precision and faster response times allow better process control and safety monitoring. Manufacturers focus on developing cost-effective solutions that meet evolving industry requirements. These technological improvements expand the range of applications and customer base.

Stringent Regulatory Standards and Safety Requirements

Electrical safety and energy efficiency regulations compel industries to adopt reliable voltage measurement devices. Compliance with international standards such as IEC and ANSI ensures safe operation and reduces risks of electrical hazards. The AC voltage transducer market grows as companies replace outdated equipment with compliant products. It also supports efforts to minimize energy waste through accurate monitoring and control. Regulatory pressures increase demand in sectors including power generation, transmission, and manufacturing. This drives continuous innovation to meet evolving safety protocols. The focus on regulatory adherence strengthens market growth prospects.

Market Trends

Integration of Digital and Smart Technologies in Voltage Transducers

The AC voltage transducer market increasingly incorporates digital technologies to enhance device functionality and connectivity. Manufacturers develop transducers with digital outputs that allow seamless integration into industrial automation and smart grid systems. It enables real-time voltage monitoring and data analytics, improving operational efficiency. Compatibility with IoT platforms and wireless communication protocols gains traction, facilitating remote diagnostics and predictive maintenance. These smart features respond to the growing demand for intelligent electrical infrastructure. The trend toward digitalization drives innovation and expands market applications.

- For instance, LEM, a key player in voltage measurement, offers digital voltage transducers with Hall Effect and Fluxgate sensor technologies that deliver precise real-time monitoring and compatibility with industrial IoT systems.

Miniaturization and Enhanced Durability of Transducer Designs

Compact and robust design emerges as a key trend in the AC voltage transducer market. Developers focus on reducing device size while maintaining high accuracy and reliability. It allows easier installation in space-constrained environments and supports portable equipment. Advanced materials improve resistance to temperature fluctuations, vibrations, and electrical noise. This durability ensures consistent performance in harsh industrial conditions. Market players invest in research to balance miniaturization with long-term stability. Smaller, rugged transducers meet evolving customer requirements across diverse sectors.

Growing Adoption in Renewable Energy and Electric Vehicles

The transition toward renewable energy and electric mobility creates new demand for voltage transducers. Solar, wind, and energy storage systems require precise voltage measurement for efficient power conversion and grid integration. The AC voltage transducer market benefits from the increasing deployment of these clean energy technologies. It supports electric vehicle charging infrastructure and battery management systems. Rising investments in sustainable energy solutions stimulate innovation in transducer performance and reliability. This trend expands the market’s scope beyond traditional power and industrial applications.

- For instance, wind farms co-locating distributed storage systems utilize voltage transducers for reactive power control to manage voltage levels effectively during fluctuating wind conditions.

Focus on Compliance with Evolving Regulatory Standards

Meeting updated electrical safety and energy efficiency regulations drives product development in the AC voltage transducer market. Manufacturers design transducers that comply with stricter international standards, including IEC 61869 and UL certifications. It ensures safe operation and reduces electrical risks in various industries. Compliance demands also encourage features like enhanced insulation and fault detection capabilities. Market growth aligns with regulatory enforcement in power generation, transmission, and industrial automation. Companies continuously improve products to address changing legal and safety requirements.

Market Challenges Analysis

High Initial Costs and Complex Integration in Industrial Systems

The AC voltage transducer market faces challenges due to the relatively high initial costs of advanced transducers. Industries often hesitate to replace existing equipment with newer technology because of budget constraints. It requires substantial investment in both hardware and system integration. Complex compatibility issues with legacy systems increase installation time and costs. Technical expertise is necessary to ensure proper calibration and configuration, which may limit adoption in smaller enterprises. These factors slow market penetration despite the clear benefits of modern transducers. Companies must balance cost with long-term operational efficiency to encourage broader acceptance.

Sensitivity to Environmental Factors and Reliability Concerns

Environmental conditions pose a significant challenge for the AC voltage transducer market. Devices exposed to temperature extremes, moisture, electromagnetic interference, or mechanical vibrations may experience degraded accuracy and lifespan. It demands robust design and high-quality materials, which can raise production costs. Variability in electrical grid conditions, including voltage fluctuations and harmonics, also affects performance reliability. Customers require consistent, fault-tolerant devices for critical applications, increasing pressure on manufacturers to deliver durable products. Meeting these reliability expectations while controlling costs remains a critical market hurdle.

Market Opportunities

Expansion in Emerging Economies and Industrial Modernization

Emerging economies present significant growth opportunities for the AC voltage transducer market due to rapid industrialization and infrastructure development. Increasing investments in power generation, distribution, and automation systems drive demand for reliable voltage measurement solutions. It enables industries to enhance operational efficiency and meet growing energy needs. Governments in these regions prioritize electrification projects and smart grid implementation, further stimulating market growth. The rising focus on upgrading aging electrical infrastructure offers a large addressable market for advanced transducers. Companies can capitalize on this trend by tailoring products to meet regional requirements and affordability.

Advancements in Renewable Energy and Smart Grid Integration

The global shift toward renewable energy sources and smart grid technologies creates new opportunities for the AC voltage transducer market. Accurate voltage monitoring remains critical in integrating solar, wind, and energy storage systems into existing grids. It supports grid stability, fault detection, and energy management in increasingly complex power networks. The growing adoption of electric vehicles and distributed generation further expands transducer applications. Market players can leverage innovations in digital interfaces and IoT connectivity to deliver value-added solutions. This evolving landscape encourages continuous product development and diversification, opening avenues for sustained market expansion.

Market Segmentation Analysis:

By Product Type

The AC voltage transducer market segments into single-phase and three-phase products based on voltage measurement requirements. Single-phase transducers cater to low-power applications, including residential and light commercial setups. They offer cost-effective solutions with simpler installation processes. Three-phase transducers serve industrial and utility sectors demanding higher accuracy and reliability for complex electrical systems. It supports monitoring of balanced and unbalanced loads, essential for efficient energy management. Market growth favors three-phase devices due to expanding industrial automation and smart grid projects.

- For instance, ABB’s Power Transducer Series 50 offers configurable models that measure current and voltage in both single-phase and three-phase systems, delivering accuracy class 0.3 with advanced features for industrial applications.

By Application

Industrial applications dominate the AC voltage transducer market due to extensive use in manufacturing plants, automation systems, and process control. Commercial sectors require these transducers for building management and energy monitoring, driving moderate demand. Utilities rely on accurate voltage measurement for power distribution, grid stability, and fault detection, making them a key application segment. Residential use remains limited but grows with smart home and energy management trends. It also finds niche applications in transportation and other specialized fields.

- For example, Schneider Electric’s SmartStruxure platform uses voltage transducers to optimize energy consumption in commercial buildings.

By End-User

Power generation leads the AC voltage transducer market by demanding precise voltage monitoring for turbine control, grid synchronization, and safety. Manufacturing industries require it for process automation, equipment protection, and energy optimization. Transportation sectors, including railways and electric vehicles, increasingly adopt voltage transducers for system monitoring and safety assurance. Other end-users comprise commercial buildings, data centers, and infrastructure projects. Market expansion depends on meeting diverse end-user requirements through customized solutions.

Segments:

Based on Product Type

Based on Application

- Industrial

- Commercial

- Residential

- Utilities

- Others

Based on End-User

- Power Generation

- Manufacturing

- Transportation

- Others

Based on Distribution Channel

- Direct Sales

- Distributors

- Online Sales

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the AC voltage transducer market, accounting for 35% of the global revenue. The region benefits from well-established industrial and power sectors, which demand high-precision voltage measurement solutions. It leads in the adoption of advanced technologies, including smart grid systems and industrial automation. Strong regulatory frameworks for electrical safety and energy efficiency drive the replacement of outdated equipment with modern transducers. The presence of key market players and robust R&D infrastructure further bolster growth. It also supports expanding applications in renewable energy and electric vehicle infrastructure, strengthening market demand.

Europe

Europe captures 28% of the AC voltage transducer market, driven by extensive industrialization and investments in power infrastructure modernization. Countries in Western Europe emphasize compliance with stringent regulatory standards, which increase demand for reliable and accurate voltage transducers. It supports smart grid projects and energy management initiatives across the region. Growing focus on sustainability and renewable energy integration contributes to market expansion. Europe’s mature manufacturing sector requires sophisticated voltage monitoring to optimize operations. Market players invest in product innovation to meet diverse industry needs and maintain competitive advantage.

Asia-Pacific

Asia-Pacific accounts for 25% of the AC voltage transducer market share and exhibits the fastest growth rate. Rapid industrialization, urbanization, and expanding power infrastructure in countries like China, India, and Japan fuel demand. It addresses needs in manufacturing, utilities, and commercial sectors for efficient voltage measurement solutions. Governments invest heavily in smart grid deployments and renewable energy projects, supporting market penetration. Cost-sensitive buyers in the region encourage manufacturers to develop affordable yet reliable transducers. The growing electrical vehicle market also presents new opportunities for voltage transducer applications.

Rest of the World

The Rest of the World region holds a 12% share in the AC voltage transducer market, comprising Latin America, Middle East, and Africa. Increasing electrification and infrastructure development in these areas stimulate demand for voltage monitoring devices. It supports power generation and distribution projects aimed at improving grid reliability and energy access. Emerging industries and expanding commercial establishments also contribute to market growth. However, slower adoption rates and budget constraints limit market penetration compared to more developed regions. Focused efforts on regulatory compliance and technology adoption could enhance future growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- CR Magnetics Inc.

- Eaton Corporation plc

- Carlo Gavazzi Holding AG

- ABB Ltd.

- Honeywell International Inc.

- Phoenix Contact GmbH & Co. KG

- General Electric Company

- NK Technologies

- Schneider Electric SE

- LEM International SA

- Veris Industries

- Yokogawa Electric Corporation

Competitive Analysis

The AC voltage transducer market features strong competition among leading multinational corporations and specialized manufacturers. Key players such as ABB Ltd., Siemens AG, Schneider Electric SE, and Honeywell International Inc. focus on innovation, product quality, and global distribution networks to maintain market leadership. It emphasizes continuous research and development to enhance accuracy, durability, and integration capabilities of voltage transducers. Companies invest in strategic partnerships and acquisitions to expand their product portfolios and geographic presence. The market also witnesses rising competition from emerging players offering cost-effective solutions targeting regional markets. It compels established firms to optimize manufacturing processes and improve customer support services. Technological differentiation through digital interfaces, wireless communication, and IoT compatibility remains a critical factor driving competitive advantage. The AC voltage transducer market’s growth depends on how effectively companies adapt to evolving regulatory standards and customer demands for smart, reliable, and energy-efficient solutions. Firms focusing on customization and after-sales service strengthen their market position.

Recent Developments

- In February 2025, TE Connectivity acquired Richards Manufacturing Co. from funds managed by Oaktree Capital Management, strengthening its position in the industrial voltage transducer market.

- In August 2025, Bosch acquired a majority stake in Johnson Controls-Hitachi Air Conditioning India (JCHAI), expanding its presence in India’s home appliances sector amid rising demand for cooling solutions.

- Honeywell – In March 2025, announced the acquisition of Sundyne from Warburg Pincus for $2.16 billion.

- In March 2025, onsemi proposed an all-cash acquisition of Allegro MicroSystems for $35.10 per share, aiming to strengthen their combined presence in automotive and industrial markets affecting power sensing and transducer technologies.

Market Concentration & Characteristics

The AC voltage transducer market demonstrates a moderately concentrated competitive landscape dominated by a few global players such as ABB Ltd., Siemens AG, Schneider Electric SE, and Honeywell International Inc. These companies leverage strong brand recognition, extensive R&D capabilities, and broad distribution networks to maintain market leadership. It benefits from continuous innovation in sensor technology, digital integration, and enhanced accuracy, which raises barriers for new entrants. The market also experiences competition from regional manufacturers offering cost-effective solutions tailored to local requirements. It requires companies to balance product quality, customization, and pricing to capture diverse end-user segments. The market’s characteristic blend of high technical standards and evolving regulatory demands drives steady investments in product development. This environment fosters collaboration through partnerships and acquisitions, accelerating technological advancements and geographic expansion. Overall, the AC voltage transducer market combines innovation-driven growth with strategic competition among established industry leaders.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of smart grid technologies will drive demand for advanced voltage transducers.

- Integration with IoT platforms will enhance real-time monitoring and predictive maintenance capabilities.

- Growth in renewable energy installations will expand the use of voltage transducers in power management.

- Miniaturization and improved durability will enable wider application in space-constrained and harsh environments.

- Rising industrial automation will increase the need for precise voltage measurement and control.

- Expansion in emerging markets will create new opportunities for affordable and reliable transducer solutions.

- Regulatory emphasis on electrical safety and energy efficiency will encourage replacement of legacy systems.

- Development of digital output and wireless communication features will boost product functionality.

- Increased focus on customization will help manufacturers address diverse industry requirements.

- Collaboration between key players will accelerate innovation and geographic market penetration.