| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Block Pallets Market Size 2024 |

USD 35,238.56 million |

| Block Pallets Market, CAGR |

6.15% |

| Block Pallets Market Size 2032 |

USD 58,792.38 million |

Market Overview:

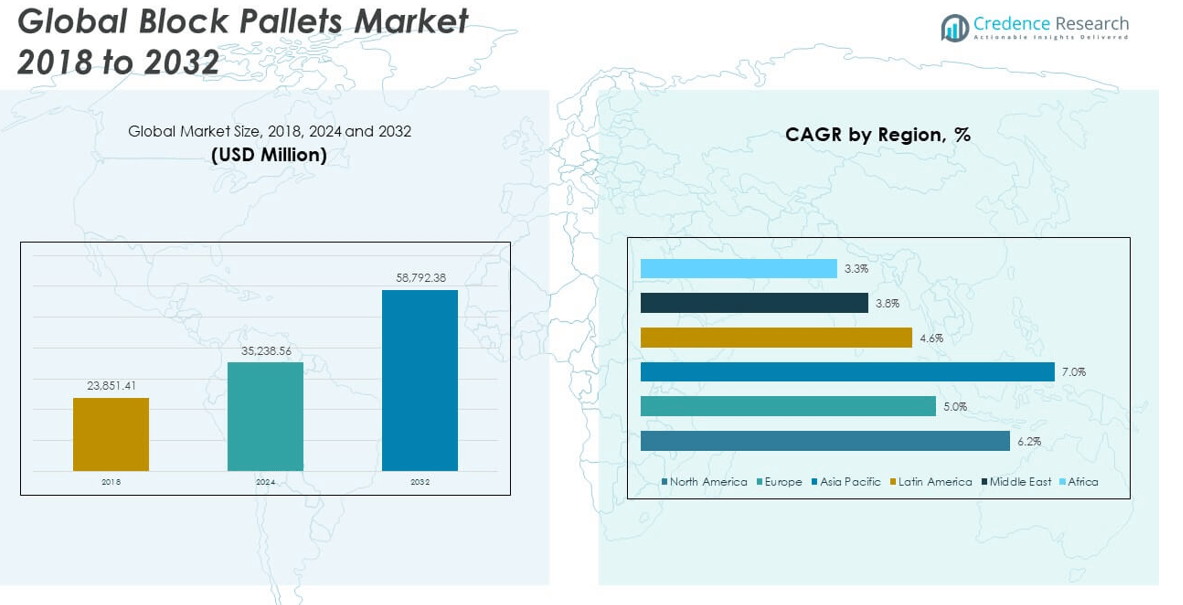

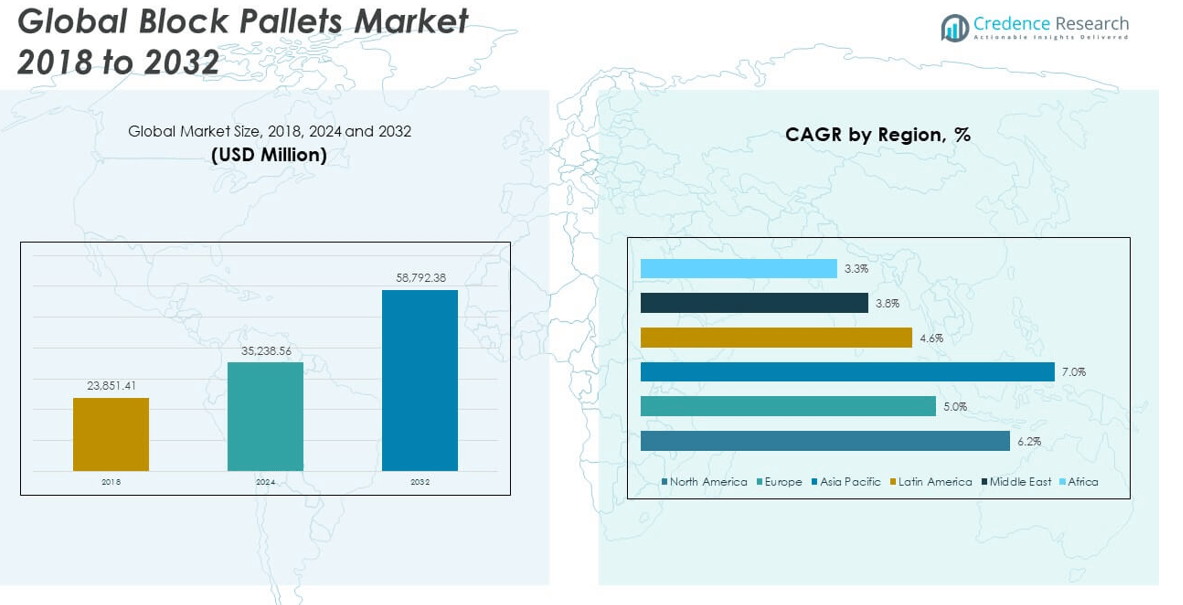

The Global Block Pallets Market size was valued at USD 23,851.41 million in 2018 to USD 35,238.56 million in 2024 and is anticipated to reach USD 58,792.38 million by 2032, at a CAGR of 6.15% during the forecast period.

The growth of the global block pallets market is primarily driven by the rising demand for robust, reusable, and high-load-bearing pallet solutions across logistics, manufacturing, and retail sectors. With the continuous expansion of e-commerce and international trade, industries are increasingly adopting block pallets due to their superior four-way entry design, which enables easy forklift access and efficient material handling. In addition, growing environmental concerns and regulatory emphasis on sustainable packaging are fueling the adoption of eco-friendly pallet materials such as recycled plastics, composite blocks, and certified timber. Companies are also seeking long-term cost efficiency through durable pallet solutions that offer extended service life and reduced replacement costs. Moreover, technological advancements in pallet production, including automation, RFID integration, and modular design, are encouraging manufacturers to offer value-added solutions that cater to diverse industrial applications. These factors, combined with the rising trend of pallet pooling and supply chain optimization, are creating a favorable environment for block pallet market expansion globally.

Regionally, Asia-Pacific dominates the global block pallets market, accounting for the largest market share due to its booming industrial and manufacturing base, rapid urbanization, and growing e-commerce sector. Countries such as China, India, and Japan are leading demand with large-scale investments in warehousing, logistics, and export-driven production. North America follows as a key revenue contributor, supported by advanced logistics infrastructure, widespread adoption of pallet pooling systems, and strong sustainability mandates among enterprises. The region also benefits from high consumer product movement and technological integration in material handling systems. Europe holds a significant share of the market as well, with increased emphasis on circular economy practices and the use of recyclable pallet materials in countries like Germany, the UK, and France. Meanwhile, Latin America and the Middle East & Africa are emerging as growth regions, propelled by rising industrial activities, infrastructure development, and increasing awareness of supply chain efficiency.

Market Insights:

- The Global Block Pallets Market was valued at USD 35,238.56 million in 2024 and is expected to reach USD 58,792.38 million by 2032, expanding at a CAGR of 6.15% during the forecast period.

- Rising demand for high-strength, reusable pallets across logistics, retail, and manufacturing sectors is driving market growth, supported by expanding e-commerce and international trade.

- The adoption of eco-friendly materials like recycled plastics and composite blocks is increasing due to regulatory pressure and corporate sustainability goals.

- Technological advancements such as RFID integration and IoT-enabled tracking are transforming block pallets into smart logistics assets.

- Companies are leveraging pallet pooling and returnable systems to reduce operational costs and improve supply chain efficiency.

- Supply chain disruptions and raw material price volatility pose challenges to consistent production and profitability, especially for smaller players.

- Asia-Pacific leads the market with the highest share, driven by strong manufacturing activity, while North America and Europe follow with mature logistics infrastructure and sustainability-driven adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Demand for Durable and Efficient Logistics Solutions

The Global Block Pallets Market is gaining traction due to the growing need for high-performance pallets that support safe, efficient, and standardized load transportation. Industries such as food and beverage, pharmaceuticals, retail, and manufacturing require pallets that can withstand frequent handling, heavy loads, and varied environmental conditions. Block pallets offer better strength, multi-directional forklift entry, and higher stackability compared to stringer pallets, making them a preferred choice for modern logistics operations. The demand is further accelerated by the shift toward globalized supply chains, where manufacturers and retailers are optimizing packaging and transportation systems. It supports rapid material movement across warehousing, distribution, and shipping networks. These structural advantages have made block pallets essential for businesses aiming to enhance operational productivity.

- For example, RM2’s BLOCKPal pallet, constructed from advanced composite materials, has been independently tested by Virginia Tech’s Center for Packaging and Unit Load Design. The results show that BLOCKPal pallets can withstand over 150 rugged trips before requiring maintenance, compared to just 3–5 trips for standard wooden pallets.

Sustainability and Regulatory Push Toward Eco-Friendly Packaging Materials

Environmental regulations and rising corporate responsibility initiatives are encouraging the use of recyclable and long-life pallet materials, significantly impacting the Global Block Pallets Market. Wood alternatives such as composite materials, recycled plastics, and engineered fiberboard blocks are receiving attention for their durability and lower environmental footprint. Governments across North America and Europe are enforcing stricter packaging standards to reduce landfill waste and promote circular economy practices. The market responds with innovations in reusable and low-emission pallet designs that align with these policies. It opens up new opportunities for companies offering sustainable pallet systems to large-scale logistics providers and retailers. Adoption is especially strong among companies with aggressive environmental, social, and governance (ESG) goals.

- For example, CHEP’s blue wood-block pallets are manufactured exclusively from 100% sustainably sourced timber, supporting compliance with stringent packaging standards in North America and Europe.

Technological Integration Enhancing Operational Efficiency and Tracking

Technology plays a transformative role in shaping the Global Block Pallets Market, particularly through the integration of digital solutions that enhance traceability and asset management. Smart pallets embedded with RFID tags or IoT sensors enable real-time monitoring of goods in transit, helping companies reduce loss, improve inventory control, and comply with regulatory traceability requirements. Automation in pallet manufacturing and repair processes also contributes to consistent quality, lower production costs, and reduced downtime in warehouse environments. It strengthens the reliability and usability of block pallets in high-throughput settings. Businesses leveraging smart logistics tools are more likely to invest in technologically advanced pallet systems. These digital enhancements elevate the role of block pallets beyond load-bearing to data-enabled logistics assets.

Cost-Effective Supply Chain Optimization and Pooling Services

Cost control remains a key factor driving the Global Block Pallets Market, especially among businesses seeking to reduce transportation and warehousing expenses. Block pallets support high-load capacities and long reuse cycles, which lowers the total cost of ownership over time. Their compatibility with pooling systems allows companies to share and reuse pallets across multiple locations, minimizing capital expenditure and pallet loss. Pallet pooling providers increasingly favor block pallets for their standardized design and durability. It creates a scalable, cost-efficient solution for industries managing large product volumes. The growing preference for outsourced logistics and returnable packaging systems continues to strengthen the demand for high-quality block pallets in both developed and emerging markets.

Market Trends:

Growing Shift Toward Customized and Industry-Specific Pallet Designs

Manufacturers and logistics providers are increasingly demanding pallet solutions tailored to their operational needs, leading to a significant trend toward customized designs in the Global Block Pallets Market. These requirements vary by industry, with sectors such as pharmaceuticals, fresh produce, and chemicals requiring specialized features like enhanced ventilation, anti-slip surfaces, or chemical resistance. It has prompted pallet manufacturers to develop variations in block dimensions, deck configurations, and structural reinforcements. Customization helps improve load safety, handling efficiency, and storage compatibility within industry-specific supply chains. The trend also reflects a growing focus on ergonomics and safety standards in material handling practices. Companies view bespoke block pallets as tools for improving workflow and reducing damage risks.

Emergence of Lightweight Composite Alternatives to Traditional Wood

The demand for lightweight and high-strength materials is influencing material innovation within the Global Block Pallets Market. Composite pallets made from recycled plastics, fiberglass, or polymer blends are gaining popularity for their reduced weight and enhanced durability. These alternatives reduce shipping costs and are resistant to moisture, pests, and chemicals, making them suitable for international trade and high-humidity environments. It allows exporters and high-turnover industries to minimize replacement frequency and meet international phytosanitary regulations. Unlike traditional wood pallets, composite block pallets require less maintenance and offer longer life cycles. Manufacturers are expanding their composite product lines to cater to industries seeking both performance and sustainability benefits.

- For example, Plastic Pallet Pros and ProStack, high-density polyethylene (HDPE) and polypropylene (PP) pallets now routinely achieve operational lifespans of 7–10 years for standard models and over 10 years for heavy-duty variants—more than double the average 3–5 year lifespan of traditional wood pallet.

Increasing Use of Digital Twins and Predictive Analytics in Pallet Lifecycle Management

Advancements in digital modeling and analytics are influencing how companies manage their pallet inventories and performance in the Global Block Pallets Market. Digital twin technology enables businesses to simulate and monitor pallet behavior under various loading, environmental, and handling conditions. It allows better forecasting of wear-and-tear, optimizing maintenance schedules and replacement planning. The integration of predictive analytics supports data-driven decisions on asset utilization and warehouse layout. These digital capabilities enhance supply chain resilience by minimizing unexpected pallet failures and improving turnaround times. It signifies a growing emphasis on precision and intelligence in logistics infrastructure planning. Companies adopting these tools gain operational visibility and cost savings.

- The Aras Innovator platform, for instance, integrates digital twin and digital thread data, allowing users to track operational life and maintenance schedules with precision. This system supports the definition and collection of critical metrics, such as expected performance and maintenance intervals, which are then compared to actual field data to optimize replacement and maintenance planning.

Rise of Circular Economy Business Models and Pallet Buyback Programs

Circular business models are gaining traction in the Global Block Pallets Market, driven by increased interest in waste reduction and material recovery. Leading pallet suppliers are offering buyback or take-back programs that encourage customers to return used pallets for refurbishment or recycling. It supports material reuse, reduces landfill contributions, and aligns with corporate sustainability goals. Companies view this closed-loop model as a way to reduce environmental impact while benefiting from cost savings and brand value. Pallet leasing models integrated with reverse logistics networks are becoming more common among large distributors and manufacturers. The market is shifting toward service-based models that prioritize longevity, reuse, and responsible disposal.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Supply Chain Disruptions

The Global Block Pallets Market faces persistent challenges due to the volatility in raw material prices, particularly timber, plastic polymers, and composite resins. Price fluctuations driven by geopolitical instability, trade restrictions, and climate-related disruptions in forestry operations directly impact production costs. It creates uncertainty for pallet manufacturers and affects profit margins, especially for small and medium-sized enterprises. Sudden increases in material costs may lead to delays in procurement, inconsistent supply volumes, and the need to renegotiate contracts with clients. The industry also grapples with shipping delays and container shortages, which disrupt the timely delivery of pallets to end-users. Manufacturers must develop resilient sourcing strategies to maintain product availability and cost competitiveness in the face of global supply chain volatility.

Lack of Standardization Across Regions and Industries

Varying pallet standards across regions and industries hinder operational efficiency and scalability in the Global Block Pallets Market. While some regions follow ISO guidelines, others rely on proprietary or national specifications that complicate cross-border pallet pooling, exchange, and reuse. It results in inefficiencies in storage, transport compatibility, and automated handling systems. Manufacturers are often forced to maintain diverse production lines to meet these fragmented requirements, increasing operational complexity and costs. Inconsistent regulatory frameworks around pallet treatment, labeling, and recyclability further limit the seamless movement of pallets across global supply chains. This lack of harmonization presents a barrier to large-scale adoption and restricts efforts to create a unified circular economy in pallet logistics.

Market Opportunities:

Expansion of Automated Warehousing and Cold Chain Infrastructure

The rise of automated warehousing and temperature-controlled logistics presents a strong growth opportunity for the Global Block Pallets Market. Advanced storage systems require pallets that can withstand frequent mechanical handling without deformation or failure. Block pallets offer the durability and uniformity necessary for seamless integration with robotic forklifts, conveyors, and vertical storage units. Cold chain networks also benefit from block pallets made from moisture-resistant and hygienic materials such as plastic or composite. It aligns with the growing demand from pharmaceutical, food, and perishable goods industries for reliable pallet solutions. As investment in smart warehouses and cold chain capacity increases worldwide, demand for compatible pallet designs is expected to grow significantly.

Growing Demand for Eco-Certified and Circular Economy-Compliant Products

Rising awareness of environmental impact and global policy support for sustainable practices are creating new opportunities in the Global Block Pallets Market. Companies are seeking pallet solutions that comply with green building standards, carbon reduction targets, and extended producer responsibility frameworks. It encourages manufacturers to innovate with recyclable materials, biodegradable coatings, and low-emission production processes. Eco-certified pallets can command premium pricing and attract procurement from ESG-driven enterprises and government buyers. The market is also poised to benefit from circular models such as pallet recovery, refurbishment, and leasing networks. These value-added services can generate long-term revenue streams while promoting sustainability leadership.

Market Segmentation Analysis:

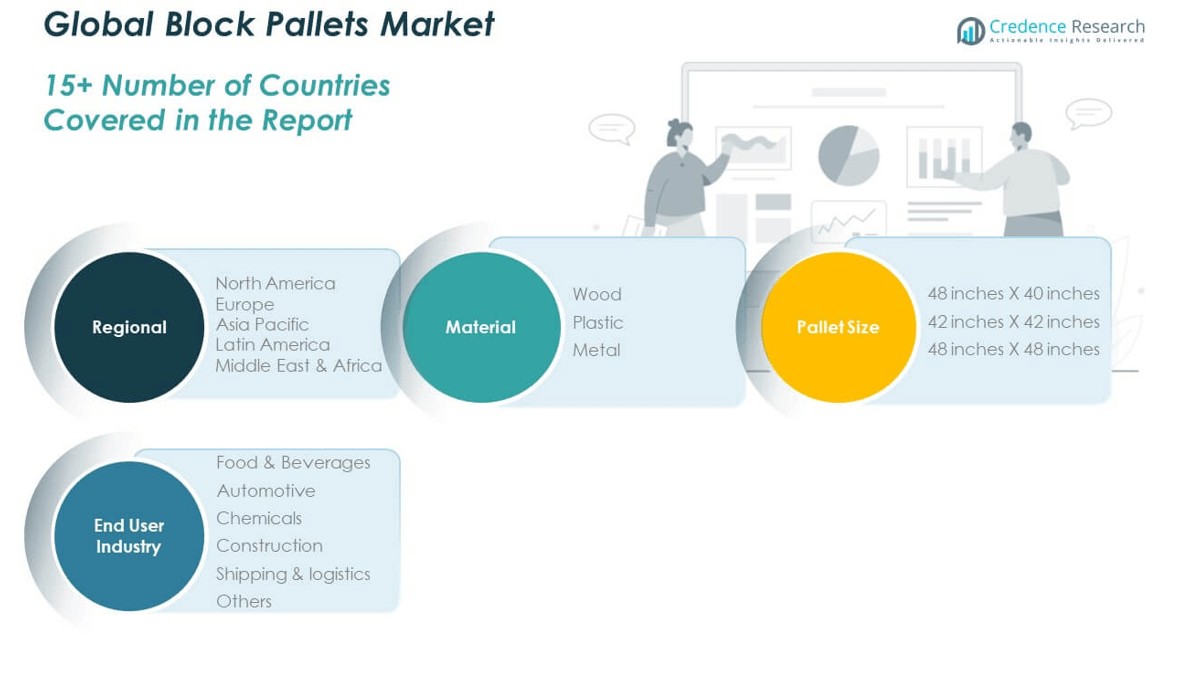

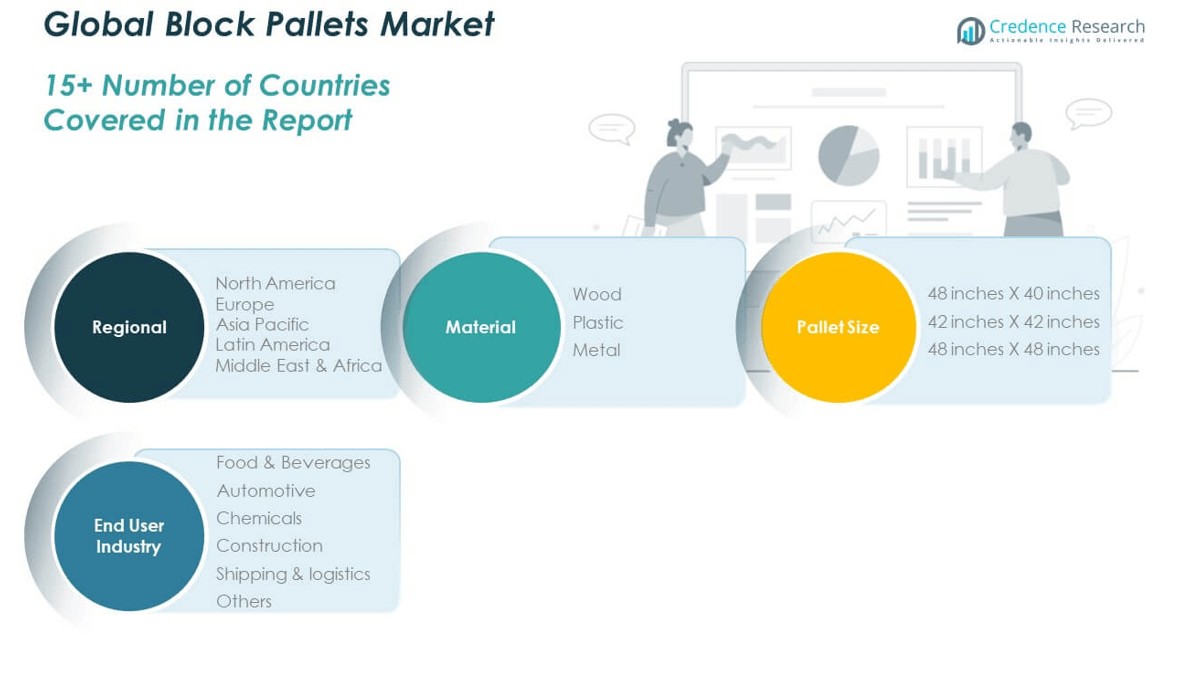

The Global Block Pallets Market is segmented by material, pallet size, and end user industry, each influencing demand trends and product innovation.

By material, wood dominates the market due to its cost-effectiveness, recyclability, and widespread availability. Plastic block pallets are gaining traction for their durability, moisture resistance, and suitability for hygienic environments, especially in food and pharmaceuticals. Metal pallets serve niche applications where fire resistance and heavy-load capacity are critical.

- For example, ORBIS Corporation supplies plastic block pallets such as the 40” x 48” Odyssey® pallet, which features a non-porous, moisture-resistant surface and supports up to 2,800 lbs in dynamic loads.

By pallet size, the 48 inches’ x 40 inches’ segment holds the largest share due to its standardization across North America and compatibility with automated systems. The 42 inches x 42 inches and 48 inches x 48 inches sizes serve specific industries that require wider base support, particularly in chemicals and beverages.

By end user industry, the food and beverages sector leads the Global Block Pallets Market due to high-volume distribution needs and strict hygiene requirements. Shipping and logistics follow closely, relying on block pallets for efficient stacking and transport. Automotive, chemicals, and construction industries contribute steady demand, driven by the need for durable, reusable load carriers in heavy-duty environments. The “others” category includes pharmaceuticals, electronics, and retail, where pallet compatibility with international standards and automation systems supports steady growth.

- For example, IKEA has implemented the OptiLedge system, a lightweight plastic block pallet alternative, for its global flat-pack furniture shipments. OptiLedge units are designed to be compatible with automated storage and retrieval systems (AS/RS) and reduce pallet weight compared to traditional wood pallets.

Segmentation:

By Material:

By Pallet Size:

- 48 inches’ x 40 inches

- 42 inches’ x 42 inches

- 48 inches’ x 48 inches

By End User Industry:

- Food & Beverages

- Automotive

- Chemicals

- Construction

- Shipping & Logistics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Block Pallets Market size was valued at USD 6,880.08 million in 2018 to USD 10,004.97 million in 2024 and is anticipated to reach USD 16,762.94 million by 2032, at a CAGR of 6.2% during the forecast period. North America holds approximately 26% of the total share in the Global Block Pallets Market. It benefits from a mature logistics infrastructure, high adoption of pallet pooling systems, and strong demand from industries like retail, food, and automotive. The presence of large pallet manufacturers and service providers enables streamlined supply chains and high-volume production capacity. The market in the U.S. and Canada is also influenced by sustainability standards and corporate ESG goals, prompting a shift toward recyclable pallet materials and recovery systems. Block pallets are widely used in automated warehouses and distribution centers across the region. The integration of advanced tracking technologies and lean inventory practices continues to boost regional demand.

Europe

The Europe Block Pallets Market size was valued at USD 4,730.81 million in 2018 to USD 6,629.00 million in 2024 and is anticipated to reach USD 10,119.21 million by 2032, at a CAGR of 5.0% during the forecast period. Europe accounts for nearly 17% of the Global Block Pallets Market share, driven by strong environmental regulations and demand for reusable packaging solutions. The region emphasizes circular economy initiatives, which has encouraged widespread adoption of wooden and plastic block pallets designed for multiple reuse cycles. Countries like Germany, France, and the UK lead demand, with retail and industrial users adopting pallets that comply with EU pallet standards. The market also benefits from the expansion of warehouse automation and cross-border logistics within the European Union. Block pallet use is increasing across industries where hygiene, uniformity, and regulatory compliance are critical. Exporters prefer block pallets due to their compatibility with international shipping norms.

Asia Pacific

The Asia Pacific Block Pallets Market size was valued at USD 10,047.03 million in 2018 to USD 15,412.25 million in 2024 and is anticipated to reach USD 27,338.99 million by 2032, at a CAGR of 7.0% during the forecast period. Asia Pacific dominates the Global Block Pallets Market with nearly 42% market share. Strong industrialization, rapid growth of e-commerce, and expansion of logistics networks across China, India, Japan, and Southeast Asia contribute to rising demand. Governments are investing in smart infrastructure and supply chain modernization, boosting adoption of high-load-capacity pallets. Manufacturers in the region are increasingly shifting from traditional stringer pallets to block pallets to support heavy-duty applications and automation compatibility. Growing awareness of pallet standardization and warehouse safety is also influencing buyer preferences. Domestic production capacity continues to rise, helping meet both local demand and export requirements.

Latin America

The Latin America Block Pallets Market size was valued at USD 1,150.45 million in 2018 to USD 1,679.00 million in 2024 and is anticipated to reach USD 2,486.14 million by 2032, at a CAGR of 4.6% during the forecast period. Latin America holds close to 5% of the Global Block Pallets Market share. The region is experiencing growing demand for reliable and reusable pallets driven by agriculture, food processing, and manufacturing exports. Countries like Brazil, Mexico, and Argentina are witnessing investments in logistics parks and automated distribution centers, where block pallets play a vital role. Adoption is gradually increasing as supply chain efficiency becomes a strategic priority. Local pallet manufacturers are focusing on durable wood and cost-effective composite materials. The shift from informal pallet use to standardized pooling systems is expected to support long-term market expansion.

Middle East

The Middle East Block Pallets Market size was valued at USD 652.22 million in 2018 to USD 878.80 million in 2024 and is anticipated to reach USD 1,231.02 million by 2032, at a CAGR of 3.8% during the forecast period. The region holds a modest 2% share of the Global Block Pallets Market but is showing steady growth due to increasing industrialization and logistics development. Countries like the UAE and Saudi Arabia are investing in warehousing, cold storage, and transport infrastructure to support economic diversification. These developments are creating new demand for block pallets in sectors such as food and beverage, healthcare, and retail. Imports and exports across major seaports also require standardized pallets to comply with international trade practices. Awareness of reusable packaging solutions is gradually improving. Market growth is expected to accelerate as regional trade hubs expand.

Africa

The Africa Block Pallets Market size was valued at USD 390.83 million in 2018 to USD 634.54 million in 2024 and is anticipated to reach USD 854.08 million by 2032, at a CAGR of 3.3% during the forecast period. Africa represents just over 1% of the Global Block Pallets Market share but offers untapped potential for future growth. The region faces structural challenges such as inconsistent logistics infrastructure and limited standardization. However, urbanization, growth in food distribution, and rising interest in regional manufacturing are creating opportunities for pallet suppliers. Countries like South Africa, Kenya, and Nigeria are emerging as key markets. Local manufacturers are starting to produce durable block pallets suited to regional needs. Increased investment in supply chain modernization will support gradual market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Brambles

- PalletOne

- PGS Group

- Loscam

- Synthite Industries Ltd.

- Millwood

- PECO Pallet

- IPP Logipal

- CABKA Group

- Schoeller Allibert

Competitive Analysis:

The Global Block Pallets Market features a moderately fragmented competitive landscape, with a mix of multinational corporations and regional manufacturers competing across material types and end-use sectors. Leading players include Brambles Limited (CHEP), PalletOne Inc., PECO Pallet Inc., Craemer GmbH, and LOSCAM, each offering a broad portfolio of wooden, plastic, and composite block pallets. It remains highly competitive due to price sensitivity, customization demands, and the growing need for sustainable and reusable solutions. Key players are investing in automation, RFID integration, and pallet pooling services to enhance operational efficiency and client retention. Strategic collaborations, acquisitions, and regional expansions are common approaches used to strengthen market presence. Regional manufacturers continue to gain traction by serving niche demands with localized production and cost advantages. The market is also witnessing an uptick in private label offerings from logistics providers and pallet pooling firms, further intensifying competition across global supply chains.

Recent Developments:

- In June 2025, PGS Group took a strategic step toward sustainability by deploying its first fully electric truck for local pallet deliveries in partnership with EUTRACO, aiming to reduce CO₂ emissions by 70.2 tons annually. This initiative is part of a broader plan to electrify 25% of EUTRACO’s fleet by the end of 2025 and achieve climate neutrality by 2035

- In June 2024, PalletOne launched an automated pallet assembly machine redeployment program to optimize capacity and improve pallet solutions for customers nationwide. This initiative follows the company’s coast-to-coast expansion as UFP Packaging’s premier wood pallet builder, with high-capacity automated machines being relocated to growth markets such as Georgia, Arizona, and Texas.

Market Concentration & Characteristics:

The Global Block Pallets Market exhibits a moderate level of market concentration, with a handful of large players accounting for a significant share while numerous small and mid-sized firms serve regional or specialized segments. It is characterized by high demand from logistics-intensive industries, recurring purchase cycles, and growing preference for standardized, reusable, and automation-compatible pallets. The market supports both large-scale pallet pooling systems and independent manufacturers catering to custom or low-volume needs. Product differentiation often centers on material durability, design precision, and environmental compliance. Regulatory alignment and innovation in pallet tracking and material sustainability define the competitive edge. The market remains sensitive to raw material pricing and is influenced by shifting logistics practices, industrial expansion, and digitalization trends across key sectors.

Report Coverage:

The research report offers an in-depth analysis based on Material, Pallet Size and End User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising automation in warehouses will increase demand for block pallets compatible with robotic handling systems.

- Expansion of e-commerce logistics will drive the need for durable, multi-use pallets across regional distribution hubs.

- Growing environmental regulations will support adoption of recyclable and composite block pallet materials.

- Advancements in RFID and IoT technologies will enhance pallet tracking and lifecycle management.

- Pallet pooling services will gain wider acceptance due to cost efficiency and sustainability benefits.

- Emerging economies will witness rising pallet demand driven by manufacturing and infrastructure growth.

- Customized pallet designs for industry-specific needs will become a key product differentiator.

- Fluctuations in timber and resin prices may prompt a shift toward alternative pallet materials.

- Strategic mergers and partnerships will shape global supply capacity and market consolidation.

- Increased focus on ESG compliance will position block pallets as part of circular logistics solutions.