Market Overview

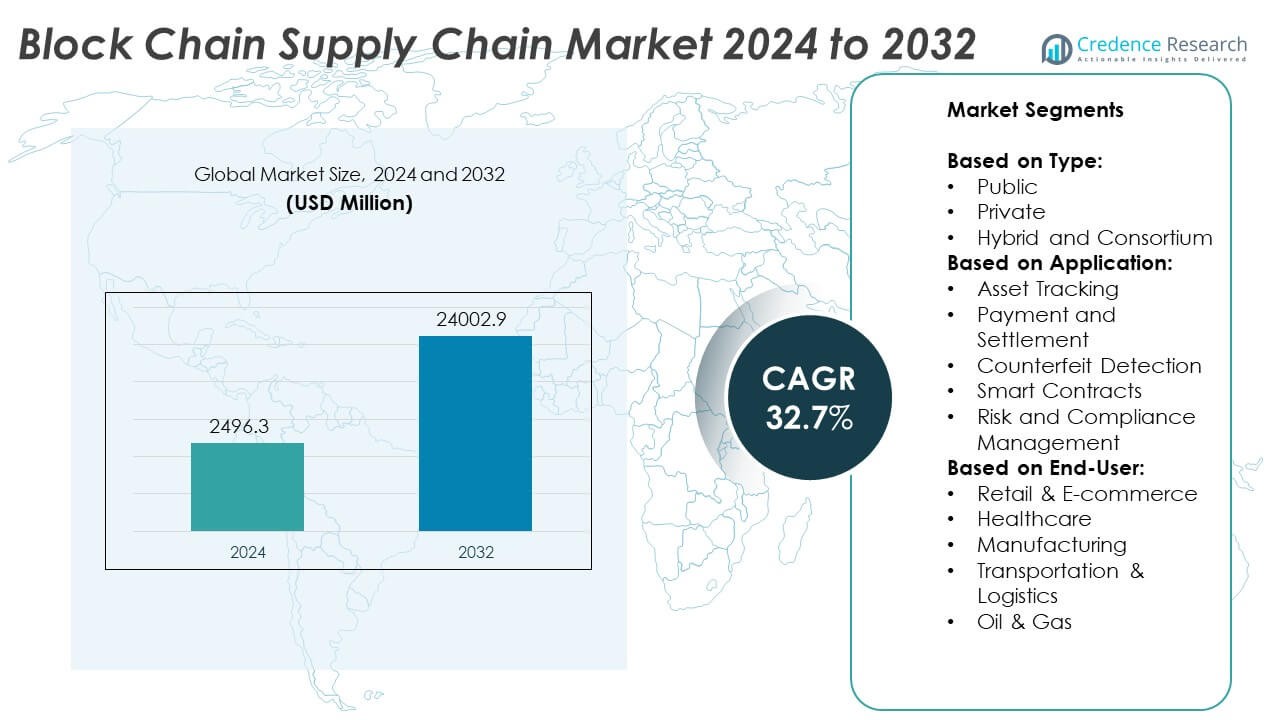

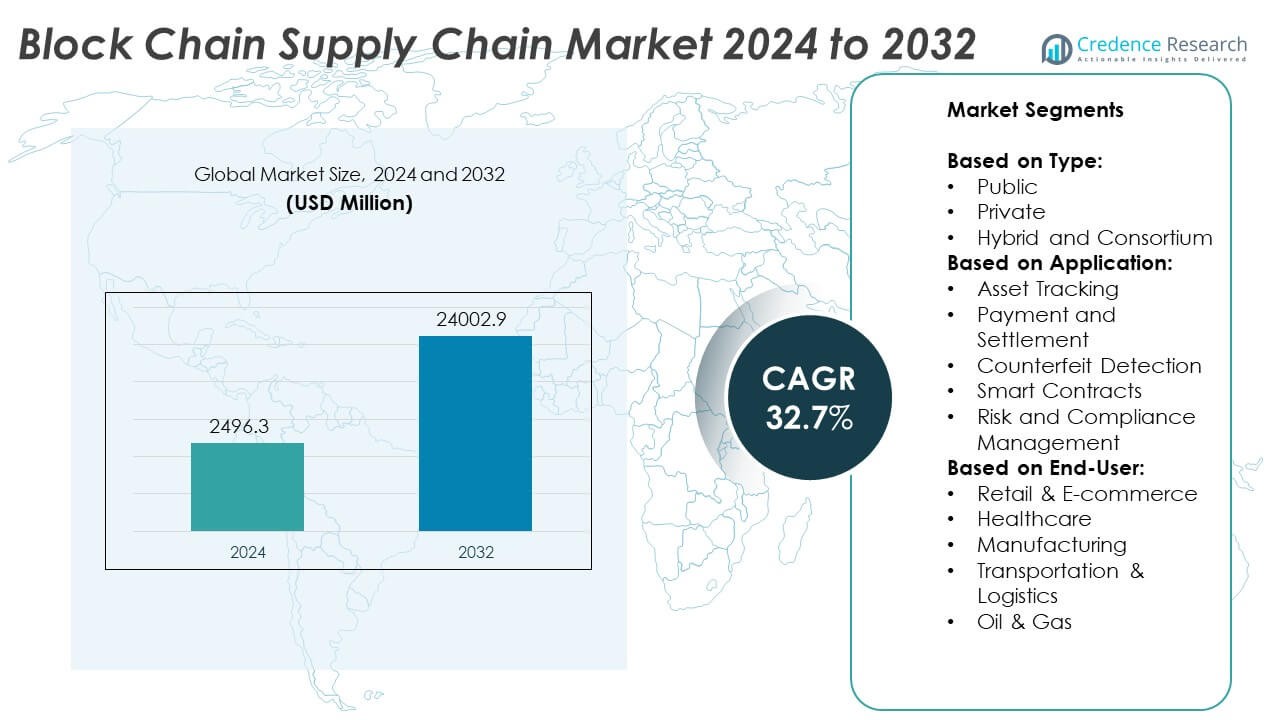

The Blockchain Supply Chain Market size was valued at USD 2,496.3 million in 2024 and is anticipated to reach USD 24,002.9 million by 2032, at a CAGR of 32.7% during the forecast period from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blockchain Supply Chain Market Size 2024 |

USD 2,496.3 Million |

| Blockchain Supply Chain Market, CAGR |

32.7% |

| Blockchain Supply Chain Market Size 2032 |

USD 24,002.9 Million |

The Block Chain Supply Chain market grows due to increasing demand for transparency, traceability, and security across complex supply networks. Companies adopt blockchain to enhance product provenance, reduce fraud, and automate processes with smart contracts. Integration with IoT and AI drives real-time monitoring and data-driven decision-making, improving efficiency and compliance. Rising focus on interoperability and cross-industry collaboration further accelerates blockchain deployment.

The Block Chain Supply Chain market shows strong adoption in North America, Europe, and Asia-Pacific, driven by technological advancement and supportive regulatory environments. North America leads with significant innovation from key players, while Europe focuses on compliance and cross-border interoperability. Asia-Pacific experiences rapid growth through government initiatives and expanding digital infrastructure. Prominent companies shaping the market include IBM Corporation, Microsoft, Amazon Web Services Inc., and Accenture. These organizations drive blockchain integration across industries by developing advanced platforms and solutions that enhance transparency, security, and efficiency in supply chain management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Blockchain Supply Chain Market was valued at USD 2,496.3 million in 2024 and is projected to reach USD 24,002.9 million by 2032, growing at a CAGR of 32.7% during the forecast period.

- Increasing demand for supply chain transparency and traceability drives market growth by enabling stakeholders to track products securely and reduce fraud.

- Integration of blockchain with IoT and artificial intelligence supports real-time monitoring and predictive analytics, enhancing supply chain efficiency and decision-making.

- Companies prioritize smart contracts to automate transactions and enforce compliance, reducing operational costs and delays.

- Market growth faces challenges from high implementation costs and complex integration with existing legacy systems, which hinder widespread adoption.

- North America, Europe, and Asia-Pacific lead blockchain adoption due to advanced technological infrastructure, regulatory support, and growing digital economies.

- Key players such as IBM Corporation, Microsoft, Amazon Web Services Inc., and Accenture actively develop innovative blockchain solutions, driving competition and expanding market reach globally.

Market Drivers

Increasing Demand for Transparency and Traceability in Supply Chains Drives Adoption of Blockchain Technology

The growing need for transparency and traceability in supply chains significantly propels the Block Chain Supply Chain market. Companies seek to enhance product provenance and ensure authenticity throughout the supply chain network. Blockchain technology enables immutable record-keeping, which reduces fraud and counterfeiting risks. It allows stakeholders to track goods from origin to final delivery with real-time data access. This capability strengthens consumer trust and regulatory compliance. Businesses in sectors such as food, pharmaceuticals, and luxury goods prioritize blockchain integration to meet these demands. The technology’s decentralized nature eliminates single points of failure, increasing data security and operational reliability.

- For instance, IBM’s Food Trust platform has enabled over 250 participants globally, facilitating traceability across more than 300 million food units monthly.

Rising Implementation of Smart Contracts Automates and Streamlines Supply Chain Processes

Smart contracts embedded within blockchain networks transform traditional supply chain operations by automating contractual obligations. They enforce predefined rules without human intervention, reducing delays and minimizing errors. The Block Chain Supply Chain market benefits from enhanced efficiency in procurement, payment settlements, and shipment verification. This automation cuts administrative costs and accelerates transaction speeds. It also enables better coordination among multiple parties, improving overall supply chain responsiveness. By reducing reliance on intermediaries, smart contracts lower operational risks and enhance transparency. Companies adopting this technology achieve greater agility in complex supply networks.

- For instance, Microsoft’s Azure Blockchain Service has supported smart contract deployments that execute over 500,000 transactions monthly.

Growing Focus on Enhancing Security and Reducing Fraudulent Activities in Supply Chain Operations

Supply chains face increasing threats from cyberattacks and data manipulation, which disrupt operations and damage reputations. Blockchain technology strengthens security by providing a tamper-proof ledger that records every transaction and movement. The Block Chain Supply Chain market expands as enterprises implement blockchain to mitigate risks related to data breaches and unauthorized access. It ensures data integrity and enforces strict access controls among participants. Enhanced security builds confidence among supply chain partners and regulators. Organizations gain improved visibility into suspicious activities and faster resolution of disputes. The technology supports compliance with stringent industry standards and legal frameworks.

Increasing Integration of Blockchain with Emerging Technologies to Boost Supply Chain Efficiency

The convergence of blockchain with artificial intelligence (AI), Internet of Things (IoT), and big data analytics enhances supply chain performance. These integrations empower companies to monitor inventory, predict demand, and optimize logistics with higher accuracy. The Block Chain Supply Chain market leverages this synergy to deliver smarter, data-driven decision-making capabilities. IoT devices capture real-time environmental and location data, while blockchain secures this information against tampering. AI algorithms analyze patterns to identify inefficiencies and recommend corrective actions. This combination reduces waste, improves asset utilization, and shortens delivery cycles. Businesses gain competitive advantages by adopting integrated technology solutions to meet evolving market demands.

Market Trends

Widespread Adoption of Blockchain for Enhancing Supply Chain Transparency and Efficiency

The Block Chain Supply Chain market experiences rapid growth due to widespread adoption across various industries seeking improved transparency and operational efficiency. Companies integrate blockchain solutions to establish immutable records and real-time visibility into product movement. It allows stakeholders to reduce errors, eliminate fraud, and streamline audits. Supply chains benefit from enhanced collaboration between partners by sharing verified information securely. This trend reflects a shift toward decentralized data management, which empowers organizations to make faster, more informed decisions. The technology supports tracking of goods from raw materials to end consumers, fostering trust throughout the supply chain network.

- For instance, Microsoft’s Azure Blockchain Service, now retired, supported smart contract deployments that could handle over 500,000 transactions per month. This service was designed to simplify blockchain development and integration with other Azure services.

Increasing Integration of Blockchain with Internet of Things (IoT) to Drive Real-Time Supply Chain Monitoring

The convergence of blockchain with IoT technology transforms the Block Chain Supply Chain market by enabling continuous real-time monitoring of assets and environmental conditions. IoT sensors collect data on location, temperature, humidity, and other critical parameters, which blockchain securely records to ensure data integrity. It facilitates quick identification of deviations or anomalies, supporting proactive responses to potential issues. This integration improves inventory management, reduces losses, and strengthens compliance with regulatory requirements. Companies leverage this trend to enhance end-to-end supply chain visibility and accountability. It also fosters innovation in automated tracking and reporting mechanisms.

- For instance, Walmart utilizes IBM’s Food Trust blockchain platform integrated with IoT sensors to monitor the condition of perishable goods across its supply chain. The system tracks over 15 million food units monthly, capturing temperature and location data at 100% of monitored checkpoints, reducing spoilage rates significantly and accelerating contamination tracebacks from weeks to under two days

Rising Focus on Developing Interoperable Blockchain Platforms to Support Cross-Industry Collaboration

The Block Chain Supply Chain market trends toward creating interoperable blockchain platforms that enable seamless data exchange across different systems and industries. These platforms reduce fragmentation caused by multiple proprietary solutions and improve communication between supply chain participants. It promotes unified standards and protocols to facilitate scalability and adoption. Enterprises focus on building ecosystems that connect suppliers, manufacturers, logistics providers, and retailers efficiently. Interoperability drives cost savings by reducing redundancy and streamlining processes. This trend encourages partnerships and collaborative innovation to tackle complex supply chain challenges globally.

Expanding Use of Blockchain-Based Smart Contracts to Automate Compliance and Payment Processes

Smart contracts continue to gain traction in the Block Chain Supply Chain market by automating routine contractual obligations and compliance verification. These self-executing contracts trigger actions such as payment release or shipment authorization when predefined conditions meet. It enhances speed and accuracy while minimizing disputes and administrative overhead. Companies adopt smart contracts to enforce regulatory compliance, reduce manual intervention, and improve transparency across supply chain stages. This trend supports faster transaction cycles and builds stronger trust among supply chain stakeholders. Growing awareness of these benefits accelerates smart contract implementation in supply chain management.

Market Challenges Analysis

High Implementation Costs and Complex Integration Hinder Widespread Blockchain Adoption in Supply Chains

The Block Chain Supply Chain market faces significant challenges due to the high costs associated with implementing blockchain technology. Enterprises must invest in specialized hardware, software, and skilled personnel to develop and maintain blockchain networks. It requires substantial time and resources to integrate blockchain with existing legacy systems, causing operational disruptions. Small and medium-sized businesses often find these barriers prohibitive, limiting market penetration. Complex interoperability issues arise when connecting multiple blockchain platforms across diverse supply chain partners. These technical and financial hurdles slow adoption rates and delay the realization of blockchain’s full potential in supply chain management.

Data Privacy Concerns and Regulatory Uncertainty Create Obstacles for Blockchain Deployment

Concerns regarding data privacy and confidentiality affect the Block Chain Supply Chain market’s growth prospects. Participants worry about exposing sensitive information to competitors within a decentralized network. It challenges companies to balance transparency with protection of proprietary data. The evolving regulatory landscape adds uncertainty, as governments worldwide develop differing standards for blockchain use and data governance. Compliance with multiple jurisdictions complicates blockchain deployment, especially in global supply chains. These factors contribute to hesitation among stakeholders in adopting blockchain solutions. Without clear regulatory frameworks and enhanced privacy measures, widespread implementation remains constrained.

Market Opportunities

Expansion of Blockchain Applications in Emerging Markets Presents Significant Growth Potential

The Block Chain Supply Chain market holds considerable opportunity in emerging economies where supply chains often face inefficiencies and lack transparency. These regions increasingly adopt blockchain solutions to address challenges such as counterfeit goods, complex logistics, and regulatory compliance. It enables businesses to establish trust with partners and consumers by providing verifiable data on product origin and movement. Growing digital infrastructure and government support for blockchain initiatives further accelerate adoption in these markets. Companies can capitalize on this trend by tailoring blockchain offerings to local needs and scaling solutions across sectors like agriculture, manufacturing, and retail. Expansion into emerging markets offers untapped revenue streams and competitive advantages.

Advancements in Blockchain Technology Integration with AI and IoT Unlock New Supply Chain Capabilities

The convergence of blockchain with artificial intelligence (AI) and Internet of Things (IoT) technologies creates vast opportunities for the Block Chain Supply Chain market. It facilitates real-time data collection, enhanced predictive analytics, and automated decision-making within supply networks. Combining these technologies improves asset tracking, demand forecasting, and risk management, boosting operational efficiency. Businesses can develop innovative solutions that increase responsiveness to market changes and reduce costs. Enhanced interoperability and standardization efforts further support seamless technology integration. This trend encourages the development of intelligent, transparent supply chains that meet evolving customer and regulatory demands.

Market Segmentation Analysis:

By Type:

The market categorizes blockchain solutions into public, private, hybrid, and consortium types. Public blockchains operate on open networks, providing transparency and decentralization but facing scalability constraints. Private blockchains restrict access to authorized participants, offering enhanced privacy and faster processing. Hybrid blockchains combine public and private features, allowing selective data sharing while maintaining security. Consortium blockchains enable a group of organizations to govern the network collectively, balancing transparency and control. The Block Chain Supply Chain market experiences growing preference for hybrid and consortium blockchains, as they offer flexibility and trust in multi-stakeholder environments.

- For instance, Hyperledger Fabric, a consortium blockchain framework developed by IBM, supports over 300 enterprises globally, enabling transaction throughput of up to 3,500 transactions per second in supply chain use cases, significantly enhancing scalability and data privacy for multi-party collaboration.

By Application:

Applications in the market include asset tracking, payment and settlement, counterfeit detection, smart contracts, and risk and compliance management. Asset tracking leverages blockchain to create immutable records that improve visibility and reduce losses. Payment and settlement applications accelerate transactions and reduce reliance on intermediaries. Counterfeit detection ensures product authenticity, addressing growing concerns in industries like pharmaceuticals and luxury goods. Smart contracts automate agreement enforcement, reducing errors and accelerating processes. Risk and compliance management uses blockchain to maintain accurate, auditable records, enhancing regulatory adherence. The Block Chain Supply Chain market benefits from strong demand across these applications, driving digital transformation in supply chain functions.

- For instance, SAP’s Blockchain-as-a-Service platform processes over 200,000 smart contract executions monthly across industries, automating payment settlements and shipment verifications, which reduced processing times by approximately 35% in key logistics clients.

By End-User:

The market serves diverse end-users including retail & e-commerce, healthcare, manufacturing, transportation & logistics, and oil & gas sectors. Retail and e-commerce companies use blockchain to verify product origins and streamline inventory. Healthcare providers implement blockchain to secure patient data and ensure drug supply integrity. Manufacturing firms focus on quality control and supplier transparency. Transportation and logistics players adopt blockchain for real-time shipment tracking and improved coordination. Oil & gas companies apply blockchain to enhance asset management and compliance monitoring. The Block Chain Supply Chain market witnesses widespread adoption across these sectors, driven by the need for transparency, efficiency, and security.

Segments:

Based on Type:

- Public

- Private

- Hybrid and Consortium

Based on Application:

- Asset Tracking

- Payment and Settlement

- Counterfeit Detection

- Smart Contracts

- Risk and Compliance Management

Based on End-User:

- Retail & E-commerce

- Healthcare

- Manufacturing

- Transportation & Logistics

- Oil & Gas

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a commanding position in the Block Chain Supply Chain market, accounting for approximately 35% of the global market share. The region benefits from advanced technological infrastructure, widespread blockchain adoption, and supportive regulatory frameworks. The presence of key industry players and innovative startups accelerates the deployment of blockchain solutions across various sectors. Companies in North America emphasize transparency, security, and efficiency in their supply chains, driving demand for blockchain-based platforms. The healthcare, retail, and manufacturing sectors actively implement blockchain for asset tracking, smart contracts, and counterfeit detection. Investments in research and development further strengthen the region’s leadership. The increasing collaboration between technology providers and supply chain stakeholders promotes continuous innovation and adoption.

Europe

Europe represents the second-largest market, capturing around 28% of the Block Chain Supply Chain market share globally. Strong government initiatives aimed at digital transformation and blockchain-friendly policies support market growth. European organizations prioritize compliance with stringent data protection regulations, prompting the adoption of secure blockchain systems. The manufacturing and logistics industries lead in blockchain integration to enhance transparency and traceability. Cross-border trade within the European Union benefits from interoperable blockchain platforms that simplify documentation and payment processes. Collaborative projects between public and private sectors stimulate ecosystem development. Europe’s focus on sustainability and ethical sourcing also drives blockchain use to verify supply chain integrity and reduce fraud.

Asia-Pacific

The Asia-Pacific region accounts for approximately 25% of the global Block Chain Supply Chain market share and demonstrates rapid growth fueled by increasing digitization and expanding e-commerce. Emerging economies like China, India, Japan, and South Korea actively invest in blockchain technology to address challenges in logistics, counterfeit prevention, and regulatory compliance. Government support and rising awareness among enterprises accelerate adoption in sectors such as retail, manufacturing, and transportation. The region benefits from a growing base of technology developers and integration of blockchain with IoT and AI. Supply chains in Asia-Pacific focus on improving efficiency and transparency to compete in global markets. Expansion of infrastructure and cloud services also lowers entry barriers for small and medium enterprises.

Latin America

Latin America holds a smaller but growing share of about 7% in the Block Chain Supply Chain market. The region faces supply chain challenges due to complex logistics and regulatory environments, creating opportunities for blockchain solutions. Brazil, Mexico, and Argentina lead adoption efforts with pilot projects and increasing investments in blockchain for asset tracking and counterfeit detection. Companies seek to enhance transparency and reduce operational costs through blockchain integration. The growing fintech ecosystem supports blockchain payments and smart contracts. Regulatory clarity remains a work in progress, but increasing collaboration between governments and private players fosters confidence. Latin America’s expanding e-commerce sector also drives demand for blockchain-enabled supply chain management.

Middle East and Africa

The Middle East and Africa region captures around 5% of the global Block Chain Supply Chain market share, showing steady growth driven by infrastructure development and digital innovation initiatives. Countries such as the UAE, Saudi Arabia, and South Africa invest in blockchain to improve logistics, compliance, and transparency across industries including oil & gas, manufacturing, and retail. The focus on diversifying economies away from oil dependency motivates adoption of advanced supply chain technologies. Strategic partnerships with global blockchain providers accelerate implementation. Challenges related to regulatory frameworks and digital literacy exist but gradually diminish with government support and training programs. The region’s increasing participation in global trade encourages blockchain use to enhance supply chain reliability and security.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- IBM Corporation

- Amazon Web Services Inc.

- Accenture

- Bitfury Group Limited

- SAP SE

- Digital Treasury Corporation

- Guardtime

- TIBCO Software

- Omnichain Solutions

Competitive Analysis

Key players in the Block Chain Supply Chain market include IBM Corporation, Microsoft, Amazon Web Services Inc., Accenture, SAP SE, Bitfury Group Limited, Guardtime, Omnichain Solutions, Digital Treasury Corporation, and TIBCO Software. These companies focus on developing advanced blockchain platforms and solutions tailored to enhance transparency, security, and efficiency in supply chain operations. They invest heavily in research and development to integrate blockchain with emerging technologies such as artificial intelligence and Internet of Things, creating innovative applications for asset tracking, smart contracts, and counterfeit detection.Market leaders differentiate themselves through strategic partnerships, acquisitions, and collaborations with industry stakeholders to expand their service offerings and geographical reach. They prioritize scalability and interoperability to address the complexities of multi-party supply chains. Many emphasize cloud-based blockchain services to lower adoption barriers for small and medium enterprises.Competitive intensity remains high due to continuous innovation and the entry of new players offering specialized solutions. Established companies leverage their global presence and strong client networks to maintain market dominance. Focus on customer-centric customization and compliance with regional regulations further strengthens their positions. Overall, these leading firms drive the Block Chain Supply Chain market forward by setting technological standards and enabling widespread blockchain adoption across diverse industries.

Recent Developments

- In June 2025, IBM’s blockchain services emphasize transparency and resilience in supply chains during disruptions. IBM is also involved in automotive supply chain blockchain projects with Renault, focusing on compliance and data sharing in complex regulatory environments as seen in recent industry commentary.

- In 2025, Bitfury is indeed recognized as a key player in the blockchain technology space, particularly within the automotive and aerospace supply chain sectors. Bitfury is listed among other major companies like IBM, Oracle, and Microsoft as having a significant presence in developing blockchain solutions for supply chain management.

- In July 2023, Hyundai Motor Company and Kia Corporation have introduced a blockchain-based Supplier CO2 Emission Monitoring System (SCEMS) to manage the carbon emissions of their cooperative business partners or suppliers. This system uses artificial intelligence (AI) and blockchain technology to monitor and track the carbon emissions of suppliers, helping them to reduce their environmental impact and improve their sustainability.

- In August 2022, OrionOne and VeChain have integrated their technologies to enable logistics companies to easily adopt blockchain technology. OrionOne’s logistics platform is now connected to VeChain’s blockchain platform, allowing companies to rapidly onboard and start using blockchain without significant investments in infrastructure or cryptocurrency management.

Market Concentration & Characteristics

The Block Chain Supply Chain market exhibits a moderately concentrated structure dominated by several large multinational corporations alongside emerging specialized players. Leading companies hold significant market shares due to their extensive resources, technological expertise, and global reach. These key players invest heavily in innovation and strategic partnerships to develop scalable, interoperable blockchain solutions that address complex supply chain challenges. The market also includes smaller firms offering niche products tailored to specific industries or regional requirements, fostering competitive diversity. It operates within a dynamic environment characterized by rapid technological advancements, evolving regulatory frameworks, and growing demand for transparency and security. Customer expectations for customizable, efficient, and cost-effective solutions drive continuous improvement and differentiation. The market’s characteristics include high barriers to entry due to technical complexity and capital requirements, balanced by increasing adoption of cloud-based and modular platforms that lower implementation hurdles. Industry participants focus on integrating blockchain with emerging technologies such as IoT and artificial intelligence to enhance real-time monitoring and predictive analytics. These factors collectively shape the Block Chain Supply Chain market’s competitive landscape, promoting innovation while demanding agility and collaboration among stakeholders to capture growth opportunities.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Block Chain Supply Chain market will experience rapid expansion due to increasing adoption across industries.

- Integration with AI and IoT will enhance real-time tracking and predictive analytics capabilities.

- Smart contracts will become more prevalent, automating complex supply chain processes.

- Demand for greater transparency and security will continue to drive blockchain implementation.

- Interoperability among blockchain platforms will improve, facilitating smoother data exchange.

- Emerging markets will see accelerated blockchain adoption supported by digital infrastructure growth.

- Cloud-based blockchain solutions will lower entry barriers for small and medium enterprises.

- Regulatory frameworks will evolve, providing clearer guidelines and boosting market confidence.

- Collaboration between technology providers and supply chain participants will increase innovation.

- Blockchain’s role in sustainability and ethical sourcing will strengthen, aligning with global priorities.