Market Overview

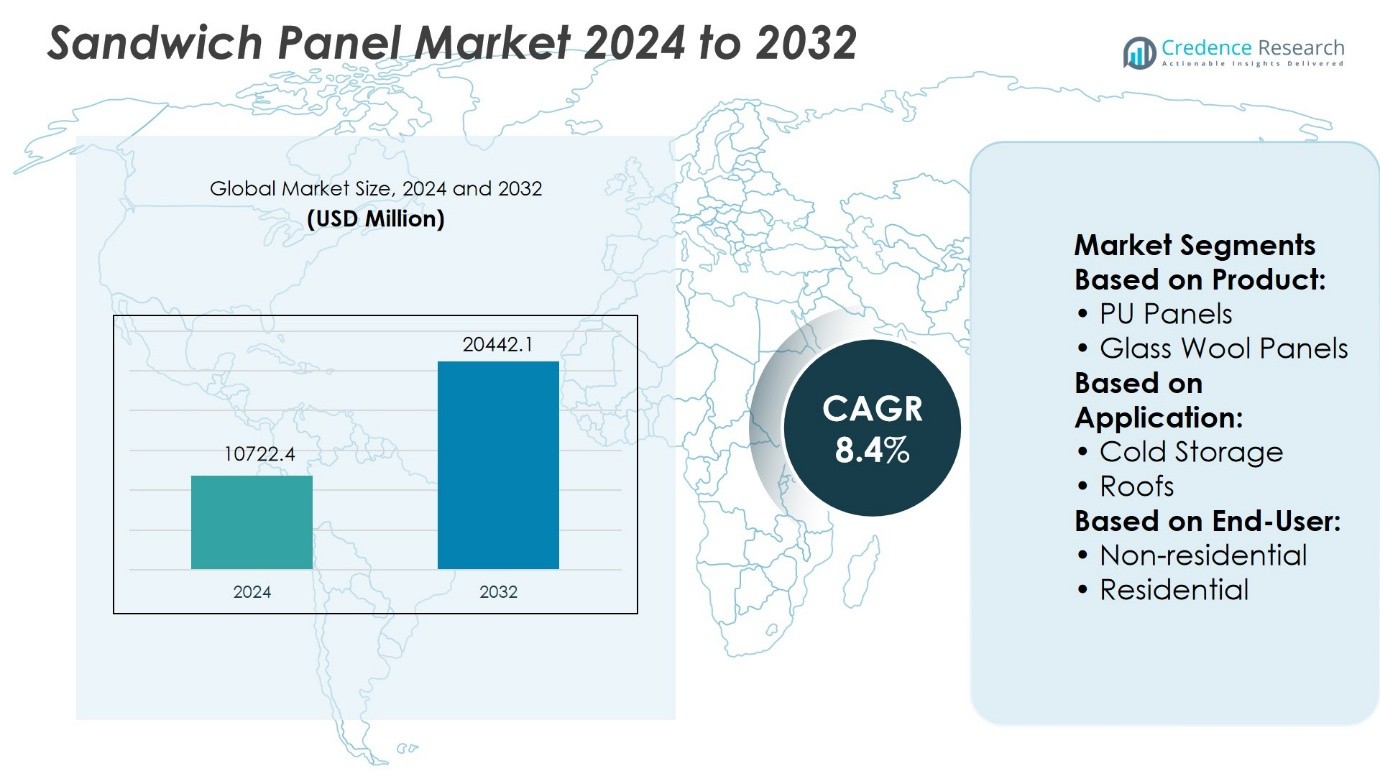

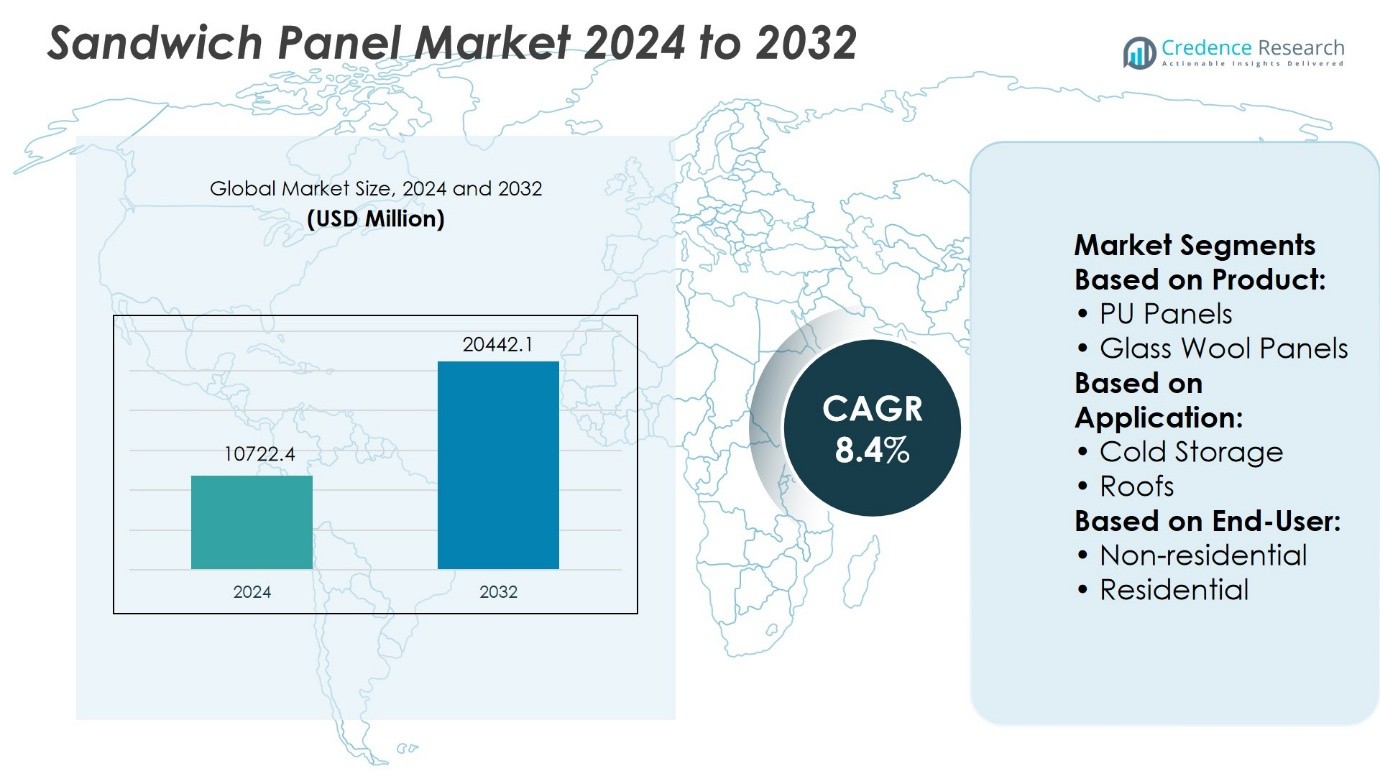

Sandwich Panel Market size was valued at USD 10722.4 million in 2024 and is anticipated to reach USD 20442.1 million by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sandwich Panel Market Size 2024 |

USD 10722.4 Million |

| Sandwich Panel Market, CAGR |

8.4% |

| Sandwich Panel Market Size 2032 |

USD 20442.1 Million |

The Sandwich Panel Market grows on the strength of rising demand for energy-efficient construction, rapid urbanization, and expanding cold storage facilities across industrial and logistics sectors. It benefits from strict regulations promoting sustainable and fire-resistant building materials, driving adoption in both residential and non-residential projects. Advancements in lightweight composites, recyclable cores, and eco-friendly coatings enhance product performance and align with green building standards. It also reflects a clear trend toward modular and prefabricated construction, where speed, durability, and cost efficiency remain critical. These drivers and trends collectively position sandwich panels as a vital solution for modern infrastructure development.

The Sandwich Panel Market demonstrates strong geographical presence, with Europe holding the largest share, followed by Asia-Pacific, North America, Latin America, and the Middle East & Africa. It reflects diverse growth patterns, from strict energy regulations in Europe to rapid industrialization in Asia-Pacific. Leading players strengthen competitiveness through innovation, sustainability, and global reach, including Kingspan Group, Owens Corning, Isopan, PFB Corporation, Metecno Group, Green Span Profiles, American Insulated Panel, Metl-Span, KPS Global, and Dana Group of Companies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sandwich Panel Market size was valued at USD 10722.4 million in 2024 and is projected to reach USD 20442.1 million by 2032, at a CAGR of 8.4%.

- Rising demand for energy-efficient construction and rapid urbanization drive consistent market growth.

- Expanding cold storage facilities and logistics hubs strengthen adoption across industrial sectors.

- Lightweight composites, recyclable cores, and eco-friendly coatings shape key market trends.

- Leading companies focus on innovation, sustainability, and strategic partnerships to enhance competitiveness.

- Volatile raw material prices and strict compliance requirements act as restraints for smaller manufacturers.

- Europe leads the market, followed by Asia-Pacific, North America, Latin America, and the Middle East & Africa, reflecting diverse regional growth patterns.

Market Drivers

Expanding Demand in Construction and Infrastructure Development

The Sandwich Panel Market benefits strongly from rapid growth in construction and infrastructure projects across residential, commercial, and industrial sectors. Rising urbanization and large-scale development projects create demand for efficient, durable, and cost-effective building solutions. It provides thermal insulation, structural strength, and quick installation, which meet the needs of fast-paced projects. Governments promoting energy-efficient buildings support the adoption of these panels in both developed and emerging markets. It also aligns with modern architectural requirements that emphasize lightweight materials and sustainable practices. The expanding infrastructure pipeline in Asia-Pacific and the Middle East ensures a steady demand trajectory.

- For instance, Kingspan Group reported installing more than 250 million square meters of insulated sandwich panels across global projects by 2023, with its QuadCore Technology panels delivering a certified thermal conductivity.

Rising Emphasis on Energy Efficiency and Sustainability

Global efforts to reduce carbon footprints accelerate the adoption of insulated building materials, making the Sandwich Panel Market a critical component in energy-efficient construction. It supports compliance with stringent building codes and energy standards, especially in Europe and North America. Manufacturers increasingly integrate eco-friendly raw materials and recyclable cores to meet evolving environmental goals. It enhances thermal performance, reducing energy consumption in heating and cooling. Growing demand from sectors such as cold storage and logistics further drives market reliance on panels with superior insulation properties. Sustainability certifications and green building programs strengthen the market’s position worldwide.

- For instance, Isopan S.p.A. developed its Green Roof sandwich panels with an insulation core achieving a thermal transmittance as low as 0.15 W/m²K and certified over 12 million square meters of panels with LEED and BREEAM standards.

Growth in Industrial and Warehousing Applications

The expansion of manufacturing, logistics, and e-commerce significantly influences the Sandwich Panel Market. It offers rapid construction capabilities and low maintenance, making it suitable for warehouses, factories, and distribution centers. Rising global trade and supply chain diversification require robust storage facilities, directly fueling demand for panel-based structures. It reduces overall construction costs and accelerates project timelines, supporting large-scale industrial adoption. The pharmaceutical and food industries, which depend on temperature-controlled facilities, create additional opportunities for insulated panels. Increasing investments in industrial parks across emerging economies reinforce this trend.

Technological Advancements and Product Innovation

Ongoing innovation in design and materials further strengthens the growth of the Sandwich Panel Market. It includes the development of fire-resistant cores, advanced coatings, and lightweight composites that expand use in critical infrastructure. Automation in production improves panel quality and consistency, supporting large-scale deployment. It enables flexibility in design, making panels adaptable for modern architectural requirements. Integration of smart materials and digital modeling tools ensures enhanced performance and precision in installation. Collaborations between construction companies and panel manufacturers accelerate customized solutions for diverse projects. Rising investments in R&D guarantee continuous improvements in efficiency and durability.

Market Trends

Increasing Preference for Lightweight and Durable Construction Materials

The Sandwich Panel Market reflects a strong shift toward lightweight yet durable building solutions that reduce structural load without compromising strength. It delivers significant advantages in construction speed, cost efficiency, and long-term performance. Demand intensifies in high-rise projects and modular buildings where reduced weight is critical. It also ensures extended lifespan through resistance to corrosion, weather, and mechanical stress. Growing adoption in transportation and prefabricated housing highlights its versatility. This trend positions panels as a cornerstone of modern construction practices.

- For instance, Metecno Group engineered lightweight polyurethane-core sandwich panels maintaining compressive strength above 150 kPa, and by 2023, the company had supplied more than 95 million square meters of these panels globally for industrial and modular construction projects.

Expanding Role of Cold Chain and Temperature-Sensitive Applications

Rising global demand for cold storage and refrigerated logistics shapes a key trend in the Sandwich Panel Market. It enables superior thermal insulation, making it vital for food processing, pharmaceuticals, and perishable goods transportation. Expanding e-commerce and global trade push for advanced warehousing solutions with efficient temperature control. It ensures regulatory compliance for hygiene and safety in sensitive industries. Demand for energy-efficient cold chain facilities strengthens adoption across emerging economies. This sector remains one of the fastest-growing application areas for sandwich panels.

- For instance, in temperature-controlled applications, Kingspan also reports tested R-values of 7.5 per inch (~189 mm) for its insulation cores, delivering strong thermal control across operating temperatures ranging from –40 °C to +93 °C.

Advancements in Fire-Resistant and Sustainable Solutions

Innovation in fire-retardant cores and eco-friendly materials represents a defining trend in the Sandwich Panel Market. It addresses growing safety concerns in large commercial and industrial facilities. Manufacturers develop panels with mineral wool and advanced coatings to meet stringent fire protection standards. It also aligns with sustainability goals through the use of recyclable materials and low-emission adhesives. Integration of life-cycle assessments ensures panels meet green certification requirements. This focus on safety and sustainability enhances trust among regulators and end users.

Rising Adoption of Modular and Prefabricated Construction

Rapid urbanization and demand for flexible building methods promote modular construction as a dominant trend in the Sandwich Panel Market. It reduces construction timelines and minimizes waste while ensuring consistent quality. Growing investments in prefabricated housing and temporary structures highlight the efficiency of panel-based systems. It supports government-backed affordable housing initiatives and infrastructure expansion. The ability to customize design and aesthetics enhances acceptance in both residential and commercial projects. This trend reinforces panels as a preferred material for fast-developing urban landscapes.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Constraints

The Sandwich Panel Market faces significant challenges due to volatility in raw material prices, particularly steel, aluminum, and core insulation materials. It directly impacts production costs and reduces profit margins for manufacturers. Global supply chain disruptions further create delays in procurement and distribution, increasing overall project timelines. It becomes difficult for producers to maintain price stability when raw material availability fluctuates. Dependence on imports in certain regions intensifies vulnerability to currency shifts and trade restrictions. This challenge pressures companies to optimize sourcing strategies and explore alternative materials.

Stringent Regulatory Compliance and Limited Awareness in Emerging Markets

Compliance with energy efficiency, fire safety, and environmental standards poses another challenge for the Sandwich Panel Market. It requires continuous investment in R&D to meet evolving regulations across different regions. Smaller manufacturers struggle to match the cost of innovation while maintaining competitive pricing. It also faces barriers in emerging economies where awareness about advanced building materials remains low. Traditional construction practices dominate in many markets, restricting wider adoption. Overcoming regulatory hurdles and enhancing market education remain critical for long-term growth.

Market Opportunities

Expansion in Green Building and Sustainable Infrastructure Projects

The Sandwich Panel Market holds strong opportunities in the global shift toward sustainable construction and green-certified buildings. It aligns with policies that encourage energy-efficient materials and eco-friendly practices. Growing investments in renewable energy facilities, smart cities, and green industrial parks create demand for advanced insulated panels. It supports developers in achieving compliance with LEED and BREEAM standards, enhancing market attractiveness. Rising adoption of recyclable cores and low-emission adhesives positions panels as a preferred solution for environmentally responsible projects. This opportunity ensures long-term relevance in the evolving construction sector.

Rising Demand from Emerging Economies and Industrial Growth

Rapid industrialization and urban development in Asia-Pacific, Latin America, and the Middle East create favorable opportunities for the Sandwich Panel Market. It enables cost-efficient and quick construction of warehouses, factories, and logistics hubs that support expanding trade activities. Government-backed affordable housing and infrastructure programs further boost demand for prefabricated structures. It caters to sectors such as food processing, pharmaceuticals, and e-commerce logistics where insulated and durable facilities are essential. Growing foreign direct investments in manufacturing and construction strengthen adoption across these markets. This expansion secures new growth avenues for global and regional players.

Market Segmentation Analysis:

By Product

The Sandwich Panel Market divides by product into PU panels and glass wool panels, both serving distinct roles in construction and insulation. PU panels dominate due to their excellent thermal insulation and energy efficiency, making them the preferred choice for cold storage and industrial facilities. It ensures reduced energy consumption and lower maintenance, which appeal to developers in cost-sensitive projects. Glass wool panels gain traction where fire resistance and acoustic performance are critical, such as in commercial complexes and public infrastructure. It also offers recyclability, aligning with growing demand for sustainable materials. The combination of insulation performance and versatility secures both products strong adoption across varied applications.

- For instance, Owens Corning Thermafiber® FireSpan® mineral wool insulation is specifically engineered for perimeter fire containment in curtain wall systems, and fire exposure for up to 5 hours, maintaining structural integrity without backer bars.

By Application

The market demonstrates diverse applications, with cold storage and roofs as key segments driving adoption. Cold storage facilities require panels that ensure thermal efficiency and durability, making PU panels the dominant choice in this segment. It also plays a central role in the food processing and pharmaceutical industries, where temperature regulation is essential for compliance and product safety. Roof applications highlight the use of both PU and glass wool panels for energy savings and fire protection in residential and non-residential projects. It provides quick installation and reduced structural weight, which support efficiency in large-scale developments. The growing need for cost-effective, insulated roofing systems reinforces this segment’s significance.

- For instance, Kingspan QuadCore® KS1000RW Roof Panels are designed for high-performance and lightweight roofing applications. Specifically, a 100mm thick panel offers excellent thermal insulation (low U-value) for efficient installation and temperature control over large roof areas.

By End-user

By end-user, the Sandwich Panel Market divides into non-residential and residential segments, with non-residential construction accounting for a larger share. It supports industrial facilities, logistics hubs, warehouses, and commercial complexes where thermal insulation and durability are top priorities. The residential segment continues to expand, driven by demand for energy-efficient housing and affordable prefabricated solutions. It caters to urban housing projects, modular homes, and green-certified residential buildings where lightweight materials are preferred. Rising government initiatives for affordable housing in emerging economies further strengthen growth in this segment. The balance between large-scale non-residential projects and growing residential adoption highlights the broad applicability of sandwich panels in modern construction.

Segments:

Based on Product:

- PU Panels

- Glass Wool Panels

Based on Application:

Based on End-User:

- Non-residential

- Residential

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 23% of the Sandwich Panel Market, supported by advanced construction practices and strict energy efficiency regulations. The region emphasizes sustainable building materials, driving the adoption of insulated panels in commercial and industrial facilities. It benefits from strong demand in cold storage and logistics infrastructure, particularly in the United States, where e-commerce and food distribution require reliable temperature-controlled solutions. Canada demonstrates growth in residential applications, supported by government incentives for energy-efficient housing. The presence of established manufacturers and high awareness of green certifications further sustain adoption. Rising investment in prefabricated buildings strengthens North America’s position as a key contributor to global demand.

Europe

Europe holds the largest share at 32% of the Sandwich Panel Market, driven by stringent building codes and sustainability targets. The European Union enforces strict energy regulations, encouraging builders to adopt high-performance insulation materials. It experiences strong demand in industrial warehousing, cold storage, and modern commercial spaces. Germany, France, and Italy lead in advanced manufacturing of panels, while Eastern Europe shows rapid adoption through infrastructure expansion. The region also focuses on fire-resistant solutions, with mineral wool panels gaining significant traction in urban projects. Supportive policies for circular economy and green-certified buildings consolidate Europe’s leadership in this market.

Asia-Pacific

Asia-Pacific represents 28% of the Sandwich Panel Market, supported by rapid urbanization and large-scale industrial growth. China, India, and Southeast Asian countries invest heavily in affordable housing, logistics hubs, and manufacturing parks that rely on quick and cost-effective construction. It also benefits from government-backed infrastructure programs that encourage energy-efficient and lightweight materials. Cold storage facilities expand across the region due to rising demand for processed food and pharmaceuticals. Japan and South Korea demonstrate technological advancements in fire-retardant and eco-friendly panels. The combination of population growth, industrialization, and policy support positions Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America contributes 7% of the Sandwich Panel Market, with demand centered on industrial and commercial projects. Brazil and Mexico lead adoption due to growth in logistics, food processing, and retail infrastructure. It demonstrates gradual acceptance in residential construction, particularly in prefabricated housing solutions that address urban population needs. Limited awareness and higher initial costs remain barriers, yet ongoing government housing initiatives create opportunities. Cold storage expansion in agricultural economies further drives demand for PU panels. Regional players focus on expanding distribution networks to meet the needs of cost-sensitive markets.

Middle East and Africa

The Middle East and Africa account for 10% of the Sandwich Panel Market, driven by infrastructure expansion and urban development projects. Gulf countries invest heavily in commercial complexes, airports, and industrial hubs where insulated panels provide durability and efficiency. It also finds strong demand in cold storage, supporting food security initiatives in import-dependent nations. Africa demonstrates early adoption, led by South Africa and Nigeria, where urban growth and industrialization accelerate. Fire-resistant and lightweight panels are gaining traction in high-temperature climates. Continuous government spending on construction supports steady growth, although limited manufacturing capacity makes the region dependent on imports.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Sandwich Panel Market features led by Kingspan Group, Owens Corning, Isopan, PFB Corporation, Metecno Group, Green Span Profiles, American Insulated Panel, Metl-Span, KPS Global, and Dana Group of Companies. The Sandwich Panel Market demonstrates intense competition, with companies focusing on innovation, sustainability, and regional expansion to strengthen their positions. Market leaders invest in advanced insulation technologies, fire-resistant materials, and recyclable components to align with evolving regulatory standards. Strong emphasis on energy efficiency supports adoption across industrial, commercial, and residential applications. Manufacturers differentiate through tailored solutions for cold storage, logistics hubs, and modular construction, where thermal performance and quick installation remain critical. Strategic mergers, acquisitions, and partnerships expand global reach while enabling entry into emerging economies. Continuous R&D ensures improvements in panel durability, design flexibility, and cost efficiency, reinforcing competitiveness in a rapidly evolving construction landscape.

Recent Developments

- In April 2025, Philips launched the Series 7000, i9000, and i9000 Prestige Ultra electric shavers in India, featuring advanced AI-powered SkinIQ technology that adapts to individual skin and beard types for an optimized, irritation-free shave.

- In January 2025, In India, rapid urbanization and infrastructure development fuel demand for thermally efficient sandwich panels. The India market is expected to grow at a CAGR of 8.4% from 2025 to 2031, with companies like Metecno Group and Kingspan Group actively expanding their insulated and fire-resistant panel offerings for commercial and industrial.

- In June 2024, Kingspan completed the acquisition of a Thailand-based manufacturer of insulated panels, FatekAdvance Insulation Company. The facility in the Rojana Industrial Park Ayutthaya has been renamed Kingspan Insulated Panels (Thailand) Co, Limited. They aim to manufacture sandwich panels together.

- In April 2024, Supplier WNL B.V. and SAB-profiel (a manufacturer collaborating with Tata Steel Limited) resulted in the development of a unique and durable sandwich roof panel system for greenhouses called the WNL Easyjoint.

Market Concentration & Characteristics

The Sandwich Panel Market reflects a moderately concentrated structure, characterized by the dominance of global manufacturers alongside a competitive base of regional players. It is defined by high entry barriers due to capital-intensive production processes, strict regulatory requirements, and the need for advanced insulation technologies. Leading companies secure strong positions through innovation, large distribution networks, and a broad portfolio of fire-resistant and energy-efficient solutions. It also shows a clear orientation toward sustainable materials and compliance with green building standards, which enhance differentiation in mature markets. Regional producers compete by offering cost-effective and locally adapted products, especially in emerging economies where affordability influences adoption. The market maintains steady growth potential, supported by rising demand from cold storage, industrial warehouses, and prefabricated housing, while competition continues to drive product development and price optimization.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sandwich Panel Market will expand with rising demand for energy-efficient construction materials.

- It will gain momentum from the growth of prefabricated and modular building projects.

- Cold storage and logistics infrastructure will remain a core driver of adoption.

- Fire-resistant and sustainable panels will capture stronger attention from regulators and builders.

- Industrial growth in emerging economies will strengthen opportunities for manufacturers.

- Technological advancements will improve durability, insulation, and design flexibility.

- Strategic mergers and partnerships will enhance global distribution networks.

- Growing emphasis on recyclable and eco-friendly materials will influence product development.

- Residential adoption will increase with government-backed affordable housing programs.

- Digital modeling and automation will streamline production and expand customization.