Market Overview

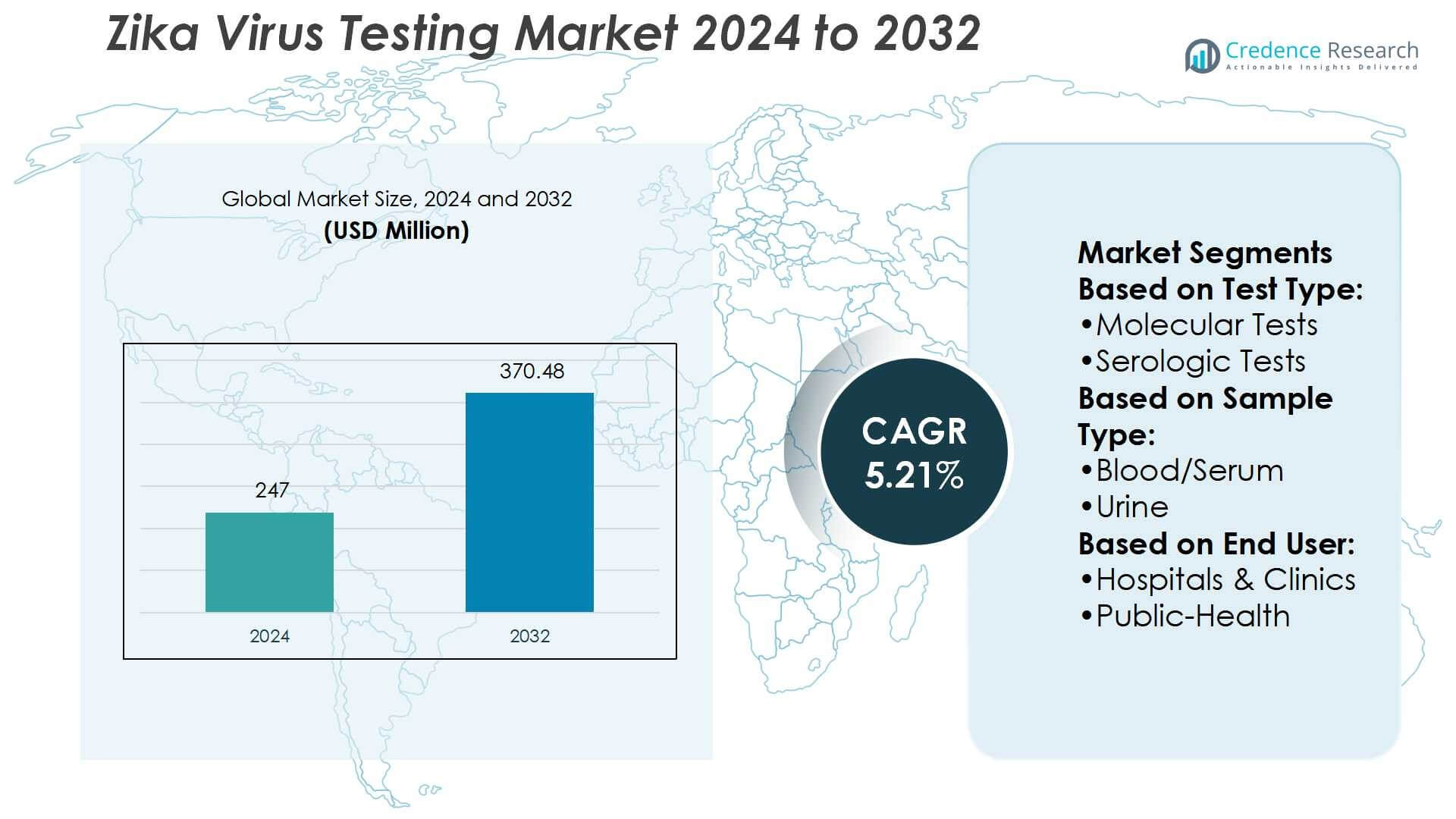

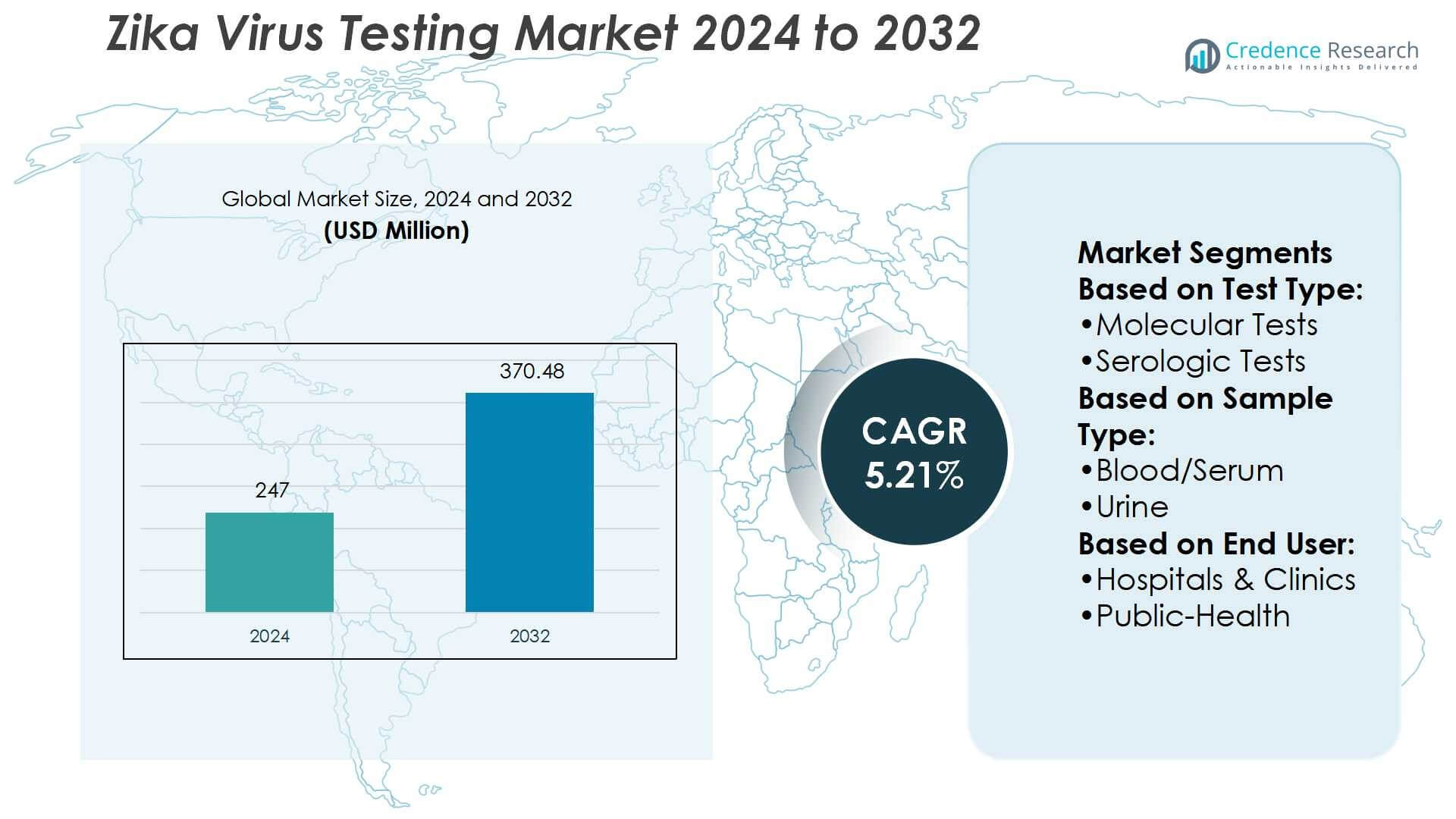

Zika Virus Testing Market size was valued USD 247 million in 2024 and is anticipated to reach USD 370.48 million by 2032, at a CAGR of 5.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zika Virus Testing Market Size 2024 |

USD 247 Million |

| Zika Virus Testing Market, CAGR |

5.21% |

| Zika Virus Testing Market Size 2032 |

USD 370.48 Million |

The Zika Virus Testing Market is shaped by top players including Abbott Laboratories, Hoffmann-La Roche Ltd, Siemens Healthcare GmbH, Quest Diagnostics, DiaSorin (Luminex Corporation), ELITechGroup F, Novacyt Group, Altona Diagnostics GmbH, ChemBio Diagnostics Inc, and Genekam. These companies compete through technological advancements in molecular and serological testing, regulatory approvals, and expanded global distribution networks. Strategic collaborations with public health agencies and research institutions further strengthen their competitive positions. North America leads the Zika Virus Testing Market with a 38% share, driven by robust healthcare infrastructure, early adoption of advanced diagnostic technologies, and strong government-led initiatives for infectious disease surveillance. This regional dominance is reinforced by the presence of established diagnostic laboratories and significant investments in research and development.

Market Insights

Market Insights

- The Zika Virus Testing Market was valued at USD 247 million in 2024 and is expected to reach USD 370.48 million by 2032, growing at a CAGR of 5.21%.

- Rising demand for accurate molecular and serological testing drives market growth, supported by government-led surveillance and outbreak preparedness programs.

- A key trend is the development of portable and rapid testing kits, along with automation in laboratories to enhance efficiency and reduce turnaround times.

- The market faces restraints such as limited awareness in low-income regions and challenges of cross-reactivity with other flaviviruses, which can reduce test reliability.

- North America holds the largest share with 38%, driven by strong healthcare infrastructure and early adoption of advanced diagnostics, while hospitals and clinics remain the leading end-user segment due to high testing volumes and established laboratory networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Test Type

Molecular tests dominate the Zika virus testing market, holding over 55% share in 2024. Their accuracy in detecting viral RNA during the acute infection phase makes them the preferred choice for early diagnosis. Real-time RT-PCR assays remain the gold standard, driven by regulatory approvals and integration into national surveillance programs. Increasing government initiatives to strengthen outbreak preparedness and rising demand for rapid, precise detection further accelerate molecular test adoption. In contrast, serologic tests and PRNT serve confirmatory or complementary roles, primarily in secondary or post-acute diagnostics.

- For instance, ELITechGroup Zika ELITe MGB Kit one evaluation, the kit achieved 100% concordance with a panel of 10 blinded Zika virus RNA samples provided by Qnostics, which included positive and negative plasma specimens.

By Sample Type

Blood and serum samples account for the largest share, representing 48% of the Zika virus testing market. Their dominance stems from widespread clinical acceptance, higher viral load during early infection, and compatibility with molecular and serologic assays. Hospitals and diagnostic labs routinely use serum-based testing for both initial screening and confirmatory diagnostics. While urine and saliva-based tests are emerging due to non-invasive collection, their limited sensitivity restricts adoption. Blood and serum continue to dominate, supported by established laboratory workflows, clinician trust, and ongoing research validating performance in outbreak settings.

- For instance, Abbott’s RealTime ZIKA assay achieves a limit of detection of 30 copies per mL in serum.Blood and serum continue to dominate, supported by established laboratory workflows, clinician trust, and ongoing research validating performance in outbreak settings.

By End-User

Hospitals and clinics lead the end-user segment with a 40% market share in 2024. Their dominance reflects strong infrastructure for molecular diagnostics, rapid access to patient samples, and the need for accurate results to guide clinical care. Public-health laboratories follow closely, benefiting from government funding and surveillance mandates during outbreaks. Point-of-care and home testing are growing but remain limited due to regulatory challenges and performance variability. Research institutes play a supporting role, advancing assay development and validation. Hospitals and clinics maintain leadership through integrated diagnostic capabilities and their central role in outbreak response.

Key Growth Drivers

Rising Incidence of Mosquito-Borne Infections

The growing prevalence of mosquito-borne infections, particularly in tropical and subtropical regions, is a major driver for the Zika virus testing market. Increased outbreaks, often linked to urbanization and climate change, heighten the need for rapid and accurate diagnostics. Governments and healthcare providers are prioritizing surveillance programs to control disease spread. This demand supports broader adoption of molecular and serologic assays, especially in high-risk regions. The need for continuous monitoring and early detection ensures sustained market growth across public health and clinical settings.

- For instance, Roche’s cobas® Zika test for the cobas 6800/8800 systems supports pooled plasma screening of up to six individual donor samples in a single test batch.

Government Initiatives and Funding Support

Strong public health investments and international collaborations significantly boost Zika testing adoption. Agencies like the CDC and WHO fund diagnostic programs, ensuring large-scale deployment of advanced molecular assays during outbreaks. Many governments have integrated Zika testing into national surveillance systems, promoting routine monitoring. Funding for R&D also accelerates the development of faster, more accurate test kits. These measures enhance laboratory infrastructure, improve response preparedness, and increase test accessibility. The combined effect of policies and funding creates a stable demand base for diagnostic companies.

- For instance, Quest Diagnostics offers a Zika Virus RNA, Qualitative TMA Panel which uses both serum (3 mL preferred) and urine (2 mL) specimens in a matched collection.

Advancements in Diagnostic Technologies

Continuous technological progress strengthens the accuracy and efficiency of Zika virus tests. Real-time RT-PCR assays offer rapid results and high sensitivity, making them the gold standard. Miniaturized platforms and portable diagnostic kits are expanding use beyond traditional laboratories, enabling point-of-care adoption. Integration of automation, digital data management, and multiplex testing further improves reliability and reduces turnaround times. These innovations attract investments from both governments and private players, reinforcing market expansion. As healthcare shifts toward precision diagnostics, advanced platforms maintain strong growth momentum in the Zika testing market.

Key Trends & Opportunities

Expansion of Point-of-Care Testing

The shift toward decentralized testing presents a strong opportunity in the Zika virus testing market. Point-of-care diagnostics provide quick results in outbreak-prone areas, especially where laboratory access is limited. Portable RT-PCR kits and rapid immunoassays enable frontline workers to diagnose cases without delays. Rising demand for home and field-based testing solutions further supports market growth. With increased focus on preparedness in resource-constrained settings, companies developing affordable, accurate, and easy-to-use point-of-care devices can capture significant market share over the forecast period.

- For instance, ChemBio offers the DPP® Zika IgM System, a 15-minute rapid immunoassay. It uses 10 µL of sample (fingerstick whole blood, EDTA whole blood, serum or plasma) to detect Zika virus IgM antibodies.

Integration of Multiplex and Digital Solutions

Multiplex testing platforms capable of detecting Zika alongside dengue and chikungunya are gaining traction. These solutions reduce testing time, minimize costs, and improve differential diagnosis accuracy in regions where multiple arboviruses circulate. Digital integration, including cloud-based data sharing and AI-driven analysis, enhances surveillance and response capabilities. Such systems support real-time outbreak tracking and informed decision-making for public health agencies. The combined adoption of multiplex assays and digital health tools represents a key trend, creating opportunities for companies offering comprehensive and scalable solutions.

- For instance, the MAGPIX® system reads 96-well plates in 60 minutes and supports up to 50 different tests per reaction in its multiplex format. The LIAISON® XL Zika Capture IgM II assay uses the Zika NS1 antigen to reduce cross-reactivity with Dengue and West Nile, improving specificity.

Key Challenges

Cross-Reactivity in Serologic Testing

One of the major challenges in Zika virus testing is cross-reactivity in serologic assays, especially with dengue virus antibodies. This issue compromises test accuracy and complicates diagnosis in endemic regions. False positives lead to clinical uncertainty and limit reliance on serologic testing for confirmatory purposes. While PRNT offers higher specificity, it requires advanced laboratory infrastructure and longer turnaround times. Addressing cross-reactivity through improved test design remains critical for ensuring reliable results and building trust among healthcare providers and patients.

Limited Access in Resource-Constrained Settings

Access to reliable diagnostics continues to challenge low- and middle-income countries where Zika is most prevalent. High costs of molecular assays and limited laboratory infrastructure restrict widespread adoption. Rural and remote regions often lack trained personnel and testing equipment, delaying timely diagnosis. These limitations hinder outbreak management and weaken public health responses. Expanding affordable point-of-care solutions and investing in infrastructure development are essential to overcome this barrier. Without addressing accessibility issues, market penetration in high-burden regions will remain constrained.

Regional Analysis

North America

North America holds the largest share of the Zika virus testing market at 35% in 2024. The region benefits from strong healthcare infrastructure, advanced laboratory networks, and significant government funding for infectious disease surveillance. The United States leads with widespread adoption of molecular assays and integration of Zika testing into public health programs. Collaborations between research institutes and diagnostic companies further enhance technological innovation. Increased awareness, preparedness strategies, and a focus on rapid response during outbreaks reinforce North America’s market dominance, making it the leading hub for high-quality diagnostic solutions and advanced testing adoption.

Europe

Europe accounts for 25% of the Zika virus testing market in 2024, supported by proactive surveillance programs and advanced healthcare systems. Countries such as Germany, France, and the United Kingdom invest heavily in molecular diagnostic platforms and cross-border health initiatives. The region emphasizes travel-related testing, given the risk of imported cases. EU regulatory standards drive the adoption of validated, high-quality assays, strengthening clinical reliability. Research collaborations with global institutions and emphasis on developing multiplex diagnostic kits further boost Europe’s position. Rising awareness of mosquito-borne infections sustains steady demand across hospitals, clinics, and public health laboratories.

Asia Pacific

Asia Pacific represents 20% of the Zika virus testing market, driven by high vulnerability to mosquito-borne diseases. Countries including India, China, and Southeast Asian nations experience recurrent outbreaks, creating urgent demand for accurate diagnostics. Limited infrastructure in rural regions boosts opportunities for portable point-of-care testing devices. Governments and international agencies are expanding surveillance programs and funding research on cost-effective diagnostic tools. The adoption of molecular assays is rising in urban centers with better laboratory facilities. With rapid healthcare investments and growing disease awareness, Asia Pacific is emerging as a key growth region for Zika virus testing solutions.

Latin America

Latin America captures 15% of the Zika virus testing market, with Brazil and Colombia as major contributors. The region is highly affected by mosquito-borne diseases, making Zika surveillance and testing a priority. Public health agencies actively collaborate with global organizations to strengthen laboratory networks and deploy rapid diagnostic tools. However, resource constraints limit the widespread use of advanced molecular assays. Growing demand for affordable and portable testing kits supports adoption in rural and semi-urban areas. Government-led outbreak response programs and rising regional awareness continue to drive testing demand, reinforcing Latin America’s strategic role in this market.

Middle East & Africa

The Middle East & Africa hold a smaller share of 5% in the Zika virus testing market. Limited healthcare infrastructure and financial constraints restrict access to advanced molecular diagnostics across much of the region. However, public health concerns related to travel-associated Zika cases are driving targeted adoption in select urban centers. Partnerships with international organizations support training and deployment of essential diagnostic kits. While testing uptake remains low, rising investments in healthcare infrastructure and growing awareness of mosquito-borne diseases present gradual opportunities for market penetration, particularly through affordable point-of-care solutions and government-supported surveillance programs.

Market Segmentations:

By Test Type:

- Molecular Tests

- Serologic Tests

By Sample Type:

By End User:

- Hospitals & Clinics

- Public-Health

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Zika Virus Testing Market features key players such as ELITechGroup F, Abbott Laboratories, Novacyt Group, Hoffmann-La Roche Ltd, Quest Diagnostics, Genekam, Siemens Healthcare GmbH, ChemBio Diagnostics Inc, DiaSorin (Luminex Corporation), and Altona Diagnostics GmbH. The Zika Virus Testing Market is characterized by strong competition driven by innovation, regulatory compliance, and global health preparedness. Companies focus on developing advanced molecular and serologic tests to improve detection accuracy and reduce turnaround times. Automation and integration of high-throughput platforms are key strategies to meet large-scale screening demands, especially during outbreak situations. Market participants also emphasize cost-effective and portable solutions to expand testing access in resource-limited regions. Strategic partnerships with healthcare providers, public health agencies, and research institutions strengthen distribution channels and enhance credibility. In addition, continuous investment in research and development supports the introduction of next-generation assays, enabling early detection and minimizing cross-reactivity with other flaviviruses. Regulatory approvals play a critical role in shaping market dynamics, with successful clearances accelerating adoption and market entry. Overall, competitive differentiation is driven by technological advancement, global outreach, and the ability to scale production in response to health emergencies.

Key Player Analysis

- ELITechGroup F

- Abbott Laboratories

- Novacyt Group

- Hoffmann-La Roche Ltd

- Quest Diagnostics

- Genekam

- Siemens Healthcare GmbH

- ChemBio Diagnostics Inc

- DiaSorin (Luminex Corporation)

- Altona Diagnostics GmbH

Recent Developments

- In February 2025, Thermo Fisher Scientific announced an agreement to acquire Solventum’s Purification & Filtration business, a global virus filtration and purification technology provider.

- In October 2024, Asahi Kasei Medical launched Planova FG1, a next-generation virus removal filter with seven times higher flux than previous models, enhancing productivity in biopharmaceutical manufacturing.

- In December 2023, Sulzer’s launch of the SULAC technology addresses growing market demand for lactic acid by enabling its efficient conversion into lactide, a critical intermediate for producing polylactic acid (PLA).

- In May 2023, TotalEnergies Corbion collaborated with Bluepha Co. Ltd for making advanced sustainable biomaterials solutions in China. This is possible by combining polyhydroxyalkanoates (PHA) of Bluepha® with Luminy® polylactic acid technology.

Report Coverage

The research report offers an in-depth analysis based on Test Type, Sample Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as global health agencies strengthen preparedness against vector-borne diseases.

- Rising investment in molecular diagnostics will improve test sensitivity and reliability.

- Portable and rapid testing kits will gain wider adoption in resource-limited settings.

- Integration of automation will enhance laboratory throughput and efficiency.

- Growing public-private partnerships will accelerate research and product development.

- Increased surveillance programs will drive demand for large-scale screening solutions.

- Point-of-care testing will emerge as a key focus for remote healthcare delivery.

- Regulatory approvals will continue to shape competitive positioning and market entry.

- Advancements in multiplex testing will support simultaneous detection of multiple infections.

- Expansion into emerging regions will create significant growth opportunities for manufacturers.

Market Insights

Market Insights