Market Overview

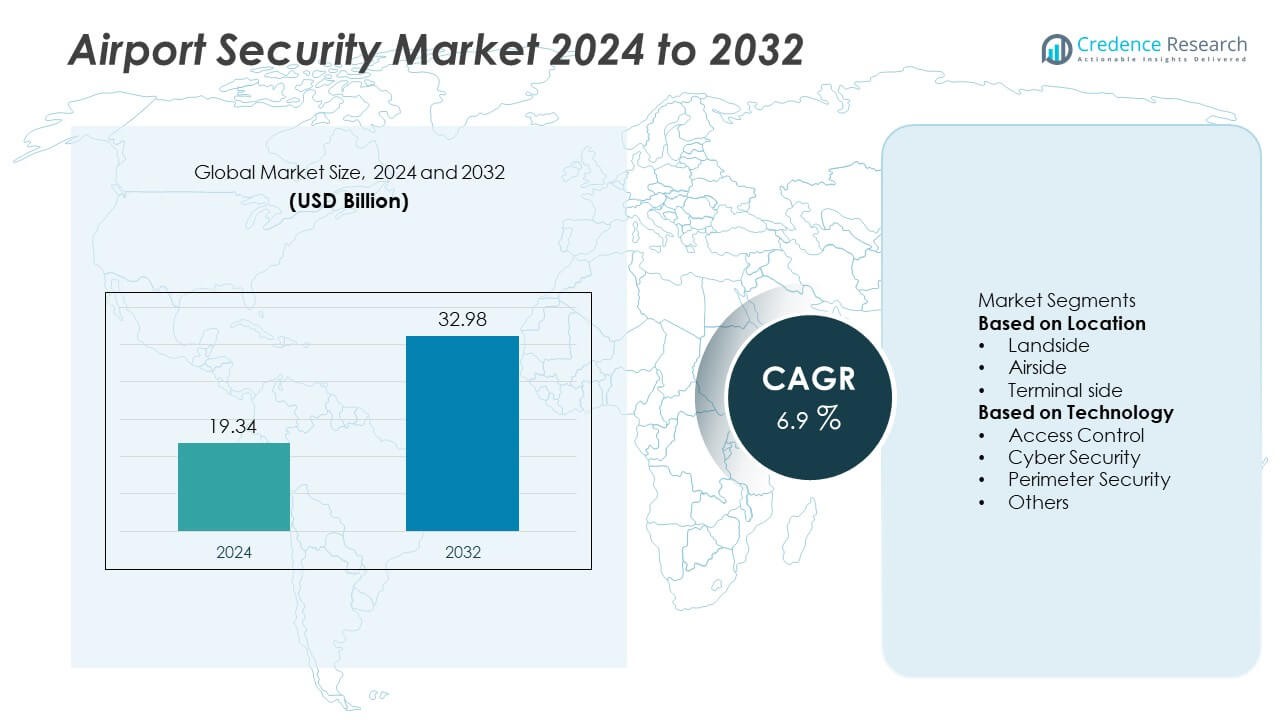

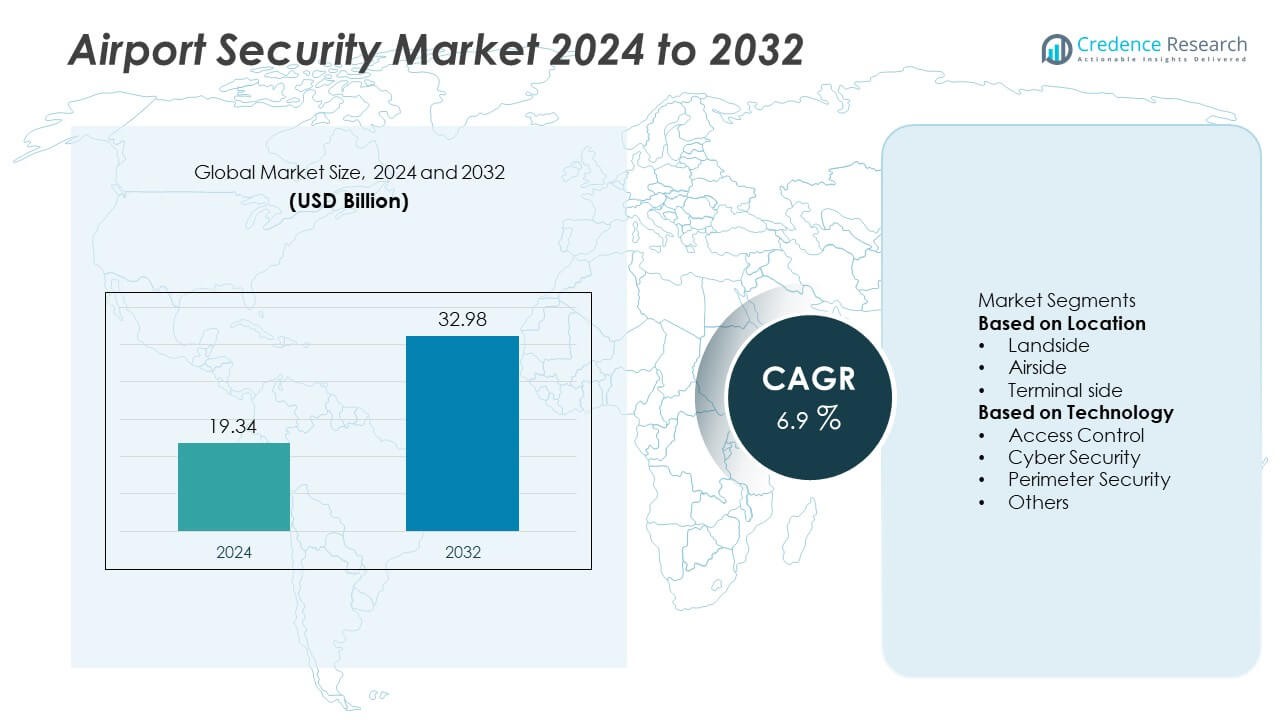

The global Airport Security Market was valued at USD 19.34 billion in 2024 and is projected to reach USD 32.98 billion by 2032, expanding at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Security Market Size 2024 |

USD 19.34 Billion |

| Airport Security Market, CAGR |

6.9% |

| Airport Security Market Size 2032 |

USD 32.98 Billion |

The airport security market is dominated by major players such as IBM, Thales, Honeywell International Inc., Siemens, Leidos, SITA, Amadeus IT Group SA, Bosch Sicherheitssysteme GmbH, Genetec Inc., and Elbit Systems Ltd. These companies lead through advanced technologies in biometric verification, cybersecurity, and smart surveillance systems. North America remains the leading region with a 36.8% market share in 2024, driven by high investment in AI-powered and integrated security infrastructure. Europe follows with 27.6% share, supported by strict aviation safety standards and modernization initiatives. Asia-Pacific shows rapid growth, fueled by airport expansion and increasing adoption of digital security solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global airport security market was valued at USD 19.34 billion in 2024 and is projected to reach USD 32.98 billion by 2032, expanding at a CAGR of 6.9%.

- Growth is driven by increasing passenger traffic, strict regulatory standards, and rising investment in advanced screening, biometric, and surveillance technologies.

- Emerging trends include integration of AI-based analytics, IoT-enabled perimeter systems, and contactless biometric verification to enhance operational efficiency and passenger convenience.

- The market is highly competitive, with key players such as IBM, Thales, Honeywell International Inc., Siemens, Leidos, and SITA focusing on digital transformation, cloud security, and smart monitoring solutions.

- North America leads with 36.8% share, followed by Europe at 27.6% and Asia-Pacific at 23.4%; by location, the airside segment dominates with 46.2% share, while access control leads the technology segment with 38.7% share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Location

The airside segment dominates the airport security market with around 46.2% share in 2024. Its leadership is driven by stringent safety mandates for aircraft operations, baggage screening, and ground personnel monitoring. Airports are investing in advanced surveillance, biometric systems, and vehicle tracking solutions to prevent unauthorized access to runways and hangars. The terminal side follows, supported by the growing adoption of passenger screening and facial recognition technologies, while the landside segment is expanding due to rising focus on public area protection and traffic management systems.

- For instance, Thales has implemented its TopSky – ATC (Air Traffic Control) automation solution at Dubai International Airport, which is helping to improve overall operational efficiency and resilience.

By Technology

The access control segment leads the market with approximately 38.7% share in 2024. Growth is fueled by the deployment of biometric identification, smart card authentication, and automated gates to ensure restricted access within high-security airport zones. Cybersecurity is gaining traction as airports adopt cloud-based operations and IoT-enabled systems, driving demand for threat detection and data protection tools. Perimeter security systems, including radar and motion detection, are also expanding with increased investment in airport infrastructure modernization.

- For instance, Heathrow Airport uses advanced biometric technology, provided by multiple suppliers like SITA and the UK Border Force’s e-gates, to verify identity and improve security at key airport checkpoints, successfully processing large numbers of passengers with minimal manual intervention.

Key Growth Drivers

Growing Passenger Traffic and Infrastructure Expansion

Rising global air travel is a major driver for the airport security market. Increasing passenger volumes demand advanced screening systems, automated gates, and efficient crowd management solutions. Airports are investing in smart surveillance, biometric verification, and baggage inspection systems to enhance safety while maintaining operational flow. The surge in international routes and new airport construction projects in Asia-Pacific and the Middle East further amplify the need for high-performance security infrastructure, fostering consistent technology adoption across terminals and airside facilities.

- For instance, Amadeus IT Group provides various biometric solutions to airports globally, which help in reducing bottlenecks and increasing security. These solutions enable a more seamless and contactless passenger experience from check-in to boarding by using facial recognition technology, without needing to repeatedly present physical documents.

Rising Threats and Regulatory Compliance Requirements

Stringent global aviation security standards are fueling demand for advanced security technologies. Growing concerns over terrorism, smuggling, and cyber threats have prompted authorities like ICAO and TSA to tighten regulatory frameworks. Airports are deploying AI-powered scanners, behavioral analytics, and perimeter defense systems to comply with evolving mandates. Continuous monitoring and upgraded surveillance are becoming essential to ensure compliance and passenger safety, compelling stakeholders to adopt integrated security ecosystems that minimize vulnerabilities and streamline regulatory reporting.

- For instance, Leidos provides AI-powered threat detection and screening technologies for aviation, ports, borders, and critical infrastructure customers globally, enhancing overall security compliance with standards like those from the TSA and ICAO. Leidos has more than 24,000 security products deployed across 120 countries and is an industry leader in fully integrated and automated checked baggage security systems.

Technological Advancements in AI and Biometric Security

Rapid adoption of AI, machine learning, and biometric technologies is transforming airport security operations. Facial recognition, fingerprint scanners, and automated access control enhance accuracy and reduce human intervention. AI-based video analytics supports real-time threat detection and predictive maintenance of surveillance equipment. These innovations improve security efficiency, reduce passenger wait times, and lower operational costs. Airports in North America and Europe are leading adoption, driving competitive differentiation and setting new benchmarks for security automation and intelligent monitoring.

Key Trends and Opportunities

Integration of Smart and Connected Security Systems

A key trend is the growing shift toward integrated, IoT-enabled airport security platforms. Smart sensors, AI analytics, and cloud-based command centers enhance situational awareness and decision-making. The integration of access control, perimeter security, and cyber defense within a unified network enables airports to respond faster to potential threats. This trend supports real-time data sharing and automation, driving improved efficiency, scalability, and predictive maintenance across security operations.

- For instance, Genetec’s unified security platform at Toronto Pearson International Airport integrates more than 2,000 security devices, providing real-time data analytics and situational awareness, enhancing response times to security threats and improving operational efficiency.

Rising Focus on Contactless and Passenger-Friendly Security

Post-pandemic operations have accelerated the shift toward contactless passenger screening and biometric verification. Airports are replacing manual ID checks with facial and iris recognition systems to streamline passenger movement. These technologies not only improve hygiene and safety but also reduce congestion at checkpoints. Major hubs such as Heathrow and Changi have implemented biometric boarding systems, highlighting a broader opportunity for technology providers offering seamless, touch-free travel experiences.

- For instance, Ben Gurion Airport has deployed a facial recognition system with biometric gates, allowing Israeli citizens and tourists to pass through automated border control, improving security and reducing the need for physical contact.

Key Challenges

High Implementation and Maintenance Costs

The cost of deploying advanced security infrastructure remains a major challenge. AI-based surveillance, biometric systems, and cybersecurity tools require significant investment and skilled workforce for operation and maintenance. Smaller airports, particularly in developing economies, face financial constraints in adopting integrated security solutions. Additionally, upgrading legacy systems to meet new compliance standards adds to operational expenses, hindering widespread adoption.

Data Privacy and Cybersecurity Risks

Increasing digitization of airport systems exposes operations to potential cyberattacks. Biometric databases, passenger records, and IoT-connected devices are frequent targets of data breaches. Ensuring robust encryption, network segmentation, and compliance with data protection regulations like GDPR is crucial. Despite growing cybersecurity investments, vulnerabilities persist due to outdated systems and third-party integrations, posing ongoing risks to airport operations and passenger trust.

Regional Analysis

North America

North America holds the largest share of the airport security market with around 36.8% in 2024. The region’s dominance is driven by advanced adoption of biometric verification, AI-based surveillance, and cybersecurity solutions. Major airports across the United States and Canada continue to invest heavily in automated screening and perimeter protection systems. The Transportation Security Administration (TSA) regulations and modernization programs further enhance technology upgrades. High passenger traffic and strong government funding support continuous innovation, making North America a leading hub for security infrastructure deployment and technology integration.

Europe

Europe accounts for about 27.6% share of the global airport security market in 2024. The region benefits from stringent EU aviation safety regulations and growing emphasis on border control and passenger screening efficiency. Leading airports in the United Kingdom, Germany, and France are adopting facial recognition and integrated monitoring systems to strengthen operational safety. Sustainability-focused infrastructure upgrades also encourage the use of energy-efficient security technologies. The growing presence of regional technology vendors and collaborative R&D initiatives across member states are further boosting the European market’s competitive position.

Asia-Pacific

Asia-Pacific captures nearly 23.4% share of the airport security market in 2024, showing rapid growth due to expanding air travel and new airport construction projects. Countries such as China, India, Japan, and Singapore are heavily investing in smart airport infrastructure. The region’s governments prioritize biometric verification, access control, and perimeter protection to address increasing passenger volumes and security threats. Strong economic growth, coupled with digital transformation initiatives in aviation management, supports the large-scale adoption of AI-driven and IoT-enabled security technologies across major regional airports.

Latin America

Latin America holds 7.1% share of the airport security market in 2024, supported by increasing modernization of airport infrastructure and rising regional connectivity. Governments in Brazil, Mexico, and Colombia are implementing advanced scanning and video surveillance systems to improve passenger safety and regulatory compliance. Regional airports are integrating smart access control and baggage inspection technologies to enhance efficiency. Despite limited funding in smaller economies, the growing focus on tourism and international flight expansion continues to drive investment in robust airport security measures across the region.

Middle East and Africa

The Middle East and Africa region accounts for around 5.1% share of the airport security market in 2024. The Middle East leads regional demand with large-scale projects such as Dubai International and Hamad International airports adopting advanced biometric and smart surveillance systems. Growing passenger traffic and strategic positioning as global transit hubs are key growth factors. African nations are increasingly investing in perimeter and access control technologies to meet international safety standards. Continued infrastructure development and security upgrades are creating new opportunities for technology providers in the region.

Market Segmentations:

By Location

- Landside

- Airside

- Terminal side

By Technology

- Access Control

- Cyber Security

- Perimeter Security

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the airport security market is characterized by strong participation from key players such as IBM, Thales, Honeywell International Inc., Genetec Inc., Siemens, Elbit Systems Ltd., Amadeus IT Group SA, Leidos, SITA, and Bosch Sicherheitssysteme GmbH. These companies focus on developing integrated security platforms combining biometric access control, AI-based surveillance, and advanced threat detection systems. Strategic partnerships with airport authorities and government agencies support the deployment of large-scale security infrastructure projects. Continuous innovation in cybersecurity, baggage screening, and smart surveillance technologies enhances operational efficiency and compliance with global aviation safety standards. Players are also emphasizing digital transformation, cloud integration, and IoT-enabled systems to deliver real-time analytics and predictive monitoring capabilities. Additionally, mergers, acquisitions, and product upgrades remain key strategies for expanding geographic presence and strengthening solution portfolios, as airports worldwide move toward fully automated and connected security ecosystems.

Key Player Analysis

Recent Developments

- In October 2025, Thales was named “Company of the Year 2025” by Frost & Sullivan for its work in automated border‑control and airport solutions.

- In June 2025, Honeywell International Inc. announced its “Cyber Proactive Defense” and OT Security Operations Center suite — AI‑enabled cybersecurity solutions for industrial and airport‑adjacent operations.

- In October 2024, Thales entered into a strategic partnership with Adani Airport Holdings Limited (AAHL) in India to deploy the “Fly‑to‑Gate” biometric passenger‑journey solution (touchless facial recognition) plus a new Airport Operations Control Centre (APOC) across AAHL’s airports.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Location, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI-driven surveillance and threat detection will enhance airport security efficiency.

- Biometric verification systems such as facial and iris recognition will become standard across major airports.

- Integration of IoT-enabled smart devices will improve real-time monitoring and incident response.

- Cybersecurity solutions will gain importance as airports digitize operations and expand cloud-based systems.

- Demand for contactless and automated screening technologies will continue to rise post-pandemic.

- Governments will increase funding for airport modernization and advanced security infrastructure.

- Collaboration between technology providers and airport authorities will accelerate innovation in security ecosystems.

- Emerging economies will invest heavily in perimeter security and access control systems.

- Predictive analytics and data integration will support proactive threat prevention and risk management.

- Sustainability goals will drive adoption of energy-efficient and low-maintenance security technologies.

Market Segmentation Analysis:

Market Segmentation Analysis: