| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Snow Removal Equipment Market Size 2024 |

USD 411.60 million |

| Airport Snow Removal Equipment Market, CAGR |

5.07% |

| Airport Snow Removal Equipment Market Size 2032 |

USD 610.09 million |

Market Overview:

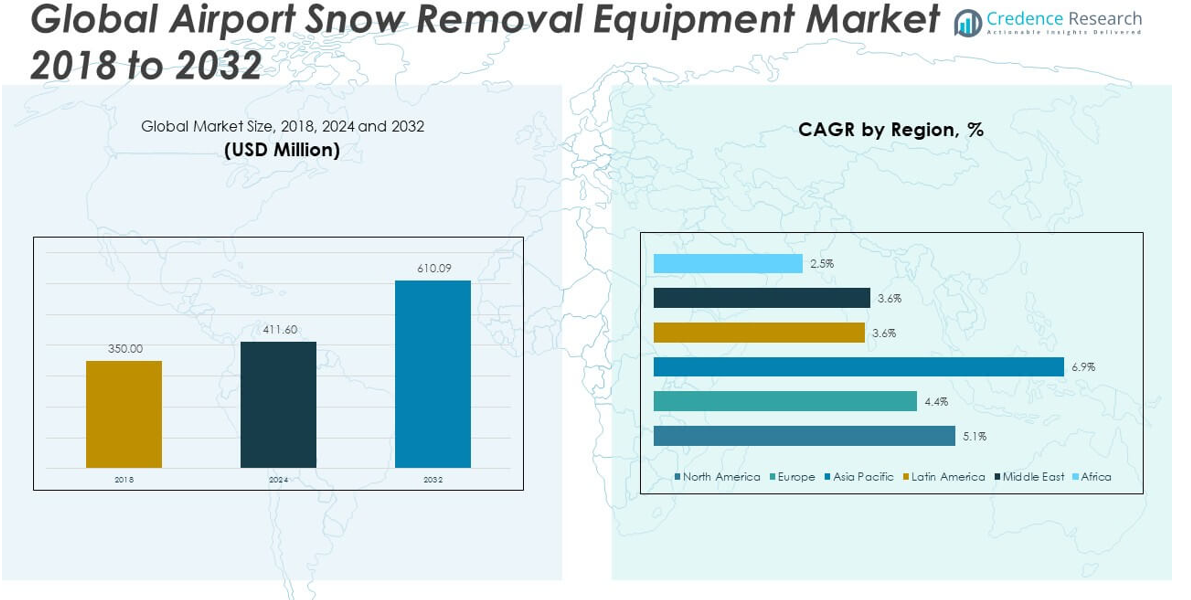

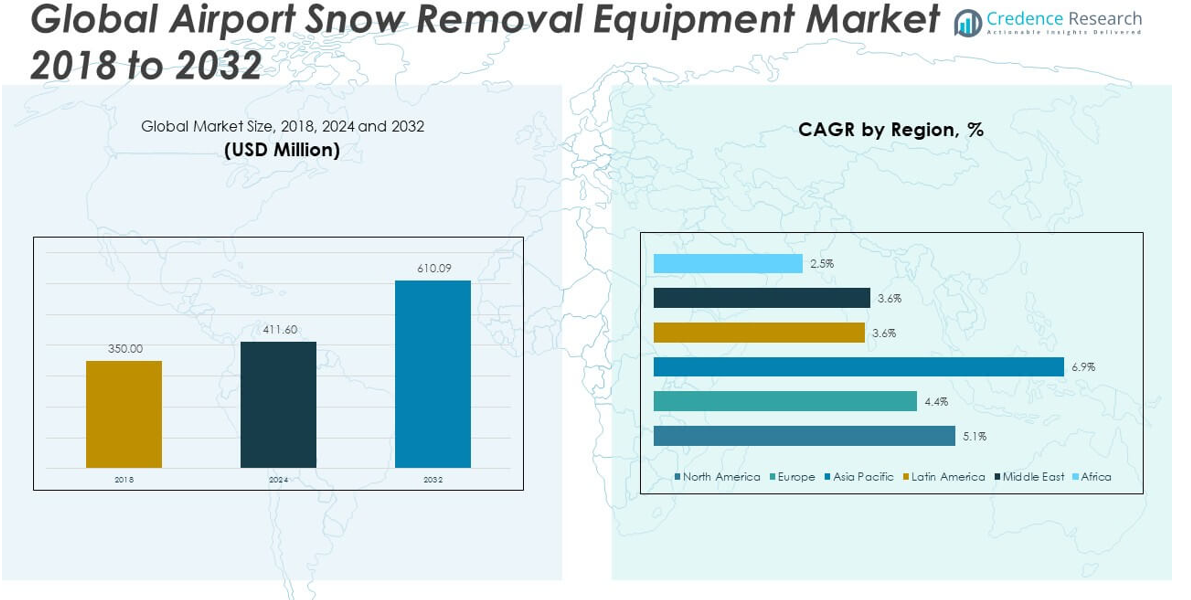

The Global Airport Snow Removal Equipment Market size was valued at USD 350.00 million in 2018 to USD 411.60 million in 2024 and is anticipated to reach USD 610.09 million by 2032, at a CAGR of 5.07% during the forecast period.

Several key factors are driving the growth of the Global Airport Snow Removal Equipment Market. Airports located in snow-prone regions face operational challenges during winter months, including runway closures, aircraft ground delays, and passenger safety risks. To address these issues, airport authorities are increasingly investing in high-performance snow removal fleets capable of clearing large surfaces quickly and efficiently. Advancements in snow removal technology—such as GPS-guided vehicles, multi-functional clearing systems, and eco-friendly de-icing solutions—are also fueling market expansion. Government regulations mandating improved airport safety and runway clearance response times are pushing operators to modernize outdated equipment. In addition, rising global air traffic, even in northern latitudes, is prompting airport authorities to adopt proactive winter operations strategies supported by robust snow management infrastructure. The growing trend toward airport privatization and the development of regional airports in cold-climate countries further enhance market potential by expanding the customer base for specialized snow removal systems.

Regionally, North America dominates the Global Airport Snow Removal Equipment Market, led by the United States and Canada. These countries operate some of the busiest airports in the world, many of which experience prolonged winter conditions that require extensive snow and ice control capabilities. The presence of leading manufacturers, stringent Federal Aviation Administration (FAA) regulations, and strong airport maintenance budgets support continued investments in advanced snow removal fleets. Europe holds the second-largest market share, with countries like Germany, Norway, Sweden, and Finland actively investing in high-efficiency winter maintenance solutions. The region prioritizes safety and punctuality in airport operations, driving the demand for automated and high-capacity equipment. Asia-Pacific is emerging as a growth hub, particularly in northern China, South Korea, and Japan, where cold winters impact major airports. Rapid air traffic growth and infrastructure upgrades across the region are encouraging broader adoption of winter operations technologies. Latin America, the Middle East, and Africa represent smaller markets, but high-altitude airports and seasonal snowfall in specific areas such as the Andes and Middle Eastern mountain regions offer selective demand. Across all regions, the need to minimize downtime, ensure flight safety, and comply with international aviation standards continues to shape the evolution of the airport snow removal equipment market.

Market Insights:

- The Global Airport Snow Removal Equipment Market was valued at USD 350.00 million in 2018, reached USD 411.60 million in 2024, and is anticipated to grow to USD 610.09 million by 2032, registering a CAGR of 5.07% during the forecast period (2024–2032).

- Changing climate patterns are increasing the frequency and intensity of snowfall in key aviation regions, prompting airports to invest in high-performance snow removal equipment to ensure continuous operations and passenger safety.

- Strict regulatory standards from aviation authorities like the FAA and ICAO mandate fast and efficient runway clearance, driving the adoption of advanced equipment with automated controls and high snow-clearing capacity.

- Rising air traffic across cold-climate regions such as Canada, Northern Europe, Russia, and Northeast Asia is boosting demand for efficient snow management systems to minimize delays, diversions, and operational risks.

- Technological advancements including GPS-guided plows, real-time performance monitoring, and eco-friendly de-icing solutions are enhancing operational efficiency and supporting airport sustainability goals.

- High capital investment remains a barrier, especially for small and regional airports with limited procurement budgets and long equipment replacement cycles, impacting overall market penetration.

- North America dominates the market, led by the United States and Canada, due to prolonged winter conditions and stringent aviation safety mandates. Europe holds the second-largest share, while Asia-Pacific is emerging rapidly, driven by rising air traffic and infrastructure development in regions like northern China, South Korea, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Frequency of Snowfall Events in Key Aviation Regions:

Changing climate patterns have led to more intense and unpredictable snowfall across several major aviation regions. Airports in North America, Europe, and parts of Asia must maintain operational readiness during prolonged and severe winter events. The Global Airport Snow Removal Equipment Market is responding to this need with robust solutions capable of fast, large-scale snow and ice removal. It supports airports in preventing delays, cancellations, and safety hazards caused by snow accumulation on runways and taxiways. With winter operations becoming a year-round preparedness concern, airports are expanding their fleets with reliable and high-capacity snow removal machinery. This driver is especially prominent in countries with busy air routes and high passenger volumes throughout the winter months.

- For instance, Øveraasen’s RS 400 runway sweeper, deployed at Oslo Airport, is capable of clearing a 60-meter-wide runway at speeds up to 60 km/h, removing up to 5,000 tons of snow per hour, as documented in Øveraasen’s technical specifications and airport operational reports.

Stringent Aviation Safety Regulations Mandating Runway Clearance:

International and national aviation authorities enforce strict standards for runway and apron conditions during winter operations. These regulations demand timely snow removal, efficient de-icing, and continuous monitoring to avoid ground incidents and protect aircraft performance. The Global Airport Snow Removal Equipment Market benefits from mandates by organizations like the FAA and ICAO, which require airports to meet specific response times and safety benchmarks. It encourages procurement of advanced equipment with faster clearance rates and automated control features. Non-compliance can lead to operational shutdowns, penalties, or loss of certifications, prompting airport authorities to prioritize equipment upgrades. The regulatory environment thus serves as a critical catalyst for sustained investment in snow removal infrastructure.

- For instance, The Boschung Jetbroom 10000, used at major airports such as Zurich, is engineered for high performance. It’s a multifunctional vehicle designed for both winter and summer operations, offering efficient snow removal, de-icing, vacuum cleaning, and surface cleaning.

Rising Air Traffic in Cold-Climate Regions Boosts Demand:

Commercial and cargo flight volumes continue to rise in regions prone to heavy snowfall, including Canada, Northern Europe, Russia, and Northeast Asia. These areas host international and domestic airports that must maintain uninterrupted operations despite adverse weather. The Global Airport Snow Removal Equipment Market serves this growing need by supplying equipment designed to maintain safe, clear runways during peak travel seasons. It enables airports to avoid financial losses caused by delays, diversions, and ground handling inefficiencies. The increasing number of regional and municipal airports in snow-prone areas further contributes to market expansion. This trend reinforces the need for scalable snow removal solutions adaptable to different airport sizes and capacities.

Technological Advancements in Snow Removal Machinery:

The market is experiencing innovation through the introduction of automated, multifunctional, and environmentally efficient snow removal equipment. Manufacturers are integrating GPS tracking, remote diagnostics, and real-time performance monitoring into their machines. The Global Airport Snow Removal Equipment Market is evolving to include high-efficiency sweepers, combination plow-blowers, and electric or hybrid-powered de-icing vehicles. It supports faster deployment, reduced manual labor, and greater energy efficiency in snow management operations. These advancements align with airport sustainability goals while meeting operational demands. Airports are increasingly investing in smart snow removal systems that reduce response time and optimize resource allocation during winter storms.

Market Trends:

Shift Toward Multi-Function and All-in-One Snow Removal Vehicles:

Airports are increasingly opting for multi-functional snow removal equipment that can perform multiple tasks in a single pass. These all-in-one machines combine plowing, sweeping, and blowing capabilities to reduce turnaround time and minimize equipment congestion on runways. The Global Airport Snow Removal Equipment Market is adapting to this trend by offering compact and integrated designs that enhance operational efficiency. It allows airports to streamline snow management processes while reducing fleet size and maintenance costs. This trend supports improved runway availability during peak winter events and enhances safety through quicker surface clearance. Manufacturers are focusing on product lines that deliver versatility and rapid deployment across different airport zones.

- For instance, M-B Companies’ MB5 multi-function snow removal vehicle, in operation at Chicago O’Hare International Airport, integrates plowing, sweeping, and air-blowing in a single unit, clearing up to 3,000 tons of snow per hour and reducing runway closure times by 30%, as detailed in M-B Companies’ product literature and airport performance reviews.

Rising Integration of Telematics and Fleet Management Systems:

Airport authorities are investing in telematics to track the performance, location, and usage patterns of snow removal fleets. These systems offer real-time data on fuel consumption, blade positioning, and operational speed, allowing for better coordination during severe weather conditions. The Global Airport Snow Removal Equipment Market is seeing growing demand for intelligent fleet management solutions that support proactive maintenance and optimized resource allocation. It helps reduce downtime, extend equipment life, and support data-driven decision-making. Centralized monitoring also improves workforce efficiency by enabling command centers to adjust operations based on live weather and runway conditions. The use of digital dashboards is becoming standard in snow operations across major international airports.

- For instance, Douglas Dynamics’ ClearPath telematics platform, implemented at Denver International Airport, provides real-time tracking of snow removal vehicles, resulting in a 20% reduction in equipment downtime and a 15% improvement in fleet utilization, as reported in Douglas Dynamics’ annual technology review and airport operational data.

Increased Preference for Electrification and Sustainable Equipment Options:

Environmental sustainability is becoming a core consideration in airport operations, including winter maintenance. Snow removal equipment manufacturers are developing electric-powered sweepers, hybrid de-icing trucks, and low-emission engines to meet airport carbon reduction targets. The Global Airport Snow Removal Equipment Market is aligning with this trend by incorporating green technologies without compromising equipment performance. It supports compliance with environmental regulations and strengthens the reputation of airports as sustainable infrastructure leaders. Airports in Europe and North America are leading early adoption, while emerging markets are gradually exploring these technologies. The trend reflects a broader industry shift toward climate-conscious aviation operations.

Growing Demand for Customization and Regional Adaptability:

Different airports face unique weather conditions, topography, and runway layouts, requiring tailored snow removal solutions. Equipment manufacturers are offering customizable configurations to match local needs, from high-speed sweepers for large international runways to compact units for regional and remote airports. The Global Airport Snow Removal Equipment Market is evolving to provide flexible solutions that can operate effectively in diverse environments. It supports modular attachments, scalable powertrains, and operator-friendly interfaces for easy adaptation. This trend promotes operational resilience and ensures that both large and small airports can maintain safe operations in winter conditions. Customization also enables better cost management and long-term equipment utility.

Market Challenges Analysis:

High Capital Investment and Limited Procurement Cycles:

Airport snow removal equipment involves significant upfront costs due to its specialized design, advanced components, and operational durability. Many small and regional airports operate under constrained budgets, making it difficult to invest in new or upgraded equipment. The Global Airport Snow Removal Equipment Market faces procurement delays due to extended funding approvals and infrequent replacement cycles. It must address the challenge of aligning high-performance expectations with cost-effective solutions. Smaller airports often continue using outdated machinery, increasing safety risks and maintenance burdens. This cost barrier slows overall market penetration, especially in emerging regions where capital allocation prioritizes terminal expansion over ground support systems.

Seasonal Demand Variability and Equipment Utilization Gaps:

Snow removal equipment operates in a highly seasonal pattern, limiting its usage to a few months each year in most regions. The limited operating window affects return on investment and complicates year-round maintenance planning. The Global Airport Snow Removal Equipment Market must balance equipment reliability with low annual utilization rates. It requires manufacturers and operators to optimize for durability, ease of storage, and off-season serviceability. Unpredictable snowfall patterns due to climate variability also make it difficult for airports to plan procurement volumes and deployment strategies. These factors introduce uncertainty into purchasing decisions and create operational inefficiencies for fleet management.

Market Opportunities:

Modernization of Regional and Mid-Sized Airports in Snow-Prone Zones:

Governments and airport authorities are expanding infrastructure in regional and mid-sized airports to support rising air traffic and enhance safety. Many of these facilities operate in cold-weather regions but lack modern snow removal fleets. The Global Airport Snow Removal Equipment Market can capitalize on this gap by offering compact, efficient, and scalable machinery suited for smaller runways and taxiways. It supports enhanced winter readiness while helping airports comply with international safety standards. Increased funding for regional airport upgrades in North America, Northern Europe, and parts of Asia creates favorable conditions for market expansion. Vendors that offer modular, low-maintenance solutions will gain traction in this emerging segment.

Adoption of Automation and Autonomous Snow Clearing Technologies:

Technological advancements in autonomous vehicles are opening new possibilities for automated snow removal operations. Airports are exploring driverless plows and sweepers to reduce labor dependency and improve response time during severe weather. The Global Airport Snow Removal Equipment Market can benefit by delivering autonomous and semi-autonomous solutions integrated with sensors, GPS, and control software. It aligns with broader trends in airport automation and supports safer, more efficient ground operations. Early trials at major airports are showing strong performance, encouraging further adoption. This opportunity favors manufacturers that invest in R&D and partner with airport innovation programs.

Market Segmentation Analysis:

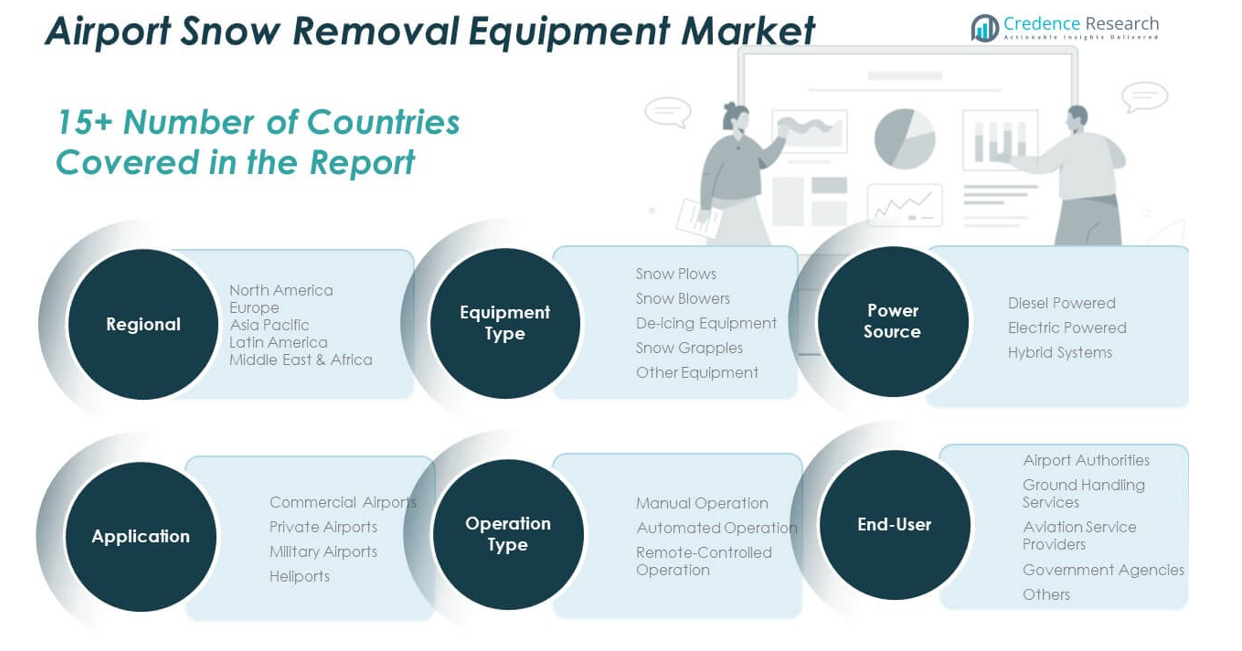

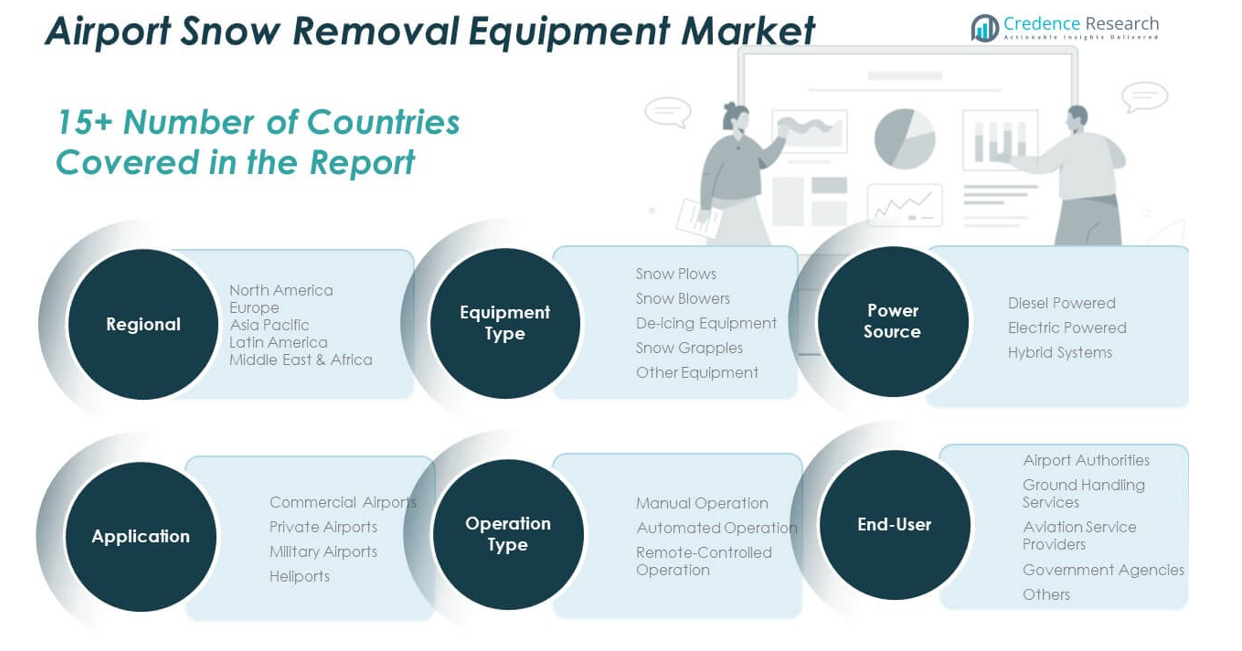

By Equipment Type

The market includes snow plows, snow blowers, de-icing equipment, snow grapples, and other specialized machinery. Snow plows lead the segment due to their efficiency in clearing large runway areas quickly. Snow blowers are widely used in regions with deep snowfall. De-icing equipment is critical for preventing ice accumulation on aircraft and runways, ensuring safety and compliance. Snow grapples and other equipment types support specialized ground operations.

- For instance, Vestergaard’s Elephant Beta de-icing unit, in use at Heathrow and Munich airports, features a 12-meter telescopic boom and can de-ice 10–20 aircraft on a single charge, with operational reports confirming reduced fluid consumption and faster turnaround times.

By Application

Commercial airports represent the largest share due to their continuous flight operations and higher exposure to delays caused by snow. Military airports follow, requiring advanced and responsive snow management. Private airports and heliports form smaller but growing segments, with increased adoption of safety and operational standards.

- For instance, Munich Airport operates a winter maintenance fleet of 184 vehicles, including 152 dedicated to airfield clearing and de-icing. The team of over 600 personnel can clear a runway over 4,000 meters long and 60 meters wide in approximately 30 minutes, ensuring continuous operations across 5.6 million square meters of airfield area.

By End-User

Airport authorities are the primary buyers, driven by safety mandates and operational responsibility. Ground handling services and aviation service providers contribute to demand through fleet and runway support. Government agencies and others play a vital role, especially in public airport modernization projects.

By Power Source

Diesel-powered equipment dominates the market for its durability and power in harsh conditions. Electric-powered systems are expanding, particularly in regions focused on sustainability. Hybrid systems are emerging as a balanced solution, offering efficiency and reduced emissions.

By Operation Type

Manual systems are still used in smaller airports, but the adoption of automated and remote-controlled equipment is rising. Larger airports prefer these systems for their speed, accuracy, and reduced labor needs.

Segmentation:

By Equipment Type

- Snow Plows

- Snow Blowers

- De-icing Equipment

- Snow Grapples

- Other Equipment

By Application

- Commercial Airports

- Private Airports

- Military Airports

- Heliports

By End-User

- Airport Authorities

- Ground Handling Services

- Aviation Service Providers

- Government Agencies

- Others

By Power Source

- Diesel Powered

- Electric Powered

- Hybrid Systems

By Operation Type

- Manual Operation

- Automated Operation

- Remote-Controlled Operation

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Airport Snow Removal Equipment Market size was valued at USD 155.12 million in 2018, reached USD 180.61 million in 2024, and is anticipated to reach USD 267.40 million by 2032, at a CAGR of 5.1% during the forecast period. North America holds the largest share of the Global Airport Snow Removal Equipment Market. It benefits from extensive snowfall across the U.S. and Canada, where major airports require high-capacity snow clearing systems. FAA regulations and strong infrastructure investment drive consistent equipment upgrades. The presence of leading manufacturers and a large number of commercial and regional airports supports steady demand. Automation, hybrid systems, and smart snow management tools are gaining adoption. The region prioritizes runway uptime, passenger safety, and minimal winter delays.

Europe

The Europe Airport Snow Removal Equipment Market size was valued at USD 103.50 million in 2018, reached USD 117.50 million in 2024, and is expected to reach USD 165.61 million by 2032, growing at a CAGR of 4.4%. Europe ranks second in market share and sees strong demand from countries with long winters, such as Germany, Norway, and Sweden. The market is driven by regulatory emphasis on safety, punctuality, and runway clearance efficiency. Airports invest in advanced snow blowers, plows, and eco-friendly de-icing solutions. The adoption of multifunctional and automated vehicles is growing, aligning with EU sustainability goals. Public and private airports continuously modernize fleets to handle severe weather. The region maintains a steady procurement cycle supported by harmonized aviation standards.

Asia Pacific

The Asia Pacific Airport Snow Removal Equipment Market was valued at USD 57.68 million in 2018, increased to USD 72.30 million in 2024, and is projected to reach USD 123.30 million by 2032, at a CAGR of 6.9%. Asia Pacific is the fastest-growing region in the Global Airport Snow Removal Equipment Market. Northern China, Japan, and South Korea face frequent snow events that disrupt operations. Rapid aviation infrastructure expansion and increasing air traffic are driving new demand. Governments are enhancing winter readiness in both major and regional airports. The market is embracing automation, electric equipment, and modular systems for flexible deployment. Long-term growth is supported by rising investment in aviation safety and operational efficiency.

Latin America

The Latin America Airport Snow Removal Equipment Market stood at USD 14.42 million in 2018, reached USD 16.71 million in 2024, and is forecasted to hit USD 22.01 million by 2032, growing at a CAGR of 3.6%. Latin America represents a small but stable segment of the market. Snow removal demand is limited to high-altitude airports in the Andes region. Countries like Chile and Argentina occasionally invest in snow clearing equipment for seasonal use. Equipment procurement is project-based and often linked to international air safety compliance. Airport authorities prefer multi-use or portable units to optimize cost. While growth remains modest, operational readiness in mountainous zones sustains ongoing procurement.

Middle East

The Middle East Airport Snow Removal Equipment Market was valued at USD 12.46 million in 2018, reached USD 13.66 million in 2024, and is projected to reach USD 18.12 million by 2032, registering a CAGR of 3.6%. The Middle East contributes a limited share to the global market, with snow primarily affecting elevated areas like parts of Turkey and Lebanon. Airports in these zones maintain minimal snow clearing capabilities to support safety standards. Market demand is sporadic and largely driven by regional weather variability. Investments are typically confined to multifunctional and mobile systems. The rest of the region has minimal exposure to snow, limiting equipment procurement. Select international airports maintain fleets for rare winter events.

Africa

The Africa Airport Snow Removal Equipment Market was valued at USD 6.83 million in 2018, increased to USD 10.83 million in 2024, and is expected to reach USD 13.65 million by 2032, growing at a CAGR of 2.5%. Africa holds the smallest market share due to limited snowfall across most of the continent. Procurement is concentrated in regions like South Africa and the Atlas Mountains, where snow occasionally affects aviation operations. Equipment investment is low and often aligned with international safety funding or contingency planning. Most airports lack permanent snow fleets and rely on contract-based services. Market expansion remains slow, restrained by minimal demand and budgetary limitations. Growth opportunities are confined to specific high-altitude zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Oshkosh

- Team Eagle

- Kiitokori

- Multihog Limited

- Boschung Group

- P.M. Tech

- Kodiak America

- Overaasen

- ASH Group

Competitive Analysis:

The Global Airport Snow Removal Equipment Market features a moderately concentrated competitive landscape dominated by established manufacturers with specialized expertise in heavy-duty ground support equipment. Key players include Oshkosh Corporation, Boschung Group, Aebi Schmidt Holding AG, M-B Companies, and Team Eagle Ltd. These companies compete on the basis of equipment durability, multi-functionality, and integration of advanced technologies such as GPS tracking and automated controls. The Global Airport Snow Removal Equipment Market values suppliers that offer complete winter maintenance solutions, including plows, sweepers, blowers, and de-icing systems tailored to airport environments. It favors firms with strong after-sales service, training programs, and global distribution networks. Product innovation, environmental compliance, and customization are critical factors shaping market leadership. New entrants face high barriers due to the capital-intensive nature of manufacturing, regulatory certification requirements, and the importance of long-standing relationships with airport authorities. Established players continue to invest in R&D to deliver efficient, sustainable, and intelligent snow removal solutions.

Recent Developments:

- In April 2025, Kodiak America, in collaboration with Chang Robotics and Roush, unveiled the world’s most powerful electric and hybrid commercial snow removal vehicle at the International Aviation Snow Symposium. The vehicle boasts a dual-use power capability, moving up to 8,300 tons of snow per hour at speeds of up to 25 mph, surpassing FAA minimum requirements. It can also serve as an emergency power source or integrate with facility power infrastructure, offering year-round utility for airports and public facilities.

- In March 2025, ASH Group (Aebi Schmidt) secured a record order from Minneapolis-St. Paul International Airport for over 60 snow removal machines, valued at nearly $56 million. The group also began testing its first fully electric airport sprayer, the eASP, at Gardermoen Airport in Oslo, built on an all-electric Volvo FM truck. The eASP applies deicing agents more efficiently and sustainably, reflecting ASH Group’s commitment to innovation and environmental responsibility in airport snow removal operations.

- In January 2025, Overaasen announced a strategic partnership with Husqvarna and Semcon, making Husqvarna a partial owner in Yeti Snow Technology. This collaboration focuses on developing autonomous snow clearing solutions for airports, with successful tests already conducted at Oslo Airport. Additionally, Overaasen introduced the TV 1000+ snowblower, featuring two engines and a capacity to remove up to 8,500 tons of snow per hour, with a unique “flying cab” for optimal operator visibility.

Market Concentration & Characteristics:

The Global Airport Snow Removal Equipment Market shows moderate concentration, with a few established players holding a significant share due to their technical expertise and long-term contracts with major airports. It is defined by high entry barriers related to capital investment, product certification, and performance reliability. The market values specialized engineering, durability under extreme conditions, and the ability to deliver multi-functional, high-efficiency equipment. It serves both large international airports and regional facilities, each with unique operational requirements. The Global Airport Snow Removal Equipment Market emphasizes fleet customization, rapid deployment capabilities, and strong after-sales support. It is characterized by seasonal demand cycles, long product lifespans, and increasing integration of automation and data-driven controls.

Report Coverage:

The research report offers an in-depth analysis based on equipment type, application, end-user, power source, and operation type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising snowfall intensity will increase demand for high-capacity, quick-deployment snow removal equipment.

- Expansion of regional airports in cold-weather zones will create new procurement opportunities.

- Autonomous and semi-autonomous snow removal systems will gain market traction.

- Electrification of ground support equipment will drive product innovation and sustainable adoption.

- Demand for multi-functional, all-in-one machines will grow to reduce operational complexity.

- Integration of telematics and real-time fleet management will become standard practice.

- Government investments in airport modernization will support long-term equipment upgrades.

- Customization for diverse airport sizes and geographies will boost vendor competitiveness.

- Climate unpredictability will prompt proactive winter operations planning and fleet expansion.

- Partnerships between equipment manufacturers and airport operators will accelerate solution development.