Market Overview:

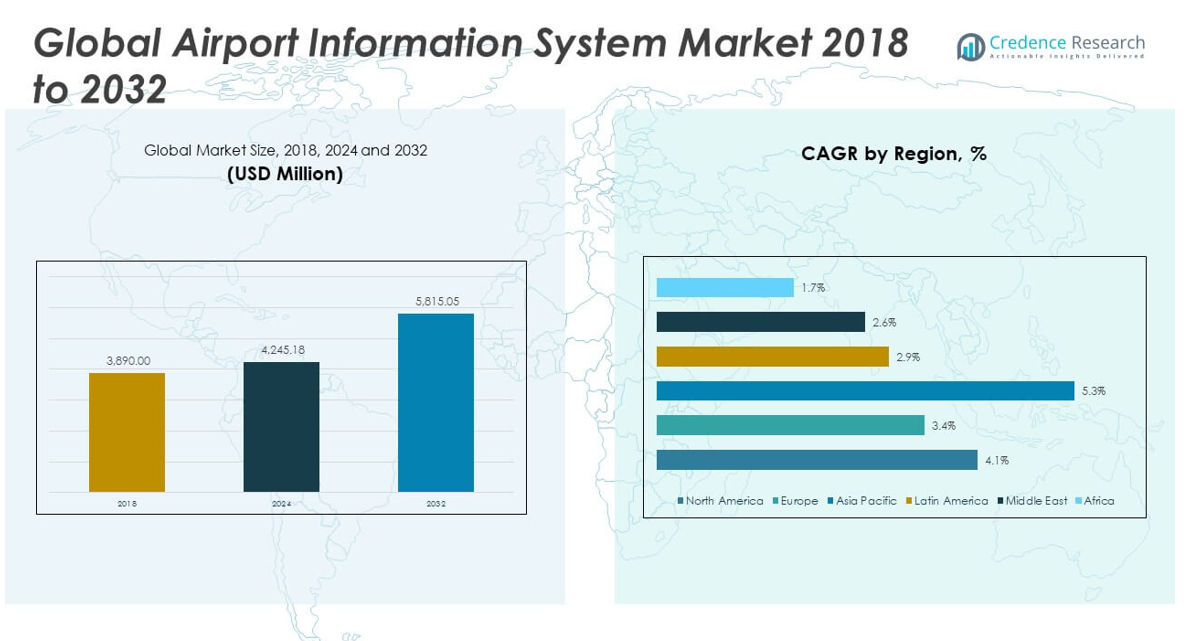

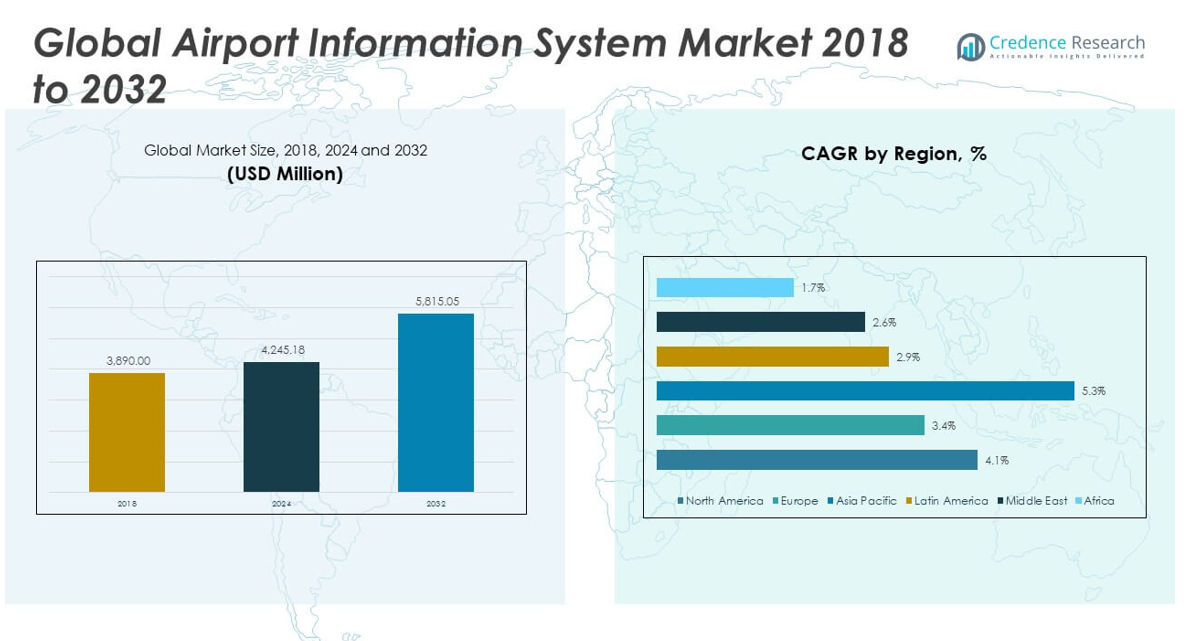

The Global Airport Information System Market size was valued at USD 3,890.00 million in 2018 to USD 4,245.18 million in 2024 and is anticipated to reach USD 5,815.05 million by 2032, at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Information System Market Size 2024 |

USD 4,245.18 million |

| Airport Information System Market, CAGR |

4.05% |

| Airport Information System Market Size 2032 |

USD 5,815.05 million |

Multiple factors are driving the robust demand for airport information systems. The increase in global air travel has created higher expectations for real-time communication, minimal delays, and efficient airport experiences. To meet these demands, airports are deploying integrated information systems that automate decision-making and reduce human error. The shift toward digital transformation in the aviation sector is prompting the adoption of AI-based analytics, IoT-enabled sensors, and cloud-based platforms within AIS solutions. These systems support seamless communication between airline operators, airport authorities, ground handling crews, and passengers. The rise of self-service technologies such as automated check-in, smart baggage handling, and biometric boarding further boosts the relevance of integrated information platforms. Airports are also focusing on cybersecurity and data integrity as information systems become more interconnected and essential for operational continuity. Increasing airline alliances and airport privatization are also contributing to the adoption of shared data platforms that require robust, scalable AIS frameworks. Together, these drivers position the market for long-term technological and service evolution.

Regionally, North America dominates the Global Airport Information System Market due to its early adoption of advanced technologies, the presence of major airport hubs, and substantial investments in airport modernization programs. The region continues to lead in deploying integrated platforms for airport resource management and passenger processing. Europe holds the second-largest market share, supported by strict aviation regulations, well-developed air traffic networks, and regional airport expansions. Countries like Germany, France, and the United Kingdom are focusing on smart mobility, energy efficiency, and digital passenger experiences, which drive investments in information systems. The Asia-Pacific region is emerging as the fastest-growing market, fueled by booming air travel demand, infrastructure development, and government investments in next-generation airports across China, India, and Southeast Asia. These countries are deploying AIS technologies to manage traffic congestion, enhance security, and deliver superior passenger services. Latin America, the Middle East, and Africa are witnessing gradual adoption, primarily through airport capacity expansion, international collaboration, and smart city integration. Across all regions, the need for real-time data, automation, and passenger-centric services continues to define the evolution of the airport information system market.

Market Insights:

- The Global Airport Information System Market was valued at USD 3,890.00 million in 2018, reached USD 4,245.18 million in 2024, and is projected to hit USD 5,815.05 million by 2032, growing at a CAGR of 4.05% during the forecast period.

- Rising global air traffic is compelling airports to invest in AIS platforms that streamline operations, minimize delays, and improve passenger satisfaction through real-time coordination and automation.

- The market is advancing through the adoption of AI, IoT, and cloud technologies, which enable predictive maintenance, dynamic scheduling, and seamless integration across airport operations.

- Real-time data sharing among airline operators, airport authorities, ground crews, and passengers enhances transparency, reduces errors, and supports regulatory compliance in daily airport workflows.

- Government investments in smart infrastructure and airport modernization—particularly in Asia-Pacific, Latin America, and the Middle East—are creating strong momentum for AIS implementation.

- The market faces integration challenges as modern AIS platforms must operate alongside legacy IT systems, increasing deployment costs and complexity, especially in older airports.

- Growing cybersecurity risks and regulatory pressures such as GDPR are prompting airports to prioritize secure AIS frameworks that protect sensitive passenger and operational data.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Air Passenger Traffic Necessitates Efficient Airport Operations:

The rapid growth in global air travel is driving the need for streamlined and intelligent airport operations. Airports are facing increasing pressure to manage higher passenger volumes without compromising service quality, safety, or on-time performance. The Global Airport Information System Market plays a critical role by enabling real-time coordination across terminals, airside logistics, and airline operations. It helps airports maintain operational continuity and passenger satisfaction through accurate information flow and automated resource allocation. As air travel becomes more accessible and frequent across emerging markets, the demand for scalable and integrated information systems will continue to rise. This growth supports the expansion of both existing and new airport infrastructure with advanced digital platforms.

- For example, SITA’s AMS is used at Toronto Pearson Airport, where it enables dynamic stand allocation and integrates with airport data sources to optimize operational efficiency.In India, SITA’s passenger processing solutions are implemented across 43 major airports, improving over 2,700 passenger touchpoints and processing more than 500 million passengers over a multi-year period.

Emphasis on Real-Time Data Sharing and Operational Transparency:

Airports require real-time data exchange among stakeholders to operate efficiently and respond quickly to disruptions. Delays, gate changes, baggage mismanagement, and ground support errors can lead to high costs and poor passenger experiences. The Global Airport Information System Market addresses these challenges by offering centralized platforms for sharing flight status, resource availability, and operational updates. It improves situational awareness for airline operators, airport authorities, ground crews, and passengers. Enhanced transparency also supports regulatory compliance and performance benchmarking. As airports adopt collaborative decision-making (CDM) models, the demand for dynamic, data-driven information systems will intensify.

- For instance, Amadeus’ Airport Collaborative Decision Making (A-CDM) platform is operational at over 30 major airports, including Munich and Singapore Changi, where it has reduced average aircraft turnaround times by 9% and improved on-time performance by 5% through real-time data sharing among airlines, ground handlers, and air traffic control.

Integration of Smart Technologies and Digital Transformation Initiatives:

The adoption of emerging technologies such as artificial intelligence, machine learning, IoT, and cloud computing is reshaping airport operations. These technologies are central to automating decision-making, optimizing airport resource management, and enhancing predictive maintenance. The Global Airport Information System Market is evolving to support digital airports that emphasize intelligent automation and connected systems. It helps improve security, reduce turnaround times, and personalize passenger experiences through data analytics and AI-powered solutions. Digital transformation also enables cost savings and sustainability by optimizing energy usage and reducing delays. As more airports pursue smart infrastructure strategies, the integration of AIS will be a strategic imperative.

Government Investments and Regulatory Focus on Smart Infrastructure:

Public and private investment in smart airport development is creating strong momentum for AIS adoption. Governments are allocating budgets to upgrade airport infrastructure with modern IT systems, particularly in developing regions. The Global Airport Information System Market benefits from policy support aimed at enhancing transportation efficiency, safety, and international competitiveness. It aligns with regulatory mandates that promote modernization, sustainability, and data standardization across airport networks. Many countries are partnering with technology providers to accelerate digital transformation in aviation. This investment climate fosters innovation and encourages wider implementation of advanced airport information systems.

Market Trends:

Increased Adoption of Passenger Self-Service Technologies Across Airports:

Airports are increasingly deploying self-service technologies to enhance passenger convenience and reduce congestion at check-in counters, security checkpoints, and boarding gates. Kiosks, mobile apps, biometric boarding systems, and automated bag drops have become common in both major international hubs and regional airports. The Global Airport Information System Market supports these tools by providing the backend integration needed to share accurate and timely data across systems. It ensures that passengers receive real-time updates on gate changes, baggage status, and flight schedules. This trend reflects a broader shift toward touchless and user-driven travel experiences, especially in the post-pandemic environment. Self-service options also reduce operating costs and improve process speed for airport authorities.

- For instance, Collins Aerospace’s ARINC SelfServ™ kiosks and biometric eGates are deployed at over 100 airports, processing more than 250 million passengers annually. At Miami International Airport, the implementation of biometric boarding reduced average boarding times by 80%, from 20 minutes to just 4 minutes per flight, as documented in airport operational reports.

Growing Demand for Predictive Analytics in Airport Resource Management:

Airports are turning to predictive analytics to improve decision-making in areas such as gate assignment, runway usage, aircraft turnaround, and staffing. Predictive tools allow airport operators to anticipate delays, allocate resources more efficiently, and reduce operational disruptions. The Global Airport Information System Market is seeing rising integration of AI-powered analytics platforms that process vast datasets from passenger flows, weather patterns, and aircraft movements. It helps stakeholders make proactive decisions that enhance both efficiency and passenger satisfaction. Predictive capabilities also support contingency planning and emergency response, making operations more resilient. This trend aligns with the broader goal of achieving smarter, data-driven airport ecosystems.

- For instance, the Airside 4.0 suite includes advanced visual docking guidance, ramp services management, and a virtual apron control room, setting new standards for ramp operations and safety in North America.

Cloud-Based AIS Platforms Enhance Scalability and Collaboration:

Cloud computing has become a preferred deployment model for airport information systems due to its scalability, reliability, and cost-effectiveness. Cloud-based AIS platforms allow real-time collaboration between different airport stakeholders, regardless of physical location. The Global Airport Information System Market is shifting toward cloud-first strategies that enable centralized data access, system integration, and remote monitoring. It supports faster software updates, improved cybersecurity, and lower IT infrastructure costs. Cloud solutions are especially valuable for smaller airports seeking to modernize without large capital expenditures. This trend promotes agile operations and aligns with the aviation industry’s push for digital connectivity.

Integration of Sustainability Metrics into Airport Operations:

Environmental sustainability has become a strategic priority for airports, leading to the incorporation of energy and emission monitoring within information systems. AIS platforms are evolving to track fuel usage, carbon emissions, and energy consumption in real time. The Global Airport Information System Market is aligning with environmental, social, and governance (ESG) goals by offering modules that support greener operations. It enables airports to report sustainability data to regulatory bodies and make informed decisions that reduce their environmental impact. These systems also help optimize aircraft taxiing routes, gate assignments, and lighting systems to lower energy use. The trend reflects the growing role of digital tools in achieving carbon-neutral airport operations.

Market Challenges Analysis:

High Integration Complexity Across Legacy and Modern Systems:

Many airports operate with legacy IT infrastructure that lacks compatibility with new-generation digital systems. Integrating modern airport information systems with outdated hardware and siloed databases creates significant technical and operational challenges. The Global Airport Information System Market faces delays and increased costs when deploying customized solutions in environments with non-standardized interfaces. It must address compatibility issues while ensuring uninterrupted operations during upgrades or transitions. System integrators are often required to bridge gaps between new software platforms and legacy protocols, which adds complexity to implementation. This barrier slows down digital transformation efforts, especially in older or underfunded airports.

Cybersecurity Risks and Data Protection Concerns:

Airport information systems process vast volumes of sensitive data involving passengers, flights, operations, and logistics. These systems are increasingly targeted by cyber threats, raising serious concerns about data breaches, service disruptions, and regulatory violations. The Global Airport Information System Market must prioritize cybersecurity investments to ensure the integrity and confidentiality of its platforms. It faces the ongoing challenge of securing interconnected systems that involve multiple stakeholders, third-party vendors, and cloud-based services. Regulatory compliance with data protection laws such as GDPR and national cybersecurity frameworks further adds to the implementation burden. Maintaining a secure yet agile system environment remains a critical concern for both public and private airport operators.

Market Opportunities:

Expansion of Smart Airport Projects in Emerging Economies:

Rapid infrastructure development in Asia-Pacific, the Middle East, and parts of Africa is creating strong demand for advanced airport information systems. Governments are investing in new airport construction and modernization programs to accommodate rising passenger volumes and support regional economic growth. The Global Airport Information System Market can capitalize on this momentum by offering scalable, modular solutions tailored for both large international hubs and mid-sized regional airports. It supports efficient planning, resource allocation, and seamless passenger movement in high-growth environments. Smart airport initiatives often include end-to-end digital platforms, positioning AIS as a core operational asset. These projects present long-term revenue potential for system integrators and software providers.

Adoption of Biometric and Contactless Travel Technologies:

The push for safer and more efficient air travel is accelerating the adoption of biometric and contactless solutions across airport terminals. Facial recognition, digital identity verification, and touchless check-in require strong backend integration with airport information systems. The Global Airport Information System Market is well-positioned to support these advancements by enabling real-time data synchronization and secure passenger flow management. It offers opportunities for innovation in passenger tracking, automated boarding, and customized service delivery. Airports aiming to enhance user experience and operational safety will prioritize AIS upgrades that support biometric integration. This creates a favorable landscape for vendors offering secure and interoperable systems.

Market Segmentation Analysis:

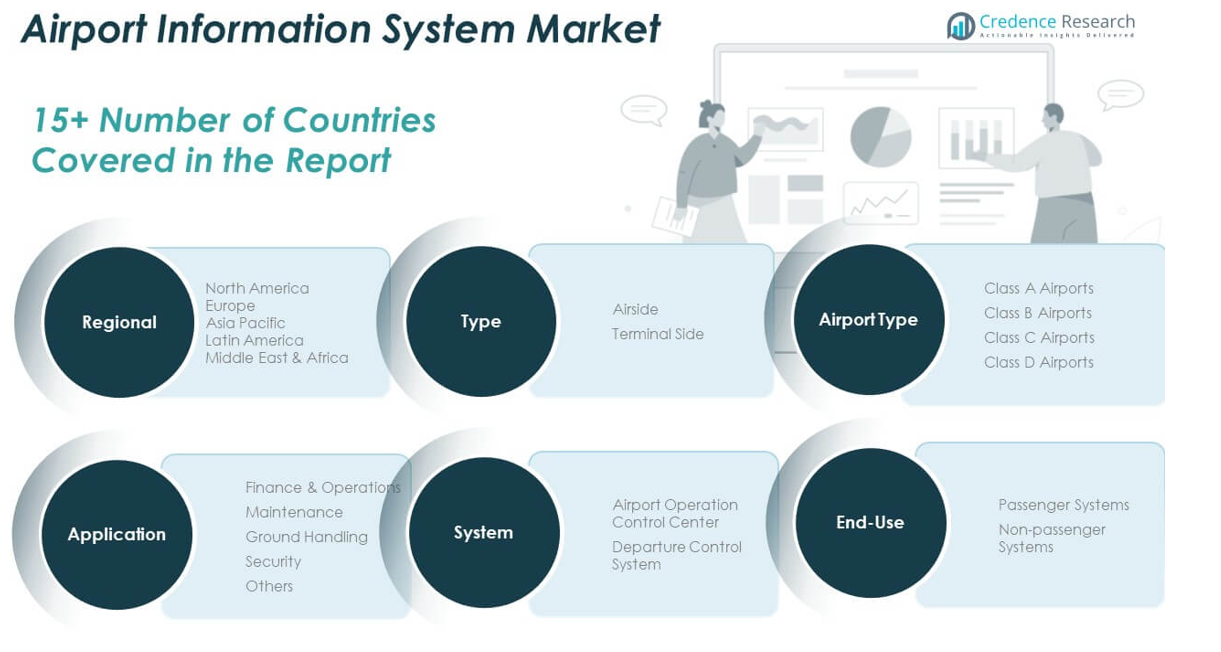

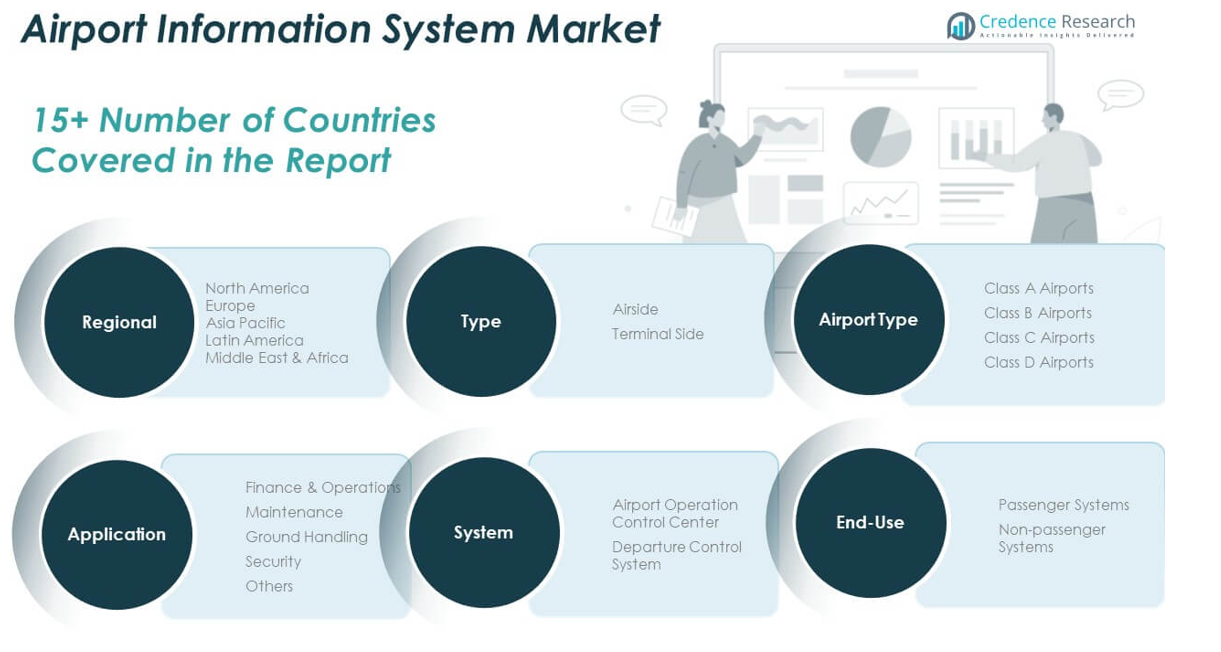

By Type

Airside systems account for the leading share, managing aircraft movement, gate assignments, and runway usage. Terminal side systems are growing steadily, driven by the rising need for efficient passenger movement, digital signage, and facility monitoring.

- For instance, ADB SAFEGATE Airside 4.0 is deployed at over 2,500 airports, providing advanced guidance and control for runway and taxiway. The platform’s digital ecosystem integrates tower, airfield, and apron operations, enhancing safety and efficiency through machine learning and real-time analytics.

By Application

Finance and operations dominate the application segment due to their central role in resource planning, billing, and airline coordination. Ground handling and maintenance applications follow, as airports aim to minimize turnaround time and equipment failure. Security applications are expanding with the adoption of biometric access, surveillance, and threat detection technologies. Other applications include environmental monitoring and utility management.

- For instance, Schneider Electric’s EcoStruxure platform monitors and optimizes energy use across more than 200 airport facilities worldwide.

By End-Use

Passenger systems form the core of the market, enabling self-check-in, flight information display systems (FIDS), baggage handling, and boarding processes. Non-passenger systems focus on airside operations, administrative control, and employee scheduling, supporting backend functions.

By System

Airport Operation Control Centers (AOCC) lead the system segment, allowing real-time oversight of entire airport operations. Departure Control Systems (DCS) are crucial for managing passenger check-ins, seating, and boarding logistics efficiently.

By Airport Type

Class A airports hold the largest market share due to higher traffic volumes, international operations, and robust digital infrastructure. Class B and Class C airports are rapidly adopting AIS to enhance service quality. Class D airports are gradually integrating basic systems to modernize small-scale terminals. The Global Airport Information System Market continues to advance across all airport classes through smart technology integration and performance optimization.

Segmentation:

By Type

By Application

- Finance & Operations

- Maintenance

- Ground Handling

- Security

- Others

By End-Use

- Passenger Systems

- Non-passenger Systems

By System

- Airport Operation Control Center (AOCC)

- Departure Control System (DCS)

By Airport Type

- Class A Airports

- Class B Airports

- Class C Airports

- Class D Airports

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Airport Information System Market size was valued at USD 1,357.22 million in 2018 to USD 1,462.44 million in 2024 and is anticipated to reach USD 2,000.39 million by 2032, at a CAGR of 4.1% during the forecast period. North America holds a 34% share of the Global Airport Information System Market, driven by early technology adoption and the presence of major international airports and IT infrastructure. The United States leads regional demand with large-scale airport modernization programs and integration of smart technologies. Airports in Canada and Mexico are also expanding their digital capabilities through public-private partnerships. Real-time data sharing platforms, biometric boarding systems, and automated passenger flow solutions are widely implemented. It benefits from a strong ecosystem of technology vendors and government support for intelligent transport systems. The region remains a frontrunner in deploying scalable, secure, and integrated AIS platforms.

Europe

The Europe Airport Information System Market size was valued at USD 1,101.65 million in 2018 to USD 1,158.82 million in 2024 and is anticipated to reach USD 1,505.82 million by 2032, at a CAGR of 3.4% during the forecast period. Europe accounts for 27% of the Global Airport Information System Market, supported by strict aviation regulations, high airport density, and emphasis on sustainable operations. Germany, France, and the UK are leading in deploying AIS for airport capacity optimization and digital passenger experiences. The region’s focus on green airports and data privacy compliance shapes the adoption of secure, efficient systems. Regional airports are upgrading systems to manage increased passenger flow and meet international connectivity demands. It benefits from joint EU funding for air mobility innovations and collaboration among airport operators. Europe maintains steady adoption of AIS to align with evolving aviation standards.

Asia Pacific

The Asia Pacific Airport Information System Market size was valued at USD 996.62 million in 2018 to USD 1,133.66 million in 2024 and is anticipated to reach USD 1,706.72 million by 2032, at a CAGR of 5.3% during the forecast period. Asia Pacific represents 29% of the Global Airport Information System Market and is the fastest-growing region. Rapid urbanization, growing air passenger volume, and expansion of low-cost carriers drive demand across China, India, Japan, and Southeast Asia. Governments are investing in next-generation airport infrastructure and digital air traffic management. New airports are designed with smart terminal concepts, incorporating AI, IoT, and cloud-based AIS. Demand for scalable and integrated systems is strong, especially in countries building aviation hubs. It shows strong momentum as regional airports upgrade technology to improve service efficiency and passenger satisfaction.

Latin America

The Latin America Airport Information System Market size was valued at USD 210.84 million in 2018 to USD 227.50 million in 2024 and is anticipated to reach USD 285.34 million by 2032, at a CAGR of 2.9% during the forecast period. Latin America holds a 5% share of the Global Airport Information System Market, led by Brazil, Mexico, and Argentina. Regional airports are gradually adopting AIS to streamline passenger processing and improve turnaround time. The focus remains on upgrading legacy infrastructure and integrating cloud-based resource management tools. Privatization and foreign investment in airport operations support modernization. It benefits from regional air traffic growth and collaboration with global tech providers. Government-backed airport expansion plans are helping to standardize digital platforms across key travel corridors.

Middle East

The Middle East Airport Information System Market size was valued at USD 138.48 million in 2018 to USD 140.91 million in 2024 and is anticipated to reach USD 172.74 million by 2032, at a CAGR of 2.6% during the forecast period. The Middle East accounts for 3% of the Global Airport Information System Market, driven by major aviation hubs in the UAE, Qatar, and Saudi Arabia. The region focuses on high-end passenger experience, with heavy investments in biometrics, digital signage, and smart baggage systems. National airlines and airport authorities deploy AIS to manage traffic at expanding terminals. Cybersecurity and integrated control centers remain high priorities due to high passenger throughput. It continues to attract global vendors offering customizable, multilingual, and real-time data solutions. Regional competition in aviation fuels demand for AIS as airports seek service excellence.

Africa

The Africa Airport Information System Market size was valued at USD 85.19 million in 2018 to USD 121.85 million in 2024 and is anticipated to reach USD 144.03 million by 2032, at a CAGR of 1.7% during the forecast period. Africa contributes 2% to the Global Airport Information System Market, reflecting steady growth in airport digitalization. Countries like South Africa, Nigeria, and Egypt are leading efforts to upgrade terminal operations and passenger communication systems. AIS adoption remains low in smaller airports but is gaining traction through government and donor-funded modernization projects. Infrastructure gaps and budget constraints slow widespread implementation. However, increasing international travel and regional connectivity initiatives drive system upgrades. It shows long-term potential as airport authorities focus on automation and integration for improved passenger service delivery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Airport Information Systems

- Amadeus IT Group

- Honeywell International

- Indra Sistemas

- NEC Corporation

- RTX

- Samsung Electronics

- Siemens

- T-Systems

- Thales

Competitive Analysis:

The Global Airport Information System Market features a competitive landscape dominated by leading technology providers and specialized aviation system integrators. Key players include SITA, Amadeus IT Group, Thales Group, Honeywell International Inc., and Collins Aerospace. These companies maintain strong positions through comprehensive product portfolios, airport partnerships, and global service networks. The Global Airport Information System Market favors vendors that offer scalable, modular platforms with real-time analytics, cloud integration, and high system reliability. It values expertise in end-to-end airport IT solutions, including flight information display systems, resource management, and passenger tracking. Players differentiate themselves through innovation in automation, AI, and cybersecurity capabilities. Strategic collaborations with airports, governments, and aviation authorities enhance market reach and long-term project pipelines. New entrants face high barriers due to complex procurement cycles, integration demands, and strict compliance standards. Competitive advantage lies in delivering seamless interoperability, consistent technical support, and adaptability to evolving aviation and passenger experience needs.

Recent Developments:

- In June 2025, Honeywell International announced the fleetwide installation of its SmartRunway and SmartLanding software on Southwest Airlines’ Boeing 737 aircraft. This technology, enabled via Honeywell’s Enhanced Ground Proximity Warning System, increases pilot situational awareness and reduces runway accident risks. Additionally, Honeywell’s next-generation Surface Alerts (SURF-A) cockpit alerting software is undergoing testing and is expected to be certified for commercial use in 2026.

- In May 2025, Indra Sistemas secured a contract to implement enhancements to its InNOVA Advanced Surface Movement Guidance and Control System (A-SMGCS) at Paris Charles de Gaulle Airport. The upgrade includes electronic flight strips, safety alerts for air traffic controllers, and optimized routing functionality to improve punctuality and reduce fuel consumption. Indra’s digital tower solutions, integrating AI and real-time data, are also being deployed to enable remote operations at 23 Norwegian airports, with further expansion planned throughout 2025.

- In March 2025, Amadeus IT Group, in partnership with Airports Council International (ACI) World, launched the 2025 Technology Innovation Awards to recognize groundbreaking advancements in airport technology. This initiative highlights Amadeus’ commitment to driving innovation in biometrics, seamless passenger experiences, and next-generation delivery management systems. The awards aim to spotlight airports and individuals leading technological progress in the industry.

- In February 2025, Honeywell also signed an agreement with Dassault Aviation to install its JetWave X high-speed in-flight connectivity system on Falcon business jets, supporting uninterrupted global coverage.

Market Concentration & Characteristics:

The Global Airport Information System Market exhibits moderate to high market concentration, with a few dominant players accounting for a significant share of global revenues. It is defined by complex procurement processes, long-term service contracts, and high customization requirements based on airport size and operational needs. The market values integration capabilities, real-time data accuracy, and compliance with international aviation standards. It serves both greenfield airport projects and upgrades in existing infrastructure, spanning commercial, regional, and cargo terminals. The Global Airport Information System Market favors vendors with proven reliability, scalable platforms, and expertise in cybersecurity, cloud computing, and predictive analytics. It is characterized by high switching costs, strong vendor-client relationships, and rising demand for intelligent, connected systems.

Report Coverage:

The research report offers an in-depth analysis based on type, application, end-use, system, and airport classification. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global air traffic will drive sustained demand for advanced airport information systems.

- Expansion of smart airport projects in emerging economies will create new installation opportunities.

- Integration of AI and machine learning will enhance predictive analytics and operational efficiency.

- Cloud-based platforms will gain adoption for scalability, cost control, and real-time collaboration.

- Passenger demand for contactless travel will accelerate adoption of biometric-integrated systems.

- Growing focus on cybersecurity will influence system architecture and vendor selection.

- Environmental monitoring tools within AIS will support sustainability and regulatory compliance.

- Increased privatization of airports will boost investments in digital infrastructure.

- Upgrades of legacy systems will create steady demand for modular and interoperable solutions.

- Strong government support for aviation infrastructure will reinforce long-term market growth.