Market Overview:

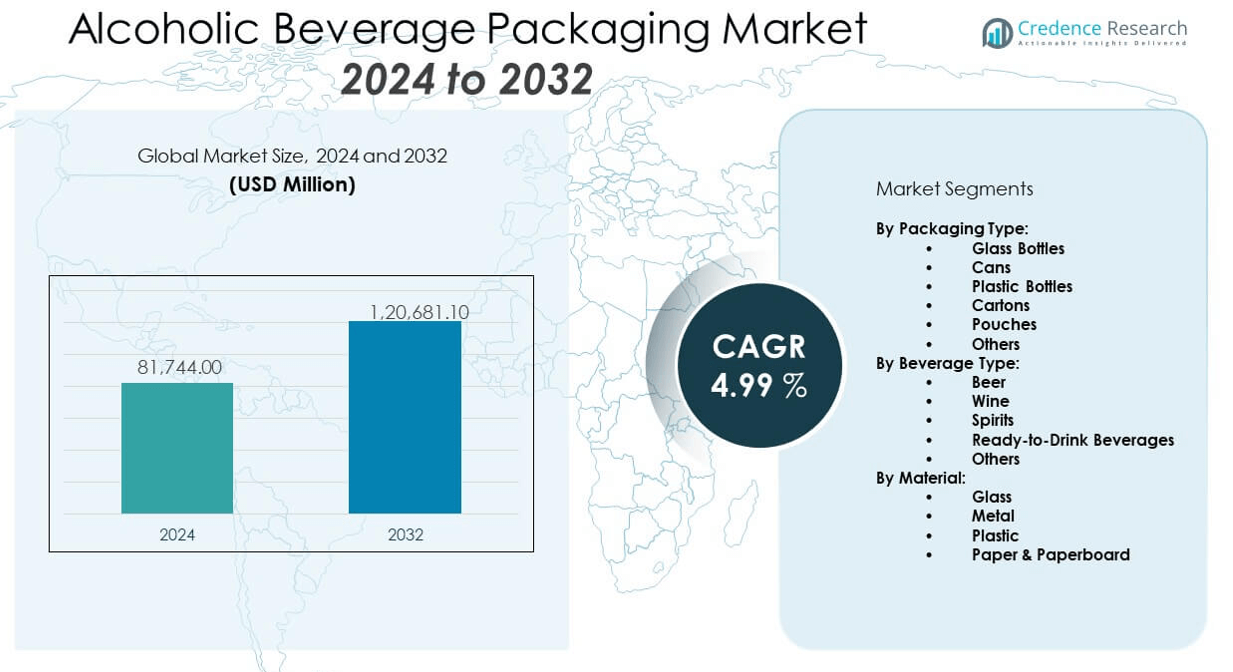

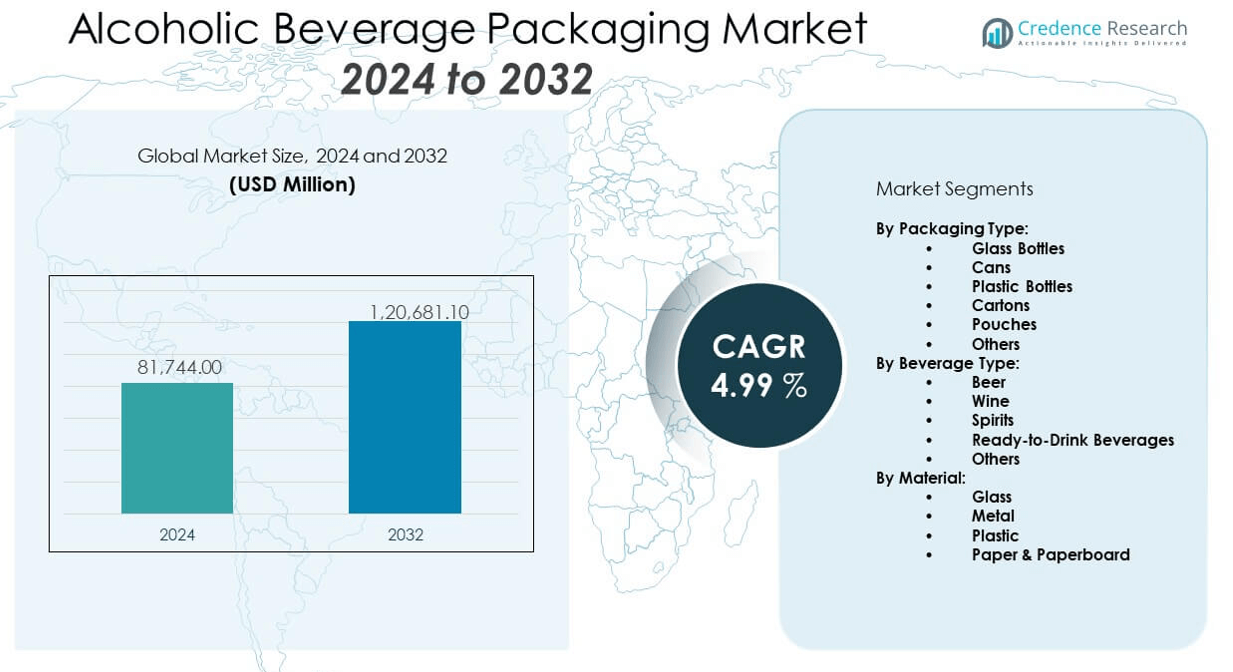

The Alcoholic Beverage Packaging Market is projected to grow from USD 81,744 million in 2024 to an estimated USD 120,681.1 million by 2032, with a compound annual growth rate (CAGR) of 4.99% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alcoholic Beverage Packaging Market Size 2024 |

USD 81,744 million |

| Alcoholic Beverage Packaging Market, CAGR |

4.99% |

| Alcoholic Beverage Packaging Market Size 2032 |

USD 120,681.1 million |

The market is expanding due to rising global consumption of alcoholic beverages, particularly in premium and craft segments. Consumers increasingly prefer appealing, sustainable packaging that enhances brand identity and shelf appeal. Glass bottles dominate premium beverage packaging, while aluminum cans and PET bottles are gaining traction due to convenience and recyclability. Moreover, innovations such as smart labeling and customized designs are driving brand differentiation, encouraging manufacturers to adopt advanced materials and technology-driven solutions.

Regionally, North America and Europe lead the alcoholic beverage packaging market, driven by high consumption levels, mature packaging infrastructure, and a strong presence of premium brands. Asia Pacific is emerging as a fast-growing market, fueled by rising disposable incomes, urbanization, and evolving consumer lifestyles in countries like China, India, and Japan. Latin America and parts of Africa also show growth potential due to increasing beverage production and modernization of packaging practices, though regulatory and infrastructural challenges remain in some developing economies.

Market Insights:

- The Alcoholic Beverage Packaging Market is projected to grow from USD 81,744 million in 2024 to USD 120,681.1 million by 2032, at a CAGR of 4.99%.

- Rising demand for premium, craft, and ready-to-drink alcoholic beverages fuels the need for innovative and visually distinctive packaging formats.

- Increasing focus on sustainability drives adoption of recyclable and biodegradable materials such as glass, aluminum, and molded fiber.

- Complex and varying regional regulations on labeling, materials, and environmental compliance restrict packaging standardization and innovation.

- North America and Europe lead the market due to mature alcohol industries, strong consumer preferences, and well-developed retail infrastructure.

- Asia Pacific emerges as the fastest-growing region, driven by rising disposable income, urbanization, and expanding legal alcohol markets.

- Packaging suppliers face margin pressure due to rising raw material costs and energy-intensive manufacturing processes, particularly for glass and metal formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising demand for premium alcoholic beverages drives packaging innovation and branding focus:

The Alcoholic Beverage Packaging Market benefits significantly from the surge in premium and craft alcohol consumption. Consumers now associate quality packaging with superior beverage experience. Brands invest in unique bottle shapes, embossing, and textured labels to reinforce identity. Demand for small-batch spirits and artisanal brews pushes suppliers to use packaging as a differentiation tool. Packaging formats play a vital role in shelf impact and consumer perception. Premium wines and whiskeys often favor glass for its elegance and preservation ability. It supports high-end positioning and durability across transport. Growing global exposure to premium beverages increases packaging expectations across all regions.

- For instance, For instance, Owens-Illinois, Inc. (O-I) launched its proprietary O-I : EXPRESSIONS digital printing technology in 2023, enabling the production of custom-decorated glass bottles with up to 360-degree designs and variable imagery.

Sustainability mandates and eco-conscious consumption reshape packaging strategies:

Sustainability exerts growing influence across the Alcoholic Beverage Packaging Market. Governments impose stricter regulations on single-use plastics and carbon emissions. This regulatory shift compels manufacturers to explore recyclable and biodegradable alternatives. Brands now integrate sustainability goals into packaging lifecycle planning. Glass and aluminum gain traction for their recyclability and perceived environmental value. It supports circular economy practices and appeals to eco-conscious consumers. Packaging suppliers introduce compostable films, lightweight bottles, and refill options to meet demand. Public awareness campaigns and corporate commitments fuel adoption of low-impact materials and designs.

- For instance, Ardagh Group S.A. also introduced a 300-gram wine bottle in July 2025—the lightest in its range—cutting glass usage by 22% compared to standard models while maintaining mechanical strength and recyclability.

Rising consumption in emerging economies expands packaging volume and format diversity:

The Alcoholic Beverage Packaging Market grows steadily in emerging economies driven by rising disposable incomes, changing lifestyles, and greater urbanization. Expansion of modern retail channels in these regions accelerates branded beverage penetration. International and local manufacturers tailor packaging formats to regional tastes and distribution needs. Demand for single-serve and convenient formats supports PET bottles and cans. It opens new channels for beer, wine, and spirits sales in supermarkets, kiosks, and online platforms. Growth in legal alcohol sales in countries such as India and Vietnam unlocks packaging investment. Younger consumer demographics increase experimentation and packaging responsiveness.

Technological advancements in packaging automation enhance efficiency and customization:

Automation and smart packaging technologies create new efficiencies and capabilities in the Alcoholic Beverage Packaging Market. Companies adopt robotic bottling lines, AI-based defect detection, and high-speed labeling systems. These technologies improve production speed, reduce waste, and allow for greater flexibility in batch runs. It enables rapid adaptation to product launches, promotional variants, and seasonal packaging. Digital printing supports on-demand customization and small-scale branding efforts. Advanced closures with tamper-evidence or freshness indicators also gain popularity. Automation helps scale premium packaging without compromising quality. These upgrades align with global competitiveness and operational streamlining.

Market Trends:

Rise of smart packaging and digital connectivity influences consumer engagement:

The Alcoholic Beverage Packaging Market experiences strong traction from smart packaging innovations. Brands integrate QR codes, NFC tags, and augmented reality features into bottles and labels. These tools offer interactive experiences, authenticity checks, and traceability information. It helps improve transparency and build brand trust among digitally active consumers. Storytelling through packaging becomes more immersive with mobile integration. Winemakers and craft brewers lead adoption to engage younger demographics. Smart features also support loyalty programs and direct-to-consumer communication. Brand owners see packaging as a powerful medium for data collection and behavioral insights.

- For instance, 19 Crimes wines from Treasury Wine Estates employ augmented reality experiences via their Living Wine Labels app. This technology brings the historic convict stories on their labels to life, having differentiated the brand as a leader in innovative consumer engagement since 2017. The AR experience supports digital storytelling and increases brand interaction at shelf.

Growth of ready-to-drink (RTD) segment reshapes packaging design and function:

Ready-to-drink alcoholic products reshape packaging formats in the Alcoholic Beverage Packaging Market. Cans, pouches, and miniature bottles dominate RTD product lines. These formats emphasize portability, convenience, and portion control. It aligns with changing lifestyles and social drinking patterns. RTDs often target on-the-go consumers, festivalgoers, or younger urban groups. Packaging suppliers prioritize resealability, lightweight construction, and branding surface area. Trends in cocktails-in-a-can and hard seltzers increase design variety. Clear cans and transparent labeling build product visibility and trust. RTD growth supports fast-moving, short-shelf-life packaging innovation.

- For instance, White Claw experienced rapid scale-up in the U.S. RTD and hard seltzer market, doubling its sales volume from 24.4 million cases to 58.5 million cases in 2020, becoming a leader in household penetration for ages 21–34. The brand’s main formats emphasize single-serve cans for portability and brand recognition, helping White Claw maintain its status as the top-selling alcohol seltzer, representing more than $1 billion in sales within convenience stores and leading all seltzer brands in total U.S. sales as of 2023.

Minimalist and clean-label aesthetics influence visual branding strategies:

Clean packaging aesthetics become increasingly prevalent across the Alcoholic Beverage Packaging Market. Brands shift from ornate designs to simple, minimal layouts that reflect quality and authenticity. Typography-focused designs and neutral color palettes dominate shelves. It creates a premium impression and aligns with health-conscious consumer values. Minimalism also signals transparency and trustworthiness in product ingredients and origin. Craft spirits and organic wines adopt matte finishes and uncoated paper labels to create a natural, tactile experience. Clear labeling of alcohol content and origin information gains priority. This trend supports clarity in communication and differentiation in crowded markets.

E-commerce packaging optimization becomes central to retail strategy:

With growing online alcohol sales, the Alcoholic Beverage Packaging Market witnesses a push toward e-commerce-optimized formats. Packaging must withstand shipping, reduce breakage, and support unboxing experiences. Brands introduce molded inserts, compact bottle shapes, and dual-layered cartons for protection. It ensures product integrity across long distances and diverse climates. Messaging and branding appear on both inner and outer packaging to enhance consumer impression. QR codes and scan-based promotions often tie online purchase with exclusive content or discounts. E-commerce also drives demand for sustainable and reusable delivery packaging. Retailers now collaborate with manufacturers for logistics-friendly designs.

Market Challenges Analysis:

Complex regulatory landscape limits packaging innovation across regions:

The Alcoholic Beverage Packaging Market faces a diverse and evolving regulatory environment. Packaging standards vary widely by country, with strict controls on labeling, material use, and recycling compliance. Governments enforce rules on warning labels, bottle deposits, and permissible materials. It complicates product standardization and increases design-to-market timelines. Exporters must adapt packaging to meet regional requirements, inflating costs. Health warnings and content disclosures can restrict branding surface and limit creativity. Rapid changes in environmental laws force frequent material shifts, adding further compliance burdens. These inconsistencies slow innovation and deter smaller players from market entry.

High material and energy costs strain profit margins for manufacturers:

Packaging material costs significantly impact the Alcoholic Beverage Packaging Market. Price volatility in glass, aluminum, paperboard, and PET affects bottom-line performance. Energy-intensive processes such as glass molding and aluminum smelting increase operating costs. It pushes manufacturers to explore light weighting and alternative materials. Supply chain disruptions and raw material shortages post-pandemic further escalate risks. Shipping delays and freight rate hikes add pressure across global markets. Cost challenges limit investment in design enhancements or eco-friendly upgrades. Price-sensitive markets struggle to adopt premium formats, slowing innovation diffusion across developing regions.

Market Opportunities:

Expansion of premium and craft beverage segments opens packaging growth avenues:

The Alcoholic Beverage Packaging Market benefits from the global expansion of premium and craft beverage categories. Consumers seek authenticity, storytelling, and uniqueness, which packaging helps deliver. Craft brands experiment with tactile finishes, limited-edition bottles, and hand-applied labels. It allows packaging to act as a canvas for brand personality. Growth in niche spirits, organic wines, and local brews supports broader material and design demand. This segment fosters high-margin opportunities for packaging converters and decorators.

Growing demand for sustainable packaging presents material innovation potential:

Sustainability efforts continue to open new material development and market penetration pathways within the Alcoholic Beverage Packaging Market. Demand rises for glass substitutes, compostable closures, and refillable formats. It creates space for innovation in biopolymers, molded pulp, and recycled content packaging. Brands willing to invest in sustainability gain market favor and regulatory benefits. Material producers and converters who offer traceable, low-impact solutions stand to gain competitive advantage.

Market Segmentation Analysis:

By Packaging Type

In the Alcoholic Beverage Packaging Market, glass bottles lead due to their premium appearance, reusability, and preservation qualities. Cans hold strong market share, driven by increasing demand for craft beer and ready-to-drink cocktails. Plastic bottles cater to cost-sensitive markets and large-volume consumption, especially in developing regions. Cartons appeal to wine and mixed beverages seeking lightweight, eco-conscious options. Pouches gain popularity for convenience, particularly in travel-friendly and single-serve formats. The others category includes ceramic bottles, miniatures, and decorative packaging for gifting.

- For instance, Amcor plc launched its Genesis™ packaging in late 2024—an oxygen barrier recyclable PET bottle designed specifically for spirits and wine—demonstrated to reduce oxygen ingress by 80% versus standard PET.

By Beverage Type

Beer dominates in volume and packaging diversity, favoring both cans and glass formats. Wine relies on glass for shelf appeal and flavor preservation, though cartons and pouches are expanding in value segments. Spirits emphasize brand differentiation through custom-shaped bottles, embossing, and premium closures. Ready-to-drink beverages support flexible packaging formats like cans and PET bottles for portability and freshness. The others category includes alcoholic sodas, hard kombucha, and ciders, which often use innovative formats to appeal to younger consumers.

- For instance, Ball Corporation reported in its 2024 Sustainability Update that it increased the production efficiency of its proprietary lightweight 12-ounce aluminum cans by 12%, supporting the rapid expansion of RTD cocktails in the U.S.

By Material

Glass remains the most widely used material in the Alcoholic Beverage Packaging Market due to its inertness, recyclability, and consumer perception of quality. Metal, primarily aluminum, is vital for can formats and secondary components like caps and closures. Plastic offers cost efficiency and durability, although its environmental concerns drive innovation in recyclable and lightweight solutions. Paper & paperboard continue to grow, used in cartons and outer packaging that support sustainability objectives and branding flexibility. Each material balances performance, cost, and regulatory expectations across beverage segments.

Segmentation:

By Packaging Type:

- Glass Bottles

- Cans

- Plastic Bottles

- Cartons

- Pouches

- Others

By Beverage Type:

- Beer

- Wine

- Spirits

- Ready-to-Drink Beverages

- Others

By Material:

- Glass

- Metal

- Plastic

- Paper & Paperboard

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Maintain Dominance with Mature Markets and Premium Focus

North America holds the largest share in the Alcoholic Beverage Packaging Market, accounting for approximately 33.2% of global revenue. The region’s strong consumption of beer, wine, and spirits, combined with a preference for premium packaging, supports high demand for glass and metal formats. The U.S. leads with its robust craft beverage segment and advanced retail infrastructure. Europe follows closely with a 27.1% market share, driven by heritage wine and spirits industries in countries such as France, Italy, and the UK. Strict environmental regulations encourage innovation in sustainable packaging. The Alcoholic Beverage Packaging Market in these regions benefits from both consumer preference and regulatory alignment with recyclable materials and labelling standards.

Asia Pacific Emerges as the Fastest-Growing Market with Expanding Legal Alcohol Sales

Asia Pacific holds a 23.9% share of the Alcoholic Beverage Packaging Market and demonstrates the highest growth rate across regions. Rising urbanization, disposable income, and shifting cultural norms in countries such as China, India, and Japan are expanding legal alcohol consumption. It creates increasing demand for diverse packaging formats, including cans and PET bottles for mass-market and convenience retail. Local breweries and international brands invest heavily in packaging localization and innovation to capture regional consumer interest. E-commerce growth in the region further influences demand for protective, compact, and visually appealing packaging formats. Regional governments are also advancing packaging regulations, shaping investment in material innovation and compliance.

Latin America, Middle East & Africa Present Emerging Opportunities with Diverse Consumption Patterns

Latin America contributes 9.1% to the Alcoholic Beverage Packaging Market, driven by beer consumption in Brazil and Mexico. The region’s young demographic and expanding retail sector support demand for flexible and cost-effective packaging solutions. The Middle East & Africa region holds the smallest share at 6.7%, limited by regulatory restrictions in some countries. However, increasing tourism, rising disposable income, and gradual liberalization in alcohol policies present long-term potential. It creates new avenues for packaging manufacturers to provide tailored, compliant, and sustainable packaging formats. Local producers and global brands alike are exploring opportunities in value-tier and travel-focused product lines to expand their regional presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Owens-Illinois, Inc. (O-I)

- Ardagh Group S.A.

- Verallia S.A.

- Crown Holdings, Inc.

- Ball Corporation

- Amcor plc

- WestRock Company

- Vidrala S.A.

- BA Vidro S.A.

- Gerresheimer AG

Competitive Analysis:

The Alcoholic Beverage Packaging Market features a competitive landscape dominated by global players focused on material innovation, sustainability, and regional expansion. Key companies such as Owens-Illinois, Verallia, Ardagh Group, and Ball Corporation maintain strong positions through diversified portfolios and consistent investment in R&D. It witnesses consolidation trends where major firms acquire regional players to strengthen distribution and gain scale efficiencies. Leading packaging companies compete on design customization, lightweight materials, and eco-friendly solutions. Strategic partnerships with beverage brands help secure long-term supply agreements. Innovation in smart packaging and recyclable formats further distinguishes market leaders. Competitive intensity remains high in both developed and emerging markets.

Recent Developments:

- In July 2025, Ardagh Group S.A. introduced a newly designed 300g glass wine bottle. This launch demonstrates the company’s focus on lighter, more sustainable packaging solutions tailored for the wine segment in the alcoholic beverage market, reflecting ongoing innovation in structural glass packaging.

- In June 2025, the French Financial Markets Authority approved a tender offer by BWGI, the company’s largest shareholder, to acquire control of Verallia. The action strengthens Verallia’s strategic foundation and positions it for further growth in glass packaging for alcoholic beverages.Additionally, in February 2024, Verallia entered into an agreement to acquire Vidrala’s Italian

- In April 2025, Owens-Illinois, Inc. (O-I Glass) announced a renewed set of strategic initiatives under its “Fit to Win” roadmap, aiming to expand its reach in the alcoholic beverage packaging market. O-I is taking steps to radically reduce enterprise costs, optimize its value chain, and target profitable growth, specifically highlighting plans for further geographic expansion and a segmented strategy to capitalize on customer relationships in premium glass packaging.

- In March 2025, Crown Holdings, Inc. entered into a partnership with botanical beverage brand Moment. This collaboration will allow six of Moment’s most popular drinks to transition to Crown’s infinitely recyclable can format, underscoring Crown’s commitment to sustainability and packaging innovation in the alcoholic beverage market.

Market Concentration & Characteristics:

The Alcoholic Beverage Packaging Market demonstrates moderate to high market concentration, with a few global firms controlling a significant share of the value chain. It is characterized by strong vertical integration, long-term contracts, and a high degree of brand loyalty among beverage companies. The market values innovation in sustainability, print customization, and advanced sealing technologies. Entry barriers remain high due to capital requirements and regulatory compliance. Regional differentiation in consumption habits and packaging preferences shapes product design and material use.

Report Coverage:

The research report offers an in-depth analysis based on packaging type, beverage type, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable materials will shape innovation and shift production toward recyclable and biodegradable packaging solutions.

- Ready-to-drink beverages will drive adoption of lightweight, portable formats such as cans and pouches.

- Growth in e-commerce will increase demand for protective, compact, and branded shipping-friendly packaging designs.

- Premiumization across spirits and wine categories will boost demand for customized glass bottle formats.

- Smart packaging integration will support traceability, authentication, and digital consumer engagement strategies.

- Automation in filling, labelling, and inspection systems will improve operational efficiency and speed to market.

- Expansion in Asia Pacific will continue with rising legal alcohol consumption and urban retail penetration.

- Material innovation will focus on reducing carbon footprint without compromising durability or product integrity.

- Regional regulations on alcohol labelling and packaging sustainability will influence material and design decisions.

- Strategic mergers and acquisitions will accelerate market consolidation and technological capabilities.