Market Overview

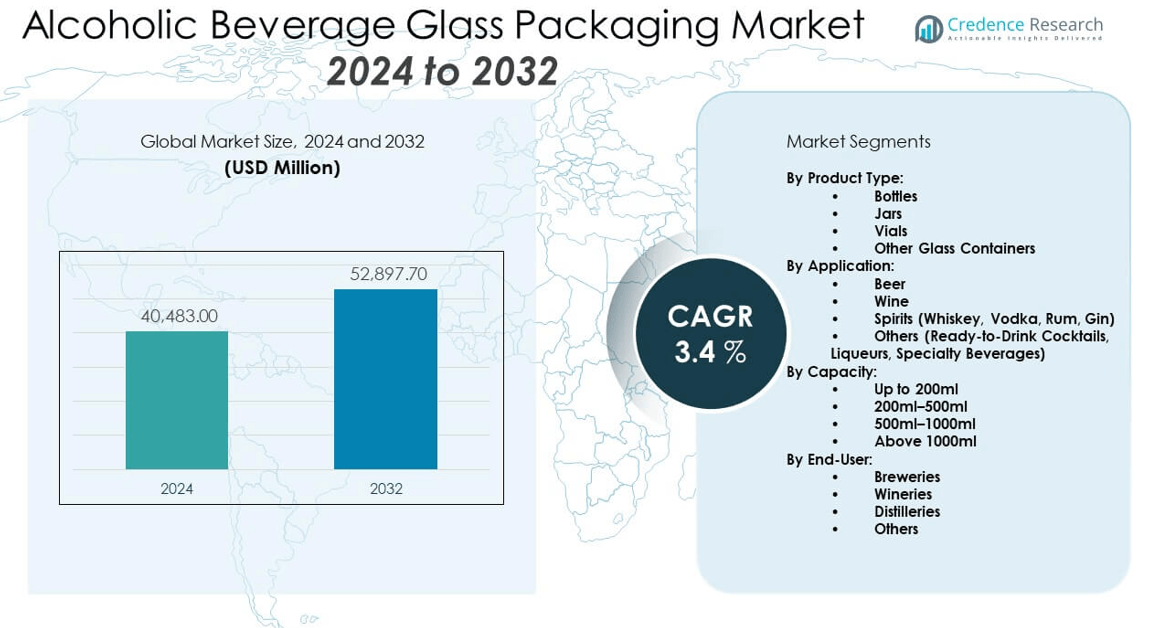

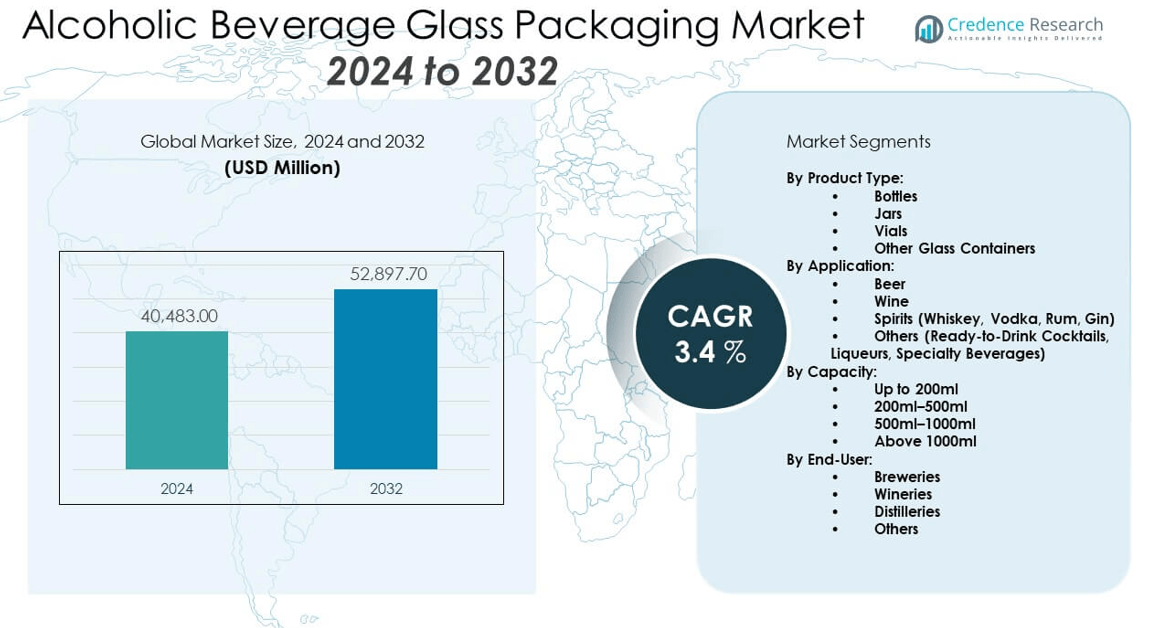

The Alcoholic Beverage Glass Packaging Market is projected to grow from USD 40,483 million in 2024 to an estimated USD 52,897.7 million by 2032, with a compound annual growth rate (CAGR) of 3.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alcoholic Beverage Glass Packaging Market Size 2024 |

USD 40,483 million |

| Alcoholic Beverage Glass Packaging Market, CAGR |

3.4% |

| Alcoholic Beverage Glass Packaging Market Size 2032 |

USD 52,897.7 million |

This market is witnessing sustained growth due to increasing consumer demand for premium alcoholic beverages, which are often associated with glass packaging for aesthetic appeal and product integrity. The rising awareness of glass as a sustainable, recyclable material also drives demand, as brands aim to reduce their environmental footprint. In addition, growing health consciousness is prompting consumers to shift from plastic to glass packaging, especially in developed economies. Beverage companies increasingly use glass to differentiate products and reinforce brand identity, enhancing consumer perception of quality and heritage. These factors collectively boost the adoption of glass packaging in the alcoholic beverage industry.

Regionally, Europe dominates the market due to a strong tradition of wine and beer consumption, especially in countries like France, Germany, and Italy. North America follows closely, supported by rising craft beer culture and consumer preference for sustainable packaging. Asia Pacific is emerging as a high-growth region, driven by increasing urbanization, rising disposable incomes, and expanding beverage consumption in countries such as China, India, and Vietnam. Latin America and the Middle East & Africa also show promising growth potential, fueled by expanding alcoholic beverage distribution networks and evolving lifestyle trends.

Market Insights:

- The Alcoholic Beverage Glass Packaging Market is projected to grow from USD 40,483 million in 2024 to USD 52,897.7 million by 2032, at a CAGR of 3.4%.

- Strong demand for premium alcoholic beverages is driving the use of glass packaging for its visual appeal and product preservation capabilities.

- Sustainability trends and increasing regulatory support for recyclable materials are pushing brands toward glass over plastic alternatives.

- High production and energy costs associated with glass manufacturing continue to restrain widespread scalability, especially in developing regions.

- Europe leads the market due to strong cultural consumption of wine and beer, with established recycling systems supporting glass use.

- Asia Pacific is emerging as a high-growth region, supported by rising disposable income, urbanization, and expansion of alcoholic beverage distribution networks.

- Market players focus on lightweight glass and smart packaging features to address logistics efficiency and enhance consumer engagement.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong consumer preference for premium packaging formats supporting glass demand:

The Alcoholic Beverage Glass Packaging Market benefits from the rising consumer inclination toward premium beverages. Glass bottles signal quality and brand prestige, aligning with consumer expectations in wine, whiskey, and craft beer segments. Brands use glass to differentiate their products on shelves and create an elevated unboxing experience. It preserves flavor integrity and avoids chemical interactions, making it suitable for long-term storage. This functionality, combined with aesthetics, reinforces its adoption. Consumers also associate glass with purity and heritage, encouraging its selection over other materials. Companies capitalize on this sentiment to attract discerning buyers. The market continues to grow with expanding middle-class consumption of aspirational beverages.

- For instance, In March 2024, Verallia announced an upgrade to its Champagne bottle production lines at the Oiry plant, integrating high-precision servo-controlled IS machines, which enable embossing with sub-0.3 mm detail for bespoke branding and luxury finish.

Growing awareness and policy push for eco-friendly and recyclable packaging:

Sustainability plays a central role in driving the Alcoholic Beverage Glass Packaging Market forward. Governments and regulatory bodies promote recyclable and reusable materials in packaging. Glass fits these criteria, being infinitely recyclable without loss of quality. It aligns with circular economy goals and supports global decarbonization efforts. Consumers actively seek brands with visible sustainability commitments, influencing packaging choices. Companies integrate recycled content into their glass bottles to reduce carbon footprint. It reduces reliance on plastics, which face rising regulatory pressures. The glass industry leverages this shift by promoting closed-loop manufacturing processes. This momentum continues to strengthen its position in the packaging ecosystem.

- For instance, Vidrala’s lightweight initiative has produced bottles with 300g unit weight (from the prior 410g average), saving approximately 11,000 tons of raw material per year according to their 2024 Environmental Performance Report.

Expansion of craft and artisanal alcohol brands requiring custom bottle solutions:

The Alcoholic Beverage Glass Packaging Market benefits from the surge in craft alcohol production. Microbreweries, boutique wineries, and artisanal distilleries increasingly adopt unique glass packaging to establish identity. Custom shapes, embossed designs, and colored glass appeal to niche segments and support storytelling. It allows small producers to build brand equity and enhance product shelf presence. This trend fuels demand for low-batch, high-quality glass production. Consumers value authenticity, which these glass designs reinforce. Suppliers expand offerings to meet design flexibility and shorter production runs. The growth of local alcohol markets supports this ongoing customization trend.

Urban lifestyle shifts and premiumization of alcoholic beverages:

Urbanization and changing lifestyles accelerate the Alcoholic Beverage Glass Packaging Market growth. Consumers in urban areas gravitate toward high-quality, ready-to-consume alcoholic products. This behavior fuels demand for aesthetically pleasing, durable packaging. Glass offers shelf impact, resilience in logistics, and compatibility with on-the-go formats like small wine bottles. It meets brand expectations across both retail and horeca channels. Premium offerings in spirits and ready-to-drink cocktails often rely on glass for visual appeal and preservation. This demand aligns with rising disposable incomes in emerging economies. Companies focus on packaging innovation to retain loyal customers. This shift sustains market expansion in both developed and growing regions.

Market Trends:

Growing adoption of smart and connected packaging for authentication and tracking:

The Alcoholic Beverage Glass Packaging Market is experiencing increased integration of smart packaging technologies. Brands embed QR codes, NFC tags, and RFID chips into labels or bottle caps to enhance consumer interaction. These tools verify product authenticity and prevent counterfeiting. It strengthens brand trust and ensures product provenance, especially in premium categories. Smart packaging supports inventory management and supply chain transparency. It allows real-time tracking during transport, improving efficiency. Consumers use smartphones to access product details, origin stories, and promotional content. The adoption of such features is growing across wine and spirits segments. This trend aligns with digitization across the packaging industry.

- For instance, Vidrala’s strategy of container light weighting, including detailed metrics on material and emissions savings, is confirmed by specific company news items and independent sustainability features.

Shift toward lightweight glass to reduce transportation emissions and costs:

Light weighting remains a prominent trend in the Alcoholic Beverage Glass Packaging Market. Producers aim to reduce the weight of bottles without compromising strength. This effort lowers emissions from transportation and cuts raw material costs. It contributes to sustainability goals while maintaining consumer appeal. Manufacturers use advanced forming technologies and material blends to achieve lighter yet durable bottles. It appeals to both mass-market and premium product lines. Lightweight glass supports e-commerce, where logistics efficiency is crucial. It also addresses environmental concerns without sacrificing shelf appeal. The trend continues to shape new product development and innovation pipelines.

- For instance, O-I’s deployment of the GOAT Hybrid Furnace, reducing both energy and emissions with innovative combustion technology, is described in O-I’s official sustainability report and on sustainability-focused news outlets.

Increasing use of specialty finishes and textures in bottle aesthetics:

Aesthetic innovation plays a vital role in shaping the Alcoholic Beverage Glass Packaging Market. Brands now prioritize unique finishes such as frosted glass, matte coatings, metallic foils, and gradient tints. These finishes enhance the visual appeal and tactile experience. It allows brands to target specific demographics and differentiate products on crowded shelves. Textured bottles create premium perception and boost memorability. Luxury spirits and limited-edition releases frequently incorporate artistic glasswork. The design evolution supports storytelling and reinforces brand identity. This trend drives demand for high-end glass manufacturing capabilities. It also fosters closer collaboration between brand teams and packaging suppliers.

Emergence of region-specific design influences and cultural themes:

The Alcoholic Beverage Glass Packaging Market reflects an increased focus on regional identity in packaging. Brands draw inspiration from local culture, art, and geography to influence bottle design. It appeals to both domestic consumers and international buyers seeking authenticity. Traditional patterns, colors, and iconography create emotional resonance. Limited editions often feature local motifs, boosting exclusivity. It enhances brand storytelling and builds connection with the origin region. This trend is strong in countries with rich winemaking and distillation heritage. Packaging designers integrate these cultural cues into modern formats. The market continues to expand with culturally informed innovation.

Market Challenges Analysis:

High production costs and energy-intensive manufacturing process:

The Alcoholic Beverage Glass Packaging Market faces cost-related challenges tied to energy use and resource dependency. Glass manufacturing requires high-temperature furnaces, consuming large volumes of fuel and electricity. This process contributes to operational costs and emissions. Volatility in energy prices directly impacts profitability for producers. It creates financial pressure, especially for small and mid-sized glass manufacturers. Limited availability of recycled cullet in certain regions increases reliance on virgin materials. Fluctuations in raw material supply can cause production delays and cost escalations. Meeting environmental regulations around emissions adds compliance costs. These factors complicate the cost structure and hinder scalability.

Logistics, fragility, and supply chain disruptions limiting market agility:

Glass packaging, while durable in presentation, remains vulnerable in transit. The Alcoholic Beverage Glass Packaging Market contends with breakage risks during storage and distribution. This fragility necessitates specialized handling and secondary packaging, increasing logistics expenses. The added weight of glass compared to alternatives inflates fuel use and carbon footprint. Transportation infrastructure inconsistencies in emerging markets complicate distribution. Global supply chain disruptions, such as port delays or container shortages, further strain fulfillment timelines. These constraints hinder rapid market response and limit access to distant regions. Managing these risks requires continual investment in logistics innovation and material handling.

Market Opportunities:

Rising demand for sustainable packaging solutions in emerging markets:

The Alcoholic Beverage Glass Packaging Market presents strong growth potential in sustainability-focused emerging economies. Governments and consumers prioritize environmentally responsible packaging alternatives. Glass, being inert and endlessly recyclable, fits these preferences. Local brands embrace glass to align with green branding strategies. Infrastructure for glass recycling is expanding, supporting long-term circular usage. Demand continues to rise as consumer awareness grows. It opens space for new entrants and local manufacturing partnerships.

Customization and digital printing enabling small-batch production flexibility:

Growing personalization trends create opportunities in the Alcoholic Beverage Glass Packaging Market. Digital printing on glass and short-run customization attract small producers. It supports limited editions, regional launches, and promotional packaging. Technological advancements reduce setup time and enhance design freedom. Brands leverage this to remain agile in competitive environments. Demand for customized packaging continues to increase across both global and local segments.

Market Segmentation Analysis:

By Product Type

In the Alcoholic Beverage Glass Packaging Market, bottles lead the segment due to their universal adoption across beer, wine, and spirits. Bottles offer durability, design flexibility, and brand visibility. Jars remain limited to certain specialty liqueurs or regional beverages. Vials are used in premium or experimental alcohol packaging, particularly in tastings or gift packs. Other glass containers, including flasks and decanters, cater to luxury or collectible formats.

- For instance, Gerresheimer AG Data Book 2024 records annual output of more than 2.1 billion glass containers, including bottles, vials (ranging from 5ml to 50ml with tight dimensional tolerances below 0.15 mm), and luxury decanters.

By Application

Beer and wine are the primary applications for glass packaging, driven by traditional consumption patterns and shelf-life requirements. Spirits such as whiskey, rum, and vodka follow closely, with producers favouring glass for its premium look and functional barrier properties. The “others” segment, including ready-to-drink cocktails and liqueurs, is expanding rapidly due to demand for convenience and innovation in alcoholic beverages.

- For instance, Ardagh Group manufactures glass bottles for the beer sector globally, integrating enhanced surface treatments to extend shelf life for oxygen-sensitive beverages.

By Capacity

The 500ml–1000ml capacity segment dominates, aligning with standard bottle sizes across global markets. The 200ml–500ml segment supports on-the-go consumption and portion control, widely used in spirits and RTD cocktails. Up to 200ml formats are mainly used for samples and miniatures, while above 1000ml caters to value packs, restaurants, and event-based consumption.

By End-User

Breweries are the largest end-users, driven by high-volume production and consistent consumer preference for glass. Wineries rely on glass for its protective qualities and role in preserving aroma and taste. Distilleries invest in glass packaging to support premiumization and custom branding. The “others” category includes private labels, contract manufacturers, and emerging beverage start-ups.

Segmentation:

By Product Type:

- Bottles

- Jars

- Vials

- Other Glass Containers

By Application:

- Beer

- Wine

- Spirits (Whiskey, Vodka, Rum, Gin)

- Others (Ready-to-Drink Cocktails, Liqueurs, Specialty Beverages)

By Capacity:

- Up to 200ml

- 200ml–500ml

- 500ml–1000ml

- Above 1000ml

By End-User:

- Breweries

- Wineries

- Distilleries

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe dominates with strong cultural consumption and established recycling systems

Europe holds the largest share of the Alcoholic Beverage Glass Packaging Market, accounting for approximately 34% of the global market. The region benefits from its longstanding traditions in wine, beer, and spirits consumption, especially in countries like France, Germany, Italy, and Spain. It supports a mature packaging infrastructure and well-established recycling networks that reinforce glass usage. European consumers associate glass bottles with heritage and premium quality, influencing brand strategies. Government initiatives and EU regulations favor sustainable packaging, which further boosts demand for glass. The presence of major glass packaging manufacturers also strengthens regional supply capabilities.

North America follows with strong craft segment and sustainability focus

North America captures around 27% of the global Alcoholic Beverage Glass Packaging Market. The region experiences high adoption of glass in spirits and craft beer categories, where packaging aesthetics are vital for shelf differentiation. It benefits from consumer preference for recyclable and chemical-free packaging formats. U.S. and Canadian manufacturers emphasize product quality and branding, driving customized and decorated glass bottle demand. The growing influence of ready-to-drink cocktails packaged in glass further supports market expansion. Government-backed recycling programs and brand commitments to carbon neutrality continue to reinforce glass as a primary packaging material.

Asia Pacific emerges as the fastest-growing region with expanding beverage markets:

Asia Pacific holds approximately 22% share in the Alcoholic Beverage Glass Packaging Market and shows the fastest growth trajectory. Rising urbanization, increasing disposable income, and changing lifestyle patterns drive alcohol consumption in countries such as China, India, Japan, and Vietnam. It gains traction as international brands expand distribution networks and local producers adopt premium packaging to compete. Emerging middle-class consumers show growing preference for high-quality, visually appealing beverage packaging. Infrastructure for glass manufacturing and recycling is improving, supporting the adoption of glass over plastic. The region presents opportunities for market expansion through localized production and regional partnerships.

Other Regions:

Latin America and the Middle East & Africa together contribute around 17% to the global market. Growth in these regions is supported by increasing alcohol consumption, improved distribution, and gradual shifts toward sustainable packaging practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Owens-Illinois (O-I) Inc.

- Verallia

- Ardagh Glass Group

- Vidrala

- BA Vidro

- Gerresheimer AG

- Amcor plc

- Ball Corporation

- Crown Holdings Inc.

- United Bottles & Packaging

- Brick Packaging LLC

Competitive Analysis:

The Alcoholic Beverage Glass Packaging Market features a moderately consolidated landscape, led by key players including Owens-Illinois (O-I) Inc., Verallia, Ardagh Glass Group, and Vidrala. These companies compete through product innovation, design capabilities, and geographic reach. It reflects strong competition in premium glass packaging formats, supported by large-scale production and customization services. Players invest in lightweight glass technologies and sustainable manufacturing to align with industry trends. Mid-sized and regional firms target niche markets and private-label segments. Competitive intensity is high in Europe and North America due to mature consumption patterns, while companies expand in Asia Pacific to tap into emerging demand. Strategic partnerships and capacity expansions drive differentiation in this market.

Recent Developments:

- In July 2025, Ardagh Glass Packaging announced the launch of the world’s first emerald green glass bottles made with NextGen hybrid furnace technology for Jägermeister. This long-term partnership aims to reduce the CO₂ impact of spirit bottles significantly. The NextGen Furnace, utilizing up to 80% renewable electrical heating and as much as 70% recycled glass, demonstrated a carbon impact reduction of 64% in prior applications.

- In March 2025, Owens-Illinois (O-I) announced the achievement of new ambitious sustainability goals, unveiling targets for 60% use of recycled glass (cullet) and 80% renewable electricity usage by 2030. This marks a substantial increase from previous commitments. The company highlighted hitting several of these goals ahead of schedule, with 2025 described as a “milestone year” for sustainability milestones and new technology integration, including GOAT hybrid furnaces and expanded community recycling programs.

- In February 2025, Vidrala launched the BD VIVA LITE 75 CL bottle, which weighs only 300 grams but maintains the robustness of its predecessor. This lighter bottle design enables significant reductions in CO₂ emissions, water, and raw material use. The innovation is part of Vidrala’s ongoing strategy to expand its portfolio of sustainable, lightweight glass packaging for the beverage market.

Market Concentration & Characteristics:

The Alcoholic Beverage Glass Packaging Market is moderately concentrated, with a few large players holding significant global shares. It features strong vertical integration and established supply chains, particularly in Europe and North America. The market prioritizes design innovation, glass quality, and sustainability. Demand patterns remain stable due to the cultural and premium associations of glass packaging. It exhibits high entry barriers due to capital-intensive manufacturing and stringent quality standards. Regional players compete through agile production and customized solutions.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, capacity and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for premium alcohol will increase the use of custom-designed glass packaging across spirits and wine categories.

- Sustainability initiatives and recycling mandates will drive adoption of eco-friendly glass production technologies.

- Lightweight glass development will support cost-efficient logistics and broader regional distribution.

- Smart packaging integration will enhance traceability, authentication, and consumer engagement.

- Craft beverage growth will push demand for short-run, branded glass bottle solutions.

- Urbanization and lifestyle shifts will continue fueling growth in emerging Asia Pacific economies.

- Increasing on-the-go consumption will expand demand for small-capacity glass packaging formats.

- Digital printing and personalized packaging will become essential for competitive brand positioning.

- Strategic mergers and acquisitions will shape market consolidation and global expansion.

- Regulatory pressure on plastics will further boost the shift toward recyclable glass containers.