Market Overview

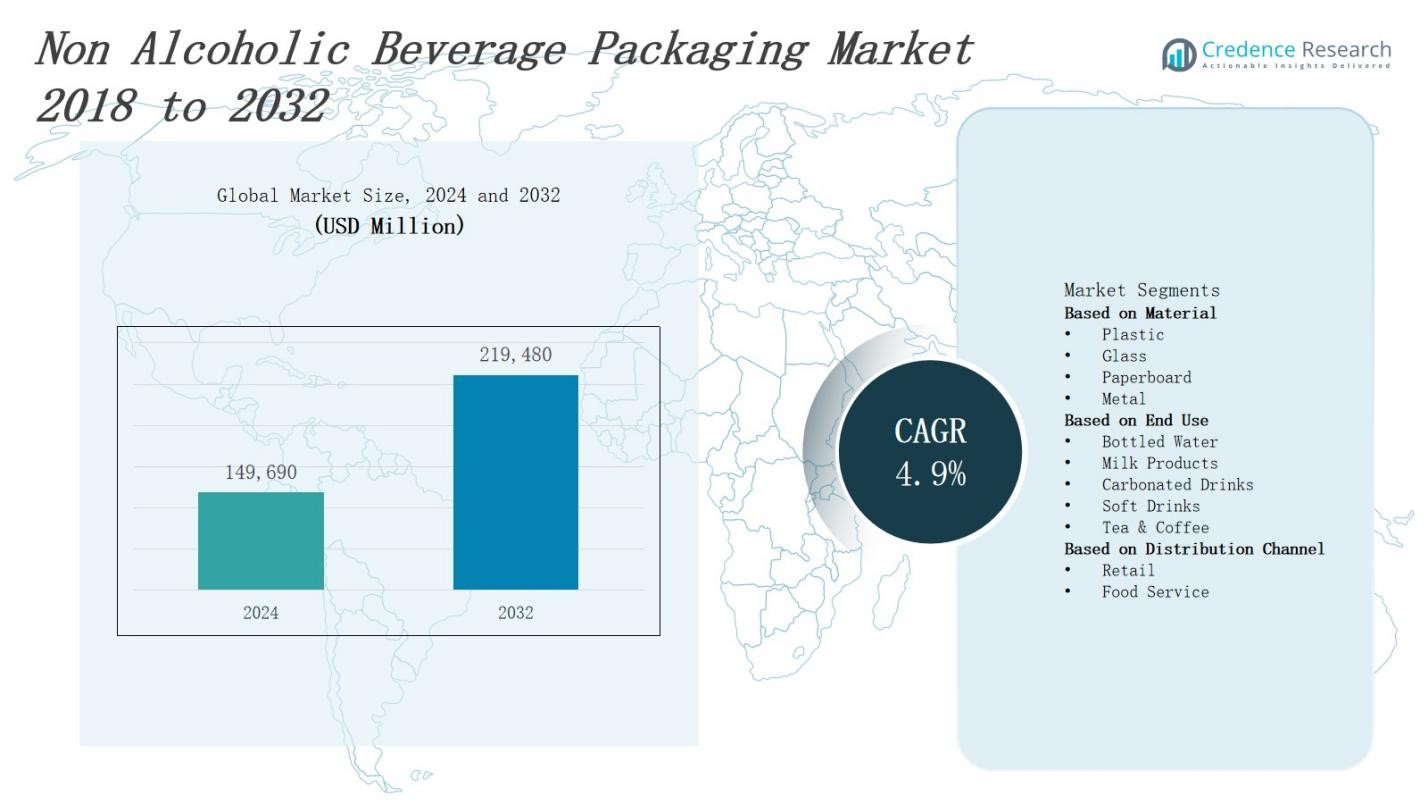

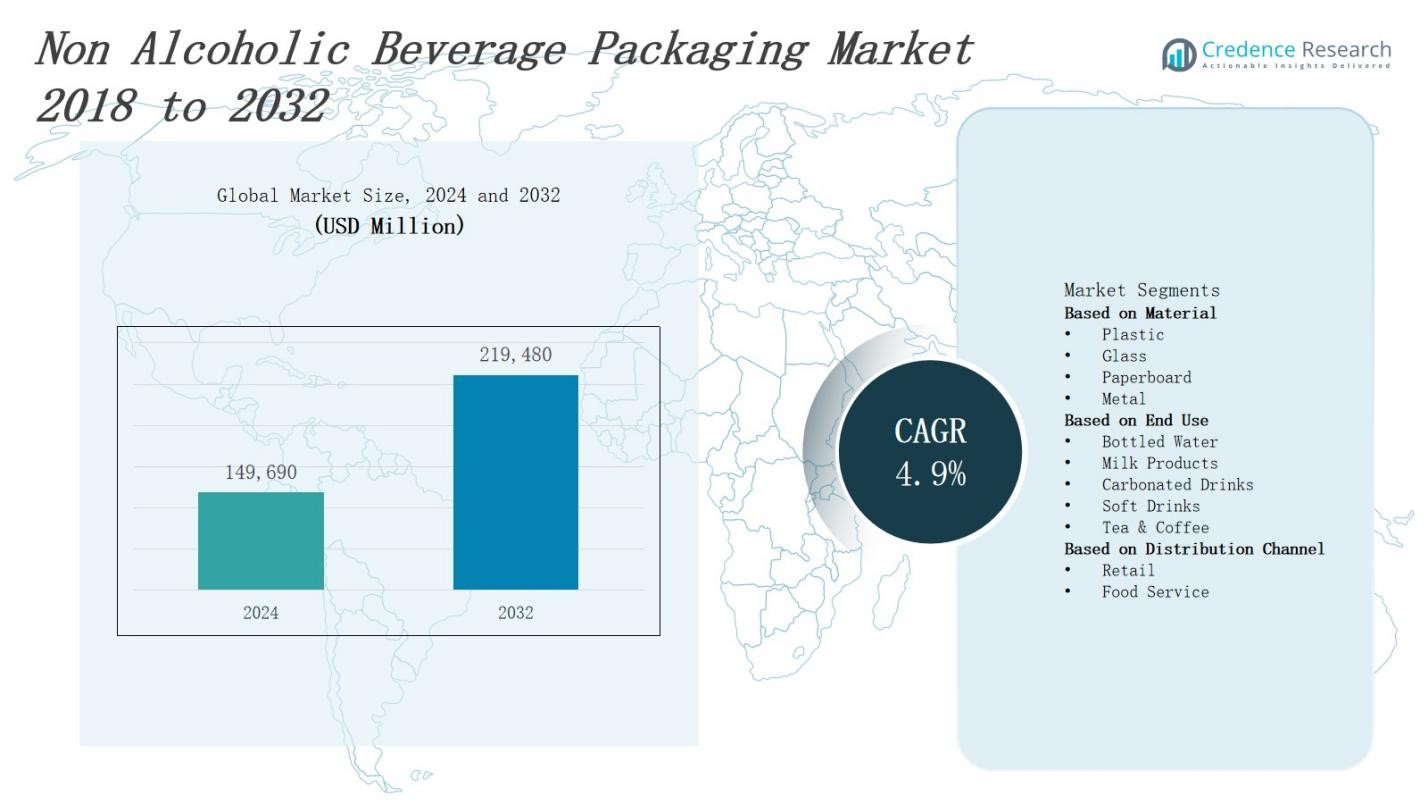

The Non Alcoholic Beverage Packaging Market is projected to expand from USD 149,690 million in 2024 to USD 219,480 million by 2032, representing a CAGR of 4.9%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Alcoholic Beverage Packaging Market Size 2024 |

USD 2745.8 Million |

| Non Alcoholic Beverage Packaging Market, CAGR |

4.9% |

| Non Alcoholic Beverage Packaging Market Size 2032 |

USD 219,480 Million |

Manufacturers innovate packaging solutions to meet growing demand for convenience and portability in the Non Alcoholic Beverage Packaging Market. They adopt lightweight, recyclable bio‑based polymers to address sustainability mandates and reduce environmental impact. Rising e‑commerce sales drive investment in durable, tamper‑evident formats that ensure product integrity throughout long‑distance shipping. Consumers favor resealable, on‑the‑go designs that preserve freshness and minimize waste. Brands leverage digital printing and smart labels to enhance traceability and personalize offerings. They adopt sustainable printing inks. Collaboration among resin producers, packaging converters, and sustainability experts accelerates development of high‑performance barrier films, supporting market growth and operational efficiency.

Geographically, the Non Alcoholic Beverage Packaging Market shows performance in North America (30% share), driven by recyclable PET innovation; Europe (20%) emphasizes circular economy initiatives; Asia Pacific (40%) grows with flexible pouches and e‑commerce demand; Latin America (6%) focuses on PET and paperboard; Middle East & Africa (4%) adapts metal cans and designs in high‑temperature climates. Key players such as Amcor Limited, Ball Corporation, Ardagh Group S.A., Crown Holdings Inc., Owens‑Illinois, Saint‑Gobain, Alcoa Inc., Rexam PLC, Reynolds Group and Tetra Laval International S.A. compete on sustainability, material technology, regional customization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Non Alcoholic Beverage Packaging Market will grow from USD 149,690 million in 2024 to USD 219,480 million by 2032 at a CAGR of 4.9%.

- Manufacturers deploy lightweight, recyclable bio‑based polymers to satisfy sustainability mandates and lower environmental impact.

- E‑commerce expansion fuels demand for durable, tamper‑evident formats that ensure integrity during long‑distance shipping.

- Consumers prefer resealable, on‑the‑go designs that preserve freshness and minimize waste.

- Brands integrate digital printing and smart labels to boost traceability, enable personalization, and enhance engagement.

- Regional shares stand at North America 30%, Europe 20%, Asia Pacific 40%, Latin America 6%, and Middle East & Africa 4%.

- Key players such as Amcor Limited, Ball Corporation, Ardagh Group S.A., Crown Holdings Inc., Owens‑Illinois, Saint‑Gobain, Alcoa Inc., Rexam PLC, Reynolds Group and Tetra Laval International S.A. compete on material innovation and regional customization.

Market Drivers

Rising Sustainability Mandates Drive Material Innovation

The Non Alcoholic Beverage Packaging Market responds to environmental regulations by adopting recyclable and bio‑based polymers. It shifts reliance from conventional plastics toward eco‑friendly materials that meet consumer demand for responsible products. Companies redesign bottles, cartons, and labels to optimize resource use and reduce footprint. Partnerships between resin suppliers and converters accelerate material development and scaling. Governments enforce extended producer responsibility schemes. Brand leaders fund research to improve barrier performance.

- For instance, The Coca-Cola Company introduced a 100% plant-based plastic bottle called the PlantBottle, produced using chemicals derived from corn and other plants, with a successful test run of 900 units ready for commercial scaling.

Growing E‑commerce Channels Boost Packaging Demand

The Non Alcoholic Beverage Packaging Market expands alongside the surge in online retail and direct‑to‑consumer channels. It requires sturdy, tamper‑evident containers that protect products during transit. Brands invest in lightweight corrugated shippers, insulated mailers, custom inserts to minimize damage. Collaboration with logistics providers enables optimized packaging dimensions that reduce shipping costs. Digital tracking solutions enhance visibility and confidence. Retailers measure packaging performance by damage rates and satisfaction. They optimize costs.

- For instance, PepsiCo’s deployment of insulated mailers designed to maintain beverage temperature during transit, reducing product spoilage.

Innovation in Smart and Functional Features

The Non Alcoholic Beverage Packaging Market embraces smart packaging that extends shelf life. It integrates RFID tags, QR codes, and freshness sensors to monitor product condition in real time. Brands deploy interactive labels to deliver digital content and incentives. Packaging specialists embed NFC chips for secure authentication and traceability. Firms adopt easy‑pour spouts and resealable closures to improve user convenience. They test ergonomic designs to enhance shelf impact and handling.

Cost Efficiency and Supply Chain Optimization

The Non Alcoholic Beverage Packaging Market tightens production processes and standardizes container formats to leverage high‑volume manufacturing. It negotiates bulk resin contracts and optimizes inventory levels to prevent stockouts. Producers deploy automated lines that streamline filling, sealing, and labeling operations. Suppliers coordinate delivery schedules to minimize lead times. They track key performance indicators such as yield loss and throughput to improve supply chain resilience. They optimize margins and cost efficiency.

Market Trends

Emphasis on Sustainable and Bio‑based Packaging

The Non Alcoholic Beverage Packaging Market prioritizes eco‑friendly solutions to meet stricter regulations and consumer demand. Producers adopt bio‑based polymers and post‑consumer recycled materials to reduce environmental footprint. Brands redesign container structures to enable circularity and ease of recycling. Suppliers develop high‑barrier films that match performance of traditional plastics. Stakeholders invest in life‑cycle assessments to guide material choices. Industry alliances support standardized labeling for recyclability. Companies track carbon footprints to identify reduction opportunities.

- For instance, Norco’s 100% food-grade rPET milk bottles save 215.21 tonnes of CO2 emissions annually and reduce virgin plastic by 125 tonnes per year through a closed-loop recycling program.

Shift Toward Lightweight and Minimalistic Designs

Lightweight constructions reduce material use without compromising durability in the Non Alcoholic Beverage Packaging Market. Designers simplify packaging geometry to optimize transport efficiency and lower costs. Thin‑wall bottles and slim cartons increase pallet density and minimize storage footprint. Corrugated shippers adopt minimalistic branding to improve recyclability. Manufacturers conduct drop tests to validate container integrity under stress. They refine closure systems to balance convenience and sealing performance. Brands monitor material thickness to achieve consistent quality.

- For instance, KISSD Water Cucumber uses an 88% plant-based cardboard carton combined with a sugarcane-based cap, enhancing recyclability and sustainability.

Adoption of Digital Printing and Personalization

The Non Alcoholic Beverage Packaging Market leverages digital printing to support on‑demand customization. Brands offer limited‑edition runs and personalized labels that resonate with consumers. Variable data printing enables targeted marketing campaigns and enhances engagement. Printers reduce setup time and waste when switching designs. Companies integrate QR codes for dynamic content and real‑time feedback. They collaborate with software providers to streamline artwork approval and improve production agility. Packaging converters invest in high‑resolution presses to enhance print clarity.

Integration of Smart Packaging and IoT

The Non Alcoholic Beverage Packaging Market incorporates smart features to boost transparency. RFID tags track inventory and prevent counterfeits. Sensors monitor temperature and freshness during distribution. IoT‑enabled caps transmit data to cloud platforms for real‑time analytics. Brands employ embedded NFC chips for interactive consumer experiences. They use smart seals to detect tampering and ensure safety. Collaborations with technology firms drive rapid adoption and pilot programs. Industry conferences showcase proof‑of‑concept trials to evaluate scalability.

Market Challenges Analysis

Escalating Raw Material Costs and Supply Chain Disruptions

Fluctuating resin and paper pulp prices challenge manufacturers in the Non Alcoholic Beverage Packaging Market. It forces them to renegotiate contracts and redesign packaging for cost reduction. Global logistics delays increase lead times and inflate freight expenses. Producers allocate resources to secure stable supplies and hedge against commodity swings. They streamline operations to offset margin erosion and improve working capital. Brands recalibrate packaging specifications to maintain profitability under tight budgets. Suppliers collaborate to forecast demand and mitigate shortages.

Complexity of Recycling Regulations and Technical Constraints

Stringent sustainability mandates vary by region and complicate compliance for the Non Alcoholic Beverage Packaging Market. It compels brands to adapt materials that meet diverse recycling standards and labeling requirements. Inconsistent curbside programs hinder recovery of multi‑layer structures and coated films. Manufacturers invest in testing to ensure compatibility with recycling streams. They face technical hurdles in replacing traditional barrier layers without sacrificing shelf life. Companies engage stakeholders to develop circular solutions and support infrastructure upgrades. Regulators evaluate policy effectiveness and adjust guidelines to promote higher recycling rates.

Market Opportunities

Expansion of Sustainable Circular Packaging Models

The Non Alcoholic Beverage Packaging Market can capitalize on growing consumer demand for refillable and returnable bottle programs. It embraces lightweight reusable PET bottles and glass deposit‑return schemes to attract eco‑conscious buyers. Collaboration between brand owners and waste management firms supports effective material recovery. Adoption of bio‑based monomaterials ensures recyclability while preserving essential barrier properties. Government incentives for circular economy initiatives encourage investment in recyclable packaging. Industry alliances drive standardization of eco‑design guidelines and clear labeling. Brands highlight sustainability credentials to strengthen consumer loyalty.

Leveraging E‑commerce and Direct‑to‑Consumer Channels

The Non Alcoholic Beverage Packaging Market can leverage e‑commerce and direct‑to‑consumer channels to drive growth. It deploys customized mailers with integrated insulation to extend product shelf life during shipping. Brands implement personalized shape and print designs to improve engagement and reduce returns. Data analytics help tailor packaging offers based on purchase behavior. Smart closures with QR codes or NFC tags enable interactive consumer experiences and post‑purchase communication. Partnerships with logistics providers secure packaging solutions that minimize damage and shipping costs. Investment in flexible packaging formats supports rapid order fulfillment and subscription models.

Market Segmentation Analysis:

By Material Type

The Non Alcoholic Beverage Packaging Market offers diverse material options tailored to performance and sustainability requirements. It employs plastic for lightweight, shatter‑proof containers that optimize transport efficiency. Glass provides premium appearance and inert barrier properties for flavor preservation. Paperboard suits single‑serve cartons and eco‑friendly offerings that enable easy recycling. Metal cans deliver superior barrier protection and shelf stability for carbonated products. Suppliers balance cost, weight and environmental impact across material portfolios.

- For instance, Ball Corporation specializes in sustainable aluminum cans widely used for carbonated non-alcoholic drinks. Their EcoDesign cans reduce material use by up to 20% while maintaining durability and shelf life, supporting both lightweight transport and environmental goals.

By End‑Use

The Non Alcoholic Beverage Packaging Market segments by end use to match consumer preferences. It supplies bottlers with designs that preserve water purity and resist contamination. Milk products benefit from opaque plastic or paperboard packaging that light‑protects nutrients. Carbonated drinks require robust metal cans and PET bottles that maintain carbonation. Soft drinks favor resealable PET to enhance portability. Tea & coffee deliver single‑serve convenience through compostable paperboard and metal capsules.

- For instance, Danone employs opaque paperboard packaging for milk products, effectively protecting sensitive nutrients from light degradation.

By Distribution Channel

The Non Alcoholic Beverage Packaging Market adapts packaging formats for retail and food service channels. It tailors retail packaging with eye‑catching graphics and shelf‑ready packs that streamline stocking. Brands deploy multipacks and slim bottles to enhance point‑of‑sale visibility. Food service channels use bulk dispensers and bag‑in‑box systems that optimize storage and handling. Manufacturers standardize carton sizes to improve pallet utilization. They equip containers with tamper‑evident seals that meet regulatory and safety standards.

Segments:

Based on Material

- Plastic

- Glass

- Paperboard

- Metal

Based on End Use

- Bottled Water

- Milk Products

- Carbonated Drinks

- Soft Drinks

- Tea & Coffee

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Non Alcoholic Beverage Packaging Market shows robust performance in North America where companies invest in innovative, sustainable designs. It holds 30% market share in the region. Brands prioritize recyclable PET bottles and carton packages that align with strict environmental regulations. Packaging converters optimize lightweight constructions to lower shipping costs across extensive distribution networks. Suppliers introduce high‑barrier films to extend shelf life for perishable drinks. Retailers demand eye‑catching labels that enhance brand visibility on crowded shelves.

Europe

The Non Alcoholic Beverage Packaging Market delivers significant growth in Europe supported by strong consumer focus on sustainability. It commands 20% market share across the region. Packaging firms adopt recycled paperboard and mono‑material plastic containers to meet circular economy targets. Regulatory bodies enforce extended producer responsibility to drive eco‑design innovation. Brands integrate tamper‑evident seals and QR codes to improve traceability and quality assurance. Manufacturers streamline production lines for efficient format changes and reduced waste.

Asia Pacific

The Non Alcoholic Beverage Packaging Market expands rapidly in Asia Pacific reflecting dynamic consumer trends and rising disposable incomes. It accounts for 40% market share in the region. Producers invest in lightweight bottles and flexible pouches that support on‑the‑go lifestyles. E‑commerce growth pushes demand for durable, tamper‑proof mailer solutions. Suppliers collaborate on bio‑based resin development to reduce environmental impact. Brands leverage smart packaging features to engage tech‑savvy customers.

Latin America

The Non Alcoholic Beverage Packaging Market gains traction in Latin America driven by expanding retail networks and growing beverage consumption. It holds 6% market share in the region. Companies introduce cost‑effective packaging formats that balance affordability with quality. Paperboard cartons and PET bottles dominate due to local sourcing and recycling capabilities. Suppliers train beverage producers on best practices for waste reduction and material recovery. Retailers enhance display solutions to attract shoppers in competitive markets.

Middle East & Africa

The Non Alcoholic Beverage Packaging Market shows steady development in Middle East & Africa supported by infrastructure investments and evolving consumer preferences. It captures 4% market share across this region. Packaging providers supply metal cans and PET bottles that withstand high temperatures and transport challenges. Brands test innovative coatings to extend product freshness in hot climates. Distributors implement standardized pallets and packaging dimensions to improve logistics efficiency. Manufacturers adapt designs to meet halal certification and safety standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ball Corporation

- Ardagh Group S.A.

- Amcor Limited

- Saint‑Gobain

- Crown Holdings Inc.

- Rexam PLC

- Alcoa Inc.

- Tetra Laval International S.A.

- Reynolds Group

- Owens‑Illinois

Competitive Analysis

The Non Alcoholic Beverage Packaging Market features intense rivalry among leading providers that compete on material innovation and sustainability credentials. It pressures vendors like Amcor Limited and Ardagh Group S.A. to develop lightweight, mono‑material solutions that simplify recycling. Ball Corporation and Crown Holdings Inc. leverage global manufacturing networks to offer rapid delivery and custom formats. Alcoa Inc. and Reynolds Group differentiate through advanced metal packaging technologies that enhance barrier performance. Owens‑Illinois and Saint‑Gobain focus on premium glass and specialty coatings to meet high‑end brand requirements. Rexam PLC and Tetra Laval International S.A. invest in automation to boost throughput and lower unit costs. Strategic partnerships between resin producers and converters accelerate product development cycles. Competitive pricing strategies and flexible order minimums attract emerging beverage brands. Regional players secure market share by tailoring packaging formats to local regulations and consumer preferences. Continuous investment in digital printing and smart label integration sets leading companies apart.

Recent Developments

- In February 2025, Ball Corporation acquired Florida Can Manufacturing to strengthen its North and Central American aluminium can supply network for sustainable beverage packaging.

- On July 14, 2025, Alcoa Corporation and its JV partner IGNIS Equity Holdings announced the restart of the San Ciprián smelter to secure aluminum supply for packaging operations.

- On May 12, 2025, Amcor plc unveiled its industry‑first StormPanel™ 2 oz retort bottle, enabling shelf‑stable, low‑acid beverage packaging in a compact, ready‑to‑use format.

- On February 28, 2025, Reynolds Consumer Products partnered with Solenis to eliminate PFAS from its barrier additives, achieving exceptional oil‑ and grease‑resistance while reducing environmental impact.

Market Concentration & Characteristics

The Non Alcoholic Beverage Packaging Market exhibits a moderately concentrated structure in which leading suppliers command significant share yet face growing competition from regional specialists. It features a mix of global giants—Amcor Limited, Ball Corporation, Ardagh Group S.A., Crown Holdings Inc., Owens‑Illinois and Saint‑Gobain—that leverage extensive production networks and advanced R&D to secure large contracts. Mid‑tier producers such as Alcoa Inc., Rexam PLC, Reynolds Group and Tetra Laval International S.A. differentiate through niche metal and glass solutions. High entry barriers stem from capital‑intensive equipment requirements and strict regulatory approvals. Buyers negotiate long‑term agreements to lock in favorable resin and material prices. Suppliers pursue strategic alliances with beverage brands to co‑develop lightweight, mono‑material formats. Market dynamics feature steady consolidation via targeted acquisitions and joint ventures. It balances scale‑driven cost efficiencies with innovation‑focused agility among smaller players.

Report Coverage

The research report offers an in-depth analysis based on Material, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Producers will expand use of recyclable mono-material packaging to enhance sustainability and streamline recycling processes.

- Brands will integrate smart sensors and IoT-enabled features to track freshness and optimize supply visibility.

- Suppliers will develop ultra-thin barrier films that preserve integrity and reduce transportation weight and costs.

- Companies will pilot refillable bottle initiatives with retailers to promote circularity and minimize packaging waste.

- Manufacturers will increase automation and AI-driven inspection systems to accelerate throughput and improve quality control.

- Brands will leverage personalized digital printing with variable data technology to deliver targeted engagement campaigns.

- Suppliers will partner with innovators to introduce compostable solutions that satisfy regulatory and consumer demands.

- Retailers will require standardized recyclable labeling across packaging formats to comply with evolving sustainability regulations.

- Logistics teams will optimize packaging dimensions and pallet configurations to reduce volumes, lowering transportation expenses.

- Stakeholders will fund circular economy projects and invest in recycling infrastructure to close material loops.