Market Overview

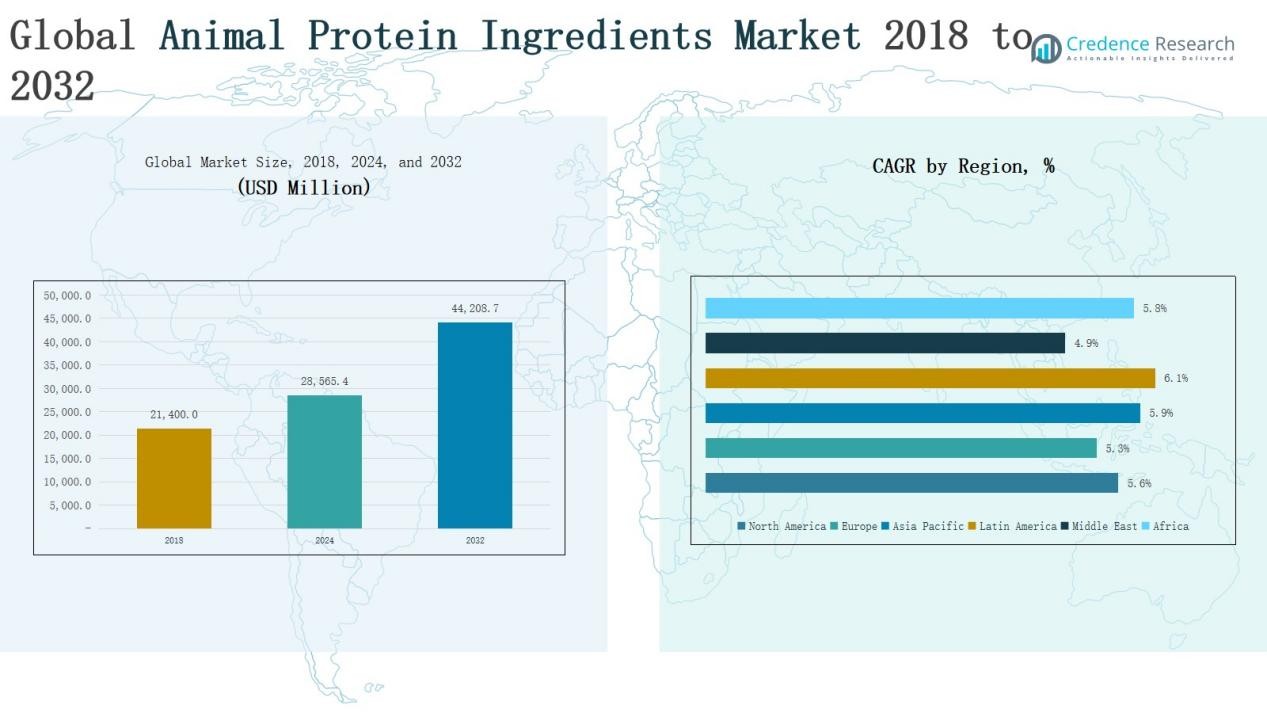

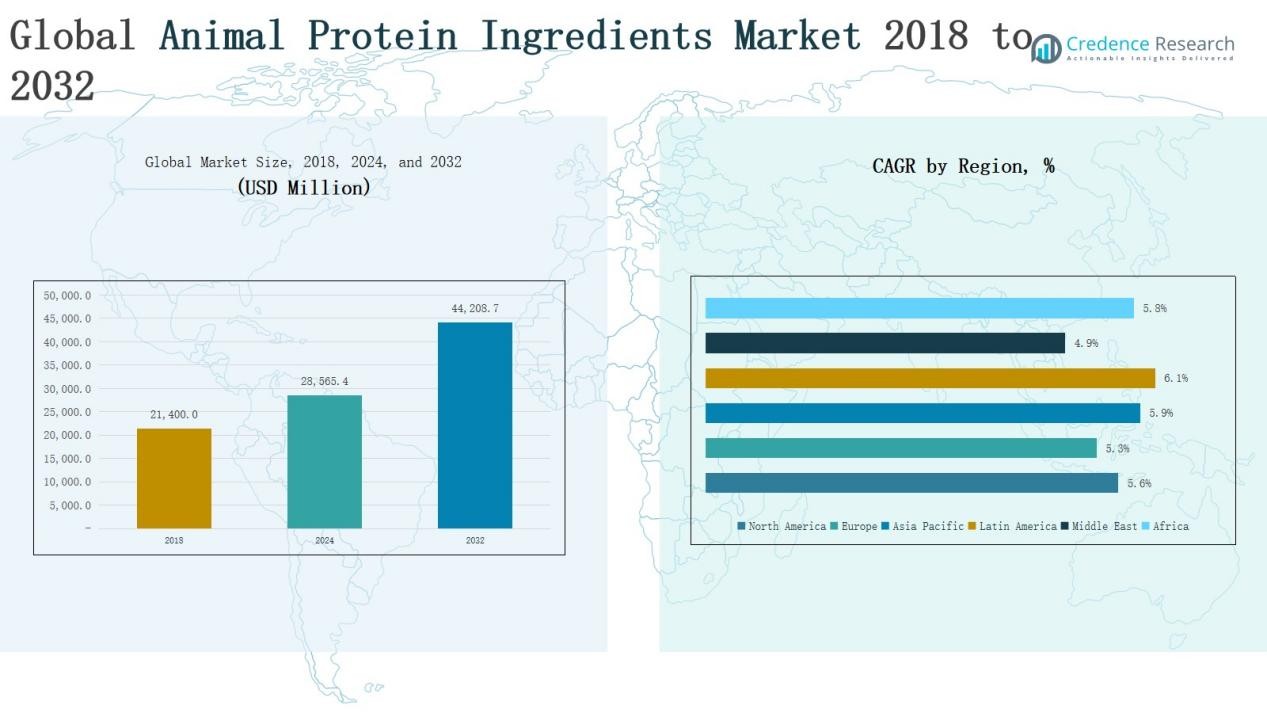

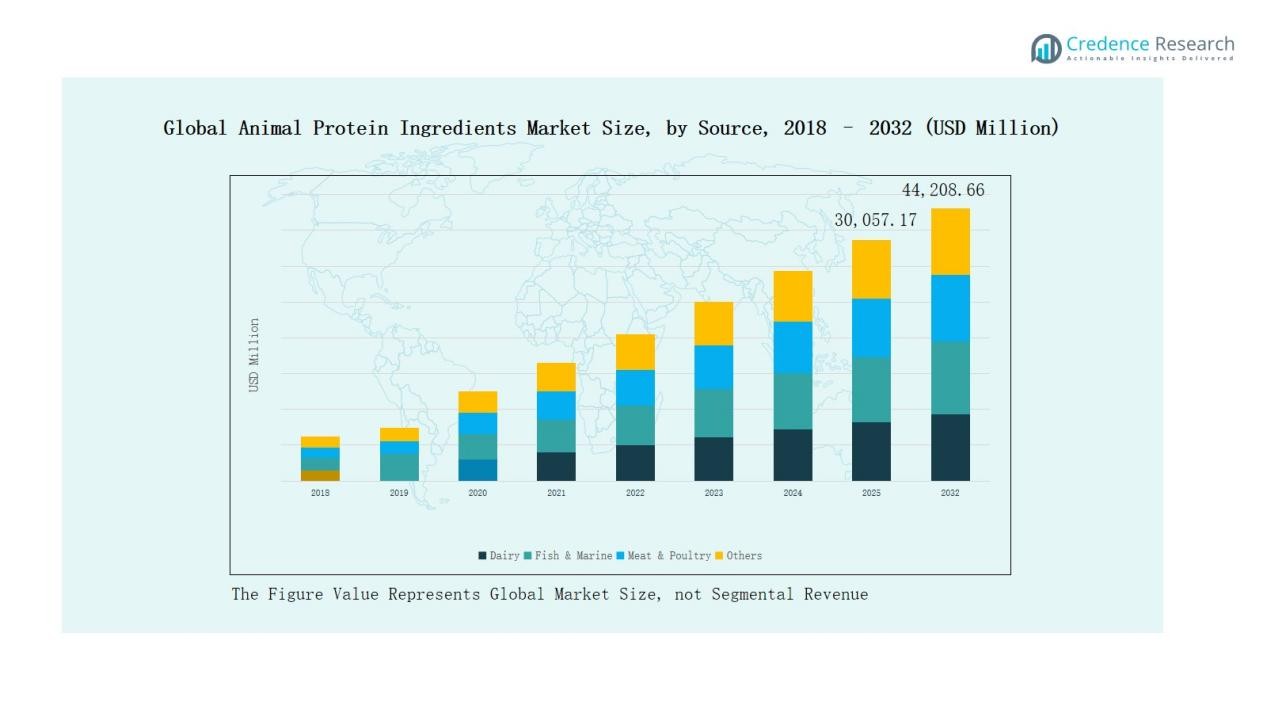

Global Animal Protein Ingredients Market size was valued at USD 21,400.0 million in 2018 to USD 28,565.4 million in 2024 and is anticipated to reach USD 44,208.7 million by 2032, at a CAGR of 5.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Protein Ingredients Market Size 2024 |

USD 28,565.4 Million |

| Animal Protein Ingredients Market, CAGR |

5.67% |

| Animal Protein Ingredients Market Size 2032 |

USD 44,208.7 Million |

The Global Animal Protein Ingredients Market is shaped by leading players including Cargill, Kemin Industries, Nutraferma LLC, CJ Selecta, Green Labs LLC, GRF Ingredients, Prinova, European Protein, NCC Food Ingredients, and BHJ. These companies strengthen their positions through diversified product portfolios, sustainable sourcing strategies, and expansion into high-growth applications such as sports nutrition, clinical nutrition, and pet food. They invest in advanced processing technologies and strategic partnerships to enhance competitiveness and global reach. Regionally, Asia Pacific dominated the market in 2024 with a 40% share, driven by rapid urbanization, aquaculture expansion, and increasing demand for protein-enriched food and feed products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Animal Protein Ingredients Market grew from USD 21,400.0 million in 2018 to USD 28,565.4 million in 2024 and is projected to reach USD 44,208.7 million by 2032, expanding at a CAGR of 67%.

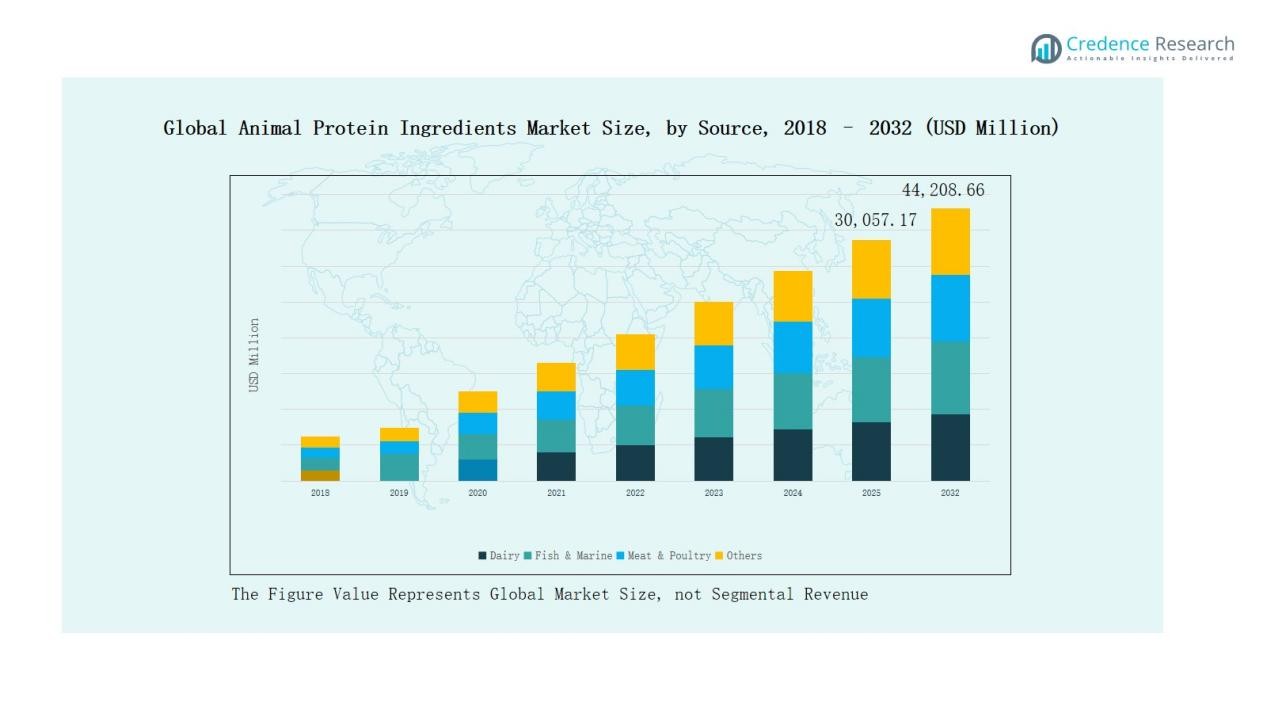

- Dairy proteins led the source segment with 42% share in 2024, followed by meat & poultry at 28%, fish & marine at 23%, and others at 7%, driven by sports, clinical, and feed applications.

- Powdered forms dominated the market with a 64% share in 2024, while granules and flakes held 21%, and liquids and pastes accounted for 15%, driven by wide usage in food, feed, and clinical nutrition.

- Sports and active nutrition remained the leading application with 35% share in 2024, followed by pet food at 22%, aquafeed and livestock feed at 19%, clinical nutrition at 18%, and other uses at 6%.

- Asia Pacific commanded the largest regional share with 40% in 2024, followed by North America at 31%, Europe at 25%, Latin America at 10%, the Middle East at 5%, and Africa at 3%, highlighting strong global diversification.

Market Segment Insights

By Source

Dairy proteins held the dominant share of 42% in 2024, driven by their widespread use in sports nutrition, clinical nutrition, and functional food products. Their high digestibility, balanced amino acid profile, and proven health benefits strengthen adoption. Fish & marine proteins accounted for 23%, supported by rising demand for collagen and omega-rich products. Meat & poultry proteins captured 28%, primarily driven by pet food and livestock feed applications. The remaining 7% share came from other sources, including insect proteins and specialty blends.

- For instance, Vital Proteins’ Marine Collagen powder provides 12 g collagen peptides (from cod) and 11 g protein per serving.

By Form

Powders dominated the market with a 64% share in 2024, owing to their versatility, longer shelf life, and high solubility across food, beverages, and supplements. Granules and flakes represented 21%, used widely in aquafeed and livestock feed due to ease of blending with bulk feed ingredients. Liquids and pastes held the remaining 15%, favored in specialized applications such as clinical nutrition, flavoring bases, and processed foods where concentrated protein extracts are required.

- For instance, Abbott Nutrition’s “Liquid Protein Fortifier” is a sterile, extensively hydrolyzed liquid protein designed for preterm infants needing extra protein.

By Application

Sports and active nutrition was the leading application with a 35% share in 2024, supported by growing consumer focus on fitness, protein supplementation, and performance enhancement. Clinical and medical nutrition accounted for 18%, driven by demand for protein-enriched formulas in elderly care, hospitals, and recovery diets. Pet food contributed 22%, benefiting from premiumization trends and rising pet ownership worldwide. Aquafeed and livestock feed secured 19%, fueled by the need for sustainable protein sources in animal husbandry and aquaculture. The remaining 6% came from other uses, including bakery, snacks, and specialty nutrition.

- For instance, Abbott’s Ensure Plus and Glucerna products are widely used in hospitals to support patient recovery and elderly nutrition.

Key Growth Drivers

Rising Demand for Functional and Sports Nutrition

The global rise in fitness awareness and preventive healthcare strongly drives protein demand. Consumers increasingly prefer protein-enriched powders, shakes, and supplements to support muscle growth, endurance, and recovery. Dairy-derived proteins dominate due to their high digestibility, while fish-based collagen expands in beauty and joint health applications. The growing penetration of e-commerce platforms further boosts accessibility, allowing sports enthusiasts and health-conscious buyers to purchase a wide range of animal protein products globally.

- For instance, in March 2025, Vivici launched Vivitein™ BLG, a precision-fermented dairy protein ingredient in the US market, offering sustainable high-performance protein with 86% less water use and 68% lower carbon footprint than conventional dairy protein production.

Expanding Applications in Clinical and Medical Nutrition

Clinical and medical nutrition drives market expansion as proteins play a critical role in patient recovery, elderly care, and disease management. Hospitals and healthcare providers increasingly prescribe protein-enriched formulas to support post-surgical healing and manage malnutrition. Dairy proteins such as whey and casein are favored for their bioavailability, while hydrolyzed proteins improve absorption in patients with digestive challenges. Growing investments in healthcare infrastructure and aging populations in Europe, North America, and Asia-Pacific strengthen long-term demand.

- For instance, Nestlé Health Science trial: 10 g whey protein microgel consumed before meals reduced postprandial glucose by 22% vs placebo in people with type 2 diabetes.

Growing Demand for Pet Food and Animal Feed

Pet ownership and rising expenditure on premium pet food significantly boost demand for high-quality animal protein ingredients. Meat and poultry proteins are widely used to provide essential amino acids, while fish proteins enrich formulations with omega fatty acids. Aquafeed and livestock feed also expand as global protein consumption rises, requiring sustainable animal nutrition solutions. Emerging markets in Asia-Pacific and Latin America experience rapid adoption, supported by expanding middle-class populations, pet humanization trends, and growing aquaculture activities.

Key Trends & Opportunities

Increasing Adoption of Collagen and Marine Proteins

Collagen from fish and marine sources emerges as a major trend, driven by rising consumer focus on skin health, joint support, and anti-aging benefits. Marine proteins are also valued for sustainability, as they utilize by-products of seafood processing. Demand is particularly strong in nutraceuticals, cosmetics, and functional food categories. This shift provides opportunities for manufacturers to diversify product portfolios and capture premium segments where consumers are willing to pay higher prices for proven health and wellness benefits.

- For instance, Rousselot launched its Peptan Marine collagen peptides, highlighting their science-backed benefits for skin hydration and joint support, targeting the nutricosmetics segment.

Rising Focus on Sustainable and Alternative Sources

Sustainability becomes a key opportunity as producers face pressure to reduce the environmental footprint of animal protein production. Companies are investing in efficient processing technologies, recycling by-products, and integrating insect-based or hybrid protein blends to complement traditional sources. Consumer preference for responsibly sourced proteins creates opportunities for certifications and eco-labeling, enhancing brand loyalty. The trend aligns with global regulatory frameworks that encourage sustainable animal feed and food solutions, supporting long-term market expansion and innovation.

- For instance, Protix opened a new insect protein facility in the Netherlands capable of producing 14,000 tons of insect-based animal feed ingredients annually, highlighting the shift toward circular protein solutions.

Key Challenges

Volatility in Raw Material Prices

The market faces challenges from fluctuating prices of dairy, meat, and fish raw materials. Climate change, disease outbreaks, and supply chain disruptions create cost instability for manufacturers. This volatility directly impacts production costs, limiting profitability for smaller players. Companies must implement robust sourcing strategies, develop alternative supply bases, and explore ingredient diversification to mitigate risks. Maintaining stable pricing while ensuring quality remains a constant challenge for industry participants operating in competitive global markets.

Rising Competition from Plant-Based Proteins

Plant-based proteins are gaining popularity as consumers shift toward vegetarian and vegan lifestyles. Soy, pea, and rice proteins increasingly replace animal-derived ingredients in sports nutrition, functional foods, and pet food. The perception of sustainability and ethical production further strengthens the appeal of plant-based alternatives. This trend intensifies competition, forcing animal protein manufacturers to emphasize superior functionality, digestibility, and unique nutritional benefits. Continuous innovation and effective marketing are crucial to maintain market relevance against plant-based challengers.

Regulatory and Ethical Concerns

Regulatory frameworks on food safety, labeling, and sustainability create compliance challenges across regions. Stricter guidelines on sourcing, animal welfare, and processing standards raise operational costs for producers. Ethical concerns regarding animal-derived ingredients also affect consumer sentiment, especially in Europe and North America. Companies must address these challenges through transparent sourcing, certifications, and ethical communication strategies. Navigating complex regulations while balancing profitability and consumer expectations remains a major hurdle for market participants.

Regional Analysis

North America

North America accounted for 31% of the global market in 2024, reaching a value of USD 7.80 billion. The region benefits from high demand in sports nutrition, functional foods, and clinical nutrition applications. Strong consumer awareness of protein-enriched diets, combined with advanced processing technologies, drives steady growth. The U.S. dominates the regional landscape, supported by large-scale production and strong brand presence. With a projected CAGR of 5.6%, North America will remain a key contributor, expanding its market value to USD 12.02 billion by 2032.

Europe

Europe captured 25% of the global market in 2024, valued at USD 6.19 billion. Demand is supported by clinical nutrition applications, strict quality standards, and rising consumer preference for high-quality dairy proteins. Germany, France, and the UK are major contributors, with growing adoption in nutraceuticals and pet food. Sustainability initiatives and ethical sourcing also shape consumer preferences across the region. With a CAGR of 5.3%, Europe is projected to achieve USD 9.32 billion by 2032, maintaining its strong role in premium protein markets.

Asia Pacific

Asia Pacific emerged as the largest market, holding 40% share in 2024, with revenue of USD 10.07 billion. Rising population, urbanization, and growing disposable incomes drive protein ingredient adoption across food, feed, and clinical applications. China and India lead growth, supported by rapid expansion in aquaculture, pet food, and dietary supplements. The increasing popularity of sports nutrition among younger consumers further boosts demand. With the highest CAGR of 5.9%, Asia Pacific is forecast to reach USD 15.86 billion by 2032, solidifying its dominance.

Latin America

Latin America represented 10% of the global market in 2024, worth USD 2.61 billion. Brazil remains the largest consumer, supported by a strong livestock industry and growing middle-class population driving demand for fortified foods. The region shows strong uptake in pet food and aquafeed segments, reflecting expanding pet ownership and aquaculture activities. With a CAGR of 6.1%, the highest among regions, Latin America is projected to reach USD 4.17 billion by 2032, offering attractive growth opportunities for market players.

Middle East

The Middle East accounted for 5% of the global market in 2024, valued at USD 1.30 billion. Rising health awareness, coupled with growing demand for protein-enriched functional foods, supports steady expansion. GCC countries dominate regional consumption due to strong purchasing power and increasing demand for clinical nutrition and sports supplements. However, reliance on imports and regulatory complexities pose challenges. With a CAGR of 4.9%, the Middle East market is expected to reach USD 1.90 billion by 2032, sustaining modest but stable growth.

Africa

Africa held a 3% share in 2024, valued at USD 576.21 million. The market is primarily driven by expanding livestock and aquaculture sectors, along with rising adoption of fortified food products in urban centers. South Africa leads the region, supported by growing consumer awareness of nutrition and increasing investments in food processing. However, limited infrastructure and affordability constraints restrict widespread adoption. With a strong CAGR of 5.8%, Africa is forecast to reach USD 901.86 million by 2032, highlighting potential for long-term expansion.

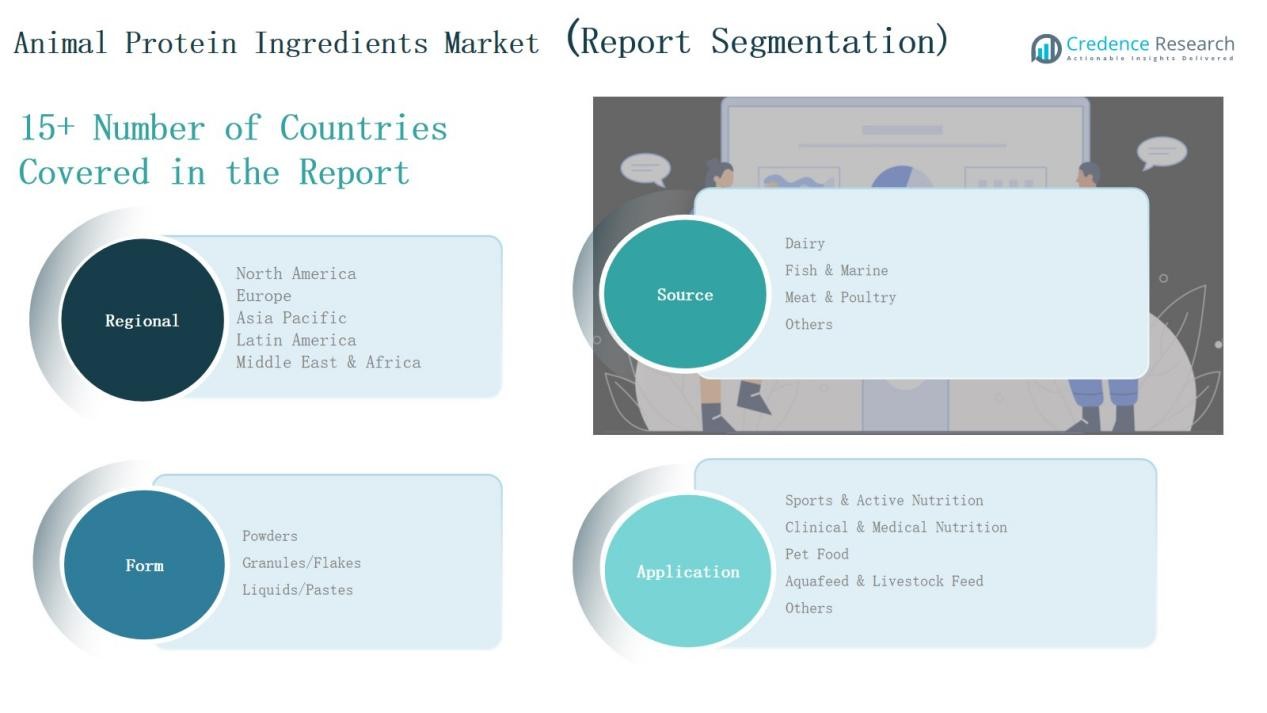

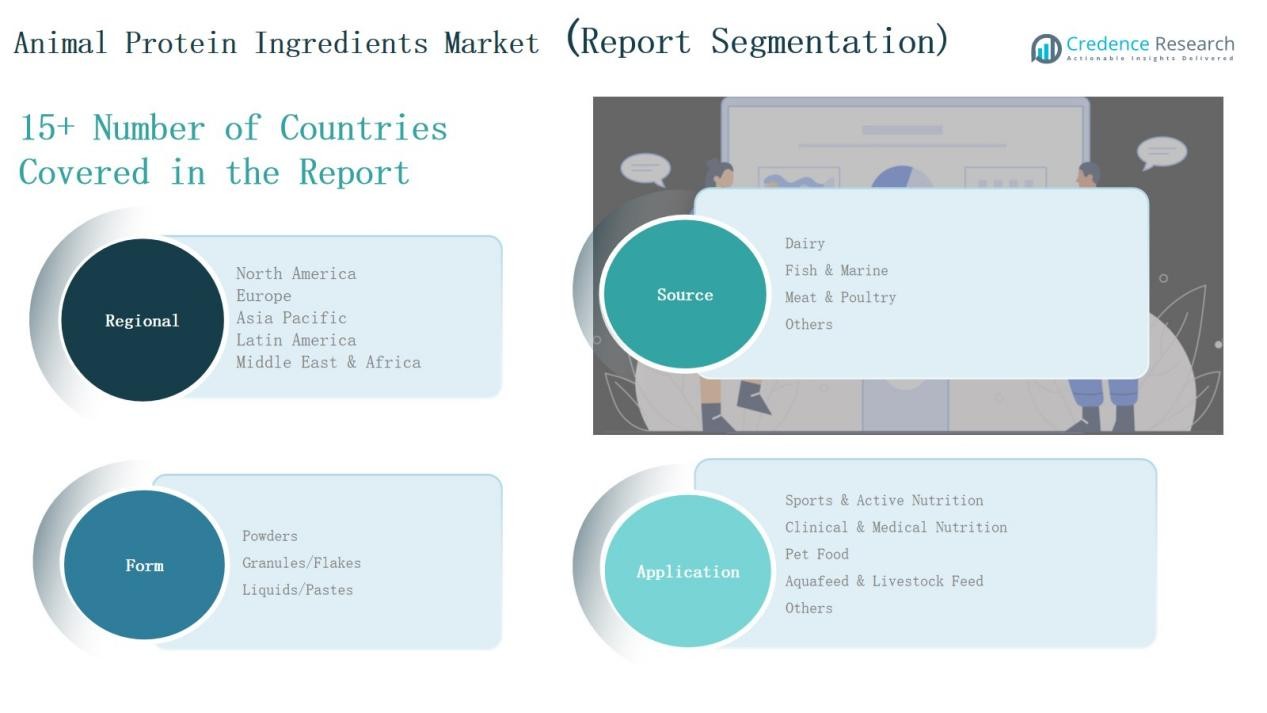

Market Segmentations:

By Source

- Dairy

- Fish & Marine

- Meat & Poultry

- Others

By Form

- Powders

- Granules/Flakes

- Liquids/Pastes

By Application

- Sports & Active Nutrition

- Clinical & Medical Nutrition

- Pet Food

- Aquafeed & Livestock Feed

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Global Animal Protein Ingredients Market is moderately fragmented, with competition driven by product innovation, sourcing strategies, and expansion into high-growth applications. Leading players such as Cargill, Kemin Industries, Nutraferma, and CJ Selecta leverage strong supply chains and diversified portfolios to maintain dominance in dairy, meat, and marine-based proteins. Mid-sized firms, including GRF Ingredients, European Protein, and Prinova, focus on specialized segments like clinical nutrition and pet food, offering tailored solutions to niche markets. Companies increasingly invest in sustainable sourcing, advanced processing technologies, and value-added protein blends to strengthen positioning. Strategic partnerships, mergers, and acquisitions are common as players expand regional presence and diversify product offerings. Rising consumer preference for functional and fortified foods pushes manufacturers to emphasize quality certifications, traceability, and product transparency. The competitive environment is expected to intensify as plant-based alternatives expand, compelling animal protein producers to highlight superior functionality and nutritional benefits to sustain growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Nutraferma LLC

- CJ Selecta

- Green Labs LLC

- GRF Ingredients

- Cargill

- Kemin Industries

- Prinova

- European Protein

- NCC Food Ingredients

- BHJ

- Other Key Players

Recent Developments

- In June 2025, Enifer partnered with FS in Brazil to produce PEKILO®Pet and PEKILO®Aqua mycoproteins using corn-ethanol side streams.

- In March 2025, Vivici launched Vivitein™ BLG, a precision-fermented dairy protein, in the U.S. market.

- In June 2025, Groan Group partnered with Aminola through a financial investment to expand sustainable ingredient supply for food, pet food, and aquafeed.

- In August 2025, v2food entered a strategic partnership with Ajinomoto Co., Inc.; v2food also acquired Daring Foods to boost clean protein product

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dairy proteins will continue to dominate due to strong use in sports and clinical nutrition.

- Marine-based proteins will gain traction as collagen and omega-rich products attract health-conscious consumers.

- Meat and poultry proteins will expand further in pet food and animal feed applications.

- Powdered protein formats will remain the preferred form across functional foods and supplements.

- Clinical nutrition demand will rise with aging populations and growing healthcare investments.

- Pet food applications will see robust growth as pet humanization trends strengthen worldwide.

- Asia Pacific will sustain leadership, driven by urbanization, aquaculture growth, and dietary shifts.

- Sustainability concerns will push manufacturers to adopt responsible sourcing and eco-friendly processing.

- Product innovation in protein blends and hydrolyzed forms will shape premium market segments.

- Competition from plant-based proteins will intensify, urging companies to emphasize unique nutritional benefits.