Market overview

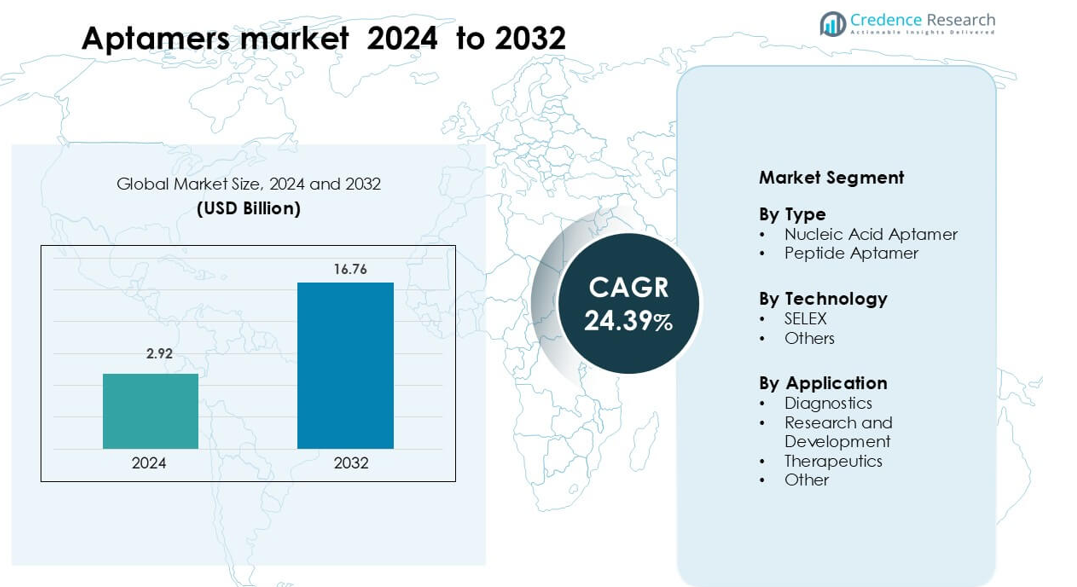

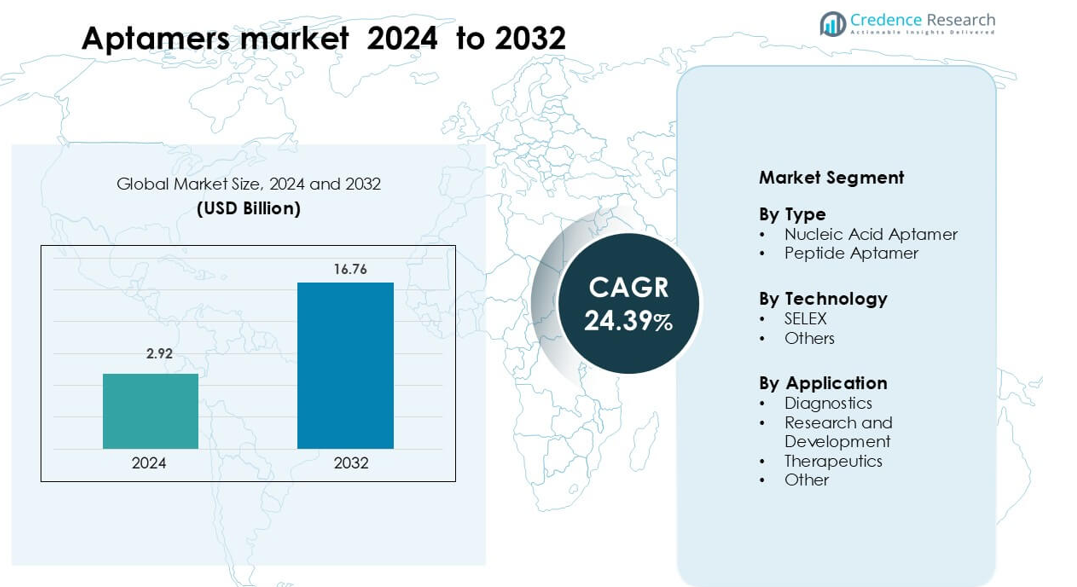

Aptamers market was valued at USD 2.92 billion in 2024 and is anticipated to reach USD 16.76 billion by 2032, growing at a CAGR of 24.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Apple Juice Market Size 2024 |

USD 2.92 billion |

| Apple Juice Market, CAGR |

24.39% |

| Apple Juice Market Size 2032 |

USD 16.76 billion |

The Aptamers market includes key players such as Aptagen, 2bind GmbH, AuramerBio, AMS Biotechnology Limited, Aptamer Group, Creative Biogene, Barrick Lab, IBA GmbH, TriLink BioTechnologies, and NeoVentures Biotechnology Inc. These companies expand their presence through advanced SELEX platforms, custom aptamer libraries, and partnerships with diagnostic and pharmaceutical firms. Product development focuses on higher target specificity, improved stability, and scalable manufacturing to serve diagnostics, therapeutics, and research applications. North America stands as the leading region, holding about 39.4% share in 2024, supported by strong biotech clusters, high R&D spending, and rapid adoption of molecular diagnostic technologies.

Market Insights

- The Aptamers market is valued at USD 2.92 billion in 2024 and is projected to reach USD 16.76 billion by 2032, growing at a CAGR of about 24.39 % during the forecast period.

- Strong demand in diagnostics acts as the key driver, with the segment holding about 46% share, driven by rapid testing needs, high binding accuracy, and expanding use in oncology and infectious disease detection.

- Market trends include rising automation in SELEX workflows, growing interest in point-of-care aptamer assays, and expanding R&D applications supported by advanced molecular screening platforms.

- Competitive landscape features companies such as Aptagen, 2bind GmbH, AuramerBio, AMS Biotechnology Limited, Aptamer Group, Creative Biogene, Barrick Lab, IBA GmbH, TriLink BioTechnologies, and NeoVentures Biotechnology Inc., all focusing on improved affinity, stability, and custom development services.

- North America leads the global market with about 39.4% share, followed by Europe at roughly 27.9%, while Asia-Pacific grows fastest with around 28.7% share, supported by strong biotech expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Nucleic acid aptamers lead this segment with about 72% share in 2024. These molecules dominate because researchers value their strong target affinity, chemical stability, and easy synthesis. Demand grows as labs adopt nucleic acid aptamers for biomarker discovery, drug targeting, and rapid diagnostics. Peptide aptamers grow at a steady pace due to higher structural diversity, but adoption remains lower because production is costlier and optimization takes longer. Rising use of nucleic acid formats in precision medicine continues to reinforce segment leadership.

- For instance, Avacta has developed Affimer reagents (a kind of peptide aptamer scaffold) that inhibit immune-complex binding by targeting FcγRIIIa, showing that peptide-based scaffolds can be used with high specificity in protein–protein interaction modulation.

By Technology

SELEX holds the dominant position with nearly 81% share in 2024. The process leads because SELEX enables systematic selection of high-affinity aptamers for complex biological targets. Growth rises as SELEX workflows become faster through automation and enhanced screening methods. The “Others” category, including cell-based and microfluidic platforms, expands as firms seek higher throughput, yet uptake stays smaller due to limited standardization. SELEX continues to lead adoption as researchers depend on its proven selection accuracy and reproducible performance.

- For instance, Capillary Electrophoresis (CE)-SELEX, as used in advanced labs, can complete aptamer selection in just 1–4 rounds, compared to the 8–20 rounds typical of conventional SELEX.

By Application

Diagnostics remain the largest application with around 46% share in 2024. Diagnostic use leads because aptamers help create rapid, sensitive tests for infectious diseases, cancer markers, and metabolic disorders. Healthcare labs prefer aptamer-based assays due to low batch variability and quick response time. Research and development follows as scientists apply aptamers for target validation and molecular screening. Therapeutics grow as firms explore aptamer-drug conjugates, but regulatory pathways remain longer. Strong demand for fast diagnostic tools drives the dominance of this segment.

Key Growth Drivers

Rising Adoption in Diagnostics

Demand rises as hospitals shift toward fast testing methods using aptamer-based tools. Many labs prefer aptamers because the molecules bind targets with strong accuracy. These traits support reliable detection of cancer markers and viral proteins. Diagnostic firms now design low-cost kits for wide testing use. The approach reduces batch variation and helps maintain steady output. Healthcare centers choose these kits to speed patient screening. Point-of-care devices also drive market growth. Many devices use aptamers to improve test sensitivity. Global disease surveillance programs increase testing needs. Research groups supply new sequences for advanced detection. Expanding screening programs raise consumable use. The trend strengthens demand across major markets.

- For instance, a group using graphene-oxide cell-SELEX selected 96 ssDNA aptamers over 11 rounds to target SARS-CoV-2; two aptamers showed dissociation constants (Kₙ) in the range of ~200–500 nM, and one (Apt 91) detected virus in over 97 % of clinical nasopharyngeal samples.

Growth in Targeted Therapeutics

Pharma firms explore aptamers for targeted drug delivery systems. Many companies value the strong binding features. The approach helps direct treatment with improved precision. Developers test aptamer-drug pairs for safer therapy. Early results show strong targeting strength. This benefit reduces unwanted effects and improves dose control. Firms build platforms for rapid aptamer selection. These tools shorten development cycles. Research improves sequence stability for longer drug action. Investment grows as the method supports precision therapy goals. Clinical trials expand in key disease areas. These studies drive interest from large drug makers.

- For instance, researchers engineered the DNA aptamer sgc8c (which binds PTK7 on ALL cells) conjugated to doxorubicin via a hydrazone linker; in cell assays, this sgc8c–DOX conjugate internalized efficiently into CCRF-CEM cells and exhibited therapeutic potency similar to free DOX but with much lower non-target cell toxicity.

Expansion in Research Applications

Research centers use aptamers for protein tracking and cell studies. Many labs trust the high binding accuracy. The approach supports clean and repeatable results. Universities adopt aptamers for low-cost experiments. The method helps students access reliable tools. Scientists use advanced SELEX platforms for faster selection. Automation expands research output. Many studies test new targets each year. These results broaden market reach. Growth continues as funding supports biomarker programs. Global research networks share new formats. This knowledge flow strengthens adoption worldwide.

Key Trends and Opportunities

Shift Toward Automated SELEX Platforms

Automation makes selection steps faster and cleaner. Many labs adopt compact systems. The tools support high-throughput screening tasks. This change improves sequence quality and yield. Firms launch improved devices for faster rounds. Automation reduces manual errors. Many researchers value consistent results. Companies bundle software for quicker data checks. Adoption grows across small labs. These gains help widen aptamer discovery use. The trend supports lower selection time. Market interest rises as automation improves workflow strength.

- For instance, the HAPIscreen method uses a 384-well (and potentially 1,536-well) automated format, shortening the time from enriched SELEX pools to high-affinity aptamer identification by at least 50%.

Rising Focus on Point-of-Care Tools

Point-of-care kits use aptamers for rapid testing. These tools support quick checks in clinics. Many kits run without complex hardware. Developers build light and sturdy formats. The approach improves emergency screening speed. Governments support quick testing systems. This support encourages wider deployment. Aptamers help improve device sensitivity. Many firms target rural areas. Growth accelerates in emerging regions. These trends create new product lines. Market players expand supply networks.

- For instance, Zentek uses single-stranded DNA aptamers in a portable electrochemical sensor that gives saliva-based COVID-19 test results in under 10 minutes using minimal hardware.

Key Challenges

Complex Regulatory Pathways

Therapeutic aptamers face long review steps. Many agencies require deep safety checks. This increases development time. Companies must run wide trials. These trials demand high resources. Small firms face pressure. Many projects slow without funding. Delays impact launch timelines. Developers must meet strict quality rules. These rules add heavy workload. Market entry becomes slower. Growth in therapeutics gets limited. These hurdles challenge new players.

Stability and Delivery Limitations

Some aptamers need improved stability. Molecules may degrade inside the body. This reduces treatment impact. Firms test chemical fixes. These fixes raise cost levels. Delivery systems remain under development. Many formats need better shielding. Weak delivery lowers product success. Research tries new carriers. Carriers add extra steps. These challenges slow therapeutic growth. Market players push for improved designs. Continuous work is required.

Regional Analysis

North America

In 2024, North America accounted for about 39.4% share of the global Aptamers market, based on regional revenue estimates from Verified Market Research The region benefits from a mature biotechnology ecosystem, strong university–industry links, and high healthcare spending. Extensive clinical pipelines for aptamer-based oncology and ophthalmology drugs further reinforce leadership. The U.S. alone contributed over 40% of global aptamers revenue in 2023, which underlines regional dominance. Supportive regulators and robust venture funding continue to drive adoption of aptamer platforms in diagnostics, therapeutics, and drug discovery workflows.

Europe

The Aptamers market in Europe represented roughly 27.9% global share in 2024, calculated from regional revenue of about 0.85 billion against total regional sales. Grand View Research also reported that Europe captured 25.3% share in 2023, confirming its role as the second-largest regional cluster. Growth in 2024 is supported by strong pharma and biotech bases in Germany, the U.K., and France, where nucleic acid aptamers dominate type demand Increasing approvals of advanced molecular diagnostics, together with EU funding for precision medicine and in-vitro diagnostic innovation, continue to expand use of aptamer assays and research tools.

Asia-Pacific

In 2024, Asia-Pacific held an estimated 28.7% share of the global Aptamers market, derived from regional revenue of about 0.876 billion versus the summed regional total. Horizon data show Asia-Pacific aptamers revenue at 494.7 million in 2023, which already equated to just over one-fifth of global sales and was growing at more than 26% CAGR. China, Japan, India, and South Korea drive demand through rapid expansion of biotech infrastructure, strong government funding, and rising clinical research activity. The region is now the fastest-growing Aptamers market, with extensive opportunities in oncology diagnostics, infectious disease testing, and low-cost research reagents.

Latin America

Latin America accounted for a smaller but meaningful 1.1% share of the global Aptamers market in 2024, based on a regional valuation of 0.035 billion Grand View Research reported 140.2 million aptamers revenue for Latin America in 2023, which translates to roughly 6% of global turnover in that year, reflecting early but accelerating adoption. Brazil and Mexico lead regional demand as laboratories modernize molecular diagnostics and pharmaceutical quality testing. Key drivers include growing oncology and infectious disease burdens, interest in cost-effective biosensors, and partnerships bringing international aptamer platforms into local clinical laboratories and research institutes.

Middle East & Africa

The Middle East & Africa held about 2.9% share of the global Aptamers market in 2024, derived from a regional value of 0.087 billion against combined regional revenue. Market Data Forecast separately reported Middle East & Africa aptamers revenue near 14.91 million for 2024 in a narrower segment view, confirming a relatively small but growing base. Adoption concentrates in Gulf Cooperation Council countries, Israel, and South Africa, where healthcare investment and advanced diagnostic infrastructure are expanding. Growth in 2024 is driven by rising cancer diagnostics, imported high-end analyzers that integrate aptamer assays, and national strategies to upgrade laboratory capabilities across tertiary hospitals and reference labs.

Market Segmentations

By Type

- Nucleic Acid Aptamer

- Peptide Aptamer

By Technology

By Application

- Diagnostics

- Research and Development

- Therapeutics

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive Landscape

Competitive landscape in the Aptamers market features key companies such as Aptagen, 2bind GmbH, AuramerBio, AMS Biotechnology Limited, Aptamer Group, Creative Biogene, Barrick Lab, IBA GmbH, TriLink BioTechnologies, and NeoVentures Biotechnology Inc. These players compete by advancing SELEX efficiency, improving chemical stability, and expanding custom aptamer development services. Many firms invest in automation to shorten selection cycles and increase throughput for diagnostics, therapeutics, and research applications. Strategic collaborations with pharma and diagnostic developers strengthen market reach, while new product launches focus on higher binding affinity and improved assay performance. Companies also expand manufacturing capabilities to support rising demand for nucleic acid aptamers across oncology, infectious diseases, and biomarker discovery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aptagen

- 2bind GmbH

- AuramerBio

- AMS Biotechnology Limited

- Aptamer Group

- Creative Biogene

- Barrick Lab

- IBA GmbH

- TriLink BioTechnologies

- NeoVentures Biotechnology Inc.

Recent Developments

- In October 2024, GmbH: 2bind announced a new Co-CEO leadership team, with Dr. Maximilian Plach and Dr. Cosimo Kropp leading the CRO’s expansion in biophysical services, including its aptamer discovery and characterization offerings for pharma and biotech partners

- In September 2024, Aptagen secured a contract from the FDA’s Center for Biologics Evaluation and Research to develop Amb a 1-specific aptamers to measure the biological potency of commercial ragweed pollen extracts, strengthening its position as a specialist aptamer developer for regulated applications

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Aptamers market will expand rapidly as demand rises for high-specificity diagnostic tools.

- Therapeutic aptamers will gain traction as stability and delivery technologies improve.

- Automation in SELEX processes will shorten development cycles and increase adoption across labs.

- Point-of-care devices will integrate more aptamer-based assays to support faster clinical decisions.

- Pharma collaborations will strengthen as companies explore aptamer-drug conjugates for targeted treatments.

- Research institutions will increase aptamer use for biomarker discovery and molecular screening.

- Advances in chemical modification will improve aptamer durability for complex clinical environments.

- Emerging markets in Asia-Pacific will accelerate growth through expanding biotechnology infrastructure.

- Regulatory clarity will improve, supporting smoother development pathways for therapeutic products.

- New companies will enter the market with innovative platforms, raising competition and technological advancement.