Market Overview

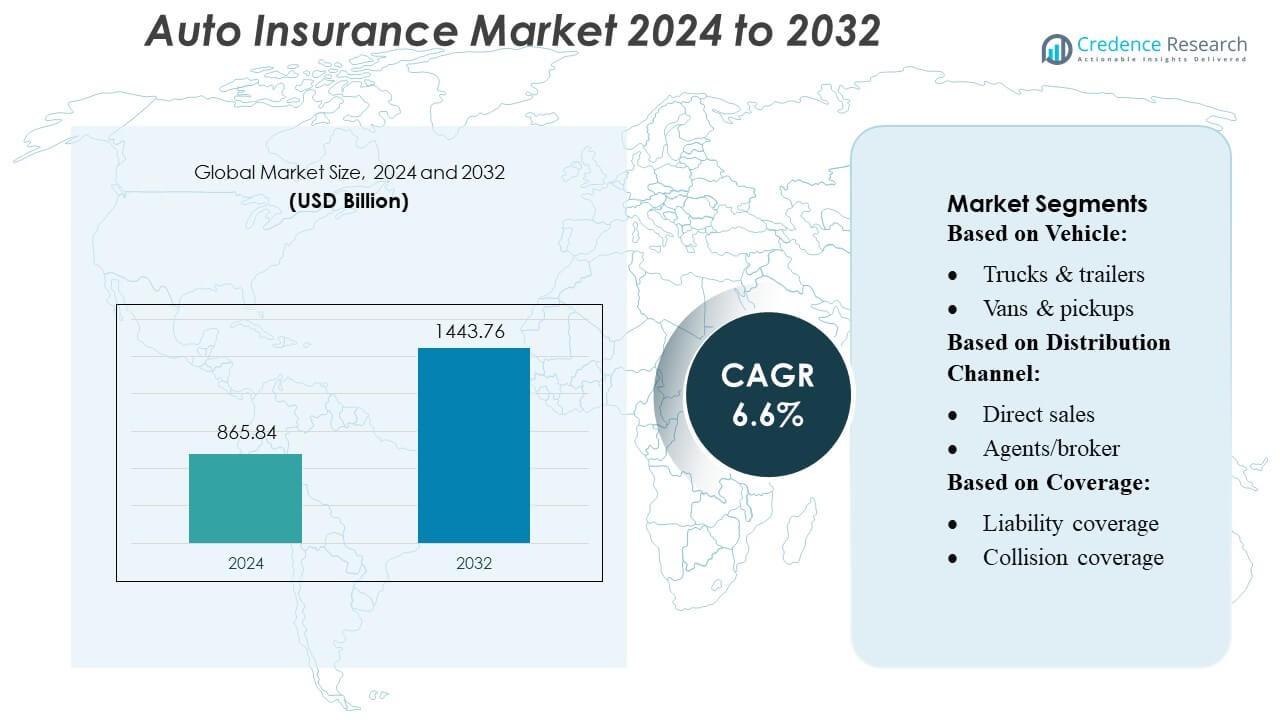

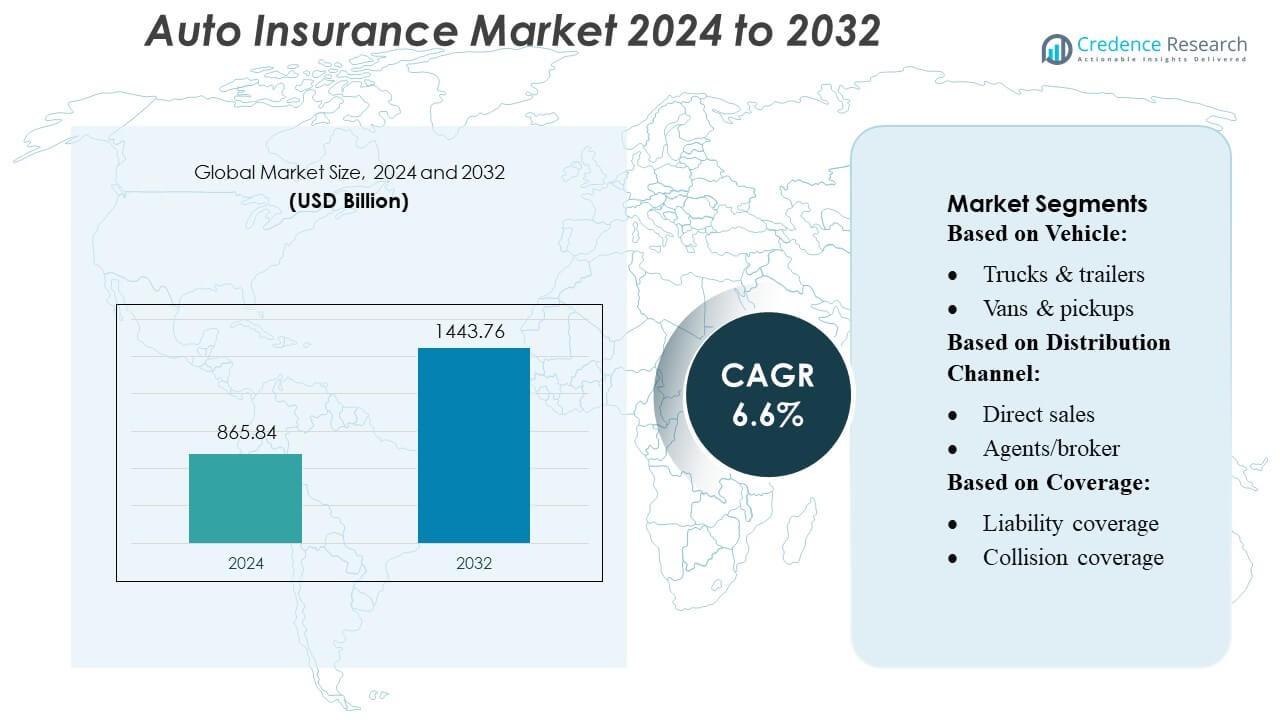

Auto Insurance Market size was valued USD 865.84 billion in 2024 and is anticipated to reach USD 1443.76 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Auto Insurance Market Size 2024 |

USD 865.84 Billion |

| Auto Insurance Market, CAGR |

6.6% |

| Auto Insurance Market Size 2032 |

USD 1443.76 Billion |

The global auto-insurance market is dominated by a cohort of major players including State Farm, Progressive, GEICO (Berkshire Hathaway), Allstate, Liberty Mutual, Allianz, AXA, Zurich, Generali, and Ping An, all of whom leverage broad underwriting capacity, technology, and strong brand presence. Leading insurers like State Farm and Progressive command a significant share in the U.S., while Allianz, AXA, Zurich, and Generali bolster their reach in Europe and Asia. Regionally, North America leads the auto insurance market with about 35 %.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Auto Insurance Market reached USD 865.84 billion in 2024 and is projected to hit USD 1443.76 billion by 2032, expanding at a CAGR of 6.6% during the forecast period.

- Rising vehicle ownership, stricter road-safety regulations, and increasing adoption of telematics-based policies continue to drive steady premium growth across key markets.

- Usage-based insurance, AI-driven claims automation, and digital distribution channels are emerging as major trends, improving pricing accuracy and customer engagement.

- The market remains competitive, with State Farm, Progressive, GEICO, Allstate, Liberty Mutual, Allianz, AXA, Zurich, Generali, and Ping An strengthening their positions despite challenges such as rising claim costs and regulatory compliance pressures.

- North America holds the largest regional share at 35%, while the passenger-vehicle insurance segment maintains the highest contribution globally, supported by expanding urban mobility and increased demand for comprehensive coverage.

Market Segmentation Analysis:

By Vehicle

Trucks and trailers hold the dominant position in the auto insurance market, accounting for an estimated 38–42% share, driven by their extensive use in commercial logistics and higher exposure to operational risks. Vans and pickups follow, supported by rising SME adoption and last-mile delivery needs. Buses contribute moderately due to fleet-level insurance requirements in public and private transport networks. The “others” category—comprising passenger utility vehicles and specialized fleets—remains smaller but grows steadily with expanding industrial mobility and custom policy offerings targeting niche transportation activities.

- For instance, Chubb’s major-accounts team serves fleets with 500 or more vehicles, many of which include a significant portion of light commercial vans and pickups.

By Distribution Channel

Direct sales remain the leading distribution channel with an estimated 45–50% market share, driven by strong digital adoption, competitive pricing, and simplified online policy issuance. Agents and brokers maintain a significant share by serving customers requiring personalized consultation, particularly in commercial fleet insurance and high-value policies. Their advisory role supports higher conversion rates and tailored risk-assessment services. The dual-channel ecosystem continues to expand as insurers invest in digital onboarding tools, improving transparency and policy comparison efficiency while sustaining advisor-assisted models for complex coverage needs.

- For instance, Liberty Mutual reported that its direct sales and call-center channels are complemented by a partner network (specifically its Safeco independent agent network) that spans over 22,000 independent agencies.

By Coverage

Liability coverage dominates the segment with an estimated 40–45% share, supported by regulatory mandates and its essential role in covering third-party injury and property damage. Collision coverage follows, driven by rising accident rates and increasing vehicle repair costs. Comprehensive coverage gains traction owing to broader protection against theft, natural disasters, and non-collision events. Uninsured and underinsured motorist coverage show steady growth as insurers address rising concerns over inadequate coverage among road users, encouraging customers to adopt supplemental protection for financial risk mitigation.

Key Growth Drivers

- Rising Vehicle Ownership and Expanding Mobility Ecosystem

Increasing global vehicle ownership continues to fuel demand for auto insurance, particularly in emerging markets where rising incomes accelerate new car purchases. Growth in commercial mobility—ride-hailing fleets, logistics networks, and last-mile delivery operators—further expands the insured vehicle base. Insurers benefit from higher policy volumes and additional coverage requirements such as liability, collision, and commercial fleet protection. This expanding mobility ecosystem directly boosts premium revenue and strengthens long-term market growth.

- For instance, AXA Sigorta (AXA Turkey) developed a mobile telematics app called AXA GO and launched a pilot program with approximately 1,000 policyholders (the prompt mentions young drivers, but reports indicate it was offered to a tech-savvy focus group including young drivers).

- Advancements in Telematics and Usage-Based Insurance (UBI)

Rapid adoption of telematics devices and smartphone-based driving behavior analytics enhances underwriting accuracy and supports usage-based insurance models. Insurers leverage real-time data on braking patterns, mileage, and acceleration to personalize premiums and reduce risk exposure. This improves customer transparency, strengthens retention, and reduces claims frequency. As automotive IoT becomes mainstream, UBI policies accelerate market penetration by rewarding safe driving and enabling more precise risk segmentation across diverse customer groups.

- For instance, AIG’s global claims organization—which comprises more than 5,500 claims professionals—has been exploring the use of large language models and generative AI to streamline various internal processes, including claims handling.

- Government Regulations and Mandatory Insurance Policies

Strict regulatory frameworks and mandatory third-party liability insurance requirements significantly drive market expansion. Governments across many regions enforce compliance through digital monitoring systems, e-verification platforms, and automated penalty structures. These mechanisms increase policy penetration and curb uninsured vehicle rates. Additionally, regulatory incentives promoting digital claim processing and anti-fraud mechanisms strengthen insurer efficiency. Continuous regulatory modernization ensures steady demand and a stable revenue base for insurers operating in competitive and mature markets.

Key Trends & Opportunities

1. Digitalization and AI-Driven Claims Automation

Insurers increasingly deploy artificial intelligence, automated claims platforms, and digital self-service portals to improve operational efficiency and customer experience. AI-enabled image analytics, instant damage assessment, and automated approvals significantly reduce claim settlement time. This trend opens opportunities for insurers to scale digital-only policies, lower operational costs, and enhance fraud detection. The shift toward paperless, omnichannel customer engagement strengthens competitive positioning and attracts tech-savvy consumers seeking faster service.

- For instance, State Farm has filed numerous patents in AI, focusing on areas like generating 3D LIDAR-based models and mobility-profile analysis, and has also actively pursued patents in digitalization, including for edge-computing architectures to integrate telematics and personal data securely.

2. Growth of Electric Vehicles and Specialized Insurance Products

The global shift toward electric vehicles (EVs) presents new premium streams for insurers, driven by evolving risk profiles related to battery safety, repair costs, and charging infrastructure. EV-specific policies, extended warranty plans, and battery protection coverage create attractive growth avenues. As EV adoption accelerates across Asia, Europe, and North America, insurers can develop specialized underwriting models and partner with automakers to deliver bundled digital insurance products.

- For instance, Progressive’s Accident Response feature — built in collaboration with Cambridge Mobile Telematics — now serves over 1.5 million app users, using smartphone sensors and AI to automatically dispatch emergency services or initiate a claim following a detected collision.

3. Expansion of Embedded Insurance with Automotive OEMs

Automotive manufacturers increasingly integrate embedded insurance offerings directly into vehicle purchase and financing processes. This trend enables seamless policy onboarding, transparent pricing, and improved customer convenience. For insurers, partnerships with OEMs unlock access to large customer bases and real-time vehicle data that enhances underwriting precision. Embedded insurance solidifies long-term customer relationships and supports cross-selling opportunities across multiple coverage types.

Key Challenges

1. Rising Claims Costs and Repair Inflation

Increasing repair costs, driven by advanced vehicle components, expensive sensors, and complex electronics, continue to pressure insurer profitability. Labor shortages and supply-chain disruptions further inflate claims expenses and lengthen repair cycles. High medical costs and litigation trends in certain regions intensify liability claim burdens. Insurers must balance premium adjustments with market competitiveness while implementing predictive analytics to manage cost escalation and maintain sustainable margins.

2. Growing Exposure to Fraud and Cybersecurity Risks

Fraudulent claims, staged accidents, and identity manipulation pose significant challenges for insurers, contributing to substantial financial losses annually. As digital channels expand, cybersecurity vulnerabilities—including data breaches, system intrusions, and ransomware attacks—expose insurers to operational disruptions and reputational risks. Strengthening fraud-detection algorithms, enhancing verification protocols, and investing in robust cybersecurity frameworks are essential to mitigate these threats and maintain customer trust in digital insurance ecosystems.

Regional Analysis

North America

North America holds about 34% of the global auto insurance market, supported by high vehicle ownership, strict mandatory insurance laws, and a mature regulatory framework. The U.S. leads premium generation due to large insured vehicle fleets and strong adoption of telematics and usage-based insurance. Digital claims processing, AI-based pricing, and embedded insurance partnerships continue to strengthen competitiveness. The region’s stable economic environment and advanced distribution channels support steady premium growth and maintain its position as one of the most developed auto insurance markets globally.

Europe

Europe accounts for roughly 25–30% of the global market, driven by mandatory third-party liability requirements and high insurance penetration across major countries such as Germany, the UK, Italy, and France. Strong regulatory frameworks and advanced digital infrastructure support efficient claims management and pricing accuracy. European insurers increasingly adopt telematics, pay-as-you-drive models, and EV-specific products. The region’s well-organized automotive sector and rising electric vehicle sales continue to shape product innovation, ensuring consistent demand for both comprehensive and specialized auto insurance policies.

Asia-Pacific

Asia-Pacific contributes the largest share around 37–38% to the global auto insurance market, supported by rapid urbanization, rising disposable incomes, and expanding vehicle sales in China, India, Japan, and Southeast Asia. Governments are improving enforcement of motor insurance laws, which increases policy uptake. Digital platforms, online aggregators, and telematics adoption are accelerating distribution and underwriting efficiency. Growing demand for EVs and connected vehicles provides insurers opportunities to design customized coverage. The region’s large population and fast-growing mobility ecosystem continue to drive premium volume growth.

Latin America

Latin America represents about 3–4% of the global market, with growth driven by increasing vehicle ownership, gradual economic improvement, and stronger enforcement of compulsory motor insurance laws. Markets such as Brazil, Mexico, Argentina, and Chile lead regional premium generation. Digital insurers and online distribution channels are expanding access to low-cost policies. Although penetration remains lower than in mature markets, rising demand for financial protection and fleet insurance supports steady growth. The region presents long-term potential as insurance awareness and regulatory consistency improve.

Middle East & Africa

The Middle East & Africa region accounts for roughly 6–8% of the global auto insurance market. Demand increases with rising car ownership, expanding commercial fleets, and stricter implementation of mandatory vehicle insurance laws. Countries such as the UAE, Saudi Arabia, South Africa, and Egypt drive most premium activity. Digital underwriting and automated claims tools are gaining traction, and insurers are offering more tailored coverage for commercial transport and logistics. Although overall penetration is still developing, MEA offers significant growth potential due to regulatory modernization and expanding urban mobility.

Market Segmentations:

By Vehicle:

- Trucks & trailers

- Vans & pickups

By Distribution Channel:

- Direct sales

- Agents/broker

By Coverage:

- Liability coverage

- Collision coverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The auto insurance market features an intensely competitive landscape led by major global and regional insurers such as Chubb, Liberty Mutual Insurance, AXA, Bajaj Finserv, American International Group (AIG), State Farm Mutual Automobile Insurance Company, Progressive Casualty Insurance Company, Zurich Insurance Group, The Travelers Indemnity Company, and Allianz Group. The auto insurance market is highly competitive, characterized by a mix of global insurers, regional carriers, and emerging digital-first companies that continuously innovate to strengthen their market positions. Competition intensifies as insurers invest in advanced underwriting technologies, telematics-based pricing models, and AI-driven claims automation to enhance accuracy and reduce processing time. Digital distribution platforms, online aggregators, and embedded insurance offerings are reshaping customer acquisition strategies, while strong regulatory oversight ensures pricing discipline and compliance. As customer expectations shift toward personalized coverage, faster claim settlements, and transparent policy terms, insurers focus on product innovation, fraud prevention tools, and data-driven service models. This evolving competitive environment encourages continuous modernization, enabling insurers to differentiate through customer experience, technological capabilities, and scalable digital operations.

Key Player Analysis

- Chubb

- Liberty Mutual Insurance

- AXA

- Bajaj Finserv

- American International Group (AIG)

- State Farm Mutual Automobile Insurance Company

- Progressive Casualty Insurance Company

- Zurich Insurance Group

- The Travelers Indemnity Company

- Allianz Group

Recent Developments

- In December 2024, Bajaj Allianz General Insurance launched two new motor insurance: Eco Assure – Repair Protection and Named Driver Cover. These insurances provide comprehensive and customized coverage.

- In August 2024, ICICI Lombard launched the industry’s first innovative “Smart Saver Plus” add-on for motor insurance policies. This insurance aims to address concerns of policyholders regarding prolonged turnaround times and the need for reliable repair quality by providing quality assurance, swift servicing, and customer convenience.

- In March 2024, Hub International (Hub) disclosed its acquisition of the assets of William R Cargill Insurance Agency, Inc (Cargill Insurance). Cargill Insurance is a family-owned, full-service insurance agency providing an array of personal coverage options, encompassing home, auto, personal umbrella, boat, and life insurance, alongside commercial and general liability insurance offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Distribution Channel, Coverage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt telematics and driving-behavior analytics to enable more accurate and personalized premium pricing.

- Digital claims automation and AI-driven assessments will significantly shorten settlement cycles and improve customer satisfaction.

- Usage-based and pay-per-mile insurance models will expand as consumers seek flexible, cost-efficient coverage options.

- Electric and connected vehicles will drive demand for specialized policies tailored to battery risks, software failures, and advanced sensor repair costs.

- Embedded insurance partnerships with automakers and mobility platforms will become a mainstream distribution channel.

- Insurers will rely more on predictive analytics to reduce fraud, optimize underwriting, and enhance portfolio profitability.

- Growing adoption of autonomous driving technologies will reshape liability models and require new risk frameworks.

- Climate change and rising natural disasters will prompt insurers to refine risk pricing and strengthen catastrophe management strategies.

- Digital-only insurers and insurtechs will intensify competition by offering faster, more transparent policy experiences.

- Regulatory modernization will continue to promote compliance, data security, and greater transparency across insurance ecosystems.