Market Overview

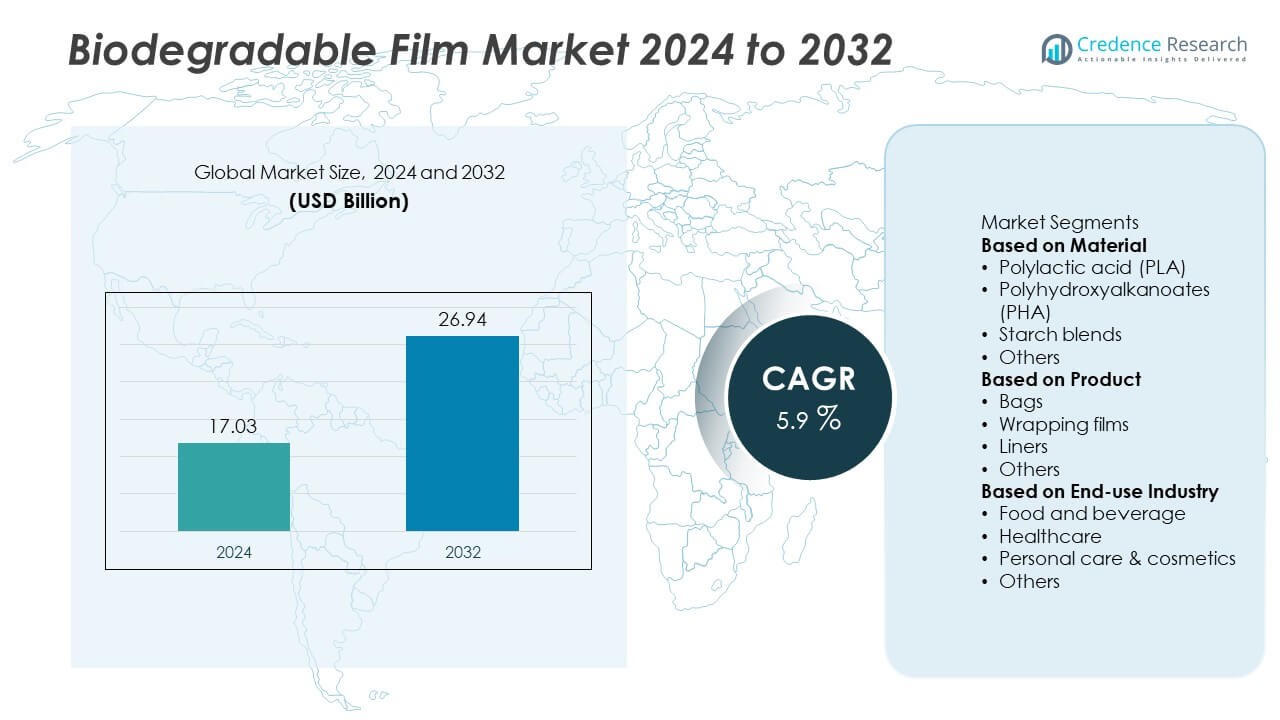

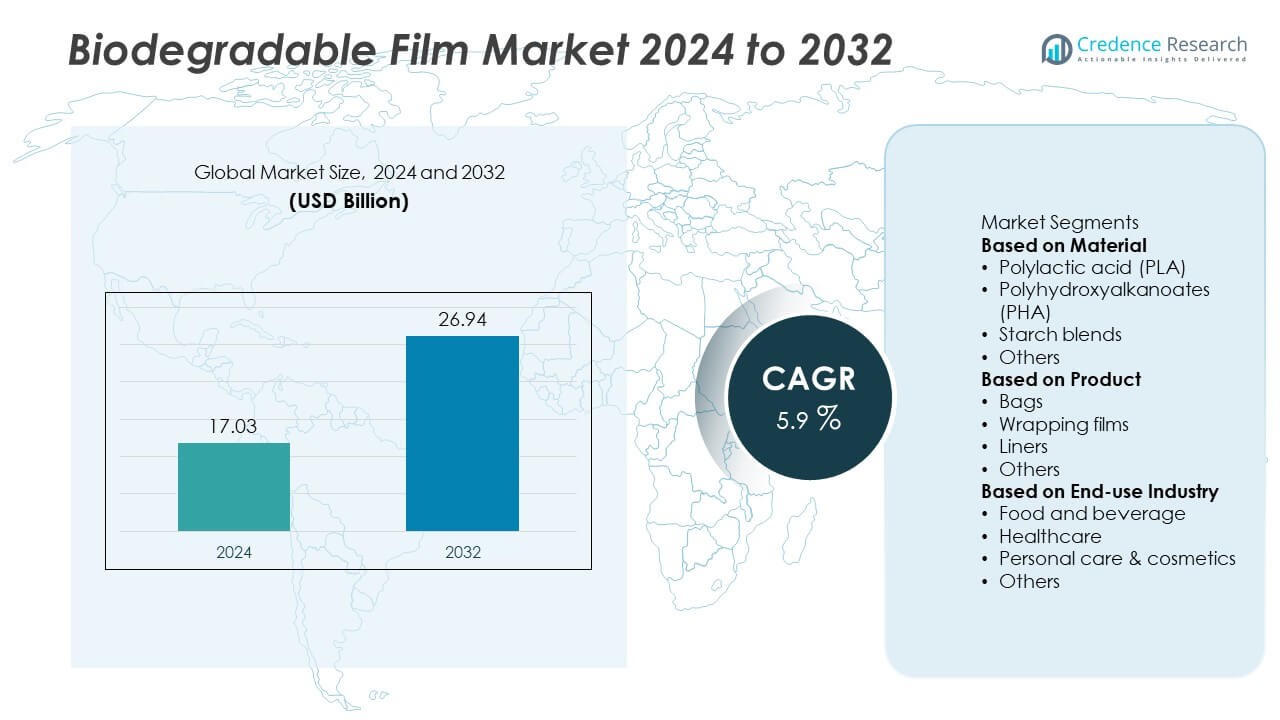

The Biodegradable Film Market was valued at USD 17.03 billion in 2024 and is projected to reach USD 26.94 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biodegradable Film Market Size 2024 |

USD 17.03 Billion |

| Biodegradable Film Market, CAGR |

5.9% |

| Biodegradable Film Market Size 2032 |

USD 26.94 Billion |

The Biodegradable Film market is led by key players such as Mondi, DS Smith, Biome Bioplastics, Opackgroup, Futamura, Barbier, Kuber Polyfilms, Cortec, Bleher Folientechnik, and Nufab Green. These companies dominate through innovations in compostable and bio-based polymer films, focusing on performance, sustainability, and regulatory compliance. Continuous advancements in PLA, PHA, and starch-based materials are strengthening their market competitiveness. North America leads the global market with a 36.8% share, driven by strong environmental regulations and high adoption in food packaging, followed by Europe with a 31.2% share, supported by circular economy initiatives and advanced biodegradable film technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Biodegradable Film market was valued at USD 17.03 billion in 2024 and is expected to reach USD 26.94 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Rising environmental concerns and government bans on single-use plastics are driving strong demand for biodegradable film across packaging and agriculture sectors.

- Rapid advancements in biopolymer technologies such as PLA and PHA, along with a growing shift toward compostable and recyclable materials, are shaping market trends.

- The market is moderately competitive, with key players including Mondi, DS Smith, Biome Bioplastics, and Futamura focusing on R&D and sustainable product innovation.

- North America leads with a 36.8% share, followed by Europe at 31.2% and Asia-Pacific at 24.6%, while the starch-based biodegradable film segment dominates with a 41.2% share, supported by its cost-effectiveness and high biodegradability.

Market Segmentation Analysis:

By Type

The starch-based biodegradable film segment dominated the Biodegradable Film market in 2024, holding a 41.2% share. Its dominance is attributed to cost-effectiveness, wide availability of raw materials, and strong biodegradability under natural conditions. Starch-based films are widely used in food packaging, agriculture, and disposable products due to their flexibility and compostable nature. The growing preference for renewable and sustainable materials among consumers and industries supports its demand. Continuous innovation in polymer blending and film strength enhancement is further expanding its application across commercial and industrial packaging sectors.

- For instance, Biome Bioplastics produces potato-starch and corn-starch based film grades, some of which are blended with other biopolyesters, that are certified industrially compostable and approved for food contact.

By Application

The food packaging segment accounted for the largest 49.6% share of the Biodegradable Film market in 2024. Rising awareness of plastic waste and strict environmental regulations are driving adoption of biodegradable alternatives in the packaging of fruits, vegetables, snacks, and bakery products. These films provide effective moisture barriers and compostability, maintaining food freshness and reducing environmental impact. Growing demand for sustainable packaging from global food retailers and quick-service chains has accelerated usage. Additionally, innovation in transparent and high-performance films continues to strengthen their adoption in the food industry.

- For instance, Futamura’s NatureFlex cellulose-based films deliver an oxygen transmission rate below 1.0 cm³/m²/day and water vapor transmission of 38 g/m²/day, offering high barrier protection for dry foods and bakery packaging under certified compostable standards.

By Material

The polylactic acid (PLA) segment held a 33.8% share of the Biodegradable Film market in 2024. PLA films are favored for their clarity, strength, and compostability, making them suitable for packaging, agriculture, and labeling applications. Derived from renewable sources like corn starch and sugarcane, PLA aligns with global sustainability goals and circular economy initiatives. Growing R&D in enhancing PLA film heat resistance and mechanical properties is broadening its commercial viability. The increasing use of PLA in consumer goods and industrial packaging is further propelling the segment’s steady market expansion worldwide.

Key Growth Drivers

Rising Environmental Awareness and Regulatory Support

Increasing global concern over plastic pollution is a major growth driver for the biodegradable film market. Governments worldwide are enforcing bans and restrictions on single-use plastics, encouraging industries to adopt eco-friendly alternatives. Regulatory frameworks such as the EU’s Green Deal and various national sustainability targets are pushing manufacturers toward biodegradable solutions. Consumers are also shifting preferences toward compostable and renewable packaging. This growing awareness, combined with supportive policies, is driving investment in biodegradable film production and innovation across multiple industries.

- For instance, DS Smith introduced fully recyclable and biodegradable film coatings capable of decomposing within 180 days under controlled composting conditions, reducing plastic waste across its packaging network covering over 200 production facilities.

Expansion of Sustainable Packaging in Food and Beverage Industry

The growing demand for eco-friendly packaging from the food and beverage sector significantly boosts the biodegradable film market. Companies are replacing conventional plastics with compostable films to enhance brand sustainability and meet consumer expectations. These films offer excellent moisture and gas barrier properties, maintaining product freshness while reducing environmental impact. The rise in online food delivery and packaged snacks further increases adoption. Partnerships between packaging producers and food manufacturers are accelerating large-scale implementation of biodegradable materials globally.

- For instance, Mondi offers a range of paper-based barrier solutions, including its PerFORMing Monoloop, which enables sustainable food trays that meet major European retailer specifications for chilled foods, and its FunctionalBarrier Paper Ultimate, a high-performance paper providing a water vapor transmission rate of below 0.5 g/m²/day.

Advancements in Biopolymer Technology

Continuous innovation in biopolymer formulations has improved the strength, flexibility, and degradability of biodegradable films. Research in polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch blends has expanded their performance range and cost competitiveness. Enhanced film properties now allow broader application in agriculture, packaging, and medical uses. Investment in bio-refinery infrastructure and scalable production methods is also reducing material costs. These advancements are enabling manufacturers to meet regulatory standards while maintaining performance and aesthetics, strengthening the overall market potential.

Key Trends & Opportunities

Shift Toward Compostable and Recyclable Solutions

A major trend in the market is the shift toward fully compostable and recyclable biodegradable films. Manufacturers are developing products that decompose in industrial composting facilities without leaving harmful residues. The growing focus on circular economy practices and zero-waste packaging is creating new opportunities. Innovations such as water-soluble and marine-degradable films are addressing disposal challenges in diverse environments. This trend aligns with global sustainability initiatives, making biodegradable films a key part of long-term waste management strategies.

- For instance, Cortec Corporation launched its Eco Works 100 film which achieved 100 % USDA-certified biobased content and is certified industrially compostable by TÜV Austria

Rising Adoption in Agricultural Applications

The use of biodegradable films in agriculture, particularly as mulch films, is gaining momentum. These films help maintain soil temperature, reduce weed growth, and eliminate the need for plastic removal after harvest. Governments in several regions are promoting their use through subsidies and eco-friendly farming policies. The shift from traditional polyethylene films to biodegradable alternatives is reducing soil contamination and improving crop yields. Expanding organic farming practices and environmental certification programs continue to drive this adoption globally.

- For instance, a field study found that the use of biodegradable mulch films led to crop yield increases of over 13 % compared to non-mulched controls in onion cultivation.

Key Challenges

High Production Costs and Limited Scalability

The cost of producing biodegradable films remains a major barrier to widespread adoption. Raw materials like PLA and PHA are more expensive than petroleum-based polymers, and production requires specialized infrastructure. Limited manufacturing capacity and complex processing methods further raise costs. Small and medium manufacturers face challenges in scaling production to meet growing demand. Addressing these cost barriers through improved economies of scale and raw material sourcing will be crucial for long-term market growth.

Performance Limitations Compared to Conventional Plastics

While biodegradable films are eco-friendly, they often lag behind conventional plastics in terms of durability, heat resistance, and shelf life. These limitations restrict their use in high-performance applications such as heavy-duty packaging and industrial products. Environmental conditions also affect biodegradation rates, posing challenges in product consistency. Manufacturers are investing in R&D to enhance mechanical properties and barrier performance. Overcoming these limitations is essential to expand market penetration and ensure long-term competitiveness against traditional materials.

Regional Analysis

North America

North America dominated the Biodegradable Film market in 2024 with a 36.8% share. The region’s growth is driven by strong environmental policies, corporate sustainability initiatives, and consumer preference for eco-friendly packaging. The United States leads with widespread adoption of compostable films in food packaging, agriculture, and retail sectors. Technological advancements in biopolymer manufacturing and collaboration between material suppliers and packaging producers support innovation. Government incentives for sustainable materials and bans on single-use plastics further accelerate market expansion, positioning North America as a leader in biodegradable film development and commercialization.

Europe

Europe held a 31.2% share of the Biodegradable Film market in 2024, supported by strict environmental regulations and advanced recycling infrastructure. The European Union’s Green Deal and circular economy targets have spurred adoption of compostable and bio-based packaging. Countries such as Germany, France, and the Netherlands lead in biodegradable film production and usage across food and agriculture sectors. Growing consumer awareness and retailer-led sustainability commitments are fueling continuous demand. Innovation in PLA and starch-based film technology further enhances Europe’s leadership, ensuring steady growth driven by regulatory compliance and environmental responsibility.

Asia-Pacific

Asia-Pacific accounted for a 24.6% share of the Biodegradable Film market in 2024, driven by rapid industrialization and increasing awareness of plastic pollution. Countries such as China, Japan, and India are investing heavily in bioplastic production facilities and R&D. Rising demand for sustainable packaging in food and consumer goods sectors supports strong market growth. Government policies promoting green materials and restrictions on plastic use are stimulating domestic production. Expanding urban populations and evolving retail structures continue to boost biodegradable film adoption, making Asia-Pacific a key growth engine in the global market.

Middle East & Africa

The Middle East and Africa region captured a 4.2% share of the Biodegradable Film market in 2024. Growing environmental awareness and government initiatives aimed at reducing plastic waste are driving adoption. The United Arab Emirates and Saudi Arabia are leading regional efforts with sustainability-focused regulations and investments in eco-friendly materials. Demand for biodegradable films in agriculture and food packaging is gradually increasing. However, limited production infrastructure and high costs constrain market penetration. Continuous regulatory support and regional collaborations with international firms are expected to strengthen market presence over the coming years.

Latin America

Latin America held a 3.2% share of the Biodegradable Film market in 2024. Growth is primarily fueled by rising sustainability initiatives in Brazil, Mexico, and Chile, where industries are transitioning toward compostable and recyclable materials. Expanding agricultural production and growing packaged food sectors are creating strong opportunities for biodegradable film applications. Government efforts to reduce plastic waste and encourage green innovation are supporting this shift. Despite infrastructure challenges, regional demand is increasing steadily as both consumers and manufacturers embrace eco-friendly packaging alternatives to meet environmental goals.

Market Segmentations:

By Material

- Polylactic acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch blends

- Others

By Product

- Bags

- Wrapping films

- Liners

- Others

By End-use Industry

- Food and beverage

- Healthcare

- Personal care & cosmetics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Biodegradable Film market features key players such as Mondi, DS Smith, Biome Bioplastics, Opackgroup, Futamura, Barbier, Kuber Polyfilms, Cortec, Bleher Folientechnik, and Nufab Green. These companies focus on expanding their product portfolios through innovation in bio-based polymers, compostable materials, and high-performance film technologies. Strategic collaborations, acquisitions, and investments in R&D are helping them enhance film strength, moisture resistance, and heat stability. Manufacturers are increasingly adopting PLA, PHA, and starch-based materials to meet global sustainability standards and regulatory mandates. The competition is further intensified by the growing demand for recyclable and compostable films across packaging, agriculture, and consumer goods sectors. Leading players are also integrating circular economy principles and scaling production capacities to reduce costs, improve efficiency, and maintain a strong position in the evolving biodegradable film market.

Key Player Analysis

- Mondi

- DS Smith

- Biome Bioplastics

- Opackgroup

- Futamura

- Barbier

- Kuber Polyfilms

- Cortec

- Bleher Folientechnik

- Nufab Green

Recent Developments

- In July 2025, Cortec Corporation introduced its “Eco Works 100” film, certified industrially compostable and made from 100% USDA-certified biobased content.

- In May 2025, Futamura Group launched a fully compostable sachet laminate structure using its “NatureFlex” cellulose film technology for flexible packaging applications.

- In January 2025, OPACKGROUP announced new biodegradable grow bags via its subsidiary Oerlemans Plastics which leverage biodegradable film for the horticulture sector.

- In February 2023, Toppan Speciality Films and Polymateria launched a new ‘biotransformed’ packaging solution that breaks down and returns to nature harmlessly within just 176 days, leaving no microplastics or toxins behind.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and compostable packaging will continue to accelerate across industries.

- Advancements in biopolymer technology will improve film strength, flexibility, and durability.

- Expansion of food packaging and agriculture applications will remain key growth drivers.

- Regulatory policies banning single-use plastics will encourage faster market adoption.

- Investment in large-scale bioplastic production facilities will reduce manufacturing costs.

- Partnerships between packaging firms and biopolymer producers will enhance innovation.

- Consumer awareness of sustainability will boost demand for biodegradable alternatives.

- Asia-Pacific will emerge as a major production hub supported by policy incentives.

- Development of recyclable and marine-degradable films will open new opportunities.

- Integration of circular economy models will shape the long-term growth of the market.