Market Overview

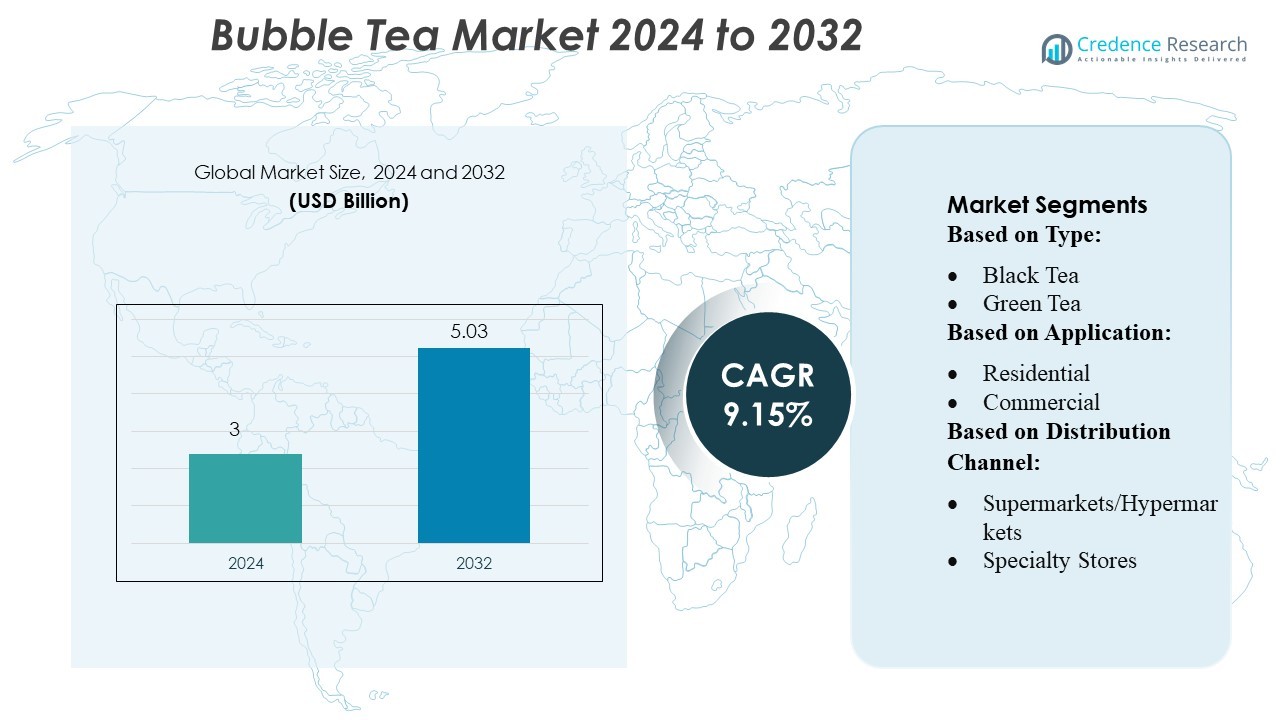

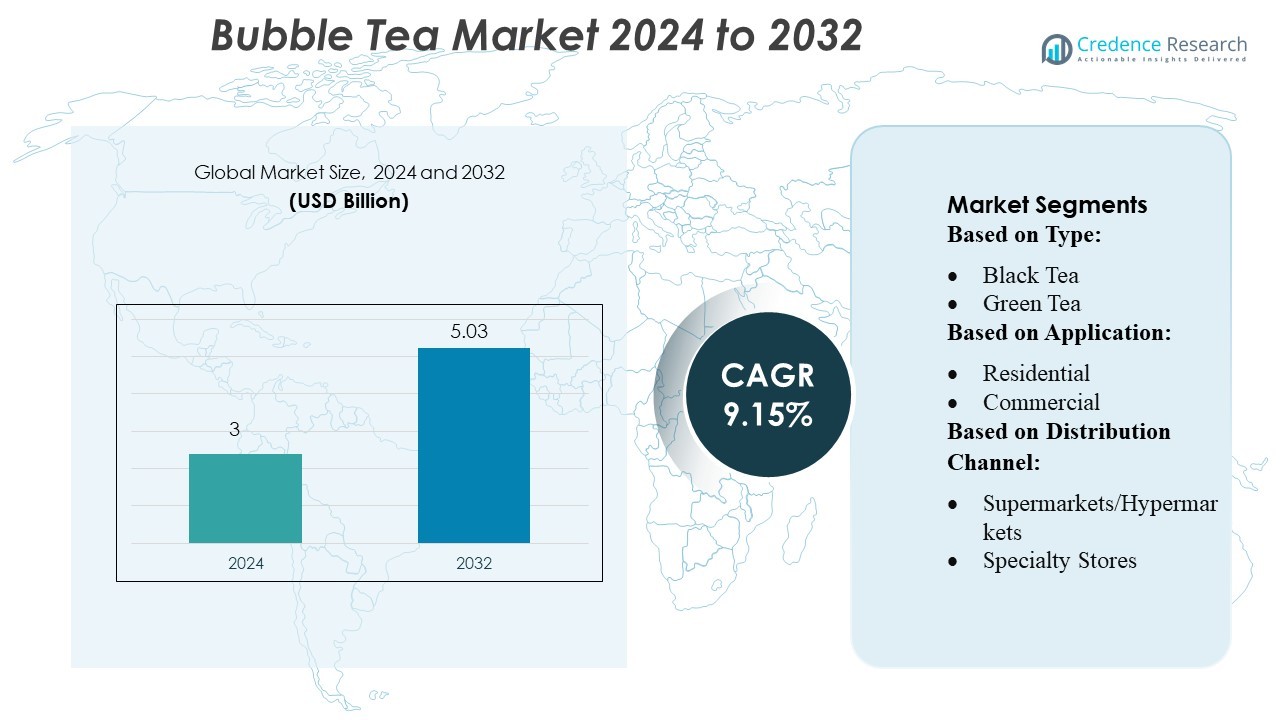

Bubble Tea Market size was valued USD 3 billion in 2024 and is anticipated to reach USD 5.03 billion by 2032, at a CAGR of 9.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bubble Tea Market Size 2024 |

USD 3 Billion |

| Bubble Tea Market , CAGR |

9.15% |

| Bubble Tea Market Size 2032 |

USD 5.03 Billion |

The global Bubble Tea market is increasingly competitive, with major players like Troika JC, ChaTime, Bubble Tea Supply, Inc., Ten Ren’s Tea Time, Gong Cha, Bobabox Ltd., Fokus, Inc., T Bun International, Bubble Tea House Company, and Lollicup USA, Inc. driving growth through innovation, franchise expansion, and strong brand reach. These companies focus on developing new flavor variants, healthier offerings, and scalable franchise models to capture diverse consumer segments. The Asia-Pacific region leads the market, holding 46.22% of the global share in 2024, thanks to its deep cultural affinity for tea, dense urban population, and mature café infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bubble Tea Market reached USD 3 billion in 2024 and is projected to hit USD 5.03 billion by 2032, registering a CAGR of 9.15%, driven by rising global café culture and growing demand for customizable beverages.

- Market growth is fueled by consumer preference for flavored, low-sugar, and plant-based milk options, along with increased adoption of tapioca alternatives, fruit-based add-ins, and functional ingredients such as collagen and probiotics.

- Major players including Gong Cha, ChaTime, Ten Ren’s Tea Time, and Lollicup USA strengthen competitiveness through aggressive franchising, menu diversification, and regional expansions, intensifying innovation cycles across global markets.

- High sugar content concerns and fluctuating tapioca prices act as key restraints, particularly in Western markets where regulatory pressure on sweetened beverages is rising and supply chain disruptions affect ingredient availability.

- Asia-Pacific dominates with 46.22% share, followed by North America’s growing premium café penetration, while fruit-flavored and milk-tea segments together hold over 60% consumption share due to strong urban millennial demand.

Market Segmentation Analysis:

By Type

Black tea leads the bubble tea market with an estimated 40–45% share, driven by its strong flavor profile, high consumer familiarity, and suitability for pairing with tapioca pearls and flavored syrups. Its versatility in both traditional and innovative formulations makes it a preferred base among major bubble tea chains. Green tea follows closely, supported by rising demand for antioxidant-rich beverages, while oolong tea appeals to premium consumers seeking nuanced taste experiences. Other specialty teas, including fruit and herbal blends, continue to grow as brands expand health-oriented and customizable offerings to attract younger demographics.

- For instance, Troika J.C. (Qbubble) reported over 4.5 million annual units of black-tea-based powders and tapioca pearls distributed to U.S. cafés in their most recent financials, demonstrating its dominance in supplying traditional black-tea bubble tea.

By Application

The commercial segment dominates the bubble tea market with nearly 70% market share, fueled by rapid expansion of dedicated bubble tea cafés, QSR outlets, and beverage kiosks across urban regions. Increasing footfall in malls and lifestyle hubs and the rise of franchised bubble tea chains further accelerate adoption. Residential consumption is growing as well, supported by DIY bubble tea kits and ready-to-drink (RTD) options. However, commercial outlets remain the key revenue driver due to higher consumption frequency, premium pricing, and diversified menu innovation targeting youth and working professionals.

- For instance, Bigelow Tea installed rooftop solar panels that generate up to 15% of the energy used by its Fairfield facility, demonstrating its commitment to sustainable production aligned with high-volume black tea operations.

By Distribution Channel

The B2C segment holds the dominant position with over 60% market share, primarily driven by supermarkets/hypermarkets and specialty stores that offer a wide range of RTD bubble tea products, toppings, and tea bases. Specialty stores contribute significantly as consumers seek authentic and customizable formulations. Online retail is expanding rapidly due to convenience, home delivery, and the availability of DIY kits. Meanwhile, the B2B segment supports cafés and restaurant chains through bulk supply of ingredients, but B2C remains the largest contributor as retail availability and impulse purchases elevate overall market penetration.

Key Growth Drivers

Rising Demand for Novel and Customizable Beverages

Consumers increasingly prefer beverages that offer personalization, novel textures, and unique flavor combinations, positioning bubble tea as a leading choice in the specialty drink category. Customization options—including sugar levels, toppings, tea bases, and fruit infusions—enhance consumer engagement and repeat purchases. The popularity of experiential consumption among younger demographics further accelerates demand. Cafés leveraging creative menus and seasonal flavors continue to attract high footfall, supporting steady market expansion across both developed and emerging markets.

- For instance, Yorkshire Tea reports that 75 % of its tea bag material is now natural-based fibres (a mix of wood pulp and plant-based fibres) in its UK packaging.

Expansion of Bubble Tea Franchises and Retail Chains

Rapid growth of franchise-based bubble tea brands has significantly widened market reach, with global and regional players aggressively expanding through mall kiosks, storefronts, and delivery-centric formats. Standardized preparation methods, strong brand positioning, and consistent flavor profiles help chains maintain customer loyalty. Investment in efficient supply chains, automated tea brewing systems, and scalable franchise models further strengthens market penetration. The rapid proliferation of branded outlets across North America, Europe, and Asia-Pacific continues to create favorable growth momentum.

- For instance, Unilever now generates visuals 2 × faster and at 50% lower cost by using digital twin and AI platforms such as NVIDIA Omniverse; over 500 AI applications are deployed across the business.

Increasing Preference for Health-Oriented Tea Beverages

The shift toward tea-based beverages with perceived health benefits supports bubble tea adoption, particularly variants featuring green tea, oolong tea, and low-sugar formulations. Manufacturers increasingly promote natural ingredients, organic tea leaves, and plant-based milk alternatives to appeal to health-conscious consumers. The introduction of reduced-calorie toppings, fresh fruit blends, and functional ingredients such as collagen and probiotics also broadens market appeal. This transition toward healthier indulgence helps the segment attract new customer groups seeking balanced yet flavorful beverage options.

Key Trends & Opportunities

Growth of Ready-to-Drink (RTD) and DIY Bubble Tea Products

Rising demand for convenience has prompted brands to introduce RTD bubble tea cans, bottled formats, and DIY kits for home preparation. These products appeal to consumers seeking café-quality taste without visiting retail outlets. Online platforms have amplified visibility, boosting sales of premixed teas, dehydrated tapioca pearls, and flavor syrups. Convenience-driven innovations also expand penetration into nontraditional markets such as office spaces and travel retail. As manufacturers refine shelf-stable formulations and packaging solutions, the RTD category presents significant long-term growth potential.

- For instance, Harris Tea has achieved a 34% GHG reduction from its baseline year of 2009. The company reports its greenhouse gas emissions through the Carbon Disclosure Project (CDP).

Digitalization and Delivery-Driven Consumption Models

The surge in food delivery platforms and mobile app ordering has become a major enabler for bubble tea sales, especially in urban regions. Brands increasingly rely on digital promotions, loyalty programs, and social media engagement to target younger consumers. Cloud kitchens and delivery-only models allow companies to scale rapidly with lower operational costs. Technology integration—such as automated cup sealing, digital POS systems, and data-driven product recommendations—further enhances operational efficiency. This trend opens opportunities for wider geographic expansion without heavy investment in physical storefronts.

- For instance, Starbucks deployed an AI-powered inventory system across 11,000+ company-owned stores in North America by September 2025, enabling inventory to be counted 8× more frequently than before.

Innovation in Flavors, Toppings, and Plant-Based Alternatives

To retain consumer interest, brands continuously expand their offerings with exotic fruit blends, cheese foam toppings, popping boba, and vegan alternatives. Growing interest in plant-based diets has led to wider adoption of oat, almond, and soy milk in bubble tea formulations. Flavor innovation aligned with regional preferences—such as matcha, taro, lychee, and brown sugar variants—supports localization strategies. This trend allows brands to differentiate and broaden appeal while addressing dietary preferences and lactose intolerance concerns.

Key Challenges

Concerns Over High Sugar Content and Calorie Levels

Bubble tea often contains high levels of sugar and calories due to sweetened milk, flavored syrups, and tapioca pearls. Rising consumer awareness of diabetes, obesity, and metabolic disorders creates growing scrutiny of such beverages. Health-conscious consumers may limit consumption or shift to lower-calorie alternatives unless brands adapt their formulations. Companies must therefore invest in reduced-sugar variants, natural sweeteners, and nutritional transparency to mitigate negative perceptions and sustain customer loyalty in health-focused markets.

Supply Chain Instability and Ingredient Price Volatility

Key bubble tea ingredients—such as tapioca pearls, tea leaves, flavor powders, and milk alternatives—are subject to global supply chain fluctuations. Disruptions caused by transportation delays, crop variability, and import regulations can lead to inconsistent availability and rising costs. Small and medium bubble tea businesses face higher vulnerability due to limited sourcing capabilities. To address this challenge, manufacturers must diversify suppliers, strengthen inventory management, and adopt localized sourcing strategies to ensure stable operations and pricing.

Regional Analysis

North America

North America holds an estimated 28–30% share of the global Bubble Tea market, driven by strong consumer preference for flavored beverages, expanding Asian foodservice chains, and high adoption of premium café formats. The United States leads regional demand as major brands introduce reduced-sugar formulations, plant-based milk options, and innovative toppings to appeal to health-conscious consumers. Rapid expansion of franchise networks in urban centers, coupled with growing availability of ready-to-drink (RTD) boba products in retail stores, supports market growth. Cross-cultural influence and rising social media visibility further accelerate product acceptance across younger demographics.

Europe

Europe accounts for approximately 18–20% of the global Bubble Tea market, supported by increasing exposure to Asian beverage culture and rising café-chain penetration in Western and Central Europe. The United Kingdom, Germany, and France remain the key revenue contributors, where consumers show strong interest in fruit-based teas, vegan milk alternatives, and innovative flavor blends. Regulatory emphasis on reduced sugar content is prompting brands to reformulate healthier variants. Growth is further reinforced by specialty tea bars and pop-up stores that attract younger consumers. Online delivery platforms and RTD formats continue to broaden accessibility and drive incremental demand.

Asia-Pacific

Asia-Pacific dominates the global Bubble Tea market with an estimated 45–48% share, reflecting its origin, widespread cultural acceptance, and high consumption frequency across urban populations. Taiwan, Thailand, Japan, and South Korea serve as major production and innovation hubs, introducing new textures, toppings, and artisanal blends. Strong franchise expansion, rising disposable incomes, and increasing adoption of café culture significantly influence market performance. China represents the largest individual market, supported by digital ordering platforms and rapid store proliferation. Product innovation—such as cheese-foam teas, brown sugar variants, and low-calorie formulas—continues to strengthen the region’s leadership.

Latin America

Latin America holds roughly 6–8% of the global Bubble Tea market, with growth led by Brazil, Mexico, and Chile. Rising interest in Asian beverages, expanding youth population, and increasing penetration of international tea chains underpin market development. Consumers show strong preference for fruit-flavored teas and tropical ingredients that align with local taste profiles. Growth in mall-based retail outlets, foodservice partnerships, and social-media-driven brand engagement continues to expand awareness. Despite being in an early adoption phase, the region exhibits high growth potential as local entrepreneurs introduce cost-effective concepts and RTD bubble tea options enter specialty retail channels.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4–5% of global Bubble Tea market share, supported by rising café culture, increasing expatriate population, and expanding premium beverage consumption in countries such as the UAE, Saudi Arabia, and South Africa. Demand centers on specialty tea shops offering customizable sweetness levels, dairy alternatives, and diverse flavor combinations. Tourism growth and retail development in Gulf nations also contribute to market expansion. Although price sensitivity and limited local production pose challenges, rising franchise investments and the introduction of innovative RTD bubble tea products are helping the region gain momentum.

Market Segmentations:

By Type:

By Application:

By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Bubble Tea market features a diverse and expanding competitive landscape, led by key players Troika JC, ChaTime, Bubble Tea Supply, Inc., Ten Ren’s Tea Time, Gong Cha, Bobabox Ltd., Fokus, Inc., T Bun International, Bubble Tea House Company, and Lollicup USA, Inc. The Bubble Tea market continues to intensify as brands focus on expanding their global presence, enhancing product innovation, and improving operational efficiency. Companies are investing heavily in new flavor developments, healthier low-sugar or plant-based formulations, and customizable beverage options to align with evolving consumer preferences. Franchising remains the most influential expansion model, enabling rapid market penetration across urban centers and emerging economies. Digital ordering platforms, loyalty programs, and social-media-driven marketing strategies play a central role in customer acquisition and retention. Additionally, manufacturers are optimizing supply chains, adopting sustainable packaging, and introducing ready-to-drink formats to strengthen competitiveness and appeal to health- and convenience-oriented consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, Tata Tea Gold unveiled a limited edition of Kumartuli-themed packs to celebrate the Durga Puja festival. The packs incorporate five symbolic elements: Dhunuchi dance, Shankho Dhwani, Dhaki, Ashtami Pujarin, and Sindoor Khela.

- In March 2024, Pansari Group launched TVOY GREEN TEA, a new line of green tea sourced from the Nilgiris in Tamil Nadu. The tea is grown at an elevation of 1900 meters and is certified as eco-friendly, with ISO 9001:2008, HACCP, and Fair Trade certifications. The launch was featured at the AAHAR 2024 food and hospitality fair in New Delhi.

- In March 2024, PepsiCo and Unilever partnered to launch Pure Leaf Zero Sugar Sweet Tea, which is sweetened with sucralose and acesulfame potassium to provide a sweet tea flavor without sugar. This new product is a direct response to the growing consumer demand for zero-sugar beverages and is intended to offer a healthier, lower-calorie option while maintaining a sweet taste.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as demand for flavored and customizable beverages grows across global urban centers.

- Brands will introduce more low-sugar, organic, and plant-based formulations to align with health-conscious consumer preferences.

- Ready-to-drink bubble tea products will gain wider retail penetration, improving accessibility and driving incremental sales.

- Franchising models will accelerate market entry for new players and support faster expansion in emerging regions.

- Digital ordering platforms and mobile apps will strengthen customer engagement and streamline delivery operations.

- Product innovation will increase as companies experiment with new toppings, textures, and artisanal tea blends.

- Sustainability initiatives will gain importance, prompting brands to adopt eco-friendly packaging and responsible sourcing.

- Localized flavor development will rise as brands adapt menus to regional taste preferences.

- Supply chain optimization and automation will improve production efficiency and reduce operational costs.

- Social-media-driven marketing will continue shaping brand visibility and influencing purchasing decisions among young consumers.