| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| UK Gluten Free Products Market Size 2023 |

USD 242.93 Million |

| UK Gluten Free Products Market, CAGR |

7.80% |

| UK Gluten Free Products Market Size 2032 |

USD 477.58 Million |

Market Insights

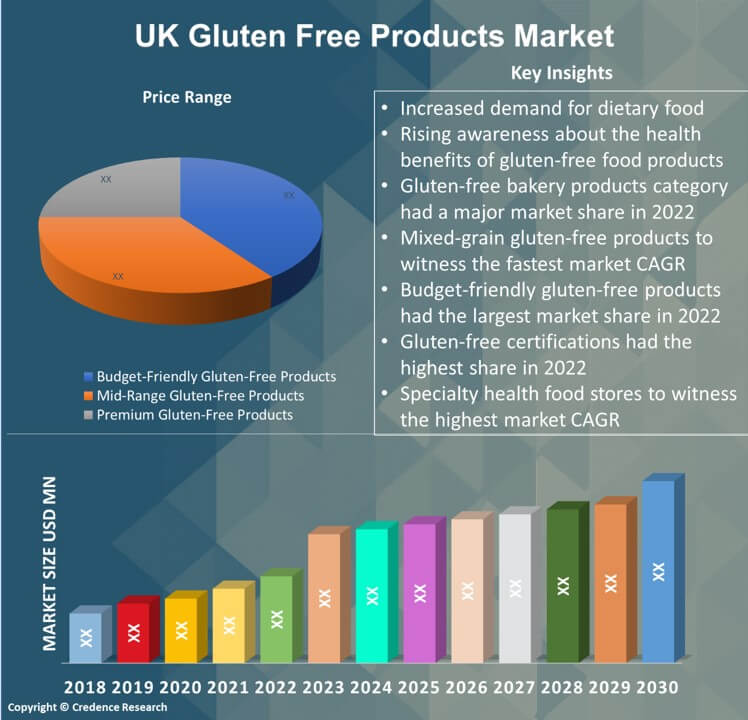

- The UK gluten-free products market is forecasted to grow from USD 242.93 million in 2023 to USD 477.58 million by 2032, with a compound annual growth rate (CAGR) of 7.80%.

- The gluten-free bakery products segment is the market leader in product categories, accounting for more than 18% of total value in 2022, while gluten-free snacks are likely to grow rapidly throughout the projection period.

- The gluten-free certifications dominated the market need for gluten-free products, accounting for more than 60% in 2022.

- The budget-friendly gluten-free products segment accounted for the largest market share of over 40% in 2022.

- The organic & natural gluten-free products segment dominated the market with 28% of the total revenue share by consumer preferences. However, the non-GMO gluten-free products category will expand fastest in the upcoming years.

- The speciality health food stores category is predicted to grow fastest over the projection period, while the supermarkets & hypermarkets distribution channels segment had a market share of more than 35% in 2022.

- With a projected high CAGR growth rate and a market share of over 62% in 2022, the adult & general audience products category will continue to lead market demand for gluten-free products in the UK.

- The rice-based gluten-free products category is the market leader in grain types, accounting for more than 25% of total value in 2022, while the corn-based gluten-free products segment is expected to grow fast over the forecasted period.

- The market has seen an increase in gluten-free convenience foods, such as frozen meals, pizzas, and ready-to-eat snacks, providing convenience to consumers with busy lifestyles.

- Restaurants, cafes, and food service providers have incorporated gluten-free menu items to cater to customers with dietary restrictions, expanding the market beyond retail.

- E-commerce platforms have become popular channels for purchasing gluten-free products, offering convenience and a wide selection to consumers across the UK.

Executive Summary

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Definition

The gluten-free products market encompasses the industry producing, distributing, and retailing food and beverage products formulated and manufactured without gluten. These products are specifically designed to cater to individuals with celiac disease, gluten sensitivity, or those choosing a gluten-free lifestyle. The market includes a wide range of gluten-free items, such as bread, pasta, snacks, baked goods, cereals, and more, all of which undergo stringent manufacturing processes to ensure they meet gluten-free standards and regulations. Gluten-free products provide safe and accessible dietary alternatives for those who must avoid gluten due to medical conditions or opt for gluten-free choices to maintain a health-conscious and gluten-restricted diet.

Market Overview

The UK gluten-free products market is forecasted to grow from USD 242.93 million in 2023 to USD 477.58 million by 2032, with a compound annual growth rate (CAGR) of 7.80%.

Gluten is a protein group that usually appears in foods such as barley, wheat, rye, and other cereal products. It is responsible for the soft, chewy texture of most gluten-containing cereal-based items. Gluten has numerous positive effects on foods; hence, it is found in many food products, including beverages. However, some exhibit sensitivity and allergy to gluten-containing items, posing a concern for the food sector. This concern prompted the development of gluten-free products as an alternative to gluten-containing food.

Dietary patterns are changing in the Western world, with a growing percentage of health-conscious customers. The desire of customers to live a healthy lifestyle is a major factor contributing to the popularity of dietary foods in the United Kingdom, where this trend is evident. According to a survey conducted by Public Health England in January 2021, 8 in 10 persons over the age of 18 have opted to change their lifestyle, with 7 in 10 adults motivated to adopt healthier habits due to coronavirus. The increased prevalence of gluten intolerance, irritable bowel syndrome (IBS), and celiac disease in the UK is one of the main factors propelling the expansion of the gluten free products market.

Segmentation by Product Categories

- The gluten-free snacks segment is expected to experience substantial growth in the UK gluten-free products market, driven by consumer demand for convenient, on-the-go gluten-free options.

- Currently, gluten-free bakery products dominate the market, accounting for over 18% in 2022. This category includes a wide range of baked goods, such as bread, pastries, and cakes, mainly serving as staples for those following a gluten-free diet.

Segmentation by Grain Types

- Rice-based gluten-free products are the dominant grain type category, attracting more than 25% of the market demand in 2022. Rice serves as a versatile and commonly used substitute for gluten-containing grains in various gluten-free items.

- Mixed-grain types address the diverse needs of the UK gluten-free products market, offering combinations of different grains to enhance product nutritional profile and taste.

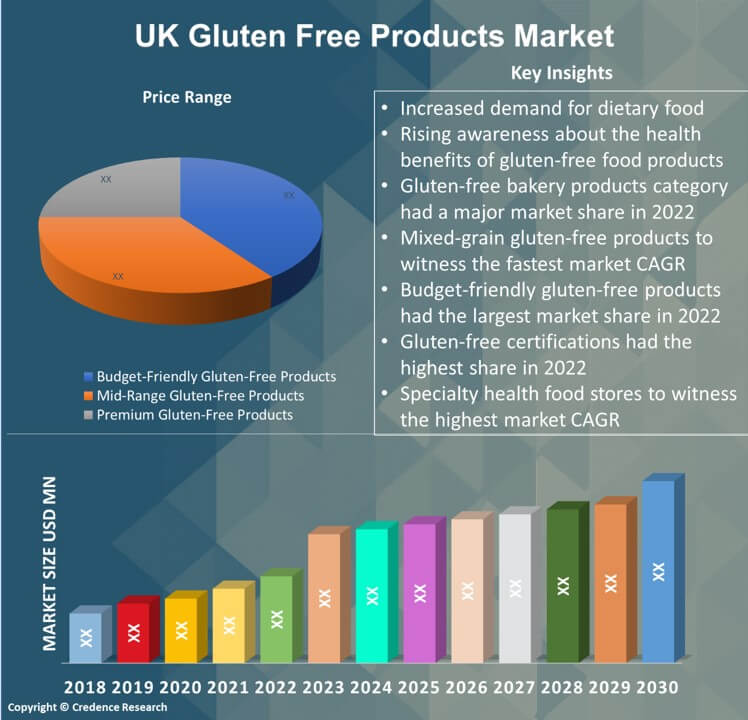

Segmentation by Price Range

- The mid-range gluten-free products category is poised for substantial growth, providing a balance between quality and affordability, catering to a broader consumer base.

- Budget-friendly gluten-free products currently lead the market share with over 40% in 2022, making gluten-free options accessible to cost-conscious consumers.

Segmentation by Distribution Channels

- Speciality health food stores are projected to achieve the highest market CAGR, offering a diverse range of gluten-free products, often curated for specific dietary preferences.

- The supermarkets and hypermarkets segment currently leads with a market share of nearly 35% in 2022, largely providing a convenient shopping experience for a wide array of gluten-free items under one roof.

Key Highlights of the Report

The UK gluten-free products market is segmented by product categories, grain types, consumer preferences, distribution channels, certifications and allergen labels, demographics and target audience, and price range. Gluten-free bakery products, such as bread, pastries, and cakes, dominate the market, mainly serving as staples for those adhering to a gluten-free diet. Rice-based gluten-free products hold the leading market position in grain types, commonly meeting the versatile needs of UK consumers. Mid-range and budget-friendly price ranges cater to different consumer budgets, ensuring accessibility and affordability. Non-GMO gluten-free products are anticipated to gain traction, aligning with consumer preferences for natural and genetically unaltered ingredients. Speciality health food stores are projected to grow remarkably, while supermarkets & hypermarkets maintain their dominant market presence. Gluten-free certification assures the absence of gluten in certified products, capturing a majority market share of consumer demands.

The UK market share is primarily driven by the increasing awareness of gluten-related health issues, including celiac disease and gluten sensitivity. This has increased demand for safe and accessible gluten-free food options. The industry also benefits from the broader health & wellness trend, with consumers seeking healthier dietary choices, including gluten-free products. For example, in the United Kingdom, consumption of gluten-free foods climbed by 12% between 2013 and 2020. Emerging advancements in gluten-free product development, improving taste and texture, have made these products more appealing to a broader consumer base, further contributing to market developments. However, the market faces challenges in achieving the same taste and texture as gluten-containing counterparts, cross-contamination concerns during manufacturing, and the elevated cost of gluten-free ingredients, limiting accessibility for some consumers.

What Are The Main Drivers Of The UK Gluten-Free Products Market?

The main drivers of the UK gluten-free products market are the rising prevalence of celiac disease and gluten sensitivity, driving increased diagnosis and the need for safe gluten-free food options. Besides, the broader health and wellness trend has led consumers to seek gluten-free products as a dietary choice, further propelling market growth. Expanding awareness and improved diagnosis of gluten-related health issues have enhanced demand for gluten-free offerings. At the same time, the growing support of healthcare professionals and dieticians has strengthened consumer trust in these products. Furthermore, advancements in gluten-free product development, including improved taste and texture, have made gluten-free options more appealing to a broader consumer base, contributing to market expansion.

What Are The Major Challenges Faced By The UK Gluten-Free Products Market?

The UK gluten-free products market faces several challenges, including the risk of cross-contamination during production processes, which requires rigorous manufacturing standards to maintain the integrity of gluten-free items. Moreover, the higher cost of gluten-free ingredients and specialised manufacturing processes can lead to elevated product prices, potentially limiting accessibility for budget-conscious consumers. Ensuring consistent taste and texture in gluten-free products, often challenging due to the absence of gluten, poses another hurdle for manufacturers. In addition, there are concerns about mislabeling and the accuracy of gluten-free claims, emphasising the need for stringent regulations and reliable certification processes.

What Are The Growth Opportunities In The UK Gluten-Free Products Market?

The UK gluten-free products market presents growth opportunities in various areas, including expanding product innovation and development to enhance taste, texture, and nutritional profiles, making gluten-free options more appealing to a wider consumer base. Collaborations with healthcare professionals and dieticians can provide endorsements and recommendations for gluten-free products, increasing consumer trust and awareness. The market can further explore introducing more affordable options and value-driven gluten-free products to accommodate budget-conscious customers. Moreover, reaching out to international markets with a growing demand for gluten-free and health-focused products also opens up export opportunities.

Market Drivers

Several factors drive the gluten free products market in the UK. The following are the key drivers of the UK gluten-free products market:

Increasing Awareness and Diagnoses of Gluten-Related Disorders

One of the primary drivers of the UK gluten-free products market expansion is the escalating awareness and diagnoses of gluten-related disorders, such as celiac disease and non-celiac gluten sensitivity. In recent years, healthcare professionals, advocacy groups, and public awareness campaigns have played a key role in educating the population about these conditions. As a result, more individuals with gluten-related disorders are being properly diagnosed and advised to follow a gluten-free diet.

A National Health Service (NHS) report from 2021 states that at least 1 in 100 UK citizens have celiac disease. This expanding consumer base drives the demand for a wide variety of gluten-free products, ranging from basic staples like bread and pasta to snacks and desserts tailored to those with gluten-related disorders.

Market Restraints

The UK gluten free products market faces challenges that may hinder its growth. These include the following:

Higher Product Costs

One major restraint in the UK gluten-free products market is the higher production costs associated with gluten-free ingredients and manufacturing processes. Gluten-free products require specialised ingredients like alternative flours (e.g., rice flour, almond flour), binders, and thickeners to replace gluten’s binding and textural properties. These ingredients can be more expensive than traditional wheat flour.

Besides, stringent quality control measures are necessary to prevent cross-contamination with gluten during production. As a result, gluten-free products tend to have higher price points than their gluten-containing counterparts. This pricing disparity can deter price-sensitive consumers, limiting their ability to purchase gluten-free items regularly. The cost factor hinders the market’s potential for broad accessibility and affordability, especially for individuals who require gluten-free diets for medical reasons.

Opportunities

The UK gluten-free products market offers major growth opportunities. These include the following:

Health and Wellness Marketing

The emerging focus on health and wellness provides a substantial opportunity for marketing gluten-free products as healthier alternatives. Gluten-free items are often considered beneficial for digestion, energy levels, and overall well-being. Manufacturers leverage this perception by promoting the nutritional benefits of gluten-free products, emphasising natural ingredients, lower sugar content, and higher fibre content, among other health-focused attributes. Collaborations with nutritionists, dieticians, and health influencers can further enhance the credibility of these products.

Moreover, companies can capitalise on the growing demand for organic and non-GMO products within the gluten-free category. Manufacturers can also attract health-conscious consumers willing to pay a premium for products contributing to their overall health goals by aligning gluten-free products with the broader health and wellness trend. Strategic marketing and product positioning in alignment with health and wellness trends present a major opportunity for growth in the UK gluten-free products industry.

Competitive Landscape

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

The competitive landscape of the UK gluten-free products market is characterised by a diverse range of manufacturers and brands offering a wide selection of gluten-free food and beverage options. The following are some of the top market players and their market shares:

- Amys Kitchen Inc

- Co-Operative Group Ltd

- Fria Brod A B

- Genius Food Ltd

- McCormick Foods Ltd

- Nairns Oatcakes Ltd

- Natures Path Foods

- Nestle S.A.

- Prima Foods

- The Kraft Heinz Co.

- Others

Major players in the food industry have extended their product lines to include gluten-free items, ensuring accessibility and trust in the market. In addition to established brands, numerous smaller and niche players have entered the market, contributing to product innovation and variety. Supermarkets and retail chains play a major role, offering private-label gluten-free products alongside well-known gluten-free brands.

Moreover, the market features a diverse range of speciality and artisanal gluten-free producers, catering to niche consumer preferences. Online retail platforms have become important channels for established brands and new entrants, enabling them to reach a broader customer base. Partnerships with healthcare professionals and nutritionist endorsements also serve as competitive advantages, enhancing consumer trust in specific gluten-free products.

In May 2022, Lindt Lindor introduced gluten-free chocolates in various formulations and flavours, such as orange & almond, hazelnut, caramel & sea salt, and many others.

In April 2021, Signature Brew, a British brewer, introduced a new gluten-free Indian Pale Ale (IPA) and reintroduced another beer underneath the same brand name in its home UK market.

Summary of Key Findings

- The UK gluten-free products market has experienced substantial growth in recent years, owing to the elevating awareness of celiac disease and gluten sensitivity and a broader trend towards healthier eating.

- Market segmented by product categories, grain types, consumer preferences, distribution channels, certifications and allergen labels, demographics and target audience, and price range.

- Supermarkets and hypermarkets remain the primary distribution channels for gluten-free products, offering extensive product selections and contributing to market accessibility.

- Premium and gourmet gluten-free products have gained market traction, appealing to consumers willing to pay higher prices for high-quality, gluten-free options.

- The snack segment within the gluten-free market has witnessed notable growth, with consumers seeking convenient and on-the-go options, including gluten-free chips, bars, and cookies.

- Challenges in the market include addressing cross-contamination issues in production, managing the cost of gluten-free ingredients, and improving the nutritional profile of some products.

Future Outlook

- Consumers are increasingly seeking clean-label products, leading to a demand for gluten-free products with minimal, natural, and recognisable ingredients, without artificial additives or preservatives.

- The market is influenced by various dietary trends, such as paleo, keto, and vegan diets, with some overlap between these trends and the gluten-free lifestyle.

- The development of functional gluten-free products fortified with vitamins, minerals, and other beneficial ingredients, catering to health-conscious consumers, is expected to become a trend in the market.

- Products with additional health claims, such as low sugar, high fibre, or organic certifications, will gain market prominence, offering consumers gluten-free options that align with specific health goals.

Segmentation

- By Product Categories

- Bakery Products

- Condiments, Seasonings, and Spreads

- Dairy/Dairy Substitutes

- Meat/Meat Substitutes

- Others

- By Grain Types

- Rice-Based Gluten-Free Products

- Corn-Based Gluten-Free Products

- Quinoa-Based Gluten-Free Products

- Nut-Based Gluten-Free Products

- Others

- By Age

- By Distribution Channels

- Supermarkets and Hypermarkets

- Specialty Health Food Stores

- Online Retail

- Foodservice and Restaurants

- By Price Range

- Budget-Friendly Gluten-Free Products

- Mid-Range Gluten-Free Products

- Premium Gluten-Free Products