Market Overview:

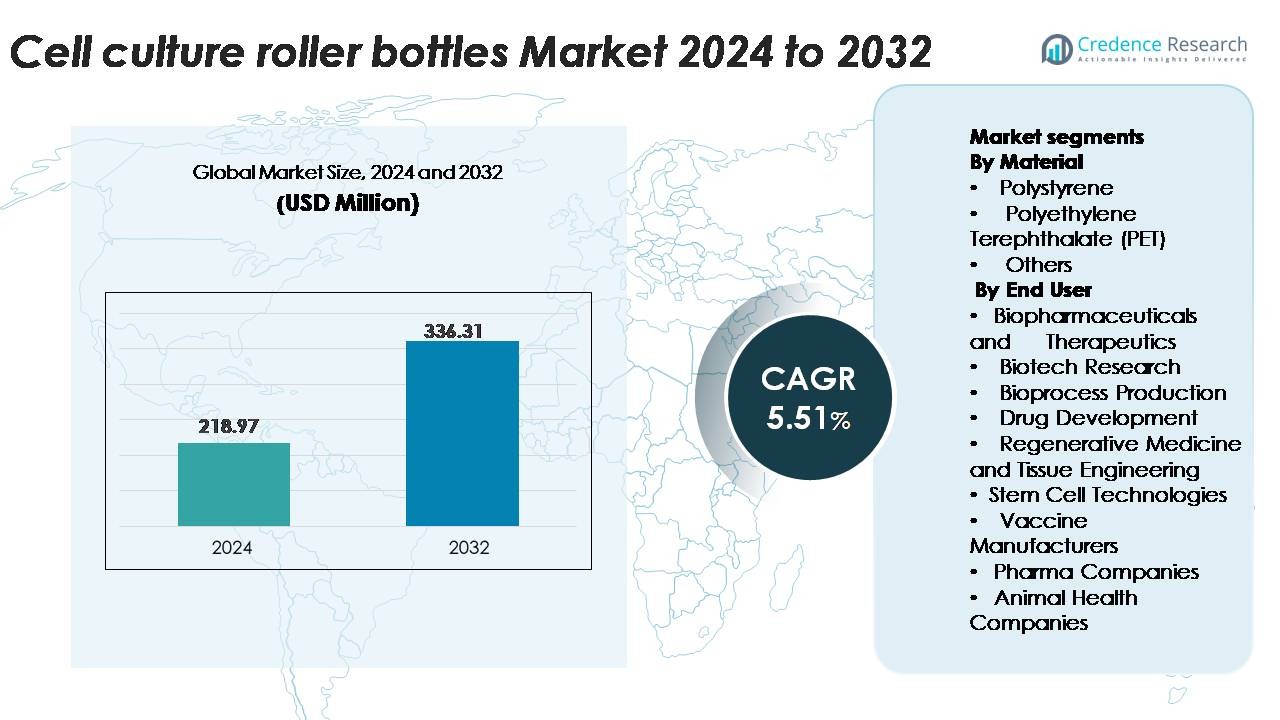

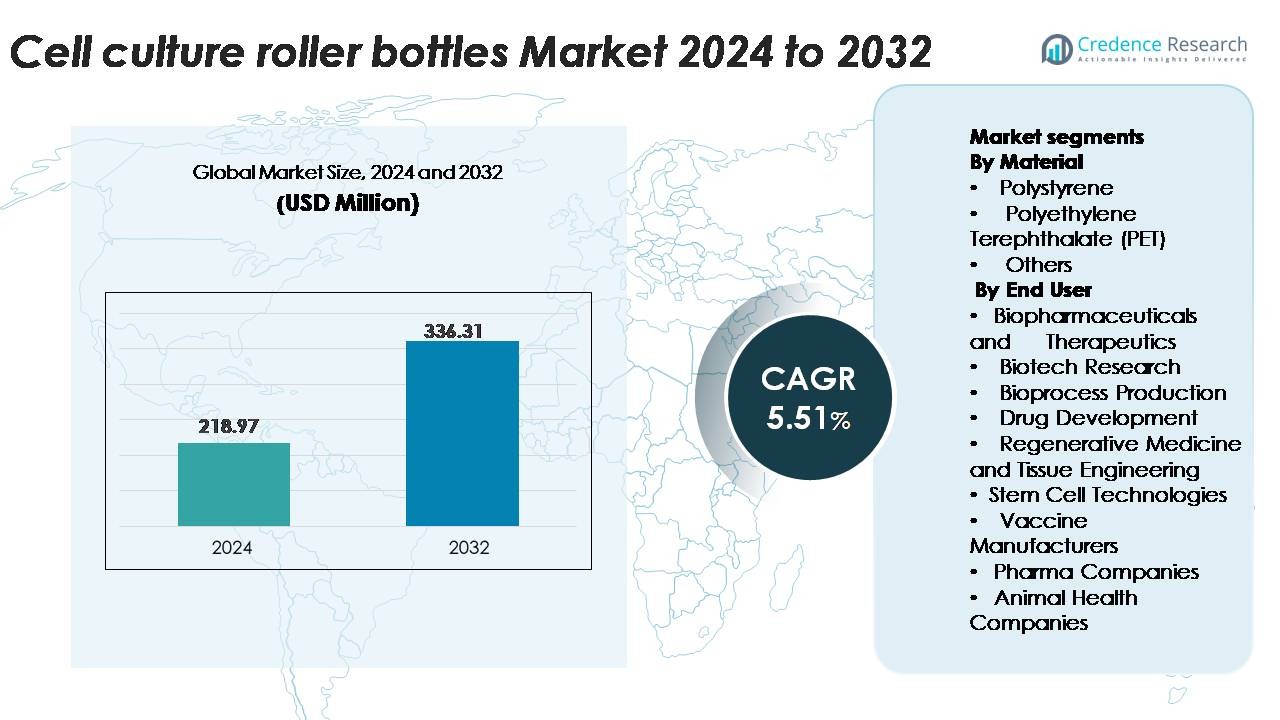

The global Cell Culture Roller Bottles Market was valued at USD 218.97 million in 2024 and is projected to reach USD 336.31 million by 2032, reflecting a CAGR of 5.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell Culture Roller Bottles Market Size 2024 |

USD 218.97 Million |

| Cell Culture Roller Bottles Market, CAGR |

5.51% |

| Cell Culture Roller Bottles Market Size 2032 |

USD 336.31 Million |

The cell culture roller bottles market is shaped by a group of prominent global players, including Greiner Bio-One, BD Biosciences, MP Biomedicals, SPL Life Sciences, Affymetrix (Thermo Fisher Scientific), DWK Life Sciences, Cell Essentials, Merck KGaA, Analytical Biological Services Inc., Corning Life Sciences B.V., VWR, GE Healthcare, and Bio Sciences. These companies compete through enhanced polymer quality, surface-treated culture vessels, and automation-compatible roller systems designed for high-reliability adherent cell expansion. Geographically, North America leads the market with around 42% share, driven by strong biologics and vaccine manufacturing infrastructure. Europe follows with approximately 28%, supported by mature GMP facilities, while Asia-Pacific holds about 23%, reflecting rapid biomanufacturing expansion and increasing adoption of cell culture–based workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global cell culture roller bottles market was valued at USD 218.97 million in 2024 and is projected to reach USD 336.31 million by 2032, registering a CAGR of 5.51%, supported by steady demand for adherent cell expansion in biologics and vaccine production.

- Strong market drivers include increasing adoption of roller bottles in viral vaccine manufacturing, gene therapy seed-train development, and biotech research workflows that require controlled, low-shear adherent culture environments.

- Key trends include growing preference for automation-ready roller systems, expansion of single-use gamma-sterilized bottle formats, and rising uptake of surface-enhanced polymers that improve cell attachment and consistency.

- Competitive activity is shaped by Greiner Bio-One, BD Biosciences, Corning Life Sciences, Merck KGaA, Thermo Fisher Scientific, and others, with leading players focusing on premium polymer quality, GMP compliance, and integration with semi-automated handling systems; restraints relate to labor-intensive workflows and the shift toward high-density bioreactors.

- Regionally, North America holds ~42%, Europe ~28%, and Asia-Pacific ~23%, while polystyrene dominates the material segment, driven by clarity and surface stability essential for high-quality adherent culture.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material

Polystyrene remains the dominant material segment, accounting for the largest share of cell culture roller bottle demand due to its optical clarity, gamma-stability, and consistent surface characteristics that support uniform adherent cell attachment. Manufacturers prefer polystyrene for large-scale vaccine production and recombinant protein workflows, where predictable growth kinetics are essential. PET is gaining traction because of its enhanced mechanical strength and reduced breakage risk during automated handling. The “Others” category, including glass and specialty polymers, serves niche research applications requiring solvent resistance or high chemical compatibility.

- For instance, Corning’s polystyrene CellBIND® roller bottles offer a growth surface area of 1,700 cm², achieved through a microwave-plasma surface activation process that enhances hydrophilicity for improved cell adhesion.

By End User

Vaccine manufacturers represent the leading end-user segment, holding the highest market share as roller bottles remain widely used for adherent cell expansion in viral vaccine production, including influenza, rabies, and veterinary biologics. Biopharmaceutical and therapeutic developers also maintain strong adoption due to controlled-scale adherent cell culture needs. Biotech research organizations increasingly use roller bottles for assay development, while drug development and regenerative medicine applications benefit from their flexibility in small-batch production. Stem cell technologies, pharma companies, and animal health manufacturers further contribute to demand through exploratory, pilot-scale, and regulatory-driven culture workflows.

- For instance, Corning’s CellBIND® roller bottles provide up to 1,700 cm² of growth surface, enabling high-density Vero and MDCK cultures for viral seed expansion.

KEY GROWTH DRIVERS

Rising Demand for Adherent Cell Expansion in Vaccines and Biologics

The market benefits significantly from sustained global demand for adherent cell expansion in vaccine manufacturing and recombinant biologics production. Roller bottles remain indispensable in workflows using Vero, MDCK, and BHK cell lines because they offer controlled shear conditions, high cell viability, and batch-to-batch consistency. Manufacturers continue to rely on roller bottle systems for seasonal influenza vaccines, veterinary vaccines, and pilot-scale viral vector programs where scalability and sterility assurance are critical. Their compatibility with standard CO₂ incubators and minimal requirement for complex automation also appeals to facilities operating under constrained infrastructure. Continuous investment in public health preparedness and the expansion of fill–finish networks further reinforce their role as a stable, low-risk production format. As global biologics pipelines diversify, roller bottles maintain strong relevance for projects requiring reliable early-stage adherent cell yields.

- For instance, Corning’s CellBIND® roller bottles provide a growth surface of 1,700 cm², enabling high-density viral seed production for influenza and rabies vaccines.

Growth of Biotech Research and Academic Cell Culture Programs

Academic institutions, translational research centers, and university-based biotechnology programs increasingly drive demand for roller bottles due to their simplicity, low cost of operation, and suitability for exploratory cell biology work. Research groups use roller bottles to evaluate new cell lines, optimize media performance, and perform early-stage virus propagation without investing in advanced bioreactor systems. Their large surface area and multi-bottle capacity allow scalable experimentation while maintaining strict environmental control. In many emerging markets, research infrastructure expansion and increased grant funding accelerate the adoption of roller-bottle-based culture. The format also supports diverse applications such as assay development, protein expression screening, and diagnostic reagent manufacturing. Because roller bottles bridge the gap between flasks and automated platforms, they remain a preferred choice for laboratories that require flexibility, reproducibility, and dependable culture outcomes during discovery and feasibility studies.

- For instance, Corning’s CellBIND® polystyrene roller bottles, offering 1,700 cm² of growth surface, enable research teams to screen new adherent cell lines without transitioning to complex bioreactor formats.

Increased Use in Gene Therapy, Regenerative Medicine, and Cell-Based Technologies

The expansion of gene therapy vectors, stem cell platforms, and regenerative medicine products strengthens the market for roller bottles as controlled adherent culture vessels. Early-stage vector development including AAV, adenovirus, and lentiviral systems often uses roller bottles to establish production baselines before transitioning to scalable bioreactor formats. Regenerative medicine programs utilize roller bottles for fibroblasts, mesenchymal stem cells, and feeder layer preparation, where uniform oxygenation and stable rotation cycles enhance cell quality. Their compatibility with high-density seeding and serum-free media improves process consistency for preclinical and translational-grade materials. Moreover, contract development organizations adopt roller bottles to support rapid prototyping, bridging the gap between R&D and GMP-compliant production. As personalized and cell-centric therapies expand, roller bottles maintain relevance as dependable tools for seed-train development and preclinical manufacturing.

KEY TRENDS & OPPORTUNITIES:

Shift Toward Automation-Compatible Roller Bottle Handling Systems

A major trend shaping the market is the integration of roller bottles with semi-automated platforms that support bottle rotation, environmental monitoring, and reduced manual labor. Modern roller apparatus offers programmable speed control, real-time temperature tracking, and low-vibration mechanics that improve cell adhesion and nutrient exchange. Automation-ready racks help scale up batches without increasing staffing needs, supporting vaccine manufacturers and biotech labs seeking labor-efficient workflows. Vendors increasingly design modular systems for multi-bottle parallel processing, enabling consistent mixing and improved nutrient diffusion. This trend aligns with global efforts to standardize upstream processes, minimize human error, and achieve predictable cell yields across multiple experimental batches. As facilities transition to hybrid manual–automated setups, demand for automation-compatible roller bottle systems continues to grow.

- For instance, DWK Life Sciences’ WHEATON® modular roller apparatuses are available in multiple configurations (such as 5 to 88 positions total in modular or production systems) and typically operate within a range of 0.25 to 8.1 RPM (when using standard 110 mm diameter bottles), enabling multi-bottle parallel processing with uniform, digitally controlled motion (accurate to 0.01 RPM).”

Expansion of Single-Use and Surface-Enhanced Bottle Designs

Growing interest in single-use technologies offers new opportunities for roller bottle innovation. Manufacturers now produce pre-sterilized, gamma-stable roller bottles with enhanced surface treatments that boost cell attachment and growth uniformity. Plasma-treated and collagen-coated bottles broaden applicability across sensitive cell lines, including primary cells and stem cells. Single-use roller bottles also reduce cleaning validation requirements, supporting GMP-compliant workflows and lowering contamination risks. Their adoption is rising in environments where quick turnaround, reduced downtime, and audit-ready traceability are essential. As the biopharmaceutical sector shifts toward disposable platforms, roller bottles offering higher surface area-to-volume ratios and improved ergonomic design capture increasing demand from both research and production environments.

- For instance, Corning’s CellBIND® surface-treated single-use roller bottles provide 1,700 cm² of culture area and use a microwave-plasma modification process that increases hydrophilicity for sensitive cell lines.

Increasing Adoption in Veterinary Biologics and Animal Health Markets

The expansion of veterinary vaccine and biologics manufacturing creates additional opportunities for roller bottle systems. Many veterinary viral platforms remain reliant on adherent cell lines that perform optimally in roller-based culture conditions. Roller bottles allow manufacturers to meet diverse production volumes, from small-batch formulations for regional livestock vaccines to larger runs for global distribution. The rising incidence of zoonotic and livestock diseases drives consistent investment in research, where roller bottles facilitate controlled, scalable viral propagation. Their cost-efficiency and adaptability make them especially valuable for government laboratories, animal health companies, and private research centers exploring new diagnostic and prophylactic technologies.

KEY CHALLENGES:

Transition Toward Automated, High-Density Bioreactor Systems

A major challenge for the roller bottle market is the industry-wide migration toward automated, high-density fixed-bed and single-use bioreactors. These systems offer far greater scalability, reduced manual intervention, and lower contamination risks, making them attractive for large-volume biologics and vaccine production. As biopharmaceutical companies adopt intensified manufacturing strategies, reliance on traditional adherent culture formats decreases. While roller bottles remain essential for early-stage development, seed-train generation, and niche biologics, they compete with technologies that provide higher throughput and continuous operation. The shift toward digitally controlled bioprocessing may reduce roller bottle demand in large-scale GMP facilities over time.

High Labor Intensity and Process Variability Compared to Advanced Platforms

Roller bottle workflows require considerable manual handling, including bottle rotation setup, media exchanges, and harvesting procedures. This labor-intensive nature increases operational costs and introduces variability across batches, especially in high-throughput environments. Facilities with limited skilled labor may face bottlenecks in maintaining consistent rotation speeds, sterility, and incubation conditions. Additionally, roller bottles demand significant incubator space, which limits scalability compared to compact bioreactor solutions. As regulatory expectations tighten for reproducibility and process robustness, manual roller bottle operations can present compliance challenges. These constraints encourage many organizations to evaluate automated alternatives that deliver higher consistency and reduced operator dependency.

Regional Analysis:

North America

North America accounts for around 42% of the global cell culture roller bottles market, making it the leading regional contributor. Strong biopharmaceutical and vaccine manufacturing capacity in the U.S. and Canada, coupled with intensive monoclonal antibody and viral vector programs, underpins sustained demand. High R&D spending, a dense network of academic and translational research centers, and rapid uptake of automation-compatible roller systems further reinforce regional leadership. Increasing regulatory scrutiny around sterility and data integrity also encourages continued use of standardized, high-quality roller bottle platforms in GMP-compliant biologics and vaccine facilities.

Europe

Europe represents approximately 28% of global revenue, supported by mature bioprocessing infrastructure and stringent GMP and quality standards. Major markets such as Germany, France, and the UK drive demand through extensive biologics, vaccine, and cell therapy pipelines. European pharmaceutical and biotech companies deploy roller bottles for clinical and commercial-scale adherent culture, particularly where validated, low-risk formats are preferred. Strong public funding for virology, oncology, and advanced therapy medicinal products (ATMPs) in university and research hospitals further supports usage. Regulatory emphasis on robust sterility, documentation, and batch consistency sustains long-term reliance on premium roller bottle solutions.

Asia-Pacific

Asia-Pacific contributes around 23% of the global market and exhibits the fastest growth trajectory. Expanding biologics and vaccine manufacturing hubs in China, India, South Korea, and Japan, together with rising government support for bioeconomy development, drive rapid adoption of roller bottle systems. Local biotech start-ups and academic institutes increasingly use roller bottles for pilot-scale viral production and assay development, leveraging relatively low capital cost and straightforward operation. Growing investment in cell culture–based vaccines and biosimilars, combined with scaling CDMO capacity, accelerates demand. China in particular leads regional consumption as it intensifies life-science R&D and domestic biologics manufacturing.

Middle East & Africa

The Middle East & Africa holds a smaller but rising share of about 7% of the global cell culture roller bottles market. Demand is concentrated in South Africa, Saudi Arabia, the UAE, and a limited number of regional research and reference laboratories. Governments increasingly invest in healthcare infrastructure, local vaccine-fill capacity, and basic bioprocess capabilities, creating incremental opportunities for roller bottle suppliers. Academic and clinical research centers account for a substantial portion of volumes as they expand cell culture work in infectious disease, oncology, and veterinary health. Growing interest in technology transfer and local biologics manufacturing is expected to gradually lift regional penetration.

Market Segmentations:

By Material

- Polystyrene

- Polyethylene Terephthalate (PET)

- Others

By End User

- Biopharmaceuticals and Therapeutics

- Biotech Research

- Bioprocess Production

- Drug Development

- Regenerative Medicine and Tissue Engineering

- Stem Cell Technologies

- Vaccine Manufacturers

- Pharma Companies

- Animal Health Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the cell culture roller bottles market features a mix of established bioprocess suppliers and specialized consumable manufacturers that prioritize product consistency, sterility assurance, and scalability for adherent cell applications. Leading companies focus on high-clarity polymers, advanced surface treatments, and improved gamma-stable formulations to support predictable cell attachment and growth kinetics. Many vendors strengthen their portfolios through automation-ready roller apparatus, ergonomic bottle designs, and enhanced traceability features suited for GMP environments. Strategic initiatives include expanding global distribution networks, forming partnerships with vaccine producers, and developing surface-enhanced or single-use variants to meet evolving research and manufacturing needs. Additionally, companies increasingly emphasize quality-control technologies such as precise rotational mechanisms and optimized bottle geometry to support critical workflows in viral vaccine production, gene therapy development, and pilot-scale bioprocessing. As biologics and cell-based therapeutics advance, competitive differentiation increasingly centers on performance stability, regulatory compliance, and adaptability across diverse cell lines and production scales.

Key Player Analysis:

- Greiner Bio-One

- BD Biosciences

- MP Biomedicals

- SPL Life Sciences

- Affymetrix, Inc. (Thermo Fisher Scientific)

- DWK Life Sciences

- Cell Essentials, Inc.

- Merck KGaA

- Analytical Biological Services Inc.

- Corning Life Sciences B.V.

Recent Developments:

- In September 2024, Merck, a global medical technology and pharmaceutical company, announced that they have received EXCiPACT cGMP (current Good Manufacturing Practice) certification for Pharmaceutical Auxiliary Materials (PAMs) at its major global Cell Culture Media (CCM) production sites.

- In July 2024, Merck, a global medical technology and pharmaceutical company, announced that they have begun commercial production of its first GMP (Good Manufacturing Practices) compliant manufacturing line for cell culture media (CCM) in China

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for roller bottles will remain steady as vaccine manufacturers continue relying on adherent cell platforms for seasonal and veterinary vaccine production.

- Adoption will grow in early-stage gene therapy and viral vector development where controlled, small-batch adherent culture is required.

- Automation-compatible roller systems will gain traction as bioprocessing facilities prioritize reduced labor intensity and improved consistency.

- Single-use and surface-enhanced bottle designs will expand, supporting GMP workflows and minimizing contamination risks.

- Research institutions will continue using roller bottles for assay development, media optimization, and exploratory cell biology studies.

- Roller bottles will retain relevance as seed-train vessels before scale-up to fixed-bed or bioreactor-based production systems.

- Increasing biomanufacturing activity in Asia-Pacific will drive regional demand for standardized culture consumables.

- Veterinary biologics manufacturers will broaden roller bottle usage for diverse livestock and companion-animal vaccine programs.

- Material innovations will improve clarity, sterility, and cell-adherence properties, enhancing performance across cell lines.

- Roller bottle suppliers will strengthen global distribution networks to support growing adoption in emerging bioprocess markets.

Market Segmentation Analysis:

Market Segmentation Analysis: