Market Overview

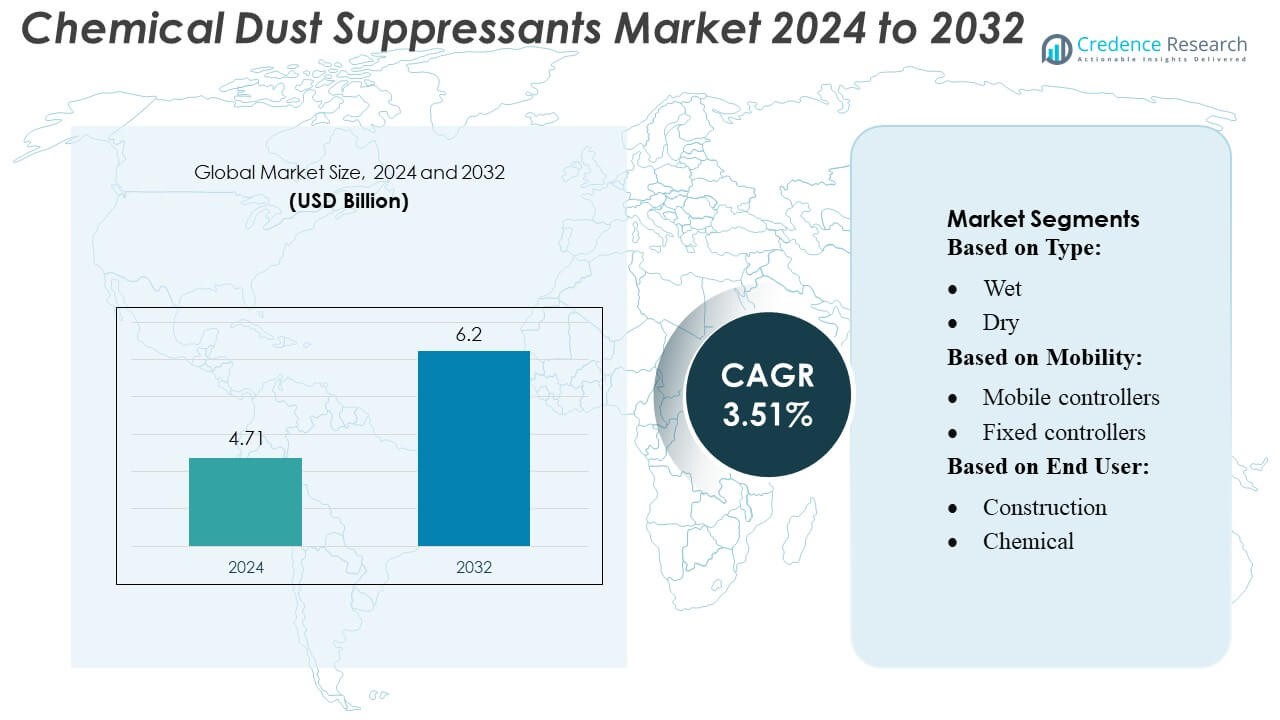

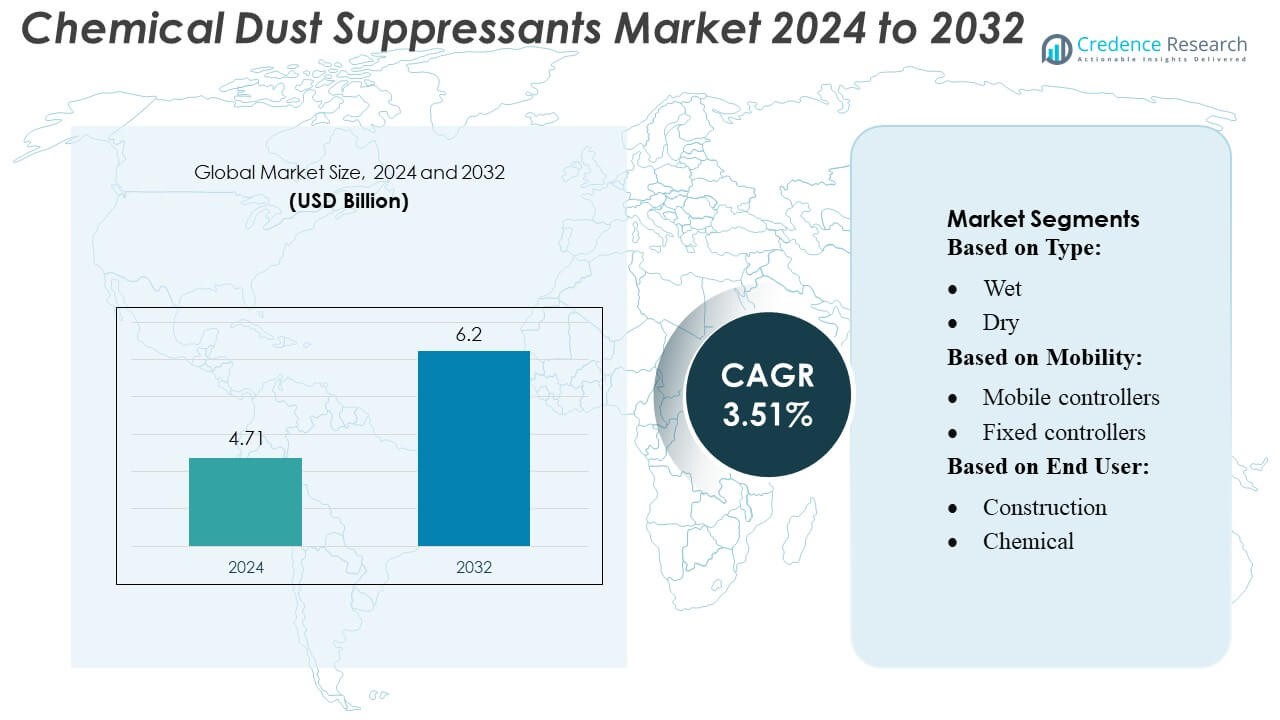

Chemical Dust Suppressants Market size was valued USD 4.71 billion in 2024 and is anticipated to reach USD 6.2 billion by 2032, at a CAGR of 3.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Dust Suppressants Market Size 2024 |

USD 4.71 Billion |

| Chemical Dust Suppressants Market, CAGR |

3.51% |

| Chemical Dust Suppressants Market Size 2032 |

USD 6.2 Billion |

The chemical dust suppressants market features several prominent players driving innovation and growth, including Nederman Holding AB, Quaker Houghton Corporation, Dust Control Technologies, Inc., Cargill Incorporated, Colliery Dust Control (Pty) Ltd, Donaldson Company, Inc., New Waste Concepts, Inc., Camfil AB, Hexion Inc., and Ecolab Inc. These companies focus on developing advanced wet and dry formulations, eco-friendly solutions, and IoT-enabled mobile and self-propelled controllers to meet stringent environmental and safety standards. North America leads the global market, capturing approximately 31% of the share, driven by robust construction and mining activities, stringent air quality regulations, and early adoption of technological innovations in dust suppression. Strategic partnerships, product innovation, and regional expansion remain key strategies for these players to strengthen market presence and cater to growing demand across construction, industrial, and oil & gas sectors worldwide.

Market Insights

- The chemical dust suppressants market was valued at USD 4.71 billion in 2024 and is projected to reach USD 6.2 billion by 2032, growing at a CAGR of 3.51% during the forecast period.

- Wet suppressants dominate the market due to their long-lasting dust control and high efficiency, while mobile controllers lead the mobility segment, offering flexibility and ease of deployment across construction and mining sites.

- North America is the leading region with approximately 31% market share, driven by stringent environmental regulations, robust construction activities, and early adoption of advanced dust suppression technologies. Europe and Asia Pacific follow closely, supported by sustainable infrastructure initiatives and rapid industrialization.

- Key drivers include increasing urbanization, stricter environmental compliance, and the growing need for occupational safety, while challenges involve high costs of advanced systems and operational limitations in extreme weather or site conditions.

- Market trends emphasize eco-friendly solutions, IoT-enabled controllers, and cross-industry adoption, with competitive players focusing on technological innovation, strategic partnerships, and regional expansion to strengthen market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the chemical dust suppressants market, the wet segment dominates, accounting for approximately 60–65% of the market share. Wet suppressants are preferred due to their high efficiency in controlling airborne dust particles and their ability to provide longer-lasting suppression under varying environmental conditions. The growing emphasis on occupational safety and stringent environmental regulations is driving demand for wet solutions in construction and mining operations. For instance, companies increasingly adopt calcium chloride-based wet suppressants, which demonstrate superior hygroscopic properties, enhancing dust binding and reducing particulate dispersion in open-air industrial sites.

- For instance, Haldor Topsoe A/S reported an h-index of 173, reflecting its scientific leadership in catalysis, and invested nearly DKK 700 million in R&D during 2023 to advance its heterogeneous catalyst technologies.

By Mobility

Within the mobility segment, mobile controllers lead with a market share of around 40–45%, driven by their flexibility and ease of deployment across large-scale and remote sites. Mobile systems allow operators to move suppression units efficiently, optimizing coverage while minimizing downtime. Self-propelled units are also gaining traction due to advanced automation and real-time monitoring capabilities. For instance, modern tractor-mounted and self-propelled units integrate IoT sensors to adjust spray intensity dynamically, improving operational efficiency and reducing chemical usage, which aligns with sustainability and cost-efficiency objectives across construction and mining operations.

- For instance, CLARITY™ digital service portal has been adopted at more than 80 plants worldwide, serving over 380 active users in 28 countries, enabling real-time monitoring and performance optimization of catalyst systems.

By End User

The construction sector emerges as the dominant end-user segment, capturing approximately 35–40% of the market, primarily due to extensive urban infrastructure projects and road construction activities. Demand is driven by the need to comply with environmental regulations and to enhance worker safety on sites generating high dust levels. Chemical and oil & gas industries are also significant adopters, leveraging specialized suppressants for process areas and material handling. For instance, large-scale construction firms increasingly deploy polymer-based wet suppressants, which exhibit superior dust binding capacity, reduce water consumption, and improve operational productivity across diverse site conditions.

Key Growth Drivers

- Increasing Regulatory Compliance and Environmental Awareness

Stringent environmental regulations globally are a major driver for the chemical dust suppressants market. Industries such as construction, mining, and oil & gas are under pressure to minimize particulate emissions and maintain air quality standards. The adoption of chemical suppressants helps companies meet regulatory requirements efficiently while reducing environmental impact. For instance, calcium chloride and polymer-based suppressants are increasingly used to comply with dust control mandates, enabling firms to avoid penalties and enhance sustainability practices, driving steady market expansion across urban and industrial zones.

- For instance, Arkema’s Siliporite® molecular sieves are used in adsorption columns in refineries and petrochemical plants to dry and separate oil and petrochemical cuts, protecting sensitive catalysts from traces of water, sulfur, and other impurities. These sieves are regenerated after each cycle and have a reported service life of four to 5 years in demanding applications.

- Rapid Urbanization and Infrastructure Development

The surge in global urbanization and large-scale infrastructure projects is fueling demand for chemical dust suppressants. Construction activities, including roads, bridges, and commercial complexes, generate significant dust, creating occupational and environmental hazards. Companies are adopting wet and mobile suppressant solutions to maintain site safety and operational efficiency. For instance, polymer-based wet suppressants are deployed extensively in urban construction sites due to their long-lasting dust binding capabilities, helping firms meet project timelines and regulatory standards while addressing rising air quality concerns.

- For instance, Honeywell UOP did launch the MTO-600 catalyst as the latest generation of its methanol-to-olefins (MTO) catalyst technology. This new formulation serves as a direct, drop-in replacement for the previous MTO-100 catalyst.

- Technological Advancements in Dust Suppression Solutions

Innovations in suppressant formulation and delivery systems are accelerating market growth. Advanced wet and dry suppressants now offer enhanced adhesion, longer residual effect, and reduced chemical consumption. Mobile, self-propelled, and IoT-enabled spray systems allow precise application and real-time monitoring, optimizing efficiency. For instance, modern tractor-mounted and handheld controllers integrate automated intensity adjustment, minimizing waste and energy use. These technological improvements not only improve operational performance but also appeal to environmentally conscious clients, further driving adoption in construction, mining, and industrial sectors.

Key Trends & Opportunities

- Shift Toward Eco-friendly and Sustainable Solutions

There is a growing trend toward environmentally friendly chemical suppressants that reduce ecological impact. Water-based polymers, biodegradable solutions, and low-toxicity compounds are being increasingly preferred by end-users seeking regulatory compliance and sustainability. For instance, major construction firms are adopting biodegradable wet suppressants, which offer effective dust control while minimizing groundwater contamination. This trend opens opportunities for manufacturers to innovate and differentiate their product lines, targeting clients prioritizing green construction and industrial practices.

- For instance, Nebula® bulk metal catalyst—commercialised more than ten years ago—has been deployed across over 60 refineries with more than 130 unit cycles, according to the company’s 2016 announcement.

- Integration of Automation and IoT in Suppression Systems

Automation and smart technologies are transforming the market by enabling real-time monitoring and precision application of dust suppressants. IoT-enabled controllers, self-propelled units, and automated sprayers optimize chemical usage, reduce operational costs, and enhance efficiency. For instance, sensor-integrated mobile units adjust spray intensity based on dust concentration, improving coverage and reducing waste. This technological shift presents opportunities for manufacturers to develop advanced solutions that cater to digitalized construction and industrial sites, fostering market growth.

- For instance, “Verdium™” offering allows customers to trace recycled platinum-group metals with carbon savings exceeding 30 metric tons CO₂ per kilogram of material used.

- Expanding Adoption Across Emerging End-use Industries

While construction leads, sectors such as food & beverage, pharmaceuticals, and textiles are increasingly adopting dust suppressants to ensure product quality and safety. Dry powder suppressants are used in grain handling and chemical processing to prevent airborne contamination. This expanding application spectrum offers manufacturers a chance to diversify their offerings and develop specialized formulations for niche industries, creating incremental revenue streams and strengthening market penetration beyond traditional sectors.

Key Challenges

- High Cost of Advanced Suppression Systems

The initial investment for technologically advanced suppressants and mobile application systems remains a significant challenge for end-users. Self-propelled, IoT-integrated, and automated units involve higher upfront costs, limiting adoption among smaller construction or mining firms. Additionally, premium polymer-based suppressants are more expensive than conventional solutions, creating budget constraints for widespread use. Companies must balance cost with operational efficiency and regulatory compliance, which may slow market growth despite the evident benefits of advanced dust control technologies.

- Operational and Environmental Limitations

Effectiveness of chemical dust suppressants can be influenced by weather, soil type, and site conditions, posing operational challenges. Wet suppressants, for example, may be less effective under heavy rainfall or extremely windy conditions, while dry solutions may require frequent reapplication. Additionally, improper use can lead to chemical runoff, environmental contamination, or health hazards. These limitations necessitate careful selection and application strategies, demanding technical expertise from operators and potentially restricting adoption in certain regions or industrial contexts.

Regional Analysis

North America

North America dominates the chemical dust suppressants market, holding approximately 30–32% market share, driven by stringent environmental regulations and advanced infrastructure development. The United States and Canada are leading adopters, with widespread application in construction, mining, and oil & gas sectors. Increased emphasis on occupational safety, urban infrastructure projects, and sustainable practices is propelling demand for both wet and dry suppressants. For instance, major construction firms are deploying calcium chloride and polymer-based wet solutions combined with mobile and self-propelled controllers, enhancing dust control efficiency while ensuring compliance with federal and state-level air quality standards.

Europe

Europe accounts for around 25–27% of the global market, driven by strict environmental policies and sustainable urbanization initiatives. Countries such as Germany, France, and the UK are increasingly adopting chemical dust suppressants in construction, mining, and industrial sectors to meet air quality and worker safety standards. The demand for eco-friendly, biodegradable wet suppressants is rising, aligning with the EU’s sustainability mandates. For instance, major European infrastructure projects utilize polymer-based wet solutions with automated spray controllers, improving operational efficiency and minimizing chemical consumption while addressing regulatory compliance and environmental protection objectives.

Asia Pacific

The Asia Pacific region holds roughly 28–30% market share, fueled by rapid urbanization, industrial expansion, and large-scale infrastructure projects in countries such as China, India, and Australia. The construction and mining sectors are major end-users, adopting wet and mobile suppressant systems for effective dust management. Technological advancements, such as IoT-enabled mobile and self-propelled controllers, are increasingly implemented to optimize application and reduce chemical usage. For instance, polymer-based wet suppressants are widely used in highway and urban development projects, providing efficient dust control and long-lasting protection while supporting compliance with evolving environmental regulations.

Latin America

Latin America represents approximately 8–9% of the market, supported by mining, oil & gas, and construction activities in Brazil, Mexico, and Chile. Regulatory frameworks are strengthening, encouraging the adoption of chemical dust suppressants to reduce occupational hazards and environmental impact. Wet suppressants, particularly calcium chloride solutions, are widely applied in open-pit mining and large construction sites due to their high dust-binding efficiency. For instance, mobile and tractor-mounted controllers are employed in Brazilian mining operations, enhancing coverage and operational efficiency while ensuring compliance with local environmental standards, creating steady growth opportunities in the region.

Middle East & Africa

The Middle East & Africa region accounts for around 6–7% market share, driven primarily by oil & gas, mining, and large-scale construction projects. Countries such as Saudi Arabia, UAE, and South Africa are adopting chemical dust suppressants to manage harsh, dusty environments and comply with occupational safety regulations. Wet and dry suppressants are deployed across industrial and infrastructure sites, with mobile and self-propelled systems enhancing application efficiency. For instance, polymer-based wet solutions are increasingly used in desert mining operations and road construction projects, offering long-lasting dust suppression and reducing water consumption, which aligns with regional sustainability and operational objectives.

Market Segmentations:

By Type:

By Mobility:

- Mobile controllers

- Fixed controllers

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chemical dust suppressants market is highly competitive, with key players including Nederman Holding AB, Quaker Houghton Corporation, Dust Control Technologies, Inc., Cargill Incorporated, Colliery Dust Control (Pty) Ltd, Donaldson Company, Inc., New Waste Concepts, Inc., Camfil AB, Hexion Inc., and Ecolab Inc. The chemical dust suppressants market is characterized by intense competition, driven by innovation, product differentiation, and strategic expansion. Companies focus on developing advanced wet and dry suppressant formulations, eco-friendly solutions, and IoT-enabled mobile and self-propelled controllers to meet stringent environmental and safety regulations. Technological advancements such as polymer-based suppressants with enhanced adhesion and long-lasting dust control are gaining prominence, while automation and real-time monitoring improve operational efficiency. Market players are leveraging mergers, acquisitions, and strategic collaborations to expand geographic reach and distribution networks. The competitive environment emphasizes sustainable solutions, cost optimization, and diversified product portfolios to capture growing demand from construction, mining, oil & gas, and industrial sectors worldwide.

Key Player Analysis

Recent Developments

- In October 2025, Camfil APC launched the Gold Series III dust collector. This upgraded system features a new design and filter technology to improve airflow and filtration efficiency, with the goal of providing longer filter service life and consistent performance.

- In October 2025, BASF and IFF announced a strategic partnership to accelerate the development of next-generation enzymes and biobased polymers for various applications, including fabric, dish, personal care, and industrial cleaning applications. The partnership aims to leverage BASF’s chemical know-how with IFF’s bioscience innovation to provide sustainable solutions at scale while performance is maintained.

- In April 2024, Donaldson Company, Inc. launched the Downflo® Evolution Pre-assembled Small (DFPRE 2), a compact and dependable filtration system designed for various manufacturing applications. This pre-assembled unit addresses the demand for powerful dust control systems in a smaller footprint.

- In April 2023, GELITA AG, a leading player in the industry, launched a fast-setting gelatin which allows a breakthrough in fortified gummy manufacturing. CONFIXX, the new gelatin brand, enables the starch-free manufacture of gummies with a sensorial profile that was previously possible only with a starch-based production process.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Mobility, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing urbanization and infrastructure development globally.

- Adoption of eco-friendly and biodegradable dust suppressants will rise in response to environmental regulations.

- Technological advancements in IoT-enabled and automated dust suppression systems will enhance operational efficiency.

- Wet suppressants will continue to dominate due to their long-lasting dust control and high efficiency.

- Expansion of the construction and mining sectors in emerging economies will create new demand opportunities.

- Integration of real-time monitoring and precision application systems will become more prevalent.

- Polymer-based and advanced chemical formulations will gain traction for superior performance.

- Companies will increasingly focus on sustainable and water-efficient solutions.

- Cross-industry adoption, including food & beverage and pharmaceuticals, will support market diversification.

- Strategic collaborations and technological partnerships will drive innovation and strengthen market presence.