| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Africa Graphene Market Size 2024 |

USD69.24 million |

| South Africa Graphene Market, CAGR |

22.04% |

| South Africa Graphene Market Size 2032 |

USD 340.77 Million |

Market Overview

The South Africa Graphene Market is projected to grow from USD 64.29 million in 2024 to an estimated USD 340.77 million by 2032, with a compound annual growth rate (CAGR) of 22.04% from 2024 to 2032. The market’s growth is driven by increasing investments in graphene research and development, coupled with the expanding applications of graphene in various industries such as electronics, energy storage, and automotive.

Key drivers of market growth include advancements in graphene production techniques, which have significantly reduced the cost of production. Additionally, the growing demand for lightweight and efficient materials in industries such as automotive and electronics is fueling the adoption of graphene. Trends like sustainable development and the shift toward clean energy also promote graphene’s use in renewable energy technologies and energy storage systems, further contributing to the market’s expansion.

Geographically, South Africa is poised to become a significant hub for graphene production and application in the African continent. The country’s strategic position, coupled with increasing government and private sector investments, offers growth opportunities for the graphene market. Key players in the South African graphene market include GrapheneCA, South African Research Chairs Initiative, and Stellenbosch University, all of which contribute to advancing graphene innovation and commercialization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Africa Graphene Market is projected to grow from USD 56.93 million in 2023 to USD 340.77 million by 2032, with a CAGR of 21.63% from 2024 to 2032.

- Key drivers include advancements in graphene production technologies, reducing costs and enhancing its commercial viability across industries such as electronics, automotive, and energy.

- The growing demand for lightweight and high-performance materials in sectors like automotive and electronics is further fueling the adoption of graphene-based products.

- High production costs and scalability challenges remain a significant barrier to the widespread adoption of graphene-based materials in various applications.

- Limited awareness and slow adoption across industries in South Africa are hindering faster market growth, despite graphene’s potential.

- The Western Cape leads the market with 50% share due to its strong research and industrial base, particularly in energy storage and sustainable technology sectors.

- Gauteng, with its economic and industrial focus, holds 30% of the market share, driven by automotive, aerospace, and electronics sectors.

Report Scope

This report segments the South Africa Graphene Market as follow

Market Drivers

Advancements in Graphene Production Technologies

One of the primary drivers of the South Africa Graphene Market is the significant progress in graphene production techniques. Historically, the high cost of graphene production has hindered its commercial viability. However, recent technological breakthroughs, such as chemical vapor deposition (CVD), liquid-phase exfoliation, and chemical reduction methods, have considerably reduced production costs. This has made graphene more accessible for a wide range of applications, from electronics to energy storage solutions. As production techniques continue to improve, the South African market is expected to witness an increase in graphene availability, further stimulating demand across various industries. The continuous refinement of these production methods is crucial to enhancing the scalability of graphene-based materials, which is a pivotal factor for the market’s growth in the coming years.For instance, the CSIR’s Centre for Nanostructures and Advanced Materials (CeNAM) has developed a cost-effective graphene synthesis technology platform that is accessible to local businesses. This platform uses a modified and improved version of Hummer’s method, enabling the production of high-quality graphene materials at a scale of 1 kg per batch. Additionally, researchers at the Massachusetts Institute of Technology have successfully used additive manufacturing to print 3D objects from graphene, demonstrating strength ten times that of steel at a fraction of the mass. Furthermore, a research team in Australia has developed a method to produce single-layer graphene sheets using everyday soybean oil on a nickel substrate, potentially enabling large-area sheet production in ambient air conditions.

Rising Demand for Lightweight and High-Performance Materials in Multiple Industries

The demand for advanced materials with superior mechanical properties is growing across various sectors, particularly in automotive, electronics, and aerospace. Graphene, known for its outstanding strength-to-weight ratio, conductivity, and flexibility, offers a compelling alternative to traditional materials. In the automotive industry, for example, graphene is being explored for its potential to create lighter and more fuel-efficient vehicles, a trend driven by the need for improved performance and sustainability. The material’s exceptional electrical conductivity also enhances its applicability in electronics, where it is used for creating more efficient batteries, sensors, and displays. As industries in South Africa increasingly adopt these high-performance materials, graphene’s role becomes more pivotal. Its unique properties position it as a critical material for innovation in both existing and emerging technologies, thus accelerating its market penetration.For instance, a major automotive manufacturer has successfully incorporated graphene into car components, resulting in a significant reduction in vehicle weight while maintaining structural integrity. In the electronics sector, a leading smartphone company has developed a graphene-enhanced battery that charges faster and lasts longer than conventional lithium-ion batteries. Additionally, aerospace researchers have created graphene-reinforced composite materials that exhibit superior strength and thermal properties, potentially revolutionizing aircraft design and performance. These examples demonstrate the versatility and potential of graphene across multiple industries, driving its adoption and market growth in South Africa.

Government Support and Investment in Research and Development

Another significant factor driving the South Africa Graphene Market is the increasing government support and investment in research and development (R&D) for advanced materials. The South African government, recognizing the potential of graphene to transform industries and boost economic growth, has made efforts to foster innovation in this field. Several initiatives, such as funding R&D projects and establishing specialized research centers, have been implemented to accelerate the development and commercialization of graphene-based technologies. For instance, collaborations between universities, research institutions, and private companies are actively working to enhance graphene production techniques and explore its applications in sectors like energy storage, construction, and environmental sustainability. These efforts are not only expected to boost the domestic market for graphene but also position South Africa as a leader in graphene innovation on the African continent. With government initiatives providing both financial and infrastructural support, the South African graphene market is poised for rapid growth in the coming years.For instance, the Department of Science and Innovation has established a dedicated Graphene Initiative, allocating substantial funding to support research projects and foster collaboration between academia and industry. This initiative has led to the creation of a state-of-the-art graphene research facility at a leading South African university, equipped with cutting-edge tools and technologies. Furthermore, the government has introduced tax incentives for companies investing in graphene-related R&D, encouraging private sector participation in the development of graphene applications. These measures have resulted in an increase in patent filings related to graphene technologies by South African researchers and companies, indicating a growing innovation ecosystem in the country.

Growing Focus on Sustainable and Renewable Energy Solutions

The increasing focus on sustainable and renewable energy solutions is another key driver of the South Africa Graphene Market. As global energy consumption patterns shift towards cleaner energy, graphene’s applications in energy storage and conversion technologies are gaining significant attention. Graphene’s remarkable electrical conductivity and large surface area make it an ideal candidate for use in next-generation batteries, supercapacitors, and fuel cells. In South Africa, where the demand for reliable energy solutions is high, particularly in the context of addressing power shortages and improving energy efficiency, graphene-based technologies are emerging as promising solutions. For example, graphene is being utilized in the development of high-performance batteries and energy storage devices that can store and release energy more efficiently than conventional systems. This aligns with South Africa’s broader goals of enhancing energy security and reducing reliance on fossil fuels. Additionally, the material’s potential in solar cells and other renewable energy technologies further amplifies its relevance in the country’s energy transition. As the demand for sustainable and energy-efficient technologies grows, the South African graphene market is set to benefit from the increasing adoption of graphene-based solutions in the energy sector.For instance, a South African energy company has developed graphene-enhanced solar panels that demonstrate higher efficiency in converting sunlight to electricity compared to traditional silicon-based panels. These panels have been successfully deployed in several pilot projects across the country, showcasing their potential to improve solar energy generation. In another example, a local start-up has created graphene-based supercapacitors that can rapidly charge and discharge, providing a solution for grid stabilization and peak load management in renewable energy systems. Furthermore, researchers at a prominent South African university have made breakthroughs in using graphene to enhance the performance of hydrogen fuel cells, potentially advancing the country’s efforts in developing a hydrogen economy.

Market Trends

Increasing Integration of Graphene in Energy Storage Applications

A prominent trend in the South Africa Graphene Market is the growing integration of graphene into energy storage applications. As the world moves towards renewable energy sources such as solar and wind, the demand for efficient and high-capacity energy storage systems has surged. Graphene, with its exceptional conductivity, large surface area, and ability to facilitate faster charge and discharge cycles, is being increasingly used in the development of advanced batteries and supercapacitors. In South Africa, where energy storage solutions are in high demand due to the need for improved energy security and management, graphene-based technologies offer a promising solution. Local research institutes and private companies are focusing on developing graphene-based batteries that could potentially store more energy and have longer lifespans compared to traditional lithium-ion batteries. Furthermore, supercapacitors enhanced with graphene are expected to deliver faster energy release, which is critical for applications in electric vehicles and grid storage systems. As energy storage remains a central focus in South Africa’s energy landscape, graphene’s role is expected to expand, reinforcing its position as a transformative material in the energy sector.

Growth of Graphene-Based Electronics and Sensors

The application of graphene in electronics and sensor technologies is another growing trend in the South African market. Graphene’s exceptional electrical conductivity, flexibility, and transparency make it an ideal candidate for developing cutting-edge electronic devices. In particular, graphene is being explored in the creation of next-generation transistors, flexible displays, and transparent touchscreens. South African research institutions are working on incorporating graphene into electronics to improve their performance while reducing their energy consumption. The use of graphene in sensors, particularly for environmental monitoring, healthcare, and industrial applications, is also expanding. Graphene’s ability to detect minute changes in its environment, such as chemical compositions or temperature fluctuations, has made it a suitable material for highly sensitive sensors. The demand for such sensors in industries such as agriculture, manufacturing, and healthcare is rising in South Africa, prompting significant interest from both local startups and international companies. These advancements in graphene-based electronics and sensors are driving the market’s evolution, opening doors for more innovative products and applications.

Focus on Sustainable and Environmentally Friendly Applications

Sustainability is a core trend in the South Africa Graphene Market, with increasing emphasis on environmentally friendly and sustainable applications of graphene. As industries worldwide seek greener alternatives to traditional materials, graphene is emerging as a key material in various sustainable technologies. In South Africa, graphene’s potential in water purification, waste treatment, and energy-efficient building materials is being explored. Graphene-based filters are being tested for their ability to remove pollutants and contaminants from water, making it an ideal solution for water-scarce regions. Additionally, the use of graphene in construction materials such as cement and concrete is gaining traction. The incorporation of graphene in these materials can improve their durability, reduce their carbon footprint, and enhance their insulating properties, leading to more energy-efficient buildings. In the context of South Africa’s increasing push for sustainable development, these applications align with both local and global environmental goals, further fueling interest in graphene research and commercialization. As the demand for eco-friendly solutions continues to rise, graphene is expected to play a key role in addressing various environmental challenges while providing innovative solutions across multiple industries.

Collaboration Between Academia, Government, and Industry

Collaboration between academia, government, and industry is a significant trend in the South Africa Graphene Market, contributing to the acceleration of graphene-related innovations. South Africa’s government, recognizing the material’s potential, has been actively supporting graphene research and development initiatives. Public-private partnerships are forming to foster technological advancements, bringing together the expertise of research institutions, universities, and industry players. Notable South African research entities, such as Stellenbosch University and the South African Research Chairs Initiative, are conducting cutting-edge studies on graphene production and its applications in various sectors, including energy, electronics, and healthcare. Additionally, government-funded programs are incentivizing businesses to invest in the commercialization of graphene-based products. The collaboration between these stakeholders is leading to the creation of graphene hubs, innovation centers, and research facilities aimed at accelerating the development of graphene technologies. This trend has significantly increased the pace of innovation, helping South Africa emerge as a key player in the global graphene market. Furthermore, the collaborative efforts contribute to creating an ecosystem that supports the scaling up of graphene production, addressing challenges related to cost, availability, and application.

Market Challenges

High Production Costs and Scalability Issues

One of the primary challenges facing the South Africa Graphene Market is the high cost of graphene production and the difficulties associated with scaling up production. Despite advancements in production technologies, such as chemical vapor deposition and liquid-phase exfoliation, the manufacturing of high-quality graphene remains costly. For small-scale or emerging companies in South Africa, the expense of setting up the necessary infrastructure for mass production can be a significant barrier to entry. Additionally, while production costs have decreased over time, they still limit the widespread adoption of graphene-based products, especially in industries where cost sensitivity is crucial. The inability to scale graphene production efficiently hampers the material’s commercialization, preventing it from reaching its full potential across various sectors. For South Africa to become a leading hub in graphene production, overcoming the challenge of high production costs and achieving cost-effective scalability will be essential to ensure long-term market growth.

Limited Awareness and Market Adoption

Another significant challenge for the South Africa Graphene Market is the limited awareness and slow adoption of graphene-based technologies across industries. While graphene holds immense potential in applications such as energy storage, electronics, and construction, its adoption has been relatively slow compared to other emerging materials. Many industries remain cautious about integrating graphene into their products due to a lack of understanding of its benefits, as well as concerns regarding its long-term reliability and performance. In South Africa, the market is still in a developmental stage, and there is a need for more comprehensive education and awareness campaigns targeted at both businesses and consumers. Additionally, the perceived risks associated with new technologies, along with the complex nature of graphene’s properties, may deter companies from investing in graphene-related innovations. Increased collaboration between research institutions, industry stakeholders, and government bodies is needed to bridge the knowledge gap and promote the widespread adoption of graphene-based products in South Africa.

Market Opportunities

Expansion of Graphene in Energy Storage and Renewable Technologies

One of the most promising opportunities in the South Africa Graphene Market lies in the growing demand for advanced energy storage solutions and renewable energy technologies. Graphene’s exceptional conductivity, large surface area, and ability to enhance the performance of batteries and supercapacitors make it an ideal material for next-generation energy storage systems. With South Africa’s ongoing focus on increasing its renewable energy capacity and addressing energy security challenges, the adoption of graphene in energy storage applications presents a significant market opportunity. The development of graphene-based batteries and energy storage devices that offer higher efficiency, faster charging times, and longer lifespans could help meet the country’s energy demands while contributing to its transition towards a more sustainable energy future. Moreover, graphene’s potential use in solar energy technologies, such as more efficient solar cells, further enhances the growth prospects in the energy sector.

Growth in Advanced Manufacturing and Construction Sectors

Another significant opportunity for the South Africa Graphene Market lies in the advanced manufacturing and construction industries. Graphene’s unique properties, such as its lightweight nature, durability, and ability to improve the strength of materials, make it a highly valuable addition to construction materials like cement and concrete. The potential to create more energy-efficient, cost-effective, and sustainable construction materials aligns with South Africa’s growing emphasis on infrastructure development and green building practices. Furthermore, as industries in South Africa increasingly seek high-performance materials for automotive, aerospace, and electronics applications, graphene’s role in these sectors is expanding. The growing demand for lightweight, energy-efficient, and durable materials in these industries presents substantial growth opportunities for graphene producers and manufacturers within the country.

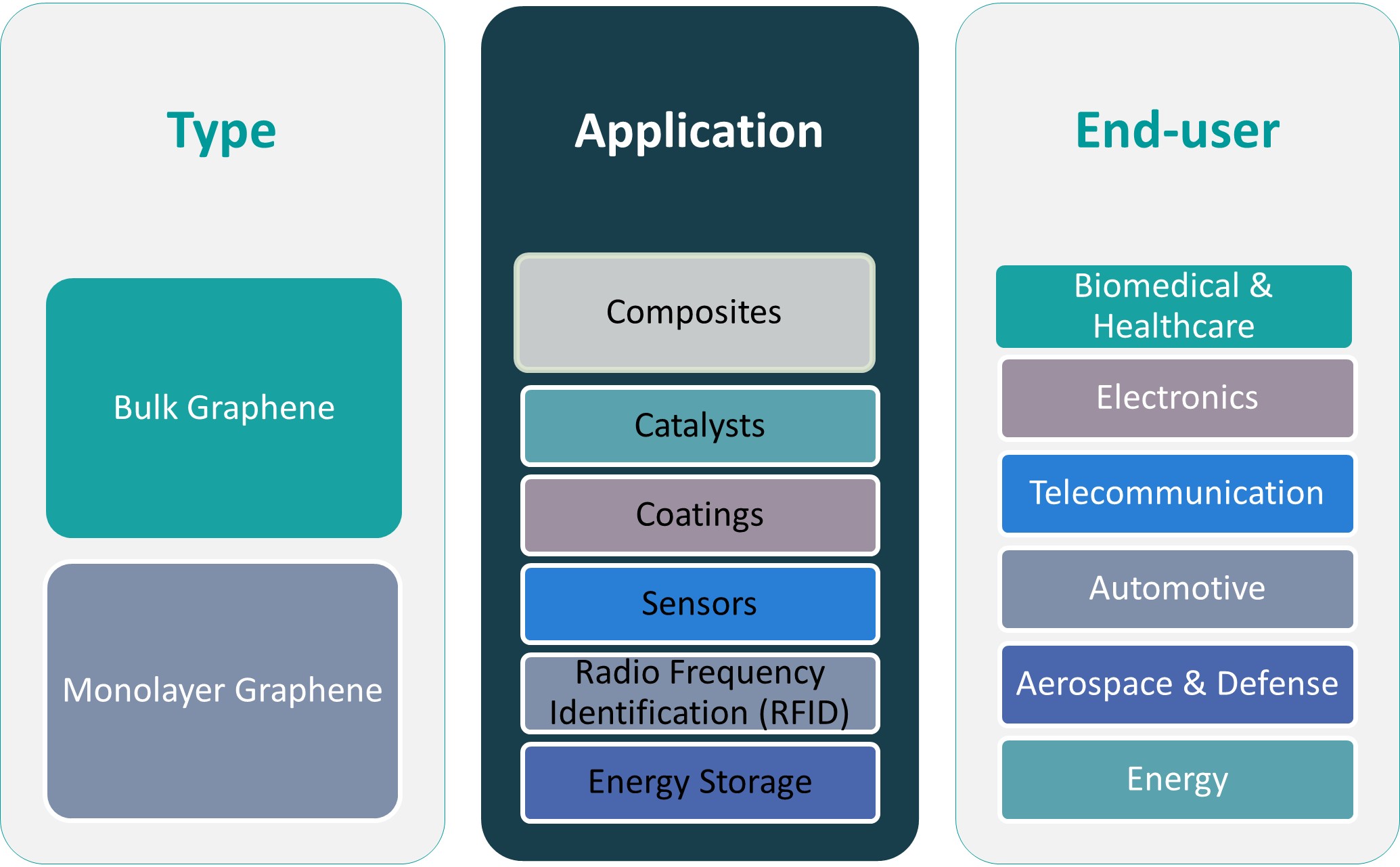

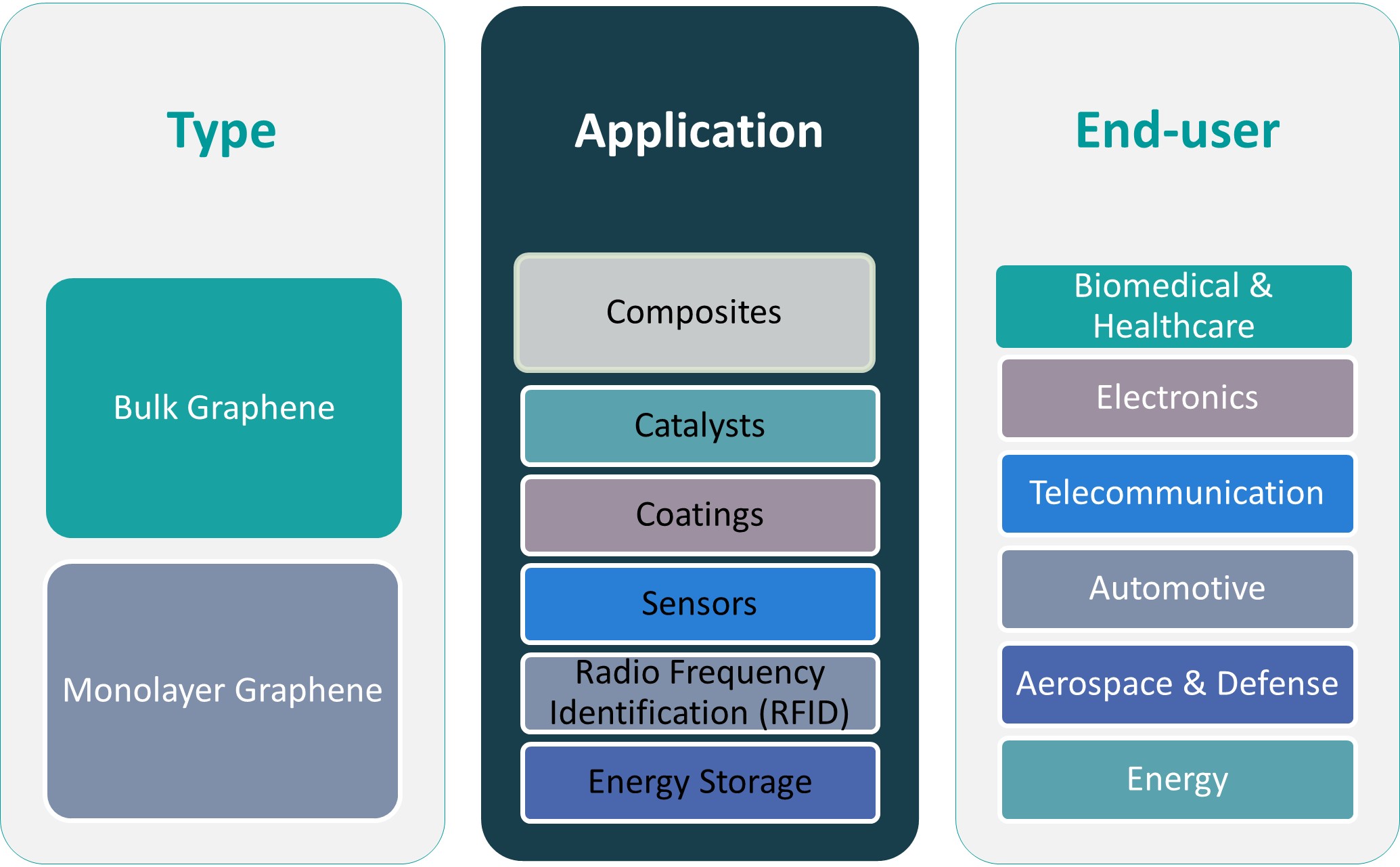

Market Segmentation Analysis

By Type:

The South Africa Graphene Market is primarily categorized into two types: Bulk Graphene and Monolayer Graphene. Bulk graphene is commonly used in a wide range of industrial applications due to its cost-effectiveness and availability in larger quantities. It is primarily employed in composites, coatings, and construction materials. On the other hand, monolayer graphene, known for its exceptional properties such as high conductivity, strength, and flexibility, is typically used in advanced electronics, sensors, and energy storage devices. Although monolayer graphene is more expensive to produce, its superior performance in specialized applications positions it as a key driver for innovation in South Africa’s high-tech industries.

By Application:

Graphene’s application potential spans multiple industries. In the composites sector, graphene is used to enhance the mechanical properties of materials such as polymers, metals, and ceramics, leading to stronger, lighter products. In catalysts, graphene serves as an effective support material, improving the efficiency of chemical reactions. Coatings enriched with graphene offer improved corrosion resistance and durability, making them ideal for the automotive, aerospace, and construction sectors. Graphene’s use in sensors is gaining momentum, particularly in environmental monitoring and healthcare devices, due to its sensitivity to various stimuli. Additionally, the application of graphene in Radio Frequency Identification (RFID) is emerging, offering enhanced performance in identification and tracking systems, crucial for logistics, supply chain management, and retail.

Segments

Based on Type

- Bulk Graphene

- Monolayer Graphene

Based on Application

- Composites

- Catalysts

- Coatings

- Sensors

- Radio Frequency Identification (RFID)

Based on End User

- Biomedical & Healthcare

- Electronics

- Automotive

- Aerospace & Defense

- Others

Based on Region

- Western Cape

- Gauteng

- Other Regions

Regional Analysis

Western Cape (50%)

The Western Cape region holds the largest market share in the South Africa Graphene Market, accounting for approximately 50% of the total market. This region is home to major research institutions, including Stellenbosch University and the University of Cape Town, which are at the forefront of graphene-related research and innovation. The proximity to key academic and scientific institutions has fostered a strong collaboration between the public and private sectors, contributing to the development of advanced graphene applications. Additionally, Cape Town’s infrastructure and established industrial base in sectors such as construction, energy, and electronics have enabled graphene to gain significant traction in these industries. The region’s emphasis on sustainable technologies and renewable energy solutions further enhances the demand for graphene in energy storage and clean energy applications.

Gauteng (30%)

Gauteng, which includes the major economic hubs of Johannesburg and Pretoria, holds approximately 30% of the market share in the South Africa Graphene Market. As the economic powerhouse of the country, Gauteng is a critical region for the commercialization of graphene-based products. The high concentration of industries such as automotive, aerospace, and manufacturing in Gauteng provides a strong demand for advanced materials, including graphene. The region’s focus on innovation and technology-driven industries has led to an increase in the adoption of graphene in various applications, particularly in high-performance automotive components and electronic devices. Additionally, the government’s support for R&D in Gauteng, coupled with the presence of key players and startups, further accelerates market growth.

Key players

- Applied Graphene Materials

- 2D Carbon Graphene Material Co., Ltd.

- Thomas Swan & Co. Ltd.

- Graphene Laboratories, Inc.

- Graphensic AB

- Graphene Square Inc.

- AMO GmbH

- Talga Group

- ACS Material

- BGT Materials Limited

- CVD Equipment Corporation

- Directa Plus S.p.A.

- Grafoid Inc.

- Graphenea

- NanoXplore Inc.

- Haydale Grace Industries PLC

- Zentek Ltd.

Competitive Analysis

The South Africa Graphene Market is highly competitive, with several established global players vying for market share. Companies like Applied Graphene Materials, Thomas Swan & Co., and Graphenea lead the market due to their advanced production capabilities and extensive product portfolios. Applied Graphene Materials is known for its strong R&D focus, offering high-quality graphene dispersions for various applications. Companies such as NanoXplore Inc. and Graphene Laboratories, Inc. are expanding their market presence through strategic partnerships and innovations in energy storage, composites, and coatings. Additionally, emerging players like Talga Group and 2D Carbon Graphene Material Co. Ltd. are gaining traction due to their advancements in scalable graphene production and cost-effective manufacturing methods. The market remains dynamic, with competition driven by technological advancements, cost reduction strategies, and new application developments.

Recent Developments

- In January 2024, Black Swan Graphene Inc. announced an agreement with Thomas Swan & Co. Ltd. for distribution and sales of graphene products in South Africa.

- In September 2023, Talga Group completed groundbreaking for its Luleå Anode Refinery, marking the start of construction for graphene production facilities.

- In June 2023, Directa Plus secured a €5.5 million, three-year contract with LIBERTY Galati, representing the company’s largest contract to date in the graphene market.

- In May 2023, Directa Plus entered into an exclusive agreement with Grassi SpA to expand the use of its Graphene Plus Thermal Planar Circuit® technology in workwear and military markets.

- In March 2023, Universal Matter UK Limited acquired Applied Graphene Materials UK Ltd. for US$1.3 million, consolidating its position in the graphene market.

- In July 2023, Haydale was awarded a contract by Cadent to produce graphene ink and coating-based heaters for low-power radiators, valued at approximately €350,000.

Market Concentration and Characteristics

The South Africa Graphene Market exhibits moderate concentration, with a mix of global players and local entities contributing to its growth. Major international companies such as Applied Graphene Materials, Thomas Swan & Co., and NanoXplore Inc. dominate the market through their established technologies and extensive research capabilities. However, the market also presents opportunities for local startups and emerging players, particularly those involved in graphene production and applications within South Africa’s key industries like energy, automotive, and construction. The market is characterized by strong competition driven by continuous innovation in production methods, cost efficiency, and product diversification. Additionally, collaborations between research institutions, industry stakeholders, and government initiatives play a pivotal role in fostering growth and accelerating the commercialization of graphene-based products. As demand across various sectors rises, market players are focusing on scaling production and expanding their application portfolios to maintain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for graphene in energy storage applications, such as batteries and supercapacitors, will continue to rise as South Africa seeks more efficient and sustainable energy solutions. Graphene’s superior conductivity and energy density will drive innovation in the sector.

- As production techniques become more cost-effective, South Africa will see a reduction in graphene manufacturing costs, making it more accessible to industries across the region. This will foster greater adoption of graphene-based products.

- The South African government will continue to provide support for research and development initiatives, promoting advancements in graphene technology. This will enhance the country’s position as a leader in graphene innovation within Africa.

- Graphene’s potential in creating lightweight, durable, and energy-efficient materials for vehicles will boost its adoption in the automotive sector. South Africa’s automotive industry is likely to see significant integration of graphene in manufacturing processes.

- South Africa’s focus on sustainable development will further push the demand for graphene in eco-friendly applications such as green building materials and water filtration technologies. This trend will solidify graphene’s role in the country’s green economy.

- The growing need for flexible, high-performance electronics in South Africa will fuel the demand for graphene in applications like flexible displays, sensors, and next-gen transistors. Graphene will play a key role in electronics innovation.

- The construction industry in South Africa will see increased use of graphene in improving the strength, durability, and energy efficiency of materials like concrete and coatings. This will enhance the overall quality of infrastructure projects.

- As the potential of graphene continues to unfold, more private sector players will invest in graphene research, production, and commercialization. This influx of investments will accelerate market growth and innovation in South Africa.

- South African companies and research institutions are likely to form more strategic partnerships with international graphene players, boosting access to advanced technologies and expanding the local market’s global reach.

- The South African graphene market will witness expanded applications in sectors such as healthcare, aerospace, and manufacturing, where graphene’s unique properties offer enhanced performance and cost efficiencies, thus driving widespread adoption.