Market Overview

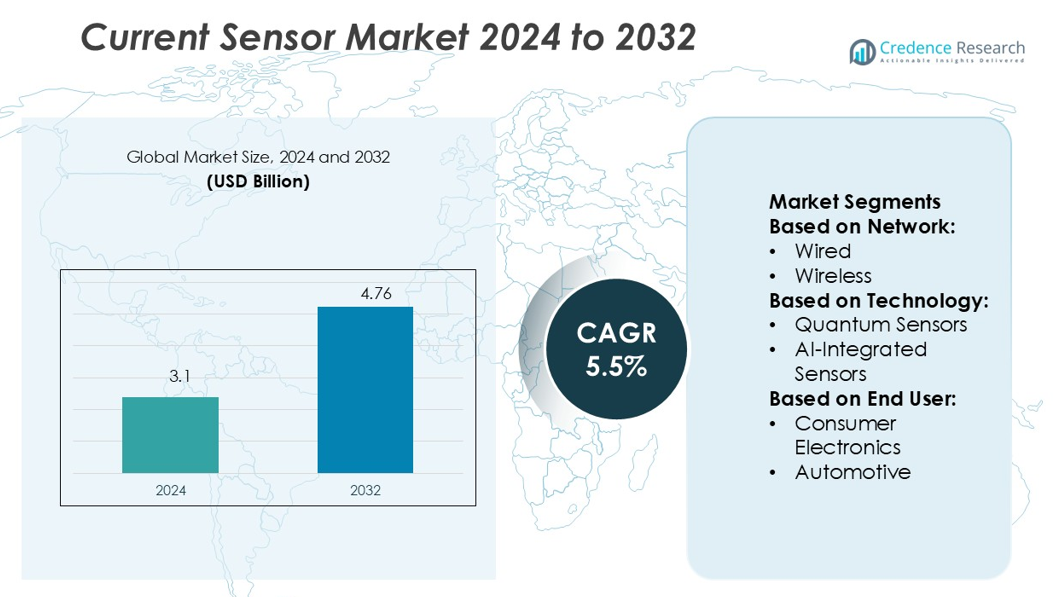

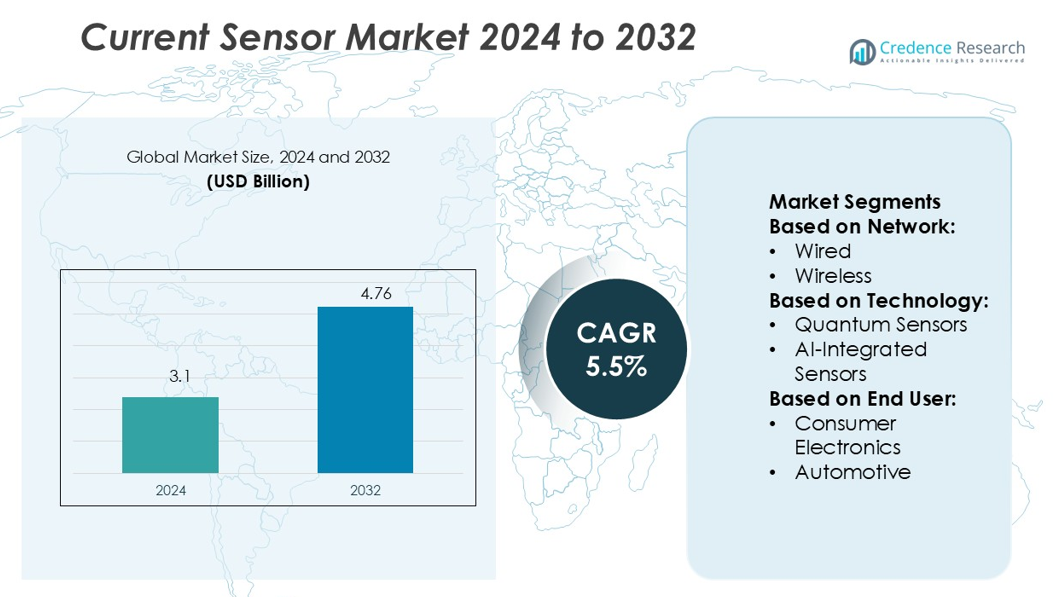

Current Sensor Market size was valued USD 3.1 billion in 2024 and is anticipated to reach USD 4.76 billion by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Current Sensor Market Size 2024 |

USD 3.1 billion |

| Current Sensor Market, CAGR |

5.5% |

| Current Sensor Market Size 2032 |

USD 4.76 billion |

The current sensor market is driven by major players such as Melexis, Infineon Technologies AG, TAMURA Corporation, Allegro MicroSystems, Inc., Omron Corporation, LEM International SA, STMicroelectronics, TDK Corporation, Honeywell International Inc., and ROHM CO. LTD. These companies focus on developing high-accuracy, miniaturized, and energy-efficient sensor solutions for electric vehicles, renewable energy systems, and industrial automation. Strategic initiatives include product innovation, partnerships, and expansion into high-growth regions. Asia Pacific leads the global market with a 34.7% share, supported by strong manufacturing capabilities, rapid EV adoption, and increasing renewable energy projects. The region’s robust supply chain and favorable government policies position it as a key hub for sensor production and technological advancement.

Market Insights

- The current sensor market was valued at USD 3.1 billion in 2024 and is expected to reach USD 4.76 billion by 2032, growing at a CAGR of 5.5%.

- Rising adoption of electric vehicles, renewable energy expansion, and industrial automation are driving strong demand for high-performance current sensing solutions.

- Companies focus on miniaturization, smart integration, and energy efficiency, while expanding their presence in fast-growing markets through innovation and partnerships.

- Complex design requirements and cost sensitivity in advanced sensor technologies act as restraints, especially for small and mid-sized manufacturers.

- Asia Pacific leads with 34.7% share, followed by North America at 31.6% and Europe at 28.4%, with the automotive and renewable energy segments dominating market adoption globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Network

The wired segment dominates the current sensor market with the largest market share. Wired networks are preferred in industrial and commercial environments for their low latency and high signal stability. These networks support real-time monitoring in critical systems like manufacturing plants, power grids, and automotive applications. Their robustness and resistance to interference make them ideal for high-precision energy management. The wireless segment is growing due to the rise of smart homes and flexible sensor deployments in distributed environments.

- For instance, Melexis’ MLX91216 wired current sensor offers a bandwidth of 250 kHz, enabling fast response in inverter systems, and integrates diagnostics features to ensure signal integrity.

By Technology

Advanced MEMS sensors lead the market with the highest share. Their compact size, high sensitivity, and low power use make them well suited for consumer electronics, automotive, and energy management applications. MEMS technology also allows integration with AI algorithms for predictive monitoring and fault detection. Quantum sensors and AI-integrated sensors are emerging segments, driven by demand for precision, automation, and edge computing capabilities. Cybersecurity-hardened sensors are gaining attention due to rising data protection concerns in connected systems.

- For instance, Infineon’s XENSIV™ SDM MEMS microphone series offers models, such as the IM73A135, that achieve a signal-to-noise ratio of up to 73 dB(A) and maintain an IP rating of IP57, enabling robust operation even in harsh environments.

By End User

The automotive segment holds the dominant market share among end users. Automotive manufacturers use current sensors in battery management systems, motor control units, and EV charging infrastructure to enhance efficiency and safety. The commercial and industrial building segment also contributes strongly, supported by smart grid integration and HVAC control. Residential smart home adoption and consumer electronics drive additional demand. Oil and gas, along with aerospace and defense, are niche but growing users due to the need for reliable power monitoring and safety compliance.

Key Growth Drivers

Rising Adoption of Electric and Hybrid Vehicles

The rapid shift toward electric and hybrid vehicles is fueling strong demand for advanced current sensors. These sensors support precise energy management and efficient battery performance. Automakers integrate Hall-effect and shunt-based sensors to ensure high measurement accuracy for traction motors and battery packs. Governments are also strengthening EV adoption targets, boosting sensor demand in charging infrastructure. Companies like Allegro MicroSystems and LEM Holding are expanding automotive-grade sensor portfolios. This trend is expected to remain a major growth engine over the next decade.

- For instance, Tamura’s F01P, F02P, and F03P S05L fluxgate current sensors accept primary currents from 6 A to 50 A and can withstand a surge pulse of 4 kAT (4 kilo-ampere-turns) with an 8/20 µs waveform.

Expansion of Industrial Automation

Industrial automation and robotics are driving higher use of current sensors in control systems. Sensors enable accurate current monitoring, which improves safety, performance, and energy efficiency in automated equipment. Sectors like manufacturing, oil and gas, and utilities are deploying Industry 4.0 solutions. These solutions rely on real-time current measurement to enhance predictive maintenance and reduce downtime. Leading players such as Honeywell and Texas Instruments are launching high-speed, low-noise current sensing solutions to meet these requirements, strengthening their industrial customer base.

- For instance, Allegro’s ACS37030MY current sensor IC offers response times 5× faster than earlier solutions, packaged in a footprint 40 % smaller than conventional 16-pin devices.

Growth of Renewable Energy Installations

The global expansion of renewable power generation is boosting demand for current sensors in solar and wind applications. These sensors enable precise current measurement in inverters, grid monitoring systems, and storage units. Governments and private developers are investing in high-capacity solar farms and wind projects, requiring reliable sensing solutions for grid stability. Companies like Tamura and Infineon Technologies offer sensors with high linearity and isolation, supporting energy efficiency goals. The rising renewable capacity pipeline is creating sustained market opportunities.

Key Trends & Opportunities

Miniaturization and Integration of Smart Sensors

Manufacturers are investing in miniaturized and integrated current sensors to support compact, high-efficiency systems. These next-generation sensors combine high accuracy with low power consumption, making them ideal for EVs, robotics, and smart grids. Integrated signal processing and digital output enable easy system design and faster response times. For instance, Allegro MicroSystems’ ACS37800 integrates power monitoring in a compact package. This trend aligns with the growing adoption of smart electronics and advanced IoT architectures.

- For instance, Omron’s SAO series solid-state plug-in current sensor supports primary currents from 1 A to 80 A or 64 A to 160 A (with corresponding current converters) and operates with a power consumption of approximately 7 VA at either 100–120 VAC or 200–240 VAC.

Expansion of Sensor Applications in Data Centers

The rapid growth of hyperscale and edge data centers is creating new opportunities for current sensor deployment. Data centers rely on accurate power monitoring to ensure uninterrupted operations and energy efficiency. Sensors integrated with AI-based energy management systems can optimize load distribution and reduce downtime. Key players are designing sensors that offer high bandwidth and isolation for critical power paths. This expansion is driving new revenue streams for sensor manufacturers.

- For instance, STMicroelectronics’ TSC1641 analog front-end (AFE) monitors current, voltage, power, and temperature synchronously using a dual-channel 16-bit ADC.

Rising Demand for Wide Bandgap Semiconductor-Compatible Sensors

The increasing use of wide bandgap semiconductors such as SiC and GaN in power electronics is pushing demand for advanced current sensors. These systems operate at higher switching frequencies and require fast, precise current measurement. Companies are developing high-speed sensors that maintain accuracy under harsh electrical conditions. This trend supports applications in EV fast charging, renewable inverters, and industrial drives, offering strong opportunities for technology differentiation.

Key Challenges

High Design Complexity and Cost

Integrating current sensors in high-performance systems involves complex design and calibration processes. Sensors must deliver accurate measurements under varying temperature, noise, and EMI conditions. High-performance sensors often require advanced packaging and isolation, raising production costs. This complexity can delay product launches and increase total system costs, especially for mid-sized manufacturers. The challenge is more significant in EV and renewable energy applications, where precision and safety standards are strict.

Supply Chain Disruptions and Raw Material Volatility

The current sensor industry is vulnerable to global supply chain issues and raw material price fluctuations. Components such as magnetic cores, semiconductors, and precision resistors face availability constraints, affecting production timelines. Disruptions during geopolitical conflicts or pandemics can reduce supply chain resilience. This volatility leads to longer lead times, higher costs, and reduced profitability. Manufacturers are now diversifying supply bases and increasing local sourcing to mitigate risks.

Regional Analysis

North America

North America holds 31.6% of the global current sensor market share, driven by strong adoption in automotive and industrial applications. The U.S. leads with rapid EV deployment, advanced manufacturing, and smart grid expansion. High investments in renewable energy and grid modernization further boost demand. Major players like Honeywell and Allegro MicroSystems are expanding sensor production to support these industries. Data centers in the U.S. and Canada are also increasing deployment of advanced power monitoring solutions. The region benefits from strong R&D investments, regulatory incentives, and a mature technology ecosystem, ensuring steady market growth.

Europe

Europe accounts for 28.4% of the current sensor market share, supported by robust renewable energy initiatives and EV adoption. Countries like Germany, France, and the U.K. are leading clean energy transitions, creating strong demand for precision sensing solutions in power electronics. The region’s stringent emission and energy efficiency regulations drive innovation in sensor technology. Key manufacturers are focusing on Hall-effect and fluxgate sensors for automotive, industrial, and grid applications. The EU’s push for electrification and sustainable infrastructure projects further strengthens regional growth, supported by leading players like LEM Holding and Infineon Technologies.

Asia Pacific

Asia Pacific leads the global market with a 34.7% share, driven by rapid industrialization and rising EV production. China, Japan, and South Korea dominate sensor demand due to their strong automotive, electronics, and energy sectors. The region’s expansion of solar and wind farms also boosts high-performance sensor deployment in grid systems. Government incentives for electrification and local manufacturing accelerate growth. Companies like Tamura, TDK, and Rohm Semiconductor are expanding production capacities. Asia Pacific’s cost advantages, strong domestic demand, and advanced supply chain make it the most dynamic market for current sensors globally.

Latin America

Latin America holds 3.1% of the current sensor market share, with growing applications in renewable energy, automotive, and industrial automation. Brazil and Mexico lead regional demand, supported by investments in solar power plants, electric mobility, and modern manufacturing facilities. Government incentives for clean energy projects and industrial upgrades are improving sensor penetration. Infrastructure modernization programs are also driving demand for grid monitoring and control. Though the market is smaller than major regions, increasing technology adoption and foreign investments are creating steady opportunities for global sensor manufacturers to expand their presence.

Middle East & Africa

The Middle East & Africa account for 2.2% of the global market share, driven by renewable energy projects and infrastructure expansion. Countries like the UAE and Saudi Arabia are investing heavily in solar energy and smart grid systems. Growing industrial and commercial construction activity further boosts demand for current sensing in power distribution. Government-led energy diversification programs support sensor integration into advanced control systems. While the region is still in an emerging phase, increasing collaboration with international technology providers is expected to accelerate adoption and enhance market potential over the forecast period.

Market Segmentations:

By Network:

By Technology:

- Quantum Sensors

- AI-Integrated Sensors

By End User:

- Consumer Electronics

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the current sensor market is defined by key players such as Melexis, Infineon Technologies AG, TAMURA Corporation, Allegro MicroSystems, Inc., Omron Corporation, LEM International SA, STMicroelectronics, TDK Corporation, Honeywell International Inc., and ROHM CO. LTD. The current sensor market is characterized by strong technological innovation and strategic expansion. Companies focus on developing high-accuracy, compact, and energy-efficient sensors to meet rising demand from electric vehicles, renewable energy systems, and industrial automation. Intense competition drives investment in advanced manufacturing, R&D, and digital integration. Market leaders prioritize strategic partnerships, mergers, and product launches to strengthen their global presence. Many players are expanding into emerging markets to capture growing opportunities in EV infrastructure and smart grid applications. This competitive intensity fosters rapid innovation, improved performance standards, and enhanced product reliability across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Melexis

- Infineon Technologies AG

- TAMURA Corporation

- Allegro MicroSystems, Inc.

- Omron Corporation

- LEM International SA

- STMicroelectronics

- TDK Corporation

- Honeywell International Inc.

- ROHM CO. LTD

Recent Developments

- In April 2025, TDK unveiled the HAL/HAR 35xy Hall-effect 2D position sensors as economical ASIL C suitable devices for automotive safety applications. The HAL 3550 (single-die) and HAR 3550 (dual-die) deliver precise 360° angle and linear position detection through their stray-field robust designs with analog/digital outputs.

- In September 2024, Allegro Microsystems introduced two XtremeSense TMR sensors, the CT456 and CT455, designed to streamline high-power density designs while reducing space and costs.

- In July 2024, Molex launched Percept Current Sensors to meet the increasing need for precise busbar current sensing in the automotive and industrial sectors. These sensors are smaller, lighter, and easier to install and integrate.

- In June 2023, Honeywell announced the DG Smart Sensor as a solution designed to enhance the efficiency and reliability of monitoring and controlling low-pressure combustion air and fuel gases. The product provided precise monitoring capabilities and aligned with digitalization trends under Industry 4.0, offering opportunities to improve combustion system performance and transform operational dynamics for OEMs, end users, and system integrators

Report Coverage

The research report offers an in-depth analysis based on Network, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for current sensors will grow with the rapid adoption of electric vehicles.

- Renewable energy projects will drive large-scale deployment of advanced current sensing technologies.

- Integration of smart features will enhance sensor performance and efficiency.

- Miniaturized and high-accuracy sensors will gain more applications in compact devices.

- Expansion of industrial automation will strengthen the need for real-time current monitoring.

- Data centers will increasingly use high-speed sensors to optimize power usage.

- Wide bandgap semiconductor technologies will accelerate sensor innovation.

- Strategic partnerships and product launches will shape competitive dynamics.

- Emerging markets will offer strong growth opportunities for sensor manufacturers.

- Advanced sensing solutions will support smart grids and energy-efficient systems.