Market overview

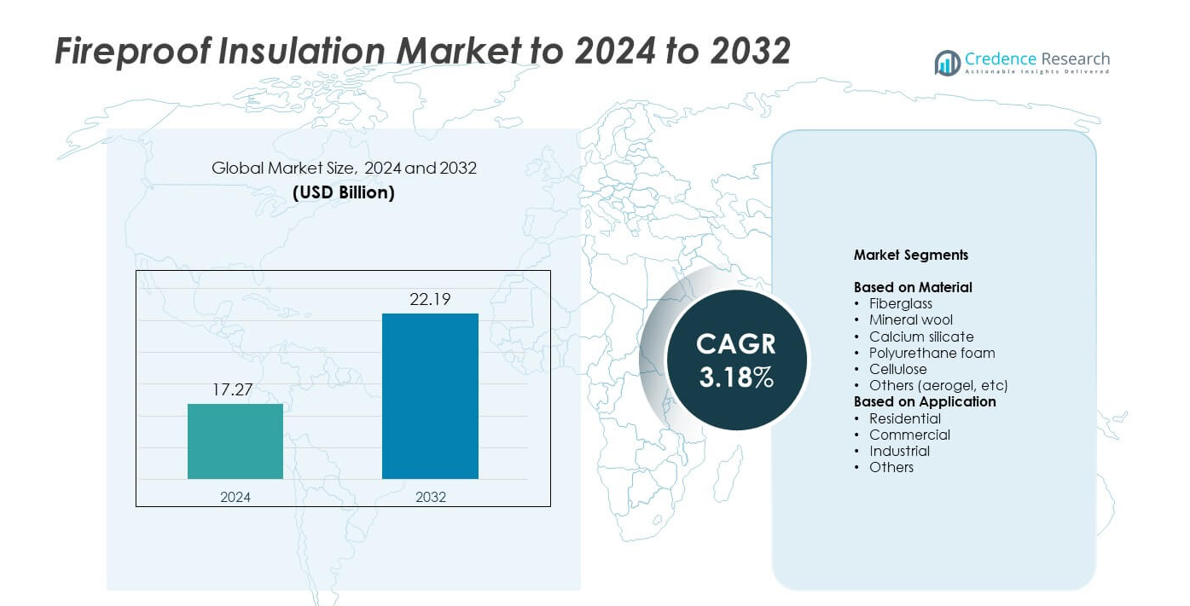

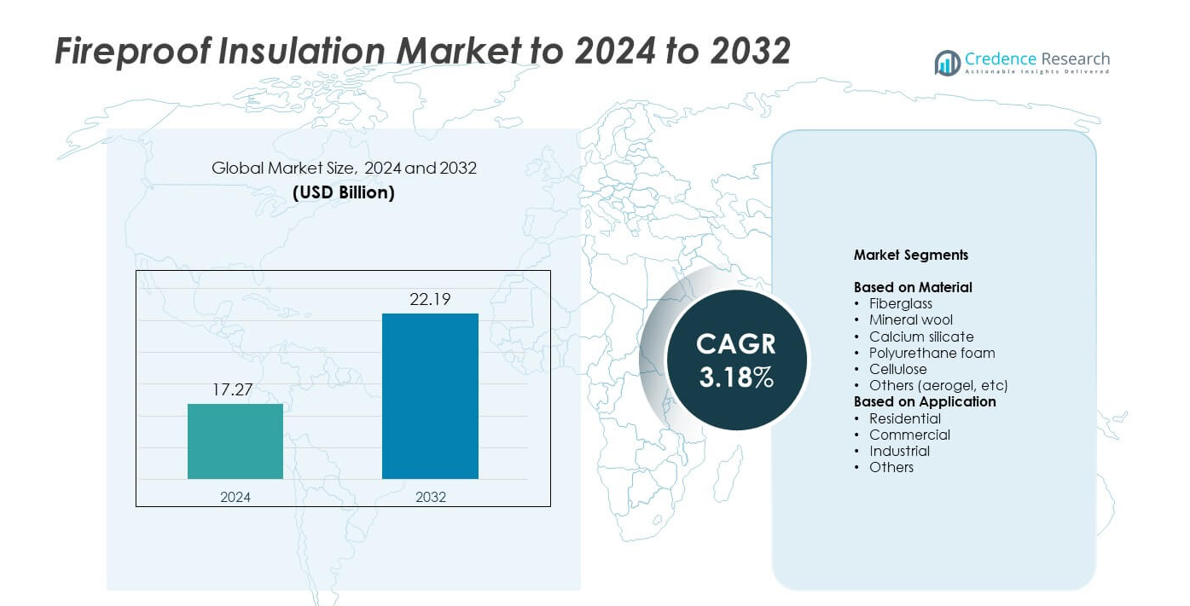

Fireproof Insulation Market size was valued at USD 17.27 Billion in 2024 and is anticipated to reach USD 22.19 Billion by 2032, at a CAGR of 3.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fireproof Insulation Market Size 2024 |

USD 17.27 Billion |

| Fireproof Insulation Market, CAGR |

3.18% |

| Fireproof Insulation Market Size 2032 |

USD 22.19 Billion |

The Fireproof Insulation market is shaped by major players such as Knauf Insulation, Morgan Advanced Materials, BASF, Saint-Gobain ISOVER, Armacell, Promat International, Owens Corning, Fletcher Insulation, Rockwool International A/S, Pittsburg Corning, Kingspan Group, Johns Manville, Thermafiber, Huntsman International LLC, and Isover. These companies strengthen their position through advanced mineral wool, fiberglass, and high-temperature solutions that support safety-driven construction and industrial needs. North America led the market in 2024 with about 33% share due to strict building codes and high adoption in retrofits, followed by Europe with nearly 29% share and Asia Pacific close behind at 28%, driven by rapid urban development and rising compliance standards.

Market Insights

- The Fireproof Insulation market reached USD 17.27 Billion in 2024 and is projected to hit USD 22.19 Billion by 2032, growing at a CAGR of 3.18% during the forecast period.

- Growth is driven by stricter fire-safety regulations, rising demand for thermal efficiency, and increased construction activity across residential, commercial, and industrial buildings.

- Trends include higher adoption of mineral wool and fiberglass, rising use of high-performance materials like aerogel, and strong momentum in green-building upgrades and retrofit projects.

- The market remains competitive as leading players expand advanced product lines and improve manufacturing efficiency while strengthening global distribution networks.

- North America led the market with about 33% share, followed by Europe at nearly 29% and Asia Pacific at around 28%, while fiberglass remained the dominant material with roughly 41% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Fiberglass dominated the FIREPROOF INSULATION Market in 2024 with about 41% share. This material led due to strong fire resistance, low cost, and wide use in residential and commercial buildings. Mineral wool followed closely as buyers valued its high heat tolerance and acoustic control. Calcium silicate grew in heavy industrial settings because it performs well in high-temperature pipelines. Polyurethane foam and cellulose advanced in retrofit projects, while aerogel and other materials expanded in premium applications. Growth across the segment was supported by stricter safety rules and rising focus on energy-efficient construction.

- For instance, in 2023, the insulation segment accounted for approximately 37% of Owens Corning’s total reportable segment net sales, which were $9.7 billion in total.

By Application

Residential applications held the largest share in 2024 with nearly 39% of the FIREPROOF INSULATION Market. Homeowners favored these products due to increasing fire-safety concerns and demand for better thermal control. Commercial buildings showed strong adoption as modern codes required higher fire-protection standards. Industrial sites used advanced materials across furnaces, boilers, and processing lines to prevent heat loss and improve worker safety. Other applications expanded steadily with growth in storage units and public facilities. Rising urban construction and renovation activity supported overall demand.

- For instance, the Rockwool Group emphasizes the importance of fire-safe construction, noting that in one specific case study, 16,000 square meters of their non-combustible insulation was installed in a large building to provide up to two hours of additional fire protection.

Key Growth Drivers

Rising Building Safety Regulations

Governments strengthened fire-safety rules across residential, commercial, and industrial structures, which increased the use of certified fireproof insulation. Builders selected materials that met strict flame-spread ratings and supported long-term safety compliance. Demand rose as inspection standards tightened and authorities pushed for safer construction in dense urban areas. The shift toward mandatory upgrades in older buildings also boosted consumption across renovation projects.

- For instance, Saint-Gobain ISOVER ensures its insulation products meet stringent fire safety standards like EN 13501-1.

Expansion of Energy-Efficient Construction

Energy-efficient buildings gained strong momentum as developers targeted lower heat loss and better indoor comfort. Fireproof insulation became a preferred choice because it combined thermal efficiency with high fire protection. Green-building certifications encouraged wider adoption of advanced materials with low emissions and strong durability. Growing investments in smart and sustainable infrastructure supported steady market expansion across major economies.

- For instance, Kingspan is a global leader in high-performance insulation and building envelope solutions, with a mission to help accelerate a net-zero future built environment. The company reports on overall sustainability initiatives, such as deploying 25 new rooftop solar-PV projects with a combined capacity of 6.8 MW and processing 858 million PET bottles into insulation in 2023 alone.

Growth in Industrial and Manufacturing Facilities

Industrial plants upgraded high-temperature systems to improve worker safety and reduce operational risks. Fireproof insulation played a key role in protecting furnaces, boilers, pipelines, and storage units. Expanding output in chemicals, metals, and power generation increased the use of advanced, high-heat-resistant materials. New capacity additions across emerging economies boosted demand for durable insulation solutions that maintained equipment stability under extreme conditions.

Key Trends & Opportunities

Increasing Adoption of High-Performance Materials

Manufacturers focused on high-performance solutions such as aerogel, advanced mineral wool, and composite insulation. These materials offered higher temperature resistance, longer service life, and improved mechanical strength. Adoption grew in sectors that needed compact, lightweight, and efficient fire barriers. Rising interest in premium building systems and modern industrial upgrades created fresh opportunities for specialized product lines.

- For instance, Aspen Aerogels is a technology leader in sustainability and electrification solutions that has sold over $1.5 billion of insulation products globally, representing an installed base of more than 500 million square feet of insulation.

Rising Renovation and Retrofit Activities

Aging buildings across major countries created strong opportunities for fireproof insulation upgrades. Homeowners and commercial operators replaced outdated insulation to meet new energy and fire-safety codes. Retrofit demand increased as cities promoted safer living spaces and improved thermal efficiency. Government incentives and sustainability programs further encouraged property owners to adopt modern fire-resistant materials.

- For instance, Knauf Insulation partnered on a deep retrofit project of 184 social homes in Halle, Belgium, which improved energy performance

Advancements in Manufacturing Technologies

Producers introduced automated systems, precision fibers, and eco-friendly binders to enhance product quality. These upgrades improved uniformity, reduced waste, and supported the production of next-generation insulation materials. Faster processing lines and better quality control helped companies meet rising global demand. The focus on cleaner manufacturing created new market opportunities for sustainable, high-performance insulation options.

Key Challenges

High Installation and Material Costs

Fireproof insulation often requires skilled labor, specialized tools, and certified materials, which increases total installation expenses. These costs limit adoption in price-sensitive markets and delay upgrades in older properties. Some high-performance materials remain expensive to produce, challenging wider availability. Cost gaps between standard and premium insulation continue to affect buyer decisions in both residential and commercial segments.

Limited Awareness in Developing Regions

Many developing regions still lack strong awareness of fire-safety standards and benefits of fireproof insulation. Builders often prioritize low-cost options over long-term protection, limiting uptake. Weak enforcement of building rules further slows adoption across smaller cities and rural areas. Limited access to advanced products also restricts growth in markets where distribution networks remain underdeveloped.

Regional Analysis

North America

North America held about 33% share of the Fireproof Insulation market in 2024. Demand stayed strong due to strict construction codes, high adoption of non-combustible materials, and ongoing upgrades in residential and commercial buildings. The United States led consumption because builders favored certified insulation for safety and energy efficiency. Renovation of aging structures and rising wildfire-related risks further increased installation. Canada expanded steadily as green-building standards grew. Continuous investment in industrial facilities and infrastructure supported wider use across pipelines, processing units, and manufacturing plants.

Europe

Europe accounted for nearly 29% share in 2024, supported by rigorous fire-safety laws and strong preference for sustainable construction. Countries such as Germany, the U.K., and France adopted advanced mineral wool and fiberglass across housing and commercial spaces. The region benefited from strict thermal performance rules that pushed builders toward high-quality insulation materials. Industrial users expanded demand as factories modernized high-temperature systems. Energy-efficiency commitments and carbon-reduction goals further encouraged adoption of durable fire-resistant products. Growth remained stable across both new construction and renovation programs.

Asia Pacific

Asia Pacific captured around 28% share in 2024 and remained one of the fastest-growing regions. China, India, Japan, and Southeast Asian markets increased consumption due to rapid urban development and rising high-rise construction. Governments strengthened building codes to reduce fire hazards, supporting wider use of certified insulation. Industrial expansion in chemicals, metals, and manufacturing boosted adoption of high-temperature-resistant materials. Growing awareness of safety and thermal efficiency encouraged use in residential upgrades. The region saw strong interest in lightweight and cost-effective insulation for large infrastructure projects.

Latin America

Latin America held close to 6% share in 2024, driven by gradual improvements in fire-safety rules and increased commercial construction. Brazil and Mexico led demand as builders adopted better thermal and fire-resistant solutions in new projects. Industrial facilities upgraded insulation across pipelines, boilers, and storage units to improve operational efficiency. Renovation activity also increased as urban areas modernized older structures. Despite price sensitivity across several countries, interest in energy-efficient materials continued to rise. Availability of cost-effective fiberglass and mineral wool supported steady expansion.

Middle East and Africa

The Middle East and Africa accounted for about 4% share in 2024, supported by infrastructure growth and industrial expansion across the Gulf states. Construction of hotels, airports, and commercial complexes increased the use of fire-resistant materials. Industrial plants in oil, gas, and power sectors adopted high-performance insulation for high-temperature equipment. Africa showed steady but slower progress due to limited awareness and weaker enforcement of building standards. However, urbanization and investment in modern housing projects continued to create new opportunities for certified fireproof insulation solutions.

Market Segmentations:

By Material

- Fiberglass

- Mineral wool

- Calcium silicate

- Polyurethane foam

- Cellulose

- Others (aerogel, etc)

By Application

- Residential

- Commercial

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fireproof Insulation market is shaped by leading companies such as Knauf Insulation, Morgan Advanced Materials, BASF, Saint-Gobain ISOVER, Armacell, Promat International, Owens Corning, Fletcher Insulation, Rockwool International, Pittsburg Corning, Kingspan Group, Johns Manville, Thermafiber, Huntsman International, and Isover. Market participants focus on expanding product portfolios that meet strict fire-safety and thermal-efficiency standards across residential, commercial, and industrial applications. Producers invest in advanced manufacturing technologies to improve material performance, reduce emissions, and enhance sustainability. Many companies prioritize mineral wool, fiberglass, and high-temperature solutions to strengthen their presence in high-risk environments. Strategic moves include capacity expansion, certification upgrades, and development of lightweight insulation options suited for modern building designs. Firms also strengthen distribution networks to reach fast-growing regions and support large-scale infrastructure and renovation projects. Rising regulatory pressure and increasing customer preference for durable, eco-friendly products continue to shape competition in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Knauf Insulation

- Morgan Advanced Materials

- BASF

- Saint-Gobain ISOVER

- Armacell

- Promat International (Etex Group)

- Owens Corning

- Fletcher Insulation

- Rockwool International A/S

- Pittsburg Corning

- Kingspan Group

- Johns Manville

- Thermafiber

- Huntsman International LLC

- Isover (a division of Saint-Gobain)

Recent Developments

- In May 2025, Huntsman International LLC launched POLYRESYST® EV5005, an intumescent polyurethane coating system designed for automotive applications, particularly electric vehicles (EVs).

- In 2025, Kingspan Group plc inaugurated its new manufacturing facility in Mattoon, Illinois, to produce K-Roc mineral fiber insulated panels known for superior fire protection.

- In 2025, Armacell introduced ArmaFlex® Ultima in North America, an elastomeric insulation product with ultra-low smoke density and the highest fire standard among flexible insulation materials.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as fire-safety regulations become more demanding.

- Demand will rise in residential renovations driven by safety upgrades and energy goals.

- Commercial buildings will adopt advanced materials to meet stricter performance standards.

- Industrial facilities will expand use of high-temperature insulation for operational safety.

- Lightweight and high-performance materials such as aerogel will gain wider acceptance.

- Manufacturers will invest in automated processes to improve product quality and output.

- Green-building certifications will push adoption of sustainable fireproof insulation options.

- Asia Pacific will strengthen its position due to rapid urban growth and industrial expansion.

- Retrofit projects across North America and Europe will support consistent long-term demand.

- Innovation in eco-friendly binders and recyclable products will shape future product development.