Market Overview

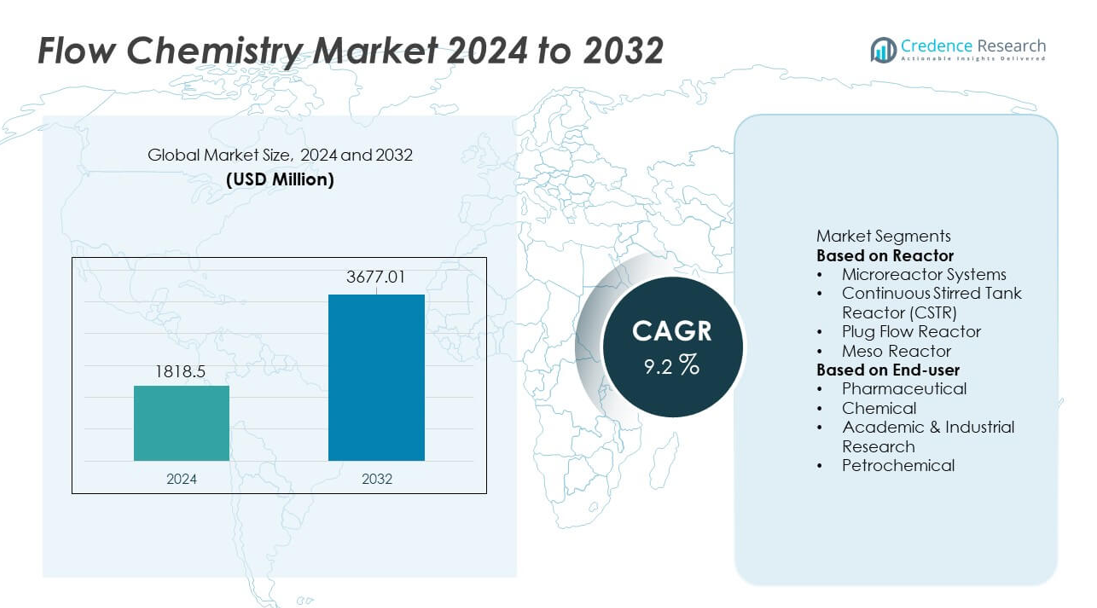

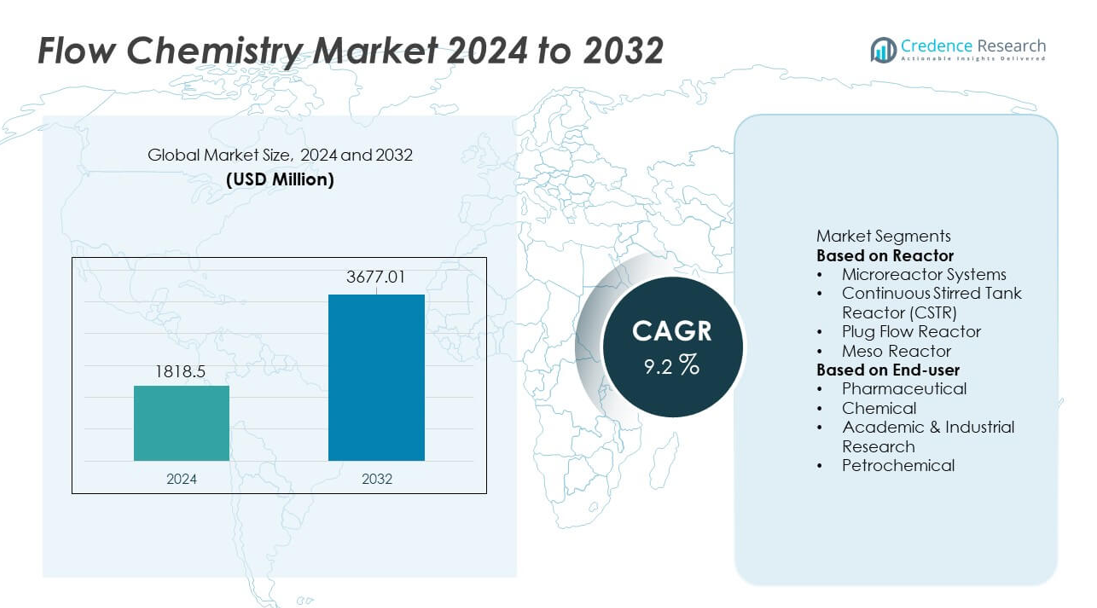

The Flow Chemistry market reached USD 1,818.5 million in 2024. The market is projected to grow to USD 3,677.01 million by 2032. This growth reflects a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flow Chemistry Market Size 2024 |

USD 1,818.5 million |

| Flow Chemistry Market, CAGR |

9.2% |

| Flow Chemistry Market Size 2032 |

USD 3,677.01 million |

The Flow Chemistry market includes leading players such as Thermo Fisher Scientific, Corning Incorporated, Lonza Group, Syrris Ltd, ThalesNano Energy, Chemtrix BV, Uniqsis Ltd, Vapourtec Ltd, AM Technology, and Milestone Srl, all of which focus on advanced reactor technologies, automation, and continuous processing solutions. These companies strengthen their presence through innovation in microreactors, scalable plug flow systems, and digital monitoring tools that support high-precision synthesis. North America leads the market with a 38% share, driven by strong pharmaceutical production and rapid adoption of continuous manufacturing. Europe follows with a 29% share, supported by green chemistry initiatives and advanced specialty chemical capabilities, while Asia Pacific holds a 23% share due to expanding API and chemical manufacturing.

Market Insights

- The Flow Chemistry market reached USD 1,818.5 million in 2024 and is set to grow to USD 3,677.01 million by 2032 at a 9.2% CAGR, supported by rising adoption of continuous processing.

- Strong market drivers include high demand for safer, faster, and cleaner reactions, with Microreactor Systems holding a 38% segment share and the pharmaceutical end-user segment leading with a 42% share due to continuous API production needs.

- Key trends highlight growth in automation, digital monitoring, and sustainable manufacturing as companies adopt smarter reactors and energy-efficient continuous systems across chemical and specialty material production.

- The competitive landscape features firms like Thermo Fisher Scientific, Corning Incorporated, Lonza Group, and Syrris Ltd, focusing on advanced reactor technology, modular systems, and real-time control capabilities to strengthen market presence.

- Regionally, North America leads with a 38% share, followed by Europe at 29%, while Asia Pacific grows steadily with a 23% share, driven by expanding chemical and pharmaceutical industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Reactor

Microreactor Systems lead the reactor segment with a 38% share, driven by strong use in pharmaceutical synthesis and fine chemical processing. These reactors offer precise thermal control, short reaction times, and enhanced safety, which accelerates their adoption over batch systems. Continuous Stirred Tank Reactors hold a 27% share, supported by their suitability for large-volume reactions. Plug Flow Reactors account for a 22% share as petrochemical and polymer plants adopt continuous processing. Meso reactors capture the remaining 13% share, gaining interest for mid-scale chemical production.

- For instance, flow microreactors, such as those used for 3-methylindole preparation with the Corning G1 reactor, enable precise control of reaction conditions due to efficient mass and heat transfer, allowing for high yields and control of by-product formation over traditional batch processes.

By End-user

The pharmaceutical sector dominates the end-user segment with a 42% share, driven by rising demand for continuous API production and improved safety in complex synthesis. Flow chemistry supports faster scale-up, reduced solvent use, and stronger process control, which encourages widespread adoption. The chemical industry follows with a 31% share due to its use in specialty and fine chemical manufacturing. Academic and industrial research holds a 17% share, supported by its role in reaction optimization. The petrochemical segment contributes the remaining 10% share, mainly for continuous hydrogenation and oxidation processes.

- For instance, Lonza integrated continuous flow lines at its Visp facility, enabling production of multi-tons of intermediates and/or APIs based on continuous flow processing. The platform provides benefits such as improved efficiency, enhanced safety for hazardous reactions due to minimized volumes, and accelerated development timelines.

Key Growth Driver

Rising Demand for Continuous Processing

Continuous processing gains strong momentum as manufacturers move away from slow batch methods. Flow chemistry delivers steady reaction control, higher productivity, and safer operation in hazardous steps. The technology lowers waste generation and improves product uniformity across large volumes. Drug makers adopt continuous methods to speed API development and reduce time-to-market. Chemical producers use flow systems to handle high-pressure and high-temperature reactions with better reliability. These benefits drive strong interest from companies seeking stable output and lower operating risks. The shift toward continuous workflows remains a major push for market expansion.

- For instance, AM Technology demonstrated its Coflore Agitated Tubular Reactor (ATR) performing continuous flow chemistry, including hydrogenation, at flow rates up to 120 liters per hour (at a 5-minute residence time).

Strong Adoption in Pharmaceutical Innovation

Pharmaceutical companies embrace flow chemistry to simplify complex reactions and improve synthesis speed. The method supports rapid scale-up while keeping reaction quality stable across units. Drug developers use flow systems for controlled nitration, hydrogenation, and photochemical steps. These processes often require precise heat and mass transfer, which flow reactors handle well. The technology reduces solvent use and lowers exposure to unsafe intermediates. Faster development cycles help firms cut delays in clinical supply. As demand for efficient API production grows, pharma firms remain a major growth engine for the market.

- For instance, the Syrris Asia flow chemistry system is designed for chemists to perform a wide variety of chemical reactions, including multi-step reactions and API synthesis applications. It allows for a wide range of reaction times, including residence times of a few seconds up to multiple hours.

Advancements in Reactor Technology

Improved reactor designs strengthen adoption across industries needing accurate process control. Microreactors offer faster mixing and tighter temperature regulation for sensitive chemical steps. Plug flow and meso reactors support medium- to large-scale production with stable performance. Modern sensors and automated controls reduce human error and improve reaction reliability. Digital interfaces allow operators to track pressure, flow rate, and heat changes in real time. These engineering gains make flow systems more flexible for varied reactions. Growing interest in integrated, modular reactors continues to boost market growth.

Key Trend & Opportunity

Expansion of Green and Sustainable Chemistry

Flow chemistry supports green chemistry by reducing solvent load and lowering energy use. Continuous systems deliver cleaner reactions with fewer by-products and safer waste profiles. Manufacturers adopt flow reactors to meet strict emission rules and sustainability goals. Higher reaction efficiency helps companies reduce resource consumption across long production runs. Government incentives for eco-friendly production boost adoption in chemicals and pharmaceuticals. The rising push for greener supply chains creates new openings for advanced reactor designs. These conditions position flow chemistry as a key tool for sustainable manufacturing.

- For instance, Vapourtec demonstrated that flow photochemistry with its R-Series system results in a significant reduction of solvent volumes compared to traditional batch processes, enabling more efficient and greener synthesis.

Growing Integration of Automation and Digital Monitoring

Automation expands across flow chemistry setups to improve accuracy and stability. Smart sensors track temperature, pressure, and reagent flow with real-time feedback. Software tools adjust reaction conditions automatically to avoid batch failure. Digital twins help engineers predict outcomes and optimize reaction steps before scale-up. Remote monitoring supports safer handling of hazardous reactions. This digital shift enables consistent quality in high-value chemicals and APIs. Increased investment in automated labs strengthens opportunities for advanced, integrated flow platforms.

- For instance, a different, hypothetical continuous manufacturing process might use advanced sensor arrays to capture numerous data points per second, allowing a control platform to adjust flow rates with high precision.

Key Challenge

High Initial Investment and Technical Barriers

Adopting flow chemistry requires significant spending on reactors, control systems, and training. Many companies hesitate due to limited technical knowledge among staff. Complex reactions often need redesign before moving from batch to continuous mode. This process adds time and cost to early adoption. Small manufacturers struggle with budget limits and lack of specialized engineers. The need for skilled operators creates extra hurdles for developing regions. These factors delay broader deployment despite long-term benefits.

Limited Standardization for Large-Scale Operations

Scaling flow processes remains difficult due to varied reactor sizes and inconsistent standards. Many reactions behave differently when moving from lab units to industrial modules. Companies face challenges aligning flow rates, pressure control, and heat transfer across larger systems. Specialized equipment is not always compatible across brands. This lack of uniformity increases engineering time and testing cycles. Petrochemical and specialty chemical makers often need custom designs for each reaction. These issues slow large-scale adoption and raise operational costs

Regional Analysis

North America

North America leads the Flow Chemistry market with a 38% share, supported by strong investments in pharmaceutical manufacturing and advanced chemical processing. Drug producers adopt continuous synthesis to reduce development time and strengthen supply stability. The region benefits from stringent safety rules that encourage the shift from hazardous batch reactions to controlled flow systems. Research institutions and biotech firms expand pilot-scale applications, boosting demand for microreactors and automated platforms. Supportive regulatory pathways for continuous API production and strong industrial automation adoption further reinforce North America’s dominant position in the global market.

Europe

Europe holds a 29% share, driven by strong adoption in fine chemicals, green chemistry, and sustainable manufacturing. The region’s regulatory focus on reducing waste and solvent emissions accelerates the transition toward continuous processing. Pharmaceutical firms integrate flow reactors for high-precision synthesis, especially in complex and hazardous reactions. Universities and research centers play a key role in developing advanced reactor designs and microfluidic systems. Growth in specialty chemical production, combined with rising focus on energy-efficient operations, strengthens Europe’s position as a leading hub for flow chemistry innovation.

Asia Pacific

Asia Pacific secures a 23% share, supported by rapid chemical production growth, expanding pharmaceutical manufacturing, and rising investment in modern process technologies. China, India, and Japan drive adoption as companies seek safer, cleaner, and scalable reaction methods. Increasing API exports motivate manufacturers to adopt continuous reactors for better consistency and process control. Government incentives for advanced manufacturing and green production boost interest in microreactors and plug flow systems. The region’s rising research activity and competitive production capabilities position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America accounts for a 6% share, driven by gradual modernization in pharmaceutical and chemical manufacturing. Companies adopt flow chemistry to improve safety in high-risk reactions and reduce production costs. Brazil and Mexico lead regional uptake as local producers upgrade facilities to meet export quality standards. Increased focus on specialty chemicals and agrochemicals supports stronger interest in continuous processing. Although adoption remains slower than major regions, expanding industrial investment and rising regulatory alignment with global manufacturing norms support steady market growth across Latin America.

Middle East & Africa

The Middle East & Africa region holds a 4% share, supported by petrochemical expansion and emerging interest in advanced processing technologies. Flow chemistry gains traction in continuous hydrogenation, oxidation, and polymer-related reactions common in regional petrochemical hubs. Pharmaceutical manufacturing grows gradually, encouraging early adoption of microreactor systems for controlled synthesis. Research institutions increase pilot-scale experimentation, improving market familiarity. While adoption remains limited by high capital costs and skills shortages, expansion of downstream chemical projects and diversification into specialty chemicals provide growth opportunities across MEA.

Market Segmentations:

By Reactor

- Microreactor Systems

- Continuous Stirred Tank Reactor (CSTR)

- Plug Flow Reactor

- Meso Reactor

By End-user

- Pharmaceutical

- Chemical

- Academic & Industrial Research

- Petrochemical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Thermo Fisher Scientific, Corning Incorporated, Lonza Group, Syrris Ltd, ThalesNano Energy, Chemtrix BV, Uniqsis Ltd, Vapourtec Ltd, AM Technology, and Milestone Srl. These companies compete through advanced reactor designs, automated control systems, and technology-driven product upgrades. Leading manufacturers focus on high-performance microreactors, scalable plug flow systems, and modular continuous platforms to meet rising demand from pharmaceutical and chemical producers. Many players invest in digital monitoring, integrated sensors, and AI-enabled optimization to improve process safety and reaction consistency. Strategic partnerships with research institutions and chemical firms help expand application areas and accelerate product validation. Companies also strengthen their market presence by offering training programs and customization support for complex reactions. Growing emphasis on energy efficiency, safe handling of hazardous materials, and compliance with global manufacturing standards continues to shape competitive strategies across the Flow Chemistry market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Vapourtec Ltd. announced a new high-temperature packed-bed reactor that extends temperature capability of its E-Series and R-Series flow systems up to 250 °C.

- In December 2023, AGI Group acquired Chemtrix B.V. This acquisition of Chemtrix B.V. is anticipated to scale up AGI Group’s capabilities in the flow chemistry market for application in the pilot as well as the manufacturing field.

- In September 2023, Vapourtec showcased its E-Series flow chemistry systems at Flow Chemistry India, underlining growing adoption in Asia-Pacific markets

Report Coverage

The research report offers an in-depth analysis based on Reactor, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for continuous processing will rise as manufacturers shift away from batch systems.

- Pharmaceutical companies will expand flow chemistry use to speed API development and improve safety.

- Adoption of microreactors will grow due to stronger need for precise control in complex reactions.

- Automation and digital monitoring will become standard features in advanced reactor platforms.

- Integration of AI-driven optimization will support faster reaction tuning and improved process stability.

- Green chemistry goals will push industries to adopt cleaner, low-waste continuous operations.

- Specialty chemical producers will increase investment in scalable plug flow and meso reactor systems.

- Research institutions will expand pilot-scale programs to validate new continuous reaction methods.

- Emerging markets will adopt flow systems as chemical and pharmaceutical production capacities grow.

- Collaboration between reactor manufacturers and chemical companies will accelerate innovation and customization.