Market overview

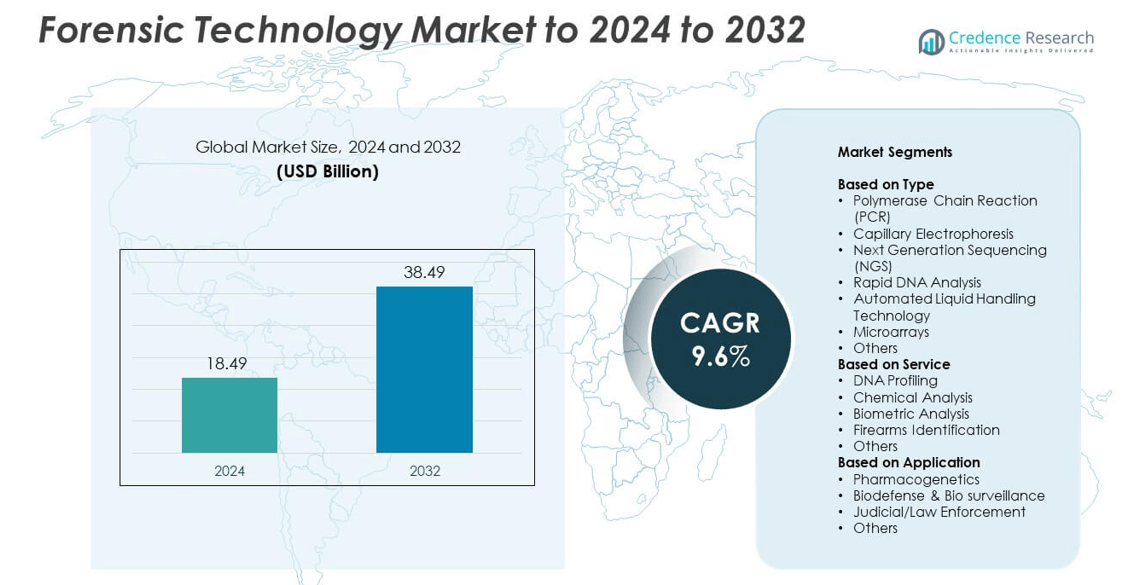

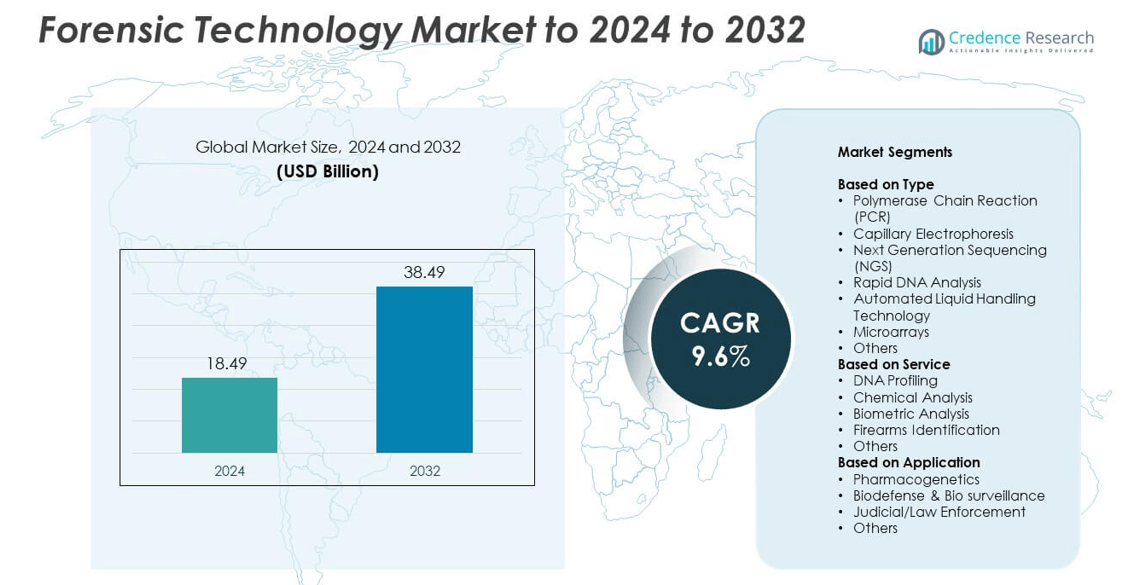

The Forensic Technology market size was valued at USD 18.49 billion in 2024 and is anticipated to reach USD 38.49 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Forensic Technology Market Size 2024 |

USD 18.49 billion |

| Forensic Technology Market, CAGR |

9.6% |

| Forensic Technology Market Size 2032 |

USD 38.49 billion |

The forensic technology market is driven by leading players such as Thermo Fisher Scientific, Agilent Technologies, GE Healthcare, QIAGEN, Eurofins Medigenomix GmbH, LGC Forensics, and NMS Labs. These companies strengthen their positions through innovations in DNA profiling, digital forensics, and automated laboratory systems. Continuous investment in AI-driven analysis and rapid DNA testing enhances efficiency and accuracy in criminal investigations. North America led the global market with a 39% share in 2024, supported by strong forensic infrastructure, government funding, and extensive adoption of advanced technologies across law enforcement and judicial sectors.

Market Insights

- The forensic technology market was valued at USD 18.49 billion in 2024 and is projected to reach USD 38.49 billion by 2032, growing at a CAGR of 9.6%.

- Advancements in DNA sequencing, digital forensics, and automated systems are driving growth by improving evidence accuracy and investigation efficiency.

- The market is witnessing trends like AI-driven analysis, cloud-based forensic platforms, and rapid DNA systems expanding real-time crime detection capabilities.

- Competition is strong among major players focusing on R&D, partnerships, and product innovation to expand service portfolios across forensic laboratories.

- North America leads with a 39% share, followed by Europe with 28% and Asia Pacific with 23%, while the Polymerase Chain Reaction segment holds the highest share of 32% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Polymerase Chain Reaction (PCR) dominated the forensic technology market with a 32% share in 2024. Its leadership is driven by high precision, speed, and widespread adoption in DNA amplification for crime scene investigations. PCR enables accurate identification even from degraded or minimal biological samples, supporting its continued use in forensic labs. The growing demand for real-time and quantitative PCR systems enhances its dominance. Next Generation Sequencing (NGS) is also expanding rapidly due to its capacity for comprehensive genomic profiling in complex criminal cases.

- For instance, the Promega PowerPlex Fusion 6C kit, which was launched in 2015, simultaneously amplifies 27 loci, including all expanded CODIS core loci, enabling broader multiplexing for forensic DNA typing.

By Service

DNA Profiling led the market with a 41% share in 2024, supported by its central role in personal identification, criminal investigation, and disaster victim recovery. The segment benefits from the integration of advanced DNA sequencing and rapid analysis tools that reduce turnaround times. Rising government investments in national DNA databases and increasing cold case reanalysis projects further strengthen this service’s position. Biometric Analysis and Chemical Analysis segments are also witnessing steady growth due to expanding digital forensics and toxicology testing applications.

- For instance, as of 2024, MSAB has supplied over 21,000 versions of its tools, including the XRY mobile forensics tool, to organizations in more than 100 countries.

By Application

Judicial and Law Enforcement applications accounted for the largest market share of 46% in 2024. The dominance is supported by the growing use of forensic technologies in criminal investigations, evidence validation, and court proceedings. Expanding law enforcement initiatives to modernize crime laboratories and improve case resolution rates further propel demand. Pharmacogenetics is gaining traction for identifying drug toxicity and genetic markers in forensic toxicology, while Biodefense and Bio surveillance are increasingly integrated to support national security and emergency response operations.

Key Growth Drivers

Advancements in DNA and Genomic Technologies

The rapid development of DNA sequencing, PCR, and next-generation genomic tools has transformed forensic accuracy and efficiency. Advanced DNA profiling enables identification from smaller and degraded samples, improving case resolution rates. Integration of automated systems and AI-supported data analysis further enhances speed and reliability. These innovations have expanded the range of forensic applications, from criminal investigations to disaster victim identification, establishing genomics as a key growth driver of the forensic technology market.

- For instance, Bionano Genomics reported that its Saphyr system maps structural variants across the genome, recommending at least 80x effective coverage for standard human samples, with up to 400x effective coverage used for detecting rarer variants in applications like mosaic or tumor samples.

Growing Crime Rates and Demand for Digital Evidence

Rising global crime rates, including cyber and biometric fraud, have driven the adoption of forensic technologies. Law enforcement agencies increasingly rely on digital forensics, biometric authentication, and data analytics for faster and more reliable investigations. Governments are investing heavily in modernizing crime laboratories to handle the surge in forensic caseloads. This rising dependence on scientific evidence to ensure judicial accuracy is strengthening the overall demand for integrated forensic solutions.

- For instance, as of March 31, 2024, the UK National DNA Database (NDNAD) contained 6,031,139 unique individual profiles, with LGC Forensics being one of the providers that contributes to its maintenance and growth by processing forensic DNA samples.

Government Initiatives and Legal Mandates

Governments are expanding national DNA databases and enforcing stronger legal frameworks to enhance criminal justice transparency. Investments in forensic laboratories, training, and cross-border data-sharing are supporting this trend. Initiatives promoting standardized forensic practices and funding for advanced equipment drive higher adoption rates. The push toward evidence-based investigation systems positions these regulatory efforts as a major growth driver in global market expansion.

Key Trends and Opportunities

Integration of AI and Automation in Forensics

Artificial Intelligence and automation are revolutionizing forensic workflows by accelerating data analysis and reducing human error. Machine learning algorithms assist in pattern recognition, image matching, and DNA sequencing, improving case turnaround times. Automated liquid handling systems and robotics further streamline lab operations. These technologies create opportunities for scalable, high-throughput forensic testing and enhance operational accuracy, making automation one of the most promising trends in the industry.

- For instance, Oxford Nanopore Technologies’ MinION sequencer is a portable, palm-sized device that has been successfully used for rapid DNA and RNA sequencing in field deployments. The company advertises a theoretical maximum output of up to 50 Gb (or 48 Gb) of sequence data from a single flow cell, particularly on its newer R10.4.1 flow cells.

Expansion of Forensic Applications Beyond Law Enforcement

Forensic technologies are increasingly applied in fields beyond criminal justice, including healthcare, insurance, and cybersecurity. Pharmacogenetics supports personalized medicine through toxicological analysis, while forensic biometrics ensures secure identity verification in financial and border control systems. The growing adoption of forensics in corporate and civil sectors opens new opportunities for market diversification, expanding the industry’s reach across multiple domains.

- For instance, the TSA PreCheck program, for which IDEMIA is an enrollment provider, surpassed 20 million active members across all providers in 2024.

Rising Adoption of Cloud-Based Forensic Platforms

Cloud-based systems are gaining traction as agencies move toward centralized data storage and collaboration. These platforms improve scalability, accessibility, and evidence sharing across regions while ensuring data integrity. Cloud integration allows secure real-time access to forensic data, enabling multi-agency cooperation and advanced analytics. This shift offers strong growth potential as organizations focus on digital transformation in evidence management.

Key Challenges

Data Privacy and Ethical Concerns

The expansion of DNA databases and biometric data usage has raised privacy and ethical concerns. Misuse or unauthorized access to sensitive genetic information poses serious legal risks. Governments and organizations must balance the need for security with privacy protection by implementing strict data governance policies. The absence of harmonized global standards continues to challenge the secure handling of forensic information.

High Costs and Technical Complexity

Advanced forensic systems such as NGS and automated DNA profiling require substantial capital investment and skilled personnel. Many developing countries face barriers in adopting these technologies due to limited budgets and infrastructure. Maintenance and calibration costs further increase operational burdens for forensic labs. The technical complexity of integrating digital, chemical, and biological forensics also limits accessibility and scalability across resource-constrained regions.

Regional Analysis

North America

North America held the largest share of 39% in the forensic technology market in 2024. The region’s dominance stems from strong government funding, advanced crime lab infrastructure, and the widespread adoption of DNA profiling and digital forensics. The United States leads with extensive investment in biometric analysis, rapid DNA systems, and AI-based crime-solving technologies. Growing criminal case volumes and national initiatives such as CODIS expansion support continuous demand. Canada also contributes to regional growth with the integration of forensic automation in law enforcement agencies and cross-border data collaboration programs.

Europe

Europe accounted for 28% of the forensic technology market in 2024, supported by robust regulatory frameworks and advanced forensic laboratories. The United Kingdom, Germany, and France lead through heavy investment in digital forensics and DNA sequencing systems. The region benefits from harmonized forensic standards promoted by the European Network of Forensic Science Institutes. Increasing criminal investigations involving cyber and biometric evidence further drive market expansion. Research collaborations among forensic institutes and growing use of cloud-based forensic data platforms strengthen Europe’s technological leadership in the sector.

Asia Pacific

Asia Pacific captured a 23% market share in 2024, driven by rising government initiatives and expanding law enforcement modernization programs. Countries such as China, Japan, and India are investing in forensic DNA databases and next-generation sequencing technologies to enhance case resolution rates. The growing incidence of cybercrime and terrorism-related investigations has accelerated the deployment of digital and biometric forensics. Increasing funding for forensic laboratories and the integration of AI-driven analytics tools support sustained growth. Local manufacturing of forensic equipment and public–private partnerships further strengthen regional competitiveness.

Latin America

Latin America represented 6% of the global forensic technology market in 2024, supported by growing adoption of forensic DNA profiling and crime scene analysis tools. Brazil, Mexico, and Argentina lead regional development through investments in law enforcement modernization and forensic education programs. Rising concerns over organized crime and cross-border trafficking have accelerated demand for forensic technologies. Despite limited infrastructure in rural areas, government-backed projects are improving access to advanced testing facilities. International collaborations with North American forensic agencies are enhancing technical capabilities and data standardization across the region.

Middle East and Africa

The Middle East and Africa accounted for 4% of the forensic technology market in 2024. Regional growth is driven by the establishment of advanced forensic laboratories in the UAE, Saudi Arabia, and South Africa. Governments are investing in DNA profiling, biometric identification, and chemical analysis systems to enhance national security and criminal investigation efficiency. The rising need for forensic evidence in judicial processes is promoting adoption. However, limited skilled personnel and high equipment costs remain challenges, though ongoing capacity-building programs continue to strengthen regional forensic infrastructure.

Market Segmentations:

By Type

- Polymerase Chain Reaction (PCR)

- Capillary Electrophoresis

- Next Generation Sequencing (NGS)

- Rapid DNA Analysis

- Automated Liquid Handling Technology

- Microarrays

- Others

By Service

- DNA Profiling

- Chemical Analysis

- Biometric Analysis

- Firearms Identification

- Others

By Application

- Pharmacogenetics

- Biodefense & Bio surveillance

- Judicial/Law Enforcement

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The forensic technology market features leading players such as Thermo Fisher Scientific, Inc., Agilent Technologies, GE Healthcare, QIAGEN, Eurofins Medigenomix GmbH, LGC Forensics, NMS Labs, Forensic Fluids Laboratories, Forensic Pathways, SPEX Forensics, Pyramidal Technologies Ltd, and Thales. These companies compete through innovation, product expansion, and strategic partnerships with law enforcement and forensic laboratories. The market is witnessing strong focus on automation, digital transformation, and AI integration to enhance evidence analysis accuracy and efficiency. Many firms are expanding their service portfolios to include rapid DNA analysis, digital forensics, and toxicology testing. Continuous investment in R&D supports advanced sequencing tools and high-throughput systems, improving turnaround times in complex investigations. Additionally, global collaborations and acquisitions are helping companies strengthen regional footprints and regulatory compliance. The competitive environment emphasizes technological advancement, cost efficiency, and data reliability as key differentiators shaping market leadership and long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Agilent Technologies Launched new intelligent liquid chromatography-mass spectrometry (LC/MS) innovations at the American Society for Mass Spectrometry (ASMS) conference to advance lab efficiency.

- In 2023, QIAGEN Acquired Verogen, a leading next-generation sequencing (NGS) company in the forensic genomics space, to strengthen its portfolio of human identification (HID) and forensic solutions.

- In 2023, Thales Introduced the mobile Evidence and Investigation Suite, allowing investigators to access professional biometric capture tools directly from their mobile devices.

Report Coverage

The research report offers an in-depth analysis based on Type, Service, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advancements in AI and automation will improve forensic data accuracy and case turnaround times.

- Integration of cloud-based forensic platforms will enable secure, cross-border evidence sharing.

- Expansion of national DNA databases will strengthen criminal identification and investigation capabilities.

- Rapid DNA analysis systems will gain wider use in field-based and mobile forensics.

- Growing demand for digital forensics will support investigations in cybersecurity and financial crimes.

- Adoption of next-generation sequencing will enhance complex genetic profiling in criminal cases.

- Government funding for forensic modernization will increase across developing regions.

- Ethical and privacy-focused frameworks will become critical in managing biometric and DNA data.

- Collaboration between public and private sectors will drive innovation in forensic solutions.

- Integration of robotics and machine learning will optimize laboratory efficiency and reduce human error.