Market Overview

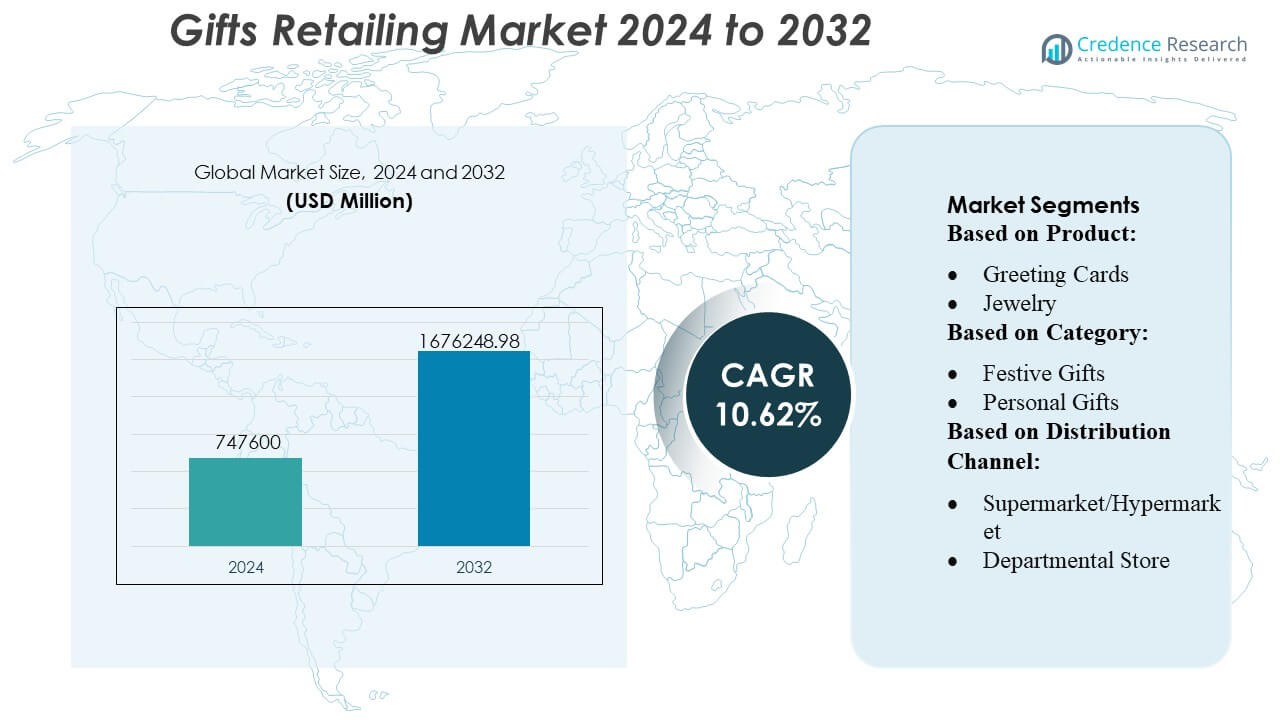

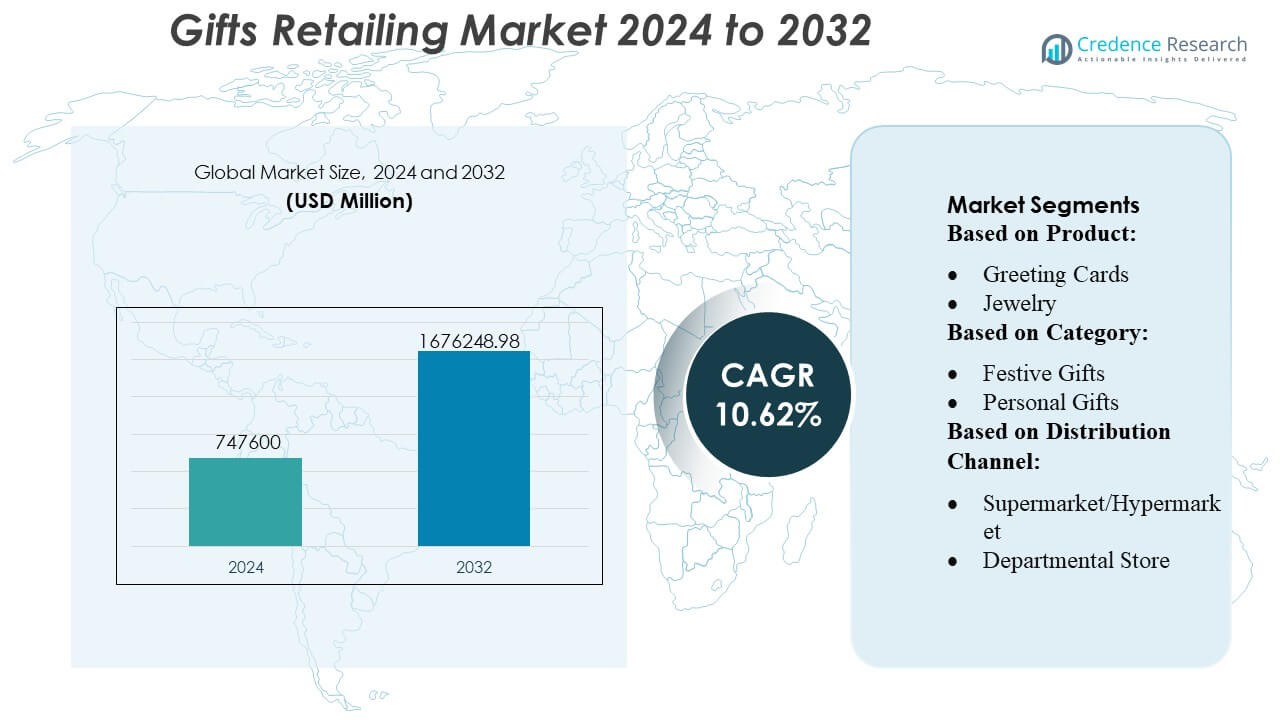

Gifts Retailing Market size was valued USD 747600 million in 2024 and is anticipated to reach USD 1676248.98 million by 2032, at a CAGR of 10.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gifts Retailing Market Size 2024 |

USD 747600 Million |

| Gifts Retailing Market, CAGR |

10.62% |

| Gifts Retailing Market Size 2032 |

USD 1676248.98 Million |

The Gifts Retailing Market is shaped by a mix of global retail chains, specialized gift boutiques, fast-growing e-commerce platforms, and emerging artisanal brands that compete through product variety, personalization services, and rapid delivery capabilities. Leading players strengthen their market reach through curated assortments, sustainable gift options, and premium packaging formats tailored to festive, personal, and corporate occasions. Digital-first retailers gain momentum by leveraging AI-driven recommendations, subscription gifting, and expanded last-mile logistics networks. North America leads the global market with an exact market share of 32–34%, supported by high consumer spending, strong holiday-driven sales cycles, and mature omnichannel retail ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gifts Retailing Market was valued at USD 747,600 million in 2024 and is projected to reach USD 1,676,248.98 million by 2032, registering a CAGR of 10.62% over the forecast period.

- Growing demand for personalized gifts, curated bundles, and premium packaging solutions acts as a major driver, supported by shifting consumer preferences toward experiential and meaningful gifting.

- Digital-first retailing, AI-assisted product recommendations, and subscription-based gifting models continue to shape market trends as e-commerce strengthens its lead with a 42–45% share.

- High competitive intensity, strong price sensitivity, and seasonal demand volatility remain key restraints, compelling retailers to optimize inventories and expand sustainable product assortments.

- North America leads with a 32–34% share, followed by Asia Pacific at 30–32%, while festive gifting holds the largest category share at 38–40%, driven by major cultural and holiday shopping seasons.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Greeting Cards dominate the Gifts Retailing Market with an estimated 24–26% share, driven by consistent demand across birthdays, anniversaries, festivals, and corporate occasions. Their affordability, personalization value, and wide availability across convenience stores, bookstores, and online channels reinforce leadership. Jewelry follows closely as premium gifting accelerates during festive seasons and relationship-driven events. Flowers & chocolates gain traction due to rapid-delivery services and curated bundles offered by e-commerce platforms. Apparel & accessories, home décor, and toys & games expand steadily, supported by rising lifestyle gifting, season-based collections, and influencer-driven product visibility.

- For instance, PVH has integrated 3D design via its proprietary Stitch Hub platform, which it initially rolled out across approximately 80% of the Tommy Hilfiger. The transition to 3D design successfully reduced the dependence on physical samples, saving time and resources. Digital reviews decreased the collection development process by as much as 2 weeks.

By Category

Festive Gifts hold the largest share at 38–40%, supported by strong seasonal peaks during Christmas, Diwali, Valentine’s Day, Mother’s Day, and regional celebrations that boost discretionary spending. Retailers leverage limited-edition assortments, premium packaging, and promotional bundles to maximize festive conversions. Personal Gifts show strong momentum as consumers prioritize customized products, experience-based gifting, and sentimental items across birthdays and personal milestones. Corporate Gifts maintain stable growth as businesses expand employee recognition programs, client appreciation packages, and sustainable gifting solutions aligned with ESG-centric procurement strategies.

- For instance, Adidas did leverage highly automated technology in its Speedfactories, including robotic cutting and the use of 3D printing (specifically, Digital Light Synthesis in partnership with Carbon, which produced the lattice structure for 4D midsoles). The goal was to drastically shorten the typical six-month production cycle to as little as 45 days.

By Distribution Channel

Online/E-Commerce leads the segment with a 42–45% market share, driven by extensive product variety, competitive pricing, and same-day or next-day delivery provided by leading marketplaces and specialty gift platforms. Personalization tools, AI-enabled recommendations, and curated subscription boxes further strengthen digital adoption. Supermarkets/hypermarkets retain steady demand due to convenient access and value-driven bundles, while departmental stores appeal to premium shoppers seeking curated gifts and branded merchandise. Other channels, including boutique stores and pop-up experiential outlets, contribute niche demand through artisanal, handcrafted, and locally themed gifting solutions.

Key Growth Drivers

- Rising Personalization and Custom Gifting Demand

Personalized gifting acts as a major growth driver as consumers increasingly seek unique, emotion-driven products that reflect individual preferences. Custom-printed merchandise, engraved jewelry, curated hampers, and photo-based gifts fuel higher premiumization and repeat purchases. Digital platforms strengthen this trend by offering design visualization tools, AI-assisted recommendations, and flexible customization options. Millennials and Gen Z contribute significantly, prioritizing experiential and meaningful gifting. Retailers benefit from higher margins on personalized items, while expanded SKU assortments support wider adoption across personal, festive, and corporate gifting categories.

- For instance, AutoStore technology at its Phoenix, Arizona distribution centre—achieving 99% order-fulfillment accuracy. Up to 85% reduction in energy consumption. Tenfold (10x) increase in warehouse capacity during peak periods.

- Expansion of E-Commerce and Same-Day Delivery Infrastructure

The rapid expansion of online retail drives strong market growth as consumers shift to digital platforms for convenience, variety, and competitive pricing. Same-day and next-day delivery capabilities, supported by logistics optimization, enable timely gifting for birthdays, anniversaries, and festival occasions. Online-exclusive bundles, subscription boxes, and curated themed gifts broaden customer selection. Mobile apps and integrated payment solutions further simplify purchases. As digital penetration deepens across emerging markets, e-commerce platforms play a critical role in scaling cross-border gifting, real-time order tracking, and seamless last-mile delivery experiences.

- For instance, VF’s fiscal The snippet mentions that direct-to-consumer (DTC) sales represented 44% of VF’s total Fiscal 2025 revenues. This is the most current figure found.

- Increasing Corporate Gifting Adoption Across Industries

Corporate gifting contributes significantly to market expansion as companies prioritize employee engagement, brand visibility, and client relationship management. Growing investment in recognition programs, milestone celebrations, festive hampers, and eco-friendly branded merchandise fuels recurring demand. Enterprises adopt customized and utility-based gifts aligned with sustainability commitments. Digital corporate-ordering portals streamline bulk purchases, reduce procurement time, and offer invoice-ready workflows. As hybrid work models expand, shipped-to-home corporate gifting packages gain popularity, enabling consistent engagement with remote teams and fostering professional goodwill throughout the year.

Key Trends & Opportunities

- Growing Popularity of Sustainable and Eco-Friendly Gifts

Sustainable gifting emerges as a prominent trend as consumers and corporations prefer products aligned with environmental values. Demand rises for biodegradable packaging, plantable stationery, organic food baskets, upcycled décor, and reusable lifestyle products. Retailers capitalize by offering plastic-free gift hampers and ethically sourced items. Brands highlight carbon-neutral shipping and transparent supply chains to appeal to eco-conscious buyers. This trend opens opportunities for small artisans, local producers, and circular-economy-based gifting startups that differentiate through sustainability-led product innovation.

- For instance, Nike’s official sustainability report confirms that 78% of all its NIKE, Jordan, and Converse products currently contain some recycled material. The popular Tempo Short product line, which is typically made from at least 75% recycled polyester (often 100%), is specifically cited as being responsible for pulling 112 million plastic bottles out of landfills and waterways to date for use in its material production.

- Increasing Influence of Social Media and Influencer-Led Gifting Choices

Social media platforms significantly shape consumer preferences by showcasing curated gift ideas, seasonal hampers, DIY concepts, and trending product categories. Influencer partnerships accelerate discovery of niche and premium gift brands, driving impulse purchases. Viral campaigns around Valentine’s Day, Mother’s Day, and holiday gifting broaden market reach. User-generated content provides authentic product validation, enhancing conversion rates. Retailers leverage shoppable posts, short-form videos, and livestream events to introduce limited-edition collections, strengthening engagement and driving higher sales among younger demographics.

- For instance, H&M reported that 89% of the materials used in their products were either recycled or sourced more sustainably. The share of materials specifically from recycled sources reached 29.5%.

- Expansion of Experiential and Subscription-Based Gifting Models

Experience-driven gifting gains momentum as consumers shift toward hobby-based, wellness-oriented, and entertainment experiences. Spa vouchers, workshops, travel packages, dining experiences, and virtual classes appeal to Millennials seeking non-material gifts. Subscription gifting—covering gourmet foods, pet products, books, grooming kits, and wellness boxes—delivers recurring revenue opportunities. Retailers integrate personalization engines to tailor subscription themes. This trend supports deeper customer loyalty, enhances lifetime value, and enables long-term engagement beyond one-time festive or occasion-specific purchases.

Key Challenges

- Supply Chain Volatility and Inventory Management Constraints

The market faces persistent challenges from fluctuating raw material costs, shipping delays, and complex global sourcing patterns. Seasonal demand spikes intensify pressure on inventory planning, leading to stockouts or overstock conditions. Retailers must manage diversified SKU assortments, variable lead times, and uncertain last-mile delivery capacity. Disruptions in international freight and packaging material shortages further impact margins. To mitigate risks, companies increasingly adopt demand forecasting tools, local sourcing strategies, and agile procurement models, though execution remains a major operational challenge.

- High Competitive Intensity and Price Sensitivity

The Gifts Retailing Market experiences intense competition from local boutiques, global platforms, artisanal sellers, and mass-market retailers. Consumers demonstrate strong price sensitivity, often comparing products across multiple online channels before final purchase. Discount-driven shopping behavior compresses retailer margins, while high customer acquisition costs challenge profitability in digital channels. Premium and personalized gift categories face imitation risks, reducing differentiation. To remain competitive, brands must invest in value-added services, stronger brand storytelling, exclusive collaborations, and curated offerings, yet sustaining long-term loyalty remains difficult.

Regional Analysis

North America

North America leads the Gifts Retailing Market with an estimated 32–34% share, supported by high consumer spending, strong holiday-driven sales cycles, and rapid adoption of digital gifting platforms. The region benefits from established retail ecosystems, widespread same-day delivery services, and strong penetration of personalized and premium gift categories. Major festive events—Christmas, Thanksgiving, Valentine’s Day, and Mother’s Day—continue to generate peak seasonal demand. Corporate gifting remains robust as enterprises expand employee engagement programs. E-commerce giants and specialty gift retailers strengthen growth by offering curated bundles, subscription boxes, and omnichannel purchase options.

Europe

Europe accounts for roughly 27–29% of the global market, driven by high acceptance of artisanal, sustainable, and culturally themed gifts. Strong gifting traditions across Christmas, Easter, and regional festivals support annual spending patterns. The region shows rising demand for eco-friendly products, premium chocolates, jewelry, and handmade items sourced from local artisans. Retailers leverage omnichannel models, combining boutique stores with online personalization platforms. Corporate gifting also grows steadily as European enterprises adopt branded merchandise aligned with sustainability norms. Increasing cross-border e-commerce simplifies access to global gift assortments, strengthening overall market expansion.

Asia Pacific

Asia Pacific holds a significant 30–32% market share, emerging as the fastest-growing region due to expanding middle-class income, urbanization, and strong cultural gifting traditions. Festivals such as Lunar New Year, Diwali, Singles’ Day, and local wedding seasons generate substantial demand across greeting cards, apparel, confectionery, and home décor. Rapid e-commerce adoption, mobile-first shopping behavior, and social-commerce platforms accelerate penetration of digital gifting. Personalization, luxury gifting, and curated hampers gain popularity among younger consumers. Retailers benefit from improving logistics networks and rising corporate gifting in China, India, Japan, and Southeast Asia.

Latin America

Latin America represents 6–8% of the market, supported by growing retail modernization and rising interest in festive and personalized gifting. Key occasions such as Christmas, Mother’s Day, and regional celebrations like Día del Niño drive seasonal demand. E-commerce expansion, driven by Brazil and Mexico, increasingly shapes consumer buying habits, offering greater product variety and competitive pricing. Local crafts, handmade gifts, and artisanal chocolates remain popular due to strong cultural preferences. However, economic fluctuations and inconsistent supply-chain infrastructure affect price-sensitive consumers and limit premium gifting adoption, slowing overall market acceleration.

Middle East & Africa

The Middle East & Africa region captures 4–5% market share, driven by rising disposable incomes, expanding retail malls, and demand for premium gifting during Ramadan, Eid, weddings, and national celebrations. Luxury perfumes, jewelry, gourmet hampers, and high-end corporate gifts remain strong categories in GCC nations. Growth in Africa is supported by increasing online retail penetration and the popularity of affordable, customized gifting options. Despite opportunities, the region faces challenges related to logistics reliability, limited product assortment in remote areas, and varying consumer price sensitivities, which moderate the overall pace of market development.

Market Segmentations:

By Product:

By Category:

- Festive Gifts

- Personal Gifts

By Distribution Channel:

- Supermarket/Hypermarket

- Departmental Store

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gifts Retailing Market features a diverse competitive landscape shaped by technology-enabled retail strategies and digital experience enhancements, with leading ecosystem enablers such as GE Digital, UiPath Inc., Rockwell Automation, Inc., International Business Machines Corporation (IBM), Honeywell International Inc., Hydro One, Inc., NXP Semiconductors NV, Cisco Systems, Inc., MindTree Ltd., and PTC Inc. The Gifts Retailing Market exhibits a highly competitive landscape defined by rapid digitalization, evolving consumer preferences, and expanding omnichannel retail strategies. Large retail chains, specialty gift stores, e-commerce platforms, and artisanal brands compete on product variety, personalization capabilities, and delivery efficiency. Online marketplaces strengthen their position through AI-driven recommendations, curated bundles, subscription gifting models, and same-day delivery services tailored to time-sensitive occasions. Brick-and-mortar retailers focus on experiential formats, premium packaging, and festival-led assortments to retain footfall. Customizable gifts, sustainable materials, and themed hampers continue to differentiate offerings, while strong pricing competition and seasonal demand volatility push companies to optimize inventory, deepen customer engagement, and expand into hybrid digital-physical retail models.

Key Player Analysis

- GE Digital

- UiPath Inc.

- Rockwell Automation, Inc.

- International Business Machines Corporation (IBM)

- Honeywell International Inc.

- Hydro One, Inc

- NXP Semiconductors NV

- Cisco Systems, Inc.

- MindTree Ltd.

- PTC Inc.

Recent Developments

- In April 2025, The Gifted Apple, a U.S.-based gift retailer, launched its first brick-and-mortar shop in Owensboro, U.S. The new store is dedicated to offering a variety of unique gifts for occasions like holidays and birthdays.

- In November 2024, India-based gifts retailer IGP (International Gifting Platform) launched its “Amazing Gifts, Samay Par” campaign, which included an ad film focused on anniversary gifting. The campaign featured a retro-futuristic style with 1990s-inspired robots and aimed to increase brand awareness by highlighting the importance of timely and thoughtful gifts.

- In September 2024, Deliveroo partnered with Not On The High Street to offer customized gifts through a new service. This collaboration expands Deliveroo’s gifting options by adding customized, unique items from Not On The High Street’s marketplace of small UK businesses to its existing gift voucher service.

- In February 2024, Kroger partnered with the AI retail analytics company Intelligence Node to improve its online marketplace. This collaboration uses Intelligence Node’s AI to create clearer, more helpful product listings for third-party vendors, which aims to enhance the customer experience by improving shoppers’ ability to make purchase decisions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Category, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift further toward hyper-personalized gifting supported by AI-driven recommendation engines and customization tools.

- Online gifting platforms will expand rapidly as same-day delivery, subscription models, and curated bundles gain broader consumer acceptance.

- Sustainable gifting options will grow significantly as buyers prioritize eco-friendly materials, ethical sourcing, and recyclable packaging.

- Experiential gifts such as workshops, events, and wellness services will gain stronger traction among younger demographics.

- Corporate gifting will expand with greater focus on employee engagement, branding, and personalized appreciation programs.

- Social commerce will influence purchasing behaviors as influencers, short-form videos, and livestream shopping drive discovery.

- Retailers will invest in advanced analytics to improve inventory forecasting and manage seasonal demand more effectively.

- Cross-border digital gifting will rise as logistics networks and global e-commerce integrations strengthen.

- Luxury and premium gifting segments will expand in urban markets driven by rising disposable income and lifestyle upgrades.

- Omnichannel retail strategies will become standard as brands integrate physical stores, mobile apps, and online platforms for seamless gifting experiences.

Market Segmentation Analysis:

Market Segmentation Analysis: