Market Overview:

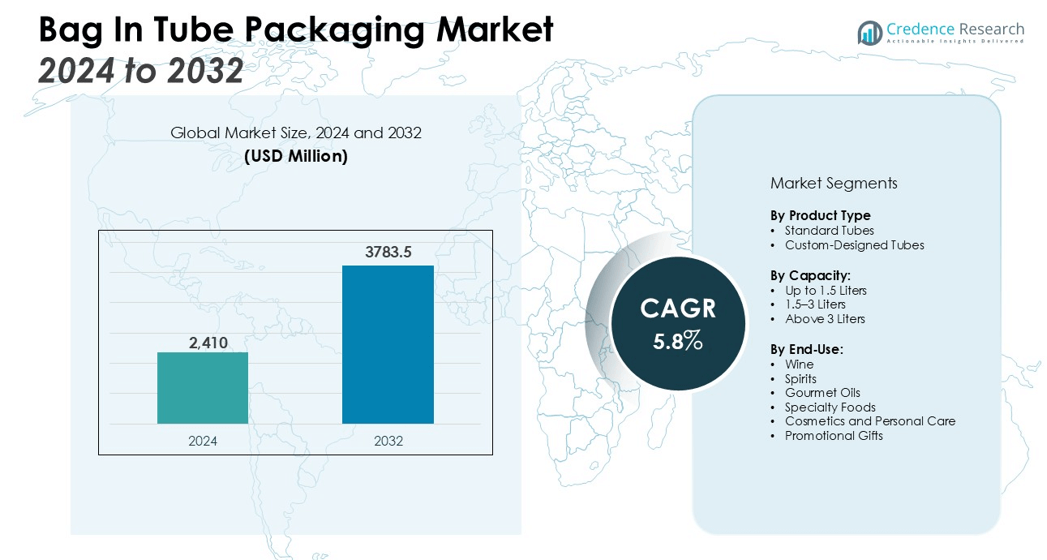

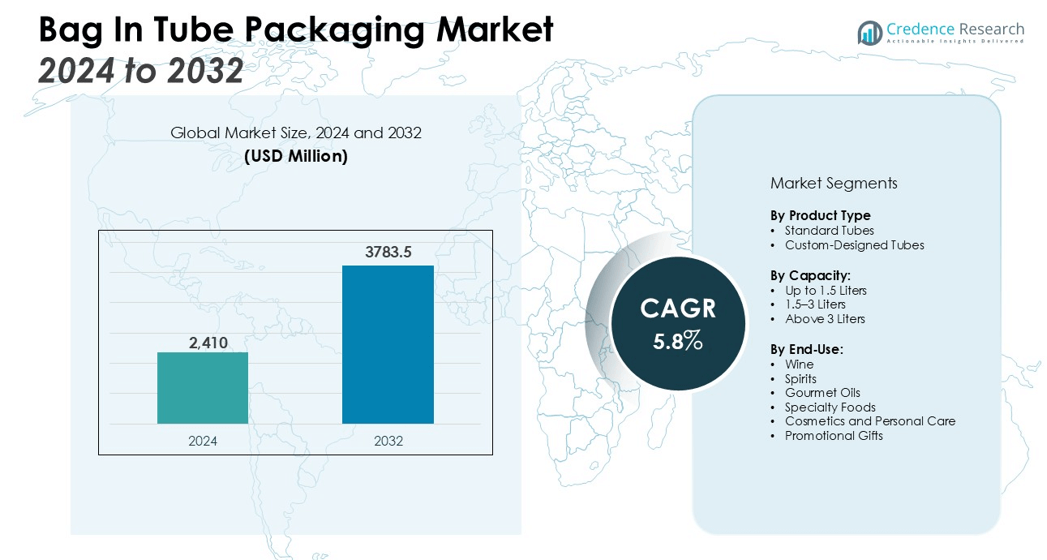

The Bag in tube packaging market size was valued at USD 2,410 million in 2024 and is anticipated to reach USD 3783.5 million by 2032, at a CAGR of 5.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bag In Tube Packaging Market Size 2024 |

USD 2,410 million |

| Bag In Tube Packaging Market, CAGR |

5.8% |

| Bag In Tube Packaging Market Size 2032 |

USD 3783.5 million |

The primary drivers of the bag in tube packaging market include strong demand for innovative, convenient, and sustainable solutions from producers of wine, spirits, oils, and luxury foods. This packaging ensures superior product preservation, extends shelf life, and reduces the need for preservatives. It meets consumer preferences for lightweight, easy-to-use, and recyclable formats. Advances in materials and design, such as better barrier films and customizable tubes, have expanded use into cosmetics, gourmet foods, and gifting. The format supports sustainability goals by using less material and reducing transportation costs.

Regionally, Europe leads the bag in tube packaging market due to established wine and spirits industries, strong design innovation, and supportive regulations for sustainable packaging. Leading companies such as Smurfit Kappa Group PLC, Parish Manufacturing Inc, Tecnicam S.r.l, and Industri-Bag drive regional growth. France, Italy, and Spain are key markets for premium and export-oriented products. North America follows, fueled by rising demand for specialty packaging among craft beverage and luxury brands. Asia Pacific shows rapid growth, with increased demand in China, Japan, and Australia for high-quality packaging.

Market Insights:

- The bag in tube packaging market reached USD 2,410 million in 2024 and is set to reach USD 3,783.5 million by 2032.

- Premium wine, spirits, oils, and gourmet foods drive strong demand for innovative and sustainable packaging formats.

- The format ensures superior product preservation, extends shelf life, and reduces the need for preservatives.

- Recyclable, lightweight, and customizable tube packaging meets growing consumer and regulatory preferences for sustainability.

- Europe holds 55% market share, led by France, Italy, and Spain, with advanced design and sustainability standards.

- North America and Asia Pacific show fast growth, driven by specialty packaging demand and rising disposable incomes.

- Leading companies include Smurfit Kappa Group PLC, Parish Manufacturing Inc, Tecnicam S.r.l, and Industri-Bag.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Premium and Differentiated Packaging Solutions:

Brand owners in the wine, spirits, and gourmet food sectors prioritize packaging formats that enhance visual appeal and customer experience. The bag in tube packaging market benefits from its ability to deliver a distinctive, elegant presentation that stands out on retail shelves. It supports high-quality graphics, custom finishes, and unique shapes, enabling brands to communicate exclusivity and quality. This premium appearance strengthens brand positioning in competitive markets. Consumers associate tube-based packaging with value, innovation, and convenience, driving adoption for luxury products. Companies leverage this format to reinforce brand loyalty and boost shelf impact.

- For instance, Smurfit Kappa’s Bag-in-Tube® solution is available in exact sizes ranging from 1.5 liters to 5 liters, using a double-layered bag and Vitop® tap designed to keep contents fresh by minimizing oxygen permeation—prolonging product shelf life after opening, as directly confirmed in official product specifications.

Growing Preference for Product Preservation and Extended Shelf Life:

Preservation of product quality remains a critical requirement in the premium beverage and specialty liquid segments. Bag in tube packaging protects contents from light, oxygen, and contaminants, ensuring freshness and minimizing spoilage. Its barrier properties reduce the need for artificial preservatives, aligning with consumer preferences for natural formulations. The packaging design prevents product wastage by enabling efficient dispensing and minimizing air exposure. Manufacturers choose this solution to extend the usability and appeal of premium liquids, resulting in higher customer satisfaction. The bag in tube packaging market sees increased uptake where product integrity is paramount.

Increasing Focus on Sustainable and Lightweight Packaging Alternatives:

Sustainability is a core driver of innovation in the packaging industry. The bag in tube packaging market addresses environmental concerns by utilizing recyclable materials and reducing overall packaging weight. This format requires fewer raw materials than traditional rigid containers and lowers carbon emissions during transportation. Companies view it as an opportunity to meet regulatory requirements and consumer expectations for eco-friendly products. It helps reduce waste across the value chain while maintaining product protection and aesthetic value. Sustainability credentials play a central role in purchasing decisions within target markets.

- For instance, a 3-liter Smurfit Kappa Bag-in-Box bag, when equipped with the Vitop Compact tap, results in a total packaging weight of only 64 grams, compared to more than 1,700 grams for an equivalent quantity of beverage packaged in standard glass bottles.

Advancements in Customization, Technology, and Material Science:

Rapid developments in packaging technology and materials have expanded the application range of bag in tube packaging. It now supports a wider array of product categories, including cosmetics, oils, and promotional gifts. Advanced manufacturing techniques enable intricate designs, improved barrier films, and greater flexibility in sizing and structure. Brands tailor the appearance and functionality to meet specific product requirements and market trends. This adaptability makes the packaging format a preferred choice for brands seeking differentiation. The bag in tube packaging market continues to evolve with new features that enhance both visual impact and performance.

Market Trends:

Increasing Emphasis on Premiumization and Visual Storytelling:

Brands now invest in packaging that delivers a luxury experience and communicates a compelling brand story. The bag in tube packaging market responds to this trend by offering options for high-definition printing, metallic foiling, and textured finishes. It allows for distinctive shapes and detailed customization that enhance product appeal and shelf visibility. Companies in the wine, spirits, and specialty food sectors use tube-based packaging to elevate unboxing experiences and support limited-edition launches. This focus on visual storytelling helps brands connect emotionally with consumers and drive repeat purchases. Enhanced aesthetics and tactile features now play a central role in packaging decisions.

- For instance, TUBES, a Dutch manufacturer, bottles and distributes wines and spirits in single-serve glass or recycled PET tubes, each with a capacity of 100ml; their tubes are commercially shelf-stable for up to 24 months when made of glass.

Expansion into New Product Categories and Functional Innovation:

Market participants increasingly explore applications beyond traditional beverages, targeting cosmetics, oils, and gourmet food products. The bag in tube packaging market supports this expansion through advancements in barrier materials, tamper-evident closures, and easy-pour designs. It appeals to brands seeking practical solutions that combine visual impact with product safety and convenience. E-commerce and gifting channels also boost demand for protective, premium, and lightweight packaging. Innovations in tube structure and fitments cater to evolving functional needs and create new opportunities across diverse market segments. Functional enhancements continue to drive adoption among forward-thinking brands seeking to differentiate.

- For instance, Amcor Flexibles launched the Shield Pack Clear High Barrier Aseptic IBC Bag, which uses a triple-barrier material of 10.8 mil thickness and achieves an Oxygen Transmission Rate of less than 0.04cc O2/100in²/24hr at 73°F, enabling the safe expansion into sensitive food and gourmet categories.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Requirements:

The bag in tube packaging market faces challenges related to elevated production costs and intricate manufacturing processes. It demands specialized machinery and skilled labor, which increase initial investment and operational expenses. Complex designs and customization requirements often extend lead times and limit scalability for small to mid-sized brands. Cost-sensitive producers may hesitate to adopt this packaging format when lower-cost alternatives exist. Maintaining consistent quality standards across diverse suppliers adds further complexity. These factors restrict broader adoption in price-driven market segments.

Limited Consumer Awareness and Adoption in Emerging Markets:

Limited consumer familiarity with tube-based packaging formats presents a hurdle for market growth, especially in emerging regions. The bag in tube packaging market relies on strong branding and effective marketing to educate buyers about its benefits. Retailers and distributors may resist new formats that require changes in shelf placement or logistics. It also competes with established rigid and flexible packaging solutions that dominate traditional retail channels. Regulatory uncertainties regarding recyclability and material compliance in some countries create additional barriers. These challenges slow the market’s penetration into new geographic areas.

Market Opportunities:

Expansion into Niche and Premium Product Segments:

The bag in tube packaging market holds significant potential in niche and premium product categories. Brands focused on limited-edition wines, craft spirits, artisanal oils, and luxury food items can leverage this format to differentiate and elevate brand perception. It offers a canvas for creative design and value-added features that attract discerning consumers. Growth in gifting, travel retail, and e-commerce channels further increases the appeal of visually striking and convenient packaging solutions. Companies can capitalize on rising demand for unique experiences by introducing tube-based packaging for seasonal and promotional launches. This approach supports premiumization and brand storytelling initiatives.

Sustainability Initiatives and Advances in Eco-Friendly Materials:

Sustainability creates compelling opportunities for the bag in tube packaging market, particularly as regulations and consumer expectations evolve. It aligns with trends toward recyclable, lightweight, and resource-efficient packaging solutions. Advances in bio-based films and renewable materials will further enhance the market’s environmental profile. Brands adopting green packaging solutions strengthen their value proposition and address growing demand for responsible sourcing. Collaborative efforts between suppliers and manufacturers can accelerate development of innovative, sustainable tube formats. These opportunities position the market to attract environmentally conscious brands and consumers.

Market Segmentation Analysis:

By Product Type:

The bag in tube packaging market features two primary product types: standard and custom-designed tubes. Standard tubes dominate volume sales due to their cost-effectiveness and suitability for mass-market applications. Custom-designed tubes appeal to premium brands seeking unique aesthetics, advanced finishes, and enhanced branding opportunities. Manufacturers provide a variety of closures, dispensing mechanisms, and surface treatments, allowing brands to align packaging with product positioning. Custom tubes find high adoption in luxury beverages, specialty foods, and gifting segments.

- For instance, Amcor Flexibles supplies over 15 closure types—including flip-top and threaded caps—that are tailored for beauty, wine, spirits, and pharmaceutical packaging to meet specific brand and product needs.

By Capacity:

Capacity segmentation covers small (up to 1.5 liters), medium (1.5–3 liters), and large (above 3 liters) formats. Small-capacity tubes are preferred for high-value products, limited editions, and trial sizes, offering convenience and portability. Medium-sized tubes serve core beverage categories and gourmet oils, balancing storage efficiency with user-friendly handling. Large-capacity tubes meet the needs of institutional and hospitality clients who require bulk dispensing and extended shelf life.

- For instance, The Packaging Company supplies 50ml cosmetic squeeze tubes engineered with multi-layered laminate structures that safely store travel-size creams, gels, and serums for high-frequency consumer use.

By End-Use:

End-use segmentation spans wine, spirits, gourmet oils, specialty foods, cosmetics, and promotional gifts. The bag in tube packaging market finds its largest demand in the wine and spirits sector, where shelf differentiation and product protection drive uptake. Gourmet oils and specialty foods leverage tube packaging for premium positioning and extended freshness. Cosmetic and personal care brands adopt tube formats to support branding and gifting initiatives, while promotional gift markets benefit from the format’s customizability and visual appeal.

Segmentations:

By Product Type:

- Standard Tubes

- Custom-Designed Tubes

By Capacity:

- Up to 1.5 Liters

- 5–3 Liters

- Above 3 Liters

By End-Use:

- Wine

- Spirits

- Gourmet Oils

- Specialty Foods

- Cosmetics and Personal Care

- Promotional Gifts

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe:

Europe holds 55% of the global bag in tube packaging market, driven by strong design innovation and advanced sustainability practices. It benefits from a well-established wine and spirits industry, where leading brands consistently adopt tube-based formats for premium and export products. Regulatory frameworks in France, Italy, and Spain encourage the use of recyclable and eco-friendly packaging materials. Design agencies and converters in the region set global trends in aesthetics and functionality. Regional consumers value unique packaging and support responsible sourcing, reinforcing demand for tube-based solutions. Continuous investment in technology and production capacity supports the region’s dominance.

North America:

North America accounts for 22% of the bag in tube packaging market, supported by increasing demand for differentiated and value-added packaging. Producers of craft beverages, gourmet foods, and cosmetics embrace tube-based formats to create shelf distinction and enhance customer experience. U.S. and Canadian brands leverage the packaging’s premium look to strengthen brand loyalty in competitive markets. E-commerce growth and changing consumer lifestyles accelerate adoption of convenient, lightweight solutions. Regulatory guidance in both countries aligns with industry sustainability targets, facilitating market expansion. Strategic collaborations between brands and packaging suppliers foster innovation in this region.

Asia Pacific:

Asia Pacific represents 17% of the bag in tube packaging market, with rapid growth fueled by rising disposable incomes and evolving consumer preferences. Key markets such as China, Japan, and Australia drive adoption, supported by demand for premium packaging in beverages and personal care. Local manufacturers invest in advanced machinery and materials to match global quality standards. Awareness of sustainable packaging increases among regional brands, influencing purchasing decisions. Product launches for festivals and gift-giving occasions further boost interest in visually appealing tube formats. The region’s dynamic retail sector and strong export activity contribute to ongoing market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Smurfit Kappa Group PLC;

- Parish Manufacturing Inc;

- Tecnicam S.r.l;

- Industri-Bag;

- Grafica Rovellosa SL;

- Sunpack Industries;

- Uline; Master Packaging Inc;

- SKS Packaging Pvt. Ltd;

- DS Smith

Competitive Analysis:

The bag in tube packaging market features a competitive landscape with a mix of global leaders and specialized regional players. Key companies such as Smurfit Kappa Group PLC, Parish Manufacturing Inc, Tecnicam S.r.l, and Industri-Bag hold prominent positions through strong technological capabilities, diverse portfolios, and established client relationships. It values innovation in materials, design, and sustainability, driving continuous investment in research and development. Leading firms collaborate closely with luxury brands to deliver customized, premium solutions. Smaller players compete by offering flexible production, rapid turnaround times, and niche product expertise. Strategic partnerships, product launches, and expansions into new regions strengthen competitive positions and support market growth.

Recent Developments:

- In November 2024, Smurfit Westrock launched the EasySplit Bag-in-Box design, a new packaging innovation developed to help customers meet forthcoming EU recyclability regulations.

- In April 2025, Sun Chemical (a major ink supplier to packaging) launched SunPak PowerPace, an advanced vegetable-oil-based sheetfed offset printing ink for sustainability, though the brand is not identical to Sunpack Industries but is a leading partner in print packaging.

- In April 2025, DS Smith, now under International Paper, launched the GoChill Cooler, a 100% recyclable, wax-free corrugated board cooler designed as a sustainable alternative to traditional coolers. The GoChill is part of DS Smith’s circular economy strategy and responds to strong consumer demand for eco-friendly options.

Market Concentration & Characteristics:

The bag in tube packaging market features a moderate to high level of concentration, with a select group of specialized manufacturers and converters dominating global supply. It relies on advanced production technology, design expertise, and access to premium materials, which create high entry barriers for new participants. Leading players set benchmarks for quality, innovation, and sustainability, while smaller firms compete through niche applications and custom designs. The market prioritizes reliability, short lead times, and collaboration between brands and packaging specialists. Continuous investment in R&D and exclusive partnerships with luxury brands further strengthen the position of established suppliers.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Capacity, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Manufacturers continue to explore new barrier technologies to enhance product protection and longevity.

- Brands aim to integrate customizable finishes and digital printing to improve shelf appeal.

- Designers focus on ergonomic closures and easy-dispense features to enhance user experience.

- Suppliers collaborate to develop fully recyclable and bio-based tube materials.

- Companies implement lightweight tube formats to reduce logistical and carbon footprint.

- Brands prioritize limited-edition packaging for seasonal and promotional campaigns.

- Innovation hubs drive material science breakthroughs that support tube durability and flexibility.

- Labels and fitments evolve to ensure tamper evidence and meet regulatory standards.

- Retailers request packaging that supports e-commerce and direct-to-consumer shipping.

- The bag in tube packaging market embraces data-driven customization, enabling small-batch personalization.