| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Roof Market Size 2024 |

USD 2,583.93 million |

| Green Roof Market, CAGR |

17.04% |

| Green Roof Market Size 2032 |

USD 9,080.06 million |

Market Overview:

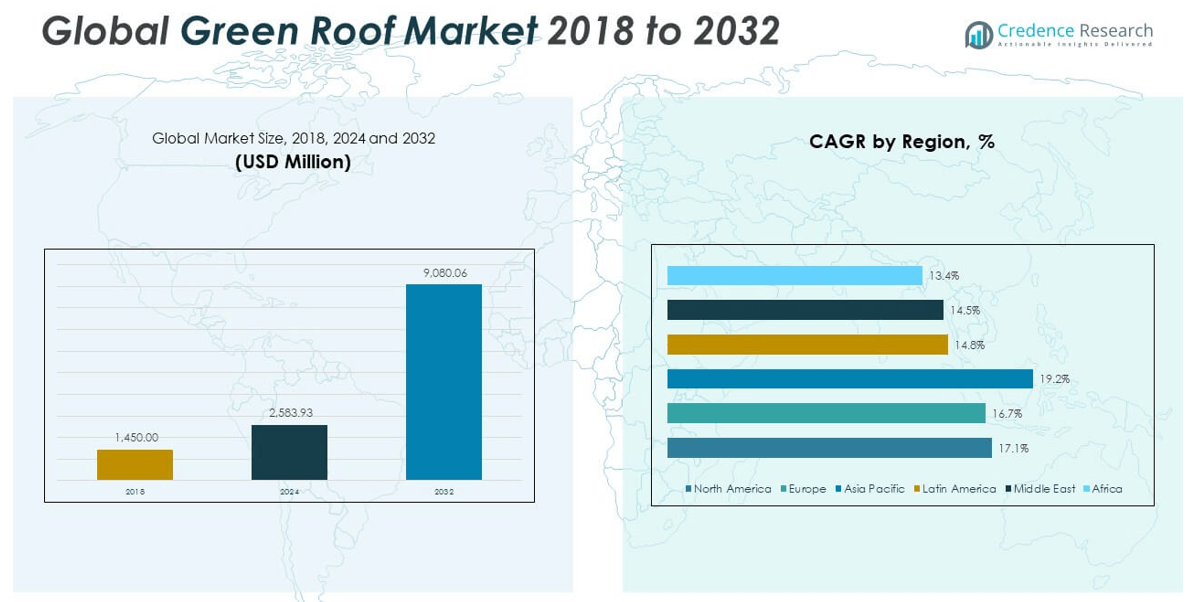

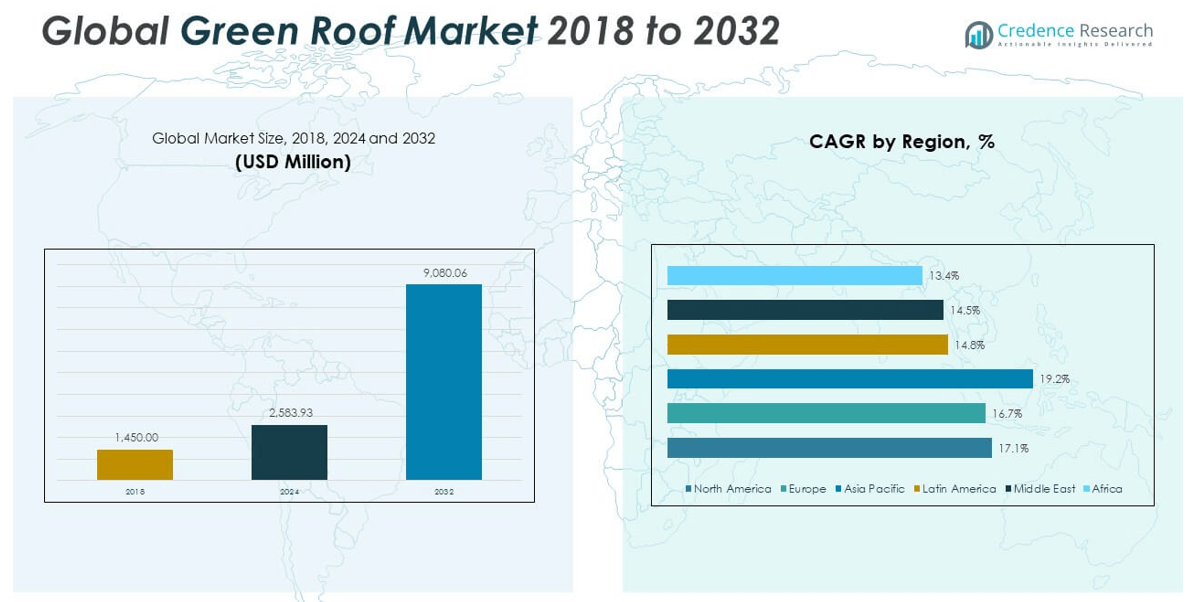

The Global Green Roof Market size was valued at USD 1,450.00 million in 2018 to USD 2,583.93 million in 2024 and is anticipated to reach USD 9,080.06 million by 2032, at a CAGR of 17.04% during the forecast period.

Several factors are propelling the green roof market forward. Urbanization is intensifying heat island effects, stormwater runoff, and air pollution—challenges that green roofs effectively mitigate. These systems improve building insulation, lower rooftop temperatures, and reduce rainwater discharge. In many regions, governments are mandating or incentivizing green roof installations. Cities such as Basel, Hamburg, Toronto, and San Francisco have enacted policies that promote or require green roofs on new and retrofitted buildings. Financial incentives, tax rebates, and alignment with global green building certifications are making green roofs more economically attractive to developers. At the same time, organizations are turning to these systems to meet environmental, social, and governance (ESG) targets, reduce operational energy consumption, and enhance building aesthetics. Technological advancements—including modular green roof kits, lightweight substrates, and integrated irrigation systems—are also making installations easier, faster, and more scalable.

Regionally, Europe dominates the green roof market, led by early adoption and consistent regulatory support. Countries like Germany, Switzerland, and the Netherlands are recognized for their long-standing commitment to urban greening. Basel was among the first cities to make green roofs compulsory on new buildings, setting a global precedent. North America holds a substantial share of the market, supported by proactive city policies in New York, Chicago, and Toronto, where stormwater management and energy efficiency programs are driving large-scale adoption. Asia-Pacific is emerging as the fastest-growing region due to expanding urban development and rising environmental awareness. Countries such as China, Japan, and Singapore are integrating green roofs into national sustainability agendas and smart city initiatives. In Latin America, the Middle East, and Africa, market activity is gradually increasing as public and private sectors begin to explore the ecological and economic benefits of green roofing. Pilot programs and regulatory shifts in Brazil, the UAE, and South Africa point to new opportunities for growth in these emerging regions.

Market Insights:

- The Global Green Roof Market grew from USD 1,450 million in 2018 to USD 2,583.93 million in 2024 and is projected to reach USD 9,080.06 million by 2032, at a CAGR of 17.04%.

- Urban heat and flooding concerns are driving green roof adoption as cities seek to reduce surface temperatures and manage stormwater runoff.

- Government policies in cities like Basel, Toronto, and New York mandate or incentivize green roofs through tax rebates, grants, and zoning benefits.

- Rising energy costs and sustainability standards are encouraging developers to adopt green roofs for insulation and to achieve green building certifications.

- Businesses are installing green roofs to meet ESG targets, reduce emissions, enhance air quality, and improve workplace environments.

- High installation costs and structural retrofit requirements limit adoption, especially in older buildings and among small-scale developers.

- Europe leads in market share due to early regulation, while Asia-Pacific is the fastest-growing region with active initiatives in China, Japan, and Singapore.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Urban Heat Island Mitigation and Climate Resilience Strategies Drive Adoption:

Urban centers continue to expand, intensifying environmental stressors such as elevated temperatures and flash flooding. Green roofs play a critical role in mitigating the urban heat island effect by lowering surface and ambient temperatures. These systems help cities manage extreme heat while improving thermal comfort for buildings. Their vegetation layers also support climate resilience by absorbing and slowing stormwater runoff, reducing strain on municipal drainage systems. The Global Green Roof Market benefits from rising demand in cities looking to enhance livability and reduce climate-related vulnerabilities. It supports broader goals of sustainable urban development by integrating ecological functions into building design.

- For instance, the green roof installed by Columbia University on its Manhattanville campus reduced roof surface temperatures by up to 30°C (54°F) during peak summer compared to conventional roofs, and captured more than 1.5 million gallons of stormwater annually, easing pressure on New York City’s drainage system.

Government Regulations and Incentive Frameworks Accelerate Implementation:

National and municipal governments are establishing mandates and offering incentives to support green roofing projects. Policy initiatives in cities such as Basel, Toronto, and New York require green roofs on certain types of new construction or offer financial rebates for installations. These frameworks encourage developers to adopt green infrastructure while reducing long-term operating costs. Government-backed programs often include tax credits, density bonuses, or grants, making green roofs financially viable for commercial and residential projects. The Global Green Roof Market gains momentum from this policy alignment, especially in regions with mature green building codes. It benefits from legal instruments that position green roofs as essential components of sustainable construction practices.

- For instance, Toronto’s Green Roof Bylaw led to the installation of over 500 green roofs totaling more than 500,000 square meters by 2022, with the City of Toronto providing up to $100 per square meter in financial incentives for eligible projects.

Energy Efficiency Demands and Building Performance Requirements Support Market Growth:

Rising energy costs and tighter performance standards are prompting developers and property owners to invest in energy-efficient solutions. Green roofs provide effective insulation, reduce air conditioning loads, and contribute to overall energy conservation. Their thermal mass and vegetative cover help maintain indoor temperatures, improving HVAC system efficiency. In commercial real estate, these benefits support LEED and BREEAM certifications, which drive property value and tenant demand. The Global Green Roof Market responds to the need for low-energy design strategies across urban construction projects. It aligns with broader trends in green architecture and net-zero energy initiatives.

Corporate Sustainability Goals and ESG Commitments Fuel Commercial Sector Demand:

Businesses are adopting sustainability practices to meet environmental, social, and governance (ESG) criteria and improve public perception. Green roofs enhance a company’s environmental credentials by promoting biodiversity, improving air quality, and reducing carbon footprints. These systems support workplace wellness, provide recreational rooftop spaces, and align with employee engagement programs. Multinational firms are integrating green infrastructure into new headquarters and existing assets to meet internal carbon reduction targets. The Global Green Roof Market benefits from this corporate demand for visible, measurable sustainability outcomes. It enables organizations to demonstrate environmental leadership while complying with evolving ESG disclosure standards.

Market Trends:

Integration of Smart Monitoring Technologies Enhances Roof Performance and Maintenance:

The adoption of IoT and sensor-based technologies is transforming green roof systems into smart infrastructure. Developers and facility managers are embedding sensors that track soil moisture, temperature, humidity, and plant health in real time. These tools optimize irrigation cycles, reduce water waste, and ensure vegetation viability across seasons. Automated alerts allow for predictive maintenance, lowering long-term operational costs and minimizing manual inspections. The Global Green Roof Market is witnessing increased integration of digital tools that support data-driven management. It reflects a growing shift toward intelligent green building solutions aligned with smart city development goals.

- For instance, Optigrün’s Smart Flow Control system, deployed on several European commercial buildings, uses real-time weather and moisture sensors to reduce irrigation water usage by up to 30% while maintaining optimal plant health, and has demonstrated a 20% reduction in manual maintenance interventions.

Expansion of Modular and Prefabricated Green Roof Systems Simplifies Installation:

Manufacturers are developing modular systems that streamline installation and reduce structural load concerns. These prefabricated units come with integrated drainage, substrate, and vegetation layers, allowing faster deployment across diverse roof types. They appeal to contractors working on retrofit projects or lightweight structures with limited load-bearing capacity. The simplified logistics and reduced installation time support wider adoption in urban areas with tight construction timelines. The Global Green Roof Market is leveraging these modular innovations to address scalability challenges and expand reach beyond high-end developments. It enables flexible configurations suited for both small-scale and large commercial applications.

- For example, ZinCo’s modular green roof solutions allow for installation on steep or low-load roofs, with build-up heights of 80–120 mm and saturated weights as low as 60–155 kg/m², making them suitable for a wide range of urban applications.

Use of Native and Drought-Resistant Plant Species Gains Preference:

Designers and horticulturists are increasingly selecting plant species that reflect local climates and require minimal maintenance. Native vegetation enhances ecological compatibility and supports urban biodiversity, including pollinators and bird species. Drought-resistant plants reduce reliance on irrigation systems, particularly in regions facing water scarcity or seasonal heatwaves. This approach improves long-term sustainability while aligning with regional green building standards. The Global Green Roof Market is responding to ecological design principles by promoting climate-adapted species and low-impact horticulture practices. It reflects a growing demand for systems that combine aesthetics with environmental responsibility.

Incorporation of Multi-Functional Rooftop Spaces Encourages Broader Utilization:

Property developers are reimagining rooftops as active, multi-functional environments that go beyond ecological performance. Green roofs are being integrated with rooftop gardens, social areas, event spaces, and urban farms to maximize utility. These spaces enhance tenant experience, increase property value, and support wellness initiatives in residential and commercial buildings. Hotels, office complexes, and mixed-use developments are using green roofs as part of amenity packages to differentiate offerings. The Global Green Roof Market is evolving to accommodate design features that serve both functional and social purposes. It reflects a broader trend toward human-centric and livable urban infrastructure.

Market Challenges Analysis:

High Initial Installation Costs and Structural Load Limitations Restrict Adoption:

The upfront cost of installing green roofs remains a major barrier for widespread adoption, particularly in cost-sensitive markets. Expenses related to waterproofing, drainage systems, structural reinforcements, and high-quality vegetation increase the overall capital investment compared to traditional roofing. Many existing buildings lack the structural capacity to support green roof systems without significant retrofitting, which further elevates costs. Budget constraints often deter small-scale developers and residential property owners from pursuing these solutions. The Global Green Roof Market faces resistance from segments unable to justify the return on investment despite long-term savings in energy and maintenance. It requires more accessible financing models and structural innovations to support broader market penetration.

Limited Technical Expertise and Maintenance Knowledge Impede Long-Term Performance:

Green roofs demand specialized knowledge in design, horticulture, irrigation, and maintenance to function effectively over time. Many regions lack qualified professionals with interdisciplinary expertise to implement and manage these systems. Poor installation or inadequate maintenance can lead to water leakage, plant failure, or structural damage, eroding user confidence and driving reluctance among building owners. Inconsistent standards across countries also complicate training and certification, creating knowledge gaps in emerging markets. The Global Green Roof Market must address workforce development challenges and build technical capacity to ensure system reliability. It depends on industry-wide collaboration to establish standardized guidelines and expand access to expert services.

Market Opportunities:

Rising Demand from Emerging Economies Creates New Growth Potential:

Urbanization and climate vulnerability in emerging economies are opening untapped markets for green roof solutions. Cities across Asia, Latin America, and the Middle East are seeking scalable infrastructure to manage heat, flooding, and air quality challenges. Governments are beginning to implement sustainability frameworks, offering a favorable policy environment for adoption. The Global Green Roof Market can expand its footprint by offering affordable, adaptable systems suited to local conditions. It holds significant potential in retrofitting public buildings, transport hubs, and housing developments. Partnerships with local contractors and urban planners will be critical for market entry and long-term growth.

Integration with Net-Zero and Circular Construction Accelerates Relevance:

The push for net-zero energy buildings and circular economy principles creates new avenues for green roof integration. Developers are incorporating green roofs to improve energy performance, reduce lifecycle emissions, and enhance building certifications. Design firms are embedding these systems into holistic sustainability strategies, combining renewable energy, rainwater harvesting, and urban agriculture. The Global Green Roof Market aligns with global climate goals and ESG investment priorities. It presents a compelling case for institutional investors and public infrastructure projects aiming for low-carbon design. Demand will strengthen as more cities enforce green building mandates tied to climate adaptation.

Market Segmentation Analysis:

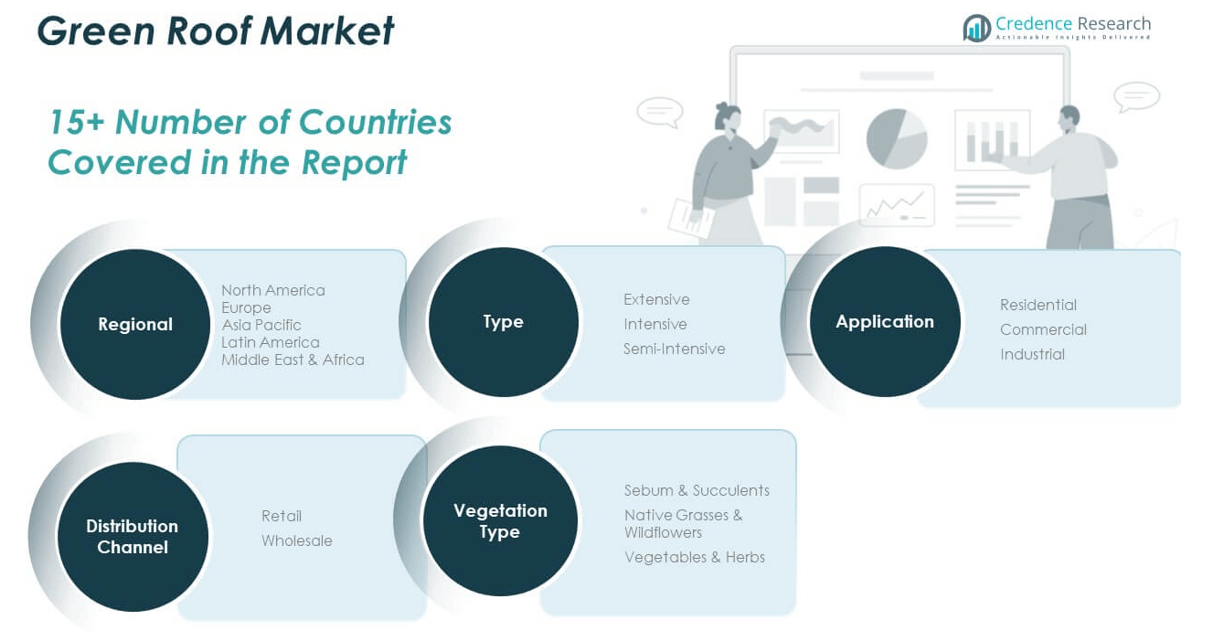

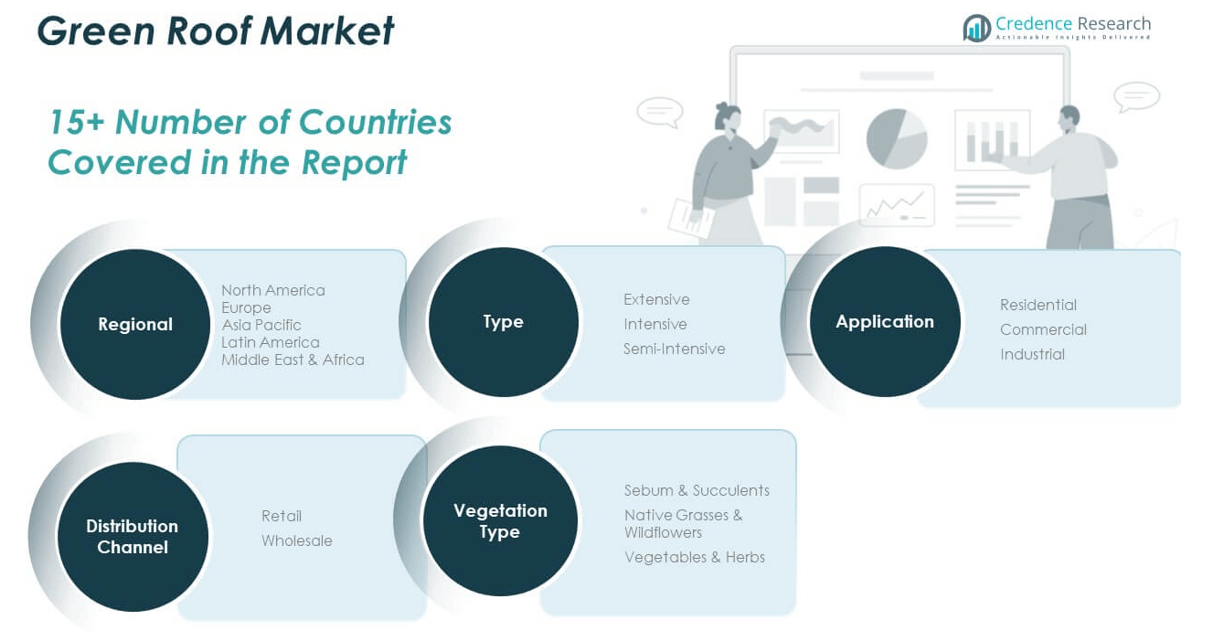

By Type

The extensive segment leads the Global Green Roof Market due to its lightweight design, lower cost, and ease of maintenance. It suits retrofitting and large-scale urban deployment. Intensive roofs, while supporting deeper vegetation and recreational use, demand higher structural load capacity and investment. Semi-intensive systems offer a hybrid approach, combining visual appeal with manageable maintenance requirements.

- For instance, Soprema’s Sopranature® extensive green roof systems are designed for lightweight installation (as low as 60 kg/m²), with substrate depths of 8–10 cm and minimal maintenance requirements, making them ideal for retrofitting and new construction alike.

By Application

Commercial buildings dominate adoption, driven by sustainability mandates, LEED certifications, and the need for operational efficiency. The residential segment is expanding, supported by urban policies and growing homeowner awareness. Industrial facilities are incorporating green roofs to reduce thermal loads and enhance site aesthetics, especially in logistics and manufacturing hubs.

- For instance, the Ford Rouge Truck Plant in Dearborn, Michigan, features a 10.4-acre (over 42,000 m²) living roof that has reduced the facility’s annual energy use by 7% and significantly decreased stormwater runoff, demonstrating large-scale environmental and operational benefits.

By Distribution Channel

Retail channels command a significant share due to increasing availability of prefabricated green roof kits and consumer-driven demand. Wholesale distribution supports large-scale installations through collaborations with landscape contractors, developers, and municipal infrastructure projects.

By Vegetation Type

Sebum & succulents are the most commonly used vegetation type, offering durability, minimal water requirements, and compatibility with shallow substrate systems. Native grasses & wildflowers are being adopted in regions promoting biodiversity and ecological integration. Vegetables & herbs occupy a smaller but growing share, aligned with urban farming initiatives and sustainability-focused developments.

Segmentation:

By Type Segment

- Extensive

- Intensive

- Semi-Intensive

By Application Segment

- Residential

- Commercial

- Industrial

By Distribution Channel Segment

By Vegetation Type Segment

- Sebum & Succulents

- Native Grasses & Wildflowers

- Vegetables & Herbs

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Green Roof Market size was valued at USD 164.14 million in 2018 to USD 281.12 million in 2024 and is anticipated to reach USD 983.39 million by 2032, at a CAGR of 17.1% during the forecast period. The Global Green Roof Market sees strong momentum in North America, driven by proactive urban sustainability policies and increasing public-private partnerships. Cities such as New York, Toronto, and Chicago have mandated or incentivized green roof installations to address stormwater runoff and urban heat islands. Adoption is rising across both commercial and institutional sectors, with property owners targeting LEED certification and long-term energy savings. The region benefits from established supply chains and advanced technologies that simplify installation. Demand for modular green roof systems continues to grow, especially in urban residential developments. North America currently holds an 11% market share and maintains steady growth through robust regulatory frameworks and expanding green infrastructure budgets.

Europe

The Europe Green Roof Market size was valued at USD 964.25 million in 2018 to USD 1,691.89 million in 2024 and is anticipated to reach USD 5,818.07 million by 2032, at a CAGR of 16.7% during the forecast period. Europe dominates the Global Green Roof Market with a 65% market share, supported by long-standing policy mandates and urban greening initiatives. Germany, Switzerland, and the Netherlands lead in both adoption rates and innovation. Basel, one of the earliest cities to enforce green roof requirements, set a strong precedent. Green roofing is embedded in municipal planning laws, supported by subsidies, density bonuses, and green building certifications. Commercial and public infrastructure segments continue to lead installations, followed by institutional and residential buildings. Europe benefits from mature ecosystems of suppliers, certified professionals, and research institutions advancing sustainable design standards.

Asia Pacific

The Asia Pacific Green Roof Market size was valued at USD 220.84 million in 2018 to USD 421.56 million in 2024 and is anticipated to reach USD 1,721.59 million by 2032, at a CAGR of 19.2% during the forecast period. The Global Green Roof Market is rapidly expanding in Asia Pacific, where smart city initiatives and environmental mandates support adoption. Countries like China, Japan, and Singapore have integrated green roofs into building codes and urban resilience plans. Rapid urbanization and rising environmental awareness are key drivers across the region. Municipalities in China are promoting rooftop greening to combat air pollution and mitigate flooding. In Japan, tax incentives and innovation in lightweight green roofing systems are fueling growth. Asia Pacific holds a 16% market share and is the fastest-growing region due to active government involvement and high-density urban construction.

Latin America

The Latin America Green Roof Market size was valued at USD 45.24 million in 2018 to USD 79.04 million in 2024 and is anticipated to reach USD 236.72 million by 2032, at a CAGR of 14.8% during the forecast period. The Global Green Roof Market in Latin America is gaining traction, supported by climate adaptation efforts and pilot projects in urban sustainability. Brazil and Mexico are emerging as early adopters, with green roofing projects tied to flood control and temperature regulation. Urban agriculture initiatives are also contributing to demand, particularly in densely populated cities. Local governments are evaluating policy frameworks to incentivize adoption. The commercial sector is leading growth, followed by municipal buildings and educational institutions. Latin America holds a 3% market share and presents long-term growth potential through regulatory alignment and public awareness campaigns.

Middle East

The Middle East Green Roof Market size was valued at USD 34.95 million in 2018 to USD 56.05 million in 2024 and is anticipated to reach USD 165.31 million by 2032, at a CAGR of 14.5% during the forecast period. The Global Green Roof Market is slowly evolving in the Middle East, where water conservation and thermal management are critical concerns. Countries like the UAE and Saudi Arabia are piloting rooftop greening as part of broader climate resilience and smart city strategies. Green roofs are being integrated into high-end commercial and government buildings to improve energy efficiency. Technological advancements in irrigation and drought-tolerant vegetation are helping address regional climate constraints. Public-private collaborations are emerging to promote sustainable architecture. The Middle East accounts for nearly 2% of the market and has untapped potential in arid climate innovation.

Africa

The Africa Green Roof Market size was valued at USD 20.59 million in 2018 to USD 54.27 million in 2024 and is anticipated to reach USD 154.99 million by 2032, at a CAGR of 13.4% during the forecast period. The Global Green Roof Market in Africa remains nascent but shows signs of steady development through localized sustainability efforts. South Africa leads regional growth, driven by environmental regulations and increasing demand for eco-friendly construction. Green roofs are being introduced in government buildings, urban schools, and mixed-use commercial developments. Budget constraints and limited technical expertise slow large-scale deployment. International development agencies and NGOs are supporting pilot installations and workforce training. Africa holds a 1% market share and will require capacity building, funding access, and education to accelerate broader adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Optigreen

- ZinCo (Germany)

- Sempergreen (Netherlands)

- Green Roof Blocks (USA)

- LiveRoof (USA)

- Tournesol Siteworks (USA)

- Xero Flor America (USA)

- Bauder (UK)

- Soprema (France)

- Vegetal i.D. (France)

- Roofmeadow (USA)

- American Hydrotech (USA)

- Carlisle Construction Materials (USA)

- Bonar (Netherlands)

- Extensive Lightweight Roofs (UK)

- Rooflite (USA)

- GAF (USA)

- Firestone Building Products (USA)

- Vitaroofs (Germany)

- Elmich (Singapore)

- Berkely Group (UK)

- Jorg Breuning (Germany)

Competitive Analysis:

The Global Green Roof Market is highly competitive, with a mix of established players and emerging innovators focusing on modular systems, advanced substrates, and integrated irrigation technologies. Leading companies such as Soprema, Optigrün International AG, ZinCo GmbH, and Sempergreen dominate through extensive product portfolios and strategic partnerships with architects, urban planners, and municipalities. It reflects strong competition in product customization, technical support, and sustainability certifications. Companies are investing in R&D to develop lightweight, scalable solutions suited for diverse climates and building types. Regional players are gaining traction through localized designs and cost-effective offerings tailored to specific urban needs. Mergers and acquisitions are shaping the competitive landscape, enabling firms to expand market reach and accelerate innovation. The market rewards firms with strong installation networks, training programs, and long-term maintenance capabilities. It continues to evolve through technological integration, design versatility, and growing collaboration between green building consultants and manufacturers.

Recent Developments:

- In April 2025, LiveRoof introduced the SolaGreen® Rack System, a breakthrough in bio-solar rooftop design. This system integrates photovoltaic solar panels with modular green roof technology, optimizing both energy production and green roof efficiency. The SolaGreen® Rack System is designed to enhance solar panel performance through rooftop cooling and qualifies for the U.S. Solar Investment Tax Credit, making it a compelling solution for sustainable building projects.

- In March 2025, Sempergreen showcased its latest innovation at Solar Solutions Amsterdam: a smart green roof system that integrates double-sided, vertically mounted solar panels with lightweight Sedum roofs. This new system, known as Over Easy Solar, allows for up to 40% more energy generation from rooftops by leveraging the cooling effect of vegetation to boost solar panel efficiency. The company also implemented this technology at its headquarters, achieving full energy neutrality with an annual generation of 9,360 kWh.

- In February 2024, ZinCo, a global leader in advanced green roof and solar systems, was acquired by Holcim, a major player in sustainable building solutions. This acquisition is set to strengthen Holcim’s position in innovative roofing systems, broadening the sustainable building envelope solutions available to customers worldwide. ZinCo will retain its brand identity post-acquisition, continuing its legacy of delivering sustainable roofing solutions for high-profile projects globally.

- In August 2024, Bauder announced the groundbreaking of its new 44,000-square-foot distribution center, set to open in Spring 2025. This facility will feature sustainable building design and significantly increase Bauder’s storage and logistics capacity, supporting its continued growth in the green roof and flat roof markets.

Market Concentration & Characteristics:

The Global Green Roof Market displays moderate market concentration, with a few key players holding significant influence while numerous regional firms serve niche applications. It features a mix of standardized modular systems and custom-engineered solutions tailored to climate, building type, and vegetation needs. Entry barriers remain moderate due to the need for specialized technical expertise, regulatory compliance, and capital investment in green infrastructure. The market is characterized by strong regulatory alignment, demand for energy-efficient construction, and increasing integration with smart city planning. It favors companies that offer full-service capabilities from design and installation to maintenance. Innovation in substrates, drainage systems, and plant selection continues to shape competitive dynamics. It responds actively to shifting environmental standards and urban sustainability goals, making adaptability a key trait among successful participants.

Report Coverage:

The research report offers an in-depth analysis based on type, application, distribution channel, and vegetation type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Urban expansion will drive demand for green roofs to manage heat islands and stormwater in densely built environments.

- Regulatory mandates and incentives will continue to promote installations across commercial and residential sectors.

- Technological innovation in lightweight substrates and modular systems will simplify installation and lower costs.

- Energy efficiency goals will encourage developers to adopt green roofs for improved thermal performance and HVAC savings.

- Growing ESG commitments will lead corporations to integrate green roofing into sustainability strategies.

- Advancements in irrigation and plant resilience will expand feasibility in arid and tropical regions.

- Integration with smart city and green infrastructure planning will strengthen public sector adoption.

- Urban agriculture and rooftop farming initiatives will create new use cases for food production.

- Increased awareness of biodiversity and environmental benefits will influence consumer and policymaker preferences.

- Global partnerships, R&D funding, and training programs will support market expansion in emerging regions.