Market Overview:

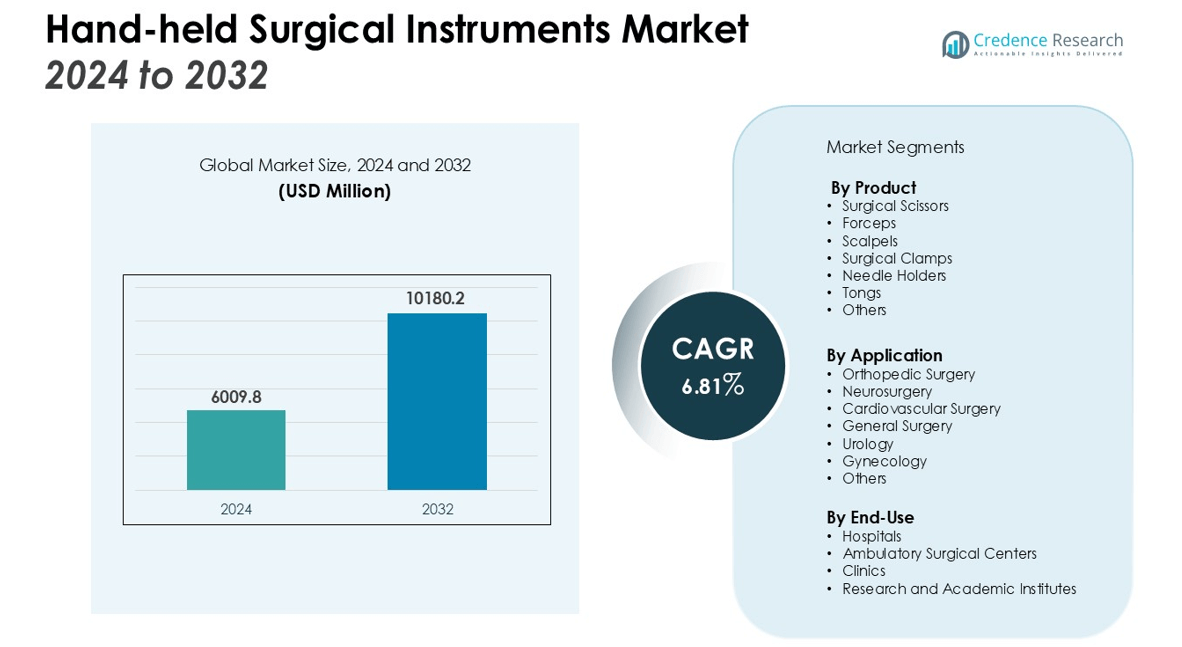

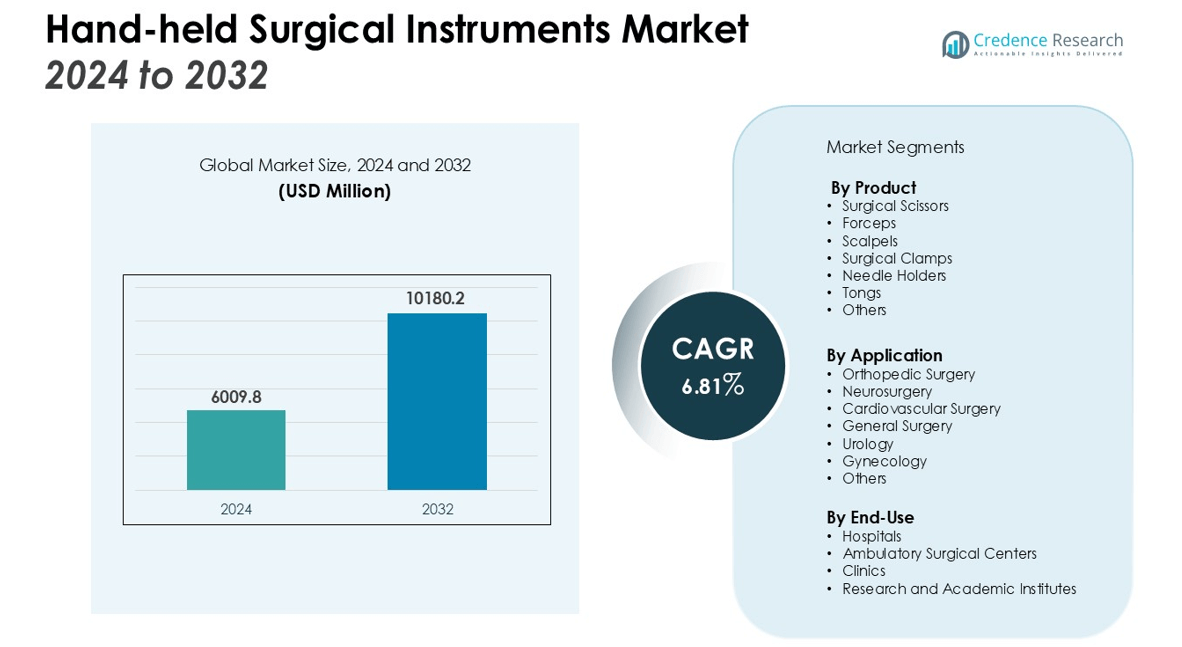

The Hand-held Surgical Instruments Market size was valued at USD 6009.8 million in 2024 and is anticipated to reach USD 10180.2 million by 2032, at a CAGR of 6.81% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hand-held Surgical Instruments Market Size 2024 |

USD 6009.8 million |

| Hand-held Surgical Instruments Market, CAGR |

6.81% |

| Hand-held Surgical Instruments Market Size 2032 |

USD 10180.2 million |

Key drivers of market growth include the growing geriatric population, the increasing incidence of surgeries, and the rising demand for precision and safety in surgical procedures. Moreover, technological advancements in hand-held surgical instruments, such as the integration of ergonomics, better precision, and enhanced durability, are anticipated to propel the market forward. Furthermore, rising healthcare investments and the shift toward outpatient surgeries are contributing to the increased demand for high-quality surgical instruments. The growing preference for minimally invasive procedures is also boosting the adoption of these instruments in various medical specialties.

Regionally, North America dominates the Handheld Surgical Instruments Market, accounting for the largest market share due to its advanced healthcare infrastructure and the high adoption rate of innovative surgical tools. Europe and Asia-Pacific are also expected to witness significant growth, driven by increasing healthcare expenditures and rising awareness of advanced surgical instruments in emerging economies. Additionally, the expanding medical tourism industry in Asia-Pacific is further accelerating market demand in the region.

Market Insights:

- The Hand-held Surgical Instruments Market was valued at USD 6009.8 million and is projected to reach USD 10180.2 million by 2032, growing at a CAGR of 6.81%.

- Key drivers include the growing geriatric population, increased surgical incidence, and the demand for precise, safe surgical procedures.

- Technological innovations in hand-held surgical tools, such as enhanced ergonomics and durability, are increasing the demand for precision in surgeries.

- The shift toward minimally invasive surgeries is driving the adoption of specialized hand-held instruments to improve control and reduce recovery times.

- Rising healthcare investments, particularly in emerging economies, are increasing access to advanced surgical tools and driving market expansion.

- High costs and regulatory challenges in global markets are limiting the widespread adoption of advanced surgical instruments, especially in developing regions.

- North America leads the market with 40% share, followed by Europe at 30%, and Asia-Pacific is growing rapidly, accounting for 20% due to healthcare investments and medical tourism.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Geriatric Population and Increasing Surgical Incidence

The Hand-held Surgical Instruments Market is significantly driven by the rising geriatric population, which often requires more frequent surgeries due to age-related health conditions such as cardiovascular diseases, orthopedic disorders, and neurological issues. As the global population ages, the need for precise surgical instruments grows, driving the demand for high-quality hand-held tools. Furthermore, the increasing incidence of surgeries, driven by both chronic diseases and lifestyle-related factors, has intensified the need for efficient and reliable surgical instruments in medical procedures across various specialties.

- For instance, the Radius Surgical System, a reusable hand-held instrument developed by Tuebingen Scientific for laparoscopy, had been successfully utilized in 260 clinical procedures, demonstrating its reliability in complex surgeries.

Technological Advancements and Demand for Precision

Technological advancements in hand-held surgical instruments are another key factor propelling market growth. Innovations that enhance precision, durability, and ergonomics in surgical tools have revolutionized the surgical field. Features such as better grip, lightweight designs, and enhanced durability are increasingly incorporated into surgical instruments, ensuring higher efficiency, safety, and comfort for both surgeons and patients. These innovations contribute significantly to the growth of the Hand-held Surgical Instruments Market by meeting the increasing demand for more advanced and effective surgical procedures.

- For instance, the Stryker SPY-PHI is a hand-held imaging device that uses a fluorescence imaging agent with an excitation light source to enable surgeons to visualize blood flow during surgery, operating with 1 near-infrared camera to enhance precision.

Shift Toward Minimally Invasive Surgeries

The shift toward minimally invasive surgeries (MIS) is accelerating the demand for hand-held surgical instruments. These procedures require specialized instruments that provide greater control and precision while minimizing incisions and recovery time. The preference for MIS across various medical fields, including orthopedics, cardiology, and neurosurgery, is fueling the growth of the market, as hand-held instruments are essential for conducting such surgeries with minimal complications.

Increased Healthcare Investments and Access to Advanced Surgical Tools

The growing investments in healthcare infrastructure across both developed and developing regions play a pivotal role in driving the Hand-held Surgical Instruments Market. Governments and private sectors are increasing funding for healthcare facilities, enabling them to adopt advanced surgical technologies. This influx of investment enhances access to high-quality surgical instruments, particularly in emerging economies, where there is a rising awareness of modern medical technologies.

Market Trends:

Shift Toward Enhanced Precision and Ergonomics in Surgical Tools

A notable trend in the Hand-held Surgical Instruments Market is the increasing demand for tools that offer enhanced precision and ergonomic design. Surgeons are increasingly adopting instruments that provide greater control, comfort, and safety during procedures. Tools with improved grip, reduced hand strain, and better maneuverability are becoming more prevalent, driven by advancements in material science and engineering. Ergonomically designed instruments help reduce fatigue during long procedures, enhancing surgeon performance and patient outcomes. Precision is also critical, especially in complex surgeries, prompting the development of instruments that allow for more accurate incisions, minimizing risks associated with human error.

- For instance, Vantedge Medical utilizes advanced CNC Swiss machining to produce intricate medical components, achieving extremely tight tolerances of ±0.0001 of an inch.

Rise in Demand for Single-Use Surgical Instruments

Another significant trend is the growing preference for single-use hand-held surgical instruments. The adoption of disposable surgical tools is gaining traction due to their ability to reduce the risk of cross-contamination, streamline sterilization processes, and eliminate the need for expensive reprocessing equipment. This trend is particularly strong in fields such as orthopedics, neurosurgery, and emergency surgeries, where the risk of infection is higher. The Hand-held Surgical Instruments Market is witnessing increased innovation in this segment, with manufacturers focusing on producing high-quality, affordable, and reliable disposable instruments to meet the growing demand in both developed and emerging healthcare settings.

- For instance, the Teleflex Weck EFx Shield® Fascial Closure System is supplied in units of 5 instruments per box, offering hospitals a ready-to-use, safety-enhanced product for efficient and standardized fascial closure in minimally invasive surgeries.

Market Challenges Analysis:

High Costs and Affordability Concerns

A significant challenge for the Hand-held Surgical Instruments Market is the high cost of advanced surgical tools, particularly in developing regions. While innovative instruments with enhanced precision and ergonomics offer significant benefits, their high price point limits accessibility for healthcare facilities with constrained budgets. This cost barrier can hinder widespread adoption, particularly in hospitals and clinics in emerging economies, where there is a greater reliance on cost-effective solutions. The market faces pressure to balance innovation with affordability to ensure broader adoption without compromising quality.

Regulatory Compliance and Standardization Issues

The Hand-held Surgical Instruments Market also grapples with stringent regulatory requirements and a lack of standardization in surgical tools. Regulatory bodies across regions impose strict guidelines to ensure safety and efficacy, which can lengthen the time-to-market for new products. Manufacturers must navigate complex regulatory environments to ensure compliance, adding layers of complexity to the development and distribution process. Additionally, the lack of uniformity in standards for surgical instruments across countries complicates the global expansion of companies, hindering the market’s overall growth potential.

Market Opportunities:

Expansion in Emerging Markets

The Hand-held Surgical Instruments Market holds significant growth potential in emerging markets, where increasing healthcare investments are driving the demand for advanced medical technologies. With the growing focus on improving healthcare infrastructure in regions such as Asia-Pacific, Latin America, and the Middle East, there is an opportunity for companies to expand their presence and cater to the rising demand for high-quality surgical instruments. These markets are witnessing improvements in surgical care, with increasing numbers of surgeries and greater access to advanced healthcare tools, creating opportunities for market players to offer cost-effective, durable solutions tailored to local needs.

Advancements in Minimally Invasive Surgery

The rise in minimally invasive surgeries (MIS) presents substantial growth opportunities for the Hand-held Surgical Instruments Market. As demand for these procedures increases, there is a greater need for specialized hand-held instruments that ensure precision and safety during surgery. MIS requires instruments that can access hard-to-reach areas with minimal incisions, driving the development of new technologies and designs. Companies that focus on creating innovative, high-performance instruments for these procedures stand to capture a larger share of the growing market. The shift toward outpatient care further emphasizes the need for smaller, more efficient surgical tools, opening avenues for innovation in this space.

Market Segmentation Analysis:

By Product

The market is primarily divided into surgical scissors, forceps, scalpels, and other hand-held surgical tools. Surgical scissors and forceps hold the largest market share due to their widespread use in various surgical procedures. The increasing demand for precision-driven instruments and innovations in these products are key drivers for their continued dominance in the market.

- For instance, Medtronic’s LigaSure™ Maryland jaw device is a multifunctional instrument capable of sealing vessels up to 7 mm in diameter, which helps ensure a reliable and permanent seal during procedures.

By Application

The market is segmented by application into orthopedic surgery, neurosurgery, cardiovascular surgery, and others. Orthopedic surgery is the leading application segment, driven by the high incidence of musculoskeletal disorders and the demand for precision tools for complex procedures. Neurosurgery follows closely due to the need for highly specialized instruments for brain and spinal surgeries.

- For instance, in orthopedics, Stryker’s Mako Robotic-Arm Assisted Surgery platform has been used in over 1 million procedures globally, aiding surgeons in executing precise bone cuts for joint replacement surgeries.

By End-Use

The end-use segment includes hospitals, ambulatory surgical centers, and others. Hospitals dominate the Hand-held Surgical Instruments Market, owing to their high surgical volumes and the demand for advanced, high-quality surgical tools. Ambulatory surgical centers are also growing, driven by the shift towards outpatient surgeries and minimally invasive procedures.

Segmentations:

By Product:

- Surgical Scissors

- Forceps

- Scalpels

- Surgical Clamps

- Needle Holders

- Tongs

- Others

By Application:

- Orthopedic Surgery

- Neurosurgery

- Cardiovascular Surgery

- General Surgery

- Urology

- Gynecology

- Others

By End-Use:

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Research and Academic Institutes

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Market Leader with Robust Healthcare Infrastructure

North America holds the largest share of the Hand-held Surgical Instruments Market, accounting for 40% of the global market. The region benefits from substantial investments in healthcare technologies, leading to widespread adoption of innovative hand-held surgical instruments across hospitals and outpatient facilities. The U.S. remains a key contributor, driven by its large number of surgeries performed annually and its commitment to providing state-of-the-art medical solutions. Strong regulatory frameworks and a high focus on patient safety further contribute to the market’s growth in this region.

Europe: Steady Growth Supported by Healthcare Advancements

Europe commands a significant portion of the Hand-held Surgical Instruments Market, with a share of 30%. The region’s healthcare system continues to evolve, with increasing emphasis on patient safety, minimally invasive surgeries, and technological advancements in medical devices. European governments are investing in healthcare modernization, resulting in greater access to high-quality surgical instruments. The demand for precision-driven surgical tools continues to rise, particularly in the fields of orthopedics, neurosurgery, and cardiology, supporting steady market growth in Europe.

Asia-Pacific: Expanding Market Fueled by Rising Healthcare Investments

Asia-Pacific accounts for 20% of the Hand-held Surgical Instruments Market, with rapid growth expected in the coming years. The region’s expanding medical infrastructure, driven by increased healthcare investments in countries like China, India, and Japan, is fostering higher adoption of advanced surgical technologies. The growing geriatric population, coupled with an increase in chronic diseases, is boosting the demand for surgical instruments. Moreover, the rise in medical tourism in countries such as India and Thailand, known for their cost-effective yet high-quality healthcare, is further driving the adoption of hand-held surgical instruments in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Integra LifeSciences Corporation

- Zimmer Biomet

- B. Braun Melsungen AG

- Medtronic, plc.

- Smith & Nephew

- Thompson Surgical Instruments Inc.

- Johnson & Johnson Services, Inc.

- Aspen Surgical

- Zimmer Biomet Holdings

- Becton, Dickinson and Company

- CooperSurgical, Inc.

Competitive Analysis:

The Hand-held Surgical Instruments Market is highly competitive, with key players focusing on innovation, quality, and global expansion. Leading companies include Medtronic, Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG, and Smith & Nephew. These players dominate the market by offering a wide range of precision surgical instruments designed for various medical specialties, such as orthopedics, neurosurgery, and cardiovascular procedures. To stay ahead, they invest heavily in research and development, driving advancements in ergonomics, durability, and functionality of surgical tools. Strategic mergers and acquisitions further strengthen their market presence, enabling companies to diversify their product offerings and expand into new regions. Regional players are also increasing their footprint by providing affordable, high-quality instruments tailored to local needs. The competition in the Hand-held Surgical Instruments Market is intensifying as demand for minimally invasive surgeries and advanced surgical technologies continues to grow.

Recent Developments:

- In July 2025, Zimmer Biomet announced a strategic partnership with Getinge to distribute Getinge’s operating room products to Ambulatory Surgery Centers.

- In March 2025, Zimmer Biomet launched its ZBX™ Ambulatory Surgery Center solutions and presented its new Z1™ Triple-Taper Femoral Hip System at the AAOS Annual Meeting.

- In May 2025, Medtronic announced its intention to separate its Diabetes business into a new standalone company.

Market Concentration & Characteristics:

The Hand-held Surgical Instruments Market is moderately concentrated, with a few key players holding a significant share. Major companies such as Medtronic, Stryker, and Johnson & Johnson dominate the market, focusing on innovation and high-quality products to maintain competitive advantage. These companies lead through strong distribution networks, strategic partnerships, and consistent product development. However, regional players are gaining traction by offering cost-effective alternatives tailored to local market needs, particularly in emerging economies. The market is characterized by a high demand for precision-driven, ergonomically designed instruments, driving continuous innovation. Companies are increasingly focusing on expanding their product portfolios to include specialized tools for minimally invasive surgeries, a trend that is reshaping the competitive landscape. The presence of both established global players and emerging regional manufacturers contributes to a dynamic, competitive market environment.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for hand-held surgical instruments will continue to rise as the global geriatric population increases, leading to more frequent surgeries.

- Technological advancements will drive the development of more precise, ergonomic, and durable surgical tools to enhance surgeon efficiency and patient safety.

- The growing preference for minimally invasive surgeries will further boost the need for specialized hand-held instruments that offer greater control and precision.

- Emerging economies will witness significant growth as healthcare investments increase, improving access to advanced surgical tools.

- Hospitals will remain the largest end-use segment, but ambulatory surgical centers will see rapid growth due to the shift towards outpatient procedures.

- The orthopedic and neurosurgery applications will see strong demand, driven by the increasing prevalence of musculoskeletal disorders and neurological diseases.

- Increased focus on reducing healthcare costs will push for more affordable yet high-quality surgical instruments, particularly in developing regions.

- The integration of smart technologies, such as IoT and robotics, into surgical instruments will create new opportunities for innovation and enhanced surgical outcomes.

- North America and Europe will continue to dominate the market, while the Asia-Pacific region will experience rapid growth fueled by expanding medical infrastructure and rising healthcare awareness.

- Competitive dynamics will intensify, with both global and regional players focusing on product innovation, partnerships, and acquisitions to capture larger market shares.