Market Overview:

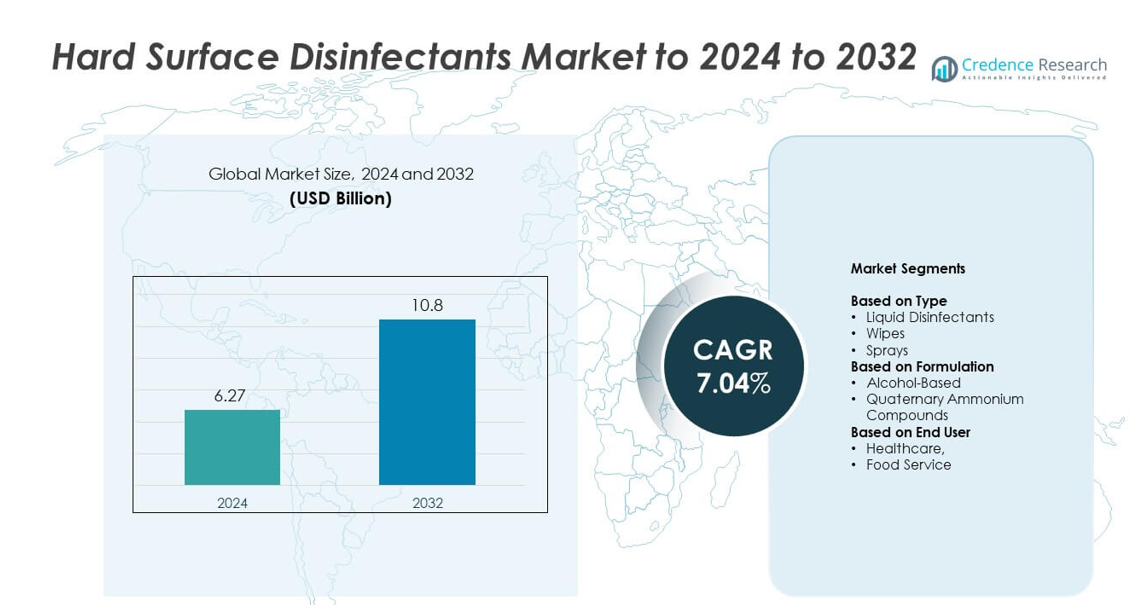

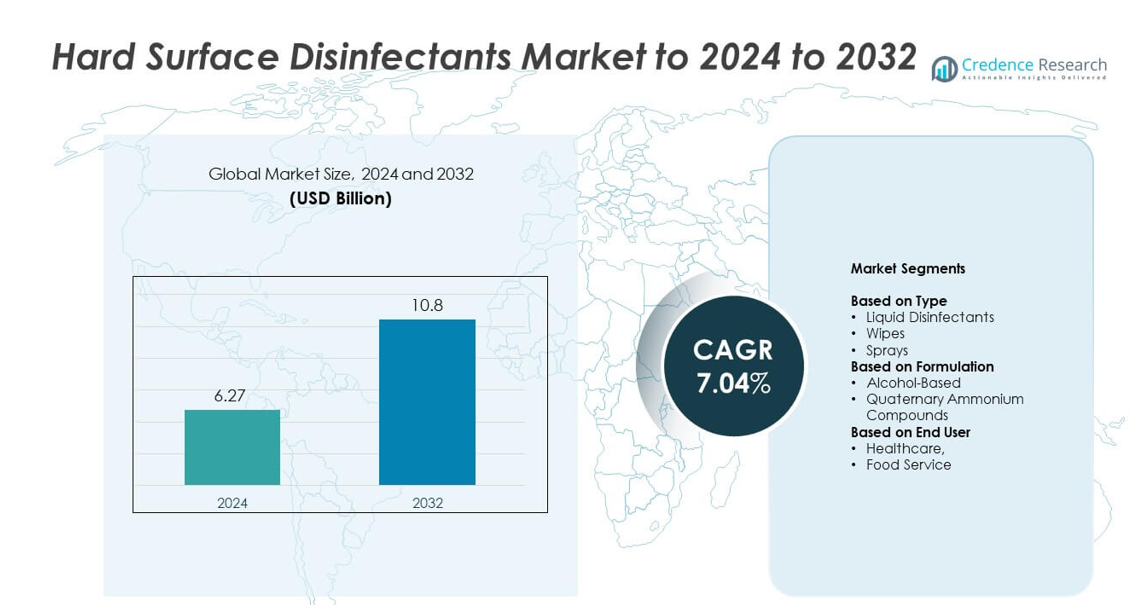

Hard Surface Disinfectants Market size was valued at USD 6.27 Billion in 2024 and is anticipated to reach USD 10.8 Billion by 2032, at a CAGR of 7.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hard Surface Disinfectants Market Size 2024 |

USD 6.27 Billion |

| Hard Surface Disinfectants Market, CAGR |

7.04% |

| Hard Surface Disinfectants Market Size 2032 |

USD 10.8 Billion |

The Hard Surface Disinfectants Market is shaped by major players such as Procter & Gamble, Metrex Research, GOJO Industries, 3M, Ecolab, The Clorox Company, Diversey, and Reckitt Benckiser, each expanding product portfolios to meet rising hygiene standards across healthcare, commercial, and food service environments. These companies compete through advanced formulations, broader pathogen coverage, and stronger sustainability features. North America leads the market with about 38% share due to strict infection-control rules and high institutional spending. Europe follows with nearly 29% share, while Asia Pacific remains the fastest-growing region with around 23% share driven by expanding healthcare and commercial infrastructure.

Market Insights

- The Hard Surface Disinfectants Market reached USD 6.27 Billion in 2024 and is projected to hit USD 10.8 Billion by 2032, growing at a CAGR of 7.04%.

- Strong demand from healthcare, food service, and commercial buildings drives market expansion as facilities increase routine disinfection of high-touch surfaces.

- Rising preference for eco-friendly and low-residue formulations shapes product development, while ready-to-use wipes and sprays show strong growth across consumer and institutional segments.

- Leading players compete through advanced formulations, broader pathogen coverage, and sustainable packaging, with liquid disinfectants holding about 51% share by type.

- North America leads the market with around 38% share, followed by Europe at about 29%, Asia Pacific at roughly 23%, Latin America at 6%, and Middle East & Africa at nearly 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Liquid disinfectants held the dominant position in 2024 with about 51% share due to wide use across hospitals, homes, laboratories, and food facilities. The liquid format supported fast coverage, deeper penetration on complex surfaces, and higher effectiveness against bacteria, fungi, and viruses. Wipes and sprays grew as users preferred convenient options for quick cleaning in homes, offices, and transport areas. Rising hygiene awareness in high-traffic locations and stronger safety rules across industries kept demand steady for all three type categories.

- For instance, around 30,000,000 Reckitt products are sold globally each day.

By Formulation

Alcohol-based formulations led the segment with nearly 57% share in 2024, supported by strong efficacy against a broad range of pathogens and rapid evaporation that reduces residue. These solutions remained standard in healthcare and commercial spaces due to compliance with global infection-control norms. Quaternary ammonium compounds expanded in food service, education, and hospitality settings because they offer longer-lasting action and material compatibility. Growth across both categories was driven by stricter sanitation protocols and increased facility-level disinfection routines.

- For instance, Ecolab holds over 15,000 patents for cleaning and sanitizing technologies worldwide.

By End User

Healthcare remained the largest end-user segment with around 46% share in 2024, driven by strict infection-prevention rules, high patient turnover, and constant sanitation needs in hospitals, clinics, and diagnostic centers. The segment benefited from continuous investments in hygiene compliance, surface sterilization, and multi-surface cleaning agents. Food service also grew due to rising food safety checks, regulatory audits, and demand for daily sanitation across kitchens, storage areas, and dining spaces. Increased focus on preventing cross-contamination supported higher consumption across both sectors.

Key Growth Drivers

Rising Infection Control Standards

Global healthcare systems continue to tighten sanitation rules to reduce hospital-acquired infections. Hospitals, clinics, and laboratories increase surface-level cleaning cycles to meet strict guidelines from health authorities. This shift boosts the need for high-efficiency liquid disinfectants, wipes, and sprays across critical care and general wards. Commercial buildings and public transport systems also raise hygiene benchmarks, which expands demand beyond medical settings. Growing focus on pathogen control keeps surface disinfection a priority for safety compliance.

- For instance, Solenis operates 78 manufacturing facilities across more than 160 countries globally

Growing Hygiene Awareness in Commercial Spaces

Workplaces, retail outlets, airports, and hotels now adopt structured cleaning routines to protect staff and visitors. Rising public attention on germ transmission encourages businesses to invest in regular disinfection of high-touch areas like counters, door handles, and restrooms. Facility managers prefer ready-to-use solutions that reduce labor time and maintain consistent hygiene results. This shift in behavior strengthens adoption across sectors with high foot traffic. Increased awareness supports sustained volume growth across multiple disinfectant types.

- For instance, Marriott International manages over 9,300 properties spread across 144 countries and territories.

Expansion of Food Safety Regulations

Food processing units and restaurants face stronger checks on cleanliness and contamination control. National authorities enforce strict sanitation rules to prevent microbial risks across preparation, packaging, and serving zones. These requirements drive higher usage of surface disinfectants that meet food-contact safety norms. Kitchens and storage spaces depend on fast-acting formulations to maintain daily compliance. Rising demand for safer dining environments ensures continuous market expansion.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Low-Toxin Products

Users in healthcare and hospitality increasingly seek disinfectants with reduced chemical load and improved material safety. Manufacturers respond by developing biodegradable, plant-based, and low-odor options that support sustainability goals. Demand rises for products that maintain strong microbial kill rates without harsh residues. Green-label certifications help brands gain traction across sensitive environments such as schools and daycare centers. This trend opens strong opportunities for innovation in non-corrosive and environmentally sound formulations.

- For instance, Seventh Generation supports the EPA’s Safer Choice program, which has labeled over 2,000 products, with total product volume reaching 2.4 billion pounds in 2024.

Growing Adoption of Ready-to-Use Wipes and Sprays

Convenience drives uptake of single-use wipes and quick-action sprays across offices, transport hubs, and homes. These formats support rapid cleaning of high-touch surfaces without dilution or preparation. Rising remote and hybrid work models also increase household demand for simple disinfection tools. Brands enhance portability and packaging to meet on-the-go use cases. Continued preference for hassle-free options creates growth opportunities in consumer and commercial sectors.

- For instance, Kimberly-Clark owned approximately 79 production facilitiesas of December 31, 2024, located across 33 countries with manufacturing operations.

Integration of Automated and Touchless Disinfection Solutions

Facilities with large footfall explore automated systems such as electrostatic sprayers and touchless dispensers for consistent coverage. These technologies reduce manual labor and improve safety during routine cleaning. Adoption grows in hospitals, airports, and retail chains aiming for higher operational efficiency. Technology-driven solutions also allow more uniform delivery of disinfectant across complex surfaces. This trend opens new revenue prospects for companies investing in smart cleaning systems.

Key Challenges

Health and Environmental Concerns

Frequent use of strong chemical disinfectants raises concerns about respiratory irritation, skin sensitivity, and ecological impact. Several agents leave harmful residues that affect indoor air quality and surface materials. Regulatory bodies now scrutinize formulations for long-term health effects. Manufacturers must balance antimicrobial strength with safer chemical profiles. These concerns create pressure to reformulate products without reducing effectiveness.

Supply Chain and Raw Material Volatility

Producers face fluctuating availability of alcohols, quaternary compounds, and specialty chemicals needed for large-scale production. Disruptions in global logistics increase cost pressure and lead to inconsistent supply for institutional buyers. Sudden demand spikes strain inventories and create gaps in distribution networks. Companies must build resilient sourcing strategies to stabilize production. Managing raw material risk remains a major challenge for market players.

Regional Analysis

North America

North America held the largest share of about 38% in 2024 due to strong demand from hospitals, laboratories, and commercial buildings that follow strict infection-control rules. Healthcare systems increased the use of liquid disinfectants and wipes to meet regulatory standards, while large retail chains and airports adopted frequent surface cleaning. High consumer awareness also supported product use in households. Growing investments in healthcare infrastructure and compliance-focused cleaning practices kept the region dominant.

Europe

Europe accounted for nearly 29% share in 2024, supported by stringent hygiene regulations across healthcare, food service, and public facilities. Hospitals and elderly-care centers adopted high-efficacy formulations to meet regional safety frameworks. Schools, offices, and transport networks expanded disinfection routines, which boosted demand for ready-to-use sprays and wipes. Rising focus on low-toxicity and sustainable products encouraged manufacturers to introduce greener alternatives. Strong regulatory oversight ensured stable growth across major economies.

Asia Pacific

Asia Pacific captured around 23% share in 2024 and remained the fastest-growing region due to expanding healthcare systems and rising sanitation awareness in densely populated cities. Hospitals, clinics, and food service outlets increased surface cleaning frequency to reduce infection risks. Rapid urbanization and growth in commercial spaces strengthened consumption of liquid disinfectants and convenient wipes. Government-led hygiene campaigns further pushed market penetration. Strong manufacturing capacity also supported wider product availability across the region.

Latin America

Latin America held about 6% share in 2024, driven by rising adoption of hygiene practices across hospitals, diagnostic centers, and food service chains. Urban areas with high foot traffic increased demand for affordable disinfectant liquids and sprays. Public health programs promoted regular cleaning of schools and transport hubs, which supported market growth. Economic recovery in key countries improved spending on cleaning supplies. Expanding retail distribution helped broaden access to consumer-grade disinfectants.

Middle East & Africa

Middle East & Africa accounted for nearly 4% share in 2024, with demand influenced by growing hospital networks, large commercial complexes, and stricter sanitation rules in food service operations. Gulf countries invested heavily in healthcare facilities that require regular surface sterilization. Urban centers adopted more structured cleaning programs in malls, airports, and hotels. Limited awareness in rural areas slowed wider penetration, but rising infection-control efforts and expanding supply chains supported gradual market growth.

Market Segmentations:

By Type

- Liquid Disinfectants

- Wipes

- Sprays

By Formulation

- Alcohol-Based

- Quaternary Ammonium Compounds

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hard Surface Disinfectants Market features leading companies such as Procter & Gamble, Metrex Research, GOJO Industries, 3M, Ecolab, The Clorox Company, Diversey, and Reckitt Benckiser in its competitive landscape. Market competition remains strong as vendors expand product portfolios across liquid disinfectants, wipes, and spray formats to serve healthcare, food service, and commercial cleaning needs. Companies focus on improving formulation efficiency, reducing toxicity, and enhancing material compatibility to meet strict regulatory expectations. Innovation centers on faster kill times, broader pathogen coverage, and environmentally responsible solutions. Many players also increase investments in sustainable packaging and low-odor products to appeal to institutional and household buyers. Strategic moves such as supply chain strengthening, geographic expansion, and digital brand visibility help firms capture emerging opportunities. Growing demand from hospitals, retail networks, and public facilities keeps competitive pressure high, encouraging continuous product upgrades and certification-driven differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Diversey introduced Oxivir Three 64, a hospital-grade accelerated hydrogen peroxide disinfectant cleaner effective in three minutes against bacteria, viruses, and fungi.

- In 2024, Ecolab introduced Disinfectant 1 Wipe, the first EPA-registered 100% plastic-free degradable wipe providing 1-minute hospital disinfection.

- In 2022, Reckitt Benckiser partnered with Essity to launch a co-branded Dettol and Tork disinfection range for professional hygiene, available from January 2023 in select European markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Formulation, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as healthcare systems strengthen infection-control routines worldwide.

- Commercial buildings will increase spending on daily surface sanitation programs.

- Eco-friendly and low-toxicity disinfectants will gain wider acceptance across sectors.

- Ready-to-use wipes and spray formats will see strong adoption for quick cleaning.

- Automation and touchless disinfection technologies will expand in high-traffic facilities.

- Food service operators will continue prioritizing strict sanitation to meet safety rules.

- Manufacturers will invest in safer formulations with improved material compatibility.

- Distribution networks will broaden to support rising household and commercial demand.

- Regulatory bodies will push companies to upgrade product safety and transparency.

- Emerging markets will drive future growth due to rising hygiene awareness and urbanization.