Market Overview

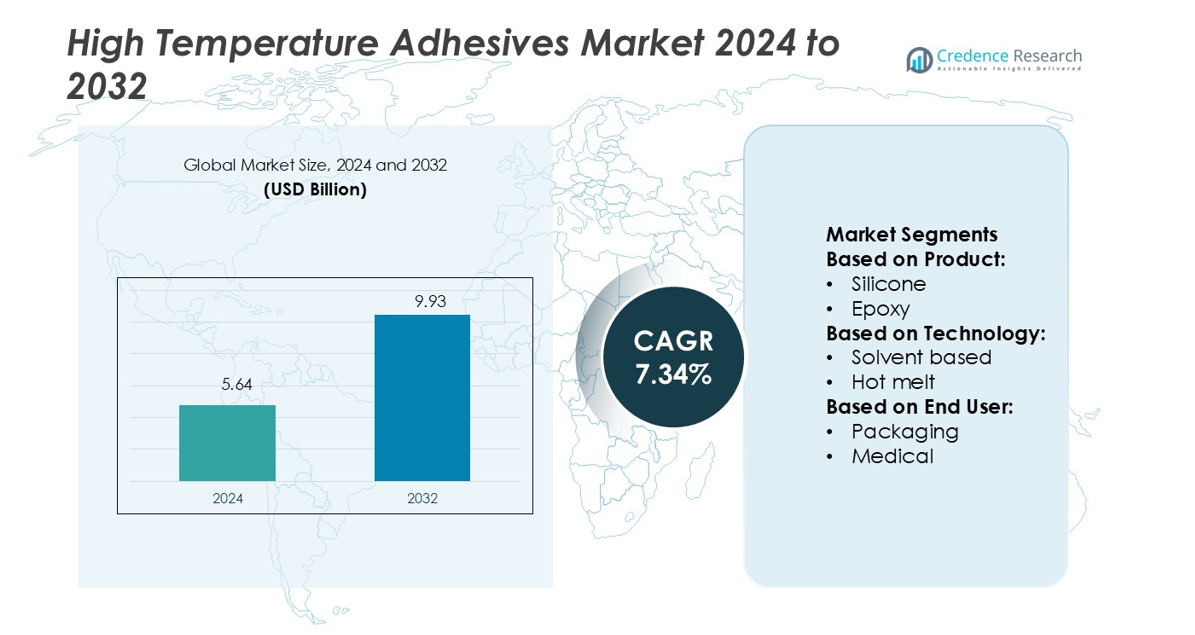

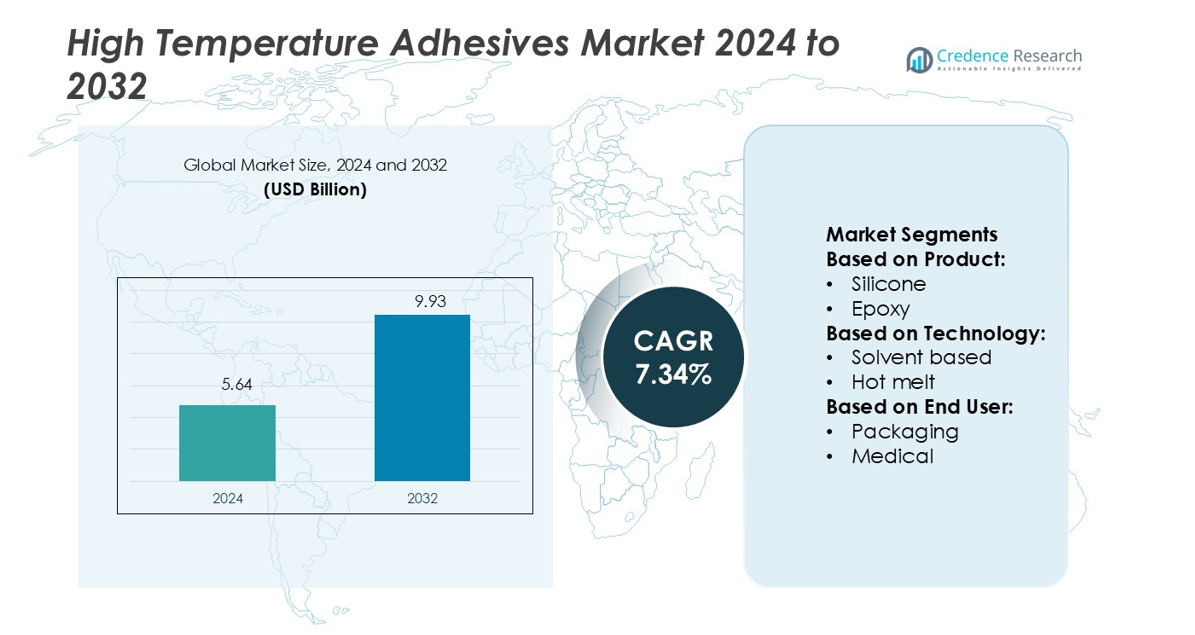

High Temperature Adhesives Market size was valued USD 5.64 billion in 2024 and is anticipated to reach USD 9.93 billion by 2032, at a CAGR of 7.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Temperature Adhesives Market Size 2024 |

USD 5.64 billion |

| High Temperature Adhesives Market, CAGR |

7.34% |

| High Temperature Adhesives Market Size 2032 |

USD 9.93 billion |

The high temperature adhesives market is shaped by leading players such as Wacker Chemie AG, Dow, Sika AG, Bostik, Jowat SE, 3M, Henkel AG & Co. KGaA, Ashland, Avery Dennison Corporation, and H.B. Fuller. These companies focus on expanding their product portfolios with advanced, heat-resistant formulations designed for automotive, aerospace, electronics, and construction applications. Strategic investments in R&D, sustainable adhesive solutions, and global distribution networks strengthen their market positions. North America leads the market with a 33.6% share, supported by strong industrial infrastructure, high adoption in transportation and electronics, and a favorable regulatory environment. This regional dominance is reinforced by technological innovation and the presence of major manufacturers.

Market Insights

- High Temperature Adhesives Market size was valued at USD 5.64 billion in 2024 and is expected to reach USD 9.93 billion by 2032, at a CAGR of 7.34%.

- Rising demand from automotive, aerospace, and electronics industries is driving market growth, supported by the need for lightweight and heat-resistant bonding solutions.

- The market is shaped by key players focusing on advanced product development, R&D investments, and sustainable adhesive formulations to strengthen their global presence.

- North America leads with a 33.6% regional share, followed by Asia Pacific with 29.2% and Europe with 27.4%, supported by strong industrial infrastructure and technological advancements.

- Silicone adhesives hold the dominant product segment share, supported by high thermal stability and wide application in engine assemblies, electronics, and construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Silicone adhesives dominate the high temperature adhesives market with the largest market share. Their strong thermal stability and resistance to temperatures exceeding 250 °C make them ideal for industrial applications. These adhesives are widely used in automotive and aerospace components, where thermal stress is high. Epoxy and polyurethane adhesives also gain traction due to their high bonding strength and durability. Increasing use in engine assembly, electronics encapsulation, and heat-resistant sealing further boosts adoption. Expanding industrial manufacturing and automotive production worldwide drives this segment’s growth.

- For instance, FLSmidth offers its HPGR Pro line with various models, including large-scale units with roll widths of 2,000 mm. An optional rotating side-plates upgrade for the HPGR Pro can yield up to 20% higher throughput and extend roll wear life by up to 30% under certain operating conditions.

By Technology

Reactive and other advanced technologies hold the leading share in the technology segment. Their ability to maintain structural integrity under extreme heat and harsh environments enhances performance in high-demand industries. These adhesives offer superior chemical resistance, thermal durability, and long-term bonding strength. Hot melt and solvent-based adhesives are also widely used for assembly and sealing processes. Rapid industrialization and the need for reliable high-performance adhesives in automotive, electronics, and aerospace manufacturing drive this segment’s expansion.

- For instance, Quintus Technologies’ press releases show their High-Pressure Processing (HPP) “QIF 400L” or “QIF 600L” vessels have a diameter of 47 cm (18.5 in), allowing larger product volumes per cycle. The QIF 150L model, intended for smaller-scale production, has a vessel diameter of 30.6 cm (12 in).

By End-User

Transportation is the dominant end-user segment in the high temperature adhesives market. The growing use of advanced adhesives in automotive engine parts, aerospace components, and high-speed rail manufacturing supports segment leadership. These adhesives replace traditional fasteners, reducing weight and improving thermal efficiency. Electrical and electronics also show significant growth, driven by rising demand for heat-resistant bonding in semiconductors and circuit assemblies. Expanding construction and packaging industries further contribute to market adoption, supported by technological advancements in adhesive formulations.

Key Growth Drivers

Expanding Industrial Applications

High temperature adhesives are gaining strong demand from automotive, aerospace, and electronics sectors. These adhesives provide thermal resistance above 250 °C, making them ideal for engine assemblies, turbine components, and semiconductor packaging. Manufacturers prefer these solutions to reduce component weight and improve energy efficiency. Their ability to replace mechanical fasteners improves structural integrity and performance. Rising investments in electric vehicles and advanced aircraft production further drive product adoption across global industries.

- For instance, Pulsemaster offers a range of PEF systems that apply microsecond high-voltage pulses. The company’s industrial products include systems with power ranges up to 100 kW and different processing capacities.

Advancements in Material Technology

Continuous innovations in silicone, epoxy, and polyurethane adhesives enhance bonding performance in harsh environments. New formulations offer improved chemical stability, flexibility, and long-term durability under extreme heat. Manufacturers are integrating nanotechnology and hybrid resin systems to meet specific industry standards. These advancements enable broader use in sensitive applications like medical devices, electronics, and renewable energy systems. Enhanced product performance directly supports market expansion in high-reliability industries.

- For instance, Stansted Fluid Power products production homogeniser unit with flow rates up to 375 L/h at pressures up to 58,000 psi (400 MPa), capable of CIP (Clean-in-Place) and SIP (Sterilization-in-Place) for easier maintenance.

Rising Demand for Lightweight and Energy-Efficient Solutions

Automotive and aerospace industries are increasingly adopting lightweight design practices to reduce emissions and energy use. High temperature adhesives allow the use of advanced composite materials without compromising strength or safety. Their heat resistance ensures structural stability in demanding operational conditions. This shift supports higher fuel efficiency and lower operational costs. Regulatory pressure to reduce carbon emissions further accelerates adhesive adoption in transportation manufacturing.

Key Trends & Opportunities

Growing Integration with Advanced Manufacturing

The rapid expansion of electric vehicles, 5G infrastructure, and automation boosts demand for heat-resistant adhesives. High-performance bonding solutions enable compact designs in EV battery systems and electronic assemblies. Automated dispensing systems improve application precision and reduce waste. As industries adopt smart factories and additive manufacturing, adhesive use in high-temperature applications continues to grow.

- For instance, Kobe Steel Ltd. manufactures high-pressure processing (HPP) systems with proven operational capacity at 686 MPa, specifically designed for food safety and preservation applications.

Shift Toward Eco-Friendly Formulations

Sustainability is shaping new opportunities in the adhesive industry. Companies are developing low-VOC, solvent-free, and bio-based adhesive formulations. These innovations help meet environmental regulations while maintaining high bonding performance. Rising adoption of green building standards and eco-friendly manufacturing enhances market growth potential. This shift aligns with global efforts toward carbon neutrality and cleaner production.

- For instance, Thyssenkrupp-Uhde’s HPP systems operate at pressures of 6,000 bar (≈ 600 MPa) during processing, applied via water‐filled vessels. In their “Uhde 700-60 TWIN” unit, throughput reaches over 3,200 kilograms per hour under those conditions.

Increasing Investment in Aerospace and Defense

Expanding defense budgets and commercial aircraft production create strong opportunities for high temperature adhesives. Lightweight, heat-resistant bonding materials reduce structural weight and enhance performance in high-speed aircraft and propulsion systems. Governments and OEMs are investing in next-generation composite materials, driving adhesive demand. This trend also supports domestic manufacturing initiatives in emerging economies.

Key Challenges

High Production and Material Costs

Advanced high temperature adhesives require expensive raw materials and specialized manufacturing processes. This increases production costs and limits adoption in cost-sensitive industries. High-performance formulations often involve strict quality control, further raising expenses. Price-sensitive end-users may opt for conventional bonding methods, slowing market penetration in some regions.

Performance Limitations Under Extreme Conditions

Although high temperature adhesives provide strong thermal resistance, they may face degradation in ultra-high temperature or chemically aggressive environments. Prolonged exposure can reduce bonding strength and durability, especially in critical aerospace or energy applications. Addressing these performance limits requires continuous R&D investment, which can be resource-intensive for smaller manufacturers.

Regional Analysis

North America

North America holds the largest share of the high temperature adhesives market at 33.6%. The region benefits from strong automotive, aerospace, and defense industries that demand advanced bonding solutions. The U.S. leads with extensive use in engine assemblies, turbine components, and electronics manufacturing. Rising investments in electric vehicles and renewable energy further support market growth. Companies are focusing on eco-friendly formulations to meet strict regulatory standards. Robust R&D infrastructure and the presence of leading manufacturers strengthen the region’s market position.

Europe

Europe accounts for 27.4% of the high temperature adhesives market. The region’s well-established automotive and aerospace sectors drive high demand for heat-resistant adhesives. Germany, France, and the U.K. lead in adopting advanced adhesive technologies for lightweight and energy-efficient applications. Strict environmental regulations encourage the development of low-VOC and solvent-free products. Ongoing innovations in green manufacturing and strong focus on sustainability further enhance market potential. Growing EV adoption and investments in high-performance materials also support steady market expansion across Europe.

Asia Pacific

Asia Pacific captures 29.2% of the high temperature adhesives market, driven by rapid industrialization and expanding manufacturing capacity. China, Japan, South Korea, and India are major contributors due to their strong automotive, electronics, and construction industries. Rising investments in EV production, 5G infrastructure, and renewable energy boost adhesive demand. The availability of cost-effective raw materials and growing local production strengthen the region’s competitive position. Increasing foreign investments and government incentives accelerate technological advancements, making Asia Pacific a fast-growing regional market.

Latin America

Latin America represents 5.6% of the high temperature adhesives market. Brazil and Mexico are key markets, supported by growing automotive production and infrastructure projects. Rising adoption of lightweight and durable bonding solutions in construction and transportation drives demand. The region is witnessing gradual technological upgrades, with industries shifting toward high-performance adhesive systems. Supportive government initiatives to modernize manufacturing and logistics are creating new opportunities. Although the market remains smaller compared to other regions, rising industrial activities signal steady growth.

Middle East & Africa

The Middle East & Africa holds a 4.2% share of the high temperature adhesives market. The region’s demand is mainly driven by infrastructure development, oil and gas projects, and increasing investments in transportation. The UAE and Saudi Arabia are leading markets due to large-scale industrial expansion. Growing interest in advanced construction materials and energy-efficient technologies is encouraging adhesive adoption. Partnerships with global manufacturers and technology transfers are improving local capabilities. Although the market is at an early stage, rising industrial diversification supports positive long-term growth.

Market Segmentations:

By Product:

By Technology:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The high temperature adhesives market is highly competitive, with major players including Wacker Chemie AG, Dow, Sika AG, Bostik, Jowat SE, 3M, Henkel AG & Co. KGaA, Ashland, Avery Dennison Corporation, and H.B. Fuller. The high temperature adhesives market features a competitive and innovation-driven landscape. Companies are focusing on enhancing adhesive performance to meet growing industrial needs in aerospace, automotive, electronics, and construction. Strategic initiatives such as mergers, acquisitions, and regional expansions strengthen their global presence. Many players are investing in advanced manufacturing technologies and sustainability-focused formulations to comply with environmental regulations. Innovation in silicone, epoxy, and polyurethane systems is enabling better thermal stability and durability. In addition, the integration of smart production techniques is improving product consistency and efficiency. This competitive environment encourages continuous product development and diversified applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wacker Chemie AG

- Dow

- Sika AG

- Bostik

- Jowat SE

- 3M

- Henkel AG & Co. KGaA

- Ashland

- Avery Dennison Corporation

- B. Fuller

Recent Developments

- In December 2024, Carlisle Companies Inc. announced that it has agreed to acquire the expanded polystyrene (EPS) insulation segment of PFB Holdco, Inc., a portfolio company of the Riverside Company.

- In October 2024, Knauf Insulation signed a deal with Texnopark, securing Texnopark’s Rock Mineral Wool insulation division. This acquisition includes a state-of-the-art Tashkent, Uzbekistan plant boasting electric melting technology that significantly reduces CO2 emissions during production.

- In October 2024, Bostik rolled out Born2Bond Ultra K85. The solution has been launched for product designers, design engineers, and manufacturers looking for providing an adhesive that offers resistance to high temperatures and humidity.

- In June 2023, Sherwin-Williams introduced a new line of Heat-Flex CUI-mitigation coatings. The line features Heat-Flex ACE (Advanced CUI Epoxy), an ultra-high-solids epoxy novolac with a specialized chemical enhancement for effective corrosion under insulation (CUI) mitigation

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong demand from automotive and aerospace industries.

- Advancements in material technology will enhance thermal resistance and bonding strength.

- Eco-friendly adhesive formulations will gain wider acceptance due to stricter regulations.

- Increased EV production will boost the use of high-performance adhesives.

- Electronics and semiconductor industries will adopt heat-resistant solutions at a faster pace.

- Automation in manufacturing will improve adhesive application efficiency.

- Strategic partnerships will expand global supply chains and production capacity.

- Infrastructure development will create new growth opportunities in emerging regions.

- Investment in R&D will accelerate product innovation and customization.

- Sustainable and lightweight bonding solutions will shape future market trends.