| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High-Performance Plastic Compounds Market Size 2024 |

USD 24,560.0 Million |

| High-Performance Plastic Compounds Market, CAGR |

9.10% |

| High-Performance Plastic Compounds Market Size 2032 |

USD 49,297.7 Million |

Market Overview:

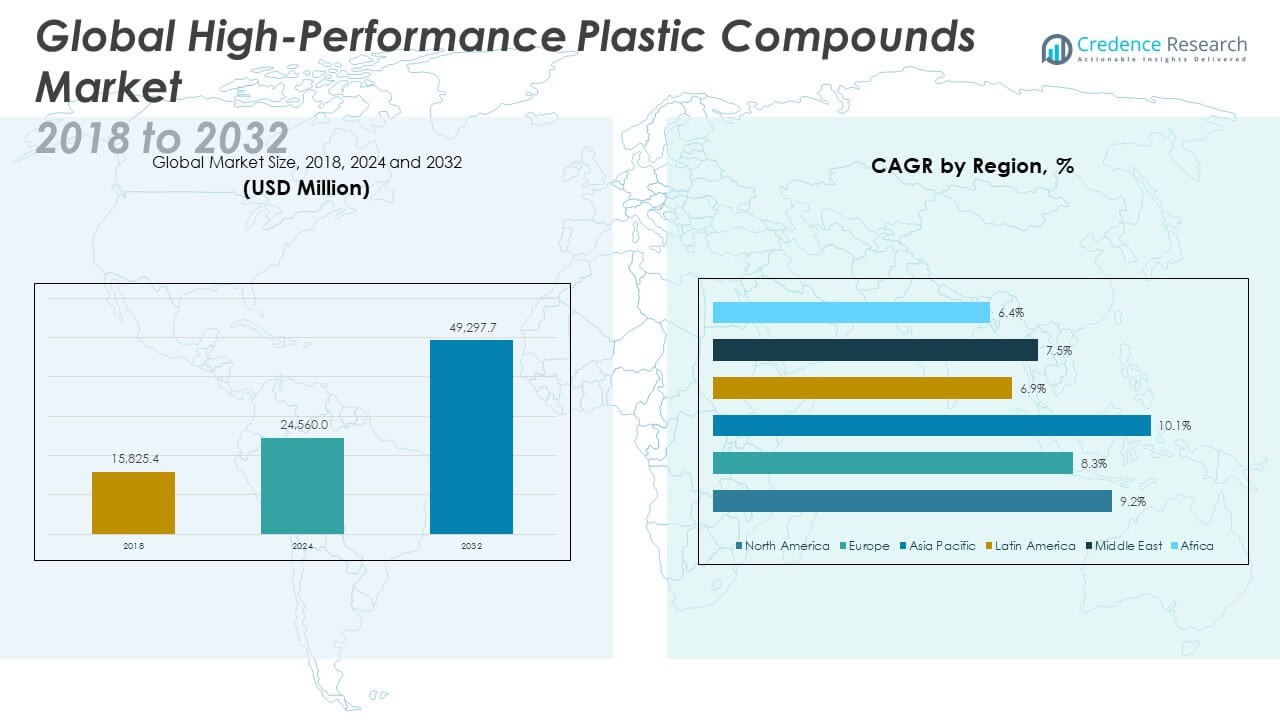

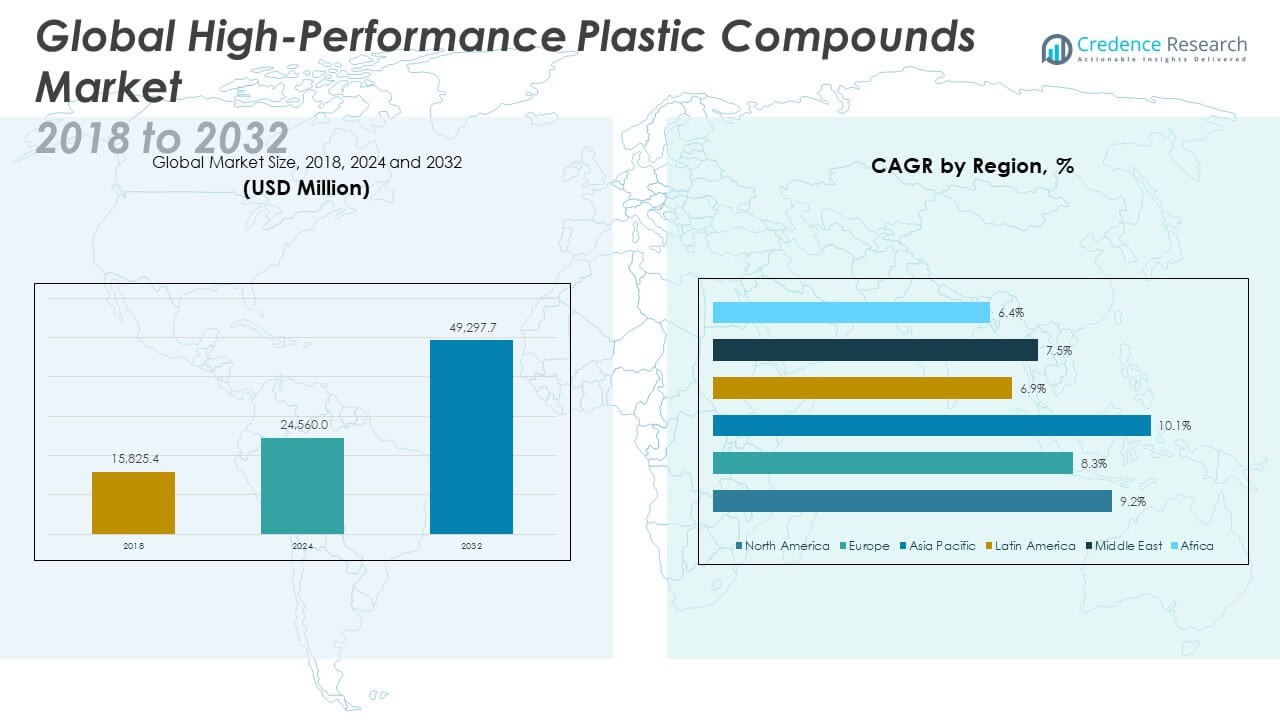

The High-Performance Plastic Compounds Market size was valued at USD 15,825.4 million in 2018 to USD 24,560.0 million in 2024 and is anticipated to reach USD 49,297.7 million by 2032, at a CAGR of 9.10% during the forecast period.

The high-performance plastic compounds market is gaining momentum due to the increasing demand from key sectors such as automotive, aerospace, electrical and electronics, and medical. Manufacturers are prioritizing lightweight materials that offer durability, thermal resistance, and mechanical strength, aligning with the growing trend of lightweighting in vehicle and aircraft production. The adoption of electric vehicles and the integration of advanced driver assistance systems are further accelerating the use of high-performance compounds. Moreover, innovations in compounding techniques, such as reinforced polymer blends and precision molding, are enhancing material performance and expanding their application base. In the medical sector, the need for biocompatible and chemically resistant plastics for surgical tools and diagnostic equipment continues to grow. Additionally, the push for environmentally friendly materials is prompting companies to explore recyclable and bio-based plastic compounds.

Regionally, the high-performance plastic compounds market exhibits varied dynamics. Asia Pacific dominates in terms of production and consumption, driven by a robust manufacturing base, increasing industrial output, and large-scale infrastructure projects. Countries like China, India, and South Korea are key contributors due to strong demand from automotive, electronics, and construction industries. North America follows with significant investments in research and development, supported by the region’s advanced aerospace, automotive, and healthcare sectors. Europe holds a mature market, backed by strict regulatory frameworks and a well-established automotive industry focused on sustainability and innovation. Latin America and the Middle East & Africa regions are gradually gaining traction due to expanding construction and industrial activities, along with rising investments in infrastructure. However, these regions face challenges related to technology access and raw material dependency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at USD 24,560.0 million in 2024 and is projected to reach USD 49,297.7 million by 2032, growing at a CAGR of 9.10%.

- Strong demand from automotive, aerospace, electronics, and medical industries is driving the shift toward lightweight, durable, and high-strength plastic compounds.

- Electric vehicle growth and the adoption of ADAS technologies are increasing the use of thermally stable and electrically insulating materials.

- Advancements in compounding techniques, such as polymer reinforcement and precision molding, are expanding the range of high-performance applications.

- Rising focus on sustainability is prompting manufacturers to invest in bio-based, recyclable, and energy-efficient plastic compounds.

- Asia Pacific dominates global production and consumption, while North America and Europe lead in innovation and regulatory compliance.

- Challenges such as high material costs, processing complexity, and raw material dependency in emerging regions are limiting broader market adoption.

Market Drivers:

Lightweighting Demands Across Transportation and Industrial Applications Boost Market Expansion

The High-Performance Plastic Compounds Market benefits from the growing demand for lightweight, durable materials in automotive, aerospace, and industrial applications. Automakers and aircraft manufacturers are replacing metal components with high-performance plastics to improve fuel efficiency, reduce emissions, and enhance design flexibility. It supports these goals by offering excellent mechanical strength, chemical resistance, and dimensional stability. Increased adoption of electric vehicles has further driven demand for heat-resistant and electrically insulating compounds in battery enclosures and motor components. The market is expanding as transportation sectors seek materials that combine lightweight properties with safety and performance standards. Manufacturers continue to develop formulations tailored to meet evolving industry specifications.

Advancements in Material Science and Compound Customization Drive Functional Integration

Material innovation plays a central role in driving the High-Performance Plastic Compounds Market. Research and development efforts are enabling the customization of compounds for precise end-use requirements, including flame retardancy, UV resistance, and enhanced mechanical behavior. It facilitates multi-functionality in critical sectors such as electronics and medical devices. Engineers can integrate these compounds into complex assemblies without compromising reliability or structural performance. The continuous evolution of polymer blends, fiber reinforcements, and specialty additives has elevated the functional appeal of high-performance plastics. Compounders are leveraging new processing technologies to ensure consistency and quality across high-volume production.

Healthcare and Electronics Sectors Propel Growth Through High Standards of Precision and Reliability

Healthcare and consumer electronics industries continue to create strong demand for high-performance compounds. These sectors require materials with excellent sterilization resistance, chemical inertness, and high purity for safe use in medical devices and electronic assemblies. The High-Performance Plastic Compounds Market is responding to stringent regulatory standards and consumer expectations for performance and safety. It enables device miniaturization and design flexibility while ensuring long-term durability in challenging environments. The surge in wearable technology, diagnostic tools, and minimally invasive equipment has accelerated the development of specialized thermoplastics and composites. Companies are investing in high-grade solutions to meet the reliability needs of these advanced applications.

- For instance, in electronics, DuPont’s Zytel® HTN FR52 non-halogen polyamide is used in USB Type-C connectors, providing superior flow rates for thin-wall molding (as little as 0.18 mm), low dielectric constant, and excellent dimensional stability, enabling device miniaturization and high data transmission rates.

Sustainability and Regulatory Pressure Accelerate Innovation in Bio-Based and Recyclable Compounds

Environmental concerns and shifting regulatory landscapes are driving a significant transition toward sustainable high-performance plastics. The market is experiencing increased interest in bio-based polymers, recyclable compounds, and closed-loop production practices. It supports corporate sustainability goals by offering alternatives to traditional petroleum-based materials without compromising performance. Manufacturers are scaling up circular economy models by integrating recycled content into compound production and reducing energy consumption in processing. Regulatory agencies are tightening controls on emissions and waste, prompting industries to adopt environmentally compliant materials. This momentum is encouraging innovation in green chemistry and expanding the market’s appeal to eco-conscious sectors.

- For instance, Arkema’s Rilsan® polyamides, derived from castor oil, have expanded into automotive fuel lines, offering greenhouse gas emission reductions of 60% versus petroleum-based PA11, with mechanical properties retained over 10 years of simulated service.

Market Trends:

Increased Integration of High-Performance Compounds in Electric and Hybrid Vehicle Manufacturing

The High-Performance Plastic Compounds Market is witnessing strong growth from the rapid expansion of electric and hybrid vehicle production. Automakers are integrating advanced polymers into powertrain components, battery housings, connectors, and cooling systems to reduce weight and enhance performance. It enables high voltage insulation, flame retardance, and thermal stability, which are essential in electric drivetrains. Demand for high-temperature resistant and low-outgassing materials has increased with the shift toward high-density battery packs. Companies are developing application-specific compounds that meet stringent automotive standards. This trend is reshaping supply chains and compelling manufacturers to innovate around mobility solutions.

- BASF’s high-performance thermoplastics, for example, are engineered with superior temperature and media resistance, excellent mechanical strength, and tailored flame retardance. These compounds are available with various fiber reinforcements and heat stabilizers, and can be easily processed via injection molding, eliminating the need for post-processing and enabling complex part designs for e-motor components.

Rise in Demand for Sustainable and Recyclable Plastic Compounds in Industrial Design

Sustainability goals are reshaping material selection across industries, fueling demand for recyclable and bio-based plastic compounds. The High-Performance Plastic Compounds Market is responding to regulatory and consumer pressure by accelerating the development of sustainable alternatives to conventional polymers. It supports circular economy models through closed-loop production systems and the use of post-consumer recycled content. Industries are prioritizing materials that offer low carbon footprints without sacrificing strength, heat resistance, or chemical stability. Brands are leveraging green certifications and eco-labels to position their products in environmentally conscious markets. This trend is strengthening the market’s alignment with long-term environmental objectives.

- SABIC, for instance, has launched new grades such as T2E-3320EH polypropylene and Xenoy T2NX2500UV/5230 PC/PET blends, each containing up to 29% mechanically recycled content. These grades are engineered as drop-in replacements for virgin materials in automotive body panels, trim, and HVAC components, maintaining high flow and UV stability.

Growing Application in Miniaturized and High-Frequency Electronic Components

The electronics sector is increasing its use of high-performance plastic compounds for compact, heat-sensitive, and precision-based components. These materials are vital in manufacturing circuit boards, connectors, sensors, and device casings where electrical insulation and dimensional stability are critical. The High-Performance Plastic Compounds Market enables the creation of lighter, more durable, and higher-functioning electronics that meet the demand for smart devices and automation systems. It supports thermal management and RF shielding in 5G and IoT hardware. The push toward miniaturization and multifunctionality is expanding opportunities for advanced polymer integration. Manufacturers are responding by developing customized grades for next-generation electronics.

Wider Adoption Across Medical Devices and Healthcare Applications

The healthcare sector is increasing adoption of high-performance plastic compounds for use in surgical instruments, diagnostic devices, implantable components, and drug delivery systems. These compounds offer biocompatibility, sterilization resistance, and consistent mechanical performance in demanding clinical environments. The High-Performance Plastic Compounds Market supports innovations in medical technology by enabling complex designs and reducing product weight. It facilitates compliance with evolving safety and quality regulations while enhancing patient outcomes. With a rising focus on minimally invasive procedures and wearable health tech, demand for high-performance materials is growing steadily. Suppliers are investing in medical-grade formulations to meet specialized healthcare needs.

Market Challenges Analysis:

High Material Costs and Complex Manufacturing Processes Limit Wider Adoption

The High-Performance Plastic Compounds Market faces challenges related to the high cost of raw materials and complex processing requirements. Specialty polymers such as PEEK, PPS, and fluoropolymers demand advanced manufacturing infrastructure and strict quality control, increasing production expenses. It creates barriers for small and mid-sized enterprises that struggle to invest in high-performance formulations. Industries with tight budget constraints often opt for lower-cost alternatives, restricting the market’s penetration into price-sensitive applications. Compounding high-performance plastics requires precise processing parameters, specialized equipment, and skilled labor, which adds to operational costs. These factors limit scalability and make cost optimization a persistent concern for manufacturers.

Fluctuating Regulatory Landscape and Supply Chain Instabilities Impact Market Stability

Regulatory shifts across regions and supply chain disruptions present ongoing challenges for the High-Performance Plastic Compounds Market. Environmental policies concerning chemical safety, emissions, and recycling influence the choice of raw materials and compound formulations. It forces manufacturers to continually adapt to new compliance standards, increasing R&D expenditure and production complexity. Global supply chains face interruptions from geopolitical tensions, raw material shortages, and logistical constraints, delaying product deliveries and increasing lead times. Companies must manage inventory risks and diversify sourcing strategies to maintain operational continuity. These instabilities create uncertainty for long-term planning and limit growth in emerging regions with underdeveloped infrastructure.

Market Opportunities:

Emerging Demand from Electric Mobility and Advanced Manufacturing Sectors Creates Growth Potential

The High-Performance Plastic Compounds Market stands to benefit from expanding electric vehicle production and next-generation manufacturing initiatives. Lightweight, heat-resistant, and electrically insulating materials are critical for battery systems, power electronics, and charging infrastructure. It offers tailored solutions for structural and functional components that support vehicle performance, safety, and energy efficiency. Growth in automation and robotics also increases demand for durable polymers that withstand repetitive mechanical stress. Manufacturers that align with evolving mobility and Industry 4.0 requirements are well positioned to capture new business opportunities across global markets.

Healthcare Innovation and Sustainability Trends Open New Frontiers for High-Value Applications

The shift toward personalized healthcare, minimally invasive procedures, and wearable medical technology creates new application areas for high-performance compounds. The High-Performance Plastic Compounds Market can support these advancements through biocompatible and sterilization-stable materials. It addresses critical performance needs in surgical devices, diagnostic equipment, and implantable systems. Environmental concerns are also driving interest in recyclable and bio-based alternatives, offering a path to innovation and differentiation. Companies investing in green chemistry and certified sustainable compounds can expand their reach into regulated and eco-conscious industries.

Market Segmentation Analysis:

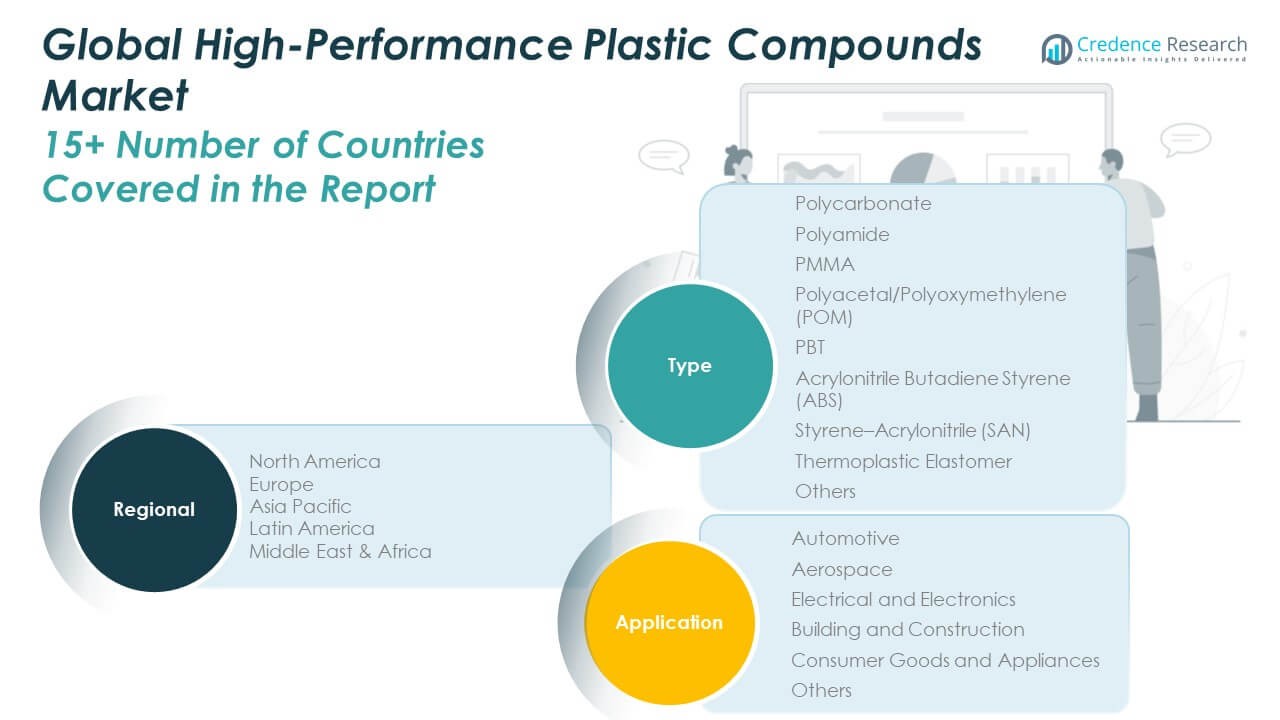

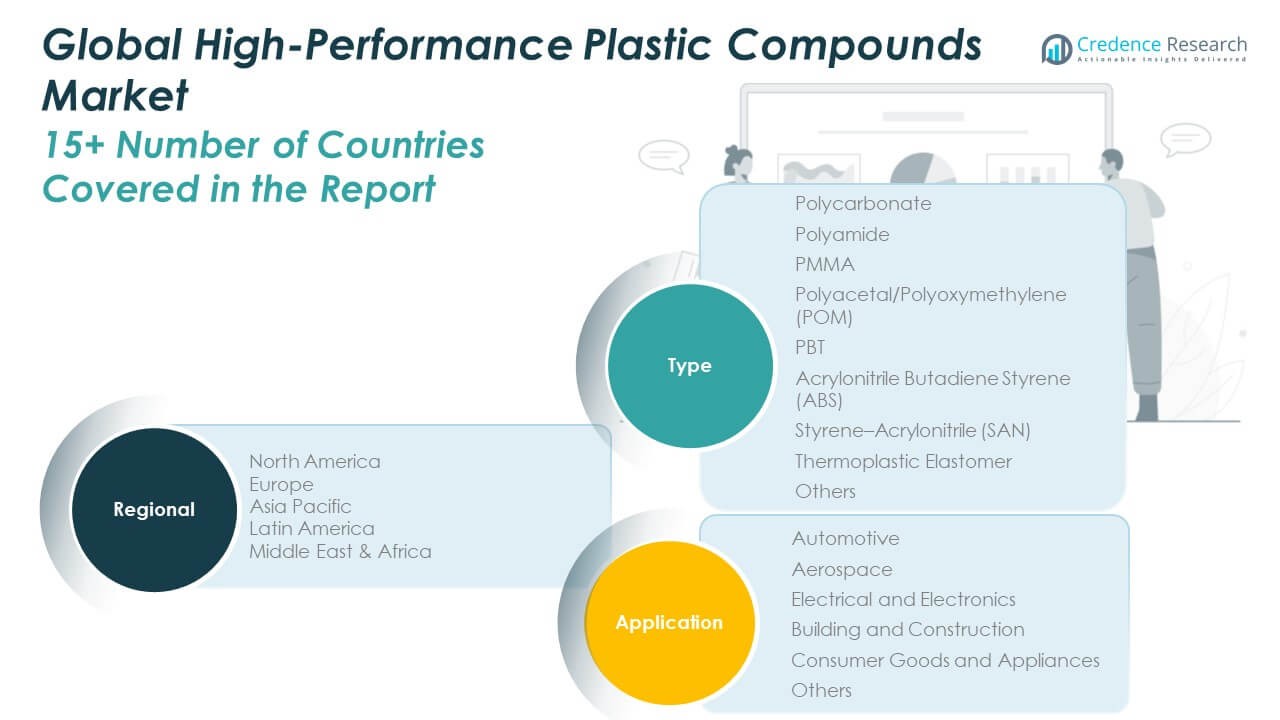

By type, the High-Performance Plastic Compounds Market includes a diverse range of material types that serve critical functions across industrial sectors. Among these, polycarbonate (PC) and polyamide (PA) account for substantial demand due to their strength, durability, and impact resistance, making them suitable for high-load and structural applications. PMMA is widely used for its optical clarity in lighting and display components. POM and PBT offer excellent dimensional stability and are favored in precision automotive and electronic parts. ABS and SAN are applied in consumer products and appliances for their ease of molding and toughness. Thermoplastic elastomers (TPEs) deliver flexibility and soft-touch characteristics used in medical devices, seals, and gaskets. The market also includes specialty formulations under the “Others” category that support custom performance requirements.

- For instance, BASF:Offers Elastollan® TPU for automotive hoses, medical tubing, and soft-touch grips, providing flexibility and chemical resistance.

By application, the automotive segment holds a leading share in the High-Performance Plastic Compounds Market due to rising demand for lightweight and fuel-efficient vehicles. The aerospace sector utilizes these compounds for weight reduction and high-temperature resistance. Electrical and electronics remain a vital segment, requiring materials that support miniaturization and thermal management. Building and construction industries use high-performance plastics for plumbing, insulation, and facade systems. Consumer goods and medical applications continue to grow, driven by innovation, hygiene standards, and device complexity. The “Others” segment encompasses specialized industrial uses that demand tailored performance.

- For instance, Ascend:HiDura™ polyamides are used in medical cable ties and battery seals for reliability and chemical resistance.

Segmentation:

By Type

- Polycarbonate (PC)

- Polyamide (PA)

- PMMA (Polymethyl Methacrylate)

- Polyacetal / Polyoxymethylene (POM)

- PBT (Polybutylene Terephthalate)

- Acrylonitrile Butadiene Styrene (ABS)

- Styrene–Acrylonitrile (SAN)

- Thermoplastic Elastomer (TPE)

- Others

By Application

- Automotive

- Aerospace

- Electrical and Electronics

- Building and Construction

- Consumer Goods and Appliances

- Medical

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America High-Performance Plastic Compounds Market size was valued at USD 4,241.2 million in 2018 to USD 5,943.5 million in 2024 and is anticipated to reach USD 10,599.0 million by 2032, at a CAGR of 9.2% during the forecast period. The region holds a substantial share of the global market, driven by strong demand from automotive, aerospace, and healthcare industries. The High-Performance Plastic Compounds Market in North America benefits from advanced manufacturing capabilities, stringent regulatory standards, and high R&D spending. It continues to expand as electric vehicles and smart medical devices gain traction. The presence of major material innovators and OEMs in the U.S. supports consistent product development. Growth in electronics and construction sectors further sustains market momentum across Canada and Mexico.

Europe

The Europe High-Performance Plastic Compounds Market size was valued at USD 3,719.0 million in 2018 to USD 5,329.5 million in 2024 and is anticipated to reach USD 9,760.9 million by 2032, at a CAGR of 8.3% during the forecast period. Europe accounts for a significant portion of global revenue, driven by a well-established automotive base and focus on sustainability. The High-Performance Plastic Compounds Market here supports lightweighting in vehicles, thermally stable components in industrial applications, and recyclable materials aligned with EU directives. It shows strong uptake across Germany, France, Italy, and the UK, where product innovation and green material adoption remain priorities. The healthcare and electronics sectors also contribute to regional demand. High environmental standards continue to influence compound formulation strategies.

Asia Pacific

The Asia Pacific High-Performance Plastic Compounds Market size was valued at USD 5,982.0 million in 2018 to USD 10,143.3 million in 2024 and is anticipated to reach USD 22,282.5 million by 2032, at a CAGR of 10.1% during the forecast period. The region leads the global market with the largest share, supported by rapid industrialization and infrastructure growth. The High-Performance Plastic Compounds Market thrives in China, India, Japan, and South Korea due to the presence of large-scale manufacturers and rising demand from automotive and electronics industries. It sees strong investment in EV development, construction projects, and precision medical devices. Government initiatives to localize material production and adopt sustainable practices fuel further expansion. Asia Pacific remains central to supply chain optimization for global manufacturers.

Latin America

The Latin America High-Performance Plastic Compounds Market size was valued at USD 506.4 million in 2018 to USD 1,007.0 million in 2024 and is anticipated to reach USD 2,317.0 million by 2032, at a CAGR of 6.9% during the forecast period. The market is growing steadily, supported by rising construction activities and increased use of plastic components in automotive and industrial equipment. The High-Performance Plastic Compounds Market in Latin America is gaining visibility, especially in Brazil and Mexico, where manufacturers invest in modernization and product quality. It faces challenges such as import dependency and fluctuating regulatory frameworks. The demand for lightweight and corrosion-resistant materials is creating opportunities across consumer goods and electrical sectors. Regional collaboration and trade agreements are likely to support future growth.

Middle East

The Middle East High-Performance Plastic Compounds Market size was valued at USD 902.0 million in 2018 to USD 1,522.7 million in 2024 and is anticipated to reach USD 3,352.2 million by 2032, at a CAGR of 7.5% during the forecast period. The market is expanding due to infrastructure development, rising investments in healthcare, and the emergence of local manufacturing hubs. The High-Performance Plastic Compounds Market supports oil and gas applications, automotive assembly, and medical device production across the region. It experiences growth in countries such as the UAE, Saudi Arabia, and Turkey, where industrial policy reforms are encouraging innovation. The need for high-temperature and chemically resistant materials fuels product adoption. Increasing emphasis on diversification beyond energy adds to market resilience.

Africa

The Africa High-Performance Plastic Compounds Market size was valued at USD 474.8 million in 2018 to USD 614.0 million in 2024 and is anticipated to reach USD 986.0 million by 2032, at a CAGR of 6.4% during the forecast period. The region represents a smaller share of the global market but holds untapped potential. The High-Performance Plastic Compounds Market is growing slowly due to limited industrial capacity and infrastructure gaps. However, rising urbanization, healthcare access, and demand for modern construction materials contribute to gradual adoption. Countries like South Africa and Egypt lead in compound consumption, supported by manufacturing and logistics hubs. Increasing awareness of lightweight and long-lasting materials is encouraging regional uptake. Public and private sector investments in industrial modernization may strengthen future market prospects.

Key Player Analysis:

- BASF SE

- Dow Inc.

- SABIC

- DuPont de Nemours, Inc.

- Solvay S.A.

- Arkema S.A.

- Evonik Industries AG

- Celanese Corporation

- Covestro AG

- Toray Industries, Inc.

- Daikin Industries, Ltd.

- Victrex plc

- Saint-Gobain Performance Plastics

- Avient Corporation

Competitive Analysis:

The High-Performance Plastic Compounds Market features intense competition among global players focused on innovation, customization, and sustainability. Leading companies such as BASF SE, Dow Inc., SABIC, DuPont, and Solvay dominate the landscape through broad product portfolios and strong research capabilities. It reflects a shift toward specialized materials that meet demanding end-user requirements across automotive, aerospace, electronics, and healthcare. Players are investing in bio-based and recyclable compounds to align with environmental standards and consumer preferences. Strategic partnerships, mergers, and acquisitions remain key growth strategies to expand geographical presence and production capacity. Emerging companies are gaining traction by offering cost-effective, application-specific formulations tailored to regional demands. Market leaders maintain competitive advantages through technical expertise, advanced compounding infrastructure, and consistent quality. Continuous development in polymer science and regulatory compliance creates opportunities for differentiation and value creation. The competitive environment encourages continuous material innovation, ensuring sustained growth and product advancement across the global market.

Recent Developments:

- In June 2025, BASF SE launched a new reduced Product Carbon Footprint (rPCF) product range for its Engineering Plastics and Thermoplastic Polyurethanes portfolio. This rPCF offering, now available in BASF’s sustainability toolbox, allows customers to customize the carbon footprint of their products by opting for renewable energies in the production process.

- In March 2025, Dow Inc. announced a strategic equity investment in Xycle, a Rotterdam-based pioneer in advanced chemical recycling technology. This partnership supports the construction of Xycle’s first commercial-scale recycling plant, expected to be operational by Q4 2026, with a plastic waste processing capacity of 21 kilotons annually.

- In March 2025, Evonik Industries AG launched TEGO® Res 1100, a new methacrylate co-polymer co-binder that improves the deinking process of plastic films for recycling. This innovation enables faster and more efficient recycling, enhancing the quality of recyclate and supporting true circularity in the packaging sector. TEGO® Res 1100 is compatible with existing solventborne ink formulations and is suitable for food contact applications, underlining Evonik’s commitment to sustainable high-performance plastics.

Market Concentration & Characteristics:

The High-Performance Plastic Compounds Market is moderately concentrated, with a mix of multinational corporations and regional players competing across specialized application areas. It features high entry barriers due to the need for advanced compounding technology, strict quality control, and significant R&D investment. Key players maintain dominance through diversified product lines, proprietary formulations, and established client relationships in industries such as automotive, aerospace, and electronics. The market favors companies with technical expertise and the ability to customize materials for performance-critical environments. It exhibits strong material innovation, driven by evolving end-user demands and regulatory standards. Long-term contracts, brand reliability, and compliance with international certifications further reinforce competitive positioning and influence buyer decisions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight, high-strength materials will rise with increasing electric vehicle and aerospace production.

- Growing investment in sustainable and bio-based compounds will shape future material development.

- Advancements in compounding technologies will enhance customization and processing efficiency.

- Expansion of 5G and IoT infrastructure will boost demand for thermally stable electronic-grade plastics.

- Medical device innovation will drive the use of sterilization-resistant and biocompatible compounds.

- Emerging markets in Asia and Latin America will contribute significantly to production and consumption growth.

- Regulatory pressure on recyclability and emissions will accelerate material reformulation across industries.

- Automation and smart manufacturing will create new opportunities for performance-based polymers.

- Strategic collaborations and acquisitions will increase to strengthen product portfolios and regional presence.

- Integration of high-performance plastics in renewable energy systems will support long-term market expansion.