Market Overview:

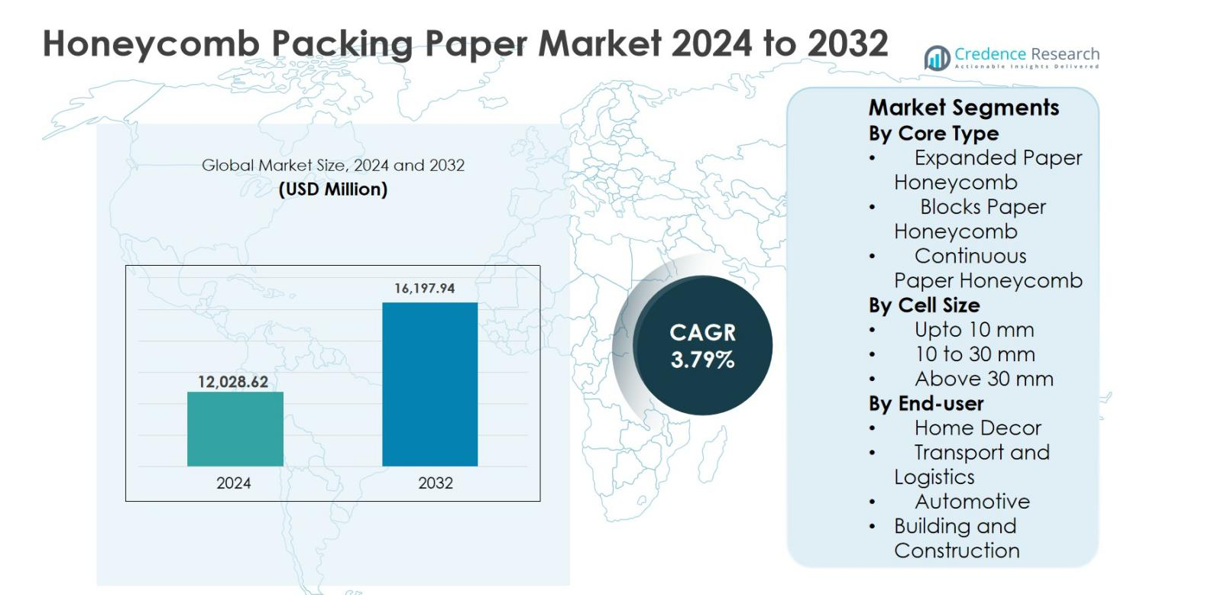

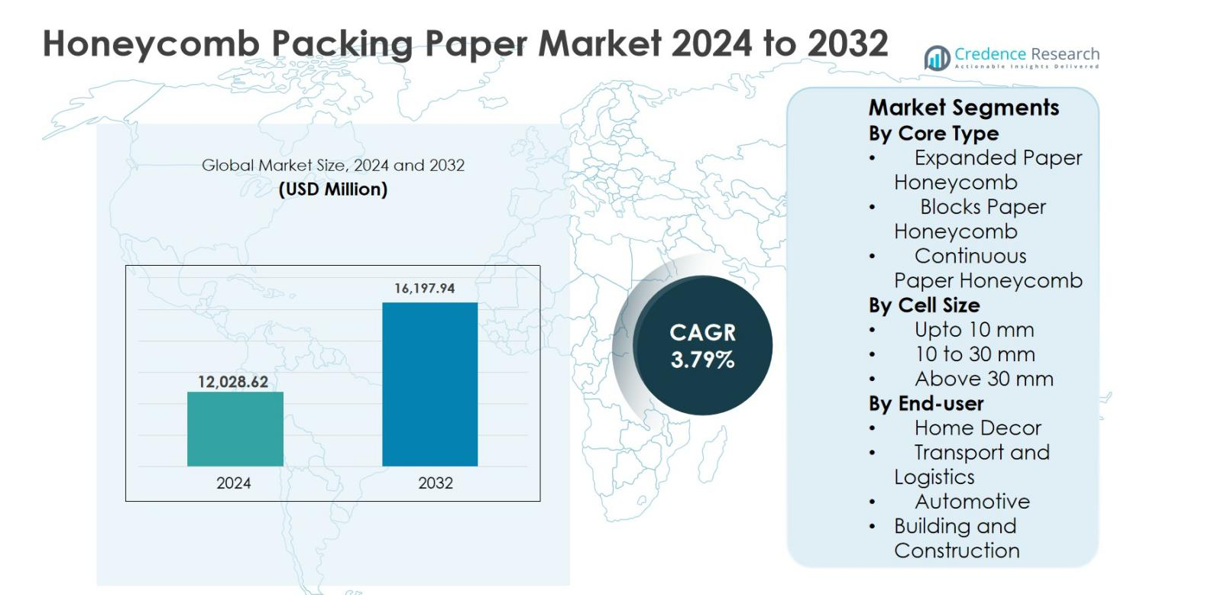

Honeycomb Packing Paper market size was valued at USD 12,028.62 million in 2024 and is anticipated to reach USD 16,197.94 million by 2032, growing at a CAGR of 3.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Honeycomb Packing Paper Market Size 2024 |

USD 12,028.62 million |

| Honeycomb Packing Paper Market, CAGR |

3.79% |

| Honeycomb Packing Paper Market Size 2032 |

USD 16,197.94 million |

Honeycomb Packing Paper market is led by established packaging solution providers focusing on sustainable and protective packaging innovations. Key players such as Ranpak Holdings Corp., Smurfit Kappa Group, Sealed Air Corporation, CPS Paper Products, BENZ Packaging, Modepack d.o.o., Primepac, Vérité Eco Packaging, EcoCushion Paper, and The Packaging Club emphasize recyclable materials, customization, and automation-compatible solutions to strengthen their market positions. North America dominated the market with a 31.6% share in 2024, driven by strong e-commerce penetration and sustainability mandates, followed by Europe with a 28.4% share, supported by strict environmental regulations and circular economy initiatives. Asia Pacific accounted for 26.9%, reflecting rapid growth in manufacturing, exports, and logistics activities, making it the fastest-growing regional market

Market Insights

- Honeycomb Packing Paper market was valued at USD 12,028.62 million in 2024 and is projected to grow at a CAGR of 3.79% through the forecast period.

- Market growth is driven by rising demand for sustainable and plastic-free packaging across e-commerce, logistics, automotive, and industrial sectors, supported by strong cushioning performance, lightweight structure, and cost efficiency compared to plastic-based alternatives.

- Key trends include increasing adoption of automated packaging systems and customization by cell size and core type, with expanded paper honeycomb dominating the segment at 46.8% share, due to high strength-to-weight performance and recyclability.

- Market structure is characterized by the presence of global and regional players focusing on eco-friendly materials, recycled paper content, and partnerships with logistics and fulfillment companies to expand reach and application scope.

- North America led with 31.6% market share, followed by Europe at 28.4% and Asia Pacific at 26.9%, while transport and logistics remained the leading end-user segment with 38.9% share driven by growing shipment volumes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Core Type

The Honeycomb Packing Paper market by core type is led by Expanded Paper Honeycomb, which accounted for 46.8% market share in 2024, driven by its superior cushioning strength, lightweight structure, and high load-bearing capacity. Expanded paper honeycomb is widely adopted in protective packaging for fragile and high-value goods due to its shock absorption and recyclability. Blocks paper honeycomb follows, supported by demand in customized packaging solutions, while continuous paper honeycomb gains traction in automated packaging lines. Growing emphasis on plastic replacement, sustainable packaging regulations, and cost-efficient material performance continue to accelerate adoption across industries.

- For instance, IKEA has reported using paper-based honeycomb structures in furniture packaging and internal components to reduce plastic and foam while maintaining load support.

By Cell Size

Based on cell size, the 10 to 30 mm segment dominated with a market share of 41.5% in 2024, owing to its balanced strength-to-weight ratio and versatility across multiple packaging applications. This cell size is widely preferred in logistics and industrial packaging where moderate compression resistance and flexibility are required. Up to 10 mm cells are increasingly used for lightweight consumer goods, while above 30 mm cells support heavy-duty cushioning needs. Rising e-commerce shipments, demand for optimized protective packaging, and increased customization in product packaging are key drivers supporting growth across cell-size categories.

- For instance, Greif’s Hexacomb solutions use larger cells in custom blocks and pallets to protect bulky or high-mass items in transit.

By End-user

By end-user, Transport and Logistics emerged as the dominant segment, capturing 38.9% of the market share in 2024, driven by the rapid expansion of global trade, e-commerce, and warehouse automation. Honeycomb packing paper is extensively used for void filling, pallet stabilization, and product protection during transit. Automotive follows, supported by demand for damage-free component transportation, while building and construction benefits from lightweight protective solutions. The shift toward eco-friendly packaging materials, reduction in transit damage costs, and rising sustainability commitments across industries continue to fuel demand across end-user segments.

Key Growth Driver

Rising Demand for Sustainable and Plastic-Free Packaging

The Honeycomb Packing Paper market is experiencing strong growth due to the accelerating shift toward sustainable and plastic-free packaging solutions across industries. Governments and regulatory bodies are tightening restrictions on single-use plastics, compelling manufacturers, retailers, and logistics providers to adopt recyclable and biodegradable alternatives. Honeycomb packing paper, made primarily from kraft paper and recycled fibers, offers high cushioning performance while remaining fully recyclable and compostable. Brand owners increasingly prefer honeycomb structures to align with corporate sustainability goals and ESG commitments. Additionally, consumer awareness regarding environmentally responsible packaging has intensified, especially in e-commerce and consumer goods. This shift is encouraging companies to redesign packaging formats using honeycomb paper to reduce carbon footprints, lower plastic waste, and improve brand perception, thereby driving consistent market expansion.

- For instance, Amazon’s “Frustration-Free Packaging” program and its move away from plastic air pillows in many markets have spurred wider adoption of paper-based cushioning and honeycomb-style materials in e-commerce fulfillment.

Expansion of E-commerce and Logistics Networks

The rapid expansion of global e-commerce and logistics infrastructure is a major driver supporting the Honeycomb Packing Paper market. Growth in online retail, cross-border trade, and same-day delivery services has increased demand for reliable protective packaging that minimizes product damage during transit. Honeycomb packing paper provides excellent shock absorption, edge protection, and load distribution while remaining lightweight, making it ideal for high-volume shipping environments. Warehousing and fulfillment centers increasingly adopt honeycomb solutions for void filling, pallet stabilization, and wrapping applications. The ability to customize honeycomb paper by thickness, cell size, and format further enhances its appeal for automated packaging lines. As logistics providers focus on reducing damage-related returns and improving packaging efficiency, demand for honeycomb packing paper continues to rise.

- For instance, Alibaba’s cross-border e-commerce operations in China have helped fuel demand for lightweight, fiber-based protective packaging to safeguard electronics, glassware, and cosmetics during long-distance transit

Cost Efficiency and Lightweight Performance Advantages

Cost efficiency combined with superior lightweight performance is another critical growth driver for the Honeycomb Packing Paper market. Compared to traditional packaging materials such as molded plastics, foam, or corrugated inserts, honeycomb paper delivers high strength-to-weight ratios using less raw material. This reduces both material costs and transportation expenses, especially in large-scale shipping operations. Manufacturers benefit from simplified packaging designs and reduced storage space due to the compact and expandable nature of honeycomb paper. Additionally, lower fuel consumption during transportation supports cost savings while aligning with sustainability goals. These economic advantages are particularly attractive to automotive, electronics, and industrial goods manufacturers seeking durable protection without escalating logistics costs, thereby reinforcing steady adoption across multiple end-use sectors.

Key Trend & Opportunity

Adoption in Automotive and Industrial Packaging

The increasing adoption of honeycomb packing paper in automotive and industrial packaging represents a significant market opportunity. Automotive manufacturers and component suppliers are increasingly replacing plastic and foam-based packaging with paper honeycomb solutions for transporting parts such as panels, trims, and sensitive components. Honeycomb structures offer high compression strength and vibration resistance, ensuring product integrity during long-distance shipments. Industrial equipment manufacturers are also adopting honeycomb paper for heavy-duty packaging due to its customizable thickness and load-bearing capabilities. As automotive production volumes rise and supply chains become more globalized, the demand for durable, recyclable, and cost-efficient packaging solutions is expected to expand, creating long-term growth opportunities for honeycomb packing paper suppliers.

- For instance, Greif’s Hexacomb business supplies paper honeycomb panels and custom dunnage widely used to protect metal parts, glass, and other industrial components in transit due to their high compression strength and vibration resistance.

Customization and Automation in Packaging Operations

Customization and automation are emerging trends creating new opportunities in the Honeycomb Packing Paper market. Packaging automation systems increasingly integrate honeycomb paper dispensers and wrapping machines to improve packing speed, consistency, and labor efficiency. Honeycomb paper can be easily tailored in terms of cell size, expansion ratio, and roll width to meet specific product protection requirements. This flexibility supports its use across diverse industries, including home décor, electronics, and building materials. Additionally, advancements in paper engineering are improving strength and moisture resistance, expanding application scope. As manufacturers invest in automated, high-throughput packaging lines, demand for compatible and customizable honeycomb packing paper solutions is expected to grow steadily.

- For instance, honeycomb paper is being engineered for use in doors, partitions, and furniture cores, where tailored thickness and cell geometry deliver both structural support and weight reduction while keeping the product fully recyclable.

Key Challenge

Limited Moisture Resistance and Durability Constraints

One of the key challenges facing the Honeycomb Packing Paper market is its limited moisture resistance compared to plastic-based alternatives. Exposure to high humidity, water, or wet handling conditions can compromise the structural integrity and cushioning performance of paper honeycomb packaging. This restricts its application in certain environments, such as maritime shipping or industries requiring moisture-proof protection. Although coatings and treated papers can improve resistance, they may increase costs or reduce recyclability. End users transporting liquids, chemicals, or temperature-sensitive goods may still prefer plastic or composite materials, limiting penetration in these segments and posing a challenge to broader market adoption.

Competition from Alternative Sustainable Packaging Materials

The Honeycomb Packing Paper market also faces competition from alternative sustainable packaging materials such as molded pulp, corrugated inserts, and biodegradable foams. These materials offer similar environmental benefits while providing different performance characteristics, including enhanced rigidity or moisture tolerance. Some end users may choose molded pulp for precision-molded protection or corrugated structures for heavier loads. Additionally, fluctuations in paper raw material prices can impact production costs and pricing stability. To remain competitive, honeycomb packing paper manufacturers must continuously innovate in material strength, functionality, and cost optimization while clearly demonstrating performance advantages over competing eco-friendly packaging solutions.

Regional Analysis

North America

North America accounted for 31.6% of the Honeycomb Packing Paper market share in 2024, driven by strong adoption of sustainable packaging across e-commerce, logistics, and automotive sectors. The United States leads regional demand due to stringent sustainability regulations, high penetration of online retail, and widespread use of protective packaging in warehousing and distribution centers. Companies increasingly replace plastic void fillers with honeycomb paper to meet ESG targets and reduce packaging waste. Growth is further supported by advanced packaging automation, high consumer awareness of eco-friendly materials, and consistent demand from furniture and home décor shipments requiring lightweight yet durable cushioning solutions.

Europe

Europe held a 28.4% market share in 2024, supported by strict environmental regulations and strong government initiatives promoting recyclable and biodegradable packaging materials. Countries such as Germany, France, and the United Kingdom drive demand due to well-established logistics networks and high adoption of sustainable packaging in manufacturing and retail. The automotive and industrial goods sectors extensively use honeycomb packing paper for component protection and pallet stabilization. Rising cross-border trade, increasing emphasis on circular economy practices, and the rapid replacement of plastic-based protective packaging continue to fuel steady market growth across the European region.

Asia Pacific

Asia Pacific captured 26.9% of the Honeycomb Packing Paper market share in 2024, driven by expanding e-commerce, manufacturing, and export activities. China, India, and Japan dominate regional demand due to rising logistics volumes and increasing awareness of sustainable packaging alternatives. Rapid urbanization, growth in consumer electronics and home décor exports, and government initiatives to reduce plastic waste are accelerating adoption. Additionally, cost-effective manufacturing, availability of raw materials, and rising investments in automated packaging solutions support strong growth momentum across Asia Pacific.

Latin America

Latin America accounted for 7.1% of the Honeycomb Packing Paper market share in 2024, with growth driven by expanding retail, food and beverage, and logistics sectors. Brazil and Mexico are key contributors due to increasing exports and gradual adoption of eco-friendly packaging solutions. Rising awareness of sustainable materials among manufacturers and logistics providers is supporting market penetration. However, adoption remains moderate compared to developed regions due to cost sensitivity and limited packaging automation. Ongoing improvements in supply chain infrastructure and growing environmental regulations are expected to support gradual market expansion across the region.

Middle East & Africa

The Middle East and Africa region held 6.0% of the market share in 2024, supported by growing logistics, construction, and industrial activities. Countries such as the United Arab Emirates and Saudi Arabia are witnessing increased adoption of honeycomb packing paper due to rising trade volumes and sustainability initiatives. Demand is also growing in construction material packaging and industrial equipment transport. While market penetration remains lower than other regions, increasing investments in logistics infrastructure, diversification of economies, and gradual regulatory focus on sustainable packaging are expected to drive steady growth across the Middle East and Africa.

Market Segmentations:

By Core Type

- Expanded Paper Honeycomb

- Blocks Paper Honeycomb

- Continuous Paper Honeycomb

By Cell Size

- Upto 10 mm

- 10 to 30 mm

- Above 30 mm

By End-user

- Home Decor

- Transport and Logistics

- Automotive

- Building and Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Honeycomb Packing Paper market features a moderately consolidated competitive landscape characterized by the presence of global packaging companies and specialized sustainable packaging providers. Key players such as Ranpak Holdings Corp., Smurfit Kappa Group, Sealed Air Corporation, CPS Paper Products, BENZ Packaging, Modepack d.o.o., Primepac, Vérité Eco Packaging, EcoCushion Paper, and The Packaging Club focus on expanding eco-friendly product portfolios and strengthening global distribution networks. Companies emphasize product innovation, improved paper strength, and customization capabilities to meet diverse end-user requirements across logistics, automotive, and industrial packaging. Strategic partnerships with e-commerce and logistics providers, along with investments in automated packaging solutions, are common approaches to enhance market reach. Additionally, players are increasing the use of recycled paper content and low-carbon manufacturing processes to align with sustainability targets and regulatory requirements, supporting long-term growth and differentiation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Smurfit Kappa Group

- Primepac

- Ranpak Holdings Corp.

- Modepack d.o.o.

- EcoCushion Paper

- Sealed Air Corporation

- BENZ Packaging

- The Packaging Club

- CPS Paper Products

- Vérité Eco Packaging

Recent Developments

- In November 2025, Sonoco Products Company announced the consolidation of its consumer packaging businesses under two geographic structures (EMEA/APAC and Americas) to drive innovation and growth across its packaging portfolio, including paper-based solutions

- In September 2025, Smurfit Westrock (combined entity of Smurfit Kappa and WestRock) launched an innovative Bag-in-Box® Powergrip packaging solution, advancing its sustainable packaging offerings.

- In March 2024, BENZ Packaging announced the launch of a new line of biodegradable honeycomb paper void fill.

Report Coverage

The research report offers an in-depth analysis based on Core Type, Cell Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Honeycomb Packing Paper market will continue to gain traction as industries accelerate the transition toward sustainable and plastic-free packaging solutions.

- Rising adoption across e-commerce and logistics will support consistent demand for lightweight and high-strength protective packaging.

- Increased integration of honeycomb paper with automated packaging systems will improve operational efficiency and scalability.

- Customization by cell size, thickness, and core type will expand application scope across diverse end-use industries.

- Automotive and industrial sectors will increasingly adopt honeycomb packing paper for component protection and pallet stabilization.

- Advancements in paper engineering will enhance load-bearing capacity and durability of honeycomb structures.

- Growing focus on reducing transportation damage and return rates will strengthen adoption in fulfillment centers.

- Expansion of manufacturing and export activities in emerging economies will support regional market growth.

- Strategic collaborations between packaging suppliers and logistics providers will enhance market penetration.

- Ongoing regulatory pressure and corporate sustainability commitments will reinforce long-term market demand.