| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Honeycomb Ceramics Market Size 2024 |

USD 2,547.0 Million |

| Honeycomb Ceramics Market, CAGR |

7.20% |

| Honeycomb Ceramics Market Size 2032 |

USD 4,442.1 Million |

Market Overview

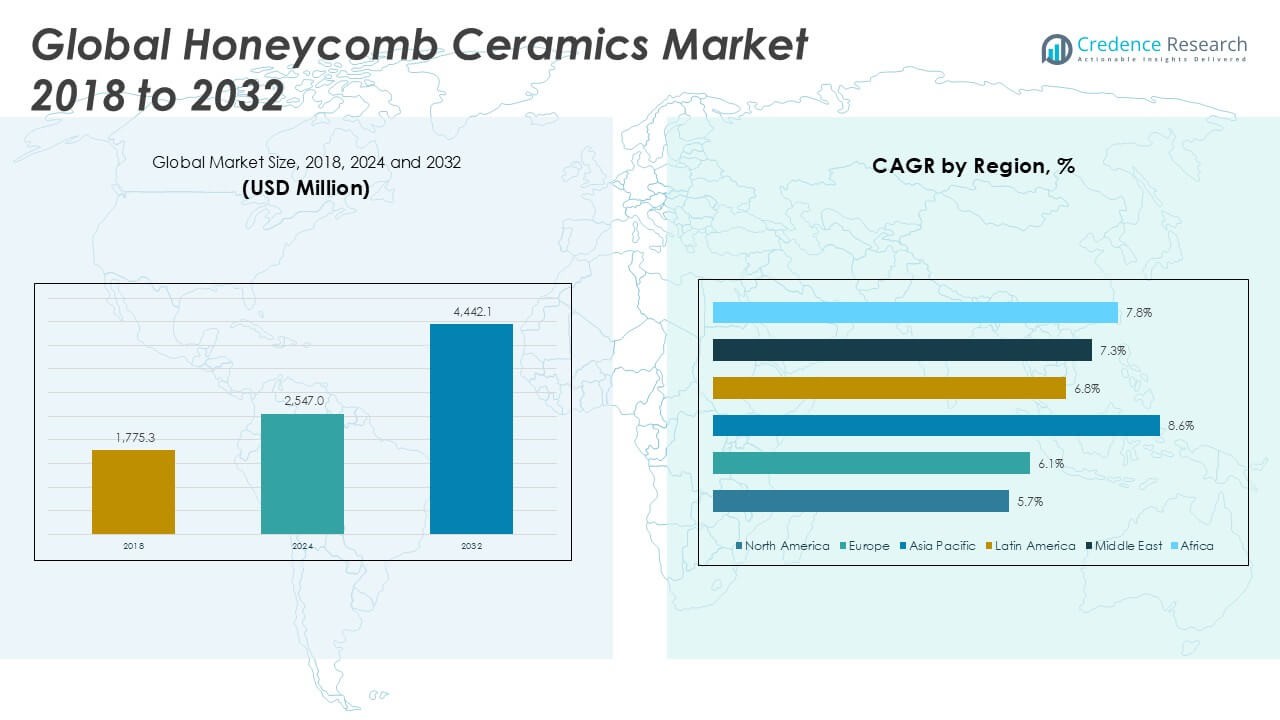

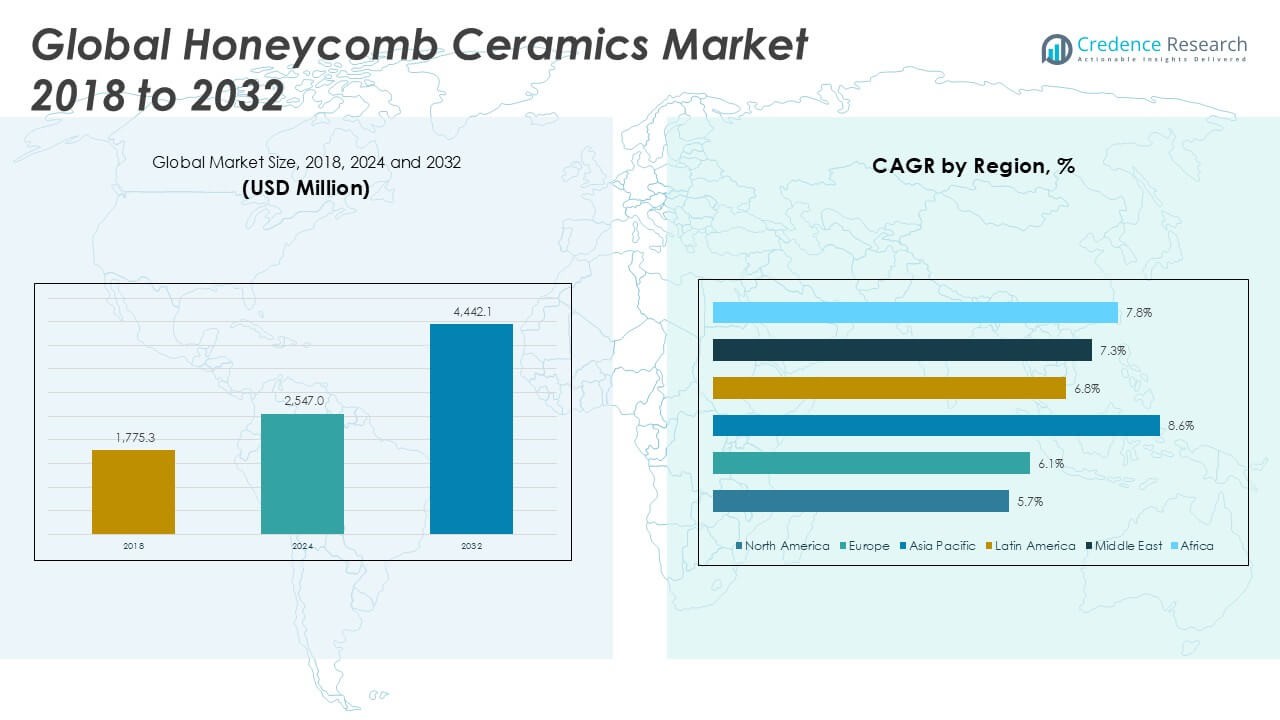

The Global Honeycomb Ceramics Market is projected to grow from USD 2,547.0 million in 2024 to an estimated USD 4,442.1 million by 2032, with a compound annual growth rate (CAGR) of 7.20% from 2025 to 2032.

Stricter environmental regulations and rising demand for cleaner emissions drive market growth. Honeycomb ceramic substrates offer high thermal efficiency and durability, which manufacturers enhance through advanced extrusion and coating techniques. The automotive sector’s shift to hybrid powertrains sustains demand for ceramic filters in catalytic converters. Growth in industrial pollution control, including flue gas treatment and energy recovery applications, further supports market momentum. Ongoing research targets cost reduction and performance optimization. Advances in ceramic ink technology and additive manufacturing open new design possibilities. Partnerships between technology providers and OEMs accelerate product innovation.

North America leads due to stringent emission standards and robust automotive manufacturing. Europe follows with high penetration of clean energy initiatives and chemical processing industries. Growth in Asia Pacific reflects rapid industrialization and infrastructure development in China and India. Emerging markets in Latin America and the Middle East show rising demand for emission control solutions. Prominent key players include NGK Insulators, Corning Incorporated, Saint-Gobain, Dr. Fritsch, Ferro Corporation, SummitReheis, and Kyocera Corporation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Honeycomb Ceramics Market is projected to grow from USD 2,547.0 million in 2024 to USD 4,442.1 million by 2032, with a CAGR of 7.20% during 2025–2032.

- Tightening global environmental regulations drive high demand for honeycomb ceramics in automotive and industrial emission control systems.

- Honeycomb ceramics support thermal energy recovery and process efficiency in manufacturing, contributing to cost reduction and sustainability goals.

- Technological advancements in extrusion, coating, and additive manufacturing enhance product performance and widen application scope.

- Complex manufacturing processes and reliance on specialized raw materials increase production costs and limit price competitiveness.

- Mechanical fragility under dynamic conditions and design constraints can restrict use in high-impact or flexible applications.

- Asia Pacific leads with a 45.2% market share in 2024, followed by North America and Europe; growth is strong in China, India, and regulatory-driven markets in the West.

Market Drivers

Stringent Emission Regulations Drive Demand for Advanced Ceramic Substrates

Governments worldwide enforce stricter emission control standards, particularly in the automotive and industrial sectors. These regulations require high-efficiency filtration systems, increasing the demand for honeycomb ceramics in catalytic converters and diesel particulate filters. The Global Honeycomb Ceramics Market benefits directly from the shift toward sustainable and compliant manufacturing practices. Honeycomb structures offer low pressure drop and high surface area, enhancing their effectiveness in pollutant removal. Industries adopt these materials to meet Euro 6, China VI, and US EPA Tier 3 standards. It ensures improved air quality and compliance with legal mandates, reinforcing adoption across multiple regions.

- For instance, as of fiscal year 2023, NGK’s automotive segment reported over 60% of its total consolidated net sales coming from automotive applications, with the company supplying millions of honeycomb ceramic carriers annually for use in emission control systems worldwide

Growing Automotive Sector Expands Market Opportunities

Rising vehicle production and adoption of hybrid and electric vehicles fuel demand for honeycomb ceramics in exhaust after-treatment systems. Automakers integrate these ceramics into selective catalytic reduction (SCR) and gasoline particulate filter (GPF) systems. The Global Honeycomb Ceramics Market sees growth supported by innovation in lightweight, thermally stable substrates for evolving powertrain technologies. It contributes to fuel efficiency and reduced emissions. Government incentives for electric vehicles further strengthen the supply chain for ceramic components. OEMs form partnerships with material science companies to develop high-performance filtration and insulation systems, advancing product integration.

- For instance, leading manufacturers like Corning and Johnson Matthey have established supply agreements with global automakers, each delivering several million honeycomb ceramic substrates per year for integration into new passenger and commercial vehicles, reflecting the scale of adoption in the automotive sector

Industrial Applications Reinforce Long-Term Market Viability

Honeycomb ceramics play a critical role in industrial processes involving thermal energy recovery, flue gas treatment, and chemical reactors. Industries adopt these ceramics for their resistance to corrosion and high temperatures. The Global Honeycomb Ceramics Market continues to grow as demand rises in metal processing, petrochemicals, and power generation. It supports cleaner operations and improved process efficiency. These ceramics also contribute to heat recovery in regenerative thermal oxidizers (RTOs), reducing energy costs. The ability to handle aggressive operating conditions makes them essential across high-temperature manufacturing environments.

Technological Advancements Improve Performance and Affordability

Continuous improvements in extrusion technology and materials engineering enhance the structural integrity and functionality of honeycomb ceramics. Manufacturers introduce multi-channel designs and thinner walls to increase efficiency without compromising durability. The Global Honeycomb Ceramics Market evolves through R\&D focused on low-cost, high-performance materials. It supports applications in electronics, air purification, and emerging hydrogen fuel cells. Innovation in ceramic 3D printing and coating processes improves design flexibility. These advancements lower production costs, expand applications, and improve competitiveness across global markets.

Market Trends

Rising Adoption in Clean Energy and Renewable Applications

The transition toward clean energy solutions increases demand for honeycomb ceramics in energy recovery, biomass combustion, and fuel cell systems. Their thermal shock resistance and efficient heat transfer capabilities make them suitable for renewable energy applications. The Global Honeycomb Ceramics Market gains traction as countries invest in green technologies to meet climate goals. It supports energy conversion and emissions control in waste-to-energy plants and solar thermal systems. Manufacturers optimize ceramic compositions for extended lifecycle and operational reliability in harsh environments. This trend aligns with global decarbonization strategies and reinforces material relevance in energy innovation.

- For instance, in 2022, the Asia-Pacific region installed nearly 45,000 selective catalytic reduction (SCR) systems using ceramic honeycombs in power plants and industrial boilers to meet NOx reduction targets, according to industry surveys

Increased Integration in Advanced Automotive Systems

The shift toward hybrid and electric vehicles accelerates the integration of lightweight ceramic components in thermal management and exhaust systems. Honeycomb ceramics support filtration in high-temperature zones and contribute to emission compliance. The Global Honeycomb Ceramics Market benefits from increased vehicle electrification and tighter emission norms. It expands through innovations in SCR and GPF technologies embedded in next-generation powertrains. Automotive OEMs collaborate with material suppliers to create compact and durable systems that meet evolving performance standards. These developments ensure long-term relevance of ceramics across automotive platforms.

- For instance, the automotive industry accounted for over 60,000,000 ceramic honeycomb units consumed annually, driven by the need for advanced catalytic converters and diesel particulate filters to comply with Euro 6 and China National VI emission standards

Growth of Industrial Air Pollution Control Technologies

Manufacturing sectors implement advanced air purification systems to meet regulatory and operational requirements. Honeycomb ceramics serve as core components in regenerative thermal oxidizers, catalytic incinerators, and NOx reduction units. The Global Honeycomb Ceramics Market sees steady growth in line with increased industrial focus on sustainability and workplace safety. It supports compliance with regional emission regulations in Asia Pacific, North America, and Europe. Rising awareness of occupational health standards reinforces demand for efficient and durable filtration materials. Honeycomb structures provide mechanical strength and high porosity, essential for high-volume gas treatment applications.

Expansion into Emerging End-Use Segments and Smart Applications

New applications emerge in electronics cooling, chemical filtration, and gas sensors using honeycomb ceramics for precision thermal and chemical performance. The Global Honeycomb Ceramics Market diversifies through R\&D in smart materials and microstructured substrates. It supports innovation in aerospace components and next-gen communication devices requiring advanced thermal control. Compact, high-strength ceramics enable integration into smaller, more efficient devices. Manufacturers explore multi-functional coatings and tailored geometries to address niche technical needs. This diversification strengthens the market’s resilience and unlocks growth in specialized, high-value domains.

Market Challenges

High Production Costs and Complex Manufacturing Processes Limit Scalability

The fabrication of honeycomb ceramics involves precision extrusion, high-temperature sintering, and specialized raw materials, which increase production costs. Manufacturers require advanced equipment and skilled labor, raising capital expenditure for new entrants. The Global Honeycomb Ceramics Market faces challenges in scaling up without compromising quality and consistency. It limits price competitiveness, especially in cost-sensitive applications or regions with low manufacturing margins. Variability in raw material supply and pricing further affects operational efficiency. Companies must invest in process optimization and automation to reduce costs and improve throughput.

- For instance, a study from Zhejiang University detailed that the pressureless sintering process for SiC honeycomb ceramics requires heating the green bodies at 2160 °C for 1 hour in an argon atmosphere, with each batch involving 10 test samples and a drying period of 24 hours at 120 °C before sintering, highlighting the intensive energy and time investments needed for quality production

Market Penetration Hindered by Performance Trade-offs and Competition

While honeycomb ceramics offer thermal stability and mechanical strength, their brittleness under dynamic load limits certain applications. Competing materials, including metal foams and polymer composites, provide flexibility and lower costs, attracting manufacturers in non-critical segments. The Global Honeycomb Ceramics Market must address technical limitations through material innovations and hybrid solutions. It competes with well-established technologies in filtration, catalysis, and thermal management, making market entry complex. Customer reluctance to switch from proven systems due to installation and maintenance concerns further restricts adoption. Demonstrating long-term performance and cost-effectiveness remains critical for broader acceptance.

Market Opportunities

Expansion in Hydrogen Energy and Fuel Cell Technologies Creates New Growth Avenues

The global push toward hydrogen-based energy systems opens promising opportunities for honeycomb ceramics in fuel cells and hydrogen reformers. These applications demand materials with high thermal resistance, chemical stability, and structural integrity—attributes met by honeycomb ceramics. The Global Honeycomb Ceramics Market can capitalize on this trend by aligning product development with emerging fuel cell technologies. It enables efficient gas diffusion and thermal insulation, critical for high-performance energy systems. Governments and private investors are increasing funding for hydrogen infrastructure, creating a favorable environment for adoption. Manufacturers that innovate for fuel cell stacks and hydrogen storage systems gain a competitive edge.

Rising Demand for Air Quality Solutions in Urban and Industrial Zones

Worsening air pollution levels in major cities and industrial hubs create opportunities for ceramic-based filtration and purification systems. Honeycomb ceramics support the design of compact and effective filters for HVAC systems, incinerators, and flue gas treatment units. The Global Honeycomb Ceramics Market can expand by serving air quality management projects driven by environmental and public health concerns. It meets demand for non-toxic, high-temperature filtration systems in urban infrastructure. Smart city initiatives and stricter indoor air quality norms boost interest in advanced ceramic filters. This demand promotes the development of energy-efficient and maintenance-friendly solutions for public and private sectors.

Market Segmentation Analysis

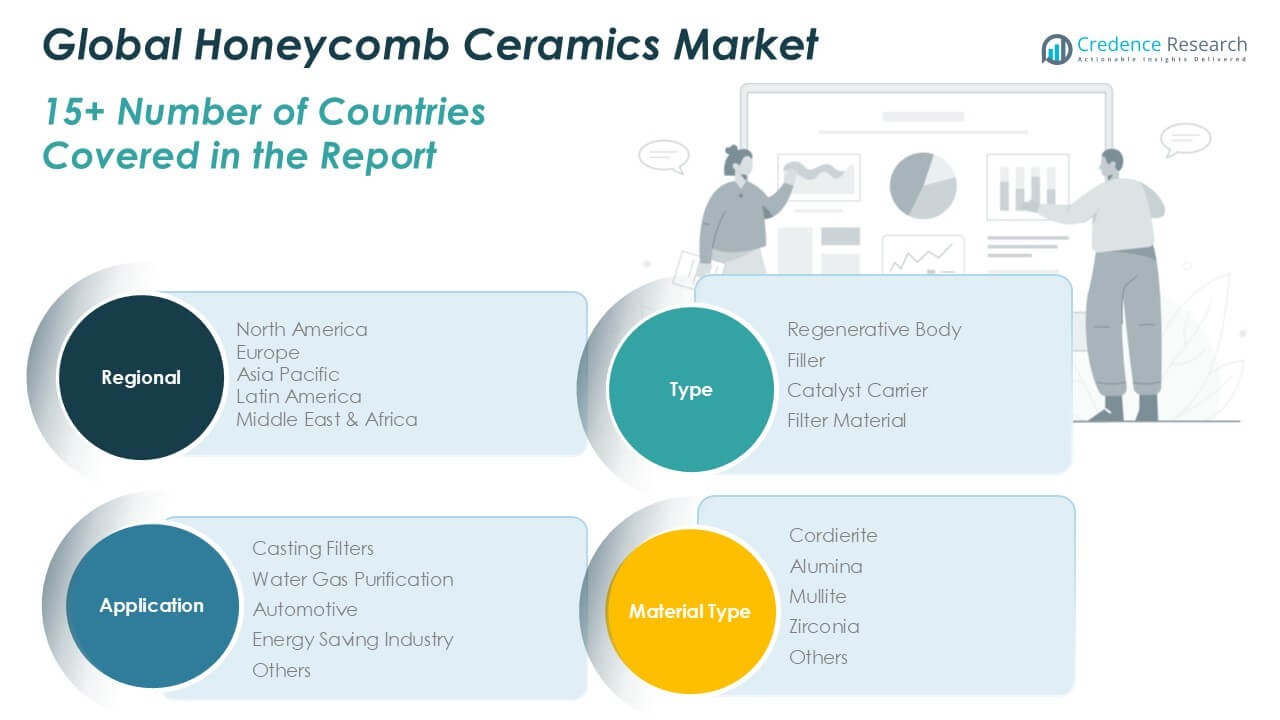

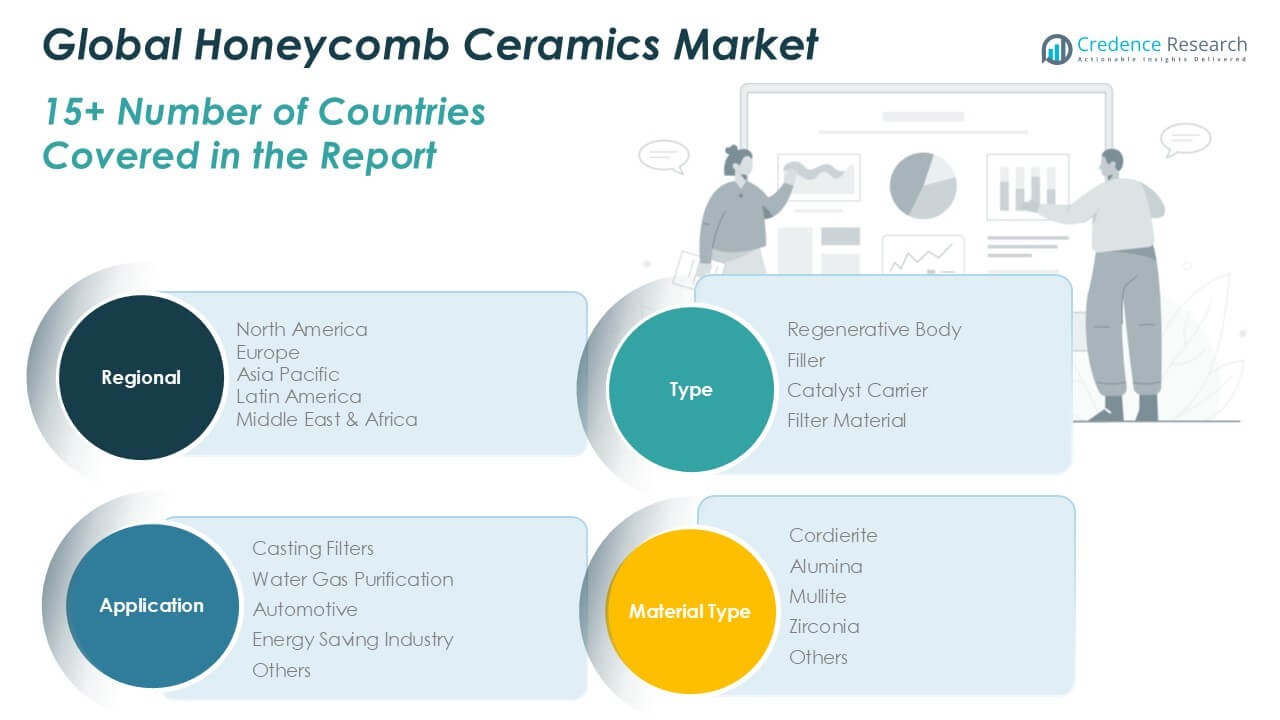

By Type

The Global Honeycomb Ceramics Market segments by type into regenerative body, filler, catalyst carrier, and filter material. Regenerative bodies hold a dominant share due to their use in heat exchange systems, where they improve thermal efficiency in industrial furnaces and gas turbines. Catalyst carriers play a critical role in automotive and chemical applications, supporting pollutant conversion and reaction efficiency. Filters serve high-demand applications in air and fluid purification, especially in manufacturing and environmental control systems. Fillers support structural and insulation functions in lightweight constructions and electronics. Each type supports performance optimization across various high-temperature and chemical-resistant use cases.

- For instance, industry data show that annual production of honeycomb ceramic blocks—primarily used as regenerative bodies and catalyst carriers—exceeded 100 million units globally in 2024

By Application

Segmented by application, the market includes casting filters, water gas purification, automotive, energy-saving industry, and others. Automotive holds a significant share due to widespread use of honeycomb ceramics in catalytic converters and particulate filters. Water gas purification and energy-saving applications are growing segments, driven by environmental regulations and the need for cleaner industrial operations. Casting filters serve metal casting industries by improving flow uniformity and reducing inclusion defects. The “others” category includes use in aerospace, electronics, and specialty chemical sectors where durability and thermal resistance are essential. The application scope continues to widen with increasing environmental compliance demands.

- For instance, government and industry surveys report that in 2024, more than 60 million honeycomb ceramic units were used in automotive catalytic converters worldwide, reflecting the scale of adoption in this application segment

By Material Type

By material type, the market categorizes into cordierite, alumina, mullite, zirconia, and others. Cordierite dominates due to its low thermal expansion and high thermal shock resistance, making it ideal for automotive and energy applications. Alumina offers high hardness and corrosion resistance, suitable for chemical and environmental industries. Mullite provides stability in extreme temperatures, serving critical industrial filtration and furnace lining functions. Zirconia offers excellent insulation and is widely used in advanced fuel cells and high-precision environments. The “others” segment includes emerging ceramic blends tailored for specialized, high-performance needs. The Global Honeycomb Ceramics Market leverages material diversity to serve a broad array of thermal and chemical demands.

Segments

Based on Type

- Regenerative Body

- Filler

- Catalyst Carrier

- Filter Material

Based on Application

- Casting Filters

- Water Gas Purification

- Automotive

- Energy Saving Industry

- Others

Based on Material Type

- Cordierite

- Alumina

- Mullite

- Zirconia

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Honeycomb Ceramics Market

The Honeycomb Ceramics Market in North America reached USD 631.7 million in 2024 and is projected to grow to USD 990.6 million by 2032, at a CAGR of 5.7%. It holds approximately 24.8% of the global market share in 2024. Demand in the region is driven by stringent emission control regulations and high adoption of catalytic converters in automotive manufacturing. The United States leads the regional market due to advanced industrial processing and environmental compliance initiatives. Growth is supported by increased investment in air purification and energy recovery technologies. Manufacturers focus on innovations that align with regulatory standards and reduce carbon footprints.

Europe Honeycomb Ceramics Market

Europe accounted for USD 506.9 million in 2024 and is expected to reach USD 799.6 million by 2032, registering a CAGR of 6.1%. This represents a 19.9% share of the global Honeycomb Ceramics Market in 2024. The region benefits from strong automotive and chemical sectors, particularly in Germany, France, and Italy. It supports adoption of ceramic filters in emission reduction and thermal management applications. EU policies targeting clean energy and green technologies further stimulate demand. Producers in the region prioritize material innovation and sustainability-driven production processes.

Asia Pacific Honeycomb Ceramics Market

Asia Pacific leads the global Honeycomb Ceramics Market with a value of USD 1,151.2 million in 2024 and projected growth to USD 2,198.8 million by 2032, at a CAGR of 8.6%. It commands the largest regional share of 45.2% in 2024. China, Japan, South Korea, and India are major contributors, driven by rapid industrialization and increasing vehicle production. The region emphasizes low-emission manufacturing, supporting the use of ceramic filters and catalysts. Expanding renewable energy and infrastructure projects bolster demand for thermal insulation and filtration components. Local production capacity and government-backed environmental initiatives strengthen regional growth.

Latin America Honeycomb Ceramics Market

Latin America is valued at USD 79.0 million in 2024 and is estimated to grow to USD 164.4 million by 2032, reflecting a CAGR of 6.8%. It holds a 3.1% share of the global market in 2024. Brazil and Mexico lead demand, driven by developments in automotive, refining, and environmental sectors. Industrial projects incorporate honeycomb ceramics to improve energy efficiency and reduce emissions. Governments implement air quality regulations that support ceramic filtration adoption. Market participants expand distribution networks and technical partnerships to meet regional performance requirements.

Middle East Honeycomb Ceramics Market

The Middle East Honeycomb Ceramics Market is forecast to grow from USD 50.9 million in 2024 to USD 106.6 million by 2032, with a CAGR of 7.3%. It accounts for 2.0% of the global market share in 2024. Strong demand stems from petrochemical and oil refining sectors that require high-performance materials for thermal processing and flue gas control. The region invests in advanced manufacturing to diversify economies and reduce emissions. Saudi Arabia and UAE lead adoption through industrial modernization programs. Manufacturers focus on expanding application scopes in energy-intensive industries.

Africa Honeycomb Ceramics Market

Africa recorded a market size of USD 127.4 million in 2024 and is projected to reach USD 182.1 million by 2032, with a CAGR of 7.8%. It contributes 5.0% to the global Honeycomb Ceramics Market in 2024. The market grows steadily with infrastructure expansion, especially in South Africa and Nigeria. Demand for clean industrial processes and energy-saving systems supports ceramic integration. Increasing investment in manufacturing and air purification enhances the region’s growth prospects. International players target the region with cost-effective and durable product offerings tailored to local operational conditions.

Key players

- Corning Inc.

- NGK Insulators, Ltd

- IBIDEN Co., Ltd

- Kyocera Corporation

- Saint-Gobain

- Applied Ceramics

- Unifrax

- Rauschert GmbH

- KEXING Special Ceramics

- CeramTec

- Pingxiang Yingchao Chemical Packing

- Vesuvius

- Sinocera

- Qingdao Terio Corporation

Competitive Analysis

The Honeycomb Ceramics Market features a moderately consolidated competitive landscape with several global and regional players. Corning Inc. and NGK Insulators lead with strong patent portfolios and advanced manufacturing capabilities. IBIDEN, Kyocera, and Saint-Gobain offer diversified product lines and strong R\&D investment. The market sees growing competition from Chinese manufacturers such as KEXING and Pingxiang Yingchao, which offer cost-effective solutions. It continues to attract investment in high-performance materials and advanced extrusion technologies. Strategic focus areas include lightweight design, thermal durability, and emission compliance. Companies pursue joint ventures, capacity expansions, and innovation in catalytic and filtration functions to strengthen market positioning.

Recent Developments

- In June 2025, Corning Incorporated emphasized that its honeycomb ceramic substrates, traditionally used in vehicle emissions control, can capture up to one ton of CO2 annually through direct air capture (DAC) applications. This application leverages Corning’s expertise in honeycomb technology and its commitment to developing solutions for environmental challenges.

- In April 2024, NGK Insulators, Ltd. established a Direct Air Capture (DAC) development area at its headquarters to advance the development of honeycomb ceramic substrates for CO2 capture. Their goal is to begin volume production of these substrates by 2030, leveraging their existing technologies for automotive catalytic converters. This initiative is part of NGK’s broader efforts to contribute to a carbon-neutral society through CO2 capture, utilization, and storage (CCUS) technologies.

Market Concentration and Characteristics

The Honeycomb Ceramics Market exhibits moderate to high market concentration, with a few dominant players such as Corning Inc., NGK Insulators, and IBIDEN Co., Ltd controlling a significant share. It is characterized by high entry barriers due to complex manufacturing processes, capital-intensive equipment, and stringent performance standards. Product differentiation is driven by material composition, cell geometry, and thermal durability. The market shows strong reliance on automotive and industrial emissions control applications, supported by regulatory compliance requirements. Regional players focus on cost-efficient solutions, while global firms invest in R&D for advanced and customized products. Long-term contracts with OEMs and industrial clients reinforce brand loyalty and limit supplier substitution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see continued demand in automotive and industrial emission control systems due to tightening global environmental regulations. Ceramic substrates will remain essential for meeting performance and compliance requirements.

- Honeycomb ceramics will play a vital role in emerging hydrogen energy systems, including reformers and fuel cell stacks. Their thermal resistance and chemical stability will support next-generation clean energy solutions.

- Although electric vehicles reduce tailpipe emissions, hybrid models still require advanced filtration. Honeycomb ceramics will remain relevant in thermal management and catalyst support for hybrid powertrains.

- Thermal energy recovery units in manufacturing and utilities will boost demand for regenerative ceramic bodies. These components will improve plant efficiency and reduce operational costs.

- Manufacturers will invest in developing thinner, high-strength honeycomb structures for enhanced performance. Material innovations will target weight reduction without compromising thermal and mechanical properties.

- Asia Pacific will continue to dominate global market share, led by industrialization in China and India. Local production capabilities and regulatory reforms will accelerate adoption across key applications.

- Urban pollution and stricter clean air and water standards will expand the use of ceramic filters in municipal and industrial systems. Honeycomb ceramics will support high-capacity, long-life filtration needs.

- 3D printing and computer-aided design will enable complex honeycomb geometries tailored to specific thermal and structural demands. These technologies will streamline prototyping and reduce time to market.

- The chemical sector will adopt honeycomb ceramics for catalysts, reactors, and separation systems. Their resistance to high temperatures and corrosive agents will drive broader application.

- Key players will form joint ventures and scale production facilities to meet growing global demand. Investment in automation and process optimization will enhance production efficiency and cost control.