Market Overview:

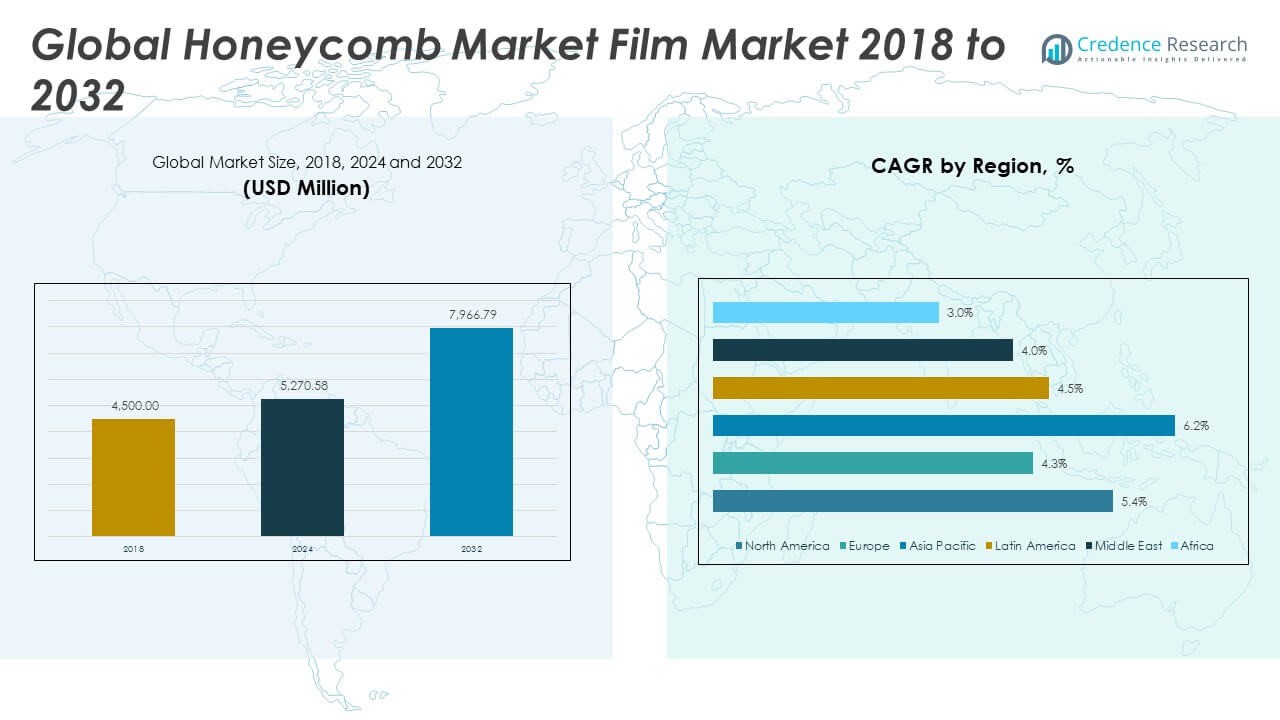

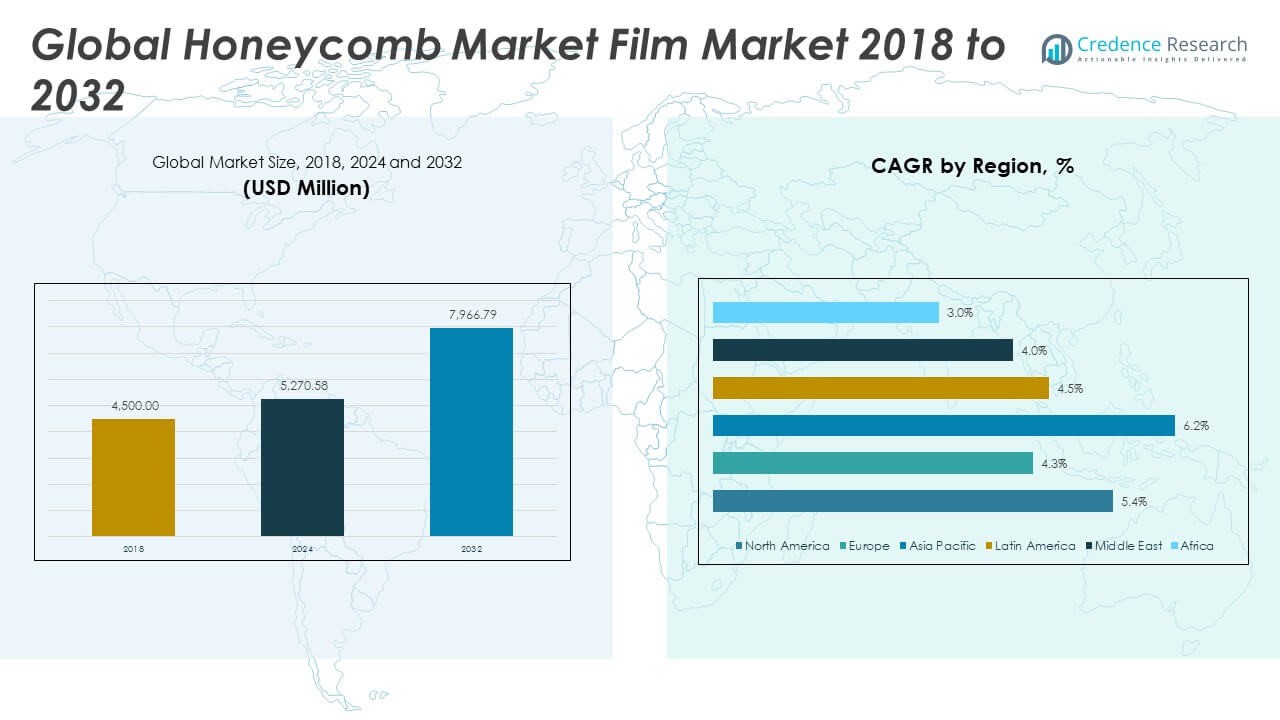

The Global Honeycomb Market size was valued at USD 4,500.00 million in 2018 to USD 5,270.58 million in 2024 and is anticipated to reach USD 7,966.79 million by 2032, at a CAGR of 5.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Honeycomb Market Size 2024 |

USD 5,270.58 Million |

| Honeycomb Market, CAGR |

5.37% |

| Honeycomb Market Size 2032 |

USD 7,966.79 Million |

The honeycomb market is growing steadily due to its increasing applications across aerospace, packaging, construction, and automotive industries. Manufacturers are leveraging honeycomb structures for their exceptional strength-to-weight ratio, energy absorption properties, and material efficiency. Demand rises as industries aim to reduce weight without compromising performance, particularly in aircraft interiors and vehicle components. Sustainable material trends also influence the market, with rising adoption of recyclable and bio-based honeycomb cores. Technological advancements in production processes and customization further support the market’s expansion across industrial and commercial sectors.

North America currently leads the honeycomb market due to its strong aerospace and defense sectors, supported by advanced manufacturing capabilities. Europe follows, driven by growing applications in automotive and construction. Meanwhile, Asia Pacific is emerging as a high-growth region due to rapid industrialization, urban development, and expanding aerospace activities in China, India, and Southeast Asia. Latin America and the Middle East & Africa are gradually advancing, supported by infrastructure projects and adoption of lightweight materials. Regional growth varies based on industrial maturity, end-user demand, and investment in lightweight technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Honeycomb Market was valued at USD 4,500.00 million in 2018, reached USD 5,270.58 million in 2024, and is projected to hit USD 7,966.79 million by 2032, growing at a CAGR of 5.37%.

- Strong demand for lightweight, high-strength materials in aerospace, automotive, and construction drives steady market expansion.

- Sustainability initiatives accelerate the adoption of recyclable and bio-based honeycomb cores across various industries.

- High initial production costs and complex manufacturing processes limit participation from small and mid-sized enterprises.

- Regulatory compliance and standardization challenges delay product approvals, especially in defense and aerospace sectors.

- North America leads the market due to strong aerospace and defense infrastructure, while Europe follows with automotive demand.

- Asia Pacific emerges as a high-growth region supported by industrialization, EV adoption, and expanding infrastructure projects.

Market Drivers:

Lightweight Structural Advantage Across Multiple Industries Fuels Product Adoption:

The Global Honeycomb Market benefits from rising demand for lightweight and durable materials in aerospace, automotive, and construction sectors. Honeycomb structures offer superior strength-to-weight ratios, making them ideal for applications requiring both load-bearing capacity and material efficiency. Aerospace manufacturers use them in aircraft interiors and engine components to improve fuel efficiency. The automotive industry integrates honeycomb cores into crash structures and body panels to meet safety and emission standards. Construction firms adopt them for facade cladding, roofing, and partitions to reduce structural load and enhance energy efficiency. Demand continues to rise due to cost savings in transportation and material handling. The market leverages these cross-industry needs to drive adoption. It supports a shift toward materials that optimize both performance and resource use.

- For instance, Airbus incorporates aluminum honeycomb sandwich panels into its A319, A320, and A321 aircraft cargo panels, where these structures can consist of up to 95% enclosed air, resulting in significant weight reductions and enhanced strength-to-weight ratios vital for aircraft interiors and structural components.

Rising Emphasis on Sustainable and Recyclable Material Solutions:

Sustainability concerns are driving the preference for recyclable and bio-based honeycomb structures across multiple applications. Governments and regulatory bodies mandate reduced carbon footprints and responsible sourcing. Manufacturers adopt paper, aluminum, and thermoplastic-based honeycomb cores that offer recyclability without compromising structural integrity. The Global Honeycomb Market aligns with circular economy goals by facilitating material recovery and waste reduction. Customers seek eco-friendly alternatives that support LEED certification and green building initiatives. Sustainable packaging formats using paper honeycomb are gaining traction in consumer goods and logistics. It enables brand owners to meet environmental targets while ensuring performance. Increasing investment in R&D enhances material properties and broadens environmental compliance. Market players position sustainable honeycomb options as a key growth driver.

- For instance, Honeycomb Cellpack offers packaging from recycled paper and water-based glue, resulting in products that are fully recyclable and biodegradable.

High Demand in Aerospace and Defense Applications Accelerates Growth:

The aerospace and defense industry serves as a dominant end-user of honeycomb structures, driving innovation and demand. Honeycomb cores are widely used in aircraft wings, fuselage panels, flooring, and bulkheads due to their energy absorption and vibration dampening capabilities. Defense contractors utilize honeycomb panels in naval vessels, military vehicles, and radar systems to reduce weight and enhance mobility. The Global Honeycomb Market benefits from government defense spending and commercial airline fleet expansion. It supports stringent quality and safety requirements through precision-engineered solutions. Honeycomb composite structures allow fuel savings, extended component life, and easier maintenance. OEMs rely on consistent performance, corrosion resistance, and thermal insulation. Expansion of MRO operations and lightweight material mandates sustain long-term market growth.

Increased Demand for Efficient and Durable Packaging Solutions:

Honeycomb panels and cores find growing usage in protective packaging, particularly for fragile, heavy, and high-value items. E-commerce expansion drives the need for cost-effective, impact-resistant packaging. Honeycomb packaging offers excellent cushioning, stackability, and recyclability. The Global Honeycomb Market supports logistics and warehousing companies seeking sustainable alternatives to foam and plastic-based materials. It enables cost reduction through reusable packaging systems and lower shipping weights. Manufacturers cater to electronics, appliances, and industrial machinery with customized packaging formats. Increased international trade also influences demand for durable transit packaging. Honeycomb solutions ensure product integrity through multiple handling cycles. The packaging segment boosts overall volume consumption and regional production scalability.

Market Trends:

Integration of Smart Materials and Adaptive Technologies in Honeycomb Structures:

Manufacturers increasingly explore the integration of smart materials into honeycomb cores for responsive applications. These materials adjust to temperature, pressure, or impact, enhancing structural performance in aerospace, automotive, and construction fields. Shape-memory alloys and piezoelectric layers are embedded within honeycomb cells for real-time feedback. The Global Honeycomb Market embraces these innovations to differentiate high-performance products. Research institutions collaborate with manufacturers to develop adaptive load-bearing structures. Defense and aviation customers show strong interest in such solutions for critical components. It enhances safety and monitoring capabilities across applications. Smart honeycomb systems expand beyond conventional passive functions, opening new commercial avenues. Investments in smart composites strengthen market positioning.

- For instance, aerospace research at The University of Michigan and Michigan State University has demonstrated superelastic nickel-titanium (NiTi) honeycomb cores capable of recovering over 50% compressive strain after unloading, enabling shape-memory and adaptive load-bearing functionalities in aircraft and defense systems

Customization and On-Demand Manufacturing Expand Design Flexibility:

Demand for customized honeycomb solutions increases as industries require tailored geometries and materials for unique applications. On-demand production using CNC machining and 3D printing offers precision and speed. The Global Honeycomb Market aligns with customer-specific design needs across transport, packaging, and infrastructure. Manufacturers provide cut-to-size panels, variable core densities, and hybrid material combinations. It reduces material waste and speeds up product development cycles. Modular and collapsible honeycomb designs support reusable structures in events and exhibitions. Rapid prototyping capabilities also support pilot testing in R&D-focused sectors. Customization enhances value-added offerings and drives client retention. Flexibility in production processes ensures scalability across global markets.

- Materialise, using advanced 3D printing techniques, enables rapid manufacturing of customized honeycomb panels and reduces mold weight by over 42% for prototyping and industrial uses, supporting industry demand for precision and tailored mechanical properties.

Widespread Adoption of Thermoplastic Honeycomb Cores in Automotive Applications:

Thermoplastic-based honeycomb cores are gaining popularity in the automotive industry due to their lightweight, recyclable, and heat-resistant properties. They replace heavier traditional materials in bumpers, trunk liners, door panels, and underbody shields. The Global Honeycomb Market responds to the need for emission control and fuel economy. Leading automakers adopt polypropylene and polycarbonate honeycomb cores for electric and hybrid vehicle structures. It offers enhanced design freedom and cost efficiency in large-scale production. Thermoplastics facilitate closed-loop recycling systems in automotive manufacturing. Demand for EV battery protection systems boosts the integration of flame-retardant honeycomb materials. This trend supports the market’s transformation toward sustainable mobility. OEM partnerships with material innovators drive product standardization.

Expansion of Architectural Applications Across Commercial Infrastructure:

Architects and engineers increasingly specify honeycomb panels in large-scale infrastructure projects to balance strength and aesthetics. Exterior cladding, curtain walls, ceilings, and partitions benefit from lightweight and durable honeycomb materials. The Global Honeycomb Market taps into urbanization and smart building projects worldwide. Aluminum and stone veneer honeycomb panels enhance facades with reduced structural stress. Design flexibility and long service life make them suitable for airports, stadiums, and commercial complexes. It also supports acoustic insulation and thermal performance in interiors. High-end retail spaces and hospitality chains adopt honeycomb elements for premium finishes. Demand grows for fire-rated and moisture-resistant variants. The trend elevates honeycomb use in construction beyond industrial applications.

Market Challenges Analysis:

High Initial Production Costs and Capital Investment Requirements:

The high cost of raw materials and advanced manufacturing equipment limits entry and expansion for smaller players. Precision forming, bonding, and curing processes increase operational complexity. The Global Honeycomb Market faces pressure from price-sensitive sectors where cost-efficiency outweighs performance benefits. It often requires specialized tooling and cleanroom facilities for aerospace-grade components. Automation reduces labor costs but demands upfront investment and technical expertise. Market growth slows in regions with limited R&D infrastructure or supply chain inefficiencies. Fluctuations in aluminum, paper, and polymer prices affect pricing stability. Manufacturers must balance innovation with cost control to remain competitive. Cost barriers hinder broader adoption in small-scale or emerging applications.

Standardization, Regulatory Compliance, and Performance Validation Barriers:

Strict quality control standards in aerospace, defense, and automotive sectors necessitate exhaustive product validation. Regulatory approvals take time and limit agility in market expansion. The Global Honeycomb Market must adhere to stringent fire safety, toxicity, and mechanical testing benchmarks. It delays commercialization of new material formulations or hybrid designs. Compliance with global standards such as FAA, EASA, or ASTM adds certification costs. Discrepancies in regional codes pose challenges for multinational supply chains. Inconsistent recycling infrastructure also limits the adoption of sustainable variants. Addressing technical documentation and traceability requirements demands skilled labor. These regulatory challenges hinder smaller firms from scaling operations globally.

Market Opportunities:

Emerging Demand Across Asia-Pacific and Middle Eastern Economies:

Rapid industrialization, infrastructure expansion, and aerospace investment in Asia-Pacific present new revenue streams for honeycomb manufacturers. China, India, and Southeast Asian countries expand airport infrastructure, EV production, and smart cities. The Global Honeycomb Market benefits from government incentives promoting lightweight and sustainable materials. It also gains traction in Middle Eastern countries focused on urban development and construction. Growing import substitution efforts support local production capacity. Demand from commercial building and automotive suppliers’ fuels supply chain localization. The market has the potential to penetrate new end-user bases in underserved regions.

Product Diversification in Medical, Marine, and Renewable Energy Sectors:

Non-traditional sectors such as medical equipment housing, boat interiors, and wind turbine blades offer new application areas. Honeycomb structures serve as impact-absorbing, corrosion-resistant, and sterile surfaces. The Global Honeycomb Market aligns with trends in lightweight and portable equipment designs. Marine applications utilize honeycomb panels for bulkheads, flooring, and furniture in yachts and ferries. Renewable energy infrastructure integrates honeycomb cores into solar panel mounting systems and turbine housings. Product diversification supports resilience against demand fluctuations in core sectors.

Market Segmentation Analysis:

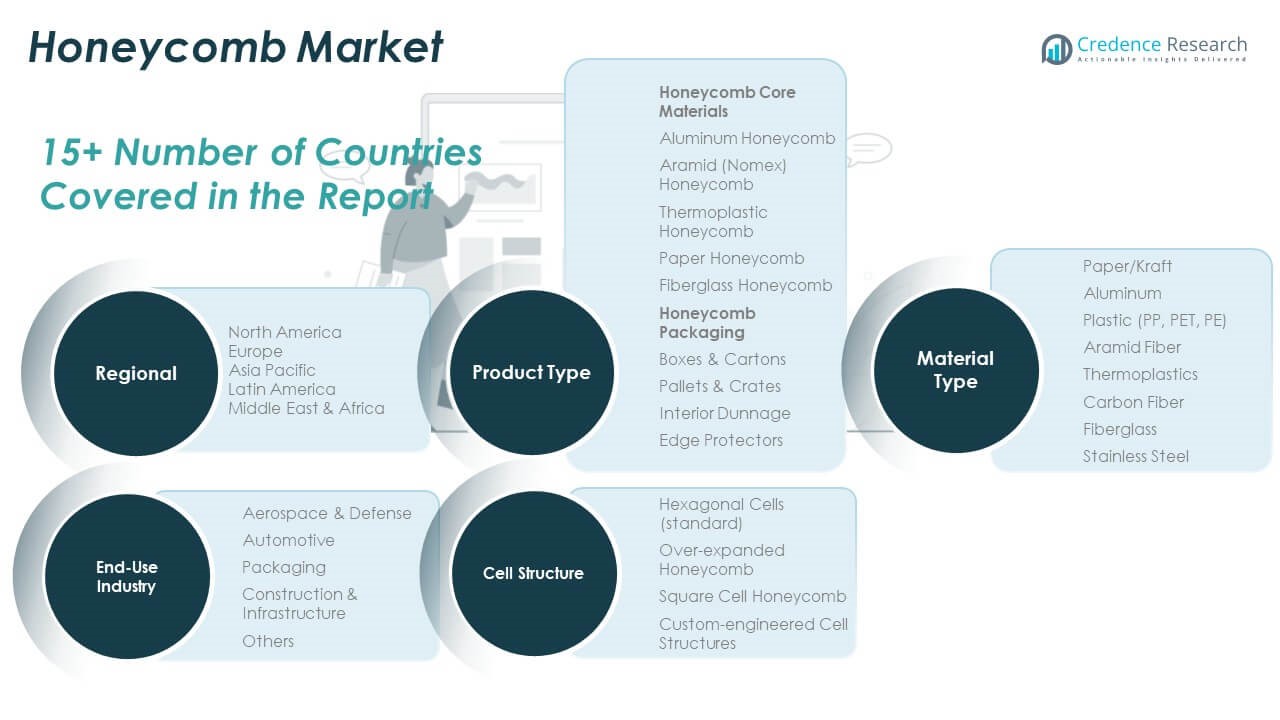

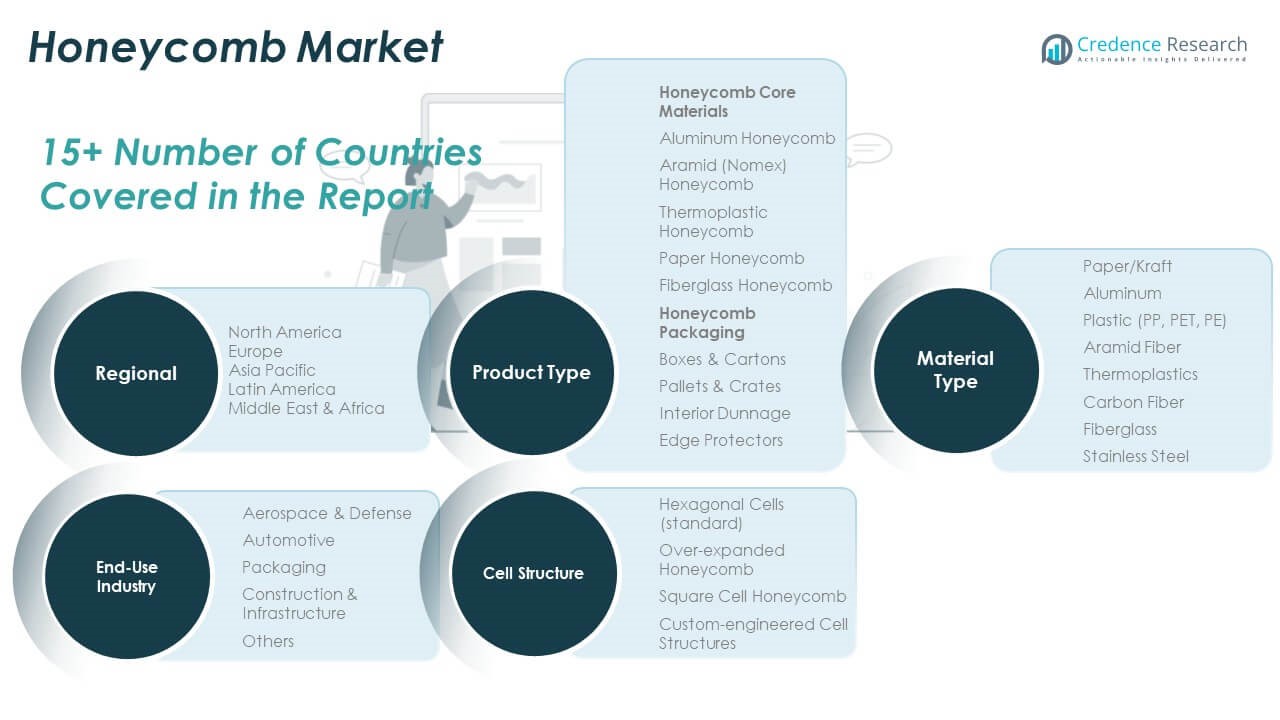

By Product Type

The Global Honeycomb Market is segmented into core materials and packaging solutions. Honeycomb core materials include Aluminum Honeycomb, Aramid (Nomex) Honeycomb, Thermoplastic Honeycomb, Paper Honeycomb, and Fiberglass Honeycomb. Aluminum cores lead due to their high strength-to-weight ratio and corrosion resistance, making them ideal for aerospace and transport applications. Aramid and thermoplastic variants offer flame retardance and recyclability, supporting automotive and defense uses. Paper honeycomb sees high demand in cost-effective and eco-friendly packaging. Fiberglass options serve well in moisture-exposed environments. In packaging, segments like Boxes & Cartons, Pallets & Crates, Interior Dunnage, and Edge Protectors support protective and stackable logistics solutions.

- For instance, aerospace manufacturers such as Airbus rely on aluminum honeycomb cores for interior partitions, bulkheads, and flooring in commercial aircraft to satisfy safety and fatigue resistance criteria

By End-Use Industry

The Global Honeycomb Market serves a broad set of industries, primarily Aerospace & Defense, Automotive, Packaging, Construction & Infrastructure, and Others. Aerospace & defense remain dominant due to their reliance on lightweight structural materials that meet stringent safety and performance standards. Automotive usage grows through adoption in crash structures and EV battery enclosures. The packaging segment benefits from demand for sustainable, durable solutions in logistics. Construction applications include cladding, partitions, and panels. Other sectors such as marine, electronics, and renewable energy drive emerging demand for specialized honeycomb solutions.

- Tesla’s Model Y, compared to the Model 3, achieved improved crash test outcomes using advanced honeycomb-type structures in its crumple zones. In moderate overlap crash tests, footwell intrusion was reduced from 21cm in Model 3 to just 1cm in Model Y, and the measured head injury criterion was cut from 88 to 22, demonstrating significant occupant safety improvements attributed to structural innovations using honeycomb design

By Cell Structure

Cell structure types include Hexagonal Cells (Standard), Over-expanded Honeycomb, Square Cell Honeycomb, and Custom-engineered Cell Structures. Standard hexagonal cells are widely adopted due to their structural efficiency and ease of manufacture. Over-expanded cells allow for higher airflow and are used in filtration and ventilation systems. Square cells support applications with specific directional strength requirements. Custom-engineered cell structures enable unique mechanical properties tailored to aerospace, defense, and advanced industrial applications. This segmentation supports the flexibility and innovation within the honeycomb manufacturing ecosystem.

By Material Type

Material segmentation of the market covers Paper/Kraft, Aluminum, Plastic (PP, PET, PE), Aramid Fiber, Thermoplastics, Carbon Fiber, Fiberglass, and Stainless Steel. Aluminum dominates due to its mechanical properties and lightweight nature. Paper/Kraft is widely used in packaging for its biodegradability and affordability. Plastic-based cores such as PP and PET enable impact resistance in automotive and industrial use. Aramid fiber and carbon fiber are employed in applications requiring high strength and fire resistance. Thermoplastics and fiberglass add value through flexibility and moisture protection. Stainless steel remains a niche choice for extreme environments.

Segmentation:

By Product Type

- Honeycomb Core Materials

- Aluminum Honeycomb

- Aramid (Nomex) Honeycomb

- Thermoplastic Honeycomb

- Paper Honeycomb

- Fiberglass Honeycomb

- Honeycomb Packaging

- Boxes & Cartons

- Pallets & Crates

- Interior Dunnage

- Edge Protectors

By Material Type

- Paper/Kraft

- Aluminum

- Plastic (PP, PET, PE)

- Aramid Fiber

- Thermoplastics

- Carbon Fiber

- Fiberglass

- Stainless Steel

By End-Use Industry

- Aerospace & Defense

- Automotive

- Packaging

- Construction & Infrastructure

- Others

By Cell Structure

- Hexagonal Cells (Standard)

- Over-expanded Honeycomb

- Square Cell Honeycomb

- Custom-engineered Cell Structures

By Region

- North America

- Europe

- UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific

- China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC

- Latin America

- Brazil, Argentina, Rest of Latin America

- Middle East

- GCC Countries, Israel, Turkey, Rest of Middle East

- Africa

- South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Honeycomb Market size was valued at USD 1,325.25 million in 2018 to USD 1,528.96 million in 2024 and is anticipated to reach USD 2,307.20 million by 2032, at a CAGR of 5.4% during the forecast period. North America accounts for approximately 29% of the Global Honeycomb Market share. It benefits from a robust aerospace and defense ecosystem, particularly in the United States, which demands lightweight, high-performance materials for aircraft interiors and structural components. The region also sees significant adoption of honeycomb packaging in logistics, electronics, and industrial goods. Automotive manufacturers integrate thermoplastic and aluminum honeycomb cores for crash management and EV battery protection. Sustainable packaging initiatives and federal regulations accelerate the shift toward recyclable honeycomb solutions. R&D investments and collaborations between OEMs and material producers support innovation. The market maintains high product standards due to strict safety certifications. It sustains growth through diversified end-use applications and well-established supply chains.

Europe

The Europe Honeycomb Market size was valued at USD 845.55 million in 2018 to USD 936.44 million in 2024 and is anticipated to reach USD 1,303.79 million by 2032, at a CAGR of 4.3% during the forecast period. Europe holds around 18% share of the Global Honeycomb Market. It leverages strong automotive and construction sectors to drive demand for lightweight, high-strength paneling and insulation. Leading EU countries, including Germany, France, and the UK, emphasize carbon emission reductions, prompting the use of thermoplastic and aramid-based honeycomb solutions. Construction projects adopt honeycomb cladding and partitions for energy efficiency and design flexibility. Demand grows for sustainable packaging in food, beverage, and e-commerce sectors. Aerospace demand remains steady with Airbus and other manufacturers sourcing advanced composite cores. Regulatory frameworks such as REACH and circular economy goals guide material innovation. The region maintains steady growth through a balance of industrial diversity and environmental compliance.

Asia Pacific

The Asia Pacific Honeycomb Market size was valued at USD 1,739.25 million in 2018 to USD 2,094.24 million in 2024 and is anticipated to reach USD 3,376.33 million by 2032, at a CAGR of 6.2% during the forecast period. Asia Pacific represents the largest share of the Global Honeycomb Market at approximately 40%. It is driven by rapid industrialization, infrastructure expansion, and a booming automotive and electronics sector. China and India lead construction applications with increasing demand for modular and lightweight building materials. Regional growth in EV production drives use of thermoplastic and aluminum honeycomb structures for battery enclosures and vehicle interiors. Packaging demand rises with expanding e-commerce and export industries. Government programs in Japan, South Korea, and Australia support aerospace-grade composites and material innovation. Local manufacturers scale up production to meet domestic and international demand. The region benefits from cost-effective manufacturing and growing investment in sustainable materials.

Latin America

The Latin America Honeycomb Market size was valued at USD 319.50 million in 2018 to USD 371.00 million in 2024 and is anticipated to reach USD 524.77 million by 2032, at a CAGR of 4.5% during the forecast period. Latin America contributes approximately 7% to the Global Honeycomb Market. Brazil and Mexico lead regional consumption, supported by automotive assembly plants and packaging industries. Infrastructure development and urbanization increase the need for lightweight construction materials. Local companies adopt paper and thermoplastic honeycomb for cost-effective, eco-conscious solutions. Import substitution policies encourage regional manufacturing of packaging and structural panels. Aerospace applications remain limited but grow through regional aircraft programs and maintenance facilities. Recycling initiatives and government regulations support demand for biodegradable packaging. The market shows consistent growth driven by industrial diversification and packaging modernization.

Middle East

The Middle East Honeycomb Market size was valued at USD 171.00 million in 2018 to USD 187.60 million in 2024 and is anticipated to reach USD 255.78 million by 2032, at a CAGR of 4.0% during the forecast period. The region holds about 5% of the Global Honeycomb Market share. Demand stems primarily from construction and infrastructure sectors, where honeycomb panels are used for cladding, ceilings, and decorative partitions. Countries like the UAE and Saudi Arabia invest in smart city and airport development, creating demand for fire-resistant and durable materials. Packaging applications also grow in consumer goods and industrial exports. While the aerospace sector is still emerging, regional carriers invest in advanced cabin materials. Sustainability mandates drive interest in recyclable honeycomb packaging formats. Import reliance limits domestic production, but investments are improving local capabilities. The market benefits from ongoing urban expansion and construction mega-projects.

Africa

The Africa Honeycomb Market size was valued at USD 99.45 million in 2018 to USD 152.34 million in 2024 and is anticipated to reach USD 198.92 million by 2032, at a CAGR of 3.0% during the forecast period. Africa represents approximately 2% of the Global Honeycomb Market share. Demand is driven by modest construction activity and packaging needs in growing urban centers. South Africa leads regional adoption, with applications in furniture, logistics, and low-cost housing materials. Paper honeycomb products dominate due to affordability and availability. Infrastructure projects supported by international aid and public investment gradually create opportunities for lightweight materials. Local manufacturing remains underdeveloped, with imports filling much of the market. Growth in e-commerce and small-scale manufacturing boosts packaging demand. The market progresses slowly, but improved logistics and trade zones may unlock long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hexacomb Corporation (Pregis)

- Smurfit Kappa Group

- DS Smith Plc

- Packaging Corporation of America

- Cascades Inc.

- UFP Technologies

- WestRock Company

- Hexcel Corporation

- Plascore, Inc.

- Euro-Composites S.A.

- Argosy International Inc.

- Toray Advanced Composites (formerly TenCate)

- The Gill Corporation

- DuPont

Competitive Analysis:

The Global Honeycomb Market features a moderately concentrated competitive landscape dominated by a mix of multinational corporations and specialized material manufacturers. Leading players such as Hexcel Corporation, Smurfit Kappa, DS Smith Plc, and Pregis (Hexacomb) focus on aerospace-grade cores, sustainable packaging, and customized structures. It witnesses strong competition in both high-performance composites and cost-effective paper-based formats. Companies invest in R&D to enhance material strength, recyclability, and application flexibility. Strategic collaborations with OEMs and end-use industries help secure long-term supply contracts. Market participants differentiate through material innovation, regional production capacity, and compliance with global certifications.

Recent Developments:

- In July 2025, Packaging Corporation of America detailed its acquisition of Greif’s U.S. containerboard business. This deal expands PCA’s manufacturing presence in key regions and increases the share of recycled content in its portfolio from 20% to about 30%. The strategic growth allows PCA to broaden its sustainable honeycomb and corrugated packaging solutions across North America, leveraging Greif’s assets for both product innovation and improved geographic reach.

- On June 20, 2025, Hexcel Corporation was selected by Flying Whales as the composite materials supplier for the new LCA60T airship, a next-generation cargo airship program. This partnership advances Hexcel’s lightweight honeycomb and composites offering for aerospace, reinforcing the company’s leadership in innovative, sustainable structural solutions for demanding transport applications.

- In May 2024, DS Smith Plc shareholders voted in favor of an all-share combination with International Paper. This merger, expected to complete in Q1 2025, is positioned to create an international leader in sustainable packaging. The integration is intended to advance both companies’ honeycomb packaging innovations and drive global market presence.

- In May 2025, Cascades Inc. reported improved year-over-year results in its Q1 2025 financials, with operating income rising to $50million from $9million the previous year. The company attributed growth to successful expansion in sustainable fiber-based packaging, including honeycomb product lines, and ongoing capital investments to enhance operational efficiency.

Market Concentration & Characteristics:

The Global Honeycomb Market maintains a moderate level of market concentration with a few large firms holding significant shares. It reflects both specialization and scale, with players catering to high-precision aerospace needs and large-volume packaging demands. Product differentiation through material type and customization remains a core strategy. The market is characterized by vertical integration, global supply chains, and rising sustainability compliance. Entry barriers exist due to certification, capital investment, and technical expertise. Competitive dynamics shift based on innovation cycles and regional regulations.

Report Coverage:

The research report offers an in-depth analysis based on product type, material type, end-use industry, and cell structure. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand from aerospace and defense will continue to drive innovation in high-performance, lightweight honeycomb structures.

- Electric vehicle growth will boost usage of thermoplastic and aluminum honeycomb cores in battery housing and structural reinforcements.

- Construction sector adoption will rise with expanding use of energy-efficient cladding and partition systems in green buildings.

- Demand for sustainable packaging will fuel the shift to paper and recyclable honeycomb formats in industrial logistics.

- Customization through CNC machining and 3D printing will expand tailored product offerings across end-use industries.

- Asia Pacific will remain the fastest-growing region due to manufacturing capacity, industrialization, and infrastructure investment.

- Material innovations such as hybrid composites and bio-based cores will strengthen product portfolios and sustainability compliance.

- Growing marine, rail, and renewable energy sectors will create new application areas for durable honeycomb materials.

- Strategic partnerships between OEMs and material manufacturers will support faster market penetration and product development.

- Market players will focus on balancing cost-efficiency with regulatory compliance to gain a competitive edge globally.