Market Overview

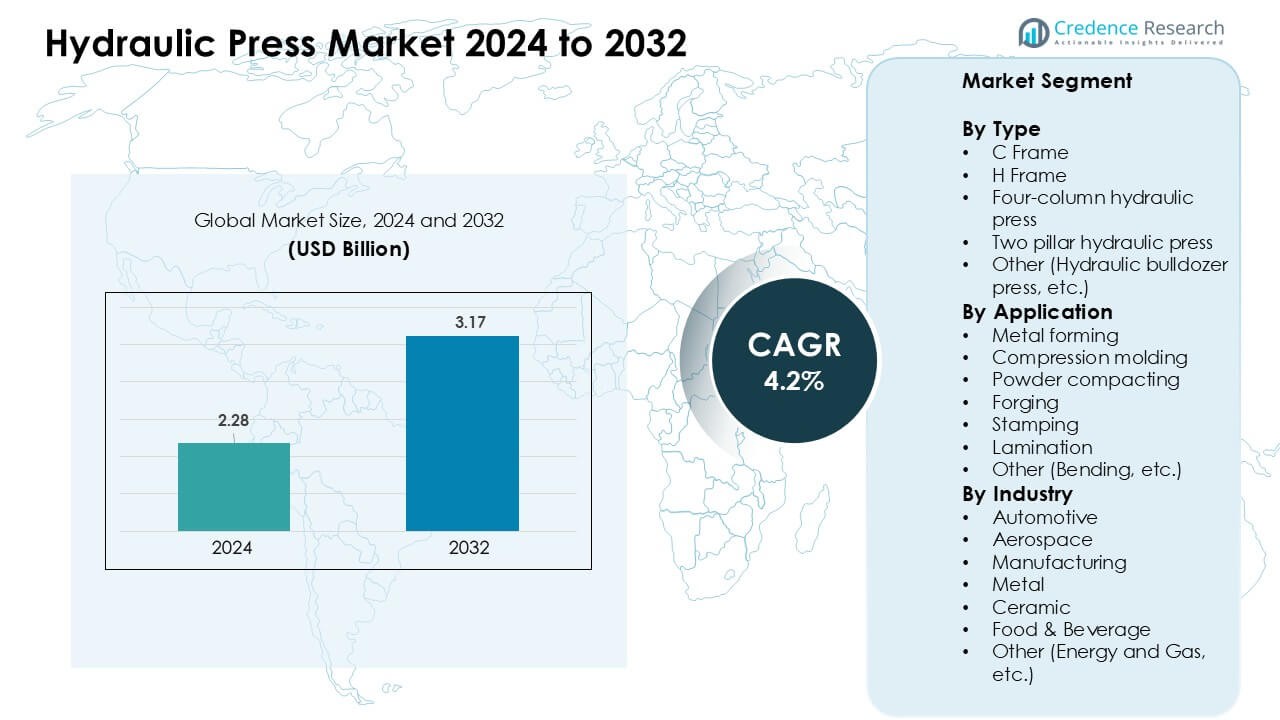

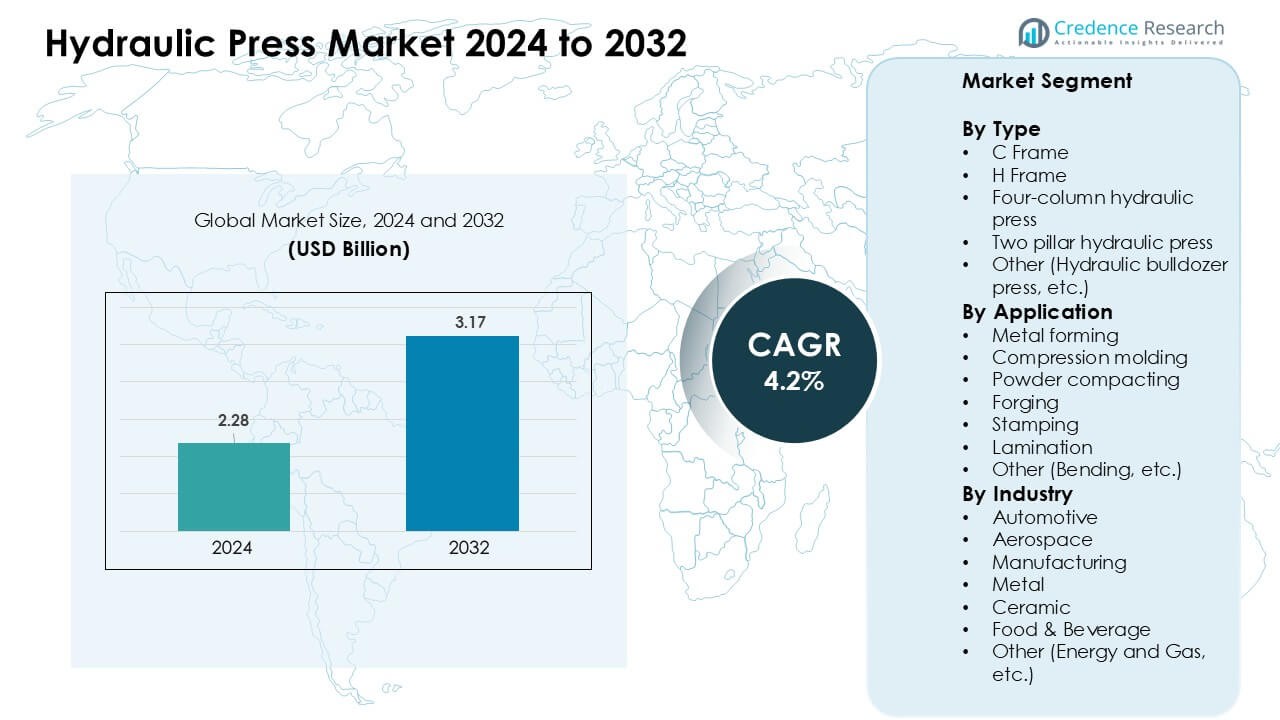

Hydraulic Press Market was valued at USD 2.28 billion in 2024 and is anticipated to reach USD 3.17 billion by 2032, growing at a CAGR of 4.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydraulic Press Market Size 2024 |

USD 2.28 Billion |

| Hydraulic Press Market, CAGR |

4.2 % |

| Hydraulic Press Market Size 2032 |

USD 3.17 Billion |

The hydraulic press market is shaped by key players such as Schuler, Greenerd Press & Machine Co., DAKE, Asai Corporation, ENERPAC, DORST Technologies GmbH & Co. KG, Betenbender Manufacturing Inc., Beckwood Press, Amino Corporation, and Hare Press. These companies compete through high-tonnage systems, automated control platforms, and advanced forming technologies that support large-scale production across automotive, aerospace, and industrial sectors. Product innovation, custom engineering, and energy-efficient hydraulic solutions strengthen their global presence. North America led the market in 2024 with a 34% share, driven by strong modernization activities and high adoption of precision forming equipment across major manufacturing hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hydraulic Press Market reached USD 28 billion in 2024 and is projected to reach USD 3.17 billion by 2032, growing at a CAGR of 4.2%.

- Demand grows as automotive and aerospace manufacturers increase the use of hydraulic systems for precision metal forming, deep drawing, and composite shaping tasks.

- Smart hydraulic presses with IoT sensors, predictive maintenance, and energy-efficient servo systems shape emerging trends, while high-tonnage units gain traction in EV and heavy-industry applications.

- Competition intensifies as key players focus on advanced control systems, customization, and high-durability frames, with leading segments such as C-frame presses holding strong performance share.

- North America led the market with a 34% share in 2024, followed by Europe and Asia-Pacific, while automotive accounted for the largest industry share, driven by large-scale forming and structural component production.

Market Segmentation Analysis:

By Type

C-frame presses led the type segment in 2024 with about 34% share. This design gained traction due to a compact frame, open-front access, and lower tooling time, which helped shops handle fast metal shaping and light-to-medium fabrication tasks. Manufacturers adopted C-frame units because the layout supports easy die changes and reduced floor space needs. H-frame and four-column presses saw steady use in heavy fabrication, while two-pillar and other hydraulic presses served niche forming and repair work where higher force or deep-draw tasks were required.

- For instance, Schuler Group supplies H-frame hydraulic presses with capacities exceeding 5,000 kN. These presses are widely used for deep drawing and large steel panel forming. Automotive and heavy-equipment plants use them for high-load, repeatable production.

By Application

Metal forming dominated the application segment in 2024 with nearly 38% share. The segment grew due to high demand for sheet shaping, deep drawing, and plate bending across automotive and machinery plants. Companies preferred hydraulic presses for consistent force control and better forming accuracy in mass production. Compression molding and powder compacting expanded in plastics and ceramics, while forging and stamping gained traction in component plants. Lamination and other bending uses also increased as industries sought stable pressure delivery for uniform product quality.

- For instance, Bystronic manufactures hydraulic press brakes under the Xpert and Xpert Pro These models offer pressing forces from about 1,500 kN to 3,200 kN.

They are widely used for precision bending in metal fabrication plants.

By Industry

Automotive led the industry segment in 2024 with around 36% share. Carmakers required hydraulic presses for body panel production, chassis parts, and structural components, driving strong adoption in assembly and tier-1 supplier networks. The industry favored these presses for repeatable pressure, high tonnage options, and precise metal shaping during large-batch output. Aerospace, manufacturing, and metal sectors also relied on hydraulic systems for alloy forming and precision shaping. Ceramic and food industries used presses for compacting and packaging tasks, while energy and gas users adopted them for heavy-duty component fabrication.

Key Growth Drivers

Rising Demand for Precision Metal Forming

The hydraulic press market grows due to an increasing need for precise and complex metal forming across automotive, aerospace, and machinery industries. Manufacturers depend on hydraulic systems because these presses deliver stable force, smooth operation, and accurate control for parts that require tight dimensional tolerance. The rising use of lightweight materials in vehicles raises the demand for deeper forming and high-pressure shaping. Many companies also upgrade older mechanical units to hydraulic systems to improve productivity and reduce scrap. This shift boosts adoption in stamping lines, panel forming, and structural part production where accuracy and repeatability drive output quality.

- For instance, Schuler AG supplies multi-station hydraulic press lines for automotive body manufacturing. Lead presses can reach 35,000 kN, with downstream presses around 20,000 kN These lines support complex deep drawing with stable quality across all forming stages.

Expansion of Industrial Automation

Hydraulic press adoption increases as factories invest in automated production lines. Press manufacturers integrate sensors, servo valves, and digital control systems to reduce manual tasks and enhance process stability. Automated presses support faster cycle times and allow operators to run multiple stages with less downtime. Robotics-based loading and unloading systems also reduce safety risks and improve material flow in high-volume plants. Industries prefer automated hydraulic presses because the systems monitor pressure, stroke, and tool condition in real time. This movement toward smart and connected equipment strengthens demand across large component plants and tier-1 supplier networks.

Growth in Composite and Advanced Material Processing

Demand rises as industries shift toward composites, powder metals, and engineered plastics. Hydraulic presses handle these materials well because the systems provide controlled pressure curves and slow, steady movement needed for molding or compacting. Aerospace and electric vehicle producers use high-tonnage presses to create strong and lightweight components. Powder metallurgy gains momentum as manufacturers adopt presses for densification, compact part shaping, and mass production. The growing use of engineered materials in tools, machinery parts, and structural components supports steady demand. This growth pushes suppliers to develop advanced press designs optimized for new material categories.

- For example, SMS Group is a confirmed supplier of large hydraulic press systems. The company delivers presses above 30,000 kN for composite forming and powder metallurgy. These systems support long dwell times with precise pressure control for aerospace use.

Key Trends & Opportunities

Adoption of Smart Hydraulic Presses

The market sees strong movement toward smart and digitally enhanced presses. Manufacturers integrate IoT platforms, pressure monitoring software, and real-time diagnostics to improve accuracy and reduce unplanned downtime. Predictive maintenance tools track seal wear, oil temperature, and cycle counts, helping users reduce breakdowns. Smart presses also adjust parameters automatically, improving consistency in high-volume plants. This trend creates new opportunities for suppliers that offer software-based upgrades. Industries that aim for higher traceability and reduced waste view smart hydraulic systems as a major step toward fully digital factories.

- For instance, Bosch Rexroth Smart Function Kits Pressing integrate sensors, servo drives, and controls. The system records force and position data in real time during each press cycle. This enables predictive maintenance and automatic process adjustment in industrial presses.

Increase in Energy-Efficient Hydraulic Systems

Efficiency-focused upgrades create major opportunities in the market. Variable-speed pumps and servo-hydraulic units help reduce energy use and heat loss during operation. Manufacturers shift away from traditional fixed-displacement systems to achieve lower operating costs. Many companies also value energy-efficient presses because they reduce noise, extend oil life, and improve environmental performance. Governments encourage cleaner manufacturing, which supports faster adoption of energy-saving systems. This trend accelerates product innovation focused on better power management and more compact hydraulic units for modern production environments.

- For instance, Bosch Rexroth supplies servo-hydraulic pump drive systems for hydraulic presses. The servomotor runs only on demand, stopping during idle phases. This design enables energy savings of up to 70% compared with conventional constant-speed systems.

Growing Demand from EV and Aerospace Sectors

Electric vehicle and aerospace programs offer strong growth openings. Both industries require lightweight metals, multi-layer composite parts, and strong structural components. High-tonnage hydraulic presses support deep drawing, forging, and compacting for advanced materials used in EV battery trays, crash structures, and aircraft panels. Suppliers benefit from rising investments in modern fabrication plants dedicated to new mobility projects. This opportunity expands further as global EV production scales and aircraft manufacturers increase output.

Key Challenges

High Maintenance Requirements

Hydraulic presses face maintenance challenges because they use fluid power systems with components that wear over time. Seal degradation, oil contamination, pump failure, and temperature fluctuations raise the need for routine inspection. Many factories struggle with downtime when leaks or pressure drops occur, especially in older machines. These issues increase operating costs and reduce productivity. Small and mid-size firms often delay maintenance, which creates more frequent equipment failures. The challenge pushes manufacturers to design more durable components and better filtration systems to reduce lifecycle issues.

Competition from Mechanical and Servo Presses

Mechanical and servo presses pose strong competition in applications requiring higher speed and lower operating costs. Servo systems offer precise control and faster cycles, which attracts electronics, automotive, and appliance industries. Many users prefer presses with lower energy needs and reduced maintenance. Hydraulic presses remain essential for high-tonnage and deep-draw tasks, but some mid-range applications shift toward servo technology. This pressure forces hydraulic press suppliers to innovate with hybrid designs and better control systems. The challenge grows as more factories invest in servo-driven equipment for accuracy and efficiency gains.

Regional Analysis

North America

North America held about 34% share in 2024, driven by strong adoption across automotive, aerospace, and industrial manufacturing. The region benefits from advanced fabrication facilities and early use of automated hydraulic systems. U.S. producers invest in high-tonnage presses for structural components, while Canada supports demand through metal and machinery production. Robotics integration, energy-efficient systems, and digital monitoring increase replacement of older mechanical units. The region’s focus on lightweight vehicle parts and rising EV manufacturing keeps demand stable. Strong capital spending and continuous plant modernization maintain North America’s leading position in the global hydraulic press market.

Europe

Europe accounted for nearly 29% share in 2024, supported by strong machinery, aerospace, and metalworking industries. Germany, Italy, and France lead adoption due to advanced engineering capabilities and strict quality standards. The region favors hydraulic presses for precision forming, composite molding, and complex alloy shaping. EU sustainability policies encourage industries to adopt energy-efficient and low-noise hydraulic systems. Automotive suppliers use presses for body panels, structural frames, and lightweight components. Growth in aerospace programs and high automation levels across factories continue to enhance market demand. Europe remains a key technical hub for innovative press manufacturing.

Asia-Pacific

Asia-Pacific dominated the growth outlook with about 31% share in 2024, driven by rapid industrialization in China, India, Japan, and South Korea. Expanding automotive production, metal fabrication, and electronics manufacturing strengthens demand. The region’s large-scale factories prefer hydraulic presses for high-volume forming, stamping, and deep drawing. China leads adoption due to strong machinery exports, while Japan advances precision press technology. Rising investment in EV manufacturing, aerospace parts, and metal forming clusters boosts market penetration. Affordable labor and expanding industrial zones help Asia-Pacific remain the fastest-growing regional market.

Latin America

Latin America held close to 4% share in 2024, supported by growing metalworking, automotive assembly, and machinery fabrication activities. Brazil and Mexico drive most installations as manufacturers increase production of stamped and formed components. Hydraulic presses see rising use in maintenance workshops and mid-scale fabrication units due to versatility and lower upfront cost than large mechanical systems. Infrastructure development and gradual industrial expansion support steady demand. Although adoption moves slower than major regions, modernization efforts and investments in manufacturing plants improve growth prospects across Latin America.

Middle East & Africa

The Middle East & Africa region captured around 2% share in 2024, reflecting gradual but steady demand growth. Adoption rises in metal fabrication, oil and gas components, and general industrial manufacturing. GCC countries invest in new machinery for infrastructure and construction projects, driving the need for high-tonnage and medium-duty hydraulic presses. South Africa supports demand through mining equipment manufacturing and repair workshops. Limited industrial base slows wider adoption, but ongoing diversification programs and manufacturing expansion in the Gulf region help create new opportunities. The region continues to develop as emerging demand builds across key industries.

Market Segmentations:

By Type

- C Frame

- H Frame

- Four-column hydraulic press

- Two pillar hydraulic press

- Other (Hydraulic bulldozer press, etc.)

By Application

- Metal forming

- Compression molding

- Powder compacting

- Forging

- Stamping

- Lamination

- Other (Bending, etc.)

By Industry

- Automotive

- Aerospace

- Manufacturing

- Metal

- Ceramic

- Food & Beverage

- Other (Energy and Gas, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hydraulic press market features strong competition among global and regional manufacturers that focus on high-tonnage systems, automated control technologies, and precision forming capabilities. Leading companies such as Schuler, Greenerd Press & Machine Co., DAKE, Asai Corporation, ENERPAC, DORST Technologies GmbH & Co. KG, Betenbender Manufacturing Inc., Beckwood Press, Amino Corporation, and Hare Press strengthen their positions through product innovation, custom engineering solutions, and advanced safety features. Many suppliers invest in servo-hydraulic systems, energy-efficient pumps, and IoT-based monitoring platforms to meet rising demand for smarter and faster forming operations. Partnerships with automotive, aerospace, and industrial manufacturers help expand global reach and support large-scale installation projects. Continuous modernization efforts in metal forming, composite molding, and forging applications further intensify competition, pushing companies to improve system durability, cycle efficiency, and precision across diverse production environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schuler

- Greenerd Press & Machine Co.

- DAKE

- Asai Corporation

- ENERPAC

- DORST Technologies GmbH & Co. KG

- Betenbender Manufacturing Inc.

- Beckwood Press

- Amino Corporation

- Hare Press

Recent Developments

- In July 2025, Asai Corporation exhibited at MF-TOKYO 2025 (company posted exhibition notices and show follow-ups in July 2025), underlining Asai’s active trade-show presence and promotion of its hydraulic and diespotting press lines

- In December 2024, Schuler partnered with Ceer to supply and install a fully automatic press shop for the Ceer Manufacturing Complex (Schuler press-shop partnership / digital-suite news).

- In July2024, Greenerd Press & Machine Co.: Featured in coverage about custom hydraulic-press solutions with integrated automation highlighting Greenerd’s focus on bespoke hydraulic presses and automation for industries such as automotive/electronics.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as industries adopt advanced forming systems for complex components.

- Automation and digital monitoring will drive upgrades across large production plants.

- Energy-efficient hydraulic units will gain strong traction due to lower operating costs.

- High-tonnage presses will see wider use in EV battery, aerospace, and structural part production.

- Adoption of servo-hydraulic technology will expand for better precision and cycle control.

- Composite and powder-metal applications will boost the need for controlled-pressure presses.

- Manufacturers will invest more in IoT-enabled predictive maintenance solutions.

- Hybrid press designs will emerge to compete with mechanical and servo presses.

- Asia-Pacific will remain a key growth region due to rapid industrial expansion.

- Global players will focus on customization and modular press platforms to meet diverse industry needs.