Market Overview:

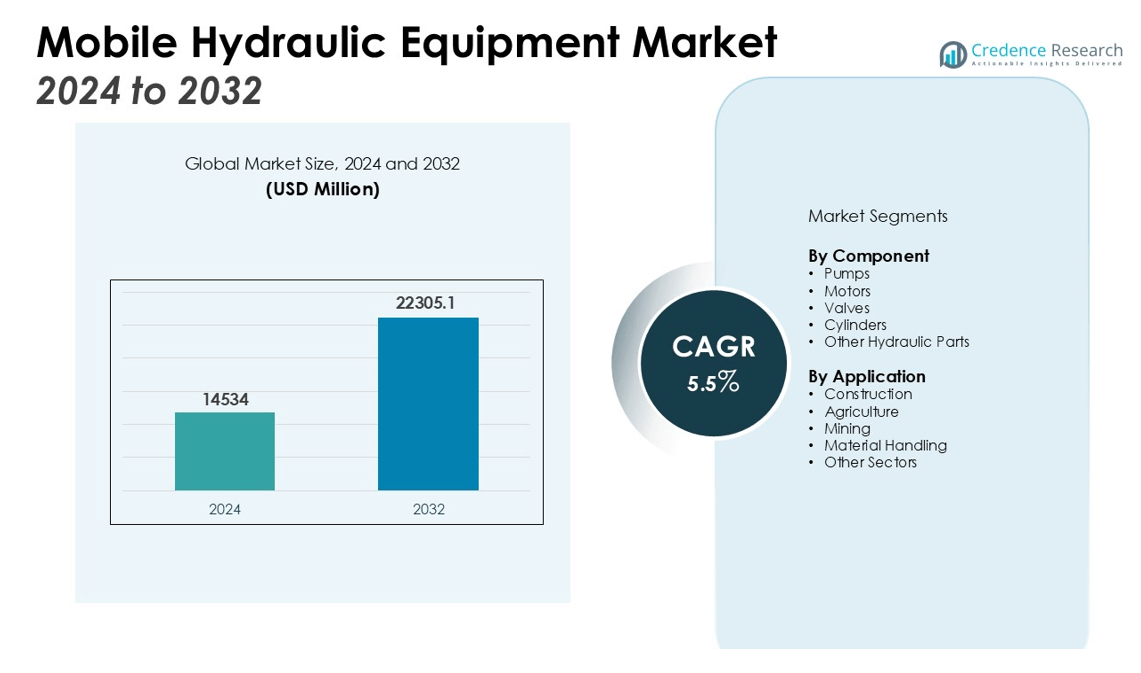

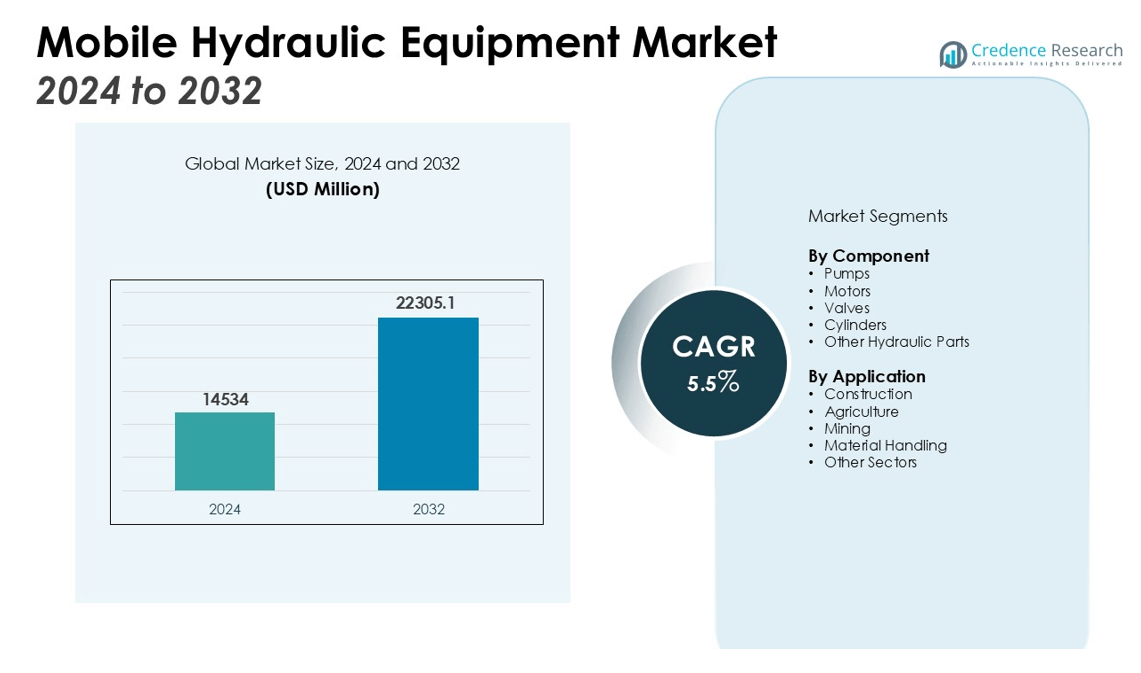

The Mobile Hydraulic Equipment Market size was valued at USD 14534 million in 2024 and is anticipated to reach USD 22305.1 million by 2032, at a CAGR of 5.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Hydraulic Equipment Market Size 2024 |

USD 14534 million |

| Mobile Hydraulic Equipment Market, CAGR |

5.5% |

| Mobile Hydraulic Equipment Market Size 2032 |

USD 22305.1 million |

Growth in the market is driven by rapid infrastructure development, urbanization, and greater mechanization in construction, agriculture, mining, and renewable energy sectors. Mobile equipment such as excavators, cranes, loaders, and harvesters continues to see robust demand due to its versatility and efficiency. Technological integration, including hybrid hydraulic systems, IoT-enabled sensors, and automation, is improving operational performance, reducing downtime, and enabling predictive maintenance, which in turn is attracting further investment in the sector.

Asia-Pacific leads the global market due to large-scale infrastructure projects and industrialization in China, India, Japan, and South Korea. The Middle East & Africa is emerging as one of the fastest-growing regions, supported by construction, mining, and oil and gas investments. North America remains a strong market, driven by innovation, safety standards, and the adoption of electric and remotely operated hydraulic solutions. Increasing emphasis on sustainability is also prompting manufacturers worldwide to develop energy-efficient and eco-friendly hydraulic equipment.

Market Insights:

- The Mobile Hydraulic Equipment Market is valued at USD 14,534 million and is projected to reach USD 22,305.1 million by 2032, reflecting a CAGR of 5.5% driven by strong demand across construction, agriculture, mining, and renewable energy sectors.

- Increasing adoption of excavators, cranes, loaders, and harvesters is boosting market expansion due to their versatility, efficiency, and ability to meet diverse industrial needs.

- Integration of hybrid hydraulic systems, IoT-enabled sensors, and automation is improving operational performance, reducing downtime, and enabling predictive maintenance for enhanced productivity.

- Asia-Pacific holds a 42% share, supported by industrialization and large-scale infrastructure projects, while North America captures 26% with strong technological adoption and regulatory compliance.

- Sustainability trends are shaping product development, with manufacturers focusing on electric and hybrid-powered equipment, eco-friendly fluids, and recyclable materials to meet global environmental standards.

- High operational and maintenance costs, coupled with the need for skilled technicians and compliance with stringent environmental regulations, present key challenges to market growth.

- The Middle East & Africa, holding 18% share, and Latin America, with 14% share, are emerging growth regions driven by mining, oil and gas, and expanding infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Infrastructure Development and Industrial Expansion

The Mobile Hydraulic Equipment Market benefits from strong demand in infrastructure development and industrial projects worldwide. Large-scale construction of roads, bridges, ports, and urban facilities increases the need for high-capacity hydraulic machinery such as excavators, cranes, and loaders. Governments are investing heavily in public infrastructure to stimulate economic growth, driving consistent equipment orders. Industrial expansion in sectors like manufacturing, energy, and mining also contributes to higher utilization rates of mobile hydraulic systems. These developments position the market for sustained growth over the forecast period.

- For instance, SANY India achieved a remarkable milestone by delivering 1,111 hydraulic excavators in the West Region during 2024, showcasing the growing industrial demand for mobile hydraulic equipment.

Advancement of Hydraulic Technology and System Efficiency

Continuous improvements in hydraulic technology enhance operational efficiency and reliability, strengthening the Mobile Hydraulic Equipment Market. Hybrid hydraulic systems, IoT integration, and automation features deliver higher precision and performance while reducing downtime. Predictive maintenance capabilities allow operators to anticipate component wear and optimize service schedules, minimizing disruptions. Energy-efficient designs reduce fuel consumption and emissions, meeting increasingly stringent environmental standards. Such advancements improve total cost of ownership, making equipment more appealing to end-users.

- For instance, Bosch Rexroth’s CytroBox, equipped with the CytroConnect IoT service, provides operators with live system status data accessible via smartphones, tablets, or PCs—supporting predictive maintenance and improving equipment uptime on-site for units with power capabilities up to 30kW.

Growing Demand in Agriculture and Mining Sectors

Expanding mechanization in agriculture and intensified mining activities create robust opportunities for the Mobile Hydraulic Equipment Market. Modern agricultural machinery, such as harvesters and tractors, increasingly relies on hydraulic systems for improved productivity. Mining operations use heavy hydraulic equipment to handle large volumes of material efficiently and safely. Rising commodity demand, particularly in emerging economies, is pushing companies to invest in high-performance mobile hydraulic solutions. These applications reinforce the market’s importance across resource-driven industries.

Stringent Safety Regulations and Sustainability Initiatives

Regulatory requirements for workplace safety and environmental compliance are shaping the Mobile Hydraulic Equipment Market. Manufacturers are integrating advanced safety systems, including load monitoring and stability controls, to meet operator protection standards. Sustainability initiatives encourage the development of eco-friendly hydraulic fluids and energy-efficient machinery. This focus on safety and environmental responsibility increases trust in equipment reliability and compliance. Companies that align with these standards gain a competitive advantage in securing large-scale contracts.

Market Trends:

Integration of Digital Technologies and Smart Hydraulic Systems

The Mobile Hydraulic Equipment Market is witnessing a significant shift toward digital integration and smart system capabilities. IoT-enabled sensors, telematics, and advanced control systems are being incorporated to improve equipment monitoring and operational precision. It allows real-time data collection on performance, enabling predictive maintenance and reducing unexpected downtime. Automation features enhance operator efficiency, supporting higher productivity in demanding work environments. Hybrid hydraulic solutions are gaining traction for their ability to optimize fuel consumption while maintaining power output. Manufacturers are investing in software-driven solutions to provide remote diagnostics and performance optimization. These advancements are redefining operational standards and expanding the market’s competitive edge.

- For instance, Danfoss’s Digital Displacement pump technology achieves up to 24.8% reduction in energy consumption in excavator applications, enabling smaller battery requirements (314 kWh versus 418 kWh) while maintaining the same operational performance through intelligent piston control and flow-on-demand capabilities.

Sustainability Focus and Shift Toward Energy-Efficient Solutions

Sustainability goals and stricter environmental regulations are influencing product development in the Mobile Hydraulic Equipment Market. Manufacturers are prioritizing the use of eco-friendly hydraulic fluids, recyclable materials, and energy-efficient system designs. It is driving the adoption of electric and hybrid-powered mobile equipment to reduce emissions and meet global climate objectives. Advances in component design are helping improve power-to-weight ratios, resulting in better fuel efficiency and reduced environmental impact. Growing awareness of lifecycle costs is encouraging end-users to invest in equipment with lower operating expenses and extended service life. Governments and industry bodies are promoting green certifications, influencing purchasing decisions in multiple sectors. This trend is expected to accelerate innovation and reshape competitive strategies in the coming years.

- For instance, Doosan DX340 LC-3 excavator—equipped with Bosch Rexroth’s D-Ecopower virtual bleed-off pump control—consumes 12 percent less fuel than comparable models, reducing emissions and operational costs in field applications

Market Challenges Analysis:

High Operational Costs and Maintenance Requirements

The Mobile Hydraulic Equipment Market faces the challenge of high operational and maintenance costs, which can deter investment in certain regions. Hydraulic systems require regular servicing, fluid replacement, and component inspections to ensure optimal performance. It increases the total cost of ownership for end-users, particularly in industries with tight budget constraints. Downtime during repairs can disrupt project timelines and reduce operational efficiency. The need for skilled technicians to handle advanced hydraulic technology further adds to expenses. Fluctuating fuel prices and spare part costs also create financial uncertainties for operators.

Regulatory Compliance and Environmental Concerns

Strict environmental regulations and safety compliance requirements present hurdles for the Mobile Hydraulic Equipment Market. Meeting emission standards and adhering to workplace safety protocols require continuous investment in design upgrades and testing. It can slow product development cycles and increase production costs for manufacturers. Environmental concerns over hydraulic fluid leaks and waste disposal demand the adoption of eco-friendly solutions, which may raise initial purchase prices. Intense global competition pressures companies to innovate while keeping costs competitive. Regulatory differences across regions create complexity for manufacturers operating in multiple markets.

Market Opportunities:

Expansion in Emerging Markets and Infrastructure Projects

The Mobile Hydraulic Equipment Market holds significant potential in emerging economies undergoing rapid industrialization and urban development. Large-scale infrastructure projects in Asia-Pacific, Africa, and Latin America are increasing demand for high-performance hydraulic machinery. It creates opportunities for manufacturers to supply equipment for construction, mining, and transportation projects. Government investments in smart cities, renewable energy facilities, and public infrastructure further boost market prospects. Local partnerships and distribution networks can help companies expand their presence in high-growth regions. Rising agricultural mechanization in developing nations also offers new avenues for hydraulic equipment adoption.

Technological Innovation and Sustainable Solutions

Advances in automation, IoT integration, and hybrid power systems are creating opportunities for differentiation in the Mobile Hydraulic Equipment Market. It enables manufacturers to deliver equipment with improved efficiency, reduced emissions, and enhanced operational safety. The shift toward electric and hybrid-powered machinery aligns with global sustainability goals and regulatory demands. Offering predictive maintenance and remote monitoring solutions can attract cost-conscious buyers seeking long-term value. Customized solutions for niche applications, such as offshore operations or precision agriculture, can open specialized market segments. Collaborations with technology providers will help companies accelerate innovation and maintain a competitive edge.

Market Segmentation Analysis:

By Component

The Mobile Hydraulic Equipment Market is segmented into pumps, motors, valves, cylinders, and other hydraulic parts. Pumps and motors hold a significant share due to their essential role in power generation and motion control within hydraulic systems. Valves are gaining importance for their ability to regulate flow and pressure, improving efficiency and safety. Cylinders remain indispensable for delivering linear motion in lifting and material handling operations. It benefits from continuous advancements in durability, energy efficiency, and integration with intelligent control systems.

- For instance, Bosch Rexroth CDL1 mill-type cylinder withstands at least 10 million double strokes at 70 percent of its 160 bar nominal pressure, operating continuously at speeds up to 0.5 m/s without failure.

By Application

The Mobile Hydraulic Equipment Market is divided into construction, agriculture, mining, material handling, and other sectors. Construction leads the segment share due to the extensive use of excavators, cranes, and loaders in infrastructure development. Agriculture is expanding with rising adoption of harvesters and tractors aimed at boosting operational productivity. Mining requires heavy-duty hydraulic systems capable of functioning in harsh environments, supporting demand for high-capacity equipment. Material handling depends on hydraulic machinery for port operations, warehousing, and logistics activities. It is driven by growing industrial activity and the requirement for reliable, high-performance mobile solutions across multiple industries.

- For instance, the Konecranes S-series rope hoist delivers enhanced performance with a lifting capacity of up to 20tons and Adaptive Speed Range technology, accelerating cycle times and improving operational efficiency for industrial clients.

Segmentations:

By Component

- Pumps

- Motors

- Valves

- Cylinders

- Other Hydraulic Parts

By Application

- Construction

- Agriculture

- Mining

- Material Handling

- Other Sectors

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Holds the Largest Regional Share

Asia-Pacific accounts for 42% of the Mobile Hydraulic Equipment Market, supported by rapid industrialization, large-scale infrastructure investments, and expanding manufacturing capabilities. Countries such as China, India, Japan, and South Korea are witnessing strong demand for hydraulic machinery in construction, mining, and agriculture. It benefits from government-backed infrastructure programs and growing urban development projects. High production capacity and cost-effective manufacturing in the region give local players a competitive edge. Increasing adoption of advanced hydraulic technologies is further enhancing operational efficiency across industries. The market in Asia-Pacific is expected to maintain its dominant position throughout the forecast period.

North America Maintains a Significant Share

North America holds 26% of the Mobile Hydraulic Equipment Market, driven by strong adoption of advanced automation and safety features. The United States and Canada show consistent demand in construction, oil and gas, and material handling applications. It benefits from stringent workplace safety regulations and rising investment in sustainable machinery. High R&D spending and the presence of major industry players support continuous product innovation. The shift toward electric and hybrid hydraulic systems is gaining momentum in the region. North America is expected to maintain steady growth supported by technology-driven advancements.

Middle East & Africa and Latin America Show Growing Share

The Middle East & Africa region holds 18% of the Mobile Hydraulic Equipment Market, fueled by investments in mining, oil and gas, and infrastructure development. Large construction projects and urban expansion initiatives in Gulf countries are increasing demand for high-capacity hydraulic machinery. It is also supported by modernization efforts in agriculture and industrial sectors. Latin America, with a 14% share, led by Brazil and Mexico, is witnessing demand from construction and resource extraction industries. Local infrastructure programs and increased private sector participation are opening new business opportunities. Both regions are positioned for accelerated growth over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bucker Hydraulics (Germany)

- Daikin (Japan)

- Bosch Rexroth (Germany)

- Eaton Corporation Plc (Ireland)

- HAWE (Germany)

- Hydac (Germany)

- Parker Hannifin (US)

- Nachi-Fujikoshi (Japan)

- Moog, Inc. (US)

- Kawasaki (Japan)

- Casappa (Italy)

- Concentric (Sweden)

Competitive Analysis:

The Mobile Hydraulic Equipment Market features a competitive landscape with global and regional players focusing on product innovation, technological integration, and market expansion. Leading companies invest in advanced hydraulic systems with IoT connectivity, automation capabilities, and energy-efficient designs to strengthen their market position. It is witnessing strategic mergers, acquisitions, and partnerships aimed at expanding distribution networks and enhancing product portfolios. Manufacturers compete on performance, durability, cost-efficiency, and compliance with environmental and safety regulations. Established brands maintain dominance through strong R&D capabilities and a broad product range, while emerging players target niche applications and price-sensitive markets. Continuous development of electric and hybrid-powered equipment is shaping competitive strategies, aligning with global sustainability trends. Regional players leverage proximity to customers and localized manufacturing to gain a competitive edge in fast-growing markets, while global leaders focus on large-scale projects and long-term contracts to secure consistent revenue streams.

Recent Developments:

- In March 2025, Daikin presented the EWYK-QZ Modular Air-to-Water Heat Pump prototype at ISH Frankfurt, featuring propane (R-290) as a refrigerant, with official market launch planned for Q4 2025.

- In March 2025, Eaton announced new duplex and in-line pressure filters, expanding its hydraulic filtration portfolio.

- In August 2025, Parker Hannifin announced the acquisition of Curtis Instruments, Inc. to expand its electrification portfolio.

Market Concentration & Characteristics:

The Mobile Hydraulic Equipment Market is moderately concentrated, with a mix of established global manufacturers and competitive regional players. It is characterized by high capital requirements, advanced engineering capabilities, and strict compliance with safety and environmental regulations. Leading companies maintain market influence through technological innovation, diverse product portfolios, and strong distribution networks. Competition centers on performance efficiency, durability, cost-effectiveness, and integration of smart technologies. The market demonstrates steady demand across construction, agriculture, mining, and material handling sectors, driven by long equipment lifecycles and recurring maintenance needs. Emerging trends such as hybrid systems, IoT-enabled controls, and sustainable designs are reshaping product development priorities. Regional manufacturers leverage proximity to key markets for faster delivery and service support, while global players focus on large-scale infrastructure and industrial projects to consolidate market presence.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness accelerated adoption of hybrid and electric-powered mobile hydraulic solutions to meet evolving environmental regulations.

- Manufacturers will focus on integrating advanced IoT-enabled systems for real-time monitoring and predictive maintenance.

- Demand from construction and infrastructure development projects will remain a primary growth driver across multiple regions.

- Agricultural mechanization will expand, increasing the requirement for high-efficiency hydraulic systems in tractors, harvesters, and other machinery.

- Mining and material handling sectors will invest in durable, high-capacity hydraulic equipment to improve operational safety and productivity.

- Technological advancements in hydraulic components will enhance performance, reduce energy consumption, and extend service life.

- Sustainability initiatives will promote the development of eco-friendly hydraulic fluids and recyclable materials.

- Asia-Pacific will maintain dominance, supported by industrial growth and large-scale infrastructure investments.

- North America and Europe will focus on advanced automation and safety features to meet stringent regulatory standards.

- Emerging markets in the Middle East, Africa, and Latin America will create new opportunities through investments in construction, mining, and oil and gas projects.