| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Hydraulic Gear Pump Market Size 2024 |

USD 9,757.42 Million |

| Automotive Hydraulic Gear Pump Market, CAGR |

3.61% |

| Automotive Hydraulic Gear Pump Market Size 2032 |

USD 13,231.55 Million |

Market Overview

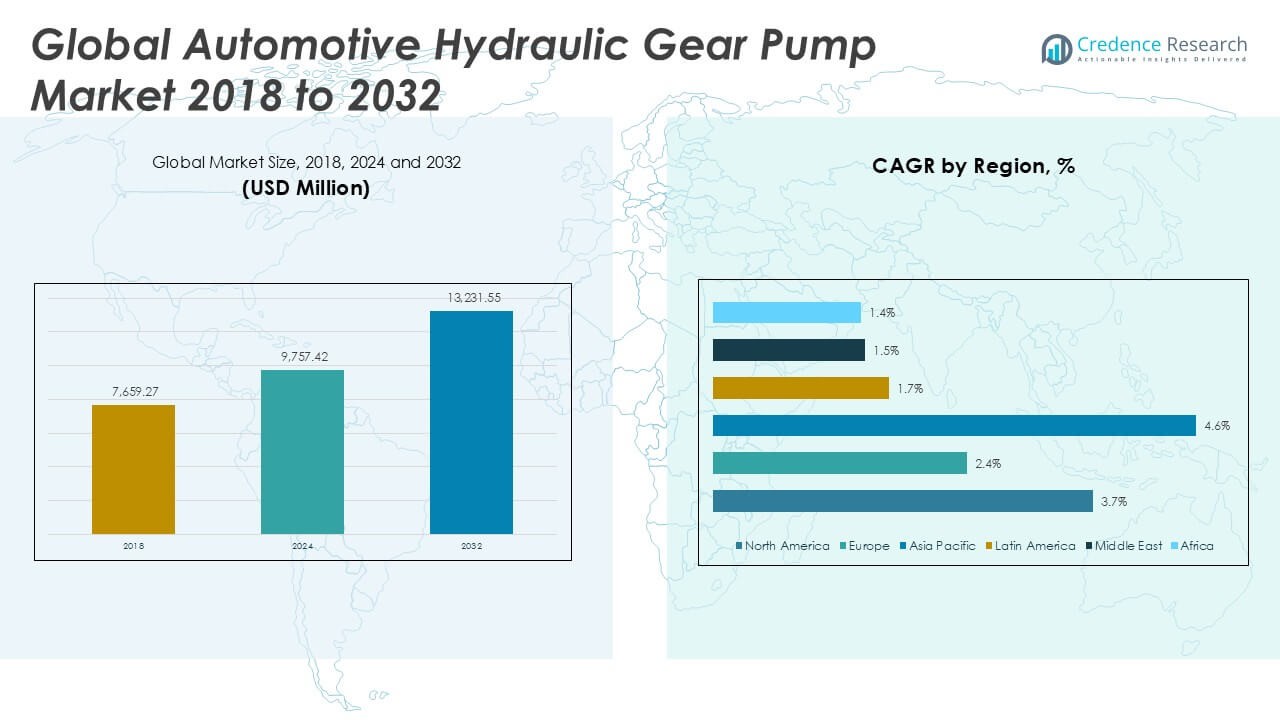

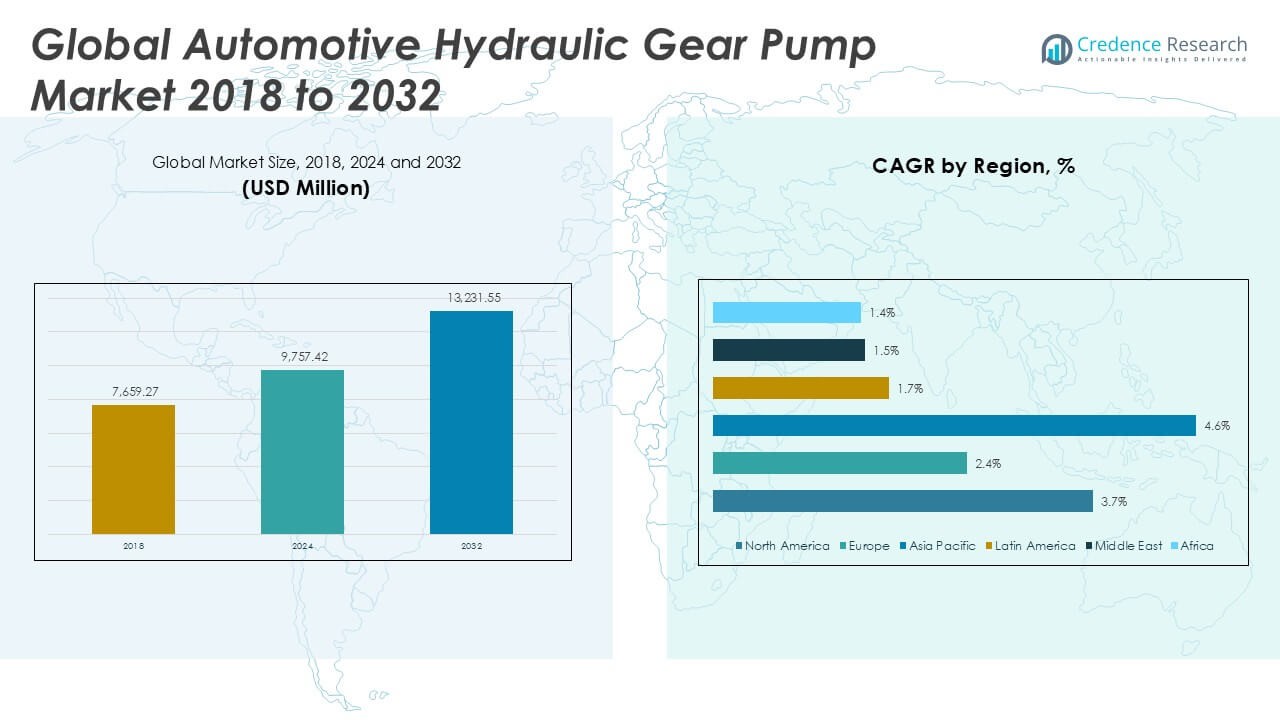

Automotive Hydraulic Gear Pump Market size was valued at USD 7,659.27 million in 2018 to USD 9,757.42 million in 2024 and is anticipated to reach USD 13,231.55 million by 2032, at a CAGR of 3.61% during the forecast period.

The Automotive Hydraulic Gear Pump Market is witnessing steady growth driven by the increasing demand for advanced hydraulic systems in vehicles, especially in commercial and off-road applications. Automakers are prioritizing fuel efficiency and vehicle performance, prompting the adoption of efficient hydraulic pumps for power steering, transmission, and braking systems. The market benefits from expanding automotive production in emerging economies, along with the rising integration of automation and electrification in vehicle designs. Stringent emission regulations encourage manufacturers to innovate lightweight and energy-efficient pump solutions. Additionally, ongoing investments in infrastructure and construction equipment support demand for heavy vehicles equipped with robust hydraulic gear pumps. Technological advancements such as improved materials, noise reduction, and digital control systems are enhancing pump performance and reliability. These factors, coupled with a shift towards sustainable and low-maintenance hydraulic solutions, continue to shape the evolving landscape of the automotive hydraulic gear pump market.

The Automotive Hydraulic Gear Pump Market demonstrates strong geographical diversity, with North America, Europe, and Asia Pacific emerging as primary hubs for demand and innovation. North America benefits from advanced manufacturing capabilities and a robust automotive industry, while Europe emphasizes engineering excellence and regulatory compliance in hydraulic systems. Asia Pacific sees rapid growth due to high vehicle production and infrastructure development, particularly in China, Japan, and India. Latin America, the Middle East, and Africa provide steady demand, driven by commercial vehicles and construction activities. Leading players such as Bosch Rexroth AG, Eaton Corporation Plc, and Bucher Hydraulics GmbH play a critical role in shaping the competitive landscape. These companies invest in research, expand product portfolios, and form strategic partnerships to address evolving industry needs across regions, ensuring reliable and advanced hydraulic gear pump solutions for diverse automotive applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Hydraulic Gear Pump Market was valued at USD 9,757.42 million in 2024 and is expected to reach USD 13,231.55 million by 2032, reflecting a CAGR of 3.61%.

- Steady demand for fuel-efficient vehicles and advancements in hydraulic systems drive market expansion, especially in power steering, transmission, and braking applications.

- Increasing integration of smart technologies and digital controls enhances pump performance and reliability, aligning with industry trends toward automation and electrification.

- Major players such as Bosch Rexroth AG, Eaton Corporation Plc, and Bucher Hydraulics GmbH focus on product innovation, regional expansion, and strategic alliances to strengthen their market positions.

- Fluctuating raw material prices and rising competition from electric and electro-hydraulic pump technologies present significant restraints for market growth.

- North America and Asia Pacific represent the largest and fastest-growing regions, fueled by strong automotive manufacturing activity and infrastructure development, with key contributions from the United States, China, and India.

- Europe maintains a leading role in regulatory compliance and sustainable technology adoption, while Latin America, the Middle East, and Africa contribute to steady demand driven by commercial vehicles and construction projects.

Market Drivers

Rising Demand for Fuel-Efficient and High-Performance Vehicles Accelerates Adoption

The Automotive Hydraulic Gear Pump Market continues to expand with the growing preference for fuel-efficient and high-performance vehicles worldwide. Automakers seek hydraulic gear pumps that deliver consistent power for steering, transmission, and braking systems while supporting overall vehicle efficiency. Consumers and fleet operators prioritize models that minimize fuel consumption without sacrificing operational effectiveness. Technological improvements in hydraulic systems offer smoother operation and greater responsiveness, enhancing vehicle handling and driver comfort. Manufacturers actively develop pumps that can support increased pressure and variable flow rates, meeting the demands of modern automotive platforms. The emphasis on reducing the environmental footprint further fuels the adoption of advanced, energy-efficient hydraulic gear pumps.

For instance, advancements in hydraulic gear pump technology have contributed to a 5.2% increase in vehicle fuel efficiency by optimizing fluid management systems.

Expansion of Automotive Manufacturing Activities in Emerging Economies Supports Market Growth

Automotive production in emerging economies plays a critical role in the ongoing growth of the Automotive Hydraulic Gear Pump Market. Rapid industrialization, rising disposable incomes, and expanding infrastructure investments stimulate vehicle sales in regions such as Asia Pacific and Latin America. Local and international manufacturers invest in new plants and production lines, which boosts the need for reliable and cost-effective hydraulic solutions. The market benefits from government incentives that encourage domestic vehicle assembly and export, creating a favorable business environment. Increased vehicle ownership in urban and rural areas requires robust hydraulic gear pumps that withstand diverse operating conditions. Market players tailor their offerings to match regional preferences and regulatory requirements, strengthening their competitive position.

For instance, the expansion of automotive manufacturing in emerging economies has led to a significant rise in demand for hydraulic gear pumps, particularly in regions experiencing infrastructure growth.

Stringent Environmental Regulations Drive Innovation in Hydraulic Pump Design

Tightening emission and efficiency standards prompt continuous innovation in the Automotive Hydraulic Gear Pump Market. Regulators in North America, Europe, and parts of Asia enforce strict guidelines on vehicle emissions, energy consumption, and material use. Manufacturers respond by designing pumps that reduce weight, improve mechanical efficiency, and lower energy loss during operation. The push for electrification in powertrains and hybrid vehicle systems creates demand for hydraulic gear pumps that integrate seamlessly with electric components. Companies focus on sustainable materials and eco-friendly manufacturing processes to align with industry regulations. Compliance with these standards ensures long-term market viability and fosters ongoing product development.

Advancements in Material Technology and Digital Integration Enhance Market Value

The evolution of materials science and digital integration significantly strengthens the Automotive Hydraulic Gear Pump Market. Adoption of lightweight composites, advanced alloys, and precision manufacturing techniques enables the production of pumps with greater durability and reduced mass. Engineers employ digital monitoring and control systems to enhance pump performance, enabling predictive maintenance and minimizing downtime. Integration with vehicle electronics improves responsiveness and efficiency, meeting the needs of next-generation automotive platforms. Investments in research and development produce hydraulic gear pumps that offer superior reliability and lifespan. These advancements secure the market’s position as a vital component supplier to automotive manufacturers globally.

Market Trends

Shift Toward Electrification and Hybrid Vehicle Platforms Reshapes Market Dynamics

The shift toward electrification and hybridization in the automotive sector introduces significant changes in the Automotive Hydraulic Gear Pump Market. Automakers implement hybrid and electric vehicles with advanced hydraulic systems to manage critical functions such as braking and steering. It drives manufacturers to innovate pump designs compatible with both internal combustion and electric drivetrains. The transition to electric mobility requires lightweight, compact, and energy-efficient hydraulic gear pumps. Investments in research yield integrated solutions that support vehicle electrification while maintaining reliability. This trend pushes the market toward specialized pumps that meet the evolving needs of next-generation vehicles.

For instance, hybrid propulsion systems now integrate electrohydraulic-powered steering, improving energy efficiency and reducing emissions.

Integration of Smart Technologies and Digital Control Systems Enhances Pump Performance

The integration of smart technologies and digital control systems marks a significant trend in the Automotive Hydraulic Gear Pump Market. Engineers develop pumps equipped with sensors and digital controllers that provide real-time monitoring and adaptive performance. It enables predictive maintenance, reduces operational downtime, and optimizes energy use in automotive applications. Manufacturers deploy advanced control algorithms to ensure precise flow rates and pressure management, meeting stringent performance standards. Digitalization streamlines diagnostics and troubleshooting, improving the user experience for both manufacturers and vehicle owners. Smart hydraulic gear pumps align with the automotive industry’s digital transformation strategies.

For instance, IoT-enabled hydraulic gear pumps have improved predictive maintenance and reduced downtime by 30% in automotive applications.

Growing Emphasis on Sustainability and Use of Eco-Friendly Materials

Sustainability initiatives increasingly influence product development within the Automotive Hydraulic Gear Pump Market. Manufacturers adopt eco-friendly materials, such as recycled metals and advanced polymers, to reduce environmental impact. It supports efforts to comply with global sustainability regulations and corporate responsibility goals. Product life cycle assessments guide decisions about raw material sourcing and manufacturing processes. The trend toward greener operations reflects consumer and regulatory expectations for sustainable mobility solutions. This focus on sustainability encourages continuous improvement in pump design, manufacturing, and recycling practices across the industry.

Expansion in Construction, Agriculture, and Off-Highway Vehicle Segments Broadens Market Opportunities

Rising demand for construction, agricultural, and off-highway vehicles expands the application base of the Automotive Hydraulic Gear Pump Market. It creates opportunities for manufacturers to supply high-performance pumps capable of handling heavy loads and challenging environments. Customization and robustness become key selling points for pumps targeting these sectors. Collaboration with original equipment manufacturers (OEMs) ensures that product offerings meet unique operational requirements. The trend toward multi-application pumps broadens the market’s reach and supports long-term growth. Expanding into adjacent vehicle segments strengthens the competitive landscape for industry participants.

Market Challenges Analysis

Rising Competition from Alternative Technologies Poses a Significant Threat

The Automotive Hydraulic Gear Pump Market faces increasing competition from alternative technologies such as electric pumps and electro-hydraulic systems. Many automakers explore these advanced solutions to improve efficiency, reduce weight, and align with electrification strategies. It challenges traditional hydraulic gear pumps, especially in new-generation electric and hybrid vehicles. Electric pumps offer advantages in noise reduction and energy savings, which appeal to OEMs focused on innovation and sustainability. Market players must invest in research to enhance the performance and adaptability of hydraulic gear pumps or risk losing market share. The pace of technological evolution in the automotive sector intensifies the urgency for differentiation and continuous improvement.

For instance, electric pumps are gaining traction due to their ability to reduce noise and improve energy efficiency, challenging traditional hydraulic gear pumps.

Fluctuating Raw Material Prices and Supply Chain Disruptions Impact Market Stability

Fluctuations in raw material prices and ongoing supply chain disruptions present persistent challenges for the Automotive Hydraulic Gear Pump Market. It depends on consistent availability of metals, polymers, and precision components to maintain production schedules and cost efficiency. Geopolitical uncertainties and logistics constraints often disrupt supply chains, leading to delays and increased operational costs. Volatility in commodity prices can erode profit margins and create difficulties in long-term planning for manufacturers. Industry players must develop resilient sourcing strategies and maintain flexibility in procurement processes. The need for stability and reliable supply channels remains critical for sustaining growth and meeting global demand.

Market Opportunities

Expansion into Emerging Markets and Untapped Vehicle Segments Drives Growth Potential

The Automotive Hydraulic Gear Pump Market holds significant growth opportunities through expansion into emerging markets and untapped vehicle segments. Rising demand for commercial vehicles, agricultural machinery, and construction equipment in regions such as Asia Pacific, Latin America, and Africa creates new avenues for market entry. It enables manufacturers to diversify their product portfolios and address unique performance requirements. Localized manufacturing and partnerships with regional OEMs can facilitate market penetration and strengthen distribution networks. The potential for infrastructure development and industrialization in these areas ensures a steady need for robust hydraulic solutions. Companies that proactively target these segments can secure a competitive advantage and drive long-term revenue growth.

Advancements in Material Science and Smart Technologies Unlock New Product Innovations

Ongoing advancements in material science and the adoption of smart technologies open new opportunities for the Automotive Hydraulic Gear Pump Market. Innovative materials, such as lightweight composites and advanced polymers, enable the production of pumps with improved durability and efficiency. It allows manufacturers to meet evolving regulatory standards and customer expectations for high-performance components. Integration of IoT sensors and digital monitoring systems enhances pump reliability and facilitates predictive maintenance, attracting forward-thinking automotive OEMs. The move toward digitalization in vehicle systems creates demand for pumps that seamlessly integrate with electronic controls. Embracing these technological advancements positions market participants at the forefront of future industry trends.

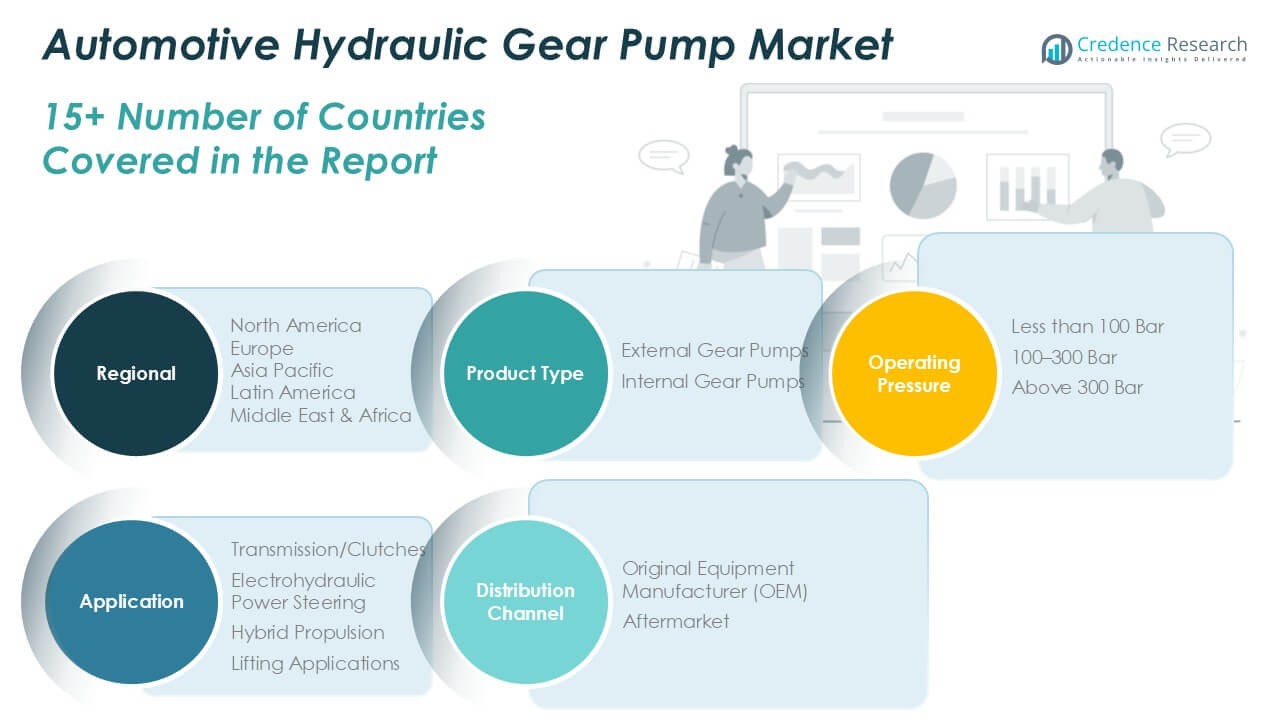

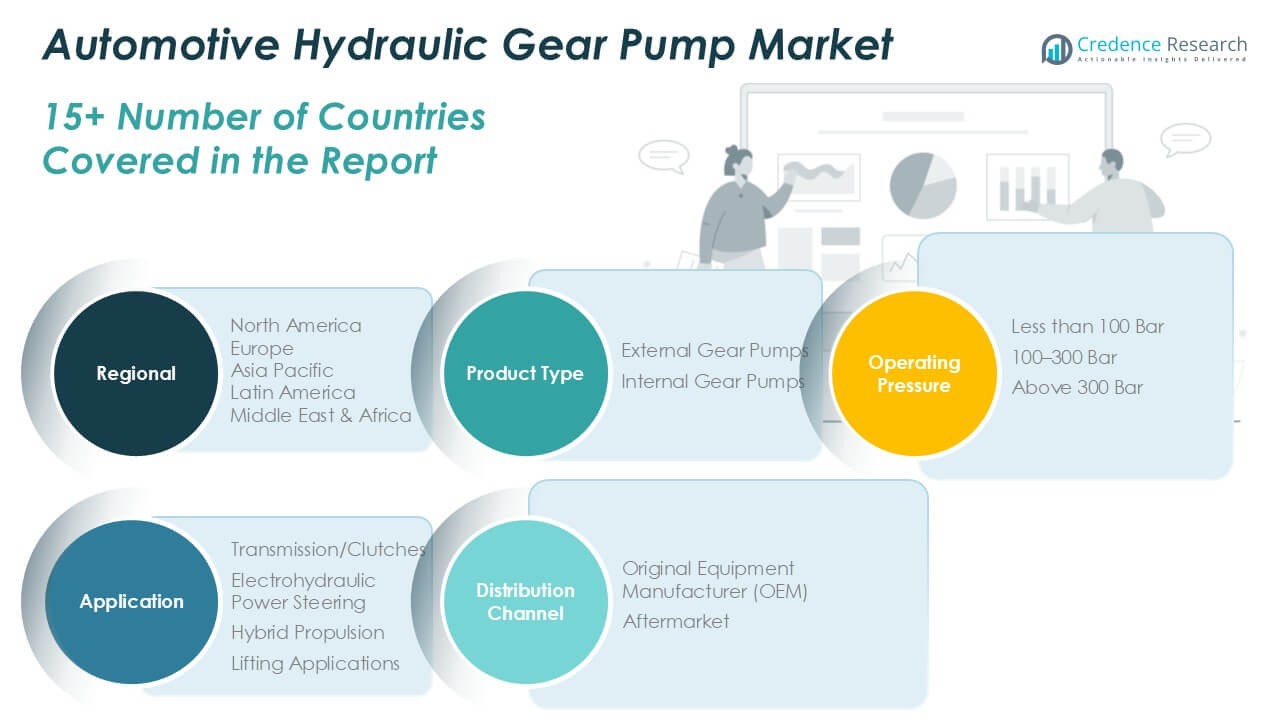

Market Segmentation Analysis:

By Product Type:

External gear pumps lead the segment, favored for their simple design, durability, and suitability for high-volume production environments. It finds extensive use in vehicles requiring robust and cost-effective solutions for power steering, transmission, and auxiliary functions. Internal gear pumps occupy a significant niche, particularly in applications demanding quieter operation and smoother flow characteristics. Their precision makes them suitable for specialized automotive systems where performance consistency is paramount.

By Operating Pressure:

The market segments by operating pressure into less than 100 bar, 100–300 bar, and above 300 bar. Pumps rated for 100–300 bar dominate the landscape, providing an optimal balance between power delivery and component longevity. It serves the core needs of mainstream passenger cars and commercial vehicles that require reliable hydraulic performance for critical systems. The less than 100 bar segment caters to light-duty applications, supporting auxiliary systems and compact vehicles where space and efficiency are priorities. Above 300 bar pumps address heavy-duty and high-performance requirements, such as in construction vehicles and specialized off-road equipment, where robust hydraulic pressure is essential for demanding tasks.

By Application:

The Automotive Hydraulic Gear Pump Market aligns its offerings to four primary categories: transmission/clutches, electrohydraulic power steering, hybrid propulsion, and lifting applications. Transmission and clutch applications remain the largest segment, benefiting from ongoing advancements in vehicle drivetrain technology. Electrohydraulic power steering systems drive growth, reflecting the trend toward enhanced driver comfort and precision handling. Hybrid propulsion presents a rising opportunity as manufacturers seek energy-efficient solutions that integrate seamlessly with electrified drivetrains. Lifting applications, prominent in commercial and industrial vehicles, require reliable and high-capacity pumps to support frequent, heavy-duty operations. The market’s segmentation ensures manufacturers can address a broad spectrum of automotive requirements, positioning it for sustained demand across traditional and emerging vehicle platforms.

Segments:

Based on Product Type:

- External Gear Pumps

- Internal Gear Pumps

Based on Operating Pressure:

- Less than 100 Bar

- 100–300 Bar

- Above 300 Bar

Based on Application:

- Transmission/Clutches

- Electrohydraulic Power Steering

- Hybrid Propulsion

- Lifting Applications

Based on Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Hydraulic Gear Pump Market

North America Automotive Hydraulic Gear Pump Market grew from USD 3,043.37 million in 2018 to USD 3,832.81 million in 2024 and is projected to reach USD 5,213.36 million by 2032, reflecting a compound annual growth rate (CAGR) of 3.7%. North America is holding a 39% market share. The United States leads the region, supported by strong demand in the automotive manufacturing sector and a high rate of technology adoption. Canada and Mexico follow, benefitting from investments in commercial vehicles and robust aftermarket activity. It remains a key market for technological innovation and advanced hydraulic solutions.

Europe Automotive Hydraulic Gear Pump Market

Europe Automotive Hydraulic Gear Pump Market grew from USD 1,496.20 million in 2018 to USD 1,806.27 million in 2024 and is projected to reach USD 2,237.69 million by 2032, reflecting a CAGR of 2.4%. Europe is holding a 17% market share. Germany, France, and the United Kingdom dominate the market with a strong focus on engineering excellence and regulatory compliance. The region benefits from the presence of leading automotive OEMs and suppliers. It continues to prioritize energy-efficient and eco-friendly hydraulic solutions to meet stringent emission standards.

Asia Pacific Automotive Hydraulic Gear Pump Market

Asia Pacific Automotive Hydraulic Gear Pump Market grew from USD 2,439.09 million in 2018 to USD 3,264.69 million in 2024 and is projected to reach USD 4,792.80 million by 2032, reflecting a CAGR of 4.6%. Asia Pacific is holding a 36% market share. China, Japan, and India serve as major growth engines, driven by rising vehicle production and infrastructure development. The region features a large base of commercial vehicles and a rapidly expanding construction sector. It represents a dynamic market where localization and cost-effective solutions drive demand.

Latin America Automotive Hydraulic Gear Pump Market

Latin America Automotive Hydraulic Gear Pump Market grew from USD 303.00 million in 2018 to USD 380.27 million in 2024 and is projected to reach USD 444.75 million by 2032, reflecting a CAGR of 1.7%. Latin America is holding a 3% market share. Brazil and Mexico lead the region, benefitting from domestic manufacturing and increased investment in fleet expansion. The market faces challenges with economic volatility, but ongoing infrastructure projects support demand. It relies on imported technologies to meet quality standards.

Middle East Automotive Hydraulic Gear Pump Market

Middle East Automotive Hydraulic Gear Pump Market grew from USD 218.75 million in 2018 to USD 255.19 million in 2024 and is projected to reach USD 293.13 million by 2032, reflecting a CAGR of 1.5%. The Middle East holds a 2% market share. Saudi Arabia and the UAE drive growth, focusing on commercial vehicles for oil and construction sectors. Investments in industrial projects and regional trade influence hydraulic gear pump demand. It prioritizes durable and high-performance systems suited to challenging environments.

Africa Automotive Hydraulic Gear Pump Market

Africa Automotive Hydraulic Gear Pump Market grew from USD 158.85 million in 2018 to USD 218.19 million in 2024 and is projected to reach USD 249.83 million by 2032, reflecting a CAGR of 1.4%. Africa holds a 2% market share. South Africa stands out as the key market, followed by Nigeria and Egypt. The region experiences steady growth in agricultural and construction vehicles, which supports hydraulic gear pump adoption. It relies on both local assembly and imported components to fulfill market needs.

Key Player Analysis

- Bosch Rexroth AG

- Bucher Hydraulics GmbH

- Casappa S.p.A.

- Concentric AB

- Daikin Industries Ltd.

- Dynamatic Technologies Ltd.

- Eaton Corporation Plc

- Eckerle

- Gemma Automotive

- Hema USA

Competitive Analysis

The competitive landscape of the Automotive Hydraulic Gear Pump Market features a strong presence of established players, including Bosch Rexroth AG, Eaton Corporation Plc, Bucher Hydraulics GmbH, Daikin Industries Ltd., and Concentric AB. These companies leverage extensive industry experience, advanced engineering capabilities, and broad product portfolios to capture significant market share. Companies compete by leveraging advanced engineering capabilities, expanding product portfolios, and prioritizing research and development to deliver high-performance and energy-efficient hydraulic gear pumps. Many market participants maintain global operations, forming strong relationships with automotive OEMs to ensure consistent demand and customized solutions for different vehicle platforms. Strategic initiatives such as regional expansion, mergers and acquisitions, and partnerships with local suppliers are common strategies to enhance market presence and address specific regulatory or technical requirements in different geographies. Firms continually invest in technological advancements to improve product reliability, reduce weight, and enable seamless integration with emerging digital control systems. The evolving needs of automotive manufacturers, along with regulatory trends focused on fuel efficiency and emissions, drive ongoing product innovation and foster a highly dynamic and responsive competitive environment within the market.

Recent Developments

- In November 2023, Danfoss Power Solutions, a major worldwide producer of mobile and industrial hydraulics as well as electric powertrain systems, has introduced the H1F fixed displacement bent axis hydraulic motor. The H1F motor is designed for both open-circuit and closed-circuit applications, and it delivers the highest efficiency performance in its class, as well as proven dependability and a compact design.

- In August 2023, Concentric AB, a leading provider of fluid power and flow control systems for trucks, buses, construction equipment, agricultural machinery, and industrial equipment, announced the availability of a CAD download tool developed by CADENAS PART Solutions. With its focus on delivering custom hydraulic solutions that speed up speed to market for design engineers, Concentric offers an industry-leading customer experience.

- In April 2023, Airbus Defence and Space and Liebherr-Aerospace signed a contract in which they will develop and manufacture the landing gear and hydraulic system of the European medium-altitude, long-range Eurodrone remote piloted air system (RPAS).

- In July 2022,Bungartz, a German manufacturer, debuted a rotating piston pump at ACHEMA. The design, in which the outer shaft torque is communicated to the pistons via magnets, decreases the pump’s maintenance requirements. The novel pump has a wide range of applications, including the pumping of poisonous, corrosive, or viscous liquids.

Market Concentration & Characteristics

The Automotive Hydraulic Gear Pump Market exhibits a moderate to high level of market concentration, with a few large, globally recognized manufacturers holding significant shares alongside a mix of regional and specialized firms. It features strong barriers to entry due to the need for advanced engineering capabilities, compliance with strict automotive standards, and established relationships with major vehicle OEMs. Product reliability, durability, and the ability to deliver customized solutions define key market characteristics, while continuous investment in research and development drives innovation. The market values supply chain resilience and global reach, ensuring consistent product quality and availability across different regions. Rapid technological advancements, regulatory requirements, and growing demand for energy-efficient solutions shape market dynamics, encouraging firms to maintain high standards and adapt quickly to automotive industry trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operating Pressure, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Automotive Hydraulic Gear Pump Market is projected to grow steadily through 2032, driven by demand for energy-efficient and compact hydraulic systems across vehicle platforms.

- Rising adoption of hybrid and electric vehicles is prompting the development of hydraulic gear pumps compatible with electrified powertrains and advanced control systems.

- Integration of smart technologies, including sensors and digital controllers, is enhancing pump performance, enabling predictive maintenance and system optimization.

- Manufacturers are focusing on lightweight materials and innovative designs to improve efficiency and meet stringent emission regulations.

- The market is experiencing increased demand from emerging economies due to rapid industrialization, infrastructure development, and expansion of the automotive sector.

- Technological advancements in pump design are leading to quieter operation and higher durability, catering to the needs of modern vehicles.

- Strategic collaborations and partnerships among industry players are fostering innovation and expanding global reach.

- The aftermarket segment is witnessing growth as vehicle owners seek cost-effective replacements and upgrades for hydraulic gear pumps.

- Fluctuating raw material prices and supply chain disruptions pose challenges, necessitating robust procurement and risk management strategies.

- Emphasis on sustainability and environmental compliance is driving the adoption of eco-friendly hydraulic solutions in the automotive industry.