Market Overview:

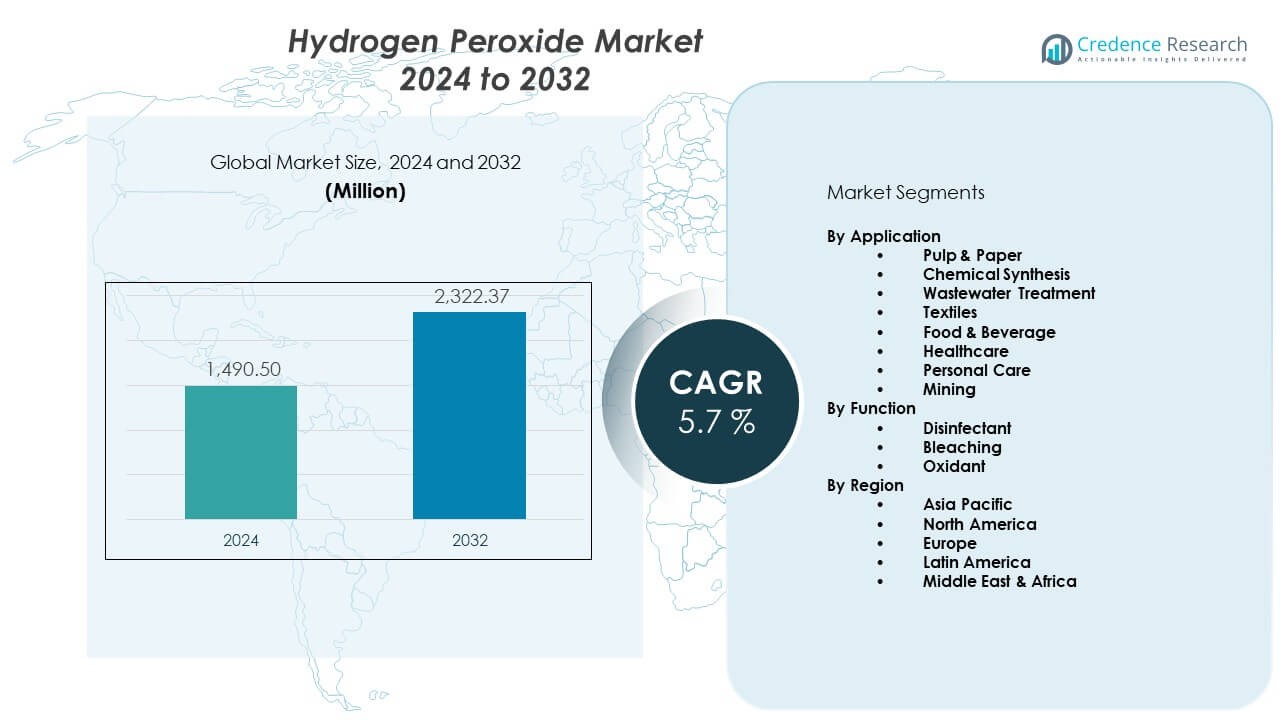

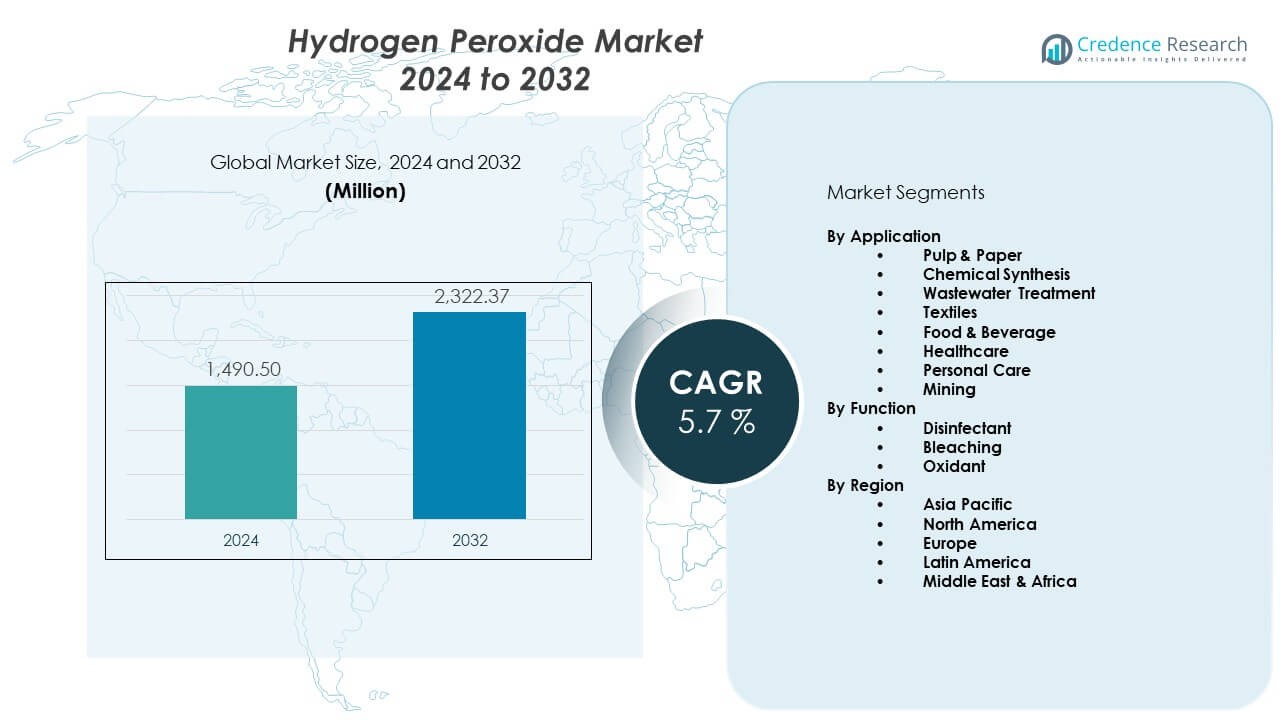

The Hydrogen Peroxide Market is projected to grow from USD 1,490.5 million in 2024 to an estimated USD 2,322.37 million by 2032, with a CAGR of 5.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Peroxide Market Size 2024 |

USD 1,490.5 Million |

| Hydrogen Peroxide Market, CAGR |

5.7% |

| Hydrogen Peroxide Market Size 2032 |

USD 2,322.37 Million |

Growing demand in pulp and paper production drives steady uptake across many plants. Producers also expand usage in textile bleaching and chemical synthesis due to cleaner processing needs. Water treatment facilities increase adoption because hydrogen peroxide supports safer oxidation without harmful residues.

Asia Pacific leads growth due to large manufacturing bases and strong chemical output. Europe maintains stable demand through strict environmental rules that favor cleaner agents. South America and parts of Africa emerge as new users because local industries invest in better treatment systems and higher-quality production standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Hydrogen peroxide market is valued at USD 1,490.5 million in 2024 and is projected to reach USD 2,322.37 million by 2032, growing at a CAGR of 5.7% during the forecast period.

- Asia Pacific (45%), Europe (25%), and North America (20%) hold the largest shares due to strong industrial bases, advanced processing technologies, and high consumption in pulp, paper, and chemical sectors.

- Asia Pacific is the fastest-growing region, supported by rapid manufacturing expansion, rising wastewater treatment needs, and strong pulp and textile processing activity.

- Pulp & Paper accounts for about 35% of total application demand, driven by high bleaching and delignification requirements across large mills.

- Bleaching holds roughly 40% of functional share due to its dominant role across pulp, textile, and industrial oxidation processes.

Market Drivers:

Rising Demand from Pulp and Paper Processing

Growing consumption of bleaching agents strengthens demand across major paper mills. Producers rely on stable oxidation performance to improve pulp brightness. The Hydrogen peroxide market gains support from rising packaging needs. Many converters prefer peroxide-based methods to reduce chemical waste. Regulatory pressure pushes firms toward cleaner bleaching routes. It helps mills cut chlorine-based inputs during routine processing. Global e-commerce stimulates packaging output across several countries. Sustainability goals motivate the shift toward eco-friendly bleaching systems.

- For instance, an organization might track its environmental metrics and share them in a published sustainability report, detailing its progress toward using more environmentally friendly processes, a practice supported by general industry trends and environmental regulations.

Expanding Use in Water and Wastewater Treatment

Growing interest in safer treatment chemicals drives demand across municipal plants. Operators adopt peroxide for sludge oxidation and odor control. The Hydrogen peroxide market benefits from rising sanitation projects. Many facilities prefer its residue-free profile during oxidation tasks. Industrial units integrate peroxide to reduce harmful by-products. It helps plants improve compliance with environmental rules. Strong focus on public health boosts treatment upgrades. Urban growth pushes higher investment in advanced purification systems.

- For instance, Veolia uses advanced oxidation processes (AOPs) in wastewater treatment for industrial and municipal clients, including a recently launched Drop technology in Europe that reportedly destroys PFAS (a type of POP) with up to 99.9999% efficiency, as mentioned in their technology descriptions.

Increasing Adoption in Electronics and Semiconductor Production

Growing semiconductor output increases demand for high-purity grades. Fabrication plants use peroxide for etching, cleaning, and surface prep. The Hydrogen peroxide market gains traction from rapid electronics expansion. Many fabs depend on reliable purity levels for micro-scale structures. It supports consistent wafer quality during sensitive processing steps. Rising chip demand encourages capacity expansion across Asia. Producers rely on advanced chemistries for safe cleaning cycles. Global investment in next-generation devices strengthens long-term needs.

Rising Use in Chemical Synthesis and Specialty Formulations

Growing need for intermediates supports peroxide consumption in chemical plants. Manufacturers use peroxide for controlled oxidation reactions. The Hydrogen peroxide market benefits from wider adoption in synthesis lines. Many facilities favor peroxide due to safer decomposed outputs. It supports production of epoxides, peracids, and specialty compounds. Strong focus on cleaner chemistry fuels process upgrades. Companies explore new catalytic routes with stable peroxide handling. Product diversification drives steady industrial application growth.

Market Trends:

Growing Shift Toward High-Purity and Electronic Grades

Rising chip fabrication expands demand for ultra-pure variants. Producers refine purification steps for tight contamination limits. The Hydrogen peroxide market moves toward higher consistency standards. Many fabs need batch-level quality checks for micro-patterning tasks. It supports stable output in complex semiconductor nodes. Global players invest in advanced distillation units. Research teams design improved storage and handling systems. Strong focus on electronics reliability shapes long-term purity trends.

- for instance, Solvay confirmed its electronic-grade hydrogen peroxide achieves contamination levels below 10 parts per billion to meet semiconductor requirements, as published in Solvay’s electronics chemicals specifications.

Increasing Focus on Onsite Generation Technologies

Rising concerns about transport risks push interest in onsite units. Producers evaluate modular systems for continuous peroxide supply. The Hydrogen peroxide market gains attention from chemical clusters. Many plants seek cost savings through reduced logistics pressure. It supports safer handling by lowering bulk transport exposure. Vendors design compact units for varied industrial settings. Energy-efficient reactors improve operational feasibility. Demand for localized supply strengthens new technology trials.

- For instance, Evonik aims for a 25% reduction in absolute Scope 1 & 2 greenhouse gas emissions by 2030 and an 11% decrease in Scope 3 emissions (which includes transport) compared to 2021 levels.

Growing Preference for Eco-Aligned Industrial Processes

Rising focus on clean chemistry drives peroxide adoption. Producers highlight its water and oxygen breakdown profile. The Hydrogen peroxide market aligns with green-processing objectives. Many industries reduce halogen-based inputs to meet global rules. It supports wider acceptance across textile, food, and environmental lines. Rising sustainability goals reshape industrial treatment strategies. Research teams explore peroxide for bio-based oxidation tasks. Cleaner technology roadmaps influence long-term usage patterns.

Advancements in Safe Storage, Handling, and Stabilization

Rising safety expectations encourage improved packaging systems. Producers upgrade stabilization formulas for longer shelf life. The Hydrogen peroxide market benefits from high-grade containment solutions. Many users seek standardized safety designs for bulk storage. It supports improved transport performance across supply networks. Vendors test new inhibitors for temperature stability. Facilities invest in advanced monitoring for secure operations. Global emphasis on workplace safety boosts related innovation.

Market Challenges Analysis:

Stringent Handling and Safety Regulations Across Industries

Growing safety requirements create complexity for many operators. Producers must maintain tight control during storage and movement. The Hydrogen peroxide market faces rising scrutiny across industrial zones. Many plants struggle with cost pressure linked to certified containment systems. It requires upgraded handling to meet evolving regulatory rules. Training gaps increase operational risk in smaller units. Global transport norms push firms to revise packaging formats. Compliance costs limit adoption in cost-sensitive regions.

Volatile Raw Material Dynamics and Supply Chain Constraints

Rising feedstock fluctuation affects peroxide production economics. Producers deal with unstable supply patterns in competitive markets. The Hydrogen peroxide market experiences pressure from shipping delays. Many buyers face longer lead times from export-dependent routes. It disrupts planning cycles across several industries. Capacity constraints hinder stable distribution in peak seasons. Firms evaluate alternate sourcing to reduce procurement stress. Complex logistics networks challenge sustained supply reliability.

Market Opportunities:

Expanding Scope in Environmental and Sustainability-Focused Applications

Growing environmental priorities create new use cases for oxidation tasks. Producers highlight peroxide’s clean breakdown profile in pollution control. The Hydrogen peroxide market gains wide potential across eco-driven programs. Many regions plan industrial transitions that favor non-toxic chemicals. It supports innovation in soil remediation, aquaculture, and odor control lines. Rising interest in green compliance boosts demand exploration. Cleaner operational frameworks strengthen long-term adoption prospects.

Rising Integration in High-Value Manufacturing and Advanced Processing

Growing manufacturing upgrades stimulate peroxide demand in precision processes. Producers supply high-grade variants to semiconductor, pharma, and electronics lines. The Hydrogen peroxide market benefits from higher purity expectations. Many advanced plants require reliable chemistries for delicate steps. It supports continuous quality improvement across modern facilities. Firms invest in advanced production units to meet niche needs. Rising global digitalization fuels expanding downstream opportunities.

Market Segmentation Analysis:

By Application

The Hydrogen peroxide market shows strong dominance from pulp and paper applications due to consistent demand for efficient bleaching and delignification processes. The sector relies on peroxide to improve brightness levels and reduce reliance on chlorine-based methods. Chemical synthesis represents another major segment where peroxide supports oxidation reactions across specialty and intermediate chemicals. Wastewater treatment uses peroxide for pollutant breakdown and odor control, driving strong uptake in municipal and industrial projects. Textiles depend on peroxide for high-quality bleaching in woven and nonwoven materials. Food and beverage processors adopt peroxide for aseptic packaging and surface sanitation. Healthcare facilities use it for disinfecting surfaces and medical tools. Personal care brands integrate peroxide into hair colorants and oral care formulations. Mining operations rely on peroxide for ore leaching and impurity removal in complex extraction environments.

- for instance, Unilever confirms peroxide use in its oral care portfolio under EU-compliant limits of up to 0.1% for over-the-counter formulations, as validated by European Commission cosmetic regulations.

By Function

The Hydrogen peroxide market expands its reach through three core functional categories. Disinfectant applications gain traction across healthcare, food processing, and hygiene-sensitive industries due to a clean decomposition profile without toxic residues. It supports high microbial control performance while meeting strict safety standards. Bleaching functions continue to lead demand across pulp, paper, and textile operations where consistent brightness and material integrity remain essential. Oxidant functions drive significant consumption across chemical synthesis, environmental treatment, and mining sectors. It helps industries achieve cleaner reaction pathways, enhanced operational control, and reduced environmental impact across diverse industrial processes.

Segmentation:

By Application

- Pulp & Paper

- Chemical Synthesis

- Wastewater Treatment

- Textiles

- Food & Beverage

- Healthcare

- Personal Care

- Mining

By Function

- Disinfectant

- Bleaching

- Oxidant

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest share of the Hydrogen peroxide market at nearly 45%, driven by strong demand from pulp and paper, textiles, and chemical synthesis industries. The region benefits from large-scale manufacturing clusters that support high-volume peroxide consumption. China and India lead production due to expanding industrial bases and steady investment in bleaching and oxidation technologies. The Hydrogen peroxide market grows quickly here because many plants adopt cleaner processing systems. It also gains strength from rising wastewater treatment needs across urban and industrial zones. Local producers expand capacity to support regional export networks. Government focus on sustainability enhances long-term application adoption.

Europe

Europe accounts for about 25% of the global share, supported by mature chemical and environmental treatment industries. Strong regulatory frameworks encourage the use of peroxide in eco-friendly bleaching, disinfection, and oxidation tasks. The Hydrogen peroxide market benefits from advanced pulp and paper operations across Scandinavia and Central Europe. It also gains momentum from rising investments in high-purity grades for electronics and specialty chemicals. Wastewater treatment plants adopt peroxide to meet strict emission and discharge norms. The region maintains stable demand due to its established industrial base. Innovation in low-impact chemical processes supports steady growth.

North America, Latin America, and Middle East & Africa

North America holds about 20% of the market, supported by strong demand from chemical synthesis, electronics, and food-processing industries. The Hydrogen peroxide market expands through advanced treatment infrastructure and high-quality manufacturing standards. Latin America captures nearly 6–7% due to growing pulp, paper, and mining activities, with Brazil leading regional consumption. It sees rising interest in peroxide-based treatment across water-intensive sectors. The Middle East & Africa hold around 5–6%, driven by emerging industrial clusters and expanding wastewater treatment projects. It gains traction through rising investment in cleaner processing methods across key economies.

Key Player Analysis:

- Solvay (Belgium)

- Evonik Industries AG (Germany)

- Arkema (France)

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- Kemira Oyj (Finland)

- Nouryon (Netherlands)

- Mitsubishi Gas Chemical Company (Japan)

- Gujarat Alkalies & Chemicals Ltd. (India)

- Taekwang Industrial Co., Ltd. (South Korea)

- National Peroxide Limited (India)

- Meghmani Finechem Limited (India)

- OCI Company Ltd. (South Korea)

- FMC Corporation (United States)

Competitive Analysis:

The Hydrogen peroxide market features a concentrated competitive landscape dominated by global chemical manufacturers with strong production networks and technology capabilities. Leading companies focus on high-purity grades, eco-friendly processing routes, and capacity upgrades to strengthen regional presence. The Hydrogen peroxide market gains stability through long-term supply agreements with pulp and paper, chemical, and wastewater treatment industries. It sees consistent innovation in stabilization chemistry, packaging safety, and oxidation efficiency. Key players invest in advanced reactors and energy-efficient production lines to improve margins. Strategic expansion in Asia, Europe, and North America supports diversified revenue streams. Companies also strengthen logistics systems to ensure reliable delivery in regulated sectors.

Recent Developments:

- In September 2025, Solvay S.A. (Belgium) doubled its annual production capacity for electronic-grade hydrogen peroxide at its facility in Zhenjiang, China. This expansion supports the semiconductor industry with ultra-pure hydrogen peroxide critical for integrated circuit manufacturing. The expansion event was attended by key company executives and marks a strategic investment in electronics and other high-tech fields such as photovoltaics and flat panel displays.

- In November 2025, Solvay signed a 10-year partnership agreement with Sapio to develop Europe’s first hub for renewable hydrogen production at Solvay’s Rosignano facility in Italy. This project is expected to be operational by mid-2026 and includes a 5 MW electrolysis system powered by a 10 MW photovoltaic installation, producing up to 756 tons of renewable hydrogen annually to reduce carbon emissions from peroxide production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Application and By Function. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing shift toward eco-friendly bleaching agents will support broader industrial use.

- Rising investment in high-purity grades will strengthen adoption in electronics and precision manufacturing.

- Expansion of wastewater treatment infrastructure will drive oxidation-based applications.

- Increasing demand from pulp and paper mills will sustain stable bulk consumption.

- Advances in safer storage technologies will improve transport and handling efficiency.

- Growth in textile processing will boost peroxide-based bleaching solutions.

- Adoption in food packaging sanitation will expand with stronger hygiene norms.

- Mining activities will increase usage in ore leaching and impurity control.

- Regional capacity additions will enhance supply reliability in emerging markets.

- Integration into green chemistry processes will support long-term sustainability goals.